Key Insights

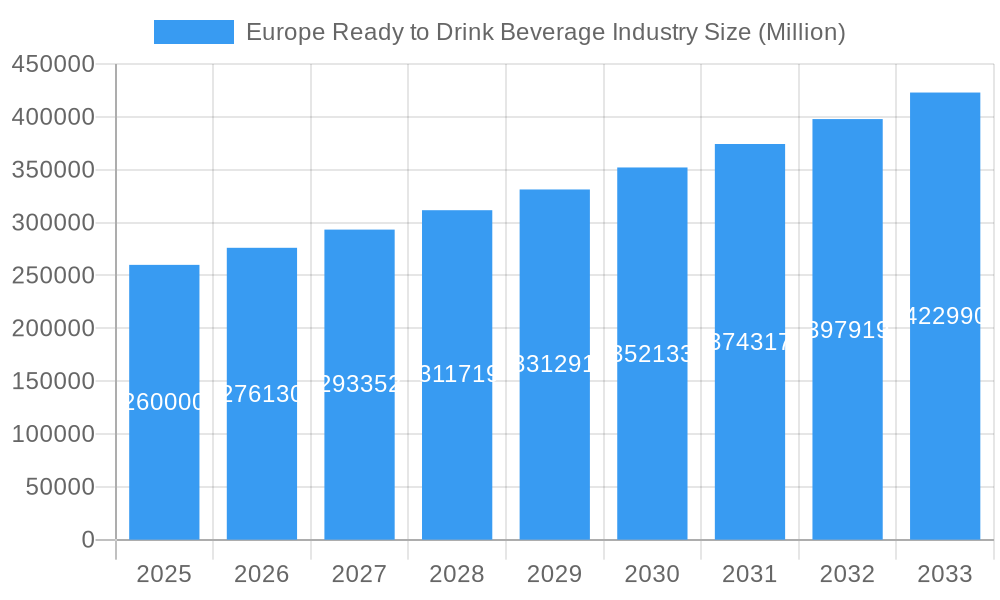

The European Ready-to-Drink (RTD) beverage market is projected for substantial growth, expected to reach USD 804.87 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.22% through 2033. This expansion is driven by increasing consumer demand for convenience and on-the-go options, alongside a growing preference for healthier beverages like functional drinks and natural juices. Innovations in product launches, appealing packaging, and strategic marketing by leading brands are crucial for market share capture. The burgeoning online retail sector also enhances accessibility and product variety.

Europe Ready to Drink Beverage Industry Market Size (In Billion)

Market challenges include evolving regulations on sugar content and labeling, intense competition from niche brands, and the premiumization of home-brewed beverages. Nevertheless, the prevailing trends of convenience, health consciousness, and premium experiences forecast continued market growth. Europe's diverse consumer preferences present a complex yet promising landscape for beverage manufacturers. Key segments such as tea, coffee, energy drinks, and fruit & vegetable juices are anticipated to lead this growth, supported by established distribution channels including supermarkets and hypermarkets, and the increasingly vital online retail segment.

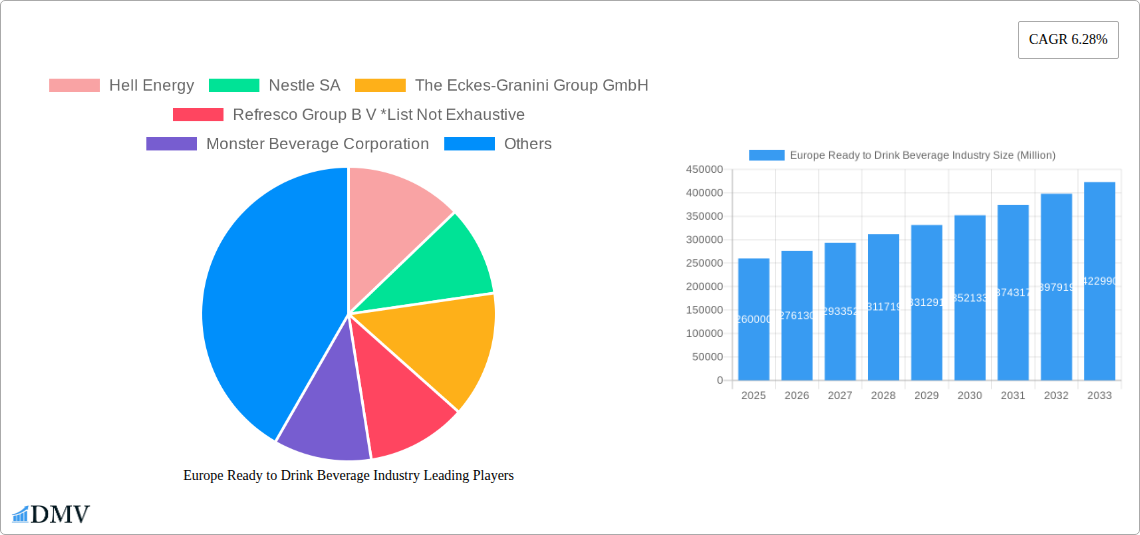

Europe Ready to Drink Beverage Industry Company Market Share

This report provides an in-depth analysis of the European Ready-to-Drink (RTD) Beverage Industry, covering market trends, growth drivers, and future opportunities from 2019 to 2033. With a base year of 2025 and a forecast period of 2025–2033, this research offers actionable insights. We examine critical segments by Product Type (Tea, Coffee, Energy Drinks, Fruit & Vegetable Juice, Dairy-based beverages, Others) and Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, Others).

Europe Ready to Drink Beverage Industry Market Composition & Trends

The European RTD beverage market is characterized by a moderate level of concentration, with key players like Red Bull GmbH, Monster Beverage Corporation, The Coca-Cola Company, PepsiCo Inc., and Nestle SA holding significant market shares. Innovation is a primary catalyst, driven by evolving consumer preferences for healthier, functional, and convenient beverage options. The regulatory landscape, while providing a framework for consumer safety, also presents challenges through stringent labeling requirements and sugar taxes in certain nations. Substitute products, such as freshly brewed coffee or homemade juices, pose a competitive threat, though the convenience of RTD beverages often outweighs this. End-user profiles are increasingly diverse, encompassing health-conscious millennials, busy professionals, and athletes seeking performance-enhancing drinks. Mergers and acquisitions (M&A) activity, valued in the hundreds of millions of Euros, continues to shape the market, with companies strategically acquiring smaller brands to expand their portfolios and market reach. For instance, Refresco Group B.V.'s strategic acquisitions have bolstered its private label capabilities. Market share distribution shows a significant portion attributed to energy drinks and fruit & vegetable juices, reflecting strong consumer demand for both invigoration and perceived health benefits.

Europe Ready to Drink Beverage Industry Industry Evolution

The European RTD beverage industry has witnessed a remarkable evolution driven by a confluence of factors, including rapid technological advancements, shifting consumer lifestyles, and an increasing awareness of health and wellness. Over the historical period (2019–2024), the market demonstrated consistent growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately 4.5%. This trajectory is projected to continue into the forecast period (2025–2033), with an anticipated CAGR of around 5.2%, reaching an estimated market size of over €70 Billion by 2033. Technological advancements in packaging, such as the development of sustainable and recyclable materials, have not only addressed environmental concerns but also enhanced product shelf-life and consumer appeal. Innovations in beverage formulation, including the integration of natural sweeteners, adaptogens, and probiotics, cater to the growing demand for functional RTD beverages that offer more than just hydration. Furthermore, the proliferation of e-commerce platforms and advancements in logistics have revolutionized distribution channels, making RTD beverages more accessible than ever before. Shifting consumer demands are paramount, with a discernible move away from sugary drinks towards healthier alternatives like low-sugar options, plant-based beverages, and functional drinks enriched with vitamins and minerals. The "on-the-go" culture prevalent across Europe further fuels the demand for convenient, ready-to-consume formats. For example, the rise of sparkling teas and enhanced water beverages reflects this trend. The increasing disposable income in many European countries also plays a crucial role in supporting premiumization and the adoption of more sophisticated RTD offerings. Market growth trajectories are robust, supported by continuous product innovation and strategic marketing campaigns that highlight the convenience and health benefits of RTD beverages.

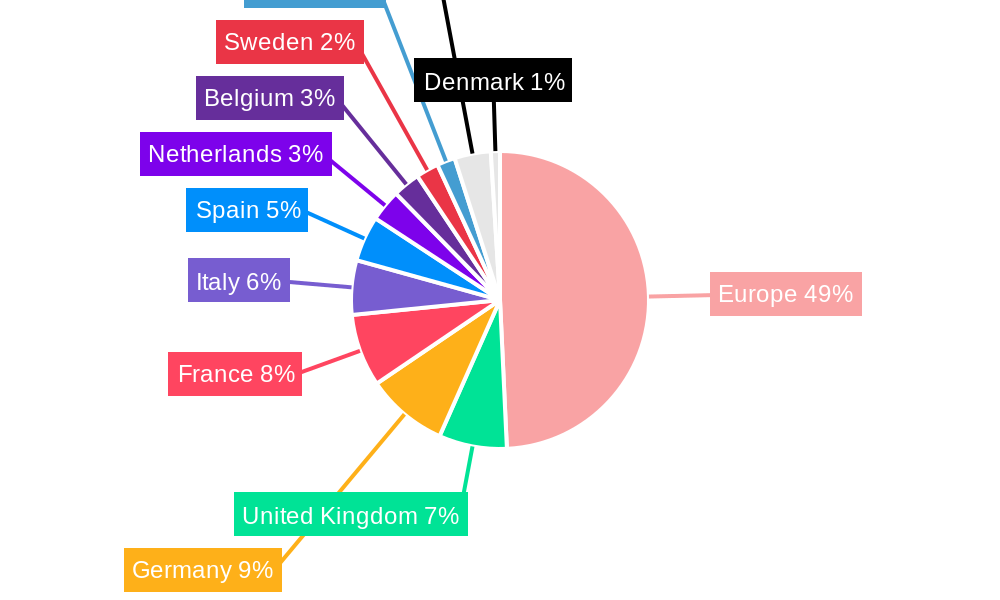

Leading Regions, Countries, or Segments in Europe Ready to Drink Beverage Industry

The European Ready to Drink Beverage Industry is experiencing significant dynamism across its various segments and geographical regions. Among the product types, Energy Drinks consistently emerge as a dominant force, driven by a young demographic, increasing participation in sports and active lifestyles, and effective marketing by major players like Red Bull GmbH and Monster Beverage Corporation. The convenience and perceived performance-enhancing benefits of energy drinks resonate strongly with consumers seeking a quick boost. Fruit & Vegetable Juice also commands a substantial market share, propelled by growing health consciousness and the demand for natural, vitamin-rich beverages. Companies like The Eckes-Granini Group GmbH are key contributors in this segment. The Coffee segment, particularly RTD coffee, is experiencing rapid expansion, fueled by the desire for convenient caffeine solutions among busy professionals and the trend of premiumization with artisanal and organic offerings. Starbucks Corp. and Suntory Beverages & Food Limited are significant players here. In terms of distribution channels, Supermarkets/Hypermarkets remain the leading channel due to their wide reach, product variety, and promotional activities. However, Online Retail Stores are exhibiting the fastest growth rate, facilitated by the increasing adoption of e-commerce and the convenience of home delivery, especially for bulk purchases. Key drivers for dominance in these segments include:

- Energy Drinks:

- Investment Trends: Significant marketing and sponsorship budgets allocated by major brands.

- Consumer Demand: Growing demand for energy and focus, particularly among younger demographics.

- Product Innovation: Introduction of sugar-free and low-calorie variants.

- Fruit & Vegetable Juice:

- Health & Wellness Trends: Increasing consumer focus on healthy eating and natural ingredients.

- Regulatory Support: Favorable regulations promoting nutritional labeling.

- Product Diversification: Expansion into functional juices with added vitamins and superfoods.

- Online Retail Stores (Distribution Channel):

- Technological Advancements: Seamless e-commerce platforms and efficient logistics.

- Consumer Convenience: Ability to purchase anytime, anywhere, with home delivery.

- Market Penetration: Rapid growth in digital adoption across all age groups.

Germany, the United Kingdom, and France represent the leading countries within Europe, driven by larger populations, higher disposable incomes, and established retail infrastructures. The high penetration of convenience stores and supermarkets in these regions facilitates widespread product availability.

Europe Ready to Drink Beverage Industry Product Innovations

Product innovation in the European RTD beverage industry is fiercely competitive and customer-centric. Recent advancements showcase a strong trend towards functional beverages. For instance, plant-powered nootropic sports drinks like OPERATE, launched in May 2022, offer cognitive enhancement benefits alongside hydration. Similarly, Applied Nutrition’s Carni-Tone, a flavoured L-Carnitine sports drink, taps into the performance nutrition market with a focus on active individuals. The growing demand for organic and ethically sourced products is exemplified by Daione's August 2021 launch of organic and Fairtrade RTD Coffee, emphasizing traceability and the absence of artificial ingredients. These innovations highlight a shift towards premiumization, natural ingredients, and specialized benefits, driving consumer engagement and brand loyalty.

Propelling Factors for Europe Ready to Drink Beverage Industry Growth

The European RTD beverage industry's growth is propelled by several key factors. Technologically, advancements in aseptic packaging and intelligent labeling enhance product shelf-life and consumer engagement. Economically, rising disposable incomes and a growing middle class in several European nations support increased consumption of convenience-oriented beverages. Regulatory influences, such as relaxed restrictions on certain beverage ingredients and the promotion of healthier options through tax incentives (in some regions), also contribute positively. The enduring "on-the-go" culture, coupled with the expanding online retail landscape, ensures consistent demand for convenient beverage solutions. Furthermore, the burgeoning health and wellness trend fuels demand for RTDs fortified with vitamins, minerals, and functional ingredients.

Obstacles in the Europe Ready to Drink Beverage Industry Market

Despite robust growth, the European RTD beverage market faces several obstacles. Stringent regulatory frameworks regarding sugar content, ingredient declarations, and marketing claims, particularly in countries like the UK and France, can increase operational costs and limit product formulations. Supply chain disruptions, amplified by geopolitical events and logistical challenges, can impact raw material availability and delivery times, potentially leading to increased production costs. Intense competitive pressures from both established giants like The Coca-Cola Company and Nestle SA, and nimble emerging brands, necessitate significant investment in marketing and innovation. The rising cost of raw materials, including fruits, coffee beans, and packaging materials, also presents a considerable challenge, potentially impacting profit margins.

Future Opportunities in Europe Ready to Drink Beverage Industry

Emerging opportunities in the European RTD beverage industry are abundant. The growing demand for plant-based and vegan RTD beverages presents a significant market expansion potential, catering to ethical and health-conscious consumers. Advancements in functional beverage technology, such as the integration of probiotics, prebiotics, and adaptogens for enhanced well-being, offer avenues for product differentiation. The expansion of online retail and direct-to-consumer (DTC) models allows for greater market reach and personalized consumer engagement, especially in underserved regions. Furthermore, the increasing interest in low-alcohol and no-alcohol RTD options, particularly within the social drinking occasion, opens up new product categories and consumer segments.

Major Players in the Europe Ready to Drink Beverage Industry Ecosystem

- Hell Energy

- Nestle SA

- The Eckes-Granini Group GmbH

- Refresco Group B V

- Monster Beverage Corporation

- PepsiCo Inc.

- Red Bull GmbH

- The Coca-Cola Company

- Suntory Beverages & Food Limited

- Starbucks Corp.

Key Developments in Europe Ready to Drink Beverage Industry Industry

- May 2022: OPERATE, a plant-powered nootropic sports drink, launched in the United Kingdom, targeting cognitive enhancement and natural ingredients.

- February 2022: Applied Nutrition, a UK-based company, introduced Carni-Tone, a new L-Carnitine flavoured spring water, expanding its RTD sports drink portfolio.

- August 2021: Daione launched a range of organic and Fairtrade RTD Coffee drinks, emphasizing traceability and the absence of artificial additives, certified by the British Soil Association.

Strategic Europe Ready to Drink Beverage Industry Market Forecast

The strategic outlook for the European RTD beverage market is exceptionally promising. Growth catalysts include the continuous pursuit of healthier and functional beverage options, the expanding online retail infrastructure enabling wider accessibility, and sustained consumer demand for convenient, on-the-go refreshment. The increasing focus on sustainability and ethical sourcing by both consumers and manufacturers will also shape market dynamics. Future opportunities lie in the innovation of novel flavors, the development of plant-based alternatives, and the integration of smart packaging solutions. Market potential is substantial, driven by evolving consumer preferences and ongoing investment in product development and distribution.

Europe Ready to Drink Beverage Industry Segmentation

-

1. Product Type

- 1.1. Tea

- 1.2. Coffee

- 1.3. Energy Drinks

- 1.4. Fruit & Vegetable Juice

- 1.5. Dairy based beverages

- 1.6. Others

-

2. Distribution Channel

- 2.1. Supermarkets/ Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Others

Europe Ready to Drink Beverage Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Ready to Drink Beverage Industry Regional Market Share

Geographic Coverage of Europe Ready to Drink Beverage Industry

Europe Ready to Drink Beverage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand For Ready Meals Food Products to Influence Growth; Increasing Demand for Organic and Vegan Ready-to-Eat food products.

- 3.3. Market Restrains

- 3.3.1. Rising Concern Over Health Issues Associated with Processed Foods

- 3.4. Market Trends

- 3.4.1. Growing Preference for Convenient and Healthy On-The-Go Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Ready to Drink Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Tea

- 5.1.2. Coffee

- 5.1.3. Energy Drinks

- 5.1.4. Fruit & Vegetable Juice

- 5.1.5. Dairy based beverages

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/ Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hell Energy

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestle SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Eckes-Granini Group GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Refresco Group B V *List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Monster Beverage Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PepsiCo Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Red Bull GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Coca-Cola Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Suntory Beverages & Food Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Starbucks Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hell Energy

List of Figures

- Figure 1: Europe Ready to Drink Beverage Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Ready to Drink Beverage Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Ready to Drink Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Europe Ready to Drink Beverage Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Europe Ready to Drink Beverage Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Ready to Drink Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Europe Ready to Drink Beverage Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Ready to Drink Beverage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Ready to Drink Beverage Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Ready to Drink Beverage Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Ready to Drink Beverage Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Ready to Drink Beverage Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Ready to Drink Beverage Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Ready to Drink Beverage Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Ready to Drink Beverage Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Ready to Drink Beverage Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Ready to Drink Beverage Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Ready to Drink Beverage Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Ready to Drink Beverage Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Ready to Drink Beverage Industry?

The projected CAGR is approximately 6.22%.

2. Which companies are prominent players in the Europe Ready to Drink Beverage Industry?

Key companies in the market include Hell Energy, Nestle SA, The Eckes-Granini Group GmbH, Refresco Group B V *List Not Exhaustive, Monster Beverage Corporation, PepsiCo Inc, Red Bull GmbH, The Coca-Cola Company, Suntory Beverages & Food Limited, Starbucks Corp.

3. What are the main segments of the Europe Ready to Drink Beverage Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 804.87 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand For Ready Meals Food Products to Influence Growth; Increasing Demand for Organic and Vegan Ready-to-Eat food products..

6. What are the notable trends driving market growth?

Growing Preference for Convenient and Healthy On-The-Go Beverages.

7. Are there any restraints impacting market growth?

Rising Concern Over Health Issues Associated with Processed Foods.

8. Can you provide examples of recent developments in the market?

In May 2022, OPERATE, a nootropic sports drink was launched in the United Kingdom. This sports drink is powered by plants and filled with natural extracts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Ready to Drink Beverage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Ready to Drink Beverage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Ready to Drink Beverage Industry?

To stay informed about further developments, trends, and reports in the Europe Ready to Drink Beverage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence