Key Insights

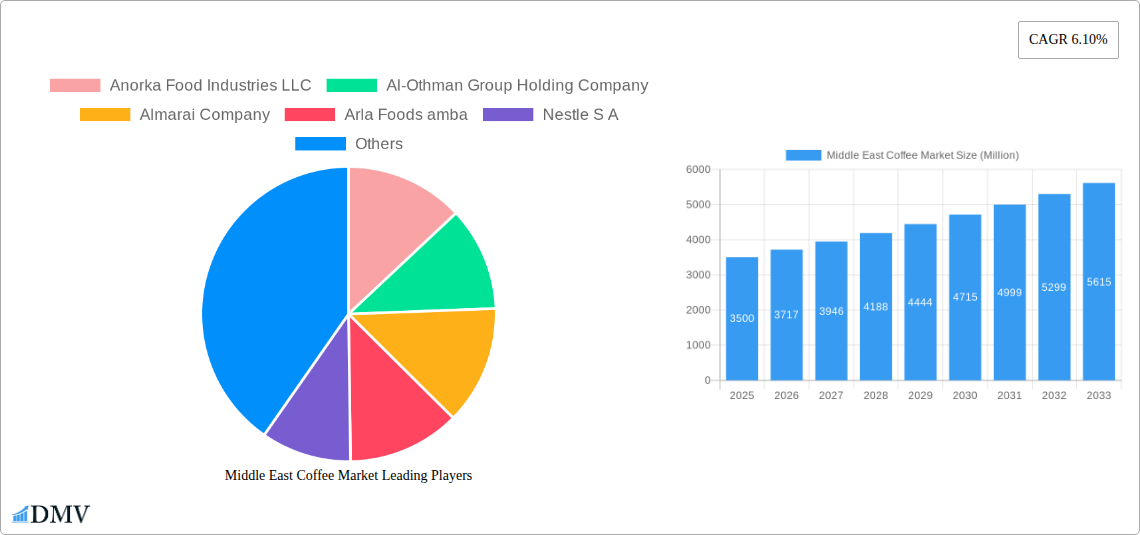

The Middle East Coffee Market is poised for substantial growth, projected to reach an estimated market size of approximately $3,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.10% through 2033. This expansion is primarily fueled by evolving consumer preferences, a rising disposable income across key economies in the region, and the increasing popularity of ready-to-drink (RTD) coffee beverages. The growing demand for convenience is a significant driver, with RTD options like cold brew and iced coffee gaining traction, appealing to a younger demographic seeking on-the-go refreshment. Furthermore, the proliferation of modern retail formats, including online platforms and specialty coffee stores, alongside traditional off-trade channels like supermarkets and convenience stores, is enhancing product accessibility and driving sales volume. The on-trade sector, encompassing cafes and restaurants, also plays a crucial role in shaping coffee consumption habits and driving market value.

Middle East Coffee Market Market Size (In Billion)

Key trends shaping the Middle East Coffee Market include the premiumization of coffee experiences, with consumers showing a greater willingness to spend on high-quality, ethically sourced beans and artisanal brewing methods. This is leading to an increased demand for specialty coffee offerings and a more sophisticated approach to coffee consumption. The influence of global coffee culture, amplified by social media and international travel, is also contributing to the diversification of the market. However, the market faces certain restraints, including fluctuating raw material prices, particularly for coffee beans, and the intense competition from established global players and emerging local brands. Stringent import regulations and differing consumer tastes across various Middle Eastern countries can also pose challenges. Despite these hurdles, the market's inherent growth potential, driven by demographic shifts and a cultural embrace of coffee, suggests a dynamic and lucrative landscape for stakeholders.

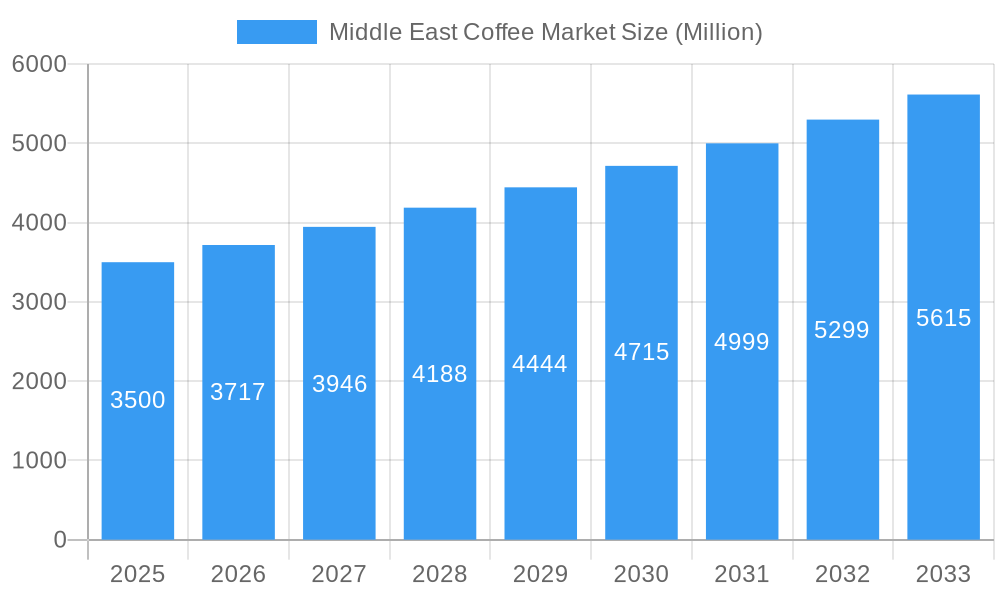

Middle East Coffee Market Company Market Share

Dive deep into the burgeoning Middle East coffee market with this meticulously crafted, SEO-optimized report. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this analysis provides unparalleled insights into market composition, industry evolution, product innovations, and future trajectories. Discover critical trends, leading players, and strategic opportunities within this dynamic and rapidly expanding sector.

Middle East Coffee Market Market Composition & Trends

The Middle East coffee market exhibits a moderate to high market concentration, driven by the presence of established global giants and strong regional players. Innovation is a key catalyst, with a surge in ready-to-drink (RTD) coffee formats and premium offerings catering to evolving consumer preferences. The regulatory landscape is generally supportive of F&B sector growth, although specific import/export duties and food safety regulations are crucial considerations for market entrants. Substitute products, such as energy drinks and traditional tea, present a competitive challenge, but the established coffee culture provides a strong defensive moat. End-user profiles are diverse, ranging from young, trend-conscious urban dwellers seeking convenience to traditional consumers valuing artisanal quality. Merger and acquisition (M&A) activities, though not extensively publicized, are anticipated to increase as larger entities seek to consolidate market share and expand their product portfolios. Market share distribution is dynamic, with leading companies holding significant stakes, while smaller, niche brands are emerging. M&A deal values are projected to be in the tens to hundreds of Million range for strategic acquisitions.

Middle East Coffee Market Industry Evolution

The Middle East coffee market has witnessed a remarkable growth trajectory over the historical period (2019-2024), with consistent year-on-year expansion driven by a confluence of factors including increasing disposable incomes, a growing young population, and a deepening appreciation for diverse coffee experiences. Technological advancements have played a pivotal role, particularly in the cold brew coffee and iced coffee segments, enabling efficient production and wider availability of these popular RTD formats. Advancements in aseptic packaging and PET bottles have further enhanced shelf life and portability, making coffee more accessible in off-trade channels. Consumer demand has shifted significantly, with a growing preference for premium, ethically sourced beans, and innovative flavor profiles. The rise of online retail and the convenience of supermarkets/hypermarkets have democratized access to a wider array of coffee products, while specialty stores cater to discerning enthusiasts. The market is projected to continue its upward momentum, with an estimated compound annual growth rate (CAGR) of XX% during the forecast period (2025-2033). Adoption metrics for RTD coffee are soaring, with penetration rates expected to reach XX% by 2033. The shift towards healthier beverage options also favors coffee, as consumers increasingly seek natural energy sources over sugar-laden alternatives.

Leading Regions, Countries, or Segments in Middle East Coffee Market

The United Arab Emirates (UAE) consistently emerges as a dominant region within the Middle East coffee market, driven by its robust tourism sector, affluent consumer base, and a cosmopolitan lifestyle that embraces global F&B trends. Within the UAE, Dubai and Abu Dhabi are key epicenters of coffee consumption, showcasing high demand for both premium and convenience-driven coffee products.

Soft Drink Type Dominance:

- Cold Brew Coffee: This segment is experiencing exceptional growth, fueled by its perceived health benefits and smooth taste profile. Its adaptability to various flavors and its suitability for on-the-go consumption make it a leader.

- Iced Coffee: A perennial favorite, iced coffee continues to command a significant market share, particularly during warmer months, with numerous product variations available.

- Other RTD Coffee: This broad category encompasses a wide range of innovative coffee-based beverages, including ready-to-drink lattes, cappuccinos, and flavored coffee drinks, catering to diverse palates and occasions.

Packaging Type Dominance:

- PET Bottles: These are leading due to their cost-effectiveness, durability, and resealability, making them ideal for both on-the-go consumption and home use. The ease of recycling also appeals to environmentally conscious consumers.

- Aseptic Packages: Offering extended shelf life without refrigeration, aseptic packaging is crucial for the widespread distribution of RTD coffee, especially in markets with varying temperature conditions.

- Metal Can: Increasingly popular for its premium appeal and excellent barrier properties, metal cans are a strong contender, particularly for single-serving cold brew and iced coffee.

Distribution Channel Dominance:

- Off-trade: This channel is the undisputed leader, with significant contributions from:

- Supermarket/Hypermarket: Offering a wide selection and competitive pricing, these are primary purchasing points for the majority of consumers.

- Online Retail: Experiencing exponential growth, online platforms provide unparalleled convenience and access to niche and premium brands.

- Convenience Stores: Essential for immediate consumption needs and impulse purchases, convenience stores are crucial for RTD coffee accessibility.

- Specialty Stores: While smaller in volume, these outlets cater to coffee aficionados, driving demand for high-quality, artisanal products.

- On-trade: While essential for the café culture experience, the on-trade segment is secondary in terms of overall volume for packaged coffee products compared to off-trade.

Key drivers for this dominance include significant investment trends by major players in establishing robust distribution networks, favorable regulatory support for F&B product imports and sales, and evolving consumer lifestyles that prioritize convenience and accessibility. The UAE's strategic location as a regional hub also facilitates efficient product distribution across neighboring markets.

Middle East Coffee Market Product Innovations

Product innovation in the Middle East coffee market is intensely focused on enhancing consumer convenience and offering novel taste experiences. The rise of cold brew coffee and iced coffee formulations, often infused with unique regional flavors like cardamom or dates, exemplifies this trend. Manufacturers are also exploring functional coffee beverages, incorporating ingredients such as collagen or probiotics to appeal to health-conscious consumers. Innovations in packaging, such as recyclable PET bottles and convenient single-serve aseptic packages, are further expanding market reach and product appeal. Performance metrics are evaluated based on shelf stability, flavor retention, and consumer acceptance, with successful innovations achieving high repeat purchase rates and positive social media engagement.

Propelling Factors for Middle East Coffee Market Growth

Several interconnected factors are propelling the Middle East coffee market's growth. Economic growth and rising disposable incomes across the region are enabling consumers to spend more on premium and convenience-driven coffee products. The young and growing population is increasingly adopting Western beverage trends, with a strong preference for RTD formats like cold brew coffee and iced coffee. Technological advancements in production and packaging, particularly in aseptic packages and PET bottles, are crucial for wider distribution and affordability. Furthermore, the increasing urbanization and a faster pace of life are driving demand for convenient, on-the-go beverage solutions. The growing awareness of coffee's potential health benefits, when consumed in moderation, also contributes to its popularity.

Obstacles in the Middle East Coffee Market Market

Despite robust growth, the Middle East coffee market faces certain obstacles. Fluctuating raw material prices, particularly for coffee beans, can impact profitability and pricing strategies. Intense competition from both global brands and a growing number of local players necessitates continuous innovation and aggressive marketing. Supply chain disruptions, exacerbated by geopolitical factors and logistics challenges, can affect product availability and lead times. Regulatory complexities and varying import duties across different countries within the region can pose barriers to market entry and expansion. Additionally, while coffee culture is growing, cultural preferences for traditional beverages like tea still hold sway in some segments, requiring targeted marketing efforts.

Future Opportunities in Middle East Coffee Market

The future of the Middle East coffee market is brimming with opportunities. The expansion of e-commerce and online retail presents a significant avenue for reaching a wider consumer base, particularly for niche and premium coffee brands. Innovations in plant-based milk alternatives within coffee beverages will cater to a growing vegan and health-conscious demographic. The development of functional coffee products, incorporating vitamins, minerals, or adaptogens, offers a chance to tap into the wellness trend. Further penetration into untapped secondary cities and rural areas through efficient distribution networks represents a substantial growth frontier. Leveraging digital marketing and influencer collaborations will be key to engaging younger consumers and building brand loyalty.

Major Players in the Middle East Coffee Market Ecosystem

- Anorka Food Industries LLC

- Al-Othman Group Holding Company

- Almarai Company

- Arla Foods amba

- Nestle S A

- National Food Industries Company Ltd

- Rauch Fruchtsäfte GmbH & Co OG

- The Kuwaiti Danish Dairy Company

- The Coca-Cola Company

- The Savola Group

- Sapporo Holdings Limited

Key Developments in Middle East Coffee Market Industry

- May 2023: Starbucks introduced Oleato, a line of beverages that combine arabica coffee with extra virgin olive oil, featuring such varieties as latte, espresso, cold brew, and iced cortado, offering a velvety smooth, deliciously lush new coffee experience.

- February 2022: Starbucks opened its 1,000th store in the Middle East region. The milestone opening took place on Bluewaters Island in Dubai, as it continued its expansion across 14 markets in the region.

- September 2020: Chef Middle East extended its partnership and collaboration with Arla Foods to include the Starbucks ‘Ready-to-drink’ range to its already vast existing portfolio of products to distribute to its food service customers.

Strategic Middle East Coffee Market Market Forecast

The strategic forecast for the Middle East coffee market is exceptionally promising, driven by persistent underlying growth catalysts. The increasing disposable incomes and a youthful demographic's embrace of Western coffee culture will continue to fuel demand for convenient and premium RTD coffee formats, including cold brew coffee and iced coffee. Innovations in healthier beverage options and the expansion of online retail channels will unlock new consumer segments and purchasing behaviors. Strategic investments in robust distribution networks, particularly within off-trade channels like supermarkets/hypermarkets and convenience stores, will be crucial for market leaders. The anticipated XX% CAGR from 2025-2033 underscores the significant potential for substantial revenue growth and market expansion in the coming years.

Middle East Coffee Market Segmentation

-

1. Soft Drink Type

- 1.1. Cold Brew Coffee

- 1.2. Iced coffee

- 1.3. Other RTD Coffee

-

2. Packaging Type

- 2.1. Aseptic packages

- 2.2. Glass Bottles

- 2.3. Metal Can

- 2.4. PET Bottles

-

3. Distribution Channel

-

3.1. Off-trade

- 3.1.1. Convenience Stores

- 3.1.2. Online Retail

- 3.1.3. Specialty Stores

- 3.1.4. Supermarket/Hypermarket

- 3.1.5. Others

- 3.2. On-trade

-

3.1. Off-trade

Middle East Coffee Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Coffee Market Regional Market Share

Geographic Coverage of Middle East Coffee Market

Middle East Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Coffee Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 5.1.1. Cold Brew Coffee

- 5.1.2. Iced coffee

- 5.1.3. Other RTD Coffee

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Aseptic packages

- 5.2.2. Glass Bottles

- 5.2.3. Metal Can

- 5.2.4. PET Bottles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Off-trade

- 5.3.1.1. Convenience Stores

- 5.3.1.2. Online Retail

- 5.3.1.3. Specialty Stores

- 5.3.1.4. Supermarket/Hypermarket

- 5.3.1.5. Others

- 5.3.2. On-trade

- 5.3.1. Off-trade

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Anorka Food Industries LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Al-Othman Group Holding Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Almarai Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Arla Foods amba

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nestle S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 National Food Industries Company Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rauch Fruchtsäfte GmbH & Co OG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Kuwaiti Danish Dairy Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Coca-Cola Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Savola Grou

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sapporo Holdings Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Anorka Food Industries LLC

List of Figures

- Figure 1: Middle East Coffee Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East Coffee Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Coffee Market Revenue Million Forecast, by Soft Drink Type 2020 & 2033

- Table 2: Middle East Coffee Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 3: Middle East Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Middle East Coffee Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Middle East Coffee Market Revenue Million Forecast, by Soft Drink Type 2020 & 2033

- Table 6: Middle East Coffee Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 7: Middle East Coffee Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Middle East Coffee Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle East Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle East Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Israel Middle East Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Qatar Middle East Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Kuwait Middle East Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Oman Middle East Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bahrain Middle East Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Jordan Middle East Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Lebanon Middle East Coffee Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Coffee Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the Middle East Coffee Market?

Key companies in the market include Anorka Food Industries LLC, Al-Othman Group Holding Company, Almarai Company, Arla Foods amba, Nestle S A, National Food Industries Company Ltd, Rauch Fruchtsäfte GmbH & Co OG, The Kuwaiti Danish Dairy Company, The Coca-Cola Company, The Savola Grou, Sapporo Holdings Limited.

3. What are the main segments of the Middle East Coffee Market?

The market segments include Soft Drink Type, Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

May 2023: Starbucks introduced Oleato, a line of beverages that combine arabica coffee with extra virgin olive oil featuring such varieties as latte, expresso, cold brew, and iced cortado offering a velvety smooth, deliciously lush new coffee experience.February 2022: Starbucks has opened its 1,000th store in the Middle East region. The milestone opening took place on Bluewaters Island in Dubai, as it continued its expansion across 14 markets in the region.September 2020: Chef Middle East has extended its partnership and collaboration with Arla Foods to include the Starbucks ‘Ready-to-drink’ range to its already vast existing portfolio of products to distribute to its food service customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Coffee Market?

To stay informed about further developments, trends, and reports in the Middle East Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence