Key Insights

The South Korean dairy alternatives market is set for substantial growth, projected to reach $0.81 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.82% anticipated from 2025 to 2033. Key growth drivers include increasing consumer awareness of health and wellness benefits, a rising incidence of lactose intolerance, and growing ethical considerations for animal welfare. Consumers are actively seeking plant-based substitutes for dairy, perceiving them as healthier and more sustainable. The non-dairy milk segment, led by almond, oat, and soy milk, is a significant contributor, driven by their versatility in beverages and culinary applications. Expanded accessibility through convenience stores, online retail, and supermarkets further amplifies demand.

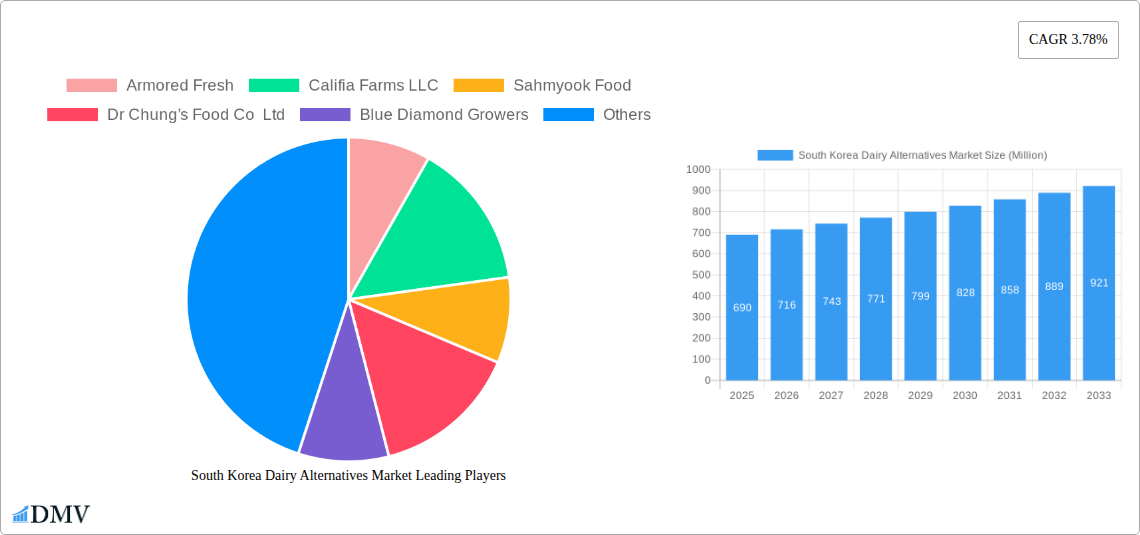

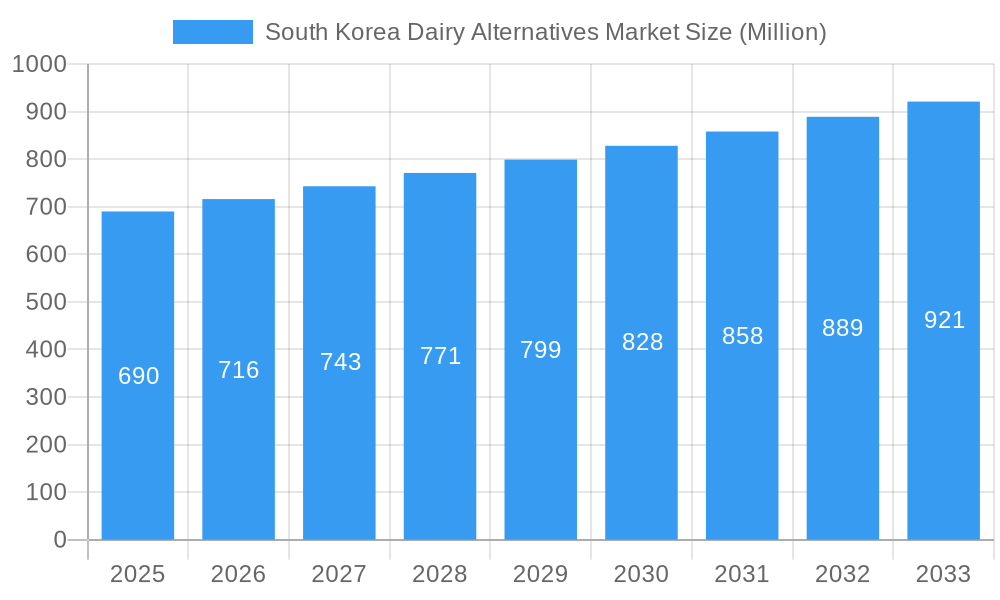

South Korea Dairy Alternatives Market Market Size (In Million)

Market expansion is supported by product innovation, enhancing taste and texture to closely mimic dairy. The rise of specialist retailers and online grocery shopping facilitates direct engagement with health-conscious consumers. However, higher price points for some alternatives compared to conventional dairy may present a challenge for price-sensitive demographics. Ongoing consumer education regarding the nutritional benefits and diverse applications of various plant-based milks is also crucial. Despite these factors, strong underlying demand for healthier, sustainable, and ethically produced food options indicates a promising future for the South Korean dairy alternatives market, fueled by continuous innovation and improved accessibility.

South Korea Dairy Alternatives Market Company Market Share

This report offers in-depth analysis of the dynamic South Korean dairy alternatives market, from burgeoning consumer demand for plant-based options to innovative product development. Covering the historical period of 2019-2024 and a forecast to 2033, with 2025 as the base year, this study provides critical insights for stakeholders. It details market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, future opportunities, major players, key developments, and strategic forecasts. Understand market share distribution, M&A activities, and the impact of evolving consumer preferences on segments like Non-Dairy Butter and various Non-Dairy Milk types (Almond, Cashew, Coconut, Oat, Soy). Explore how distribution channels, including Off-Trade (Convenience Stores, Online Retail, Specialist Retailers, Supermarkets and Hypermarkets, Others) and On-Trade, shape market penetration. This report is an essential guide to the South Korea dairy alternatives market size, plant-based milk market South Korea, vegan food trends Korea, and non-dairy beverage market trends.

South Korea Dairy Alternatives Market Market Composition & Trends

The South Korean dairy alternatives market is characterized by a moderate to high concentration, with key players actively vying for market share through strategic product launches and marketing campaigns. Innovation catalysts are predominantly driven by a growing health-conscious consumer base and increasing awareness of environmental sustainability. The regulatory landscape, while evolving, generally supports the growth of functional foods and beverages. Substitute products, primarily conventional dairy, are facing increasing competition from a widening array of plant-based options. End-user profiles are diverse, encompassing health-conscious individuals, lactose-intolerant consumers, vegans, and those seeking novel taste experiences. Mergers and acquisitions (M&A) activities, while not yet at a peak, are anticipated to increase as established food conglomerates and new entrants seek to expand their portfolios and market reach. Notable M&A deal values are still emerging in this relatively nascent, yet rapidly expanding, sector. The market share distribution is witnessing a gradual shift towards plant-based products, driven by both premium and accessible options across various price points. The growing adoption of non-dairy milk alternatives in South Korea is a significant trend, with companies investing heavily in R&D to enhance taste, texture, and nutritional profiles.

South Korea Dairy Alternatives Market Industry Evolution

The South Korean dairy alternatives market has experienced a significant evolutionary trajectory, marked by robust growth and increasing consumer adoption. From 2019 to the present, the market has transformed from a niche segment to a mainstream category, propelled by a confluence of factors. Initially, growth was primarily driven by consumers seeking solutions for lactose intolerance and dairy allergies. However, over the years, this has expanded considerably to include a broader demographic motivated by health and wellness aspirations, ethical considerations, and a desire for dietary variety. The historical period (2019-2024) witnessed a compounded annual growth rate (CAGR) of approximately 12-15%, indicating a strong and consistent upward trend. This growth has been further amplified by technological advancements in processing and ingredient sourcing, enabling manufacturers to create dairy alternatives that closely mimic the taste and texture of traditional dairy products. For instance, advancements in oat milk production have led to a creamier texture and milder flavor, making it a highly popular choice. Similarly, the development of sophisticated blending techniques for almond and cashew milk has enhanced their appeal.

Shifting consumer demands have been a pivotal force in shaping this evolution. Consumers are increasingly seeking products that are not only plant-based but also fortified with essential nutrients, lower in saturated fats, and free from artificial additives. This has led to a surge in demand for products like oat milk South Korea and almond milk South Korea, which are perceived as healthier alternatives. The influence of social media and celebrity endorsements has also played a crucial role in popularizing plant-based diets and, consequently, dairy alternatives. Furthermore, the growing awareness of the environmental impact of dairy farming has encouraged a significant segment of the population to explore sustainable food choices. The market has responded by introducing a wider variety of plant-based butter, yogurts, and cheeses, catering to diverse culinary preferences. The increasing accessibility of these products through various distribution channels, including online platforms and convenience stores, has further accelerated market penetration. The overall industry evolution points towards a future where dairy alternatives are not just a substitute but a preferred choice for a significant portion of the South Korean population.

Leading Regions, Countries, or Segments in South Korea Dairy Alternatives Market

The South Korean dairy alternatives market exhibits a clear dominance in key urban centers, with Seoul and its surrounding metropolitan areas acting as the primary hubs for consumption and innovation. This regional concentration is attributed to a higher disposable income, greater awareness of health and wellness trends, and a more developed retail infrastructure capable of stocking a diverse range of specialty products.

Dominant Segment: Non-Dairy Milk

- By Product Type: Within the non-dairy milk category, Oat Milk has emerged as a frontrunner in recent years, experiencing exponential growth. Its mild flavor, creamy texture, and perceived health benefits, particularly for those with nut allergies, have made it a preferred choice for both coffee shops and home consumers. Almond Milk continues to hold a significant market share due to its established presence and perceived health attributes, including low calorie content. Soy Milk, a traditional staple, maintains a steady consumer base, especially among older demographics and those accustomed to its taste profile. Coconut Milk is gaining traction for its rich flavor and versatility in culinary applications, while Cashew Milk is carving out a niche with its creamy consistency and mild taste.

- Key Drivers for Non-Dairy Milk Dominance:

- Growing Health Consciousness: Increasing consumer focus on low-cholesterol, low-fat, and nutrient-fortified options.

- Lactose Intolerance and Allergies: A significant portion of the population benefits from dairy-free alternatives.

- Versatility in Consumption: Non-dairy milk is used in beverages, cooking, baking, and as a direct dairy substitute.

- Product Innovation: Continuous improvement in taste, texture, and variety by manufacturers.

Dominant Distribution Channel: Off-Trade

- Online Retail: This channel has witnessed explosive growth, driven by convenience, wider product selection, competitive pricing, and the ease of home delivery. Consumers can easily compare brands and access niche products not readily available in physical stores.

- Supermarkets and Hypermarkets: These remain crucial for mass market penetration, offering a broad spectrum of dairy alternatives alongside conventional dairy products, catering to everyday grocery shopping needs.

- Convenience Stores: Their ubiquity makes them vital for impulse purchases and quick access to popular non-dairy milk options, especially smaller formats.

- Specialist Retailers: These stores, focusing on organic, health, or vegan products, attract a dedicated consumer base seeking premium and ethically sourced alternatives.

- Key Drivers for Off-Trade Dominance:

- Consumer Convenience: The ability to purchase products at any time and place.

- Product Availability and Variety: Online platforms offer a wider selection than most physical stores.

- Promotional Activities and Discounts: Online and large retail formats frequently offer attractive deals.

- Growing E-commerce Penetration: Increasing comfort and trust in online grocery shopping.

The dominance of these segments is further reinforced by strong investment trends in product development and marketing by both domestic and international players, coupled with supportive, albeit evolving, regulatory frameworks promoting food safety and labeling.

South Korea Dairy Alternatives Market Product Innovations

Product innovation in the South Korean dairy alternatives market is intensely focused on enhancing sensory attributes and nutritional value. Manufacturers are actively developing non-dairy butter formulations that offer superior spreadability and cooking performance, often fortified with vitamins and healthy fats. In the non-dairy milk segment, advancements include creating barista-quality oat milk and almond milk blends that froth and steam effectively, catering to the burgeoning café culture. Innovations also extend to creating functional beverages with added probiotics, prebiotics, and plant-based proteins for enhanced digestive health and muscle support. Unique selling propositions often revolve around allergen-free formulations, reduced sugar content, and the use of sustainably sourced ingredients, appealing to health-conscious and environmentally aware consumers. Technological advancements in ingredient processing and formulation are crucial for achieving a taste and texture that rivals traditional dairy, making these alternatives increasingly palatable and desirable.

Propelling Factors for South Korea Dairy Alternatives Market Growth

The South Korean dairy alternatives market is propelled by a synergistic interplay of several key factors. Firstly, rising health consciousness among consumers is a significant driver, with an increasing demand for products perceived as healthier, such as oat milk and almond milk, due to lower cholesterol and fat content. Secondly, growing environmental awareness is influencing purchasing decisions, as consumers seek sustainable food choices that reduce their carbon footprint, often favoring plant-based options. Thirdly, the increasing prevalence of lactose intolerance and dairy allergies creates a sustained demand for dairy-free alternatives. Fourthly, technological advancements in food processing have enabled the development of dairy alternatives with improved taste, texture, and nutritional profiles, making them more appealing to a broader audience. Finally, supportive government initiatives promoting healthy eating and food innovation, coupled with favorable regulatory frameworks for functional foods, further bolster market expansion for plant-based milk in South Korea.

Obstacles in the South Korea Dairy Alternatives Market Market

Despite the robust growth, the South Korean dairy alternatives market faces several significant obstacles. Price sensitivity remains a considerable barrier, as many dairy alternatives are priced higher than conventional dairy products, limiting their adoption among budget-conscious consumers. Consumer perception and taste preferences also present a challenge; some consumers still find the taste and texture of certain dairy alternatives inferior to traditional dairy. Regulatory complexities, particularly regarding labeling and ingredient standards, can sometimes impede innovation and market entry for new products. Supply chain disruptions, especially concerning the availability and cost of key raw materials like almonds and oats, can impact production and pricing. Furthermore, intense competition from established dairy giants introducing their own plant-based lines, alongside a growing number of startups, intensifies pressure on market share and profitability. These factors collectively can slow down the otherwise promising growth trajectory of the market.

Future Opportunities in South Korea Dairy Alternatives Market

The future of the South Korean dairy alternatives market is ripe with opportunities, driven by evolving consumer trends and technological advancements. The expansion of non-dairy butter and cheese alternatives presents a significant opportunity, catering to the growing demand for vegan and flexitarian culinary options. The development of innovative plant-based protein sources for dairy alternatives can tap into the burgeoning functional food market. Furthermore, exploring new beverage formats and flavors beyond traditional milk types, such as plant-based creams and yogurts with unique flavor profiles, will attract a wider consumer base. The increasing penetration of e-commerce channels in South Korea offers immense potential for direct-to-consumer sales and wider product distribution. Moreover, a focus on sustainable sourcing and transparent production practices can resonate with ethically-minded consumers, creating brand loyalty and market differentiation. The growing popularity of plant-based diets among younger demographics also signals a sustained long-term demand.

Major Players in the South Korea Dairy Alternatives Market Ecosystem

- Armored Fresh

- Califia Farms LLC

- Sahmyook Food

- Dr Chung’s Food Co Ltd

- Blue Diamond Growers

- Otsuka Holdings Co Ltd

- Hanmi Healthcare Inc

- Maeil Co Ltd

- Namyang Dairy Products Co Ltd

- Yoplait

Key Developments in South Korea Dairy Alternatives Market Industry

- August 2022: The addition of the new Oat Barista Blend to Califia Farms' already well-liked Original and Unsweetened Almondmilk Barista Blends demonstrated the company's commitment to quality coffee while bolstering its relationships with both old and new coffee shops.

- April 2022: Califia Farms launched unsweetened oat milk designed for at-home consumption. It can be purchased through natural, specialty, and grocery retailers.

- December 2021: Sahmyook Foods signed an MOU with Sahmyook University for "Sahmyook Food Research Consultation Center" to enhance its R&D activities.

Strategic South Korea Dairy Alternatives Market Market Forecast

The strategic forecast for the South Korean dairy alternatives market indicates continued robust growth, driven by a confluence of factors including escalating health consciousness, environmental sustainability concerns, and an increasing incidence of lactose intolerance. The market is expected to witness significant expansion in the non-dairy milk segment, with oat milk and almond milk leading the charge due to their superior taste and texture profiles. Innovation in non-dairy butter and cheese alternatives will unlock new consumer segments and culinary applications. The increasing dominance of online retail and evolving off-trade distribution channels will facilitate wider accessibility and market penetration. With ongoing investment in research and development by key players, coupled with supportive consumer trends, the market is poised for substantial value and volume growth, solidifying its position as a vital component of South Korea's food landscape.

South Korea Dairy Alternatives Market Segmentation

-

1. Category

- 1.1. Non-Dairy Butter

-

1.2. Non-Dairy Milk

-

1.2.1. By Product Type

- 1.2.1.1. Almond Milk

- 1.2.1.2. Cashew Milk

- 1.2.1.3. Coconut Milk

- 1.2.1.4. Oat Milk

- 1.2.1.5. Soy Milk

-

1.2.1. By Product Type

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Retail

- 2.1.3. Specialist Retailers

- 2.1.4. Supermarkets and Hypermarkets

- 2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 2.2. On-Trade

-

2.1. Off-Trade

South Korea Dairy Alternatives Market Segmentation By Geography

- 1. South Korea

South Korea Dairy Alternatives Market Regional Market Share

Geographic Coverage of South Korea Dairy Alternatives Market

South Korea Dairy Alternatives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing awareness towards fitness among consumers; Demand for convenient fortified foods

- 3.3. Market Restrains

- 3.3.1. Increasing vegan culture in the market

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Dairy Alternatives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Non-Dairy Butter

- 5.1.2. Non-Dairy Milk

- 5.1.2.1. By Product Type

- 5.1.2.1.1. Almond Milk

- 5.1.2.1.2. Cashew Milk

- 5.1.2.1.3. Coconut Milk

- 5.1.2.1.4. Oat Milk

- 5.1.2.1.5. Soy Milk

- 5.1.2.1. By Product Type

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Retail

- 5.2.1.3. Specialist Retailers

- 5.2.1.4. Supermarkets and Hypermarkets

- 5.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Armored Fresh

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Califia Farms LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sahmyook Food

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dr Chung’s Food Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Blue Diamond Growers

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Otsuka Holdings Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hanmi Healthcare Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Maeil Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Namyang Dairy Products Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Yoplait

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Armored Fresh

List of Figures

- Figure 1: South Korea Dairy Alternatives Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Korea Dairy Alternatives Market Share (%) by Company 2025

List of Tables

- Table 1: South Korea Dairy Alternatives Market Revenue billion Forecast, by Category 2020 & 2033

- Table 2: South Korea Dairy Alternatives Market Volume K Tons Forecast, by Category 2020 & 2033

- Table 3: South Korea Dairy Alternatives Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: South Korea Dairy Alternatives Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 5: South Korea Dairy Alternatives Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: South Korea Dairy Alternatives Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: South Korea Dairy Alternatives Market Revenue billion Forecast, by Category 2020 & 2033

- Table 8: South Korea Dairy Alternatives Market Volume K Tons Forecast, by Category 2020 & 2033

- Table 9: South Korea Dairy Alternatives Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: South Korea Dairy Alternatives Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 11: South Korea Dairy Alternatives Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: South Korea Dairy Alternatives Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Dairy Alternatives Market?

The projected CAGR is approximately 6.82%.

2. Which companies are prominent players in the South Korea Dairy Alternatives Market?

Key companies in the market include Armored Fresh, Califia Farms LLC, Sahmyook Food, Dr Chung’s Food Co Ltd, Blue Diamond Growers, Otsuka Holdings Co Ltd, Hanmi Healthcare Inc, Maeil Co Ltd, Namyang Dairy Products Co Ltd, Yoplait.

3. What are the main segments of the South Korea Dairy Alternatives Market?

The market segments include Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.81 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing awareness towards fitness among consumers; Demand for convenient fortified foods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing vegan culture in the market.

8. Can you provide examples of recent developments in the market?

August 2022: The addition of the new Oat Barista Blend to Califia Farms' already well-liked Original and Unsweetened Almondmilk Barista Blends demonstrated the company's commitment to quality coffee while bolstering its relationships with both old and new coffee shops.April 2022: Califia Farms launched unsweetened oat milk designed for at-home consumption. It can be purchased through natural, specialty, and grocery retailers.December 2021: Sahmyook Foods signed an MOU with Sahmyook University for "Sahmyook Food Research Consultation Center" to enhance its R&D activities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Dairy Alternatives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Dairy Alternatives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Dairy Alternatives Market?

To stay informed about further developments, trends, and reports in the South Korea Dairy Alternatives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence