Key Insights

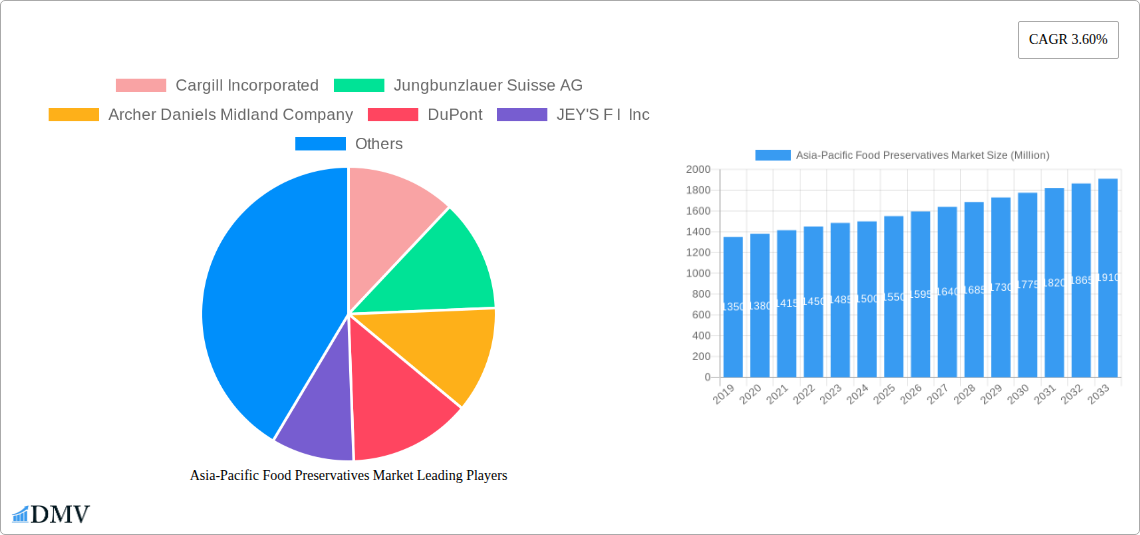

The Asia-Pacific food preservatives market is poised for steady expansion, driven by increasing consumer demand for longer shelf-life products and a growing awareness of food safety and quality. The market, valued at approximately USD 1,500 million in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.60% through 2033. This growth is underpinned by a rising middle class, urbanization, and evolving dietary habits across the region. Natural preservatives are gaining traction due to consumer preference for clean-label products, though synthetic preservatives continue to hold a significant share due to their cost-effectiveness and broad applicability. Key applications like bakery, dairy and frozen products, and confectionery are expected to spearhead demand, leveraging preservatives to maintain freshness, prevent spoilage, and extend product usability. Emerging economies like India and China are anticipated to be major growth hubs, fueled by their large populations and rapidly developing food processing industries.

Asia-Pacific Food Preservatives Market Market Size (In Billion)

However, the market faces certain restraints, including stringent regulatory frameworks surrounding the use of certain preservatives and growing consumer apprehension regarding chemical additives. The rising cost of raw materials for some preservatives could also impact profit margins. Despite these challenges, innovations in preservation technologies, particularly those focusing on natural and bio-preservatives, are expected to create new opportunities. The competitive landscape features established global players like Cargill Incorporated, Archer Daniels Midland Company, and DuPont, alongside regional specialists. Strategic collaborations, research and development investments, and a focus on sustainable sourcing will be crucial for companies to maintain and enhance their market position in this dynamic region. The trend towards convenience foods and ready-to-eat meals further bolsters the demand for effective preservation solutions, ensuring continued market relevance.

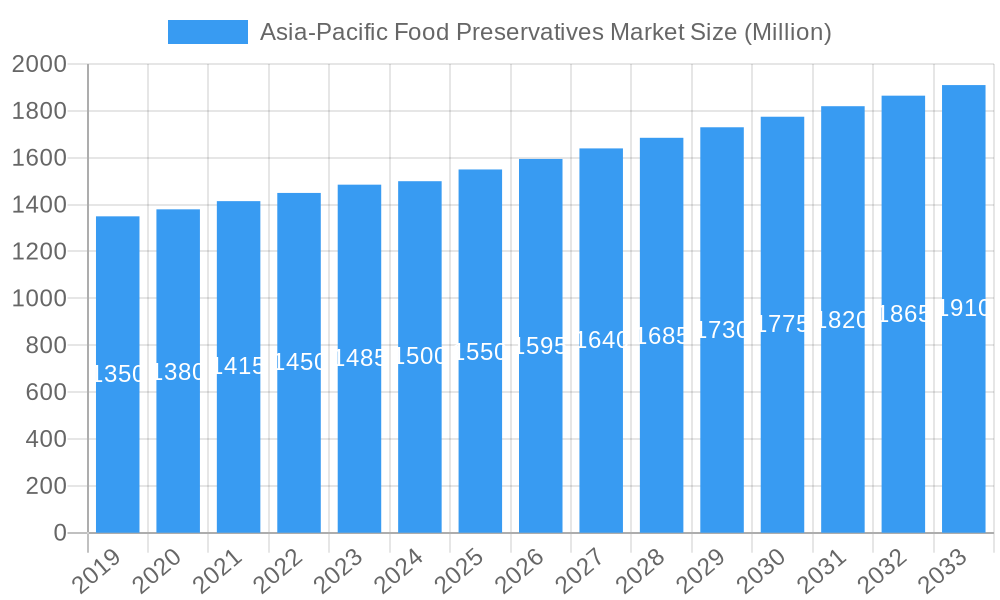

Asia-Pacific Food Preservatives Market Company Market Share

Here is the SEO-optimized and insightful report description for the Asia-Pacific Food Preservatives Market:

Asia-Pacific Food Preservatives Market: Comprehensive Analysis & Strategic Forecast (2019-2033)

This in-depth report provides a panoramic view of the burgeoning Asia-Pacific food preservatives market, a critical sector for ensuring food safety, extending shelf-life, and meeting the evolving demands of a rapidly growing population. From natural solutions to advanced synthetic compounds, this study meticulously analyzes market dynamics, industry trends, and future trajectories. With a focus on key applications like bakery, dairy, meat, and beverages, and granular segmentation across China, India, Japan, Australia, and the Rest of Asia-Pacific, this report is an indispensable resource for stakeholders seeking to navigate this dynamic landscape. Our extensive research covers the historical period (2019-2024), the base and estimated year (2025), and extends to a comprehensive forecast period (2025-2033), offering actionable insights and strategic foresight.

Asia-Pacific Food Preservatives Market Market Composition & Trends

The Asia-Pacific food preservatives market is characterized by a dynamic interplay of established players and emerging innovators, driving significant market concentration shifts. Key trends include an accelerating demand for natural food preservatives derived from sources like fruits, vegetables, and microorganisms, driven by heightened consumer awareness regarding health and wellness. Conversely, the synthetic food preservatives segment continues to hold a substantial share, particularly in applications requiring robust and cost-effective solutions for dairy and frozen products, meat, poultry, and seafood, and confectionery. Regulatory landscapes are evolving, with governments prioritizing food safety standards, influencing product development and market access. Substitute products, such as advanced packaging technologies and novel processing methods, present a growing challenge, necessitating continuous innovation in preservation techniques. End-user profiles are increasingly diverse, ranging from large-scale food manufacturers to smaller artisanal producers, each with unique preservation needs. Mergers and acquisitions (M&A) are a significant catalyst for market growth and consolidation, with recent deal values in the high tens to hundreds of millions for strategically positioned companies. The market share distribution sees major players like Cargill Incorporated and DuPont holding significant portions, with smaller, specialized companies carving out niches.

Asia-Pacific Food Preservatives Market Industry Evolution

The Asia-Pacific food preservatives market has witnessed a remarkable transformation over the historical period and is poised for continued exponential growth. The industry's evolution is primarily sculpted by escalating consumer preference for clean-label products, thereby fueling the demand for natural food preservatives. This shift has propelled research and development into plant-based and fermentation-derived preservatives, offering viable alternatives to traditional synthetic options. Concurrently, advancements in synthetic food preservatives continue to offer enhanced efficacy and cost-effectiveness for a wide array of applications, including bakery, dairy and frozen products, and meat, poultry, and seafood. Technological innovations are at the forefront, with companies investing heavily in novel extraction and synthesis methods to improve preservative performance, safety profiles, and sustainability. For instance, the development of microencapsulation technologies allows for controlled release of preservatives, optimizing their effectiveness and minimizing usage. Market growth trajectories have been consistently upward, with projected Compound Annual Growth Rates (CAGRs) in the range of 5% to 7% throughout the forecast period. This growth is underpinned by increasing disposable incomes across the region, leading to higher consumption of processed and packaged foods. Shifting consumer demands also extend to a greater emphasis on allergen-free and non-GMO preservatives, pushing manufacturers to diversify their portfolios. The adoption of these advanced preservative solutions is evident in the increasing number of product launches featuring these attributes. Investment in R&D for plant-based preservatives by leading companies underscores a strategic pivot towards sustainable and consumer-preferred ingredients, further shaping the industry's future. The expansion of the processed food industry, driven by urbanization and changing lifestyles, acts as a perpetual growth engine for the food preservatives market.

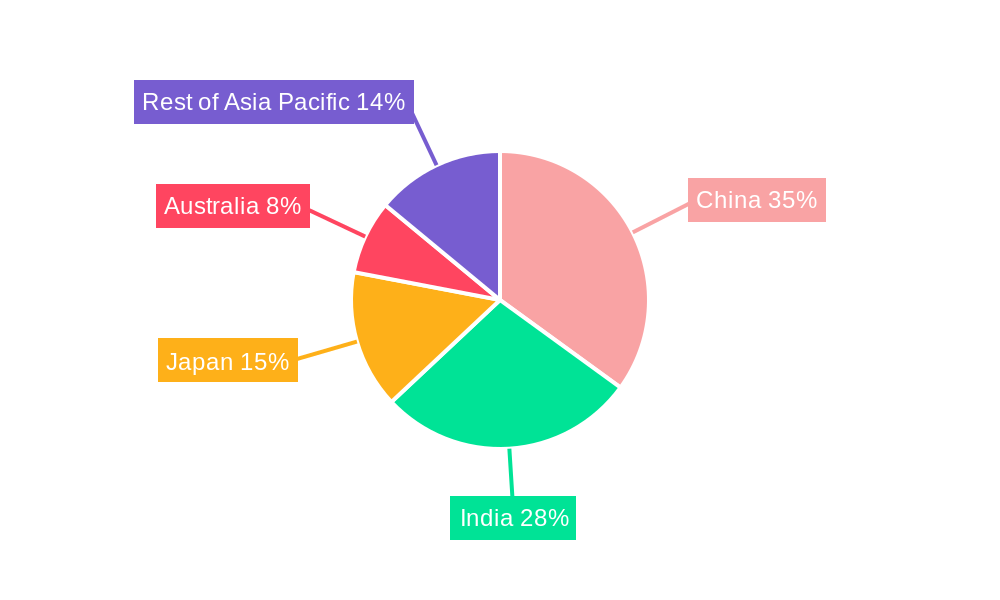

Leading Regions, Countries, or Segments in Asia-Pacific Food Preservatives Market

The China segment stands as a dominant force within the Asia-Pacific food preservatives market, propelled by its massive population, rapidly expanding food processing industry, and significant inbound and outbound trade of food products. The sheer scale of consumption across its diverse applications, including bakery, dairy and frozen products, confectionery, meat, poultry, and seafood, and beverages, makes it the largest contributor to market revenue. This dominance is further amplified by substantial government initiatives aimed at improving food safety standards and promoting local food production, which indirectly stimulates the demand for effective preservation solutions.

- Key Drivers in China:

- Massive Consumer Base: A population exceeding 1.4 billion drives unparalleled demand for a wide range of processed and packaged foods.

- Government Food Safety Regulations: Stringent regulations necessitate the use of effective preservatives to ensure product safety and compliance.

- Growth of the Food Processing Sector: Significant investments in modern food processing infrastructure and technology fuel the need for advanced preservation methods.

- Rising Disposable Incomes: Increasing consumer spending power translates to a higher demand for convenience foods and ready-to-eat meals, requiring preservation.

- Innovation Hub: China is increasingly a hub for food technology innovation, including the development and adoption of new preservative solutions.

Following closely is India, a market characterized by its rapidly growing middle class, a vast agricultural base, and a burgeoning demand for processed and convenience foods. The natural food preservatives segment is gaining significant traction in India due to a deeply ingrained preference for traditional, naturally preserved foods and a growing awareness of the health benefits of natural ingredients. However, the synthetic food preservatives segment remains robust, particularly in the production of staple processed foods and beverages.

- Key Drivers in India:

- Young and Growing Population: A large demographic of young consumers drives demand for innovative and convenient food products.

- Urbanization: The rapid shift of populations to urban centers fuels the demand for processed and packaged foods requiring preservation.

- Growth in Food Retail and E-commerce: The expansion of modern retail formats and online grocery platforms increases the availability and consumption of preserved foods.

- Government Support for Food Processing: Initiatives like "Make in India" encourage investment in the food processing sector, boosting demand for preservatives.

- Emergence of 'Clean Label' Trend: Growing consumer consciousness is fostering a strong demand for natural and minimally processed preservatives.

Japan represents a mature market with a sophisticated consumer base that highly values quality, safety, and convenience. While the demand for natural food preservatives is strong, especially for premium products, the market also utilizes advanced synthetic food preservatives to maintain the integrity of its diverse culinary offerings, including traditional and Western-style foods.

- Key Drivers in Japan:

- High Standards for Food Quality and Safety: An exceptionally demanding consumer base necessitates highly effective and safe preservation solutions.

- Aging Population: This demographic trend drives demand for convenient, long-shelf-life food products.

- Technological Sophistication: Japan is at the forefront of adopting and developing advanced food preservation technologies.

- Strong Export Market: The need to maintain product quality for international export markets influences preservative choices.

Australia presents a unique market, balancing a demand for high-quality, natural products with the needs of a significant export-oriented food industry. The natural food preservatives segment is particularly strong, aligning with consumer preferences for healthy and sustainably produced food.

- Key Drivers in Australia:

- Consumer Preference for Natural and Organic: A strong and growing demand for natural and organic food products.

- Export-Oriented Food Industry: The need for effective preservation to maintain product quality during long-distance transportation.

- Stricter Food Safety Standards: Adherence to stringent regulatory requirements for imported and domestically produced food.

The Rest of Asia-Pacific encompasses a diverse group of developing economies with rapidly expanding food processing sectors. Countries like South Korea, Taiwan, Southeast Asian nations (e.g., Indonesia, Thailand, Vietnam, Malaysia, Philippines), and the Pacific Islands collectively represent a significant growth frontier for food preservatives, driven by increasing urbanization, rising disposable incomes, and a growing demand for a wider variety of processed foods. The synthetic food preservatives segment is expected to witness substantial growth in these regions, alongside a growing, albeit nascent, demand for natural food preservatives.

- Key Drivers in Rest of Asia-Pacific:

- Rapid Economic Growth: Increasing disposable incomes and a growing middle class are fueling demand for processed foods.

- Urbanization and Changing Lifestyles: A shift towards convenience foods and Westernized diets.

- Investment in Food Infrastructure: Development of modern food processing facilities and cold chains.

- Emerging Middle Class: This demographic is increasingly demanding diverse food options requiring preservation.

Asia-Pacific Food Preservatives Market Product Innovations

Product innovation in the Asia-Pacific food preservatives market is heavily focused on enhancing natural alternatives and improving the efficacy and safety of synthetic compounds. Key advancements include the development of novel antimicrobial peptides derived from fermentation, offering broad-spectrum preservation without altering taste or texture. For instance, the launch of plant-derived antioxidant blends by leading companies provides extended shelf-life for oils and fats in bakery and confectionery products. Furthermore, innovations in encapsulation technologies for both natural and synthetic preservatives are allowing for targeted delivery and controlled release, optimizing their performance in complex food matrices such as sauces and salad mixes. These advancements not only extend product shelf-life but also address consumer demand for "cleaner" labels and improved nutritional profiles. Performance metrics such as reduction in spoilage rates, improved color stability, and maintenance of flavor are critical in validating these innovations.

Propelling Factors for Asia-Pacific Food Preservatives Market Growth

The Asia-Pacific food preservatives market is propelled by a confluence of powerful factors. A primary driver is the escalating demand for processed and convenience foods, fueled by rapid urbanization, changing lifestyles, and a growing middle class with increased disposable incomes. Technological advancements in preservation techniques, including the development of novel natural preservatives and improved synthetic formulations, are crucial. Regulatory frameworks promoting food safety and extending shelf-life also play a significant role. Furthermore, the increasing global trade of food products necessitates robust preservation methods to ensure quality and safety during transit.

Obstacles in the Asia-Pacific Food Preservatives Market Market

Despite its robust growth, the Asia-Pacific food preservatives market faces several obstacles. Stringent and evolving regulatory landscapes across different countries can create complexities in market entry and product approval. The growing consumer preference for "clean label" products and negative perceptions surrounding certain synthetic preservatives pose a challenge to market acceptance, pushing manufacturers to invest heavily in natural alternatives. Supply chain disruptions, particularly for raw materials used in natural preservatives, can impact availability and cost. Additionally, intense price competition among numerous regional and global players can squeeze profit margins.

Future Opportunities in Asia-Pacific Food Preservatives Market

Emerging opportunities in the Asia-Pacific food preservatives market are vast and varied. The expanding demand for functional foods and beverages presents opportunities for preservatives that also offer health benefits, such as antioxidant properties. The rise of e-commerce and a growing online grocery market create new avenues for direct-to-consumer sales of preserved products. Furthermore, the increasing adoption of sustainable and eco-friendly packaging solutions can be synergistic with the use of biodegradable or naturally sourced preservatives. Technological advancements in areas like precision fermentation for producing novel antimicrobial compounds also offer significant future potential.

Major Players in the Asia-Pacific Food Preservatives Market Ecosystem

- Cargill Incorporated

- Jungbunzlauer Suisse AG

- Archer Daniels Midland Company

- DuPont

- JEY'S F I Inc

- Kerry Group

- Koninklijke DSM NV

- Corbion NV

Key Developments in Asia-Pacific Food Preservatives Market Industry

- 2022: Corbion NV acquired Thai Preservatives, a strategic move to expand its natural preservative offerings and manufacturing capabilities in the vital Southeast Asian market.

- 2021: DuPont launched a new range of natural preservative solutions, enhancing its portfolio of clean-label ingredients and responding to growing consumer demand for healthier food options.

- 2020: Archer Daniels Midland Company significantly invested in the research and development of plant-based preservatives, signaling a long-term commitment to sustainable preservation technologies and product innovation.

Strategic Asia-Pacific Food Preservatives Market Market Forecast

The strategic forecast for the Asia-Pacific food preservatives market is exceptionally optimistic, driven by a powerful combination of demographic shifts, economic development, and evolving consumer preferences. The relentless urbanization and the resultant surge in processed food consumption, coupled with increasing disposable incomes, will continue to underpin demand for both natural and synthetic preservatives. Innovations in natural preservatives, driven by consumer desire for clean-label products, are expected to witness accelerated adoption. Investments in R&D for sustainable and effective solutions, alongside strategic M&A activities, will further shape market dynamics. The robust growth in key segments like bakery, dairy, and meat products, along with emerging applications, ensures a sustained upward trajectory, promising significant market potential for stakeholders who can effectively leverage these growth catalysts and adapt to the evolving landscape.

Asia-Pacific Food Preservatives Market Segmentation

-

1. Type

- 1.1. Natural

- 1.2. Synthetic

-

2. Application

- 2.1. Bakery

- 2.2. Dairy and Frozen Products

- 2.3. Confectionery

- 2.4. Meat, Poultry and Seafood

- 2.5. Beverages

- 2.6. Sauces and Salad Mixes

- 2.7. Other Applications

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

Asia-Pacific Food Preservatives Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Australia

- 5. Rest of Asia Pacific

Asia-Pacific Food Preservatives Market Regional Market Share

Geographic Coverage of Asia-Pacific Food Preservatives Market

Asia-Pacific Food Preservatives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. China Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Food Preservatives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Natural

- 5.1.2. Synthetic

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Dairy and Frozen Products

- 5.2.3. Confectionery

- 5.2.4. Meat, Poultry and Seafood

- 5.2.5. Beverages

- 5.2.6. Sauces and Salad Mixes

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Food Preservatives Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Natural

- 6.1.2. Synthetic

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bakery

- 6.2.2. Dairy and Frozen Products

- 6.2.3. Confectionery

- 6.2.4. Meat, Poultry and Seafood

- 6.2.5. Beverages

- 6.2.6. Sauces and Salad Mixes

- 6.2.7. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia-Pacific Food Preservatives Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Natural

- 7.1.2. Synthetic

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bakery

- 7.2.2. Dairy and Frozen Products

- 7.2.3. Confectionery

- 7.2.4. Meat, Poultry and Seafood

- 7.2.5. Beverages

- 7.2.6. Sauces and Salad Mixes

- 7.2.7. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia-Pacific Food Preservatives Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Natural

- 8.1.2. Synthetic

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bakery

- 8.2.2. Dairy and Frozen Products

- 8.2.3. Confectionery

- 8.2.4. Meat, Poultry and Seafood

- 8.2.5. Beverages

- 8.2.6. Sauces and Salad Mixes

- 8.2.7. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia Asia-Pacific Food Preservatives Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Natural

- 9.1.2. Synthetic

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bakery

- 9.2.2. Dairy and Frozen Products

- 9.2.3. Confectionery

- 9.2.4. Meat, Poultry and Seafood

- 9.2.5. Beverages

- 9.2.6. Sauces and Salad Mixes

- 9.2.7. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia-Pacific Food Preservatives Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Natural

- 10.1.2. Synthetic

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Bakery

- 10.2.2. Dairy and Frozen Products

- 10.2.3. Confectionery

- 10.2.4. Meat, Poultry and Seafood

- 10.2.5. Beverages

- 10.2.6. Sauces and Salad Mixes

- 10.2.7. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cargill Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jungbunzlauer Suisse AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Archer Daniels Midland Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DuPont

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 JEY'S F I Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kerry Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Koninklijke DSM NV

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Corbion NV

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Cargill Incorporated

List of Figures

- Figure 1: Asia-Pacific Food Preservatives Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Food Preservatives Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 19: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Food Preservatives Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Food Preservatives Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Asia-Pacific Food Preservatives Market?

Key companies in the market include Cargill Incorporated, Jungbunzlauer Suisse AG, Archer Daniels Midland Company, DuPont, JEY'S F I Inc, Kerry Group, Koninklijke DSM NV, Corbion NV.

3. What are the main segments of the Asia-Pacific Food Preservatives Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

China Dominates the Market.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

1. Acquisition of Thai Preservatives by Corbion in 2022 2. Launch of natural preservative solutions by DuPont in 2021 3. Investment in R&D of plant-based preservatives by Archer Daniels Midland Company in 2020

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Food Preservatives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Food Preservatives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Food Preservatives Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Food Preservatives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence