Key Insights

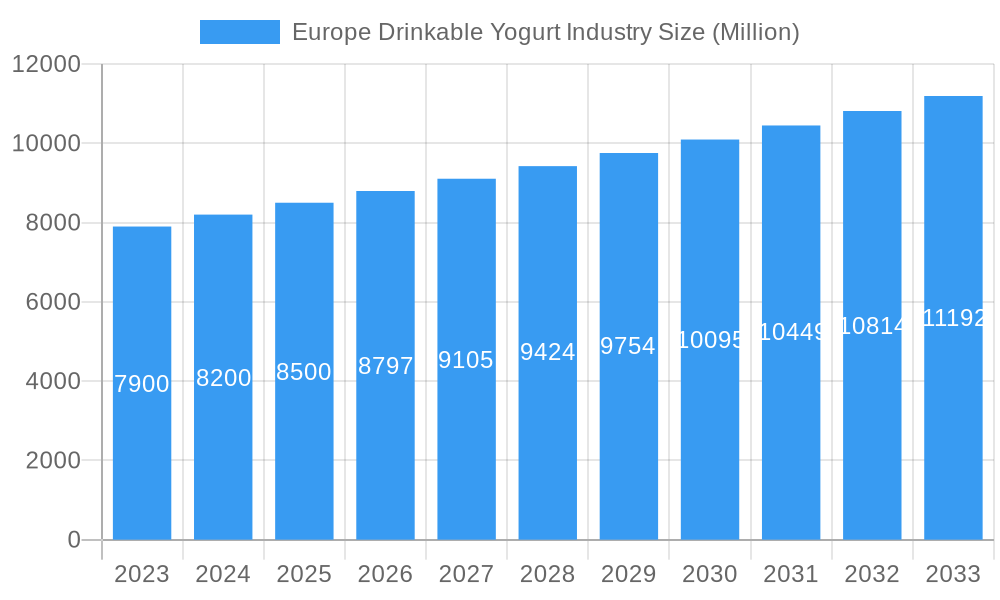

The European Drinkable Yogurt Market is projected to reach USD 12.5 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 6.3% from a base year of 2024. This growth is driven by increasing consumer demand for convenient, healthy, and portable food options, coupled with a rising awareness of yogurt's probiotic benefits for digestive health. The market offers a wide array of products, satisfying diverse dietary requirements and taste preferences.

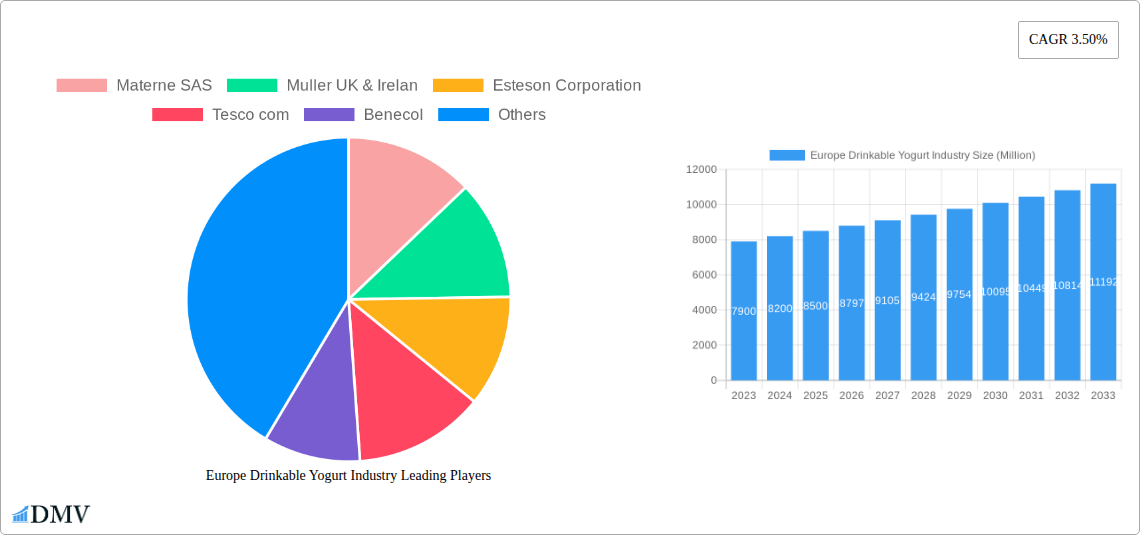

Europe Drinkable Yogurt Industry Market Size (In Billion)

Innovation in both dairy and non-dairy drinkable yogurt segments is a key market trend. While dairy yogurts maintain popularity, plant-based alternatives (almond, soy, coconut) are gaining traction due to the rise of veganism and lactose intolerance. Flavored yogurts are particularly sought after, with novel and functional flavor introductions complementing the steady demand for plain varieties. Distribution is expanding through online platforms and convenience stores. Leading companies like Danone and Müller are actively developing new products, while smaller brands are focusing on niche markets and sustainable offerings. Raw material price fluctuations and the need for ongoing product differentiation present ongoing market challenges.

Europe Drinkable Yogurt Industry Company Market Share

Europe Drinkable Yogurt Industry Market Composition & Trends

The European drinkable yogurt market is characterized by a moderate to high concentration, with Materne SAS, Muller UK & Ireland, Esteson Corporation, Tesco.com, Benecol, and Cie Gervais Danone holding significant market share. Innovation is a key driver, fueled by increasing consumer demand for healthier and convenient beverage options. Regulatory frameworks are generally supportive, focusing on food safety and labeling standards, though variations exist across EU member states. Substitute products, such as smoothies and functional beverages, pose a competitive threat, necessitating continuous product differentiation. End-user profiles range from health-conscious millennials and Gen Z seeking probiotic-rich drinks and lactose-free alternatives to busy professionals prioritizing grab-and-go nutrition. Mergers and acquisitions (M&A) activity is present, with estimated deal values in the hundreds of Million, consolidating market positions and expanding product portfolios. The market share distribution shows Dairy-based yogurt leading, but Non-dairy based yogurt is experiencing rapid growth.

- Market Concentration: Moderate to High

- Innovation Catalysts: Health & Wellness Trends, Convenience, Functional Ingredients

- Regulatory Landscape: Generally Favorable, Focus on Safety & Labeling

- Substitute Products: Smoothies, Functional Beverages, Juices

- End-User Profiles: Health-Conscious Consumers, Busy Professionals, Families

- M&A Activity: Ongoing, with deal values reaching hundreds of Million

Europe Drinkable Yogurt Industry Industry Evolution

The Europe Drinkable Yogurt Industry has undergone a significant evolution, driven by a confluence of shifting consumer preferences, technological advancements, and increasing health consciousness. Over the Study Period (2019–2033), the market has witnessed consistent growth trajectories, with the Base Year (2025) serving as a pivotal point for current market analysis. The Estimated Year (2025) suggests a healthy expansion, further projecting robust growth through the Forecast Period (2025–2033). During the Historical Period (2019–2024), early adoption of innovative packaging solutions, such as single-serve bottles and resealable pouches, played a crucial role in enhancing convenience and portability, appealing to on-the-go lifestyles. Technological advancements in fermentation processes have enabled the development of a wider range of textures and flavors, catering to diverse palates. Furthermore, the inclusion of functional ingredients like probiotics, prebiotics, vitamins, and minerals has transformed drinkable yogurts from simple dairy products into sophisticated health beverages. This evolution is underscored by a projected Compound Annual Growth Rate (CAGR) of approximately 5-7% for the forecast period. Adoption metrics for plant-based drinkable yogurts are surging, with an estimated XX% increase year-over-year as consumers seek dairy-free options. The increasing penetration of online retail channels has also democratized access, allowing consumers to conveniently purchase their preferred drinkable yogurts, further accelerating market expansion.

Leading Regions, Countries, or Segments in Europe Drinkable Yogurt Industry

The Europe Drinkable Yogurt Industry showcases distinct regional dominance and segment leadership, driven by a complex interplay of consumer behavior, economic factors, and market accessibility.

Dominant Category: Dairy-based yogurt continues to hold the largest market share, benefiting from established consumer familiarity and a perception of natural goodness. However, the Non-dairy based yogurt segment is experiencing exponential growth, fueled by rising veganism, lactose intolerance, and growing awareness of the environmental impact of dairy farming. This segment's dominance is projected to increase significantly in the coming years.

Leading Type: Flavored yogurt commands a substantial portion of the market, driven by its appeal to a broader consumer base, particularly children and young adults, seeking enjoyable taste experiences. Plain yogurt, while steady, caters to a more health-focused niche.

Primary Distribution Channel: Supermarkets/Hypermarkets remain the cornerstone of drinkable yogurt distribution across Europe due to their extensive reach and product variety. Nonetheless, Online Retailers are rapidly gaining traction, offering convenience and a growing selection of specialized and premium brands, significantly impacting market dynamics and accessibility.

Key Drivers for Dominance:

- Consumer Health Trends: Increasing demand for gut health, immunity-boosting, and low-sugar options.

- Product Innovation: Development of novel flavors, textures, and functional ingredients.

- Convenience Factor: Easy-to-consume format ideal for busy lifestyles.

- Economic Affordability: Drinkable yogurts often represent a more budget-friendly healthy option.

- Marketing & Branding: Effective campaigns highlighting health benefits and taste appeal.

In-depth Analysis of Dominance Factors: In countries like Germany and the UK, the strong presence of major supermarket chains facilitates widespread availability of diverse drinkable yogurt options. Investment trends in the health and wellness sector are directly translating into increased demand for fortified and functional drinkable yogurts. Regulatory support for novel food ingredients and clear nutritional labeling further bolsters market growth. While traditional channels like convenience stores remain relevant, the swift adoption of e-commerce platforms across Europe, particularly in urban centers, is reshaping distribution strategies and empowering smaller, niche brands to reach consumers directly. The focus on sustainable packaging and ethical sourcing is also becoming a significant differentiator, influencing purchasing decisions and contributing to the rise of specific brands and segments.

Europe Drinkable Yogurt Industry Product Innovations

Product innovation in the Europe Drinkable Yogurt Industry is primarily focused on enhancing health benefits and consumer experience. Innovations include the incorporation of prebiotics and probiotics for gut health, vitamins and minerals for immune support, and plant-based alternatives catering to vegan and lactose-intolerant consumers. Unique selling propositions often revolve around low-sugar formulations, organic ingredients, and novel flavor combinations like exotic fruits or superfood infusions. Technological advancements are enabling improved shelf-life and texture stability, ensuring product quality and appeal. Applications extend from breakfast beverages to post-workout recovery drinks and convenient snacks. Performance metrics often highlight improved digestibility and sustained energy release.

Propelling Factors for Europe Drinkable Yogurt Industry Growth

The Europe Drinkable Yogurt Industry is experiencing robust growth driven by several key factors. Increasing consumer awareness of gut health and immunity fuels demand for probiotic-rich and functional drinkable yogurts. The convenience factor of grab-and-go formats aligns perfectly with modern, fast-paced lifestyles. Economic prosperity in many European nations allows for increased spending on health-conscious food options. Furthermore, supportive regulatory environments that encourage product innovation and clear labeling contribute to market expansion. Technological advancements in production and packaging enhance product quality and accessibility.

Obstacles in the Europe Drinkable Yogurt Industry Market

Despite its growth, the Europe Drinkable Yogurt Industry faces several obstacles. Intense competition from other beverage categories, including juices, smoothies, and functional drinks, poses a significant challenge. Fluctuations in raw material prices, particularly dairy and fruit, can impact profit margins and necessitate price adjustments. Stringent regulatory hurdles for novel ingredients and health claims can slow down product development and market entry. Supply chain disruptions, exacerbated by geopolitical events or logistical complexities, can affect product availability and distribution. Additionally, consumer perception regarding sugar content in some flavored variants can act as a restraint, prompting a shift towards healthier alternatives.

Future Opportunities in Europe Drinkable Yogurt Industry

Emerging opportunities in the Europe Drinkable Yogurt Industry are abundant. The growing demand for plant-based and vegan alternatives presents a vast untapped market. Innovations in functional ingredients, such as adaptogens and nootropics, can lead to premium product offerings. Expansion into emerging markets within Eastern Europe with growing disposable incomes offers significant growth potential. The increasing adoption of personalized nutrition could lead to tailored drinkable yogurt formulations. Furthermore, the development of sustainable packaging solutions and ethical sourcing practices can attract environmentally conscious consumers.

Major Players in the Europe Drinkable Yogurt Industry Ecosystem

- Materne SAS

- Muller UK & Ireland

- Esteson Corporation

- Tesco.com

- Benecol

- Cie Gervais Danone

Key Developments in Europe Drinkable Yogurt Industry Industry

- 2023 January: Launch of a new range of lactose-free drinkable yogurts by Muller UK & Ireland, targeting the growing intolerant consumer base.

- 2023 April: Esteson Corporation announces significant investment in R&D for plant-based drinkable yogurt formulations.

- 2023 June: Tesco.com expands its online offering of specialty drinkable yogurts, including organic and high-protein options.

- 2023 September: Benecol introduces drinkable yogurts fortified with plant sterols for cholesterol management, expanding its functional beverage portfolio.

- 2024 February: Cie Gervais Danone acquires a minority stake in a European artisanal drinkable yogurt producer, signaling strategic interest in niche markets.

- 2024 May: Materne SAS innovates with a new biodegradable packaging for its drinkable yogurt pouches, aligning with sustainability trends.

Strategic Europe Drinkable Yogurt Industry Market Forecast

The strategic Europe Drinkable Yogurt Industry market forecast highlights continued expansion driven by evolving consumer priorities. The shift towards health and wellness, with a particular emphasis on gut health and immunity, will propel demand for functional drinkable yogurts. Innovations in plant-based alternatives and low-sugar formulations will unlock new market segments and cater to a wider demographic. The increasing penetration of online retail channels and a growing focus on sustainable practices will shape distribution strategies and brand positioning. Strategic investments in product development and market penetration in emerging European regions are expected to drive overall market growth, presenting substantial opportunities for stakeholders.

Europe Drinkable Yogurt Industry Segmentation

-

1. Category

- 1.1. Dairy-based yogurt

- 1.2. Non-dairy based yogurt

-

2. Type

- 2.1. Plain yogurt

- 2.2. Flavored yogurt

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Convenience Stores

- 3.3. Specialty Stores

- 3.4. Online Retailers

- 3.5. Others

Europe Drinkable Yogurt Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Drinkable Yogurt Industry Regional Market Share

Geographic Coverage of Europe Drinkable Yogurt Industry

Europe Drinkable Yogurt Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Beauty Supplements Products

- 3.4. Market Trends

- 3.4.1. Rising Demand of Non-Dairy Based Yogurt

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Drinkable Yogurt Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Dairy-based yogurt

- 5.1.2. Non-dairy based yogurt

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Plain yogurt

- 5.2.2. Flavored yogurt

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Convenience Stores

- 5.3.3. Specialty Stores

- 5.3.4. Online Retailers

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Materne SAS

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Muller UK & Irelan

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Esteson Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tesco com

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Benecol

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cie Gervais Danone

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Materne SAS

List of Figures

- Figure 1: Europe Drinkable Yogurt Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Drinkable Yogurt Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Drinkable Yogurt Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 2: Europe Drinkable Yogurt Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Europe Drinkable Yogurt Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe Drinkable Yogurt Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Drinkable Yogurt Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 6: Europe Drinkable Yogurt Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Europe Drinkable Yogurt Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Europe Drinkable Yogurt Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Drinkable Yogurt Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Drinkable Yogurt Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Drinkable Yogurt Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Drinkable Yogurt Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Drinkable Yogurt Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Drinkable Yogurt Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Drinkable Yogurt Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Drinkable Yogurt Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Drinkable Yogurt Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Drinkable Yogurt Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Drinkable Yogurt Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Drinkable Yogurt Industry?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Europe Drinkable Yogurt Industry?

Key companies in the market include Materne SAS, Muller UK & Irelan, Esteson Corporation, Tesco com, Benecol, Cie Gervais Danone.

3. What are the main segments of the Europe Drinkable Yogurt Industry?

The market segments include Category, Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products.

6. What are the notable trends driving market growth?

Rising Demand of Non-Dairy Based Yogurt.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Beauty Supplements Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Drinkable Yogurt Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Drinkable Yogurt Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Drinkable Yogurt Industry?

To stay informed about further developments, trends, and reports in the Europe Drinkable Yogurt Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence