Key Insights

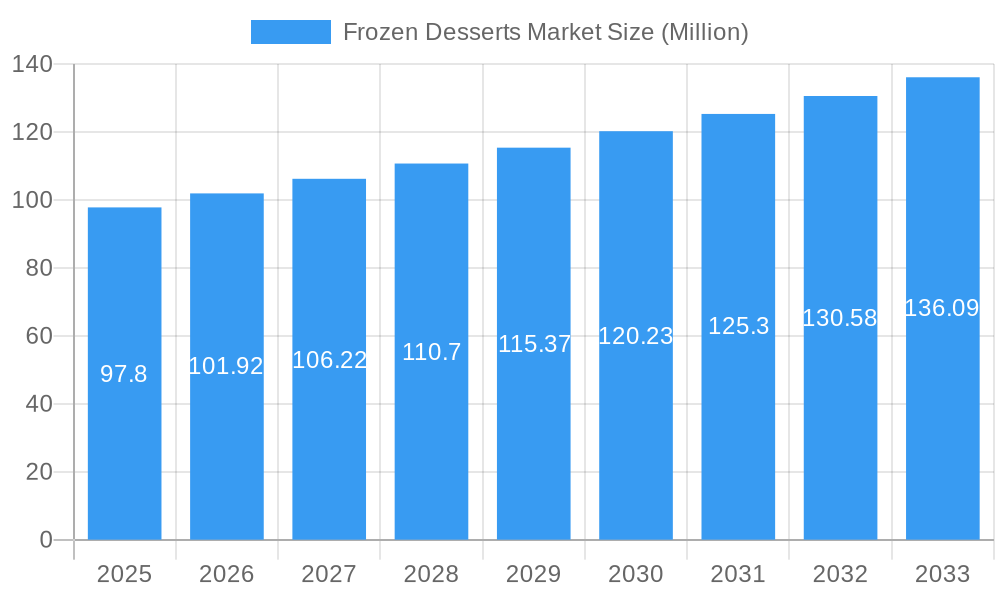

The global Frozen Desserts Market is projected for robust expansion, estimated at a significant USD 97.80 million in the base year of 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 4.15%, indicating a steady and healthy increase in market value over the forecast period of 2025-2033. The market is propelled by a confluence of factors, including evolving consumer preferences towards indulgent and convenient treat options, an increasing disposable income across key emerging economies, and a surge in product innovation with a focus on healthier formulations and diverse flavor profiles. The demand for premium and artisanal frozen desserts is also on the rise, catering to consumers seeking unique and high-quality experiences. Furthermore, advancements in freezing and storage technologies are contributing to broader accessibility and reduced spoilage, thereby bolstering market expansion. The widespread availability of frozen desserts through various distribution channels, from large supermarkets to specialized online platforms, is also a significant driver.

Frozen Desserts Market Market Size (In Million)

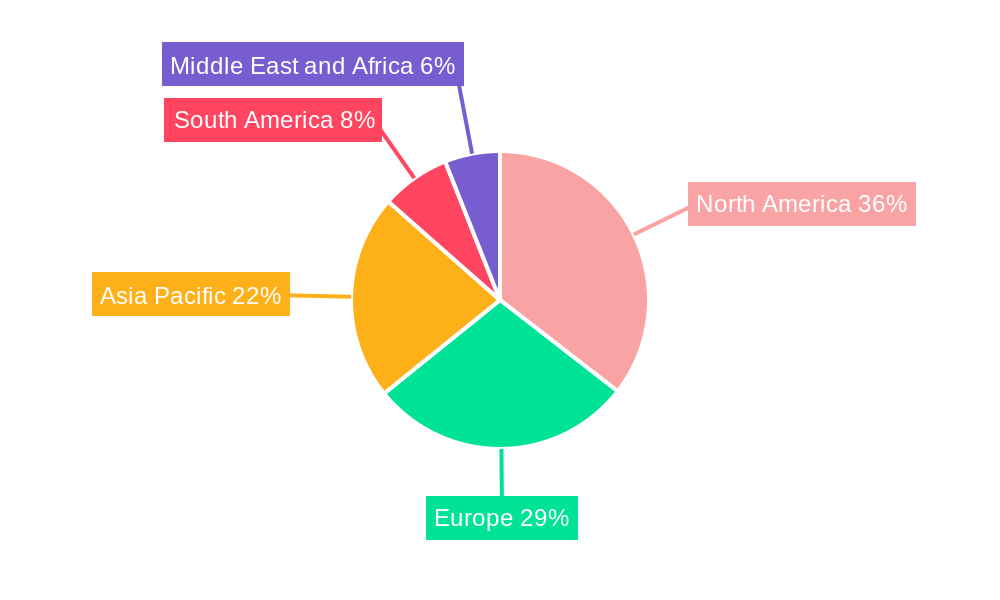

Key market segments are poised for substantial growth. The "Ice Cream" segment is expected to continue its dominance, driven by its broad appeal and continuous product development. However, "Frozen Yogurt" is witnessing remarkable traction due to its perceived healthier alternative positioning. "Frozen Cakes" are gaining popularity for celebratory occasions and as convenient dessert solutions. The distribution landscape is primarily led by "Supermarkets/Hypermarkets" due to their extensive reach and product variety, followed closely by "Convenience Stores" for impulse purchases and readily accessible treats. "Specialty Stores" cater to a niche market seeking premium and unique offerings. Geographically, North America and Europe currently represent mature markets with consistent demand, while the Asia Pacific region, particularly China and India, is emerging as a high-growth frontier, fueled by a burgeoning middle class and increasing urbanization.

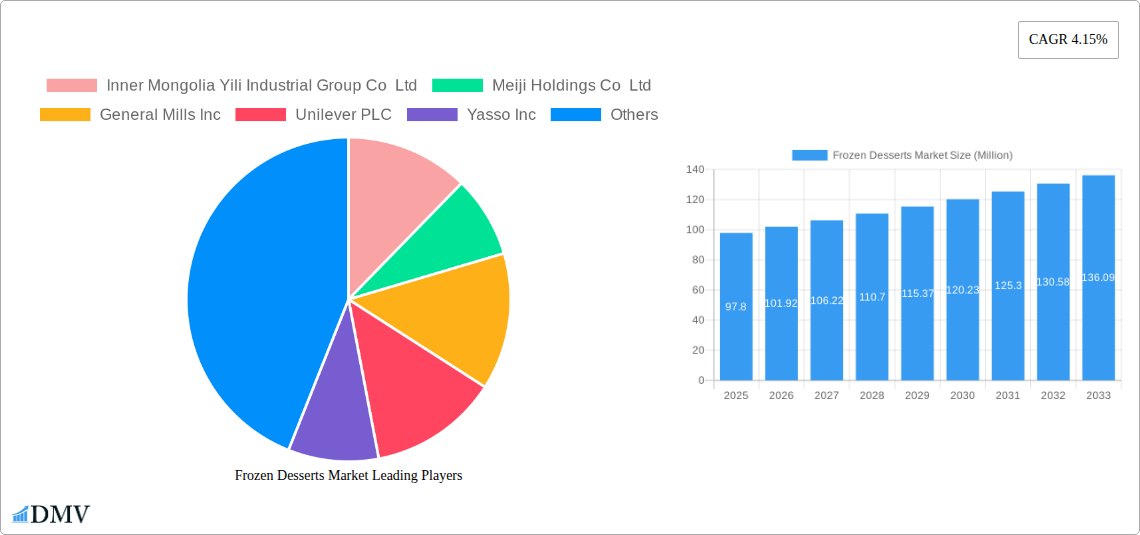

Frozen Desserts Market Company Market Share

Frozen Desserts Market: Comprehensive Growth Analysis and Forecast 2025-2033

This in-depth report provides a strategic analysis of the global frozen desserts market, offering critical insights into market composition, trends, and future trajectories. Covering the study period 2019–2033, with a base year of 2025, this research delves into market dynamics, competitive landscapes, and the evolving preferences of consumers in the frozen yogurt, ice cream, frozen cakes, and other types segments. Explore key distribution channels, including supermarkets/hypermarkets, convenience stores, specialty stores, and other distribution channels, and understand the impact of industry developments and product innovations. This report is an indispensable resource for stakeholders seeking to capitalize on the robust growth and emerging opportunities within the dynamic frozen desserts industry.

Frozen Desserts Market Market Composition & Trends

The global frozen desserts market exhibits a moderately concentrated landscape, with leading players continuously driving innovation and expansion. Key innovation catalysts include the increasing demand for premium and artisanal frozen treats, the rise of plant-based alternatives, and the integration of novel flavors and functional ingredients. Regulatory landscapes vary by region, with food safety standards and labeling requirements playing a significant role. Substitute products, such as refrigerated desserts and fresh fruit-based snacks, pose a competitive challenge, yet the inherent appeal of frozen indulgence continues to drive market dominance. End-user profiles are increasingly diverse, encompassing health-conscious consumers seeking low-calorie or plant-based options, families looking for affordable treats, and millennials and Gen Z driving demand for innovative and Instagrammable products. Mergers and acquisitions (M&A) activity remains a strategic tool for market consolidation and portfolio expansion, with significant deal values impacting market share distribution. For instance, recent strategic acquisitions have aimed to bolster market presence in emerging economies and enhance product portfolios with unique offerings.

- Market Concentration: Moderately concentrated with significant presence of multinational corporations and growing regional players.

- Innovation Catalysts: Premiumization, plant-based alternatives, novel flavors, functional ingredients, and convenience.

- Regulatory Landscapes: Focus on food safety, nutritional labeling, and ingredient sourcing regulations.

- Substitute Products: Refrigerated desserts, fresh fruit, and low-calorie snacks.

- End-User Profiles: Health-conscious consumers, families, millennials, Gen Z, and indulgence seekers.

- M&A Activities: Strategic acquisitions for market expansion, portfolio diversification, and technological integration.

Frozen Desserts Market Industry Evolution

The frozen desserts market has undergone a remarkable evolution, transforming from a simple indulgence to a diverse and innovative category catering to a broad spectrum of consumer preferences. The historical period from 2019 to 2024 witnessed consistent growth, fueled by an expanding global middle class, increasing disposable incomes, and the enduring appeal of frozen treats. Technological advancements in freezing, packaging, and distribution have been instrumental in this evolution, enabling wider accessibility and a longer shelf life for a variety of products. The base year 2025 signifies a mature yet dynamic market, poised for further expansion. The forecast period 2025–2033 is projected to see sustained growth, driven by a confluence of factors including increasing urbanization, a growing demand for healthier indulgence options, and the relentless pursuit of novel flavors and textures by manufacturers. Market growth trajectories are characterized by a steady upward trend, with an estimated Compound Annual Growth Rate (CAGR) of approximately 4.5% to 5.5% over the forecast period. Adoption metrics for new product categories, such as plant-based ice creams and low-sugar frozen yogurts, have shown significant uptake, particularly in developed markets, indicating a strong consumer willingness to embrace innovation. Shifting consumer demands are a primary driver, with a noticeable pivot towards natural ingredients, reduced sugar content, and ethical sourcing. The rise of the "free-from" movement, encompassing dairy-free, gluten-free, and allergen-friendly options, has spurred significant product development and market penetration. Furthermore, the influence of social media and influencer marketing has amplified the visibility and desirability of unique and visually appealing frozen desserts, encouraging trial and repeat purchases. The industry's ability to adapt to these evolving demands, by investing in research and development and optimizing supply chains, will be crucial for continued success.

Leading Regions, Countries, or Segments in Frozen Desserts Market

The global frozen desserts market demonstrates distinct regional dominance and segment preferences, largely driven by economic development, cultural culinary traditions, and evolving consumer lifestyles.

Dominant Region: North America

North America, particularly the United States, consistently emerges as a leading region in the frozen desserts market. This dominance is underpinned by several key factors:

- High Disposable Income: A significant portion of the population possesses the disposable income to regularly purchase premium and novelty frozen desserts. This allows for greater experimentation with diverse product offerings and higher price points.

- Established Market Infrastructure: The region boasts a well-developed retail infrastructure, including widespread supermarket chains and convenience stores, ensuring easy accessibility to a vast array of frozen dessert products.

- Strong Culture of Indulgence: Frozen desserts are deeply ingrained in the American culture as a popular treat and a staple for social gatherings and celebrations. This cultural acceptance fuels consistent demand.

- Innovation Hub: North America is a hotbed for product innovation, with manufacturers continuously introducing new flavors, textures, and healthier alternatives, such as plant-based and low-sugar options. This proactive approach keeps consumers engaged and drives market growth.

- Investment Trends: Significant investment from major players like General Mills Inc., Unilever PLC, and Yasso Inc. in product development, marketing, and distribution networks solidifies North America's leading position.

Dominant Segment: Ice Cream

Within the frozen desserts market, Ice Cream stands out as the overwhelmingly dominant segment in terms of market share and consumer preference.

- Ubiquitous Appeal: Ice cream's universal appeal transcends age groups and demographics, making it a perennial favorite worldwide. Its perceived indulgence and versatility contribute to its sustained popularity.

- Extensive Product Variety: The ice cream segment offers an unparalleled breadth of product types, from traditional dairy-based ice cream and gelato to sorbets, frozen yogurts (often categorized separately but with significant overlap), and novelties like ice cream bars and sandwiches. This diversity caters to a wide range of tastes and dietary needs.

- Brand Loyalty and Recognition: Many of the largest multinational companies in the frozen desserts industry have established iconic ice cream brands that command strong consumer loyalty, further cementing its market leadership.

- Innovation within the Segment: Despite its maturity, the ice cream segment continues to innovate with the introduction of exotic flavors, premium ingredients, and healthier formulations. Companies are actively exploring vegan and low-calorie options to capture emerging consumer trends.

- Distribution Channel Synergy: Ice cream products are widely available across all major distribution channels, including supermarkets/hypermarkets, convenience stores, and even specialty ice cream parlors, ensuring maximum market penetration. The ease of distribution and widespread consumer familiarity make ice cream the cornerstone of the frozen desserts landscape.

While other segments like Frozen Yogurt are gaining traction, particularly among health-conscious consumers, and Frozen Cakes hold a niche, Ice Cream’s established presence, broad appeal, and continuous innovation ensure its continued reign as the leading segment in the global frozen desserts market.

Frozen Desserts Market Product Innovations

The frozen desserts market is characterized by a relentless pace of product innovation, driven by evolving consumer tastes and a desire for unique experiences. Manufacturers are increasingly focusing on healthier formulations, incorporating natural sweeteners, reduced sugar, and plant-based ingredients to cater to health-conscious demographics. Novel flavor profiles, inspired by global cuisines and trending food concepts, are gaining significant traction, moving beyond traditional options to include exotic fruits, spicy infusions, and savory elements. For instance, the introduction of Gulab Jamun flavored ice cream taps into ethnic culinary trends. Furthermore, innovations in texture and form factor are enhancing consumer appeal, with offerings like creamy gelato, light sorbets, and artisanal ice cream bars providing diverse sensory experiences. The integration of premium inclusions, such as artisanal chocolate, exotic nuts, and gourmet toppings, elevates the perceived value and indulgence factor of these frozen treats.

Propelling Factors for Frozen Desserts Market Growth

Several key factors are propelling the growth of the frozen desserts market. Technological advancements in production and freezing techniques enable more efficient manufacturing and a wider range of product textures. The growing global middle class and increasing disposable incomes in emerging economies are expanding the consumer base for discretionary purchases like frozen desserts. Furthermore, a growing trend towards healthier indulgence, with demand for plant-based, low-sugar, and natural ingredient options, is driving innovation and market expansion. Evolving consumer preferences for novel flavors and premium experiences also contribute significantly to market growth. The widespread availability of frozen desserts through diverse distribution channels, from supermarkets to online delivery platforms, further enhances accessibility and purchase convenience, thereby fueling market expansion.

Obstacles in the Frozen Desserts Market Market

Despite its robust growth, the frozen desserts market faces several obstacles. Stringent regulations concerning food safety, labeling, and ingredient sourcing can increase operational costs and complexity for manufacturers. Supply chain disruptions, exacerbated by global events, can impact the availability and cost of raw materials, affecting production and pricing. Intense competition from both established brands and new market entrants leads to price pressures and necessitates continuous innovation, which can be resource-intensive. Additionally, negative consumer perceptions surrounding high sugar content and artificial ingredients in traditional frozen desserts can limit adoption for health-conscious segments, requiring ongoing efforts to reformulate and educate consumers.

Future Opportunities in Frozen Desserts Market

Emerging opportunities within the frozen desserts market are abundant. The significant growth potential in developing economies, driven by increasing urbanization and rising disposable incomes, presents a vast untapped market. The plant-based and vegan frozen dessert segment is expected to witness substantial expansion, fueled by growing consumer awareness regarding health and environmental sustainability. Innovations in functional frozen desserts, incorporating probiotics, vitamins, or specific health benefits, represent a promising avenue. The increasing popularity of personalized and artisanal frozen desserts, driven by online ordering platforms and direct-to-consumer models, offers opportunities for niche players and premium brands. Furthermore, the integration of sustainable packaging solutions and ethical sourcing practices can attract environmentally conscious consumers and enhance brand reputation.

Major Players in the Frozen Desserts Market Ecosystem

- Inner Mongolia Yili Industrial Group Co Ltd

- Meiji Holdings Co Ltd

- General Mills Inc

- Unilever PLC

- Yasso Inc

- Dairy Farmers of America

- Mondelēz International Inc

- Fonterra Co-operative Group Limited

- Dunkin' Brands Group Inc

- Bulla Dairy Foods

- Nestlé S A

Key Developments in Frozen Desserts Market Industry

- October 2022: Kwality Walls, a Hindustan Unilever brand, launched Gulab Jamun flavored ice cream in India for the festive season. The gulab jamun flavored ice cream contains an exotic taste of mithai in addition to fruits and nuts.

- January 2022: Mondelēz International, Inc. launched Oreo Frozen Desserts. The range of desserts includes bars, cones, sandwiches, and oreo trays. The bars and cones contain Oreo pieces and are dipped in a coating made from crushed Oreo wafer pieces. The sandwiches feature two large Oreo wafers.

- January 2022: Unilever USA launched 19 new frozen treats. The company launched new products across four of its packaged ice cream and frozen novelty brands, i.e., Breyers, Klondike, Magnum ice cream, and Talenti Gelato & Sorbetto.

Strategic Frozen Desserts Market Market Forecast

The frozen desserts market is poised for robust growth through 2033, driven by expanding global demand and continuous innovation. Key growth catalysts include the increasing preference for premium and artisanal frozen treats, the surge in plant-based and healthier alternatives, and the expanding middle class in emerging economies. The market's ability to adapt to evolving consumer preferences for unique flavors, functional ingredients, and sustainable practices will be crucial. Strategic investments in research and development, coupled with efficient distribution networks, will enable players to capitalize on burgeoning opportunities in both developed and developing regions. The forecast indicates sustained expansion, with significant potential for market players to enhance their product portfolios and capture a larger share of this dynamic and evolving industry.

Frozen Desserts Market Segmentation

-

1. Type

- 1.1. Frozen Yogurt

- 1.2. Ice Cream

- 1.3. Frozen Cakes

- 1.4. Other Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Speciality Stores

- 2.4. Other Distribution Channels

Frozen Desserts Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Frozen Desserts Market Regional Market Share

Geographic Coverage of Frozen Desserts Market

Frozen Desserts Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Towards Reduced Sugar and Healthier Snacking Options; Surge in Demand for Organic Food Products

- 3.3. Market Restrains

- 3.3.1. Availability of Cheaper Snacking Options

- 3.4. Market Trends

- 3.4.1. Demand for Low-fat and Non-dairy Products Increasing Consumption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Frozen Desserts Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Frozen Yogurt

- 5.1.2. Ice Cream

- 5.1.3. Frozen Cakes

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Speciality Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Frozen Desserts Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Frozen Yogurt

- 6.1.2. Ice Cream

- 6.1.3. Frozen Cakes

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Speciality Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Frozen Desserts Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Frozen Yogurt

- 7.1.2. Ice Cream

- 7.1.3. Frozen Cakes

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Speciality Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Frozen Desserts Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Frozen Yogurt

- 8.1.2. Ice Cream

- 8.1.3. Frozen Cakes

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Speciality Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Frozen Desserts Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Frozen Yogurt

- 9.1.2. Ice Cream

- 9.1.3. Frozen Cakes

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Speciality Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Frozen Desserts Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Frozen Yogurt

- 10.1.2. Ice Cream

- 10.1.3. Frozen Cakes

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Speciality Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Inner Mongolia Yili Industrial Group Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Meiji Holdings Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 General Mills Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Unilever PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Yasso Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dairy Farmers of America

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mondelēz International Inc *List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fonterra Co-operative Group Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dunkin' Brands Group Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bulla Dairy Foods

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nestlé S A

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Inner Mongolia Yili Industrial Group Co Ltd

List of Figures

- Figure 1: Global Frozen Desserts Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Frozen Desserts Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Frozen Desserts Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Frozen Desserts Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Frozen Desserts Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Frozen Desserts Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Frozen Desserts Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Frozen Desserts Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Frozen Desserts Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Frozen Desserts Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Frozen Desserts Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Frozen Desserts Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Frozen Desserts Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Frozen Desserts Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Frozen Desserts Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Frozen Desserts Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Frozen Desserts Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Frozen Desserts Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Frozen Desserts Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Frozen Desserts Market Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Frozen Desserts Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Frozen Desserts Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: South America Frozen Desserts Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Frozen Desserts Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Frozen Desserts Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Frozen Desserts Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Frozen Desserts Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Frozen Desserts Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Frozen Desserts Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Frozen Desserts Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Frozen Desserts Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Frozen Desserts Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Frozen Desserts Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Frozen Desserts Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Frozen Desserts Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Frozen Desserts Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Frozen Desserts Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Frozen Desserts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Frozen Desserts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Frozen Desserts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Frozen Desserts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Frozen Desserts Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Frozen Desserts Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Frozen Desserts Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Spain Frozen Desserts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Frozen Desserts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Frozen Desserts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Frozen Desserts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Frozen Desserts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Russia Frozen Desserts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Frozen Desserts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Frozen Desserts Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Frozen Desserts Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Frozen Desserts Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Frozen Desserts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Frozen Desserts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Frozen Desserts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Frozen Desserts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Frozen Desserts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Frozen Desserts Market Revenue Million Forecast, by Type 2020 & 2033

- Table 30: Global Frozen Desserts Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Frozen Desserts Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Frozen Desserts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Frozen Desserts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Frozen Desserts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Frozen Desserts Market Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Frozen Desserts Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Frozen Desserts Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South Africa Frozen Desserts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Frozen Desserts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Frozen Desserts Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Frozen Desserts Market?

The projected CAGR is approximately 4.15%.

2. Which companies are prominent players in the Frozen Desserts Market?

Key companies in the market include Inner Mongolia Yili Industrial Group Co Ltd, Meiji Holdings Co Ltd, General Mills Inc, Unilever PLC, Yasso Inc, Dairy Farmers of America, Mondelēz International Inc *List Not Exhaustive, Fonterra Co-operative Group Limited, Dunkin' Brands Group Inc, Bulla Dairy Foods, Nestlé S A.

3. What are the main segments of the Frozen Desserts Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 97.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Inclination Towards Reduced Sugar and Healthier Snacking Options; Surge in Demand for Organic Food Products.

6. What are the notable trends driving market growth?

Demand for Low-fat and Non-dairy Products Increasing Consumption.

7. Are there any restraints impacting market growth?

Availability of Cheaper Snacking Options.

8. Can you provide examples of recent developments in the market?

October 2022: Kwality Walls, a Hindustan Unilever brand, launched Gulab Jamun flavored ice cream in India for the festive season. The gulab jamun flavored ice cream contains an exotic taste of mithai in addition to fruits and nuts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Frozen Desserts Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Frozen Desserts Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Frozen Desserts Market?

To stay informed about further developments, trends, and reports in the Frozen Desserts Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence