Key Insights

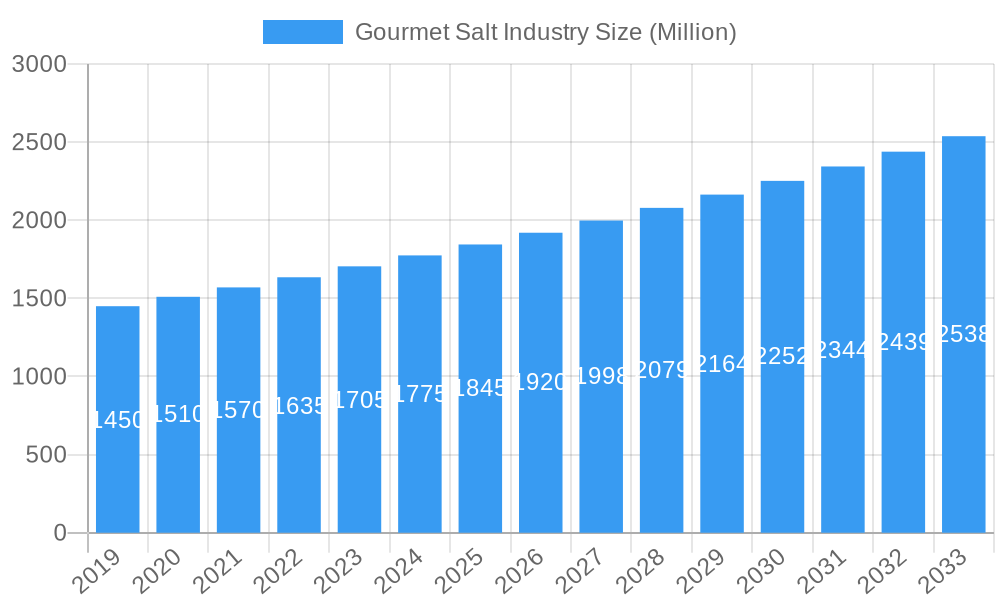

The global Gourmet Salt market is poised for significant expansion, projected to reach an estimated USD 1.84 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 4.20% anticipated throughout the forecast period extending to 2033. This growth trajectory is fueled by an increasing consumer demand for premium culinary ingredients and a growing awareness of the nuanced flavors and textures that specialty salts offer. The rising popularity of home cooking, coupled with the influence of celebrity chefs and food bloggers, is further driving the adoption of gourmet salts across various applications, from enhancing baked goods and confectioneries to elevating the taste profiles of meats, poultry, seafood, and savory dishes. The diverse range of salt types available, including Sel Gris, Flakey Salt, Himalayan Salt, and Fleur de sel, caters to a sophisticated palate, encouraging experimentation and premiumization within the food industry. This heightened appreciation for quality ingredients positions gourmet salts as a key component in both professional kitchens and home pantries.

Gourmet Salt Industry Market Size (In Billion)

Several factors are contributing to this upward market trend. The expanding middle class in emerging economies is increasingly willing to spend on higher-quality food products, including gourmet salts. Furthermore, innovations in salt production and processing, focusing on purity, mineral content, and unique textural properties, are continuously expanding the product portfolio and attracting new consumer segments. While the market benefits from these drivers, it also faces certain restraints. The premium pricing of gourmet salts compared to conventional table salt can be a barrier for some price-sensitive consumers. Additionally, the availability of a wide array of natural and unrefined salts, while a strength, also presents a challenge in terms of educating consumers and differentiating product offerings. Key market players like Cargill Inc., Morton Salt Inc., and Maldon Crystal Salt Co. are actively engaged in product development, strategic partnerships, and market expansion to capitalize on these evolving consumer preferences and capitalize on the growing demand for unique and high-quality salt experiences.

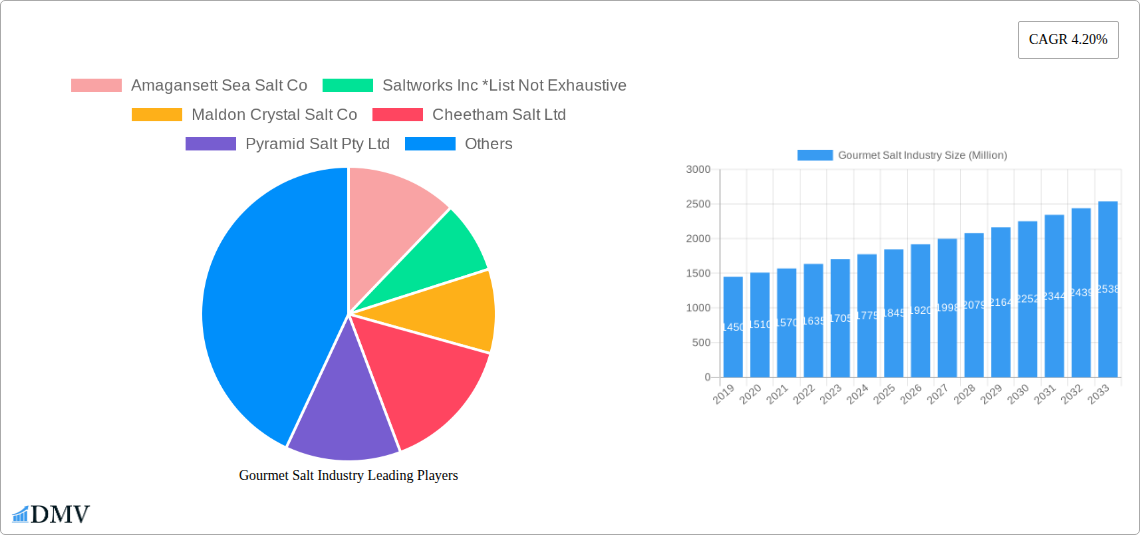

Gourmet Salt Industry Company Market Share

Gourmet Salt Industry Market Composition & Trends

This comprehensive report delves into the dynamic gourmet salt market, a burgeoning sector driven by evolving consumer preferences for artisanal and high-quality ingredients. The market exhibits a moderate concentration, with key players like Cargill Inc., Morton Salt Inc., and Cheetham Salt Ltd. holding significant market share. Innovation remains a crucial catalyst, with companies investing in novel processing techniques and unique flavor profiles. The regulatory landscape is relatively stable, primarily focusing on food safety and labeling standards. Substitute products, such as seasoned salts and blends, present a minor competitive challenge, as the demand for pure, distinct salt varieties continues to rise. End-user profiles are diverse, encompassing culinary enthusiasts, professional chefs, and the food manufacturing industry, with a growing emphasis on health-conscious consumers seeking mineral-rich options. Mergers and acquisitions (M&A) activity is expected to intensify as larger players seek to acquire niche brands and expand their product portfolios. M&A deal values are projected to reach XX Million over the forecast period. Key market share distribution indicates a projected XX% for Himalayan Salt, XX% for Flakey Salt, and XX% for Sel Gris by 2025.

Gourmet Salt Industry Industry Evolution

The gourmet salt industry is undergoing a significant transformation, propelled by a confluence of factors that are reshaping its trajectory from 2019 to 2033. The market has witnessed robust growth, with an anticipated Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). This expansion is deeply rooted in shifting consumer demands that prioritize authenticity, unique culinary experiences, and perceived health benefits associated with specialty salts. Technological advancements in salt harvesting, processing, and packaging have played a pivotal role in this evolution. Innovations in purification techniques ensure higher purity and distinct mineral profiles, while advanced milling and crystallization methods allow for a wider array of textures and grain sizes, catering to specific culinary applications. For instance, the adoption of sophisticated B2B eCommerce tools, as exemplified by SaltWorks' strategic move in April 2020, highlights a trend towards enhanced customer accessibility and streamlined distribution channels, directly impacting sales growth and operational efficiency.

Consumer awareness regarding the nuanced flavors and functional properties of different salt types has also surged. This heightened demand has spurred a diversification of product offerings, moving beyond basic table salt to include specialty varieties like Sel Gris, Fleur de Sel, and exotic Himalayan Pink Salt. The historical period (2019–2024) saw a steady climb in the popularity of these artisanal salts, driven by their appeal in fine dining establishments and home kitchens alike. The base year, 2025, marks a critical juncture where these trends are expected to solidify, with continued investment in product development and market penetration. The industry's ability to adapt to these evolving preferences, coupled with its inherent versatility across a wide spectrum of food applications, positions it for sustained growth and innovation. The integration of digital platforms for sales and marketing further amplifies market reach, enabling smaller producers to compete effectively and cater to a global audience seeking premium salt products.

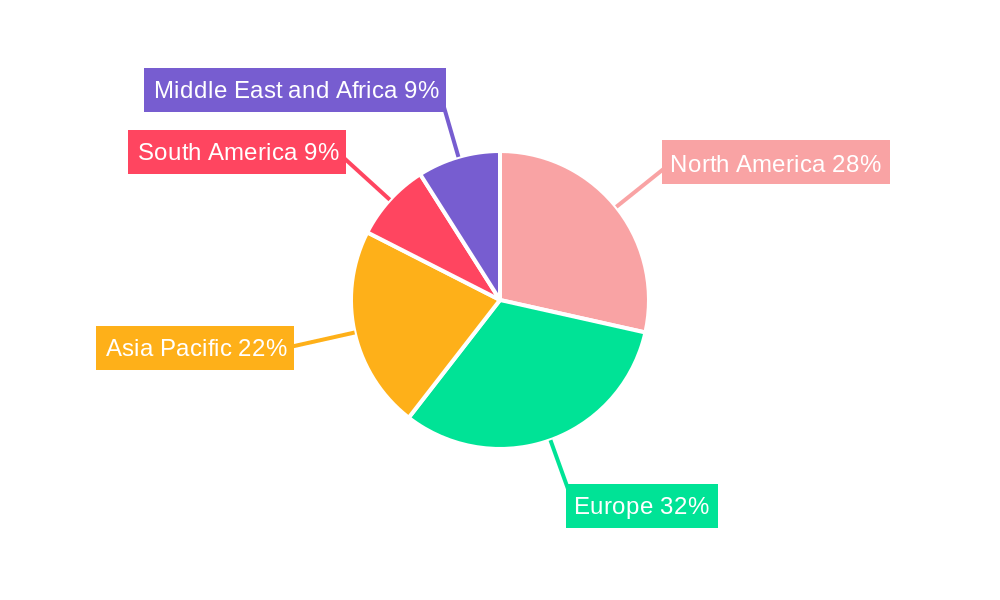

Leading Regions, Countries, or Segments in Gourmet Salt Industry

The gourmet salt industry is experiencing significant regional and segmental dominance, with North America and Europe leading the charge, driven by established culinary traditions and a strong consumer appetite for premium food products. Within this landscape, Himalayan Salt has emerged as a frontrunner, capturing an estimated XX% of the market share by 2025. Its distinctive pink hue, perceived mineral richness, and versatility across applications from cooking to decorative finishing contribute significantly to its widespread appeal.

Dominant Segments by Type:

- Himalayan Salt: Accounting for a substantial market portion due to its visual appeal and health halo. Its broad application in cooking, seasoning, and even decorative purposes makes it a highly sought-after product.

- Flakey Salt: Valued for its delicate texture and ability to provide a satisfying crunch, making it a preferred finishing salt for a variety of dishes, particularly in the bakery and meat and poultry segments.

- Sel Gris: Characterized by its coarse, grey crystals and distinctive mineral notes, derived from French sea salt marshes, making it a favorite among chefs for its complexity and depth of flavor.

- Fleur de Sel: Often referred to as the "caviar of salts," this delicate, hand-harvested sea salt offers a subtle brininess and melts beautifully on the palate, ideal for finishing delicate dishes.

- Specialty Salt: Encompassing a wide array of unique salts, including smoked salts, infused salts, and salts from specific geographical locations, catering to niche culinary demands.

Dominant Segments by Application:

- Meat and Poultry: Gourmet salts enhance the flavor and texture of cooked meats, with flakey salts offering a desirable crispness and mineral salts contributing to a richer taste profile.

- Sea Food: The delicate flavors of seafood are perfectly complemented by the subtle nuances of specialty salts, with Fleur de Sel and Sel Gris being particularly favored.

- Bakery: Gourmet salts are increasingly used to balance sweetness in baked goods, add textural contrast, and enhance overall flavor complexity in products ranging from breads to desserts.

- Confectionary: Beyond simple sweetness, gourmet salts are employed to create intriguing sweet-and-salty flavor profiles in chocolates, caramels, and other confectionery items.

Key drivers for this dominance include increasing consumer disposable incomes, a growing awareness of the impact of salt quality on culinary outcomes, and aggressive marketing by leading companies. Investment trends in product development and distribution channels within these regions are robust, further solidifying their market leadership.

Gourmet Salt Industry Product Innovations

The gourmet salt industry is continually evolving through innovative product development, driven by a desire to enhance culinary experiences and cater to niche market demands. Companies are focusing on creating salts with unique textures, mineral profiles, and flavor infusions. For example, Cargill Salt's January 2021 launch of a purified sea salt flour, an ultra-fine, powder-like sodium chloride, exemplifies innovation for specific applications requiring precise blending in dry mixes and snack food toppings. This product offers superior dispersibility and consistent performance. Similarly, Morton Salt's introduction of All-Natural Himalayan Pink Salt in September 2019, available in both fine and coarse grains, capitalized on the growing consumer trend towards natural and visually appealing salt varieties. These innovations are not just about novel ingredients but also about optimizing performance for specific food applications, from enhancing mouthfeel in bakery products to providing a nuanced flavor enhancement in savory dishes.

Propelling Factors for Gourmet Salt Industry Growth

The growth of the gourmet salt industry is propelled by a confluence of technological, economic, and cultural influences. A primary driver is the escalating consumer demand for premium and artisanal food products, fueled by a growing awareness of the impact of high-quality ingredients on culinary outcomes. This trend is further amplified by a desire for healthier and more natural food options, with consumers seeking salts that offer unique mineral compositions beyond basic sodium chloride. Technological advancements in harvesting and processing techniques enable the production of a wider array of salt textures and flavor profiles, catering to diverse applications. Economic factors, such as rising disposable incomes in developed and emerging markets, allow consumers to allocate more resources to specialty food items. Furthermore, the influence of culinary influencers, celebrity chefs, and food media continues to inspire experimentation with gourmet salts, driving their adoption in both professional kitchens and home cooking.

Obstacles in the Gourmet Salt Industry Market

Despite its robust growth, the gourmet salt market faces several obstacles. Regulatory challenges, particularly concerning labeling and origin claims, can create complexities for producers aiming for global distribution. Supply chain disruptions, especially for naturally harvested salts, can impact availability and price stability. The competitive landscape is intensifying, with both established players and new entrants vying for market share, leading to price pressures. Additionally, the perceived high cost of some gourmet salts can be a barrier for a segment of consumers, limiting widespread adoption. The energy-intensive nature of some salt processing methods also presents an environmental consideration and potential cost factor for manufacturers. Overcoming these hurdles will require strategic planning in sourcing, efficient production, and effective consumer education.

Future Opportunities in Gourmet Salt Industry

The future of the gourmet salt industry is rich with emerging opportunities. The expansion into untapped geographical markets, particularly in Asia-Pacific and Latin America, presents significant growth potential as these regions experience rising disposable incomes and increased interest in global culinary trends. The development of innovative salt blends and infused varieties, catering to specific dietary needs or flavor profiles, offers a pathway to product differentiation. Furthermore, advancements in sustainable harvesting and processing technologies can appeal to an increasingly environmentally conscious consumer base. The growing trend of personalized nutrition and wellness could also spur the development of specialized salts with targeted mineral benefits. Leveraging digital platforms for direct-to-consumer sales and educational content will be crucial for capturing these evolving market dynamics.

Major Players in the Gourmet Salt Industry Ecosystem

- Amagansett Sea Salt Co

- Saltworks Inc

- Maldon Crystal Salt Co

- Cheetham Salt Ltd

- Pyramid Salt Pty Ltd

- Alaska Pure Sea Salt Co

- Murray River Salt

- Cargill Inc

- Morton Salt Inc

- Kalahari Pristine Salt Worx

Key Developments in Gourmet Salt Industry Industry

- January 2021: Cargill Salt launched a new purified sea salt flour, an ultra-fine, powder-like sodium chloride ideal for blending in dry mixes and topping snack foods. This development caters to manufacturers requiring precise ingredient sizing.

- April 2020: SaltWorks announced its adoption of sophisticated new B2B eCommerce tools developed with OroCommerce, enhancing customer experience and fueling sales growth through a robust, flexible sales infrastructure.

- September 2019: Morton Salt added All-Natural Himalayan Pink Salt to its product line, available in fine and coarse grain sizes, tapping into the growing demand for natural, mineral-rich salt varieties.

Strategic Gourmet Salt Industry Market Forecast

The strategic forecast for the gourmet salt industry anticipates sustained growth driven by evolving consumer preferences for premium and authentic food experiences. Key growth catalysts include the increasing demand for artisanal ingredients, the expanding influence of culinary trends, and the growing consumer awareness of the nuanced flavors and health benefits associated with specialty salts. Market potential lies in the continued innovation of unique salt varieties, the expansion into emerging geographical markets, and the adoption of sustainable production practices. The industry's ability to leverage digital channels for direct-to-consumer engagement and to educate consumers about the diverse applications of gourmet salts will be pivotal in capitalizing on future opportunities, with the global market value projected to reach $XX Billion by 2033.

Gourmet Salt Industry Segmentation

-

1. Type

- 1.1. Sel Gris

- 1.2. Flakey Salt

- 1.3. Himalayan Salt

- 1.4. Fleur de sel

- 1.5. Specialty Salt

- 1.6. Other Types

-

2. Application

- 2.1. Confectionary

- 2.2. Bakery

- 2.3. Meat and Poultry

- 2.4. Sea Food

- 2.5. Sauces and Savories

- 2.6. Other Applications

Gourmet Salt Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Gourmet Salt Industry Regional Market Share

Geographic Coverage of Gourmet Salt Industry

Gourmet Salt Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Escalating Demand for Processed Poultry Products; Favorable Government Initiatives to Boost Production

- 3.3. Market Restrains

- 3.3.1. Rising Vegan Trend among Young Consumers; Deeper Penetration of Red Meat Across Saudi Arabia

- 3.4. Market Trends

- 3.4.1. Growing Demand from the Food Service Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gourmet Salt Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Sel Gris

- 5.1.2. Flakey Salt

- 5.1.3. Himalayan Salt

- 5.1.4. Fleur de sel

- 5.1.5. Specialty Salt

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Confectionary

- 5.2.2. Bakery

- 5.2.3. Meat and Poultry

- 5.2.4. Sea Food

- 5.2.5. Sauces and Savories

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Gourmet Salt Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Sel Gris

- 6.1.2. Flakey Salt

- 6.1.3. Himalayan Salt

- 6.1.4. Fleur de sel

- 6.1.5. Specialty Salt

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Confectionary

- 6.2.2. Bakery

- 6.2.3. Meat and Poultry

- 6.2.4. Sea Food

- 6.2.5. Sauces and Savories

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Gourmet Salt Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Sel Gris

- 7.1.2. Flakey Salt

- 7.1.3. Himalayan Salt

- 7.1.4. Fleur de sel

- 7.1.5. Specialty Salt

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Confectionary

- 7.2.2. Bakery

- 7.2.3. Meat and Poultry

- 7.2.4. Sea Food

- 7.2.5. Sauces and Savories

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Gourmet Salt Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Sel Gris

- 8.1.2. Flakey Salt

- 8.1.3. Himalayan Salt

- 8.1.4. Fleur de sel

- 8.1.5. Specialty Salt

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Confectionary

- 8.2.2. Bakery

- 8.2.3. Meat and Poultry

- 8.2.4. Sea Food

- 8.2.5. Sauces and Savories

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Gourmet Salt Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Sel Gris

- 9.1.2. Flakey Salt

- 9.1.3. Himalayan Salt

- 9.1.4. Fleur de sel

- 9.1.5. Specialty Salt

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Confectionary

- 9.2.2. Bakery

- 9.2.3. Meat and Poultry

- 9.2.4. Sea Food

- 9.2.5. Sauces and Savories

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Gourmet Salt Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Sel Gris

- 10.1.2. Flakey Salt

- 10.1.3. Himalayan Salt

- 10.1.4. Fleur de sel

- 10.1.5. Specialty Salt

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Confectionary

- 10.2.2. Bakery

- 10.2.3. Meat and Poultry

- 10.2.4. Sea Food

- 10.2.5. Sauces and Savories

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Amagansett Sea Salt Co

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Saltworks Inc *List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Maldon Crystal Salt Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cheetham Salt Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pyramid Salt Pty Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Alaska Pure Sea Salt Co

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Murray River Salt

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cargill Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Morton Salt Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kalahari Pristine Salt Worx

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Amagansett Sea Salt Co

List of Figures

- Figure 1: Global Gourmet Salt Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Gourmet Salt Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Gourmet Salt Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Gourmet Salt Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Gourmet Salt Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Gourmet Salt Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Gourmet Salt Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Gourmet Salt Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Gourmet Salt Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Gourmet Salt Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Gourmet Salt Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Gourmet Salt Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Gourmet Salt Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Gourmet Salt Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Gourmet Salt Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Gourmet Salt Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Gourmet Salt Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Gourmet Salt Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Gourmet Salt Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Gourmet Salt Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Gourmet Salt Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Gourmet Salt Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Gourmet Salt Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Gourmet Salt Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Gourmet Salt Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Gourmet Salt Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Gourmet Salt Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Gourmet Salt Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Gourmet Salt Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Gourmet Salt Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Gourmet Salt Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gourmet Salt Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Gourmet Salt Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Gourmet Salt Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Gourmet Salt Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Gourmet Salt Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Gourmet Salt Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Gourmet Salt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Gourmet Salt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Gourmet Salt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Gourmet Salt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Gourmet Salt Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Gourmet Salt Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Global Gourmet Salt Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Gourmet Salt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Germany Gourmet Salt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Gourmet Salt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Gourmet Salt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Gourmet Salt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Gourmet Salt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Gourmet Salt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Gourmet Salt Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Gourmet Salt Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Gourmet Salt Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: India Gourmet Salt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: China Gourmet Salt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Gourmet Salt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Gourmet Salt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Gourmet Salt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Gourmet Salt Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 30: Global Gourmet Salt Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global Gourmet Salt Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Gourmet Salt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Gourmet Salt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Gourmet Salt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Gourmet Salt Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Gourmet Salt Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 37: Global Gourmet Salt Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South Africa Gourmet Salt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: United Arab Emirates Gourmet Salt Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Gourmet Salt Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gourmet Salt Industry?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the Gourmet Salt Industry?

Key companies in the market include Amagansett Sea Salt Co, Saltworks Inc *List Not Exhaustive, Maldon Crystal Salt Co, Cheetham Salt Ltd, Pyramid Salt Pty Ltd, Alaska Pure Sea Salt Co, Murray River Salt, Cargill Inc, Morton Salt Inc, Kalahari Pristine Salt Worx.

3. What are the main segments of the Gourmet Salt Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.84 Million as of 2022.

5. What are some drivers contributing to market growth?

Escalating Demand for Processed Poultry Products; Favorable Government Initiatives to Boost Production.

6. What are the notable trends driving market growth?

Growing Demand from the Food Service Industry.

7. Are there any restraints impacting market growth?

Rising Vegan Trend among Young Consumers; Deeper Penetration of Red Meat Across Saudi Arabia.

8. Can you provide examples of recent developments in the market?

In January 2021, Cargill Salt launched a new purified sea salt flour. The ingredient is a unique type of ultra-fine cut, powder-like sodium chloride. It is suitable for applications that require extremely fine sizing for blending, including dry soup, cereal, flour, and spice mixes, as well as for topping snack foods.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gourmet Salt Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gourmet Salt Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gourmet Salt Industry?

To stay informed about further developments, trends, and reports in the Gourmet Salt Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence