Key Insights

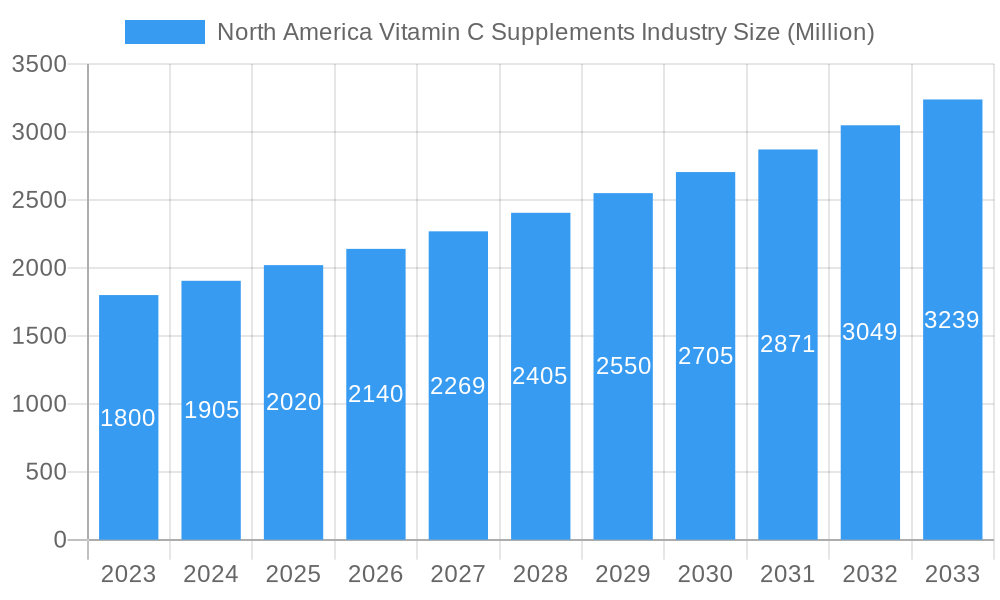

The North America Vitamin C supplements market is projected for significant expansion, expected to reach a market size of 64.06 billion by 2025, with a compound annual growth rate (CAGR) of 7.3% through 2033. This growth is driven by heightened consumer awareness of Vitamin C’s immune-boosting and overall health benefits, alongside the increasing demand for preventative healthcare solutions and the rising incidence of chronic diseases. The growing popularity of dietary supplements for general wellness and the aging population's focus on immune support and antioxidant properties are key factors. Market expansion is further supported by product innovation, such as improved absorption formulations and convenient dosage forms like gummies, meeting evolving consumer demands.

North America Vitamin C Supplements Industry Market Size (In Billion)

The competitive environment features established pharmaceutical companies and dedicated supplement manufacturers engaging in innovation and strategic alliances. Key market segments include Vitamin C and Essential Fatty Acids, with capsules and powders being the dominant forms. Distribution channels are diversifying, with online retail and pharmacies gaining prominence alongside hypermarkets, supermarkets, and direct selling. North America, led by the United States, Canada, and Mexico, is a major market due to high disposable incomes and a health-conscious demographic. Navigating stringent regulations and potential market saturation requires continuous innovation and value-added offerings to maintain growth.

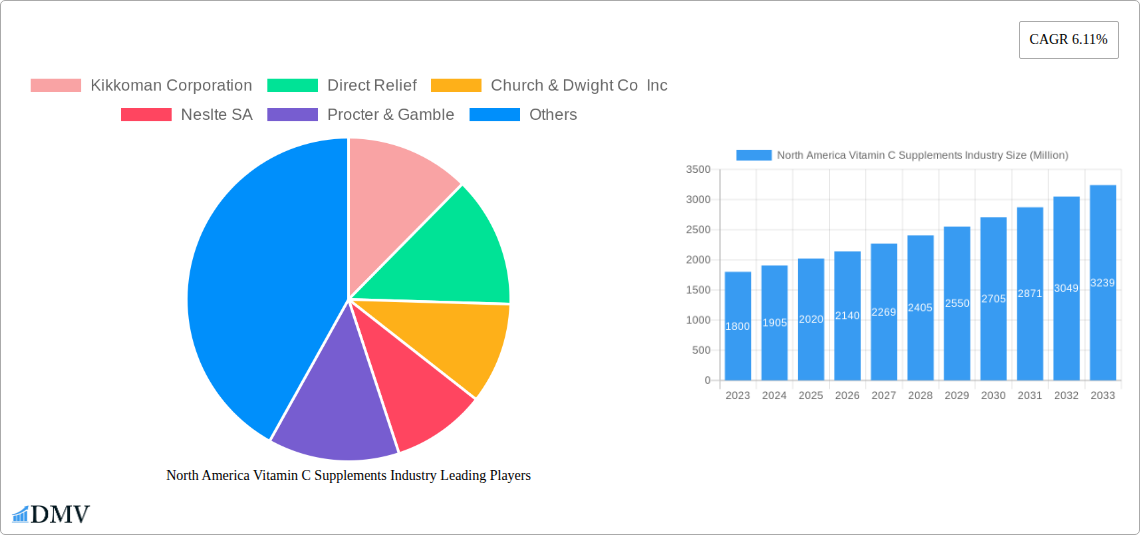

North America Vitamin C Supplements Industry Company Market Share

North America Vitamin C Supplements Industry Market Analysis & Forecast (2019–2033)

This comprehensive report offers an in-depth analysis of the North America Vitamin C Supplements Industry, providing actionable insights for stakeholders from 2019 to 2033. Covering market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, future opportunities, key players, and strategic forecasts, this report is an essential resource for understanding market dynamics and capitalizing on future growth.

North America Vitamin C Supplements Industry Market Composition & Trends

The North America Vitamin C Supplements Industry is characterized by a dynamic market structure, with a moderate level of concentration driven by key players and emerging innovators. Innovation catalysts include advancements in bioavailability, formulation technologies, and the growing consumer demand for natural and sustainably sourced ingredients. The regulatory landscape, primarily governed by the FDA in the United States and Health Canada, emphasizes stringent quality control and labeling requirements, impacting product development and market entry strategies. Substitute products, such as whole foods rich in Vitamin C, present a continuous challenge, requiring manufacturers to emphasize the convenience, precise dosage, and specific health benefits offered by supplements. End-user profiles are diverse, ranging from health-conscious individuals and athletes seeking performance enhancement to the aging population focused on immune support and disease prevention. Mergers & Acquisitions (M&A) activity is a significant trend, with deal values in the hundreds of millions of dollars influencing market consolidation and the expansion of product portfolios. For instance, strategic acquisitions of niche supplement brands by larger corporations aim to broaden market reach and integrate innovative formulations. Understanding these market dynamics is crucial for navigating competitive pressures and identifying strategic growth avenues.

North America Vitamin C Supplements Industry Industry Evolution

The North America Vitamin C Supplements Industry has witnessed a substantial evolution over the historical period (2019-2024) and is poised for continued expansion through the forecast period (2025-2033). Driven by an escalating global awareness of health and wellness, the market has seen consistent year-over-year growth rates, projected to be in the range of 7-10% annually. Technological advancements have played a pivotal role, particularly in enhancing the bioavailability and efficacy of Vitamin C. Innovations such as liposomal encapsulation and esterified Vitamin C formulations have emerged, addressing issues like gastric irritation and improving nutrient absorption, leading to higher adoption rates among consumers seeking tangible health benefits.

Shifting consumer demands are a powerful force shaping this industry. There's a marked preference for natural, organic, and non-GMO ingredients, pushing manufacturers to reformulate their products and source ethically. The rise of preventative healthcare has further amplified the demand for immune-boosting supplements, with Vitamin C being a cornerstone ingredient. Consumers are increasingly educated about the multifaceted benefits of Vitamin C, extending beyond its well-known antioxidant properties to include its role in collagen synthesis, wound healing, and iron absorption. This heightened consumer awareness translates into higher sales volumes and a greater willingness to invest in premium supplement options.

The digital revolution has also significantly impacted the industry's evolution. Online retail channels have become indispensable, offering convenience and accessibility. This shift has spurred innovation in e-commerce strategies, direct-to-consumer (DTC) models, and personalized supplement recommendations. The base year (2025) is expected to see a market valuation of approximately USD 1.5 Billion, with projections indicating a reach of over USD 3 Billion by 2033. This trajectory highlights the industry's robust growth potential, fueled by a confluence of health consciousness, technological innovation, and evolving consumer behavior.

Leading Regions, Countries, or Segments in North America Vitamin C Supplements Industry

The North America Vitamin C Supplements Industry exhibits clear leadership within specific regions and segments, driven by a confluence of socio-economic factors, health trends, and distribution strategies.

Dominant Region: United States

The United States stands as the undisputed leader in the North America Vitamin C Supplements Industry, commanding an estimated 70% of the regional market share. This dominance is attributable to several key drivers:

- High Health Consciousness and Disposable Income: A significant portion of the US population prioritizes health and wellness, with a higher disposable income enabling greater spending on supplements. Investment trends show consistent growth in health and wellness expenditure.

- Robust Healthcare Infrastructure and Awareness: Widespread access to healthcare information and a proactive approach to preventative care contribute to the strong demand for Vitamin C supplements.

- Favorable Regulatory Environment for Supplements: While regulated, the US market offers a comparatively more accessible pathway for supplement manufacturers compared to some other regions, fostering innovation and product variety.

- Extensive Distribution Networks: The availability of Vitamin C supplements across a wide array of distribution channels, from hypermarkets and supermarkets to online retail stores and pharmacies, ensures broad consumer access.

Dominant Segments:

- Type: Vitamins

- Dominance Factor: Vitamin C, as a standalone product and within multivitamin formulations, consistently represents the largest segment. Its proven benefits for immune support, antioxidant protection, and overall health make it a staple in consumer supplement routines. The market share for Vitamin C as a type is estimated to be above 45%.

- Key Drivers: Extensive scientific backing for benefits, high consumer awareness, and diverse product offerings (e.g., chewables, effervescent tablets, capsules).

- Form: Capsules

- Dominance Factor: Capsules remain the most popular form due to their ease of consumption, precise dosage control, and ability to mask taste. This segment is estimated to hold approximately 35% of the market.

- Key Drivers: Convenience, shelf stability, and perceived efficacy.

- Distribution Channel: Online Retail Stores

- Dominance Factor: The rapid growth of e-commerce has made online retail a leading distribution channel, projected to account for over 30% of sales in 2025.

- Key Drivers: Convenience, competitive pricing, wider product selection, and direct-to-consumer (DTC) models.

While other regions like Canada also contribute significantly, and segments like Gummies are experiencing rapid growth, the United States, the "Vitamins" type, "Capsules" form, and "Online Retail Stores" distribution channel currently represent the most influential pillars of the North America Vitamin C Supplements Industry.

North America Vitamin C Supplements Industry Product Innovations

Product innovation in the North America Vitamin C Supplements Industry is primarily focused on enhancing bioavailability and addressing specific consumer needs. Advanced formulations like liposomal Vitamin C offer superior absorption, leading to greater cellular uptake and efficacy. Esterified Vitamin C variants are also gaining traction for their gentler impact on the digestive system. Novel delivery systems, including chewable tablets with improved taste profiles and effervescent powders for rapid dissolution, cater to evolving consumer preferences for convenience and palatability. Furthermore, the integration of synergistic ingredients, such as zinc and elderberry, into Vitamin C supplements is a growing trend, creating comprehensive immune support formulations with enhanced unique selling propositions.

Propelling Factors for North America Vitamin C Supplements Industry Growth

The North America Vitamin C Supplements Industry is propelled by a confluence of powerful factors. Firstly, an unprecedented surge in health and wellness consciousness, amplified by recent global health events, has significantly boosted demand for immune-boosting supplements, with Vitamin C being a primary beneficiary. Secondly, ongoing technological advancements in formulation science, such as improved bioavailability methods (e.g., liposomal encapsulation), are enhancing product efficacy and consumer satisfaction, driving market penetration. Thirdly, a favorable economic climate in key North American markets, characterized by rising disposable incomes, allows consumers to allocate more resources towards health-related expenditures. Finally, a supportive regulatory framework, albeit with stringent quality standards, provides a stable environment for growth and innovation, encouraging investment from both established players and startups.

Obstacles in the North America Vitamin C Supplements Industry Market

Despite robust growth, the North America Vitamin C Supplements Industry faces several obstacles. Stringent regulatory compliance, including adherence to FDA and Health Canada guidelines, can increase research and development costs and lengthen time-to-market for new products. Supply chain disruptions, exacerbated by global events, can lead to ingredient shortages and price volatility, impacting production costs and availability. Furthermore, intense market competition from numerous brands and the availability of affordable alternatives from supermarkets and pharmacies exert downward pressure on pricing and profit margins. The perception of Vitamin C as a commodity product also challenges brands aiming for premium positioning, necessitating strong marketing and differentiation strategies.

Future Opportunities in North America Vitamin C Supplements Industry

Emerging opportunities in the North America Vitamin C Supplements Industry are abundant. The growing demand for personalized nutrition presents a significant avenue for tailored Vitamin C formulations based on individual genetic profiles or specific health goals. Expansion into niche markets, such as sports nutrition and the aging population segment, offers substantial growth potential. Advancements in sustainable sourcing and eco-friendly packaging align with increasing consumer preferences for ethical products, creating opportunities for brands that prioritize environmental responsibility. Furthermore, the exploration of novel applications for Vitamin C, beyond immune support, such as its role in cognitive health and skin rejuvenation, can unlock new product categories and consumer bases.

Major Players in the North America Vitamin C Supplements Industry Ecosystem

- Kikkoman Corporation

- Direct Relief

- Church & Dwight Co Inc

- Nestlé SA

- Procter & Gamble

- Bayer AG

- Otsuka Holdings Co Ltd (Nature Made)

- NATURELO Premium Supplements Inc

- Amway Corp

Key Developments in North America Vitamin C Supplements Industry Industry

- 2023/Q4: Launch of novel liposomal Vitamin C formulations by multiple brands, emphasizing enhanced bioavailability and reduced digestive discomfort.

- 2024/Q1: Increased M&A activity with larger supplement manufacturers acquiring smaller, innovative brands to expand product portfolios and market reach, deal values estimated in the tens of millions.

- 2024/Q2: Growing consumer demand for organic and non-GMO Vitamin C supplements, leading to reformulation and sourcing adjustments by leading companies.

- 2024/Q3: Introduction of plant-based gummy Vitamin C formulations targeting specific age demographics and dietary preferences.

- 2024/Q4: Expansion of direct-to-consumer (DTC) sales channels by several key players, leveraging e-commerce platforms for increased accessibility and customer engagement.

- 2025/Q1: Focus on sustainable packaging solutions and ethical sourcing gaining momentum, influencing brand positioning and marketing strategies.

Strategic North America Vitamin C Supplements Industry Market Forecast

The strategic forecast for the North America Vitamin C Supplements Industry anticipates continued robust growth, driven by an enduring focus on preventative health and immune support. Innovation in delivery systems and bioavailability will remain critical, offering opportunities for premiumization and differentiation. The expanding online retail landscape will facilitate wider market access and personalized consumer engagement. Strategic investments in research and development to explore novel health applications of Vitamin C, coupled with a commitment to sustainability and ethical practices, will be key to capturing future market share. The industry's trajectory indicates sustained expansion, with the market value expected to exceed USD 3 Billion by 2033, presenting significant potential for stakeholders who adapt to evolving consumer demands and technological advancements.

North America Vitamin C Supplements Industry Segmentation

-

1. Type

- 1.1. Vitamins

- 1.2. Minerals (Calcium, Iron, and others)

- 1.3. Essential Fatty Acids

- 1.4. Others

-

2. Form

- 2.1. Capsules

- 2.2. Powder

- 2.3. Gummy

-

3. Distribution Channel

- 3.1. Hypermarket/Supermarket

- 3.2. Online Retail Stores

- 3.3. Direct Selling

- 3.4. Pharmacy/Drug Store

- 3.5. Others

North America Vitamin C Supplements Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

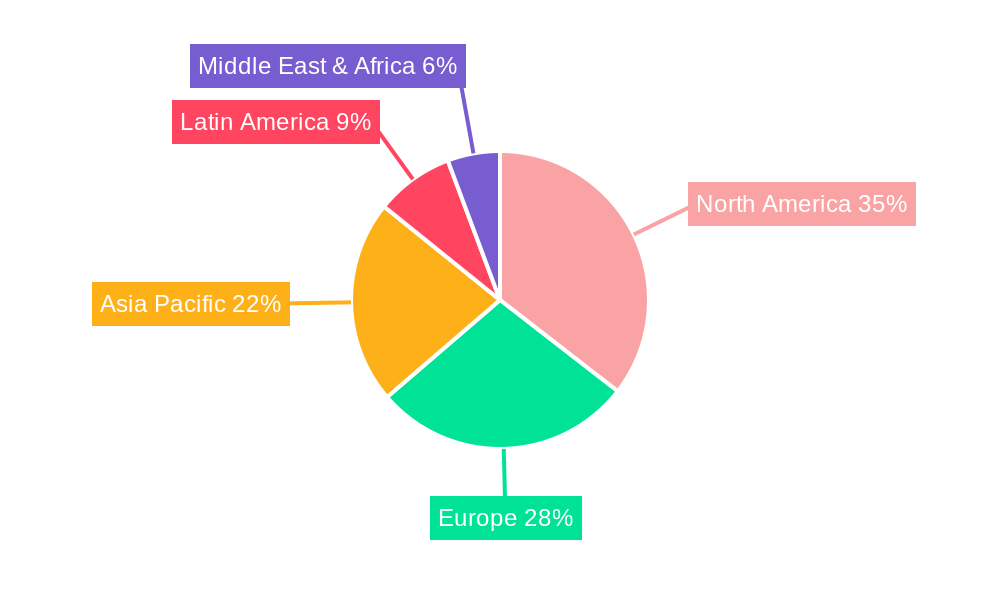

North America Vitamin C Supplements Industry Regional Market Share

Geographic Coverage of North America Vitamin C Supplements Industry

North America Vitamin C Supplements Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Consumption for Dietary Supplements

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Vitamin C Supplements Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Vitamins

- 5.1.2. Minerals (Calcium, Iron, and others)

- 5.1.3. Essential Fatty Acids

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Capsules

- 5.2.2. Powder

- 5.2.3. Gummy

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hypermarket/Supermarket

- 5.3.2. Online Retail Stores

- 5.3.3. Direct Selling

- 5.3.4. Pharmacy/Drug Store

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kikkoman Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Direct Relief

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Church & Dwight Co Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Neslte SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Procter & Gamble

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bayer AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Otsuka Holdings Co Ltd (Nature Made)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NATURELO Premium Supplements Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Amway Corp *List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Kikkoman Corporation

List of Figures

- Figure 1: North America Vitamin C Supplements Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Vitamin C Supplements Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Vitamin C Supplements Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Vitamin C Supplements Industry Revenue billion Forecast, by Form 2020 & 2033

- Table 3: North America Vitamin C Supplements Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Vitamin C Supplements Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Vitamin C Supplements Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: North America Vitamin C Supplements Industry Revenue billion Forecast, by Form 2020 & 2033

- Table 7: North America Vitamin C Supplements Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: North America Vitamin C Supplements Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Vitamin C Supplements Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Vitamin C Supplements Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Vitamin C Supplements Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Vitamin C Supplements Industry?

The projected CAGR is approximately 7.3%.

2. Which companies are prominent players in the North America Vitamin C Supplements Industry?

Key companies in the market include Kikkoman Corporation, Direct Relief, Church & Dwight Co Inc, Neslte SA, Procter & Gamble, Bayer AG, Otsuka Holdings Co Ltd (Nature Made), NATURELO Premium Supplements Inc, Amway Corp *List Not Exhaustive.

3. What are the main segments of the North America Vitamin C Supplements Industry?

The market segments include Type, Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 64.06 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Consumption for Dietary Supplements.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Vitamin C Supplements Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Vitamin C Supplements Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Vitamin C Supplements Industry?

To stay informed about further developments, trends, and reports in the North America Vitamin C Supplements Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence