Key Insights

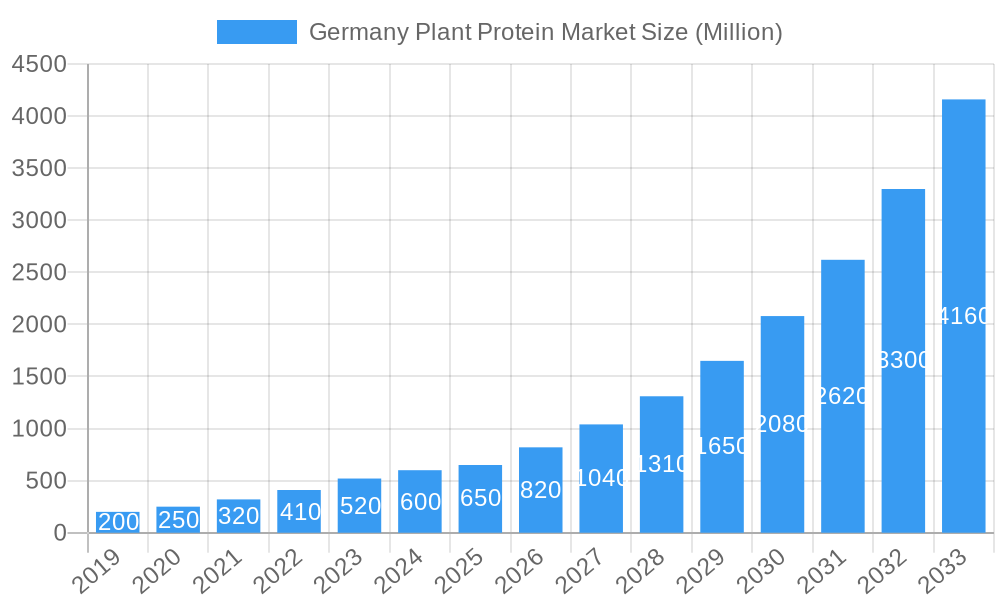

The German plant protein market is projected to reach $0.86 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 4.63% through 2033. This significant growth is driven by increasing consumer demand for healthier, sustainable food choices, heightened awareness of animal agriculture's environmental impact, and a rise in dietary sensitivities like lactose intolerance. Innovations in processing technologies are enhancing the taste, texture, and functionality of plant-based proteins, making them a viable alternative to animal-derived proteins. Key sectors, including Food and Beverages (bakery, dairy alternatives, meat alternatives) and Supplements (sports nutrition, medical applications), are experiencing substantial growth as manufacturers expand their plant-based product offerings.

Germany Plant Protein Market Market Size (In Million)

While the market exhibits strong growth potential, challenges such as elevated raw material costs for specialized plant proteins, consumer perception regarding taste and texture, and navigating the regulatory landscape for novel ingredients require strategic attention. Nevertheless, ongoing research and development, supply chain optimization, and consumer education initiatives are actively addressing these constraints. The German plant protein industry's robust growth trajectory is underpinned by evolving consumer preferences and a strong commitment to sustainability.

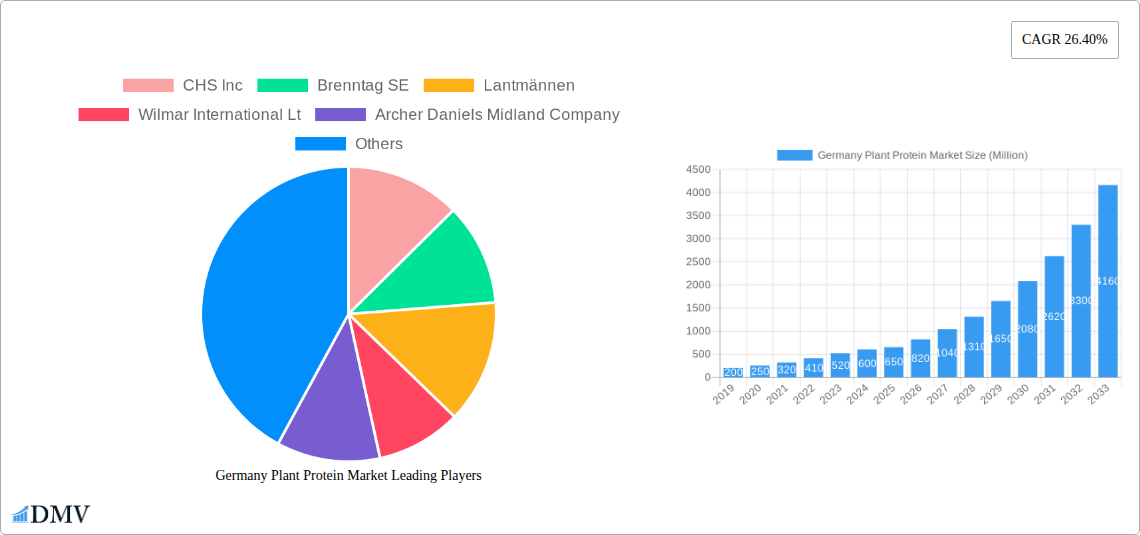

Germany Plant Protein Market Company Market Share

Unlocking the Growth Potential: Germany Plant Protein Market Report 2024-2033

Dive deep into the dynamic German plant protein landscape with this comprehensive market intelligence report. Covering the period from 2019 to 2033, with a base year of 2025, this in-depth analysis provides unparalleled insights into market composition, industry evolution, product innovations, and future opportunities. Gain a strategic advantage with expert segmentation by protein type (Hemp Protein, Pea Protein, Potato Protein, Rice Protein, Soy Protein, Wheat Protein, Other Plant Protein) and end-user applications (Animal Feed, Food and Beverages including Bakery, Breakfast Cereals, Condiments/Sauces, Confectionery, Dairy and Dairy Alternative Products, Meat/Poultry/Seafood and Meat Alternative Products, RTE/RTC Food Products, Snacks; Personal Care and Cosmetics; Supplements including Baby Food and Infant Formula, Elderly Nutrition and Medical Nutrition, Sport/Performance Nutrition). This report is your definitive guide to understanding the drivers, challenges, and trajectory of Germany's burgeoning plant-based protein industry.

Germany Plant Protein Market Market Composition & Trends

The German plant protein market is characterized by a moderate to high market concentration, with a few key players dominating specific segments, while numerous smaller innovators contribute to overall market dynamism. The increasing consumer demand for sustainable, healthy, and ethically sourced food products acts as a significant innovation catalyst, driving research and development into novel protein sources and processing technologies. The regulatory landscape in Germany, while generally supportive of food innovation, imposes stringent quality and safety standards, influencing product development and market entry strategies. Substitute products, primarily animal-based proteins, still hold a significant market share, but the gap is narrowing rapidly due to evolving consumer preferences and the growing acceptance of plant-based alternatives. End-user profiles reveal a strong emphasis on the Food and Beverages sector, particularly in meat alternatives, dairy alternatives, and sports nutrition, while the Animal Feed segment also presents substantial growth potential. Merger and Acquisition (M&A) activities, while not overtly high in reported deal values, indicate strategic consolidation and expansion by major corporations aiming to capture market share and enhance their product portfolios.

- Market Concentration: Dominance of established players in soy and pea protein, with emerging opportunities in hemp and rice proteins.

- Innovation Catalysts: Growing vegan and flexitarian populations, demand for clean labels, and advancements in protein extraction and formulation.

- Regulatory Landscape: Strict food safety regulations (e.g., EFSA guidelines) and a focus on sustainability labeling.

- Substitute Products: Continued competition from animal proteins, but declining price premiums and improving functionality of plant-based options.

- End-User Profiles: High demand in meat/seafood alternatives (XX% of F&B segment), dairy alternatives (XX%), and sports nutrition supplements (XX%).

- M&A Activities: Strategic acquisitions and partnerships focused on technology, raw material sourcing, and market access. Expected M&A deal value in the forecast period is estimated at XXX Million.

Germany Plant Protein Market Industry Evolution

The German plant protein industry has witnessed an impressive growth trajectory over the historical period (2019–2024), fueled by a confluence of factors including escalating consumer awareness regarding health and environmental sustainability, and significant advancements in processing technologies. Early adoption of plant-based diets by a segment of the German population, coupled with a broader trend towards flexitarianism, has created a robust demand for diverse plant protein sources. Technological advancements in protein extraction, isolation, and texturization have been pivotal in improving the taste, texture, and nutritional profile of plant-based products, thereby overcoming historical limitations and enhancing consumer acceptance. For instance, advancements in pea protein processing have led to highly functional isolates with significantly reduced beany notes, making them suitable for a wider array of food applications. Similarly, the development of sophisticated texturization techniques for plant proteins has enabled the creation of meat-like textures, a critical factor in the booming meat alternative market. The market has evolved from a niche offering to a mainstream choice, with an increasing number of food manufacturers integrating plant proteins into their product lines.

Shifting consumer demands are a cornerstone of this evolution. Consumers are not only seeking protein fortification but are also prioritizing natural ingredients, minimal processing, and ethical sourcing. This has spurred innovation in areas like fermented plant proteins and proteins derived from underutilized crops. The Food and Beverages segment, in particular, has been a hotbed of innovation, with plant proteins being incorporated into everything from dairy alternatives and meat substitutes to baked goods and snacks. The Supplements sector, especially sport/performance nutrition and elderly nutrition, has also seen a substantial uptake, driven by the perceived health benefits and allergen-friendliness of plant proteins compared to some animal-derived options. The Animal Feed segment, while more traditional, is also experiencing a shift towards more sustainable and digestible plant protein sources, driven by both cost-effectiveness and environmental concerns. Overall, the industry's evolution reflects a proactive response to societal trends and a continuous drive to enhance the performance and appeal of plant-based protein solutions, positioning Germany as a leading European market for these ingredients. The projected compound annual growth rate (CAGR) for the German plant protein market is estimated at XX% from 2025 to 2033, a testament to its sustained expansion.

Leading Regions, Countries, or Segments in Germany Plant Protein Market

Within the multifaceted German plant protein market, specific segments and product types are demonstrating exceptional leadership, propelled by targeted investments, favorable regulatory support, and evolving consumer preferences. The Food and Beverages segment stands out as the dominant end-user category, driven by a voracious appetite for plant-based alternatives across numerous sub-segments. Within this, Meat/Poultry/Seafood and Meat Alternative Products are experiencing explosive growth, representing a significant portion of the total market value, estimated at XX Billion in 2025. This dominance is fueled by a growing number of consumers actively seeking to reduce their meat consumption for health, environmental, and ethical reasons, leading manufacturers to invest heavily in replicating the taste and texture of animal proteins using plant-based ingredients.

The Dairy and Dairy Alternative Products sub-segment is another powerhouse, with plant-based milk, yogurt, and cheese alternatives rapidly gaining market share, valued at approximately XX Billion in 2025. This growth is attributed to increasing lactose intolerance, a desire for healthier options, and the perceived sustainability benefits of plant-based dairy. Furthermore, the Supplements sector, particularly Sport/Performance Nutrition, is a key driver of plant protein demand, with a market value estimated at XX Billion in 2025. Athletes and fitness enthusiasts are increasingly opting for plant-based protein powders and supplements due to their digestibility, allergen-friendliness, and perceived efficacy.

Analyzing the Protein Type segment, Pea Protein and Soy Protein currently lead the market, commanding a substantial share due to their established functionality, availability, and cost-effectiveness. Pea protein, in particular, has seen a surge in popularity due to its non-GMO status and excellent amino acid profile, with an estimated market share of XX% in 2025. Soy protein, a long-standing staple, continues to be a vital ingredient in numerous food applications, holding an estimated XX% market share. However, Hemp Protein and Rice Protein are emerging as high-growth segments, driven by their unique nutritional profiles and sustainability credentials. Hemp protein, with its balanced omega fatty acid content and rich fiber, is gaining traction in the health and wellness market, while rice protein is being increasingly utilized in allergen-free formulations and meat substitute applications.

- Dominant End User Segment: Food and Beverages (estimated market value of XX Billion in 2025).

- Key Sub-Segments Driving Dominance:

- Meat/Poultry/Seafood and Meat Alternative Products: Valued at XX Billion in 2025, representing strong growth due to flexitarianism.

- Dairy and Dairy Alternative Products: Valued at XX Billion in 2025, driven by health and dietary needs.

- Snacks: Growing demand for protein-fortified snacks, valued at XX Billion in 2025.

- Key Sub-Segments Driving Dominance:

- Leading Protein Types:

- Pea Protein: Holds an estimated XX% market share in 2025, characterized by its functional properties and allergen-friendly nature. Key drivers include innovation in texture and taste, and its appeal in meat alternatives.

- Soy Protein: Commands an estimated XX% market share in 2025, a versatile and cost-effective option widely used in various food applications. Drivers include established supply chains and broad applicability.

- Emerging Protein Types with High Growth Potential:

- Hemp Protein: Driven by its nutritional profile (omega-3, omega-6 fatty acids, fiber) and sustainability, with an estimated market share of XX% in 2025.

- Rice Protein: Gaining traction in allergen-free products and meat substitutes, with an estimated market share of XX% in 2025.

Germany Plant Protein Market Product Innovations

The German plant protein market is witnessing a wave of product innovations, particularly in enhancing functionality, taste, and nutritional completeness. Manufacturers are actively developing novel protein isolates and concentrates with improved solubility, emulsification, and gelling properties, crucial for replicating the sensory attributes of animal-derived products. Innovations are also focused on creating complete protein profiles from single sources or through synergistic blending of different plant proteins, thereby addressing the essential amino acid requirements for consumers. For instance, advancements in enzymatic hydrolysis are yielding plant protein hydrolysates with enhanced digestibility and reduced allergenicity. Furthermore, the development of plant-based protein ingredients with specific texturization capabilities is paving the way for a wider range of meat and seafood alternatives, offering superior bite and chew. These innovations are directly addressing consumer demand for clean labels and minimally processed ingredients, leading to the introduction of new product lines that emphasize natural sourcing and sustainable processing.

Propelling Factors for Germany Plant Protein Market Growth

Several key factors are propelling the growth of the Germany plant protein market. Increasing consumer awareness regarding the health benefits associated with plant-based diets, such as reduced risk of cardiovascular diseases and improved gut health, is a primary driver. The growing global concern over the environmental impact of animal agriculture, including greenhouse gas emissions and land use, is also significantly influencing consumer choices towards more sustainable plant-based protein sources. Technological advancements in the extraction, processing, and formulation of plant proteins have led to improved taste, texture, and nutritional profiles, making them more appealing and versatile for a wider range of applications. Furthermore, supportive government initiatives and policies promoting sustainable food systems and plant-based diets, coupled with expanding product availability in retail and food service channels, are further accelerating market expansion. The projected market size for the German plant protein market is expected to reach XX Billion by 2033.

Obstacles in the Germany Plant Protein Market Market

Despite its robust growth, the Germany plant protein market faces several obstacles. Cost-competitiveness compared to traditional animal proteins remains a challenge for some plant-based alternatives, particularly for certain protein types and specialized applications. Consumer perception and taste preferences can also be a barrier, with some consumers still finding certain plant-based products to have undesirable textures or flavors. Supply chain complexities and raw material variability can impact the consistent quality and availability of certain plant protein sources, potentially leading to price fluctuations. Additionally, regulatory hurdles and evolving labeling requirements can add complexity and cost to market entry and product development. The presence of well-established animal protein industries and their associated marketing power also presents ongoing competitive pressure.

Future Opportunities in Germany Plant Protein Market

The future of the German plant protein market is ripe with opportunities. The expansion into novel protein sources, such as fava bean, lupine, and algae-based proteins, offers a chance to diversify offerings and cater to niche consumer demands. Innovations in fermentation technology can unlock new flavor profiles and enhance the digestibility of plant proteins. The growing demand for plant-based ingredients in the personal care and cosmetics industry, leveraging their moisturizing and anti-aging properties, presents a significant untapped market. Furthermore, the increasing focus on personalized nutrition and functional foods creates opportunities for plant proteins tailored to specific health needs, such as those for athletes, children, or the elderly. The continued development of plant-based dairy alternatives with improved sensory attributes and wider applications will also drive market growth. Emerging markets within Germany, such as underserved regions or specific demographic groups, also represent growth avenues.

Major Players in the Germany Plant Protein Market Ecosystem

- CHS Inc

- Brenntag SE

- Lantmännen

- Wilmar International Lt

- Archer Daniels Midland Company

- Glanbia PLC

- Kerry Group PLC

- Südzucker AG

- Ingredion Incorporated

- A Costantino & C spa

- Roquette Frère

Key Developments in Germany Plant Protein Market Industry

- June 2022: Roquette, a leading plant-based protein manufacturer, launched two innovative rice proteins, Nutralys rice protein isolate and rice protein concentrate, specifically targeting the growing demand for meat substitute applications. This move enhances their portfolio for plant-based meat alternatives.

- May 2022: BENEO, a subsidiary of Südzucker, entered into a purchase agreement to acquire Meatless BV, a functional ingredient producer. This strategic acquisition aims to broaden BENEO's existing product offerings and strengthen its position in providing texturizing solutions for meat and fish alternatives.

- May 2021: Lantmännen's subsidiary, Lantmännen Agroetanol, made a significant investment of SEK 800 million in a new biorefinery in Norrköping. This investment is set to fortify Lantmännen’s market presence in grain-based food ingredients, particularly in gluten production, with the new production line scheduled for full operational status in Q2 2023.

Strategic Germany Plant Protein Market Market Forecast

The strategic forecast for the Germany plant protein market indicates sustained and robust growth, driven by an intrinsic synergy between evolving consumer preferences and continuous technological innovation. The increasing adoption of flexitarian and vegan lifestyles, coupled with a heightened awareness of the environmental and health implications of dietary choices, will continue to fuel demand for plant-based protein solutions across all major end-user segments. Investment in research and development is expected to yield a new generation of plant proteins with enhanced functional properties, superior taste profiles, and comprehensive nutritional completeness, further broadening their appeal and applicability. Emerging opportunities in areas like alternative dairy, plant-based meats, and specialized nutritional supplements will be key growth catalysts. The market is poised for expansion, with strategic collaborations and product diversification playing crucial roles in capitalizing on the significant untapped potential within Germany's dynamic food and beverage industry.

Germany Plant Protein Market Segmentation

-

1. Protein Type

- 1.1. Hemp Protein

- 1.2. Pea Protein

- 1.3. Potato Protein

- 1.4. Rice Protein

- 1.5. Soy Protein

- 1.6. Wheat Protein

- 1.7. Other Plant Protein

-

2. End User

- 2.1. Animal Feed

-

2.2. Food and Beverages

-

2.2.1. By Sub End User

- 2.2.1.1. Bakery

- 2.2.1.2. Breakfast Cereals

- 2.2.1.3. Condiments/Sauces

- 2.2.1.4. Confectionery

- 2.2.1.5. Dairy and Dairy Alternative Products

- 2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 2.2.1.7. RTE/RTC Food Products

- 2.2.1.8. Snacks

-

2.2.1. By Sub End User

- 2.3. Personal Care and Cosmetics

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

Germany Plant Protein Market Segmentation By Geography

- 1. Germany

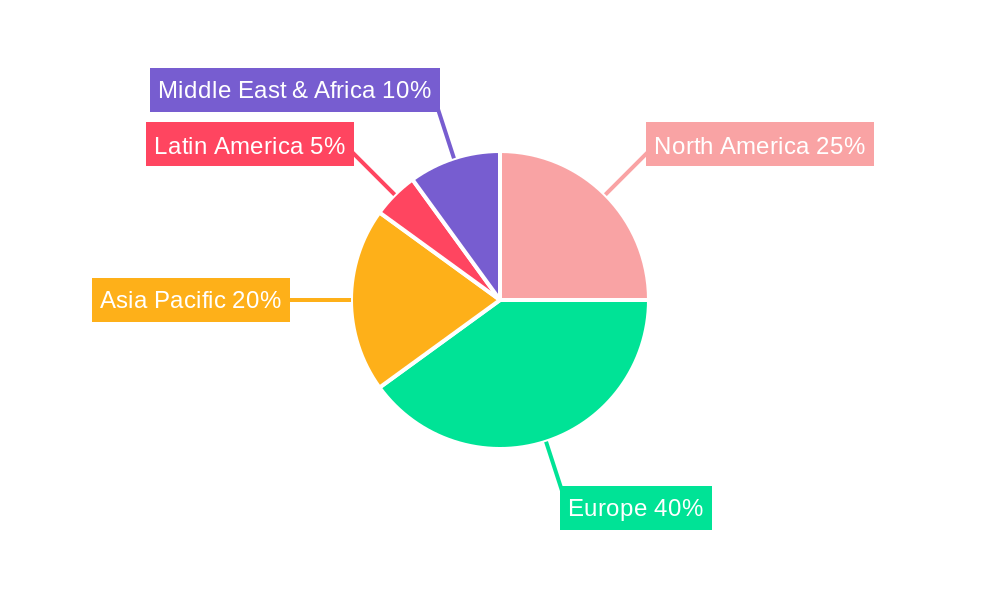

Germany Plant Protein Market Regional Market Share

Geographic Coverage of Germany Plant Protein Market

Germany Plant Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Plant Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 5.1.1. Hemp Protein

- 5.1.2. Pea Protein

- 5.1.3. Potato Protein

- 5.1.4. Rice Protein

- 5.1.5. Soy Protein

- 5.1.6. Wheat Protein

- 5.1.7. Other Plant Protein

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. By Sub End User

- 5.2.2.1.1. Bakery

- 5.2.2.1.2. Breakfast Cereals

- 5.2.2.1.3. Condiments/Sauces

- 5.2.2.1.4. Confectionery

- 5.2.2.1.5. Dairy and Dairy Alternative Products

- 5.2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.2.1.7. RTE/RTC Food Products

- 5.2.2.1.8. Snacks

- 5.2.2.1. By Sub End User

- 5.2.3. Personal Care and Cosmetics

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CHS Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Brenntag SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lantmännen

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wilmar International Lt

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Archer Daniels Midland Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Glanbia PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kerry Group PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Südzucker AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ingredion Incorporated

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 A Costantino & C spa

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Roquette Frère

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 CHS Inc

List of Figures

- Figure 1: Germany Plant Protein Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Plant Protein Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Plant Protein Market Revenue billion Forecast, by Protein Type 2020 & 2033

- Table 2: Germany Plant Protein Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Germany Plant Protein Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Germany Plant Protein Market Revenue billion Forecast, by Protein Type 2020 & 2033

- Table 5: Germany Plant Protein Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Germany Plant Protein Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Plant Protein Market?

The projected CAGR is approximately 4.63%.

2. Which companies are prominent players in the Germany Plant Protein Market?

Key companies in the market include CHS Inc, Brenntag SE, Lantmännen, Wilmar International Lt, Archer Daniels Midland Company, Glanbia PLC, Kerry Group PLC, Südzucker AG, Ingredion Incorporated, A Costantino & C spa, Roquette Frère.

3. What are the main segments of the Germany Plant Protein Market?

The market segments include Protein Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.86 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

June 2022: Roquette, a plant-based protein manufacturer, released two novel rice proteins to address the market demand for meat substitute applications. The new Nutralys rice protein line includes a rice protein isolate and a rice protein concentrate. May 2022: BENEO, a subsidiary of Südzucker, entered a purchase agreement to acquire Meatless BV, a producer of functional ingredients. BENEO is expanding its existing product offering with the acquisition to offer an even broader range of texturizing solutions for meat and fish alternatives.May 2021: Lantmannen's subsidiary, Lantmännen Agroetanol, invested SEK 800 million in a biorefinery in Norrköping. It will strengthen Lantmännen’s position in the market for grain-based food ingredients, specifically gluten production. The new production line is planned to be fully operational during the second quarter of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Plant Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Plant Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Plant Protein Market?

To stay informed about further developments, trends, and reports in the Germany Plant Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence