Key Insights

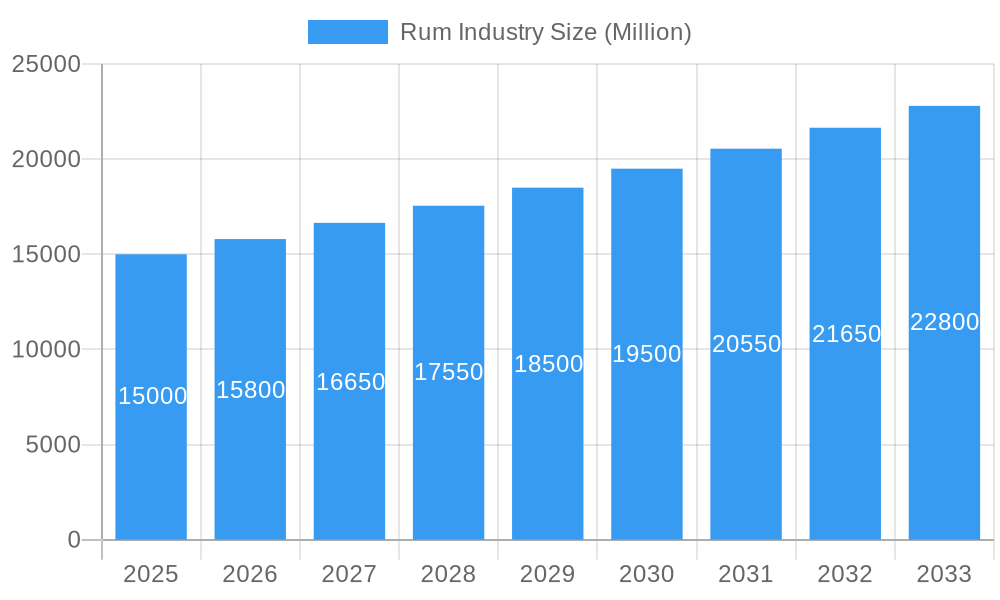

The global rum market is projected for substantial growth, with an estimated market size of $1.5 billion by 2025, driven by a Compound Annual Growth Rate (CAGR) of 2.3% over the 2025-2033 forecast period. Key growth drivers include rising disposable incomes in emerging economies, an expanding global cocktail culture, and sustained consumer demand for premium and craft spirits. The increasing popularity of rum-based cocktails, coupled with distillers' focus on product innovation with flavored, spiced, and aged varieties, is attracting a diverse consumer base. The premiumization trend further bolsters the market, as consumers increasingly opt for high-quality, artisanal rum, boosting sales of premium white, gold, and dark categories.

Rum Industry Market Size (In Billion)

Market expansion is supported by strategic development in both off-trade and on-trade distribution channels, complemented by increased accessibility through online retail and experiential marketing. Potential restraints include fluctuations in raw material prices and stringent government regulations. Despite these challenges, the rum industry demonstrates dynamic growth, characterized by innovation, premiumization, and expanding global reach. Key industry players are strategically positioned to capitalize on these opportunities.

Rum Industry Company Market Share

This report provides a comprehensive analysis of the global rum industry, examining market composition, historical trends, future projections, and the strategic landscape. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, it offers critical insights for stakeholders. The analysis encompasses various rum types (White, Gold, Dark, Other) and categories (Plain, Flavored, Spiced), along with a meticulous examination of distribution channels (Off-Trade, On-Trade).

Rum Industry Market Composition & Trends

The global Rum Industry exhibits a dynamic market composition influenced by evolving consumer preferences and a growing appreciation for premium and artisanal spirits. Market concentration varies significantly across regions, with major players holding substantial shares, yet a rising number of craft distilleries are challenging established brands, fostering innovation. Key innovation catalysts include the development of unique aging processes, the introduction of novel flavor profiles, and a focus on sustainable sourcing and production. The regulatory landscape, while generally supportive of the spirits industry, presents distinct challenges and opportunities across different geographical markets, impacting market entry and product development. Substitute products, primarily other aged spirits like whisky and brandy, pose a consistent competitive threat, necessitating a focus on distinct brand narratives and quality differentiation. End-user profiles are diversifying, ranging from casual drinkers seeking accessible, flavored options to connoisseurs appreciating complex, aged rums. Mergers and acquisitions (M&A) activities within the industry, valued in the Million range, are strategically shaping market consolidation and portfolio expansion. While precise market share distribution is detailed within the full report, initial analyses suggest a significant contribution from established global brands alongside the rapid ascent of niche producers. The total M&A deal value is projected to reach [insert projected M&A deal value in Millions] Million by the end of the forecast period.

Rum Industry Industry Evolution

The Rum Industry has undergone a remarkable evolution throughout the historical period of 2019–2024 and is poised for continued expansion in the coming years. This evolution is characterized by robust market growth trajectories, driven by increasing disposable incomes in emerging economies and a sustained global interest in premium spirits. Technological advancements in distillation and aging techniques have played a pivotal role, enabling distilleries to create more complex and nuanced flavor profiles, thereby attracting a wider consumer base. Shifting consumer demands are a significant force, with a discernible trend towards craft and artisanal rums, as well as an increasing preference for sustainably produced and ethically sourced products. This has led to a diversification of product offerings beyond traditional white and dark rums to include a wider array of aged varieties, spiced infusions, and flavored options. The market has witnessed an average annual growth rate of approximately [insert projected CAGR]% during the historical period, with projections indicating a sustained [insert projected CAGR]% growth rate for the forecast period. Adoption metrics for premium and super-premium rum segments have seen a substantial increase, with [insert percentage]% of consumers now actively seeking out these higher-value offerings. The on-trade channel continues to be a significant contributor to sales, complemented by the growing importance of e-commerce and direct-to-consumer sales in the off-trade sector.

Leading Regions, Countries, or Segments in Rum Industry

The global Rum Industry's dominance is currently held by [insert dominant region/country/segment], driven by a confluence of factors including robust domestic consumption, significant export volumes, and supportive industry policies. Within the Type segment, Dark Rum consistently leads, its rich flavor profile appealing to a broad consumer base seeking premium and aged spirits. The Category segment sees Plain Rum holding a substantial market share, forming the backbone for many cocktails and sipping experiences, while Flavored and Spiced Rum are experiencing rapid growth due to their appeal to younger demographics and their versatility in mixology. The Distribution Channel landscape is characterized by the strong performance of Off-Trade, fueled by the growth of supermarkets and online retail, alongside a resilient On-Trade sector, particularly in regions with thriving hospitality industries.

Key drivers for the dominance of [insert dominant region/country/segment] include:

- Investment Trends: Significant foreign and domestic investment in distillery infrastructure, aging facilities, and marketing campaigns, totaling [insert investment value in Millions] Million in the last fiscal year.

- Regulatory Support: Favorable government policies, including reduced excise duties and streamlined export processes, incentivizing production and international trade, estimated to have boosted exports by [insert export growth percentage]%.

- Consumer Preferences: A deep-rooted cultural appreciation for rum, coupled with a growing trend towards premiumization and exploration of diverse rum styles.

- Supply Chain Efficiency: Well-established agricultural supply chains for sugarcane and molasses, ensuring a consistent and cost-effective raw material supply.

The analysis of dominance factors reveals a strong emphasis on brand heritage, coupled with a proactive embrace of innovation in product development and marketing. For instance, in [dominant region/country], the proliferation of craft distilleries has injected new vitality into the market, offering unique, small-batch expressions that cater to discerning palates. This dynamic interplay between established giants and agile newcomers is shaping a competitive yet prosperous Rum Industry.

Rum Industry Product Innovations

Product innovation within the Rum Industry is a critical factor driving market expansion and consumer engagement. Significant advancements are being made in aging techniques, including the exploration of unique barrel woods and extended aging periods to develop more complex flavor profiles. The introduction of exotic fruit infusions and the creative blending of spices are revolutionizing the flavored and spiced rum segments, appealing to adventurous palates. Performance metrics indicate that these innovative products have contributed to an estimated [insert percentage]% uplift in sales for brands that prioritize R&D, with unique selling propositions like single-estate sourcing and heritage distillation methods gaining traction. Technological advancements in distillation, such as the adoption of advanced copper pot stills, are enabling finer control over the spirit's character, resulting in premium offerings that command higher price points and foster brand loyalty.

Propelling Factors for Rum Industry Growth

The Rum Industry is propelled by a confluence of powerful growth factors. Technological advancements in distillation, fermentation, and aging techniques are enabling the creation of more diverse and nuanced rum profiles, attracting a wider consumer base. Economically, rising disposable incomes in emerging markets and a global trend towards premiumization in alcoholic beverages significantly boost demand for quality rums. Regulatory support in key producing nations, including favorable trade agreements and investment incentives, further fuels expansion. For example, government initiatives promoting artisanal spirits have led to a [insert percentage]% increase in craft rum production. The growing popularity of cocktail culture worldwide also acts as a major catalyst, with rum being a foundational spirit in numerous iconic drinks.

Obstacles in the Rum Industry Market

Despite its growth, the Rum Industry faces several obstacles. Regulatory challenges, including varying import duties, stringent labeling requirements, and fluctuating excise taxes across different countries, can hinder market access and increase operational costs, amounting to an estimated [insert percentage]% increase in export expenses for some smaller producers. Supply chain disruptions, particularly those related to the availability and pricing of sugarcane and molasses, exacerbated by climate change and geopolitical events, can impact production volumes and profitability. Competitive pressures from other spirit categories, such as whisky and gin, necessitate continuous innovation and effective marketing to maintain market share. Furthermore, consumer perception issues in some markets, where rum may still be perceived as a lower-tier spirit, require concerted efforts to educate and elevate its image.

Future Opportunities in Rum Industry

The Rum Industry is brimming with future opportunities. The burgeoning craft rum movement presents a significant avenue for growth, with consumers actively seeking unique, small-batch, and artisanal expressions. Emerging markets in Asia and Africa offer substantial untapped potential for market penetration and brand building. The increasing consumer interest in sustainability and ethical sourcing creates opportunities for brands that can demonstrate commitment to environmental and social responsibility. Furthermore, the digitalization of sales channels, including e-commerce and direct-to-consumer platforms, provides new avenues for reaching a global customer base and building direct relationships. The development of innovative rum-based products, such as ready-to-drink (RTD) cocktails and aged rum liqueurs, also holds considerable promise for future growth.

Major Players in the Rum Industry Ecosystem

- Mohan Meakin Ltd

- Bacardi and Company Ltd

- Cayman Spirits Co

- Westerhall Estate Ltd

- William Grant & Sons Ltd

- HOVI Trading Ltd

- Pernod Ricard

- Tanduay Distillers Inc

- Remy Cointreau Group

- Diageo PLC

Key Developments in Rum Industry Industry

- August 2022: The French Artisanal Rum brand 'Plantation' introduced varieties of Rum from the French discipline and the tropical passion of ancient craftsmanship in India. The two entrants, Plantation Rum i.e., 3 Stars and Original Dark, were launched in Mumbai and Goa and are slated for expansion across Maharashtra, Delhi, and Bangalore with Third Eye Distillery (TED) as the official partner in India.

- August 2022: Hilton Head Distillery announced its upcoming launch of Panela and Solera Rum products at the distillery and retail locations across South Carolina. Limited batches of each unique copper pot-distilled rum will be released.

- July 2022: The Bush Rum Co., a United Kingdom-owned firm, launched its sustainable drink in India through its local partner, Mumbai-based Monika Alcobev Limited. The company also introduced brands like Jose Cuervo, Templeton Rye whisky, and Rutini wines to the Indian market.

Strategic Rum Industry Market Forecast

The strategic forecast for the Rum Industry indicates a period of sustained and robust growth, driven by a combination of increasing global demand, evolving consumer preferences, and continuous product innovation. The premiumization trend, coupled with the rising popularity of artisanal and craft rums, will continue to propel market expansion, particularly in developed and emerging economies. The increasing emphasis on sustainability and ethical production practices presents a significant opportunity for brands that can align with these values. Furthermore, the exploration of new flavor profiles and innovative aging techniques will capture the attention of a diverse consumer base. The strategic integration of digital sales channels will broaden market reach and enhance consumer engagement, solidifying the Rum Industry's position as a dynamic and lucrative sector within the global beverage market, with an estimated market value reaching [insert projected market value in Millions] Million by 2033.

Rum Industry Segmentation

-

1. Type

- 1.1. White

- 1.2. Gold

- 1.3. Dark

- 1.4. Other Types

-

2. Category

- 2.1. Plain

- 2.2. Flavored

- 2.3. Spiced

-

3. Distibution Channel

- 3.1. Off-Trade

- 3.2. On-Trade

Rum Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

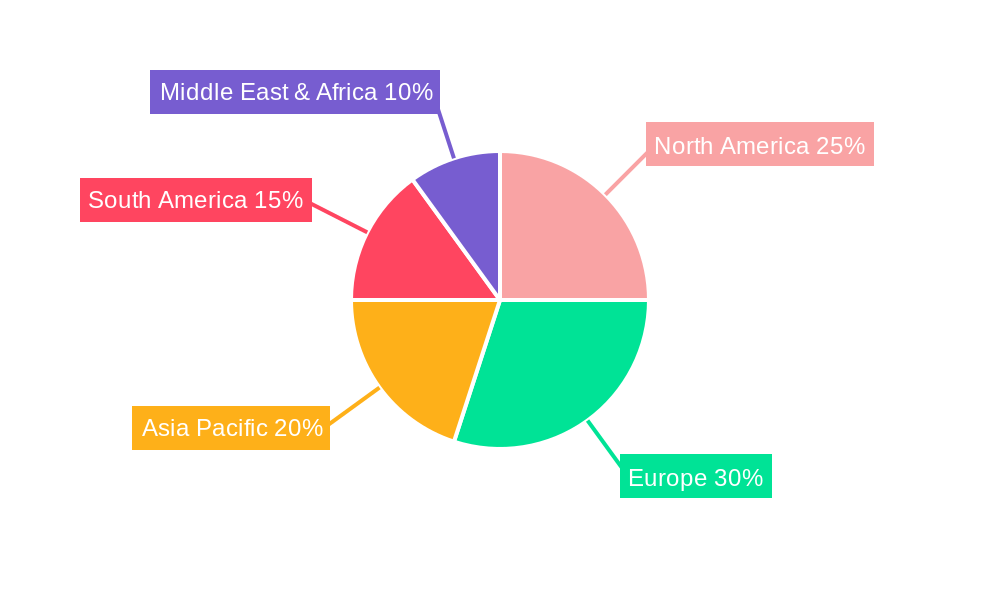

Rum Industry Regional Market Share

Geographic Coverage of Rum Industry

Rum Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. Innovations And Product Launches Are Expected To Drive The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rum Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. White

- 5.1.2. Gold

- 5.1.3. Dark

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Plain

- 5.2.2. Flavored

- 5.2.3. Spiced

- 5.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.3.1. Off-Trade

- 5.3.2. On-Trade

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East

- 5.4.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Rum Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. White

- 6.1.2. Gold

- 6.1.3. Dark

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Category

- 6.2.1. Plain

- 6.2.2. Flavored

- 6.2.3. Spiced

- 6.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.3.1. Off-Trade

- 6.3.2. On-Trade

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Rum Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. White

- 7.1.2. Gold

- 7.1.3. Dark

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Category

- 7.2.1. Plain

- 7.2.2. Flavored

- 7.2.3. Spiced

- 7.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.3.1. Off-Trade

- 7.3.2. On-Trade

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Rum Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. White

- 8.1.2. Gold

- 8.1.3. Dark

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Category

- 8.2.1. Plain

- 8.2.2. Flavored

- 8.2.3. Spiced

- 8.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.3.1. Off-Trade

- 8.3.2. On-Trade

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Rum Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. White

- 9.1.2. Gold

- 9.1.3. Dark

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Category

- 9.2.1. Plain

- 9.2.2. Flavored

- 9.2.3. Spiced

- 9.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 9.3.1. Off-Trade

- 9.3.2. On-Trade

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Rum Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. White

- 10.1.2. Gold

- 10.1.3. Dark

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Category

- 10.2.1. Plain

- 10.2.2. Flavored

- 10.2.3. Spiced

- 10.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 10.3.1. Off-Trade

- 10.3.2. On-Trade

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Saudi Arabia Rum Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. White

- 11.1.2. Gold

- 11.1.3. Dark

- 11.1.4. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Category

- 11.2.1. Plain

- 11.2.2. Flavored

- 11.2.3. Spiced

- 11.3. Market Analysis, Insights and Forecast - by Distibution Channel

- 11.3.1. Off-Trade

- 11.3.2. On-Trade

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Mohan Meakin Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Bacardi and Company Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Cayman Spirits Co *List Not Exhaustive

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Westerhall Estate Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 William Grant & Sons Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 HOVI Trading Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Pernod Ricard

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Tanduay Distillers Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Remy Cointreau Group

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Diageo PLC

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Mohan Meakin Ltd

List of Figures

- Figure 1: Global Rum Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Rum Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Rum Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Rum Industry Revenue (billion), by Category 2025 & 2033

- Figure 5: North America Rum Industry Revenue Share (%), by Category 2025 & 2033

- Figure 6: North America Rum Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 7: North America Rum Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 8: North America Rum Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Rum Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Rum Industry Revenue (billion), by Type 2025 & 2033

- Figure 11: Europe Rum Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Rum Industry Revenue (billion), by Category 2025 & 2033

- Figure 13: Europe Rum Industry Revenue Share (%), by Category 2025 & 2033

- Figure 14: Europe Rum Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 15: Europe Rum Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 16: Europe Rum Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Rum Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Rum Industry Revenue (billion), by Type 2025 & 2033

- Figure 19: Asia Pacific Rum Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Rum Industry Revenue (billion), by Category 2025 & 2033

- Figure 21: Asia Pacific Rum Industry Revenue Share (%), by Category 2025 & 2033

- Figure 22: Asia Pacific Rum Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 23: Asia Pacific Rum Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 24: Asia Pacific Rum Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Rum Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Rum Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: South America Rum Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Rum Industry Revenue (billion), by Category 2025 & 2033

- Figure 29: South America Rum Industry Revenue Share (%), by Category 2025 & 2033

- Figure 30: South America Rum Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 31: South America Rum Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 32: South America Rum Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: South America Rum Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Rum Industry Revenue (billion), by Type 2025 & 2033

- Figure 35: Middle East Rum Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East Rum Industry Revenue (billion), by Category 2025 & 2033

- Figure 37: Middle East Rum Industry Revenue Share (%), by Category 2025 & 2033

- Figure 38: Middle East Rum Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 39: Middle East Rum Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 40: Middle East Rum Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East Rum Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Saudi Arabia Rum Industry Revenue (billion), by Type 2025 & 2033

- Figure 43: Saudi Arabia Rum Industry Revenue Share (%), by Type 2025 & 2033

- Figure 44: Saudi Arabia Rum Industry Revenue (billion), by Category 2025 & 2033

- Figure 45: Saudi Arabia Rum Industry Revenue Share (%), by Category 2025 & 2033

- Figure 46: Saudi Arabia Rum Industry Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 47: Saudi Arabia Rum Industry Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 48: Saudi Arabia Rum Industry Revenue (billion), by Country 2025 & 2033

- Figure 49: Saudi Arabia Rum Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Rum Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Rum Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 3: Global Rum Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 4: Global Rum Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Rum Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Rum Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 7: Global Rum Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 8: Global Rum Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Rum Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Rum Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Rum Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Rum Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Rum Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Rum Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 15: Global Rum Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 16: Global Rum Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Rum Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Germany Rum Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Rum Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: France Rum Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Italy Rum Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Russia Rum Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Rum Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Rum Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 25: Global Rum Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 26: Global Rum Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 27: Global Rum Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 28: China Rum Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Japan Rum Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: India Rum Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Australia Rum Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Rum Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Global Rum Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 34: Global Rum Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 35: Global Rum Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 36: Global Rum Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Rum Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Rum Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Rum Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Global Rum Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 41: Global Rum Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 42: Global Rum Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 43: Global Rum Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 44: Global Rum Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 45: Global Rum Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 46: Global Rum Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 47: Global Rum Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 48: South Africa Rum Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: Rest of Middle East Rum Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rum Industry?

The projected CAGR is approximately 2.3%.

2. Which companies are prominent players in the Rum Industry?

Key companies in the market include Mohan Meakin Ltd, Bacardi and Company Ltd, Cayman Spirits Co *List Not Exhaustive, Westerhall Estate Ltd, William Grant & Sons Ltd, HOVI Trading Ltd, Pernod Ricard, Tanduay Distillers Inc, Remy Cointreau Group, Diageo PLC.

3. What are the main segments of the Rum Industry?

The market segments include Type, Category, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

Innovations And Product Launches Are Expected To Drive The Market.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

In August 2022, the French Artisanal Rum brand 'Plantation' introduced the varieties of Rum from the French discipline and the tropical passion of ancient craftsmanship in India. The two entrants of Plantation Rum i.e., 3 Stars and Original Dark were launched in Mumbai and Goa and will be launched across Maharashtra, Delhi, and Bangalore with Third Eye Distillery (TED) (Parent company of Stranger and Sons) as the official partner for the brand in India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rum Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rum Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rum Industry?

To stay informed about further developments, trends, and reports in the Rum Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence