Key Insights

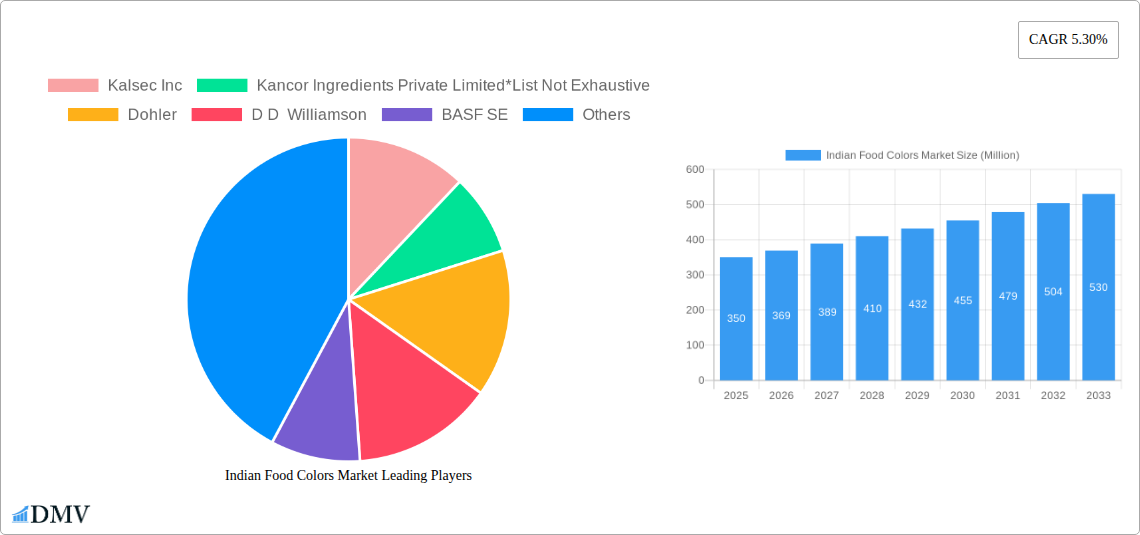

The Indian food colors market is projected for substantial growth, driven by increasing consumer demand for visually appealing food products and an expanding processed food sector. The market, valued at $4.83 billion in 2025, is anticipated to grow at a CAGR of 6.3% by 2033. This expansion is primarily fueled by a rising demand for natural food colorants derived from fruits, vegetables, and other botanical sources, aligning with consumer preferences for clean labels and healthier options. Growing middle-class incomes and increased consumption of packaged foods, beverages, dairy, bakery, and confectionery products further bolster this demand. Government initiatives like "Make in India" and support for the food processing industry are also encouraging domestic manufacturers, fostering innovation and meeting regional preferences.

Indian Food Colors Market Market Size (In Billion)

While the market exhibits strong growth, certain challenges exist. Fluctuations in raw material costs, especially for natural colorants, can affect profitability. Stringent regulations on synthetic food colors and ongoing discussions regarding their health impacts also pose hurdles. Nevertheless, the trend towards natural and organic ingredients, coupled with advancements in extraction and stabilization technologies for natural colors, is expected to offset these challenges. The market is segmented into natural and synthetic colors, with a clear shift towards natural alternatives. Key application areas include beverages, dairy and frozen products, bakery, confectionery, and meat, poultry, and seafood. Leading companies are investing in R&D for innovative and sustainable food color solutions in the Indian market.

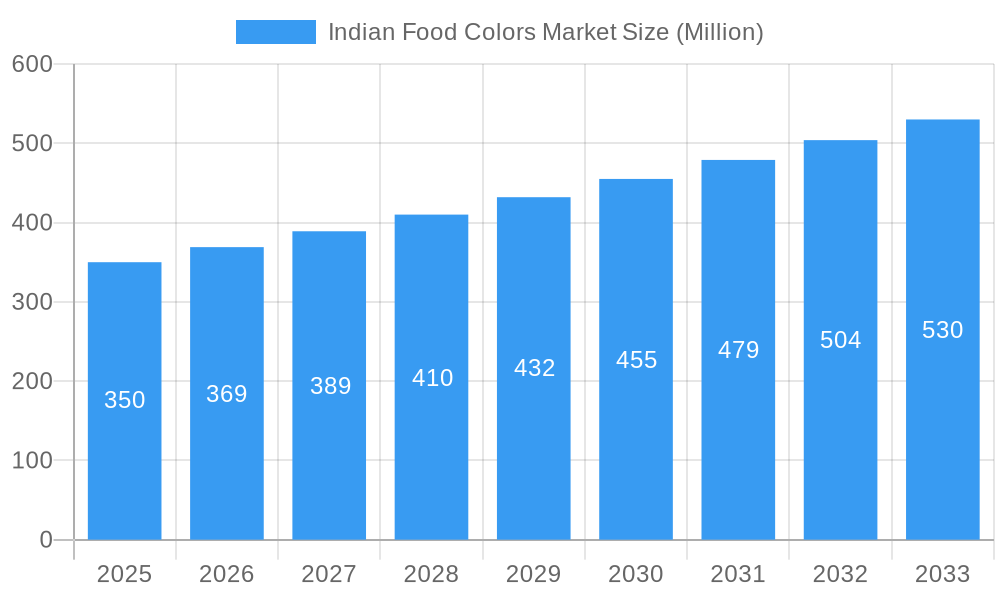

Indian Food Colors Market Company Market Share

This report offers a comprehensive analysis of the Indian food colors market, covering its structure, trends, and future outlook from 2019 to 2033, with 2025 as the base year. It provides critical insights for stakeholders aiming to leverage opportunities in this dynamic sector, examining market drivers, key players, technological advancements, and evolving consumer preferences shaping the Indian food colors industry.

Indian Food Colors Market Market Composition & Trends

The Indian food colors market exhibits a dynamic composition characterized by a growing emphasis on natural alternatives and a robust demand from diverse food and beverage applications. Market concentration is influenced by both established global players and emerging domestic manufacturers, each vying for market share through innovation and strategic partnerships. Key innovation catalysts include advancements in extraction technologies for natural colors, improved stability and color intensity of synthetic variants, and increasing consumer awareness regarding health and wellness. The regulatory landscape, though evolving, plays a crucial role in defining product standards and market entry barriers. Substitute products, primarily from traditional sources or less processed ingredients, offer consumers alternatives, albeit with varying color performance. End-user profiles are broad, encompassing large-scale food manufacturers, small and medium-sized enterprises (SMEs), and niche product developers. Mergers and acquisitions (M&A) activities are projected to gain traction as companies seek to expand their product portfolios, geographical reach, and technological capabilities. For instance, M&A deal values are estimated to reach a cumulative XX Million in the forecast period.

- Market Share Distribution:

- Natural Colors: Estimated XX%

- Synthetic Colors: Estimated XX%

- Key Innovation Drivers:

- Enhanced stability and shelf-life of natural colorants.

- Development of novel colors from underutilized botanical sources.

- Technological advancements in color encapsulation for improved application.

- Regulatory Influence:

- Strict adherence to FSSAI (Food Safety and Standards Authority of India) guidelines.

- Evolving norms on permissible levels of synthetic food colorants.

- M&A Activity:

- Strategic acquisitions to broaden product offerings.

- Consolidation to achieve economies of scale.

Indian Food Colors Market Industry Evolution

The Indian food colors market has witnessed significant evolution driven by a confluence of factors. Historically, synthetic colors dominated the market due to their cost-effectiveness and vibrant hues. However, the past decade has seen a paradigm shift, propelled by increasing consumer consciousness about health and the potential adverse effects of artificial additives. This has led to a substantial surge in demand for natural food colors, derived from sources like fruits, vegetables, and spices. Technological advancements have been instrumental in this transition, enabling the development of natural colorants with improved stability, brighter shades, and a wider application spectrum. For example, advancements in extraction and purification techniques have unlocked the potential of previously overlooked natural sources, making them commercially viable. The market growth trajectory has been consistently upward, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period. Shifting consumer demands are at the heart of this transformation. Consumers are increasingly scrutinizing ingredient lists, favoring products that are perceived as "clean label" and free from artificial additives. This preference is not limited to urban areas; it is gradually permeating Tier 2 and Tier 3 cities as well, influenced by social media trends and increased awareness campaigns. This evolving demand has compelled manufacturers to invest heavily in research and development for natural color solutions. The adoption rate of natural food colors has accelerated, now accounting for an estimated XX% of the total market. Concurrently, the synthetic food colors segment, while still significant, is experiencing a slower growth rate, with some applications witnessing a decline due to regulatory pressures and consumer preference for natural alternatives. The Indian food colors market is thus a testament to how evolving consumer demands and technological innovation can reshape an entire industry, driving it towards more sustainable and health-conscious solutions.

Leading Regions, Countries, or Segments in Indian Food Colors Market

The Indian food colors market is characterized by dominant segments and regions that are steering its growth and innovation. Among the product types, Natural Color is emerging as the leading segment, driven by the overwhelming consumer preference for clean-label products and growing health consciousness. This segment is expected to capture a significant market share, estimated at XX% by 2033. The demand for vibrant and appealing natural colorants is soaring across various applications, pushing manufacturers to invest in research and development to enhance their performance and stability.

The Beverages application segment stands out as a dominant force, accounting for a substantial portion of the market, estimated at XX% in 2025. The sheer volume and variety of beverages consumed in India, ranging from soft drinks and juices to dairy-based drinks and alcoholic beverages, necessitate the use of food colors to enhance visual appeal and brand identity.

Dominant Product Type: Natural Color

- Drivers:

- Growing consumer demand for health-conscious and clean-label products.

- Increasing awareness of the potential side effects of synthetic dyes.

- Technological advancements in extraction and stabilization of natural pigments.

- Favorable regulatory shifts encouraging the use of natural alternatives.

- Analysis: The shift towards natural colors is a fundamental transformation. Consumers are actively seeking products free from artificial additives, making natural colorants a preferred choice for manufacturers across all food categories. This trend is further supported by innovations that are making natural colors more versatile and cost-effective.

- Drivers:

Dominant Application: Beverages

- Drivers:

- High consumption volume of a wide array of beverages in India.

- Need for aesthetic appeal to attract consumers and differentiate brands.

- Versatility of food colors in masking natural variations in fruit and vegetable juices.

- Growth of the ready-to-drink (RTD) beverage market.

- Analysis: The beverage industry is a primary consumer of food colors, and its continued expansion in India directly fuels the demand for both natural and synthetic colorants. The ability of colors to enhance the visual appeal of beverages is crucial for market success, making this segment a consistent growth engine for the Indian food colors market.

- Drivers:

Indian Food Colors Market Product Innovations

Innovation in the Indian food colors market is primarily focused on enhancing the performance and sustainability of natural colorants. Recent advancements include the development of microencapsulated natural colors, offering superior heat and light stability for demanding applications like baking and processed meats. Novel extraction techniques are yielding brighter, more consistent hues from botanical sources previously underutilized. Performance metrics such as color fastness, pH stability, and solubility are continuously being improved, making natural colors a viable and often superior alternative to synthetics. Unique selling propositions lie in the ability to achieve specific color profiles and meet stringent clean-label requirements, catering to the evolving demands of health-conscious consumers and stringent regulatory bodies.

Propelling Factors for Indian Food Colors Market Growth

Several key factors are propelling the Indian food colors market. The escalating consumer demand for "natural" and "clean label" products is a primary driver, pushing manufacturers to reformulate their products with plant-based colorants. Technological advancements in extraction, purification, and stabilization of natural colors are making them more commercially viable and versatile. Additionally, growing health consciousness and increased awareness about the potential adverse effects of synthetic food dyes are contributing significantly. Government initiatives promoting food processing and standardization, coupled with a rising disposable income leading to increased expenditure on processed foods and beverages, are further bolstering market growth.

Obstacles in the Indian Food Colors Market Market

Despite the promising growth, the Indian food colors market faces certain obstacles. The cost-effectiveness of synthetic colors remains a challenge for some manufacturers, especially in price-sensitive segments. Ensuring the consistent quality and supply of natural raw materials can be complex due to seasonal variations and agricultural practices. Stringent and sometimes evolving regulatory frameworks, while beneficial for consumer safety, can also lead to compliance challenges and increased production costs for manufacturers. Furthermore, consumer education is still required to fully appreciate the benefits and efficacy of high-quality natural food colors.

Future Opportunities in Indian Food Colors Market

The Indian food colors market presents numerous future opportunities. The increasing penetration of processed foods in smaller towns and rural areas offers a significant untapped market. The development of novel natural colorants from indigenous Indian flora with unique color profiles and health benefits is a promising avenue. Furthermore, exploring applications in the growing nutraceutical and pharmaceutical sectors, where coloration plays a role in product identification and patient compliance, presents exciting prospects. The continued demand for plant-based and vegan food products will also drive innovation and market expansion for natural food colors.

Major Players in the Indian Food Colors Market Ecosystem

- Kalsec Inc

- Kancor Ingredients Private Limited

- Dohler

- D D Williamson

- BASF SE

- Riken Vitamin Co Ltd

- Chr Hansen Holding A / S

Key Developments in Indian Food Colors Market Industry

- 2023: Launch of new range of stable natural color solutions by Kancor Ingredients, catering to bakery and confectionery applications.

- 2023: BASF SE expands its portfolio of natural food colorants, focusing on enhancing carotenoid-based colors for the beverage industry.

- 2024: Chr Hansen Holding A / S announces strategic partnerships to increase the sourcing of premium natural color ingredients within India.

- 2024: D D Williamson invests in advanced R&D for anthocyanin-based colors to meet growing demand in dairy and frozen products.

- 2024: Dohler introduces innovative color solutions for meat and seafood applications, focusing on visual appeal and shelf-life extension.

Strategic Indian Food Colors Market Market Forecast

The Indian food colors market is poised for robust growth, driven by the unwavering shift towards natural and clean-label products. Innovations in extraction and stabilization technologies for natural colorants will continue to expand their application scope, making them more competitive and versatile. The growing health consciousness among Indian consumers, coupled with supportive government policies for food processing, will act as significant growth catalysts. The market will witness increased consolidation and strategic partnerships as players aim to secure raw material supply chains and enhance their product portfolios. The forecast indicates a dynamic and expanding market, with natural colors leading the charge and opening new avenues for growth and innovation.

Indian Food Colors Market Segmentation

-

1. Product Type

- 1.1. Natural Color

- 1.2. Synthetic Color

-

2. Application

- 2.1. Beverages

- 2.2. Dairy and Frozen Products

- 2.3. Bakery

- 2.4. Meat, Poultry, and Seafood

- 2.5. Confectionery

- 2.6. Oils and Fats

- 2.7. Other Applications

Indian Food Colors Market Segmentation By Geography

- 1. India

Indian Food Colors Market Regional Market Share

Geographic Coverage of Indian Food Colors Market

Indian Food Colors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Health Consciousness among consumer

- 3.3. Market Restrains

- 3.3.1. High Cost of natural Ingredients

- 3.4. Market Trends

- 3.4.1. Easy Availability of Raw Materials

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indian Food Colors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Natural Color

- 5.1.2. Synthetic Color

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Beverages

- 5.2.2. Dairy and Frozen Products

- 5.2.3. Bakery

- 5.2.4. Meat, Poultry, and Seafood

- 5.2.5. Confectionery

- 5.2.6. Oils and Fats

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kalsec Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kancor Ingredients Private Limited*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dohler

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 D D Williamson

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BASF SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Riken Vitamin Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Chr Hansen Holding A / S

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Kalsec Inc

List of Figures

- Figure 1: Indian Food Colors Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Indian Food Colors Market Share (%) by Company 2025

List of Tables

- Table 1: Indian Food Colors Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Indian Food Colors Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Indian Food Colors Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Indian Food Colors Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Indian Food Colors Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Indian Food Colors Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indian Food Colors Market?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Indian Food Colors Market?

Key companies in the market include Kalsec Inc, Kancor Ingredients Private Limited*List Not Exhaustive, Dohler, D D Williamson, BASF SE, Riken Vitamin Co Ltd, Chr Hansen Holding A / S.

3. What are the main segments of the Indian Food Colors Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.83 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Health Consciousness among consumer.

6. What are the notable trends driving market growth?

Easy Availability of Raw Materials.

7. Are there any restraints impacting market growth?

High Cost of natural Ingredients.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indian Food Colors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indian Food Colors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indian Food Colors Market?

To stay informed about further developments, trends, and reports in the Indian Food Colors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence