Key Insights

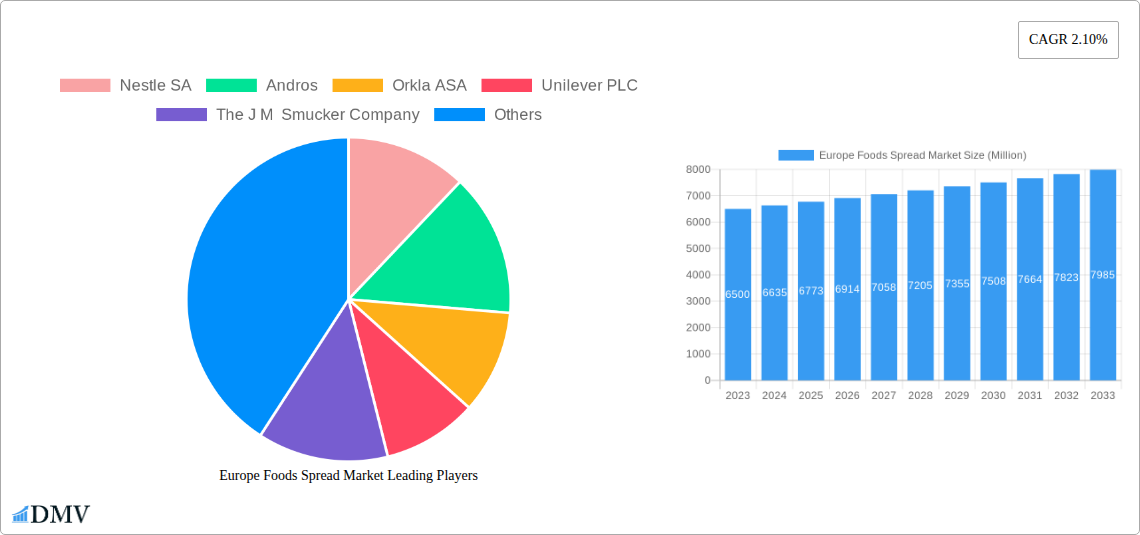

The European Foods Spread Market is projected for robust growth, driven by increasing consumer demand for convenient, healthy, and indulgent food choices. The market is anticipated to achieve a CAGR of 3.27%, reaching a market size of 11.1 billion by 2025. Key growth drivers include the rising popularity of nut and seed-based spreads, aligning with the global shift towards plant-based diets and their perceived health advantages. Fruit-based spreads also maintain strong consumer interest, especially for breakfast and baking. E-commerce and specialized online retail are revolutionizing distribution, enhancing consumer access and choice. Convenience stores are responding with smaller, single-serving options to meet on-the-go needs. The competitive environment features major global players like Nestle SA, Unilever PLC, and The J M Smucker Company, who are actively innovating and expanding their product lines.

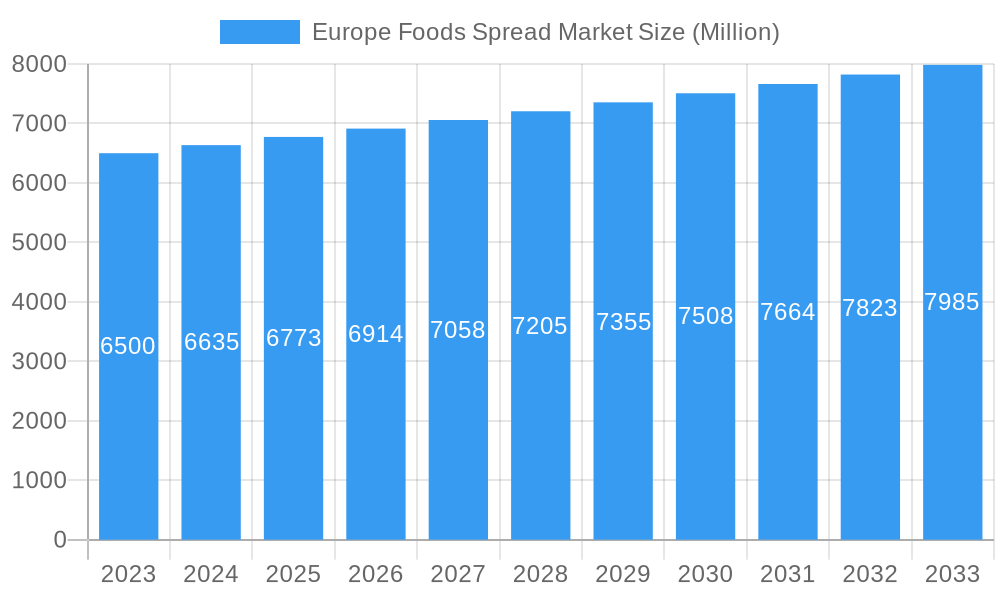

Europe Foods Spread Market Market Size (In Billion)

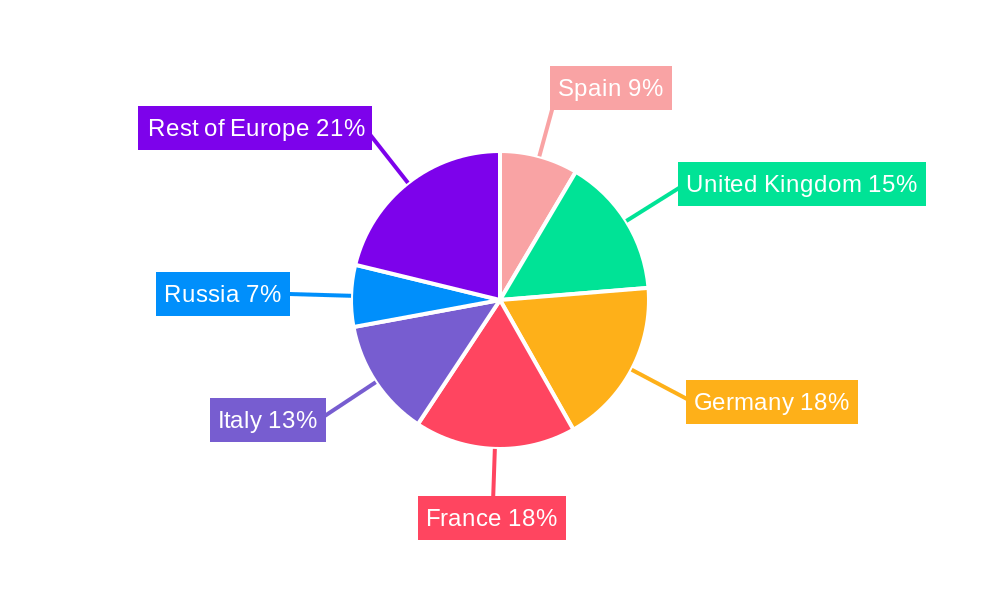

Challenges impacting market expansion include price volatility of essential raw materials like nuts and fruits, which can affect profitability and pricing. Growing consumer concern over sugar content, particularly in chocolate spreads, is pushing manufacturers to develop healthier alternatives with reduced sugar and artificial ingredients. The "Other Product Types" segment, which includes innovative or niche offerings, shows potential for future growth by addressing these consumer preferences. Germany, France, and the United Kingdom are key European markets, characterized by high consumption, well-developed retail infrastructure, and established consumer habits. The forecast period anticipates sustained demand, with product innovation and sustainable sourcing being crucial for enduring success.

Europe Foods Spread Market Company Market Share

Europe Foods Spread Market: In-Depth Analysis and Future Outlook (2019–2033)

This comprehensive report delivers a granular examination of the Europe foods spread market, a dynamic sector shaped by evolving consumer preferences, technological innovation, and robust growth potential. Spanning from 2019 to 2033, with a focus on the base year 2025 and a forecast period from 2025 to 2033, this analysis provides actionable insights for stakeholders seeking to navigate this competitive landscape. We dissect market composition, industry evolution, leading regions, product innovations, growth drivers, obstacles, and future opportunities, offering a strategic roadmap for success.

Europe Foods Spread Market Market Composition & Trends

The Europe foods spread market exhibits a moderately consolidated structure, with key players like Nestle SA, Andros, Orkla ASA, Unilever PLC, and The J M Smucker Company holding significant market share. Innovation remains a crucial catalyst, driven by increasing demand for healthier options, plant-based alternatives, and premium ingredients. Regulatory landscapes, particularly concerning food safety and labeling, are continuously evolving, influencing product development and market entry strategies. Substitute products, such as yogurt and fresh fruit, present ongoing competition, while end-user profiles are diversifying, encompassing health-conscious consumers, families, and impulse buyers. Mergers and acquisitions (M&A) are strategic tools for expansion and portfolio diversification, with recent deal values estimated to be in the hundreds of millions. For instance, key M&A activities are projected to contribute $500 Million to market consolidation. The market share distribution sees Nut and Seed-based Spreads commanding approximately 35%, followed by Fruit-based Spreads at 30%, Chocolate-based Spreads at 20%, and Honey at 10%, with other product types making up the remaining 5%.

Europe Foods Spread Market Industry Evolution

The Europe foods spread market has undergone significant evolution, marked by consistent growth trajectories and technological advancements. From the historical period of 2019-2024, the market witnessed an average annual growth rate of 4.2%, driven by an expanding product portfolio and increasing consumer disposable income. The base year 2025 is expected to see this growth accelerate to 5.1%, a testament to the market's resilience and adaptability. Shifting consumer demands have played a pivotal role, with a pronounced trend towards healthier, natural, and sustainably sourced ingredients. This has fueled the demand for nut and seed-based spreads, particularly those free from added sugars and artificial preservatives. The adoption of innovative processing techniques, such as advanced roasting and grinding methods for nuts, has enhanced the texture and flavor profiles of spreads, further appealing to discerning consumers. Online retail stores have emerged as a transformative distribution channel, offering unparalleled convenience and a wider selection, contributing an estimated 15% to overall sales in 2025. Furthermore, the industry has seen a rise in the adoption of functional ingredients, incorporating probiotics, omega-3 fatty acids, and plant-based proteins, aligning with the growing wellness trend. The total market value is projected to reach $20 Billion by 2025, with a projected CAGR of 5.5% through 2033.

Leading Regions, Countries, or Segments in Europe Foods Spread Market

Dominant across the Europe foods spread market are Supermarkets/Hypermarkets, accounting for an estimated 55% of sales in 2025. This channel's dominance is driven by its broad reach, accessibility, and the ability to cater to diverse consumer needs, from everyday staples to premium offerings. Germany, the United Kingdom, and France represent the leading countries, collectively holding over 40% of the European market share. Germany's leadership is attributed to a high per capita consumption of breakfast items and a strong preference for nut and seed-based spreads, particularly peanut butter and almond butter. The UK follows closely, influenced by a significant demand for fruit-based spreads and jams, coupled with a growing interest in innovative flavor combinations. France, on the other hand, demonstrates a strong affinity for chocolate-based spreads and artisanal fruit preserves.

Key drivers for dominance in these regions include:

- Investment Trends: Significant investment in modern retail infrastructure and expanding distribution networks within these key countries.

- Regulatory Support: Favorable food safety regulations and government initiatives promoting healthy eating contribute to market growth.

- Consumer Preferences: Deep-rooted cultural preferences for specific types of spreads, coupled with increasing disposable incomes.

- Retailer Strategies: Proactive merchandising and promotional activities by major supermarket chains to drive sales of spreads.

Within Product Types, Nut and Seed-based Spreads are projected to maintain their lead, capturing 38% of the market share by 2025, fueled by their perceived health benefits and versatility. Fruit-based Spreads will follow, holding 32%, driven by demand for natural ingredients and traditional breakfast staples. Chocolate-based Spreads will account for 22%, appealing to indulgence and family consumption, while Honey and Other Product Types will represent the remaining 8%.

The distribution channel landscape is also evolving, with Online Retail Stores demonstrating a robust growth rate of 18% year-on-year, expected to capture 15% of the market share by 2025. This surge is propelled by the convenience it offers, the increasing adoption of e-commerce by consumers, and the ability of online platforms to showcase a wider variety of specialized and niche products.

Europe Foods Spread Market Product Innovations

Product innovations in the Europe foods spread market are revolutionizing consumer choices. We are witnessing a surge in plant-based and allergen-free spreads, catering to dietary restrictions and vegan lifestyles. Unique flavor fusions, such as chili-infused peanut butter or lavender-infused honey, are gaining traction, offering novel taste experiences. The integration of functional ingredients, like probiotics and adaptogens, is a key technological advancement, transforming spreads into health-boosting options. Performance metrics indicate enhanced shelf stability and improved texture achieved through advanced processing, ensuring premium quality and consumer satisfaction. These innovations are crucial for differentiation and capturing a larger market share.

Propelling Factors for Europe Foods Spread Market Growth

Several factors are propelling the Europe foods spread market. Technologically, advancements in ingredient processing and packaging are enhancing product quality and appeal. Economically, rising disposable incomes and a growing middle class in many European nations translate to increased consumer spending on premium and convenience food items. Regulatory influences, such as supportive policies for organic and natural food production, are also contributing to market expansion. For example, the EU's commitment to sustainable agriculture indirectly benefits the fruit-based spread segment. Furthermore, the increasing consumer focus on health and wellness, driving demand for plant-based and nutrient-rich options, is a significant growth catalyst.

Obstacles in the Europe Foods Spread Market Market

Despite robust growth, the Europe foods spread market faces several obstacles. Regulatory challenges, particularly stringent labeling requirements and differing food safety standards across member states, can pose complexities for manufacturers. Supply chain disruptions, as seen with the volatility in raw material prices for nuts and fruits, can impact profitability and product availability. Competitive pressures from both established brands and emerging niche players, alongside the constant threat of substitute products like fresh fruits and dairy alternatives, require continuous innovation and effective marketing strategies. Quantifiable impacts include an estimated 5% increase in production costs due to raw material price fluctuations.

Future Opportunities in Europe Foods Spread Market

Emerging opportunities in the Europe foods spread market are abundant. The untapped potential in Eastern European countries presents a significant avenue for expansion, driven by increasing urbanization and evolving consumer habits. The growing demand for personalized nutrition and functional foods opens doors for innovative product development, incorporating specialized ingredients catering to specific health needs. Technologies like precision fermentation could revolutionize the production of dairy-free spreads, offering enhanced taste and texture. Furthermore, the rise of direct-to-consumer (DTC) models and subscription services offers new channels for reaching niche customer segments and building brand loyalty.

Major Players in the Europe Foods Spread Market Ecosystem

- Nestle SA

- Andros

- Orkla ASA

- Unilever PLC

- The J M Smucker Company

- Hero Group

- Ferrero International S A

- Premier Foods PLC

- The Hershey Company

- Sioux Honey Association Co-op

Key Developments in Europe Foods Spread Market Industry

- 2023 March: Unilever PLC launched a new line of plant-based nut butters, expanding its vegan offerings.

- 2023 August: Nestle SA acquired a significant stake in a leading European organic fruit spread manufacturer, signaling a focus on premium and natural products.

- 2024 January: Orkla ASA introduced innovative sugar-free fruit spreads in the Scandinavian market, tapping into the growing health-conscious consumer base.

- 2024 May: The J M Smucker Company announced strategic partnerships with online retailers to enhance its e-commerce presence for its spreads portfolio.

- 2024 October: Hero Group expanded its presence in the Eastern European market by opening a new production facility dedicated to fruit-based spreads.

Strategic Europe Foods Spread Market Market Forecast

The Europe foods spread market is poised for continued robust growth, fueled by an increasing demand for healthier, plant-based, and premium products. Strategic focus on innovation, particularly in functional ingredients and novel flavor profiles, will be crucial for capturing market share. The expansion of online retail channels and the exploration of untapped Eastern European markets present significant growth catalysts. With a projected CAGR of 5.5% through 2033, the market offers substantial potential for stakeholders who can effectively adapt to evolving consumer preferences and navigate the competitive landscape.

Europe Foods Spread Market Segmentation

-

1. Product Type

- 1.1. Nut and Seed-based Spread

- 1.2. Fruit-based Spread

- 1.3. Honey

- 1.4. Chocolate-based Spread

- 1.5. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Retailers

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

Europe Foods Spread Market Segmentation By Geography

- 1. Spain

- 2. United Kingdom

- 3. Germany

- 4. France

- 5. Italy

- 6. Russia

- 7. Rest of Europe

Europe Foods Spread Market Regional Market Share

Geographic Coverage of Europe Foods Spread Market

Europe Foods Spread Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations and Product Guidelines

- 3.4. Market Trends

- 3.4.1. High Demand for Fruit-based Spreads

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Foods Spread Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Nut and Seed-based Spread

- 5.1.2. Fruit-based Spread

- 5.1.3. Honey

- 5.1.4. Chocolate-based Spread

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Retailers

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.3.2. United Kingdom

- 5.3.3. Germany

- 5.3.4. France

- 5.3.5. Italy

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Spain Europe Foods Spread Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Nut and Seed-based Spread

- 6.1.2. Fruit-based Spread

- 6.1.3. Honey

- 6.1.4. Chocolate-based Spread

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialist Retailers

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Europe Foods Spread Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Nut and Seed-based Spread

- 7.1.2. Fruit-based Spread

- 7.1.3. Honey

- 7.1.4. Chocolate-based Spread

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialist Retailers

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Germany Europe Foods Spread Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Nut and Seed-based Spread

- 8.1.2. Fruit-based Spread

- 8.1.3. Honey

- 8.1.4. Chocolate-based Spread

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialist Retailers

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. France Europe Foods Spread Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Nut and Seed-based Spread

- 9.1.2. Fruit-based Spread

- 9.1.3. Honey

- 9.1.4. Chocolate-based Spread

- 9.1.5. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Specialist Retailers

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Italy Europe Foods Spread Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Nut and Seed-based Spread

- 10.1.2. Fruit-based Spread

- 10.1.3. Honey

- 10.1.4. Chocolate-based Spread

- 10.1.5. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Specialist Retailers

- 10.2.4. Online Retail Stores

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Russia Europe Foods Spread Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Nut and Seed-based Spread

- 11.1.2. Fruit-based Spread

- 11.1.3. Honey

- 11.1.4. Chocolate-based Spread

- 11.1.5. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Supermarkets/Hypermarkets

- 11.2.2. Convenience Stores

- 11.2.3. Specialist Retailers

- 11.2.4. Online Retail Stores

- 11.2.5. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe Europe Foods Spread Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Nut and Seed-based Spread

- 12.1.2. Fruit-based Spread

- 12.1.3. Honey

- 12.1.4. Chocolate-based Spread

- 12.1.5. Other Product Types

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Supermarkets/Hypermarkets

- 12.2.2. Convenience Stores

- 12.2.3. Specialist Retailers

- 12.2.4. Online Retail Stores

- 12.2.5. Other Distribution Channels

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Nestle SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Andros

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Orkla ASA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Unilever PLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 The J M Smucker Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Hero Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Ferrero International S A

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Premier Foods PLC*List Not Exhaustive

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 The Hershey Company

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Sioux Honey Association Co-op

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Nestle SA

List of Figures

- Figure 1: Europe Foods Spread Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Foods Spread Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Foods Spread Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Europe Foods Spread Market Volume k Tons Forecast, by Product Type 2020 & 2033

- Table 3: Europe Foods Spread Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe Foods Spread Market Volume k Tons Forecast, by Distribution Channel 2020 & 2033

- Table 5: Europe Foods Spread Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Foods Spread Market Volume k Tons Forecast, by Region 2020 & 2033

- Table 7: Europe Foods Spread Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Europe Foods Spread Market Volume k Tons Forecast, by Product Type 2020 & 2033

- Table 9: Europe Foods Spread Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Europe Foods Spread Market Volume k Tons Forecast, by Distribution Channel 2020 & 2033

- Table 11: Europe Foods Spread Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe Foods Spread Market Volume k Tons Forecast, by Country 2020 & 2033

- Table 13: Europe Foods Spread Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Europe Foods Spread Market Volume k Tons Forecast, by Product Type 2020 & 2033

- Table 15: Europe Foods Spread Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 16: Europe Foods Spread Market Volume k Tons Forecast, by Distribution Channel 2020 & 2033

- Table 17: Europe Foods Spread Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Europe Foods Spread Market Volume k Tons Forecast, by Country 2020 & 2033

- Table 19: Europe Foods Spread Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Europe Foods Spread Market Volume k Tons Forecast, by Product Type 2020 & 2033

- Table 21: Europe Foods Spread Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 22: Europe Foods Spread Market Volume k Tons Forecast, by Distribution Channel 2020 & 2033

- Table 23: Europe Foods Spread Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Foods Spread Market Volume k Tons Forecast, by Country 2020 & 2033

- Table 25: Europe Foods Spread Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: Europe Foods Spread Market Volume k Tons Forecast, by Product Type 2020 & 2033

- Table 27: Europe Foods Spread Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: Europe Foods Spread Market Volume k Tons Forecast, by Distribution Channel 2020 & 2033

- Table 29: Europe Foods Spread Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Europe Foods Spread Market Volume k Tons Forecast, by Country 2020 & 2033

- Table 31: Europe Foods Spread Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 32: Europe Foods Spread Market Volume k Tons Forecast, by Product Type 2020 & 2033

- Table 33: Europe Foods Spread Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 34: Europe Foods Spread Market Volume k Tons Forecast, by Distribution Channel 2020 & 2033

- Table 35: Europe Foods Spread Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Europe Foods Spread Market Volume k Tons Forecast, by Country 2020 & 2033

- Table 37: Europe Foods Spread Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 38: Europe Foods Spread Market Volume k Tons Forecast, by Product Type 2020 & 2033

- Table 39: Europe Foods Spread Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 40: Europe Foods Spread Market Volume k Tons Forecast, by Distribution Channel 2020 & 2033

- Table 41: Europe Foods Spread Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Europe Foods Spread Market Volume k Tons Forecast, by Country 2020 & 2033

- Table 43: Europe Foods Spread Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 44: Europe Foods Spread Market Volume k Tons Forecast, by Product Type 2020 & 2033

- Table 45: Europe Foods Spread Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 46: Europe Foods Spread Market Volume k Tons Forecast, by Distribution Channel 2020 & 2033

- Table 47: Europe Foods Spread Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Europe Foods Spread Market Volume k Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Foods Spread Market?

The projected CAGR is approximately 3.27%.

2. Which companies are prominent players in the Europe Foods Spread Market?

Key companies in the market include Nestle SA, Andros, Orkla ASA, Unilever PLC, The J M Smucker Company, Hero Group, Ferrero International S A, Premier Foods PLC*List Not Exhaustive, The Hershey Company, Sioux Honey Association Co-op.

3. What are the main segments of the Europe Foods Spread Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend.

6. What are the notable trends driving market growth?

High Demand for Fruit-based Spreads.

7. Are there any restraints impacting market growth?

Stringent Government Regulations and Product Guidelines.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in k Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Foods Spread Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Foods Spread Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Foods Spread Market?

To stay informed about further developments, trends, and reports in the Europe Foods Spread Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence