Key Insights

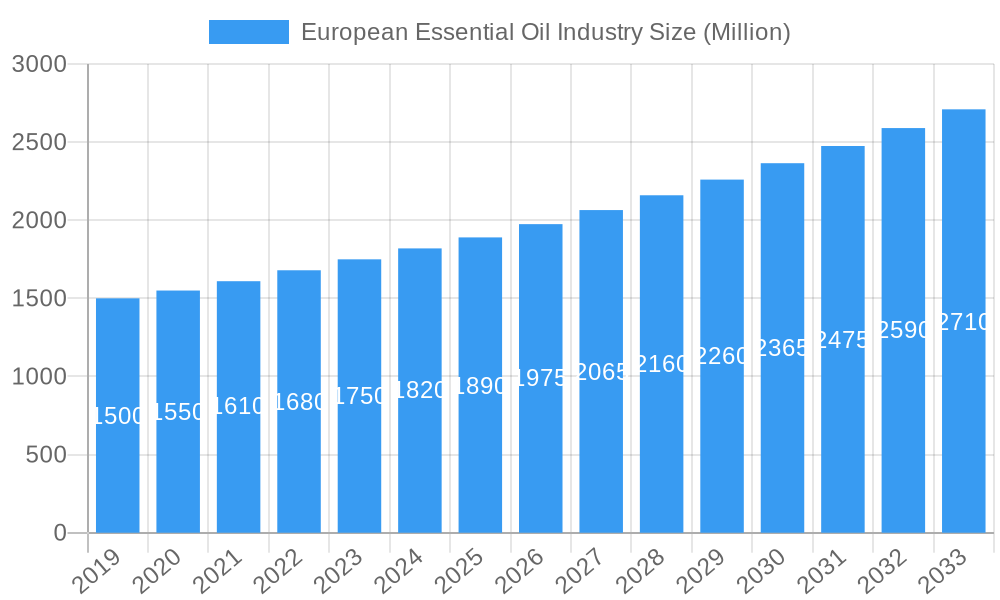

The European essential oil market is poised for substantial growth, projected to reach an estimated \$1.89 billion by 2025 and expanding at a Compound Annual Growth Rate (CAGR) of 5.03% through 2033. This robust expansion is fueled by an increasing consumer preference for natural and organic products across various sectors. The demand for essential oils in aromatherapy and personal care is particularly strong, driven by heightened consumer awareness of their therapeutic benefits and a growing desire for holistic wellness solutions. Furthermore, the food and beverage industry is actively incorporating essential oils for natural flavoring and preservation, while the pharmaceutical sector is exploring their medicinal properties. Key drivers such as the rise of clean beauty, the demand for stress-relief products, and the ongoing pursuit of healthier lifestyles are propelling market penetration. Innovative product development and an expanding distribution network are also contributing to this positive market trajectory.

European Essential Oil Industry Market Size (In Billion)

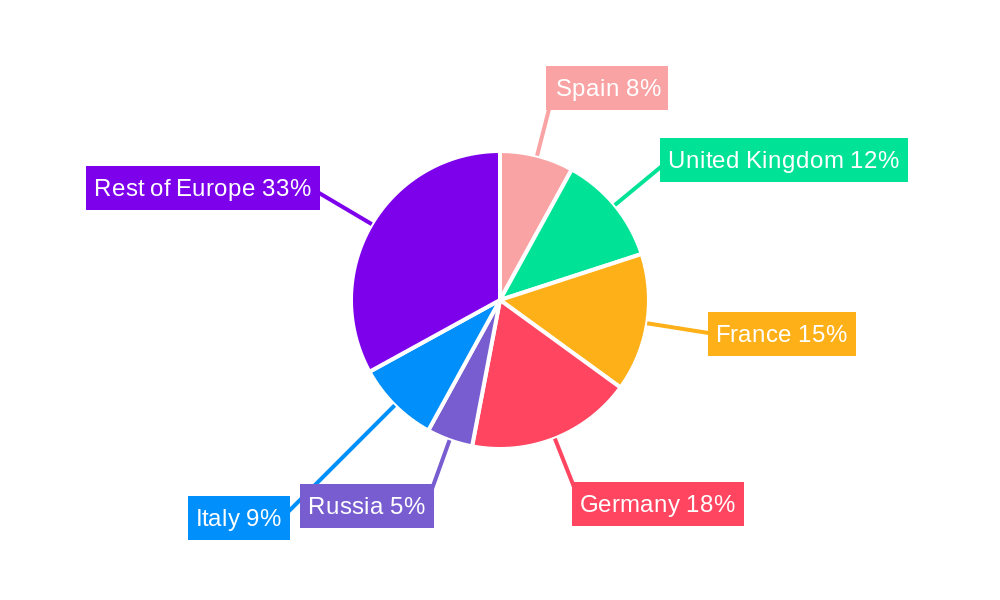

The market is characterized by a diverse range of product types, with Lavender Oil, Orange Oil, and Eucalyptus Oil holding significant shares due to their widespread applications and established consumer recognition. However, emerging oils like Tea Tree and Rosemary are gaining traction, supported by growing scientific research into their benefits. Geographically, key European markets such as Germany, France, and the United Kingdom are expected to lead the growth, owing to mature economies, higher disposable incomes, and a strong consumer base for premium natural products. While the market benefits from these strong drivers, it faces certain restraints, including fluctuating raw material prices and stringent regulatory frameworks governing the production and sale of essential oils. Nevertheless, the overall outlook remains highly positive, with significant opportunities for both established players and new entrants to capitalize on the burgeoning demand for natural and sustainable wellness solutions.

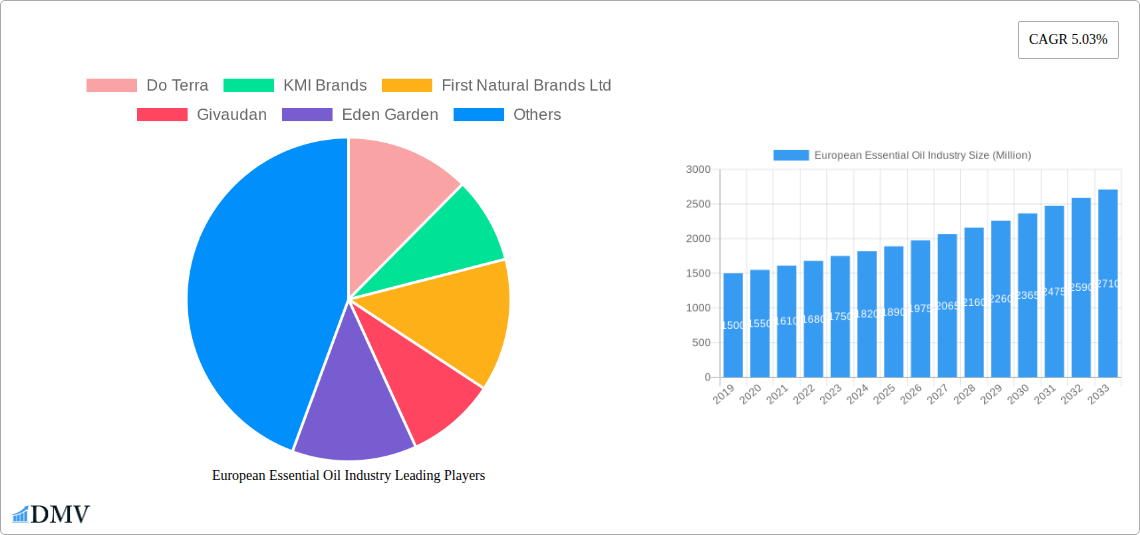

European Essential Oil Industry Company Market Share

European Essential Oil Industry Market Composition & Trends

The European essential oil industry is characterized by a dynamic market structure with a moderate concentration of key players, including global giants and specialized regional producers. Innovation remains a primary catalyst, driven by increasing consumer demand for natural and sustainable ingredients across various applications. The regulatory landscape, while providing a framework for quality and safety, also presents complexities for market entry and expansion. Substitute products, such as synthetic fragrances and alternative wellness solutions, pose a competitive threat, necessitating continuous product differentiation and value proposition enhancement. End-user profiles are diverse, spanning the Food and Beverages sector seeking natural flavors and aromas, the Aromatherapy market for therapeutic benefits, the Pharmaceuticals industry for active compounds, and the Cosmetics and Personal Care segment for fragrances and active ingredients. Mergers and acquisitions (M&A) activities are strategic moves to consolidate market share, acquire new technologies, and expand geographical reach. For instance, significant M&A deals are reshaping the competitive landscape, with deal values often reaching hundreds of millions. Market share distribution sees established companies holding significant portions, while niche players carve out specialized segments. Key trends include the rise of organic and ethically sourced essential oils, a growing emphasis on transparency in sourcing and production, and the integration of essential oils into novel product formulations.

- Market Concentration: Moderate, with a mix of large multinational corporations and specialized regional players.

- Innovation Catalysts: Growing consumer demand for natural and sustainable products, advancements in extraction technologies, and R&D in novel applications.

- Regulatory Landscapes: Stringent regulations concerning purity, labeling, and safety standards across different European Union member states.

- Substitute Products: Synthetic fragrances, alternative natural extracts, and a broad range of wellness and personal care products.

- End-User Profiles: Food & Beverages, Aromatherapy, Pharmaceuticals, Cosmetics & Personal Care, and Household products.

- M&A Activities: Driven by market consolidation, technology acquisition, and expansion into new product categories and regions. Deal values are substantial, reflecting strategic importance.

European Essential Oil Industry Industry Evolution

The European essential oil industry has witnessed a robust and evolving trajectory, driven by a confluence of shifting consumer preferences, technological advancements, and a burgeoning awareness of natural product benefits. Over the historical period of 2019-2024, the market experienced steady growth, fueled by the increasing popularity of aromatherapy and the incorporation of essential oils into a wide array of consumer goods. Growth rates in this period were estimated to be in the range of 4-6% annually, a testament to the sustained demand. The base year of 2025 is projected to see continued expansion, with forecasts extending to 2033 indicating a sustained upward trend, potentially reaching an annual growth rate of 5-7%. This evolution is deeply intertwined with technological advancements in extraction and distillation techniques, leading to higher purity, improved yields, and the development of novel essential oil profiles. Supercritical CO2 extraction, for instance, has gained prominence for its ability to preserve delicate aromatic compounds.

Consumer demand has been a pivotal force, shifting from purely functional use to a holistic approach encompassing wellness, mental well-being, and a preference for natural, ethically sourced ingredients. The "clean beauty" movement has significantly impacted the cosmetics and personal care sector, pushing for the inclusion of natural essential oils over synthetic fragrances. Similarly, the food and beverage industry is increasingly opting for natural flavorings derived from essential oils to meet consumer demand for clean-label products. The pharmaceutical sector is also exploring the therapeutic potential of essential oils for various applications, from pain management to antimicrobial treatments. Adoption metrics for essential oils in new product formulations across these sectors have seen significant increases, with an estimated XX% rise in new product launches featuring essential oils in the last five years. The overarching narrative of the industry's evolution is one of increasing sophistication, diversification of applications, and a deep integration into the broader wellness and natural products economy.

Leading Regions, Countries, or Segments in European Essential Oil Industry

Within the expansive European essential oil market, certain regions, countries, and product segments stand out due to their significant contributions to market growth and innovation. France, historically a powerhouse in perfumery and fine fragrances, continues to be a dominant force, particularly in the production and export of high-quality essential oils like Lavender and Rose. Germany and the United Kingdom also represent substantial markets, driven by a strong consumer base for aromatherapy and natural personal care products.

The Product Type segment showcases remarkable dominance by Lavender Oil. Its widespread application in aromatherapy, cosmetics, and its recognized calming properties make it a perennial favorite. The global demand for Lavender Oil, estimated to be in the billions of dollars, is significantly influenced by European production and consumption. Following closely are Orange Oil and Eucalyptus Oil, driven by their versatility in food and beverage flavoring, cleaning products, and their therapeutic benefits. Peppermint Oil and Spearmint Oil are crucial for the oral care and confectionery industries.

In terms of Application, the Cosmetics and Personal Care segment is a leading driver of demand for essential oils. The "natural and organic" trend has propelled the use of essential oils in skincare, haircare, and fragrances. The Aromatherapy segment, though perhaps smaller in sheer volume, represents a high-value market where the therapeutic benefits of essential oils are paramount. The Food and Beverages application segment also plays a vital role, utilizing essential oils for natural flavoring and aroma. The Pharmaceuticals sector, while still developing, presents significant future potential with increasing research into the medicinal properties of essential oils.

Key drivers for dominance in these segments include:

- Investment Trends: Significant investments in sustainable farming practices and advanced extraction technologies to ensure high-quality yields. For instance, investments in the French Grasse region, a hub for perfumery, often exceed XX Million annually for research and development.

- Regulatory Support: Harmonized EU regulations, while stringent, provide a clear framework that fosters trust and market confidence. Subsidies and support for organic farming also contribute.

- Consumer Preferences: A well-established consumer inclination towards natural and holistic wellness solutions in Europe.

- Established Infrastructure: Robust supply chains and established distribution networks for key essential oil producers.

European Essential Oil Industry Product Innovations

Product innovation in the European essential oil industry is increasingly focused on enhancing purity, exploring novel extraction methods, and developing synergistic blends for specific applications. Advanced techniques like subcritical water extraction and ultrasonic-assisted extraction are yielding higher-quality oils with preserved therapeutic properties. Companies are innovating with pre-diluted essential oil blends for direct consumer use in aromatherapy and topical applications, offering convenience and safety. Furthermore, there's a notable trend in creating functional essential oil formulations for the cosmetics sector, targeting concerns like anti-aging, acne control, and skin hydration. Performance metrics for these innovations include improved bioavailability, enhanced efficacy in target applications, and extended shelf life. The unique selling proposition often lies in the sustainable sourcing of rare botanicals and the scientifically validated benefits of these new formulations, pushing the boundaries of natural ingredient utilization in consumer products.

Propelling Factors for European Essential Oil Industry Growth

The European essential oil industry is propelled by several key factors, including the escalating consumer preference for natural and organic products, driven by a growing awareness of health and wellness. Technological advancements in extraction and distillation processes are enabling higher yields and purer essential oils, making them more accessible and cost-effective. The expanding applications of essential oils beyond traditional aromatherapy, into food and beverages, pharmaceuticals, and cosmetics, are opening up new market avenues. Supportive regulatory frameworks in many European countries also encourage the use of natural ingredients. The increasing investment by major players in sustainable sourcing and production further bolsters market growth. For example, initiatives to promote organic farming practices for key aromatic plants have seen investment figures in the tens of millions across the continent.

Obstacles in the European Essential Oil Industry Market

Despite its growth, the European essential oil market faces several significant obstacles. Regulatory challenges, particularly the differing standards and registration requirements across EU member states, can hinder market access and increase compliance costs, potentially amounting to millions in administrative expenses per company. Supply chain disruptions, stemming from unpredictable weather patterns affecting harvests, geopolitical instability, and fluctuating raw material prices, can lead to price volatility and shortages, impacting production costs by as much as 15-20% in some instances. Intense competitive pressures from both established players and emerging niche brands, coupled with the constant threat from synthetic alternatives, necessitate continuous innovation and marketing efforts, requiring substantial investment. Furthermore, ensuring the authenticity and purity of essential oils from various sources requires rigorous quality control measures, adding to operational complexities.

Future Opportunities in European Essential Oil Industry

The European essential oil industry is poised for significant future opportunities, primarily driven by the sustained global demand for natural and sustainable products. The growing interest in holistic wellness and preventative healthcare presents a substantial avenue for essential oils, particularly in aromatherapy and therapeutic applications. The expanding research into the pharmaceutical potential of essential oils for treating various ailments offers a long-term growth prospect, with potential market expansion into the billions. Furthermore, innovation in encapsulation technologies will enable the more effective delivery and wider application of essential oils in food, beverages, and functional ingredients. Emerging markets and niche applications, such as essential oils for mood enhancement in smart home devices or for specialized industrial purposes, also represent untapped potential, promising significant market diversification and growth.

Major Players in the European Essential Oil Industry Ecosystem

- Do Terra

- KMI Brands

- First Natural Brands Ltd

- Givaudan

- Eden Garden

- Young Living

- Rocky Mountain Essential Oils

- Roberta SA

- Sensient Technologies Corporation

- Farotti Essenze

Key Developments in European Essential Oil Industry Industry

- May 2022: KMI Brands launched Plantopia, a wellness brand also offering essential oils, marking their entry into the UK wellness market. This development signals a strategic move by KMI Brands, known for Noughty Hair & Body Care and Ted Baker Fragrance, to capitalize on the growing wellness trend with a dedicated essential oil offering.

- February 2022: Givaudan acquired Myrissi in France. Myrissi's expertise in Artificial Intelligence is expected to significantly enhance Givaudan's capabilities in suggesting novel organoleptic methods to customers, thereby strengthening their long-term strategy in fragrances, including essential oils, and the broader beauty sector.

- December 2021: First Natural Brands, a producer of wellness products and essential oils, announced plans for international expansion, supported by a EUR 6.25 million funding package from Santander UK. This significant financial backing underscores the company's ambitious growth objectives and the market's confidence in its expansion strategy.

Strategic European Essential Oil Industry Market Forecast

The strategic forecast for the European essential oil industry points towards sustained and robust growth, fueled by an unwavering consumer preference for natural, ethically sourced, and sustainable products. Key growth catalysts include the expanding applications of essential oils in sectors like pharmaceuticals and functional foods, where their therapeutic and health-promoting properties are increasingly recognized and validated by scientific research. Technological advancements in extraction and formulation are expected to unlock new product possibilities and enhance efficacy, driving demand. Furthermore, the industry's proactive approach to sustainability and transparency in sourcing is building consumer trust and loyalty. The market is projected to witness significant value growth, with strategic investments in research and development, global expansion by key players, and the emergence of innovative product lines expected to further solidify its position as a vital component of the global wellness economy. The market is anticipated to reach figures in the tens of billions by 2033.

European Essential Oil Industry Segmentation

-

1. Product Type

- 1.1. Lavender Oil

- 1.2. Orange Oil

- 1.3. Eucalyptus Oil

- 1.4. Peppermint Oil

- 1.5. Spearmint Oil

- 1.6. Lemon Oil

- 1.7. Rosemary Oil

- 1.8. Geranium Oil

- 1.9. Tea Tree Oil

- 1.10. Other Product Types

-

2. Application

- 2.1. Food and Beverages

- 2.2. Aromatherapy

- 2.3. Pharmaceuticals

- 2.4. Cosmetics and Personal Care

- 2.5. Other Applications

European Essential Oil Industry Segmentation By Geography

- 1. Spain

- 2. United Kingdom

- 3. France

- 4. Germany

- 5. Russia

- 6. Italy

- 7. Rest of Europe

European Essential Oil Industry Regional Market Share

Geographic Coverage of European Essential Oil Industry

European Essential Oil Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.03% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Alternative Proteins

- 3.4. Market Trends

- 3.4.1. The Rise of Aromatherapy in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Essential Oil Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Lavender Oil

- 5.1.2. Orange Oil

- 5.1.3. Eucalyptus Oil

- 5.1.4. Peppermint Oil

- 5.1.5. Spearmint Oil

- 5.1.6. Lemon Oil

- 5.1.7. Rosemary Oil

- 5.1.8. Geranium Oil

- 5.1.9. Tea Tree Oil

- 5.1.10. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverages

- 5.2.2. Aromatherapy

- 5.2.3. Pharmaceuticals

- 5.2.4. Cosmetics and Personal Care

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Germany

- 5.3.5. Russia

- 5.3.6. Italy

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Spain European Essential Oil Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Lavender Oil

- 6.1.2. Orange Oil

- 6.1.3. Eucalyptus Oil

- 6.1.4. Peppermint Oil

- 6.1.5. Spearmint Oil

- 6.1.6. Lemon Oil

- 6.1.7. Rosemary Oil

- 6.1.8. Geranium Oil

- 6.1.9. Tea Tree Oil

- 6.1.10. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverages

- 6.2.2. Aromatherapy

- 6.2.3. Pharmaceuticals

- 6.2.4. Cosmetics and Personal Care

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom European Essential Oil Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Lavender Oil

- 7.1.2. Orange Oil

- 7.1.3. Eucalyptus Oil

- 7.1.4. Peppermint Oil

- 7.1.5. Spearmint Oil

- 7.1.6. Lemon Oil

- 7.1.7. Rosemary Oil

- 7.1.8. Geranium Oil

- 7.1.9. Tea Tree Oil

- 7.1.10. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverages

- 7.2.2. Aromatherapy

- 7.2.3. Pharmaceuticals

- 7.2.4. Cosmetics and Personal Care

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France European Essential Oil Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Lavender Oil

- 8.1.2. Orange Oil

- 8.1.3. Eucalyptus Oil

- 8.1.4. Peppermint Oil

- 8.1.5. Spearmint Oil

- 8.1.6. Lemon Oil

- 8.1.7. Rosemary Oil

- 8.1.8. Geranium Oil

- 8.1.9. Tea Tree Oil

- 8.1.10. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverages

- 8.2.2. Aromatherapy

- 8.2.3. Pharmaceuticals

- 8.2.4. Cosmetics and Personal Care

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Germany European Essential Oil Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Lavender Oil

- 9.1.2. Orange Oil

- 9.1.3. Eucalyptus Oil

- 9.1.4. Peppermint Oil

- 9.1.5. Spearmint Oil

- 9.1.6. Lemon Oil

- 9.1.7. Rosemary Oil

- 9.1.8. Geranium Oil

- 9.1.9. Tea Tree Oil

- 9.1.10. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food and Beverages

- 9.2.2. Aromatherapy

- 9.2.3. Pharmaceuticals

- 9.2.4. Cosmetics and Personal Care

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Russia European Essential Oil Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Lavender Oil

- 10.1.2. Orange Oil

- 10.1.3. Eucalyptus Oil

- 10.1.4. Peppermint Oil

- 10.1.5. Spearmint Oil

- 10.1.6. Lemon Oil

- 10.1.7. Rosemary Oil

- 10.1.8. Geranium Oil

- 10.1.9. Tea Tree Oil

- 10.1.10. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food and Beverages

- 10.2.2. Aromatherapy

- 10.2.3. Pharmaceuticals

- 10.2.4. Cosmetics and Personal Care

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Italy European Essential Oil Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Lavender Oil

- 11.1.2. Orange Oil

- 11.1.3. Eucalyptus Oil

- 11.1.4. Peppermint Oil

- 11.1.5. Spearmint Oil

- 11.1.6. Lemon Oil

- 11.1.7. Rosemary Oil

- 11.1.8. Geranium Oil

- 11.1.9. Tea Tree Oil

- 11.1.10. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Food and Beverages

- 11.2.2. Aromatherapy

- 11.2.3. Pharmaceuticals

- 11.2.4. Cosmetics and Personal Care

- 11.2.5. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe European Essential Oil Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Lavender Oil

- 12.1.2. Orange Oil

- 12.1.3. Eucalyptus Oil

- 12.1.4. Peppermint Oil

- 12.1.5. Spearmint Oil

- 12.1.6. Lemon Oil

- 12.1.7. Rosemary Oil

- 12.1.8. Geranium Oil

- 12.1.9. Tea Tree Oil

- 12.1.10. Other Product Types

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Food and Beverages

- 12.2.2. Aromatherapy

- 12.2.3. Pharmaceuticals

- 12.2.4. Cosmetics and Personal Care

- 12.2.5. Other Applications

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Do Terra

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 KMI Brands

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 First Natural Brands Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Givaudan

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Eden Garden

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Young Living

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Rocky Mountain Essential Oils

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Roberta SA*List Not Exhaustive

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Sensient Technologies Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Farotti Essenze

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Do Terra

List of Figures

- Figure 1: European Essential Oil Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Essential Oil Industry Share (%) by Company 2025

List of Tables

- Table 1: European Essential Oil Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: European Essential Oil Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: European Essential Oil Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: European Essential Oil Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: European Essential Oil Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: European Essential Oil Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: European Essential Oil Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: European Essential Oil Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 9: European Essential Oil Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: European Essential Oil Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: European Essential Oil Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: European Essential Oil Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: European Essential Oil Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: European Essential Oil Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: European Essential Oil Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: European Essential Oil Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: European Essential Oil Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 18: European Essential Oil Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: European Essential Oil Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: European Essential Oil Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 21: European Essential Oil Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: European Essential Oil Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 23: European Essential Oil Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: European Essential Oil Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Essential Oil Industry?

The projected CAGR is approximately 5.03%.

2. Which companies are prominent players in the European Essential Oil Industry?

Key companies in the market include Do Terra, KMI Brands, First Natural Brands Ltd, Givaudan, Eden Garden, Young Living, Rocky Mountain Essential Oils, Roberta SA*List Not Exhaustive, Sensient Technologies Corporation, Farotti Essenze.

3. What are the main segments of the European Essential Oil Industry?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

The Rise of Aromatherapy in Europe.

7. Are there any restraints impacting market growth?

Presence of Alternative Proteins.

8. Can you provide examples of recent developments in the market?

May 2022: The launch of Plantopia, a wellness brand that also offers essential oils, marked KMI Brands' entry into the wellness market in the United Kingdom. KMI Brands is the maker of Noughty Hair & Body Care and the licensed distributor of Ted Baker Fragrance and Toiletries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Essential Oil Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Essential Oil Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Essential Oil Industry?

To stay informed about further developments, trends, and reports in the European Essential Oil Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence