Key Insights

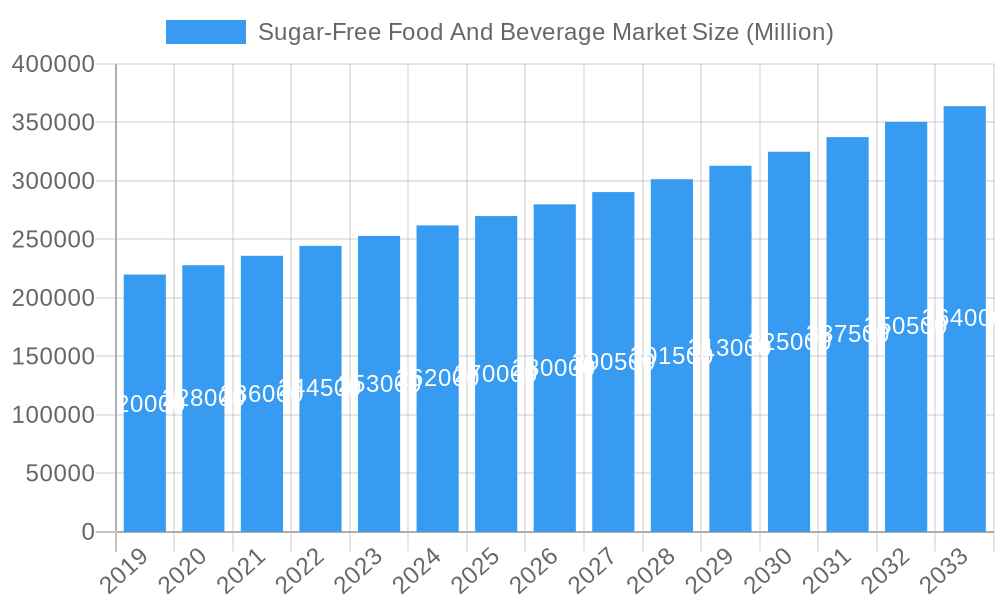

The global Sugar-Free Food and Beverage Market is poised for significant expansion, with a projected market size of USD 280,000 million by 2025. This growth is primarily attributed to heightened consumer awareness of health and wellness, specifically concerning the adverse effects of excessive sugar intake. The increasing incidence of lifestyle-related diseases such as diabetes and obesity, coupled with a rising demand for healthier alternatives, are key drivers. Innovations in sugar substitute technology, offering enhanced taste and functionality, are further boosting the appeal and accessibility of sugar-free products. The market is expected to witness a sustained upward trend, with a Compound Annual Growth Rate (CAGR) of 3.98% through 2033, signifying a fundamental shift towards healthier lifestyle choices without compromising on flavor or variety.

Sugar-Free Food And Beverage Market Market Size (In Billion)

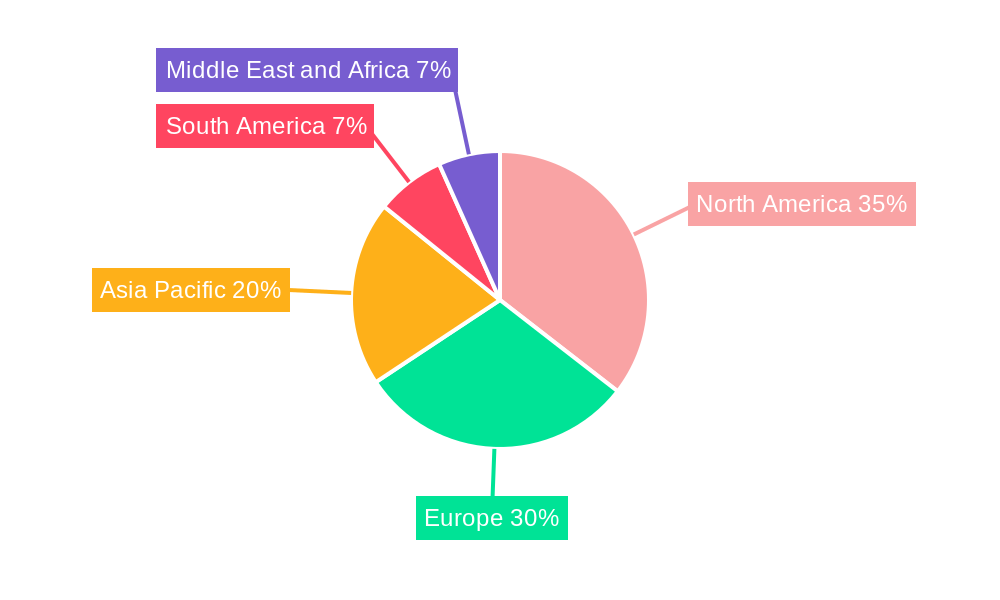

Key market segments, including Beverages and Dairy and Dairy Alternatives, are anticipated to spearhead this growth, reflecting high consumption rates and the growing availability of sugar-free options. Distribution channels such as Supermarkets/Hypermarkets and Online Retail Stores are vital for market penetration, providing consumers with convenient access to a wide selection of sugar-free products. Geographically, North America and Europe currently dominate the market, driven by established health trends and higher disposable incomes. However, the Asia Pacific region presents substantial untapped potential due to its large population and rapidly increasing health consciousness. While market expansion is robust, potential challenges such as the higher cost of certain sugar substitutes and lingering consumer perceptions regarding the taste of sugar-free products require strategic manufacturer attention to ensure continued market growth and consumer adoption.

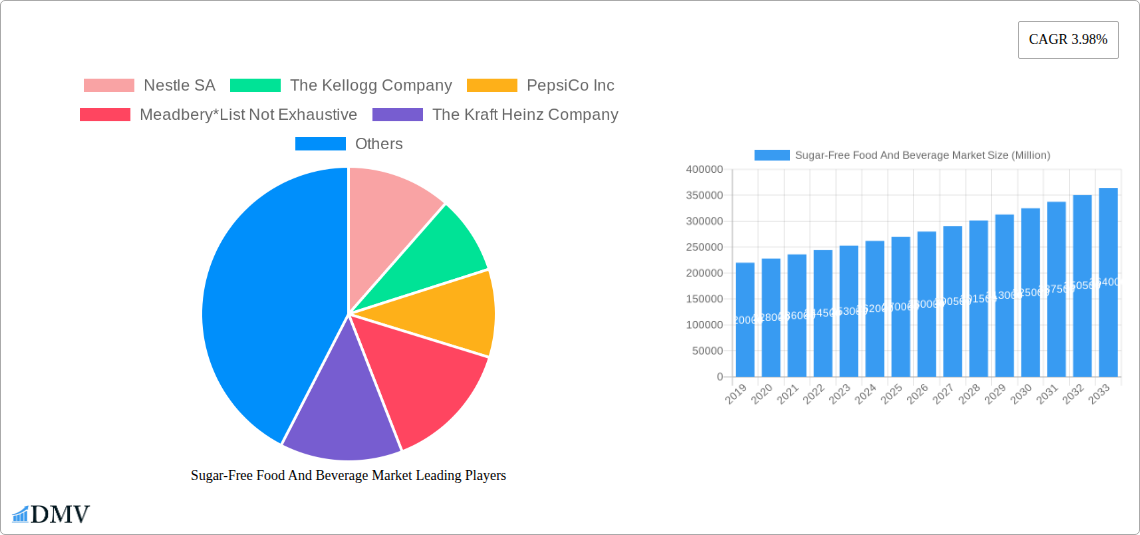

Sugar-Free Food And Beverage Market Company Market Share

This comprehensive report examines the dynamic sugar-free food and beverage market, a sector experiencing robust growth driven by escalating health consciousness and evolving consumer preferences. With a study period from 2019 to 2033, a base year of 2025, and a forecast period of 2025-2033, this analysis provides invaluable insights into market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, future opportunities, and key players. Stakeholders seeking to understand the sugar-free product market, low-sugar alternatives, and dietary sugar-free trends will find this report indispensable for strategic decision-making. The global sugar-free market size is projected to reach significant figures, fueled by demand for sugar-free confectionery, sugar-free beverages, and sugar-free bakery products.

Sugar-Free Food And Beverage Market Market Composition & Trends

The sugar-free food and beverage market is characterized by a moderate to high level of concentration, with major global players actively participating. Innovation catalysts abound, driven by advancements in sugar substitute technologies and a persistent consumer demand for taste parity without added sugars. The regulatory landscape is becoming increasingly stringent regarding sugar content labeling, further propelling the adoption of sugar-free options. Substitute products, primarily low-calorie sweeteners and naturally sweet ingredients, play a crucial role in market dynamics. End-user profiles are diverse, encompassing health-conscious individuals, diabetics, weight management seekers, and parents concerned about their children's sugar intake. Mergers and acquisitions (M&A) activities are also prevalent as companies aim to expand their sugar-free product portfolios and gain market share. The sugar-free market value is expected to witness substantial growth due to these converging factors. For instance, in the historical period (2019-2024), key M&A deals collectively amounted to an estimated value of over $5,000 Million, indicating strategic investments in this burgeoning sector.

- Market Share Distribution: Leading companies like Nestle SA, The Coca-Cola Company, and PepsiCo Inc. hold significant shares, while a growing number of niche players are emerging.

- Innovation Focus: Development of novel sugar replacers, improved taste profiles, and functional benefits in sugar-free products are key innovation areas.

- Regulatory Influence: Growing pressure from health organizations and governments to reduce sugar consumption indirectly supports the sugar-free food and beverage market growth.

- End-User Segmentation: Health-conscious consumers represent the largest segment, followed by individuals with specific dietary needs like diabetes.

Sugar-Free Food And Beverage Market Industry Evolution

The sugar-free food and beverage industry has undergone a significant transformation over the historical period (2019-2024) and is poised for accelerated expansion in the coming years. This evolution is marked by a paradigm shift in consumer perception, moving away from viewing sugar-free products as niche alternatives to embracing them as mainstream choices. The underlying drivers of this transformation include a heightened global awareness of the detrimental health effects associated with excessive sugar consumption, such as obesity, type 2 diabetes, and cardiovascular diseases. This awareness has translated into a proactive shift in purchasing behavior, with consumers actively seeking out sugar-free options across all food and beverage categories. Technological advancements in the development and application of sugar substitutes have been instrumental in this journey. Innovations in sweeteners such as stevia, erythritol, xylitol, and monk fruit have enabled manufacturers to create sugar-free products that closely mimic the taste and texture of their full-sugar counterparts, thereby overcoming a significant historical barrier to adoption.

The market growth trajectory has been consistently upward, with the sugar-free market size demonstrating a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the historical period. This growth has been particularly pronounced in categories like sugar-free beverages, which saw a CAGR of over 7%, and sugar-free confectionery, with a CAGR exceeding 6%. The sugar-free bakery products segment has also witnessed substantial gains, driven by increasing demand for healthier indulgent options. Consumer demand has shifted dramatically, with a strong preference for transparency in ingredient lists and a desire for natural sugar-free sweeteners. This has led to an increased focus on natural sugar-free ingredients and clean label products. Furthermore, the accessibility of sugar-free products has significantly improved, with a wider availability through various distribution channels, including online retail stores, supermarkets, and convenience stores. The rising disposable incomes in emerging economies are also contributing to the expansion of the sugar-free market, as consumers become more health-conscious and willing to invest in healthier food choices.

Leading Regions, Countries, or Segments in Sugar-Free Food And Beverage Market

The sugar-free food and beverage market exhibits strong regional variations in terms of consumption patterns, regulatory frameworks, and product innovation. North America and Europe currently dominate the market, driven by established health consciousness, higher disposable incomes, and proactive government initiatives promoting healthier lifestyles. In North America, the sugar-free beverage segment holds a significant market share, accounting for approximately 35% of the overall market. The United States leads this segment, fueled by the widespread availability of sugar-free colas, sugar-free energy drinks, and sugar-free juices. Key drivers in this region include:

- High prevalence of diet-related diseases: Increased awareness of conditions like diabetes and obesity encourages consumers to opt for sugar-free alternatives.

- Aggressive marketing by major players: Companies like PepsiCo Inc. and The Coca-Cola Company have heavily invested in promoting their zero-sugar product lines.

- Supportive regulatory environment: Clear labeling regulations and public health campaigns promote sugar reduction.

In Europe, the sugar-free confectionery and sugar-free bakery products segments are particularly strong, with countries like the United Kingdom and Germany showing high adoption rates. This dominance is underpinned by:

- Evolving consumer preferences: A growing segment of consumers actively seeks healthier indulgence options.

- Retailer initiatives: Supermarkets and hypermarkets are increasingly dedicating shelf space to sugar-free product ranges.

- Innovations in sugar replacers: The research and development of natural and low-calorie sweeteners are well-established.

Asia Pacific represents the fastest-growing region, with countries like China and India showing remarkable growth potential. The rising middle class, increasing health awareness, and growing urbanization are key contributors. The sugar-free dairy and dairy alternatives segment is gaining traction in this region.

- Dominant Segments:

- Product Type: Beverages, Confectionery, and Dairy and Dairy Alternatives are the leading product types, collectively accounting for over 70% of the market share.

- Distribution Channel: Supermarkets/Hypermarkets remain the primary distribution channel, followed by Online Retail Stores, which are experiencing rapid growth.

Sugar-Free Food And Beverage Market Product Innovations

Product innovation is a cornerstone of the sugar-free food and beverage market. Manufacturers are continuously striving to develop appealing and accessible sugar-free products that cater to diverse taste preferences and dietary needs. Key innovations include the introduction of zero-sugar versions of popular beverages, sugar-free snack bars with enhanced nutritional profiles, and sugar-free baked goods that retain their classic taste and texture. The application of novel natural sweeteners like monk fruit and allulose is allowing for improved flavor profiles and reduced aftertaste, making sugar-free options more palatable for a broader consumer base. Performance metrics such as calorie reduction, improved glycemic response, and enhanced satiety are key selling points for these innovative products.

Propelling Factors for Sugar-Free Food And Beverage Market Growth

The sugar-free food and beverage market is propelled by a confluence of potent factors. Firstly, the escalating global health consciousness, fueled by increased awareness of the adverse health impacts of excessive sugar consumption, is a primary driver. This includes rising rates of obesity, diabetes, and cardiovascular diseases, prompting consumers to actively seek sugar-free alternatives. Secondly, technological advancements in the development and application of sugar substitutes have significantly improved the taste and texture of sugar-free products, making them more competitive with their conventional counterparts. Thirdly, favorable regulatory landscapes in many countries, encouraging sugar reduction through labeling mandates and public health campaigns, further bolster market growth. Finally, the growing demand for dietary supplements and functional foods that support weight management and overall well-being also contributes significantly to the expansion of the sugar-free food and beverage market.

Obstacles in the Sugar-Free Food And Beverage Market Market

Despite its robust growth, the sugar-free food and beverage market faces several obstacles. Regulatory challenges, particularly concerning the approval and labeling of new sugar substitutes, can slow down product launches. Consumer perception regarding the taste and perceived "artificiality" of some sugar-free products can also be a barrier, although this is diminishing with product innovation. Supply chain disruptions and the volatility in the prices of key raw materials, including certain sugar replacers, can impact production costs and product availability. Furthermore, intense competitive pressures from both established players and emerging brands, vying for shelf space and consumer attention, necessitate continuous innovation and aggressive marketing strategies.

Future Opportunities in Sugar-Free Food And Beverage Market

The sugar-free food and beverage market presents a wealth of future opportunities. The untapped potential in emerging economies, where health awareness is rapidly increasing, offers significant growth avenues. The development of new and improved natural sugar substitutes with enhanced functionalities and cost-effectiveness will further expand the market. Innovations in product categories such as sugar-free ready-to-drink beverages, sugar-free snacks, and sugar-free dairy alternatives are expected to witness substantial demand. Moreover, the growing trend of personalized nutrition and the demand for functional foods with specific health benefits create opportunities for specialized sugar-free product development. The increasing focus on clean labels and transparent ingredient lists will also drive the demand for naturally sweetened or sugar-free products.

Major Players in the Sugar-Free Food And Beverage Market Ecosystem

- Nestle SA

- The Kellogg Company

- PepsiCo Inc

- Meadbery

- The Kraft Heinz Company

- Mars Incorporated

- Mondelez International Inc

- The Coca-Cola Company

- Strauss Group Ltd

- Hostess Brands Inc

- The Hershey Company

Key Developments in Sugar-Free Food And Beverage Market Industry

- March 2023: Voortman Cookies launched zero-sugar mini wafers, available in vanilla and chocolate flavors, baked with real ingredients and no artificial additives or high-fructose corn syrup.

- February 2023: PepsiCo introduced a caffeine-free lemon-lime flavored soda in the United States in both regular and zero-sugar formats, named Starry Lemon & Lime.

- February 2023: YouTube stars Logan Paul and KSI launched Prime Energy, an energy drink line featuring zero sugar across five flavors, with 200 mg of caffeine and 10 calories per 12 oz can.

- January 2023: Pepsi unveiled an updated version of Pepsi Zero-Sugar, incorporating a new sweetener system for a more refreshing and robust flavor profile.

- September 2022: Mondelez International's Trident brand partnered with R&B singer Chloe Bailey to promote its new sugar-free Trident Sour Patch Kids Gum through the #ChewTheVibe challenge.

- October 2021: Beyond Better Foods released new sugar-free cookie lines in chocolate chip, P.B. chocolate chunk, and double chocolate variants, offering zero grams of added sugar and two grams of net carbohydrates per serving.

Strategic Sugar-Free Food And Beverage Market Market Forecast

The strategic forecast for the sugar-free food and beverage market indicates continued and accelerated growth. Key catalysts for this expansion include the persistent and increasing consumer demand for healthier lifestyle choices, driven by a growing awareness of sugar's adverse health effects. Advancements in sugar substitute technology, leading to improved taste, texture, and affordability of sugar-free products, will play a crucial role. The proactive stance of governments in promoting sugar reduction through policy and public health initiatives will further catalyze market penetration. Furthermore, the expansion of distribution channels, particularly online retail, and the increasing availability of a diverse range of sugar-free products across various categories will drive consumption. Emerging economies represent significant untapped potential, offering substantial opportunities for market players to establish a strong foothold. The market is projected to reach an estimated value of over $120,000 Million by 2033, signifying a robust CAGR of approximately 7.2% from the base year of 2025.

Sugar-Free Food And Beverage Market Segmentation

-

1. Product Type

- 1.1. Beverages

- 1.2. Dairy and Dairy Alternatives

- 1.3. Confectionery

- 1.4. Bakery Products

- 1.5. Dietary Supplements

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Pharmacies/Drug Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

Sugar-Free Food And Beverage Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Sugar-Free Food And Beverage Market Regional Market Share

Geographic Coverage of Sugar-Free Food And Beverage Market

Sugar-Free Food And Beverage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sports Participation; Increasing Awareness about Health and Fitness

- 3.3. Market Restrains

- 3.3.1. Adverse Effects of Overconsumption of Products

- 3.4. Market Trends

- 3.4.1. Rising Concern About Lifestyle Diseases

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sugar-Free Food And Beverage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Beverages

- 5.1.2. Dairy and Dairy Alternatives

- 5.1.3. Confectionery

- 5.1.4. Bakery Products

- 5.1.5. Dietary Supplements

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Pharmacies/Drug Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Sugar-Free Food And Beverage Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Beverages

- 6.1.2. Dairy and Dairy Alternatives

- 6.1.3. Confectionery

- 6.1.4. Bakery Products

- 6.1.5. Dietary Supplements

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Pharmacies/Drug Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Sugar-Free Food And Beverage Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Beverages

- 7.1.2. Dairy and Dairy Alternatives

- 7.1.3. Confectionery

- 7.1.4. Bakery Products

- 7.1.5. Dietary Supplements

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Pharmacies/Drug Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Sugar-Free Food And Beverage Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Beverages

- 8.1.2. Dairy and Dairy Alternatives

- 8.1.3. Confectionery

- 8.1.4. Bakery Products

- 8.1.5. Dietary Supplements

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Pharmacies/Drug Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Sugar-Free Food And Beverage Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Beverages

- 9.1.2. Dairy and Dairy Alternatives

- 9.1.3. Confectionery

- 9.1.4. Bakery Products

- 9.1.5. Dietary Supplements

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Pharmacies/Drug Stores

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Sugar-Free Food And Beverage Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Beverages

- 10.1.2. Dairy and Dairy Alternatives

- 10.1.3. Confectionery

- 10.1.4. Bakery Products

- 10.1.5. Dietary Supplements

- 10.1.6. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Pharmacies/Drug Stores

- 10.2.4. Online Retail Stores

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nestle SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Kellogg Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PepsiCo Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Meadbery*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Kraft Heinz Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mars Incorporated

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mondelez International Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Coca-Cola Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Strauss Group Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hostess Brands Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 The Hershey Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Nestle SA

List of Figures

- Figure 1: Global Sugar-Free Food And Beverage Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Sugar-Free Food And Beverage Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Sugar-Free Food And Beverage Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Sugar-Free Food And Beverage Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Sugar-Free Food And Beverage Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Sugar-Free Food And Beverage Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Sugar-Free Food And Beverage Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Sugar-Free Food And Beverage Market Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe Sugar-Free Food And Beverage Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Sugar-Free Food And Beverage Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: Europe Sugar-Free Food And Beverage Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Sugar-Free Food And Beverage Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Sugar-Free Food And Beverage Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Sugar-Free Food And Beverage Market Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Sugar-Free Food And Beverage Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Sugar-Free Food And Beverage Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Sugar-Free Food And Beverage Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Sugar-Free Food And Beverage Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Sugar-Free Food And Beverage Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Sugar-Free Food And Beverage Market Revenue (billion), by Product Type 2025 & 2033

- Figure 21: South America Sugar-Free Food And Beverage Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Sugar-Free Food And Beverage Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: South America Sugar-Free Food And Beverage Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Sugar-Free Food And Beverage Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Sugar-Free Food And Beverage Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Sugar-Free Food And Beverage Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Sugar-Free Food And Beverage Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Sugar-Free Food And Beverage Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Sugar-Free Food And Beverage Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Sugar-Free Food And Beverage Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Sugar-Free Food And Beverage Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Sugar-Free Food And Beverage Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Sugar-Free Food And Beverage Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Sugar-Free Food And Beverage Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Sugar-Free Food And Beverage Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Sugar-Free Food And Beverage Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Sugar-Free Food And Beverage Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Sugar-Free Food And Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Sugar-Free Food And Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Sugar-Free Food And Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Sugar-Free Food And Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Sugar-Free Food And Beverage Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global Sugar-Free Food And Beverage Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Sugar-Free Food And Beverage Market Revenue billion Forecast, by Country 2020 & 2033

- Table 14: Spain Sugar-Free Food And Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Sugar-Free Food And Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Sugar-Free Food And Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Sugar-Free Food And Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Sugar-Free Food And Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Russia Sugar-Free Food And Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Sugar-Free Food And Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Sugar-Free Food And Beverage Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Sugar-Free Food And Beverage Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Sugar-Free Food And Beverage Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: China Sugar-Free Food And Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Sugar-Free Food And Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: India Sugar-Free Food And Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Sugar-Free Food And Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Sugar-Free Food And Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Sugar-Free Food And Beverage Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 30: Global Sugar-Free Food And Beverage Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Sugar-Free Food And Beverage Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Sugar-Free Food And Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Sugar-Free Food And Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Sugar-Free Food And Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Sugar-Free Food And Beverage Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 36: Global Sugar-Free Food And Beverage Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Sugar-Free Food And Beverage Market Revenue billion Forecast, by Country 2020 & 2033

- Table 38: South Africa Sugar-Free Food And Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Sugar-Free Food And Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Sugar-Free Food And Beverage Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sugar-Free Food And Beverage Market?

The projected CAGR is approximately 14.7%.

2. Which companies are prominent players in the Sugar-Free Food And Beverage Market?

Key companies in the market include Nestle SA, The Kellogg Company, PepsiCo Inc, Meadbery*List Not Exhaustive, The Kraft Heinz Company, Mars Incorporated, Mondelez International Inc, The Coca-Cola Company, Strauss Group Ltd, Hostess Brands Inc, The Hershey Company.

3. What are the main segments of the Sugar-Free Food And Beverage Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.35 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sports Participation; Increasing Awareness about Health and Fitness.

6. What are the notable trends driving market growth?

Rising Concern About Lifestyle Diseases.

7. Are there any restraints impacting market growth?

Adverse Effects of Overconsumption of Products.

8. Can you provide examples of recent developments in the market?

March 2023: Voortman Cookies launched zero-sugar mini wafers. The new mini wafers are available in two delectable flavors: vanilla and chocolate. The poppable, shareable wafers are baked with real vanilla or cocoa, include no artificial flavors or colors, no high-fructose corn syrup, and are packaged in resealable stand-up pouches.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sugar-Free Food And Beverage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sugar-Free Food And Beverage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sugar-Free Food And Beverage Market?

To stay informed about further developments, trends, and reports in the Sugar-Free Food And Beverage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence