Key Insights

The U.S. Jam, Jelly, and Preserves market is projected for significant growth, expected to reach $5.81 billion by 2025, with a robust CAGR of 16.8% through 2033. This expansion is driven by shifting consumer preferences towards artisanal and premium fruit spreads, coupled with the increasing demand for convenient breakfast and snack options. The market offers a diverse product range, from traditional jams and jellies to sophisticated marmalades and fruit-rich preserves, catering to varied tastes. Distribution channels are diversifying, with online retail gaining prominence alongside established supermarket and hypermarket presence, reflecting evolving shopping habits. Convenience stores also facilitate on-the-go accessibility. Key players are prioritizing product innovation, introducing organic, low-sugar, and unique flavor varieties to attract health-conscious consumers and capture market share.

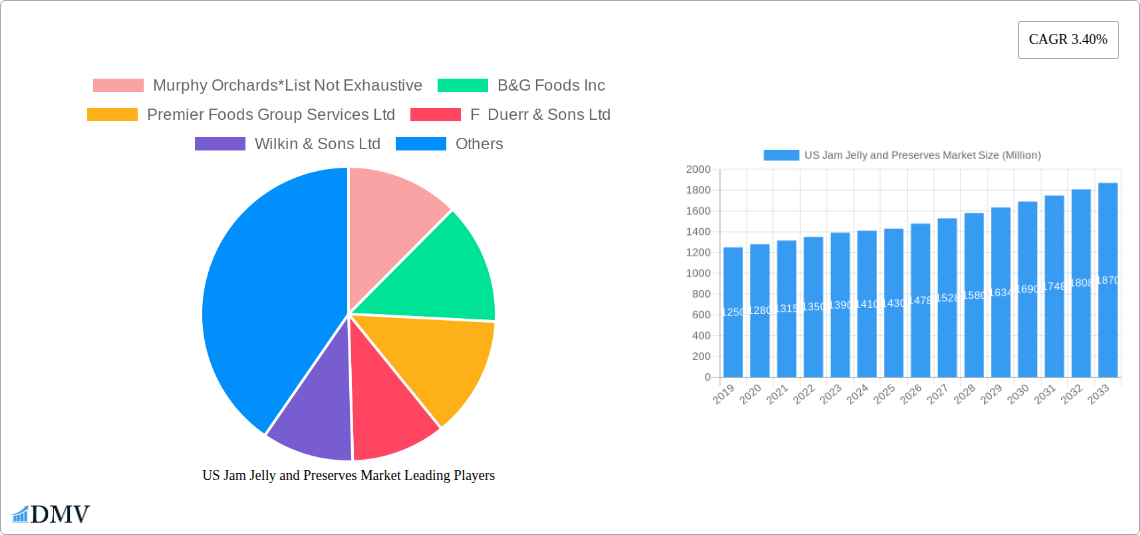

US Jam Jelly and Preserves Market Market Size (In Billion)

Demographic shifts and evolving lifestyles further support the U.S. jam, jelly, and preserves market's growth. The escalating demand for convenient, ready-to-eat food items, particularly among busy households and younger consumers, positions these fruit spreads as a versatile solution. Growing interest in health and wellness fuels demand for products with natural ingredients and reduced sugar, prompting manufacturers to innovate and explore new ingredient sources. Despite the positive outlook, challenges include rising raw material costs for fruits and intense competition from established and emerging niche brands, potentially impacting profit margins. Stringent food production and labeling regulations also add operational complexity. However, strategic marketing, product differentiation through unique flavors and premium positioning, and expanded distribution networks are anticipated to mitigate these challenges and ensure sustained market expansion.

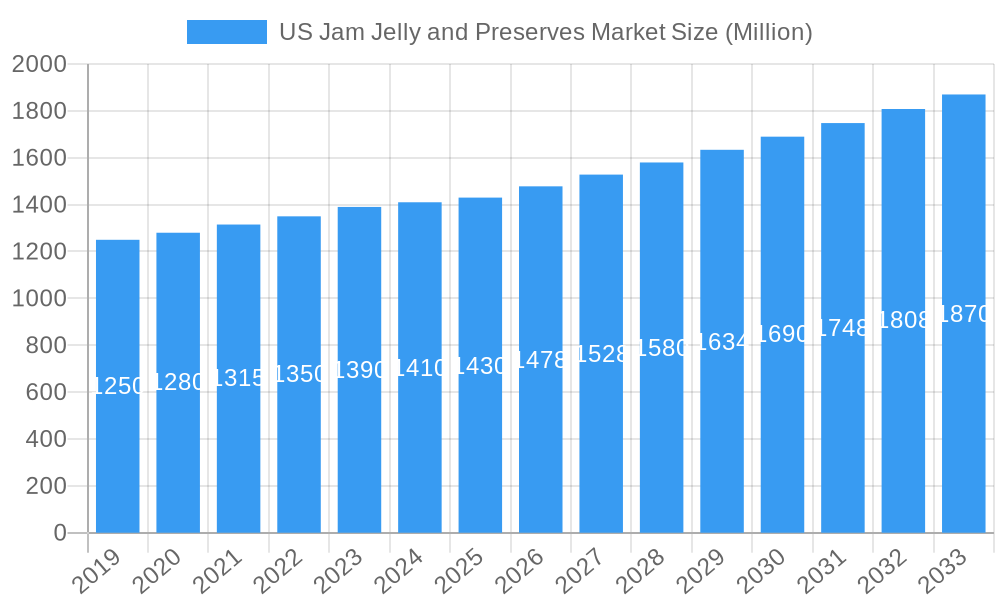

US Jam Jelly and Preserves Market Company Market Share

This comprehensive report provides an in-depth analysis of the dynamic U.S. Jam, Jelly, and Preserves market, covering fruit spreads, jams, jellies, and marmalades. The study period spans 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033. It offers stakeholders actionable insights into market composition, industry evolution, product innovations, growth drivers, and future opportunities. Utilizing high-ranking keywords such as "jam market," "jelly market," "preserves market," "fruit spreads," "US food industry," "specialty jams," "organic preserves," "keto jams," "vegan spreads," "private label jams," and "food manufacturing trends," this report aims to enhance search visibility and engage key decision-makers.

US Jam Jelly and Preserves Market Market Composition & Trends

The US Jam Jelly and Preserves Market exhibits a moderately consolidated structure, with The J M Smucker Company, The Kraft Heinz Company, and B&G Foods Inc. holding significant market share, estimated to be in the range of $3.5 Billion collectively in the base year of 2025. Innovation remains a key catalyst, driven by increasing consumer demand for healthier, premium, and flavor-diverse fruit spreads. Regulatory landscapes, primarily concerning food safety standards and labeling requirements, are well-established but can influence new product introductions. Substitute products, including honey, syrups, and nut butters, present a consistent competitive challenge, though the unique appeal of jams, jellies, and preserves ensures continued market presence. End-user profiles are diverse, ranging from households seeking convenient breakfast accompaniments to bakeries and food manufacturers incorporating these ingredients into larger product lines. Mergers and Acquisitions (M&A) activities, though not consistently high, play a crucial role in market consolidation and expansion. For instance, recent years have seen strategic acquisitions aimed at bolstering portfolios in the specialty and organic segments, with estimated deal values reaching up to $150 Million for niche brands.

- Market Concentration: Moderate, with top players holding substantial but not dominant shares.

- Innovation Catalysts: Demand for natural ingredients, reduced sugar options, unique flavor profiles, and convenience.

- Regulatory Landscape: FDA regulations on food safety, labeling (e.g., "low sugar," "organic"), and ingredient transparency.

- Substitute Products: Honey, maple syrup, nut butters, fruit purees.

- End-User Profiles: Households, bakeries, food service, food manufacturers.

- M&A Activities: Strategic acquisitions of niche brands for portfolio enhancement and market penetration.

US Jam Jelly and Preserves Market Industry Evolution

The US Jam Jelly and Preserves Market has undergone a significant transformation over the historical period of 2019-2024, setting the stage for continued evolution through the forecast period of 2025-2033. Initially characterized by a reliance on traditional flavors and mass-market appeal, the industry has witnessed a dramatic shift towards greater sophistication and diversification. This evolution is deeply intertwined with broader trends in the US food industry, including a growing consumer consciousness regarding health and wellness, a heightened interest in premium and artisanal products, and a demand for transparency in ingredient sourcing.

Market growth trajectories have been consistently positive, albeit with varying paces across different segments. The jam and jellies segment continues to dominate in terms of volume, driven by its widespread use and affordability. However, the preserves segment, with its larger fruit pieces and richer texture, has seen a notable surge in popularity, particularly among consumers seeking a more authentic fruit experience. Marmalades, while a smaller niche, have also experienced a resurgence, appealing to a sophisticated palate with their complex citrus notes. The overall market size for fruit spreads is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 3.5% from 2025 to 2033, reaching an estimated $4.2 Billion by the end of the forecast period.

Technological advancements have played a subtle yet important role. Innovations in fruit processing techniques have enabled the preservation of natural flavors and textures, leading to higher-quality end products. Furthermore, advancements in packaging technology have improved shelf-life, reduced waste, and enhanced convenience, catering to the on-the-go lifestyles of modern consumers. The adoption of sugar reduction technologies and the use of natural sweeteners have also been critical, aligning with the growing demand for healthier alternatives.

Shifting consumer demands are perhaps the most significant driver of industry evolution. The "clean label" movement has led to a strong preference for products with fewer artificial ingredients and recognizable names. Organic preserves and non-GMO verified jams have witnessed substantial growth as consumers actively seek out products that align with their personal values. Furthermore, the rise of specialized diets, such as keto and vegan lifestyles, has opened up new avenues for innovation. Brands are increasingly developing keto-friendly jams using sugar substitutes and vegan preserves free from animal-derived ingredients, expanding the addressable market considerably. This segment is projected to witness a CAGR exceeding 5% over the forecast period. The increasing prevalence of online retail channels has also influenced product development, with smaller batch, artisanal products finding wider distribution and consumer reach.

Leading Regions, Countries, or Segments in US Jam Jelly and Preserves Market

Within the vast US Jam Jelly and Preserves Market, several regions and specific segments stand out for their dominance and growth potential. The Supermarket/Hypermarket distribution channel continues to be the undisputed leader, accounting for an estimated 65% of market sales in 2025. This dominance is driven by their extensive reach, ability to cater to a broad demographic, and the convenience they offer to consumers for one-stop shopping. Major retailers have also become crucial partners for both established brands and emerging players, offering significant shelf space for private label jams and branded products alike.

The Jam and Jellies segment remains the largest within the Product Type category, holding an approximate 55% market share. This is primarily due to their established presence in households, versatility in applications (breakfast, baking, snacking), and generally lower price points compared to more specialized preserves. However, the Preserves segment is exhibiting robust growth, projected to expand at a CAGR of 4.2% through 2033. This growth is fueled by consumer preference for more substantial fruit texture and authentic fruit flavor, aligning with the premiumization trend in the food industry.

Geographically, the Northeastern United States and the Western United States often lead in terms of per capita consumption and adoption of premium and specialty fruit spreads. These regions tend to have a higher concentration of affluent consumers who are more willing to experiment with new flavors and pay a premium for high-quality, artisanal products. Investment trends in these regions often focus on local sourcing and unique flavor combinations, reflecting a growing interest in regional specialties.

The Online Stores distribution channel, while currently smaller in market share (estimated at 15% in 2025), is experiencing the most rapid growth, with an anticipated CAGR of 6.8% through 2033. This surge is attributed to the convenience of home delivery, the ability to discover niche and specialty brands not readily available in brick-and-mortar stores, and the increasing adoption of e-commerce for grocery shopping. This channel is crucial for brands specializing in organic preserves, keto jams, and unique artisanal offerings.

- Dominant Distribution Channel: Supermarket/Hypermarket (approx. 65% market share), offering wide product availability and consumer accessibility.

- Leading Product Type: Jam and Jellies (approx. 55% market share), driven by staple usage and broad consumer appeal.

- Fastest Growing Product Type: Preserves, witnessing a surge in popularity due to demand for authentic fruit texture and premium appeal.

- Key Growth Distribution Channel: Online Stores (approx. 15% market share and growing at 6.8% CAGR), enabling access to niche brands and specialty products.

- Geographical Hotspots: Northeastern and Western US, characterized by higher disposable incomes and a greater receptiveness to premium and artisanal food products.

- Investment Drivers: Focus on natural ingredients, unique flavor profiles, local sourcing, and expansion into online retail.

US Jam Jelly and Preserves Market Product Innovations

Product innovation in the US Jam Jelly and Preserves Market is increasingly focused on addressing evolving consumer demands for health-consciousness, unique flavors, and convenience. Brands are actively developing low-sugar and sugar-free jams using natural sweeteners like stevia and erythritol, catering to the growing keto-friendly and diabetic-conscious consumer base. The inclusion of functional ingredients, such as added vitamins or probiotics, is also emerging as a niche innovation. Furthermore, the exploration of exotic fruits and novel flavor combinations, like spicy mango jam or lavender-infused blackberry preserves, is differentiating products in a crowded market. Packaging innovations, such as single-serve portions and resealable jars, enhance portability and reduce waste. Performance metrics for these innovations are measured by increased sales volume, enhanced consumer engagement, and improved product perception in consumer surveys.

Propelling Factors for US Jam Jelly and Preserves Market Growth

Several key factors are propelling the growth of the US Jam Jelly and Preserves Market. The rising consumer preference for natural and minimally processed foods directly benefits organic preserves and fruit spreads with clean labels. An increasing awareness of the health benefits associated with fruit consumption, coupled with the versatility of jams, jellies, and preserves in various culinary applications, fuels demand. Furthermore, the growth of the specialty food market and a desire for premium, artisanal products are driving sales of higher-value fruit spreads. Economic factors such as rising disposable incomes enable consumers to spend more on perceived indulgences like premium fruit spreads. Finally, advancements in food technology allowing for extended shelf-life and improved product quality contribute to sustained market growth.

Obstacles in the US Jam Jelly and Preserves Market Market

Despite robust growth, the US Jam Jelly and Preserves Market faces several obstacles. Fluctuations in the prices of raw fruits, due to weather patterns or agricultural challenges, can impact production costs and profit margins for jam and jelly manufacturers. Stringent food safety regulations and labeling requirements, while ensuring quality, can add to operational complexities and costs. Intense competition from established brands and the increasing prevalence of private label jams can put pressure on pricing strategies. Additionally, supply chain disruptions, as experienced in recent years, can affect the availability of both raw materials and finished products, impacting delivery schedules and consumer satisfaction. Shifting consumer preferences towards entirely new snacking or breakfast categories could also pose a long-term challenge.

Future Opportunities in US Jam Jelly and Preserves Market

The US Jam Jelly and Preserves Market presents numerous future opportunities. The burgeoning vegan market offers significant potential for the development and expansion of vegan preserves and fruit spreads. Growth in keto-friendly products continues to present lucrative avenues for brands offering low-sugar, high-fruit-content options. The increasing demand for artisanal and gourmet jams provides opportunities for smaller producers to differentiate themselves through unique flavor profiles and premium ingredients. Furthermore, expanding the reach of fruit spreads into new applications, such as savory dishes or cocktail ingredients, can unlock novel revenue streams. The continued growth of online retail channels offers a powerful platform for direct-to-consumer sales and reaching niche consumer segments.

Major Players in the US Jam Jelly and Preserves Market Ecosystem

- Murphy Orchards

- B&G Foods Inc.

- Premier Foods Group Services Ltd.

- F Duerr & Sons Ltd.

- Wilkin & Sons Ltd.

- The Hain Celestial Group Inc.

- National Grape Cooperative Association

- The J M Smucker Company

- The Kraft Heinz Company

- Andros Group

- Conagra Foods Inc.

Key Developments in US Jam Jelly and Preserves Market Industry

- January 2023: Conagra Brands unveiled a new line of products, including the Snack Pack Starburst All Pink Juicy Gels. These delightful treats are specifically crafted with the signature all-pink flavor to replicate the irresistible experience of savoring a strawberry-flavored Starburst. This move taps into nostalgia and extends brand recognition into related confectionery-inspired spreads.

- September 2022: Kraft Heinz collaborated with a start-up accelerator StartLife to promote innovation. The partnership will see The Kraft Heinz Company work with agri-food tech accelerator StartLife to help its portfolio of products fulfill consumer expectations, potentially leading to advancements in ingredient sourcing, processing, or novel product development in the jam and preserves category.

- February 2021: Good Good, an Iceland-based food brand, introduced three new jam flavors to its existing keto-friendly and no added sugar product portfolio. These new launches had natural fruit flavors and were keto and vegan-friendly, underscoring the growing demand for dietary-specific and health-conscious fruit spread options.

Strategic US Jam Jelly and Preserves Market Market Forecast

The strategic forecast for the US Jam Jelly and Preserves Market is one of sustained growth, driven by a confluence of evolving consumer preferences and strategic industry advancements. The increasing demand for healthy and natural food options will continue to propel the market for organic preserves and low-sugar jams. The expansion of specialized diets, particularly keto and vegan lifestyles, presents significant opportunities for product innovation and market penetration. Furthermore, the continued growth of online retail channels will democratize access to a wider array of artisanal and gourmet fruit spreads, catering to niche consumer tastes. Strategic players will focus on product diversification, flavor innovation, and leveraging digital platforms to connect with consumers, ensuring a sweet future for the US jam, jelly, and preserves market.

US Jam Jelly and Preserves Market Segmentation

-

1. Product Type

- 1.1. Jam and Jellies

- 1.2. Marmalade

- 1.3. Preserves

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarket

- 2.2. Convenience Store

- 2.3. Online Stores

- 2.4. Other Distribution Channels

US Jam Jelly and Preserves Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

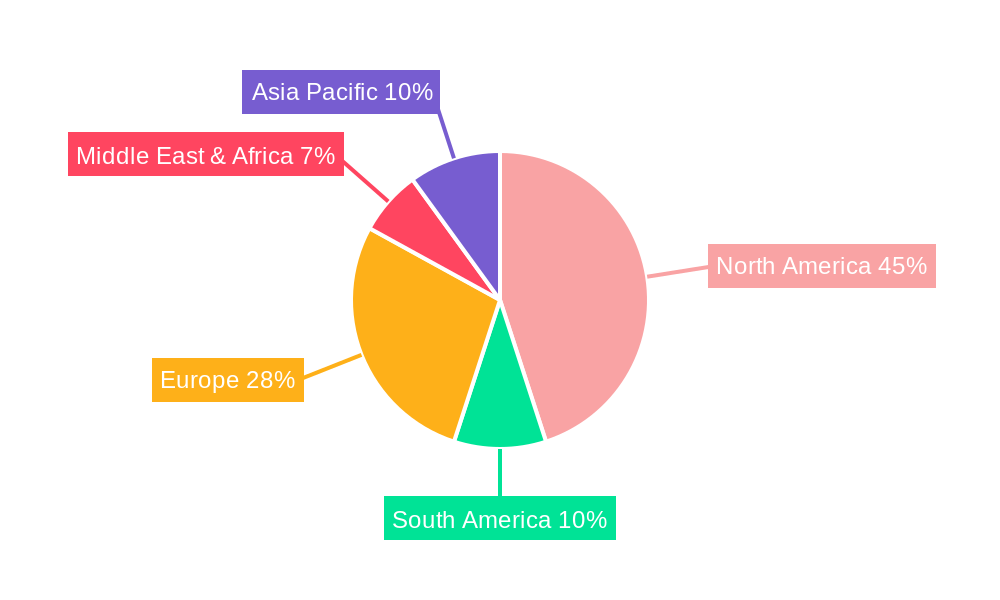

US Jam Jelly and Preserves Market Regional Market Share

Geographic Coverage of US Jam Jelly and Preserves Market

US Jam Jelly and Preserves Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Prevalence of Lactose Intolerance Driving the Market; Growing Influence of Healthy Lifestyle Trends and Rising Non-Traditional Users

- 3.3. Market Restrains

- 3.3.1. Wide Availability of Alternative Protein Sources

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Organic Food Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Jam Jelly and Preserves Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Jam and Jellies

- 5.1.2. Marmalade

- 5.1.3. Preserves

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarket

- 5.2.2. Convenience Store

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America US Jam Jelly and Preserves Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Jam and Jellies

- 6.1.2. Marmalade

- 6.1.3. Preserves

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarket/Hypermarket

- 6.2.2. Convenience Store

- 6.2.3. Online Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America US Jam Jelly and Preserves Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Jam and Jellies

- 7.1.2. Marmalade

- 7.1.3. Preserves

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarket/Hypermarket

- 7.2.2. Convenience Store

- 7.2.3. Online Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe US Jam Jelly and Preserves Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Jam and Jellies

- 8.1.2. Marmalade

- 8.1.3. Preserves

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarket/Hypermarket

- 8.2.2. Convenience Store

- 8.2.3. Online Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa US Jam Jelly and Preserves Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Jam and Jellies

- 9.1.2. Marmalade

- 9.1.3. Preserves

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarket/Hypermarket

- 9.2.2. Convenience Store

- 9.2.3. Online Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific US Jam Jelly and Preserves Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Jam and Jellies

- 10.1.2. Marmalade

- 10.1.3. Preserves

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarket/Hypermarket

- 10.2.2. Convenience Store

- 10.2.3. Online Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Murphy Orchards*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 B&G Foods Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Premier Foods Group Services Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 F Duerr & Sons Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Wilkin & Sons Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Hain Celestial Group Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 National Grape Cooperative Association

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The J M Smucker Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The Kraft Heinz Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Andros Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Conagra Foods Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Murphy Orchards*List Not Exhaustive

List of Figures

- Figure 1: Global US Jam Jelly and Preserves Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global US Jam Jelly and Preserves Market Volume Breakdown (Liters, %) by Region 2025 & 2033

- Figure 3: North America US Jam Jelly and Preserves Market Revenue (billion), by Product Type 2025 & 2033

- Figure 4: North America US Jam Jelly and Preserves Market Volume (Liters), by Product Type 2025 & 2033

- Figure 5: North America US Jam Jelly and Preserves Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America US Jam Jelly and Preserves Market Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America US Jam Jelly and Preserves Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 8: North America US Jam Jelly and Preserves Market Volume (Liters), by Distribution Channel 2025 & 2033

- Figure 9: North America US Jam Jelly and Preserves Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America US Jam Jelly and Preserves Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America US Jam Jelly and Preserves Market Revenue (billion), by Country 2025 & 2033

- Figure 12: North America US Jam Jelly and Preserves Market Volume (Liters), by Country 2025 & 2033

- Figure 13: North America US Jam Jelly and Preserves Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America US Jam Jelly and Preserves Market Volume Share (%), by Country 2025 & 2033

- Figure 15: South America US Jam Jelly and Preserves Market Revenue (billion), by Product Type 2025 & 2033

- Figure 16: South America US Jam Jelly and Preserves Market Volume (Liters), by Product Type 2025 & 2033

- Figure 17: South America US Jam Jelly and Preserves Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: South America US Jam Jelly and Preserves Market Volume Share (%), by Product Type 2025 & 2033

- Figure 19: South America US Jam Jelly and Preserves Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 20: South America US Jam Jelly and Preserves Market Volume (Liters), by Distribution Channel 2025 & 2033

- Figure 21: South America US Jam Jelly and Preserves Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: South America US Jam Jelly and Preserves Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: South America US Jam Jelly and Preserves Market Revenue (billion), by Country 2025 & 2033

- Figure 24: South America US Jam Jelly and Preserves Market Volume (Liters), by Country 2025 & 2033

- Figure 25: South America US Jam Jelly and Preserves Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America US Jam Jelly and Preserves Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe US Jam Jelly and Preserves Market Revenue (billion), by Product Type 2025 & 2033

- Figure 28: Europe US Jam Jelly and Preserves Market Volume (Liters), by Product Type 2025 & 2033

- Figure 29: Europe US Jam Jelly and Preserves Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Europe US Jam Jelly and Preserves Market Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Europe US Jam Jelly and Preserves Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 32: Europe US Jam Jelly and Preserves Market Volume (Liters), by Distribution Channel 2025 & 2033

- Figure 33: Europe US Jam Jelly and Preserves Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Europe US Jam Jelly and Preserves Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: Europe US Jam Jelly and Preserves Market Revenue (billion), by Country 2025 & 2033

- Figure 36: Europe US Jam Jelly and Preserves Market Volume (Liters), by Country 2025 & 2033

- Figure 37: Europe US Jam Jelly and Preserves Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe US Jam Jelly and Preserves Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa US Jam Jelly and Preserves Market Revenue (billion), by Product Type 2025 & 2033

- Figure 40: Middle East & Africa US Jam Jelly and Preserves Market Volume (Liters), by Product Type 2025 & 2033

- Figure 41: Middle East & Africa US Jam Jelly and Preserves Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: Middle East & Africa US Jam Jelly and Preserves Market Volume Share (%), by Product Type 2025 & 2033

- Figure 43: Middle East & Africa US Jam Jelly and Preserves Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 44: Middle East & Africa US Jam Jelly and Preserves Market Volume (Liters), by Distribution Channel 2025 & 2033

- Figure 45: Middle East & Africa US Jam Jelly and Preserves Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Middle East & Africa US Jam Jelly and Preserves Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Middle East & Africa US Jam Jelly and Preserves Market Revenue (billion), by Country 2025 & 2033

- Figure 48: Middle East & Africa US Jam Jelly and Preserves Market Volume (Liters), by Country 2025 & 2033

- Figure 49: Middle East & Africa US Jam Jelly and Preserves Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa US Jam Jelly and Preserves Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific US Jam Jelly and Preserves Market Revenue (billion), by Product Type 2025 & 2033

- Figure 52: Asia Pacific US Jam Jelly and Preserves Market Volume (Liters), by Product Type 2025 & 2033

- Figure 53: Asia Pacific US Jam Jelly and Preserves Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Asia Pacific US Jam Jelly and Preserves Market Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Asia Pacific US Jam Jelly and Preserves Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 56: Asia Pacific US Jam Jelly and Preserves Market Volume (Liters), by Distribution Channel 2025 & 2033

- Figure 57: Asia Pacific US Jam Jelly and Preserves Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Asia Pacific US Jam Jelly and Preserves Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Asia Pacific US Jam Jelly and Preserves Market Revenue (billion), by Country 2025 & 2033

- Figure 60: Asia Pacific US Jam Jelly and Preserves Market Volume (Liters), by Country 2025 & 2033

- Figure 61: Asia Pacific US Jam Jelly and Preserves Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific US Jam Jelly and Preserves Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Jam Jelly and Preserves Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global US Jam Jelly and Preserves Market Volume Liters Forecast, by Product Type 2020 & 2033

- Table 3: Global US Jam Jelly and Preserves Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global US Jam Jelly and Preserves Market Volume Liters Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global US Jam Jelly and Preserves Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global US Jam Jelly and Preserves Market Volume Liters Forecast, by Region 2020 & 2033

- Table 7: Global US Jam Jelly and Preserves Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Global US Jam Jelly and Preserves Market Volume Liters Forecast, by Product Type 2020 & 2033

- Table 9: Global US Jam Jelly and Preserves Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global US Jam Jelly and Preserves Market Volume Liters Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global US Jam Jelly and Preserves Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global US Jam Jelly and Preserves Market Volume Liters Forecast, by Country 2020 & 2033

- Table 13: United States US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 15: Canada US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 17: Mexico US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 19: Global US Jam Jelly and Preserves Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Global US Jam Jelly and Preserves Market Volume Liters Forecast, by Product Type 2020 & 2033

- Table 21: Global US Jam Jelly and Preserves Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global US Jam Jelly and Preserves Market Volume Liters Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global US Jam Jelly and Preserves Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global US Jam Jelly and Preserves Market Volume Liters Forecast, by Country 2020 & 2033

- Table 25: Brazil US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Brazil US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 27: Argentina US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Argentina US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 31: Global US Jam Jelly and Preserves Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 32: Global US Jam Jelly and Preserves Market Volume Liters Forecast, by Product Type 2020 & 2033

- Table 33: Global US Jam Jelly and Preserves Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global US Jam Jelly and Preserves Market Volume Liters Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global US Jam Jelly and Preserves Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global US Jam Jelly and Preserves Market Volume Liters Forecast, by Country 2020 & 2033

- Table 37: United Kingdom US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 39: Germany US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Germany US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 41: France US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: France US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 43: Italy US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Italy US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 45: Spain US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Spain US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 47: Russia US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Russia US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 49: Benelux US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Benelux US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 51: Nordics US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Nordics US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 55: Global US Jam Jelly and Preserves Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 56: Global US Jam Jelly and Preserves Market Volume Liters Forecast, by Product Type 2020 & 2033

- Table 57: Global US Jam Jelly and Preserves Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 58: Global US Jam Jelly and Preserves Market Volume Liters Forecast, by Distribution Channel 2020 & 2033

- Table 59: Global US Jam Jelly and Preserves Market Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global US Jam Jelly and Preserves Market Volume Liters Forecast, by Country 2020 & 2033

- Table 61: Turkey US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Turkey US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 63: Israel US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: Israel US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 65: GCC US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: GCC US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 67: North Africa US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: North Africa US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 69: South Africa US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: South Africa US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 73: Global US Jam Jelly and Preserves Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 74: Global US Jam Jelly and Preserves Market Volume Liters Forecast, by Product Type 2020 & 2033

- Table 75: Global US Jam Jelly and Preserves Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 76: Global US Jam Jelly and Preserves Market Volume Liters Forecast, by Distribution Channel 2020 & 2033

- Table 77: Global US Jam Jelly and Preserves Market Revenue billion Forecast, by Country 2020 & 2033

- Table 78: Global US Jam Jelly and Preserves Market Volume Liters Forecast, by Country 2020 & 2033

- Table 79: China US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: China US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 81: India US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 82: India US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 83: Japan US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 84: Japan US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 85: South Korea US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 86: South Korea US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 87: ASEAN US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 88: ASEAN US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 89: Oceania US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 90: Oceania US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific US Jam Jelly and Preserves Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific US Jam Jelly and Preserves Market Volume (Liters) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Jam Jelly and Preserves Market?

The projected CAGR is approximately 16.8%.

2. Which companies are prominent players in the US Jam Jelly and Preserves Market?

Key companies in the market include Murphy Orchards*List Not Exhaustive, B&G Foods Inc, Premier Foods Group Services Ltd, F Duerr & Sons Ltd, Wilkin & Sons Ltd, The Hain Celestial Group Inc, National Grape Cooperative Association, The J M Smucker Company, The Kraft Heinz Company, Andros Group, Conagra Foods Inc.

3. What are the main segments of the US Jam Jelly and Preserves Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.81 billion as of 2022.

5. What are some drivers contributing to market growth?

Prevalence of Lactose Intolerance Driving the Market; Growing Influence of Healthy Lifestyle Trends and Rising Non-Traditional Users.

6. What are the notable trends driving market growth?

Increasing Demand for Organic Food Products.

7. Are there any restraints impacting market growth?

Wide Availability of Alternative Protein Sources.

8. Can you provide examples of recent developments in the market?

January 2023: Conagra Brands unveiled a new line of products, including the Snack Pack Starburst All Pink Juicy Gels. These delightful treats are specifically crafted with the signature all-pink flavor to replicate the irresistible experience of savoring a strawberry-flavored Starburst.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Liters.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Jam Jelly and Preserves Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Jam Jelly and Preserves Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Jam Jelly and Preserves Market?

To stay informed about further developments, trends, and reports in the US Jam Jelly and Preserves Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence