Key Insights

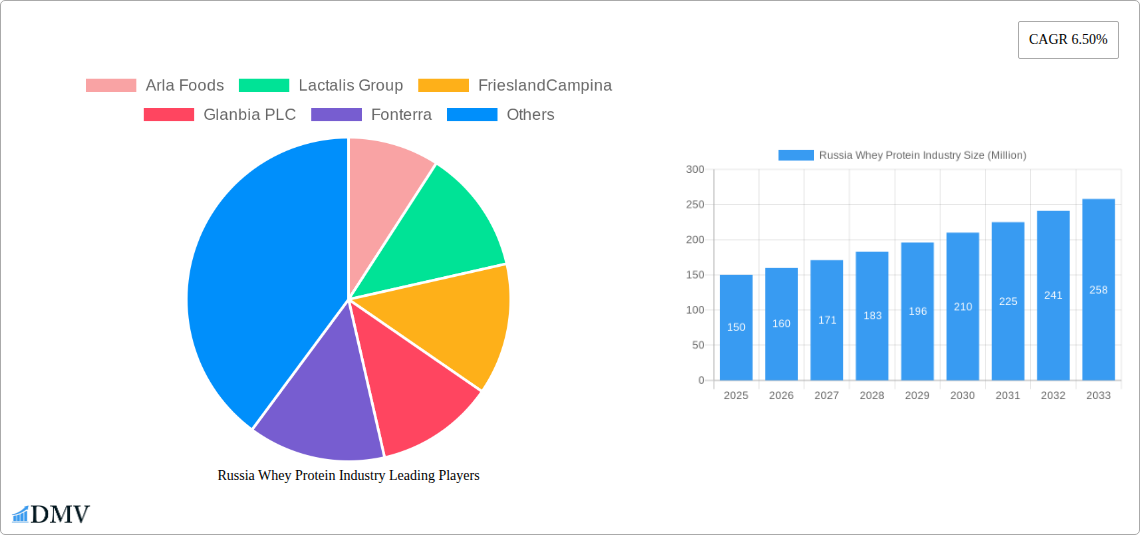

The Russian whey protein market is poised for significant expansion, projected to reach a valuation of approximately XX million by 2033. This growth is driven by a substantial Compound Annual Growth Rate (CAGR) of 6.50%, indicating a robust and expanding demand for whey protein products across various applications. A key driver for this market surge is the increasing consumer focus on health and wellness, particularly among the younger demographic actively participating in sports and fitness activities. The growing popularity of sports nutrition products, coupled with a rising awareness of the health benefits associated with whey protein, is fueling demand for products like whey protein concentrate and isolate. Furthermore, the application in infant formula, driven by the perception of whey protein as a high-quality nutrient source for infants, contributes significantly to market expansion.

Russia Whey Protein Industry Market Size (In Million)

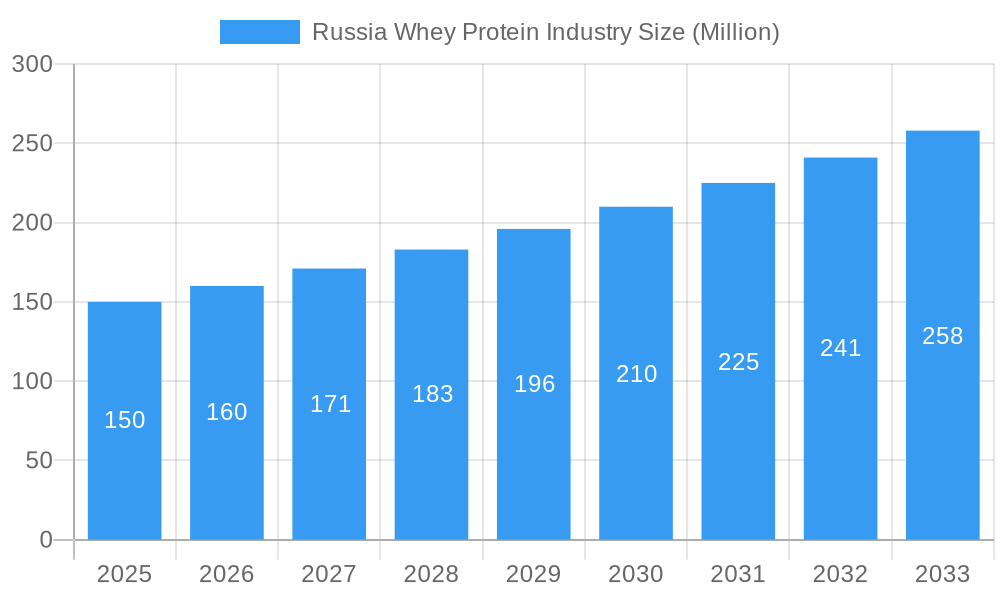

The functional food and beverage sector also presents a substantial growth avenue, with manufacturers increasingly incorporating whey protein to enhance the nutritional profile of their offerings. This trend aligns with a broader consumer shift towards fortified and health-conscious food choices. While the market exhibits strong growth potential, certain restraints need to be considered. Fluctuations in raw material prices, primarily milk, can impact production costs and subsequently affect product pricing. Additionally, evolving regulatory landscapes concerning food additives and nutritional claims may present challenges for manufacturers. Despite these factors, the overarching trends of increased health consciousness, a burgeoning sports nutrition industry, and the versatile applications of whey protein in functional foods and beverages are expected to propel the Russian whey protein market forward. Key players in the global market, such as Arla Foods, Lactalis Group, FrieslandCampina, Glanbia PLC, and Fonterra, are likely to play a crucial role in shaping the competitive landscape within Russia.

Russia Whey Protein Industry Company Market Share

Russia Whey Protein Industry: Market Dynamics, Growth Prospects, and Competitive Landscape (2019-2033)

Dive deep into the burgeoning Russia whey protein industry with our comprehensive market research report. This in-depth analysis offers unparalleled insights into market composition, historical trends, future trajectories, and the competitive ecosystem. Discover the key drivers propelling the demand for whey protein concentrate, whey protein isolate, and hydrolyzed whey protein across diverse applications, from sports and performance nutrition to infant formula and functional foods. Gain a strategic advantage by understanding innovation catalysts, regulatory landscapes, and emerging opportunities within this dynamic market.

Russia Whey Protein Industry Market Composition & Trends

The Russia whey protein market exhibits a moderate concentration, with a few key international players and a growing number of domestic manufacturers vying for market share. Innovation is primarily driven by the increasing demand for specialized protein formulations catering to specific health and fitness goals. Regulatory frameworks, while evolving, are generally supportive of the food and beverage sector, with stringent quality control measures in place. Substitute products, such as soy protein and plant-based protein powders, present a competitive challenge, particularly for health-conscious consumers seeking vegan alternatives. End-user profiles are expanding beyond traditional athletes to include the general population interested in health, wellness, and weight management. Mergers and acquisitions (M&A) activity, while not yet at peak levels, is anticipated to increase as larger entities seek to consolidate their market presence and expand their product portfolios. The estimated market share distribution for whey protein concentrate currently stands at approximately 60%, with whey protein isolate at 30%, and hydrolyzed whey protein at 10%. M&A deal values within the broader dairy ingredients sector have seen significant growth, with projections indicating an upward trend in the whey protein segment as well, estimated to reach XXX Million by 2025.

Russia Whey Protein Industry Industry Evolution

The Russia whey protein industry has undergone a significant transformation, evolving from a niche segment catering primarily to bodybuilders and athletes to a mainstream product embraced by a wider consumer base. This evolution is intricately linked to shifting consumer demands for healthier lifestyles, increased awareness of the nutritional benefits of protein, and the growing popularity of fitness culture. Market growth trajectories have been consistently positive, fueled by an expanding middle class with greater disposable income and a heightened focus on preventative healthcare. Technological advancements in processing and extraction techniques have played a crucial role in enhancing the purity, bioavailability, and taste profiles of various whey protein types, including whey protein concentrate, whey protein isolate, and hydrolyzed whey protein. These innovations have not only improved product quality but also enabled the development of new applications.

Consumer demand has diversified, moving beyond basic protein supplementation to functional benefits such as muscle recovery, satiety, immune support, and cognitive health. This trend is evident in the burgeoning sports and performance nutrition segment, which continues to dominate, but also in the rapid growth of infant formula, functional/fortified food, and functional beverages. The adoption of whey protein in these diverse applications is supported by ongoing research highlighting its efficacy. For instance, the growth rate in the sports and performance nutrition segment has been a steady 7% year-on-year, while the infant formula segment, driven by the need for high-quality protein for infant development, has seen a robust 5% annual growth. Adoption metrics across the functional food and beverage sectors are also on an upward trend, with an estimated 15% of new product launches incorporating whey protein by 2025. The historical period (2019-2024) witnessed a compound annual growth rate (CAGR) of approximately 6.5%, with the base year (2025) expected to see continued strong performance. The forecast period (2025-2033) anticipates sustained growth, driven by ongoing innovation and increasing consumer acceptance.

Leading Regions, Countries, or Segments in Russia Whey Protein Industry

Within the dynamic Russia whey protein industry, the Sports and Performance Nutrition segment unequivocally holds the position of market leadership. This dominance is a direct consequence of heightened consumer awareness regarding the critical role of protein in muscle synthesis, repair, and overall athletic performance. The increasing prevalence of gym culture, professional sports, and a general shift towards active lifestyles across Russia have amplified the demand for protein supplements. Investment trends within this segment are robust, with both domestic and international companies channeling significant resources into product development, marketing, and distribution networks tailored to athletes and fitness enthusiasts. Regulatory support, while comprehensive, has generally been conducive to the growth of this segment, focusing on product safety and efficacy.

Delving deeper into the specific segments:

Type:

- Whey Protein Concentrate: This remains the most prevalent type, accounting for approximately 60% of the market share, owing to its cost-effectiveness and versatile applications in various food products and supplements.

- Whey Protein Isolate: With a growing demand for higher protein purity and lower fat/lactose content, isolate's market share is steadily increasing, projected to reach 35% by 2033. This is particularly favored in specialized sports nutrition products.

- Hydrolyzed Whey Protein: Though currently the smallest segment (around 5%), its rapid absorption rate makes it a premium option for post-workout recovery, indicating significant future growth potential.

Application:

- Sports and Performance Nutrition: This segment is the undisputed leader, driven by a pervasive fitness culture and the increasing adoption of protein supplements by amateur and professional athletes alike. Key drivers include a growing number of fitness centers, organized sports leagues, and a general consumer desire for improved physical capabilities.

- Infant Formula: This segment is experiencing substantial growth due to the recognized importance of high-quality protein for infant development and increasing parental concern for providing optimal nutrition. Innovation in this area focuses on hypoallergenic and easily digestible formulas.

- Functional/Fortified Food: The integration of whey protein into everyday food products like bars, snacks, and dairy alternatives is on the rise as consumers seek convenient ways to boost their protein intake.

- Functional Beverages: Ready-to-drink protein shakes and enhanced beverages are gaining traction as convenient on-the-go nutrition solutions.

- Other Applications: This encompasses niche uses in clinical nutrition and specialized dietary supplements, representing a smaller but growing market.

The dominance of the Sports and Performance Nutrition segment is sustained by targeted marketing campaigns, endorsements by athletes, and the continuous innovation of new product formulations and delivery systems. The estimated market size for the Sports and Performance Nutrition segment is expected to reach XXX Million by 2025, with a projected CAGR of 8% through 2033.

Russia Whey Protein Industry Product Innovations

Product innovation in the Russia whey protein industry is primarily focused on enhancing bioavailability, taste, and functional benefits. Advancements in microfiltration and ultrafiltration technologies have led to the development of highly pure whey protein isolate and hydrolyzed whey protein with improved digestibility and reduced allergenicity. Unique selling propositions often revolve around extended-release formulations for sustained amino acid delivery, inclusion of digestive enzymes for enhanced absorption, and the incorporation of prebiotics and probiotics for gut health. Furthermore, the development of lactose-free and plant-based hybrid protein blends caters to a wider consumer base. Performance metrics are increasingly being highlighted, such as rapid muscle recovery times and improved satiety, supported by emerging clinical research.

Propelling Factors for Russia Whey Protein Industry Growth

Several key factors are propelling the Russia whey protein industry forward. The escalating health and wellness consciousness among Russian consumers is a primary driver, leading to increased demand for protein-rich foods and supplements. Technological advancements in protein processing and extraction are yielding higher quality and more versatile products, such as whey protein isolate and hydrolyzed whey protein, catering to specialized dietary needs. The growing popularity of sports and fitness activities further fuels the sports and performance nutrition segment. Economically, rising disposable incomes allow for greater spending on premium health products. Regulatory support for the food and beverage industry, coupled with increasing investment in dairy processing infrastructure, also contributes significantly to market expansion.

Obstacles in the Russia Whey Protein Industry Market

Despite robust growth, the Russia whey protein industry faces certain obstacles. Stringent import regulations and customs procedures can sometimes create supply chain disruptions and increase costs for imported raw materials and finished products. Price sensitivity among a segment of consumers, particularly when compared to more affordable protein sources, can limit market penetration. Fluctuations in global dairy commodity prices can impact the cost of raw whey, affecting profit margins for manufacturers. Furthermore, the need for consistent product quality and adherence to international safety standards presents an ongoing challenge for some domestic producers, alongside intense competition from established global brands and emerging plant-based alternatives.

Future Opportunities in Russia Whey Protein Industry

The Russia whey protein industry is ripe with future opportunities. The expansion of functional beverages and functional/fortified food applications presents significant untapped potential as consumers seek convenient and healthy options. Growing interest in personalized nutrition and specialized dietary needs opens avenues for niche product development, including allergen-free and easily digestible formulations. The increasing demand for high-quality protein in infant formula and clinical nutrition sectors offers further growth avenues. Furthermore, advancements in sustainable sourcing and processing technologies could provide a competitive edge and appeal to environmentally conscious consumers. Exploring new distribution channels, including e-commerce and specialized health stores, will also be crucial for market penetration.

Major Players in the Russia Whey Protein Industry Ecosystem

- Arla Foods

- Lactalis Group

- FrieslandCampina

- Glanbia PLC

- Fonterra

- Olam International

- Raben Group

- Spomlek

- Meggle Group

Key Developments in Russia Whey Protein Industry Industry

- 2023/08: Launch of new high-protein ready-to-drink beverages by a major Russian dairy producer, targeting the functional beverage market.

- 2023/05: Glanbia PLC announces expansion of its whey processing capabilities, aiming to meet increasing global demand for whey protein isolate.

- 2022/12: Fonterra introduces an innovative infant formula ingredient with enhanced bioavailability, boosting its presence in the infant nutrition segment.

- 2022/09: Arla Foods invests in new research and development for specialized whey protein applications in fortified foods.

- 2021/07: Lactalis Group acquires a significant stake in a Russian dairy cooperative, strengthening its local presence and supply chain.

- 2021/03: FrieslandCampina highlights its commitment to sustainable sourcing of whey, a growing consumer concern.

Strategic Russia Whey Protein Industry Market Forecast

The Russia whey protein industry is poised for sustained growth, driven by an expanding health-conscious consumer base and increasing demand for protein-enriched products. Key growth catalysts include the continuous innovation in whey protein isolate and hydrolyzed whey protein formulations, catering to niche applications like sports nutrition and infant formula. The shift towards functional foods and beverages, coupled with increasing disposable incomes, will further propel market expansion. Strategic investments in R&D, efficient supply chain management, and targeted marketing campaigns will be crucial for players to capitalize on the burgeoning market potential and solidify their competitive positions. The overall market outlook remains highly positive, with significant opportunities for both established and emerging companies.

Russia Whey Protein Industry Segmentation

-

1. Type

- 1.1. Whey Protein Concentrate

- 1.2. Whey Protein Isolate

- 1.3. Hydrolyzed Whey Protein

-

2. Application

- 2.1. Sports and Performance Nutrition

- 2.2. Infant Formula

- 2.3. Functional/Fortified Food

- 2.4. Functional Beverages

- 2.5. Other Applications

Russia Whey Protein Industry Segmentation By Geography

- 1. Russia

Russia Whey Protein Industry Regional Market Share

Geographic Coverage of Russia Whey Protein Industry

Russia Whey Protein Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Efficient processing abilities and growing applications of whey protein; Rising number of fitness and sports enthusiasts

- 3.3. Market Restrains

- 3.3.1. High processing and production cost of whey protein

- 3.4. Market Trends

- 3.4.1. Growing Fitness Trend in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Whey Protein Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Whey Protein Concentrate

- 5.1.2. Whey Protein Isolate

- 5.1.3. Hydrolyzed Whey Protein

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Sports and Performance Nutrition

- 5.2.2. Infant Formula

- 5.2.3. Functional/Fortified Food

- 5.2.4. Functional Beverages

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arla Foods

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lactalis Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FrieslandCampina

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Glanbia PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fonterra

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Olam International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Raben Group (Spomlek

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Meggle Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Arla Foods

List of Figures

- Figure 1: Russia Whey Protein Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Russia Whey Protein Industry Share (%) by Company 2025

List of Tables

- Table 1: Russia Whey Protein Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Russia Whey Protein Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Russia Whey Protein Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Russia Whey Protein Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Russia Whey Protein Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Russia Whey Protein Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Whey Protein Industry?

The projected CAGR is approximately 4.28%.

2. Which companies are prominent players in the Russia Whey Protein Industry?

Key companies in the market include Arla Foods, Lactalis Group, FrieslandCampina, Glanbia PLC, Fonterra, Olam International, Raben Group (Spomlek, Meggle Group.

3. What are the main segments of the Russia Whey Protein Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Efficient processing abilities and growing applications of whey protein; Rising number of fitness and sports enthusiasts.

6. What are the notable trends driving market growth?

Growing Fitness Trend in the Country.

7. Are there any restraints impacting market growth?

High processing and production cost of whey protein.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Whey Protein Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Whey Protein Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Whey Protein Industry?

To stay informed about further developments, trends, and reports in the Russia Whey Protein Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence