Key Insights

The Indian pea protein market is projected for substantial growth, anticipated to reach $324.04 million by 2029, exhibiting a Compound Annual Growth Rate (CAGR) of 7.3%. This expansion is driven by increasing consumer health consciousness, a rising demand for plant-based protein sources, and a growing preference for vegetarian and vegan diets. The "Free From" trend, favoring allergen-free products, further boosts pea protein adoption, while increasing disposable incomes support investment in premium nutritional products.

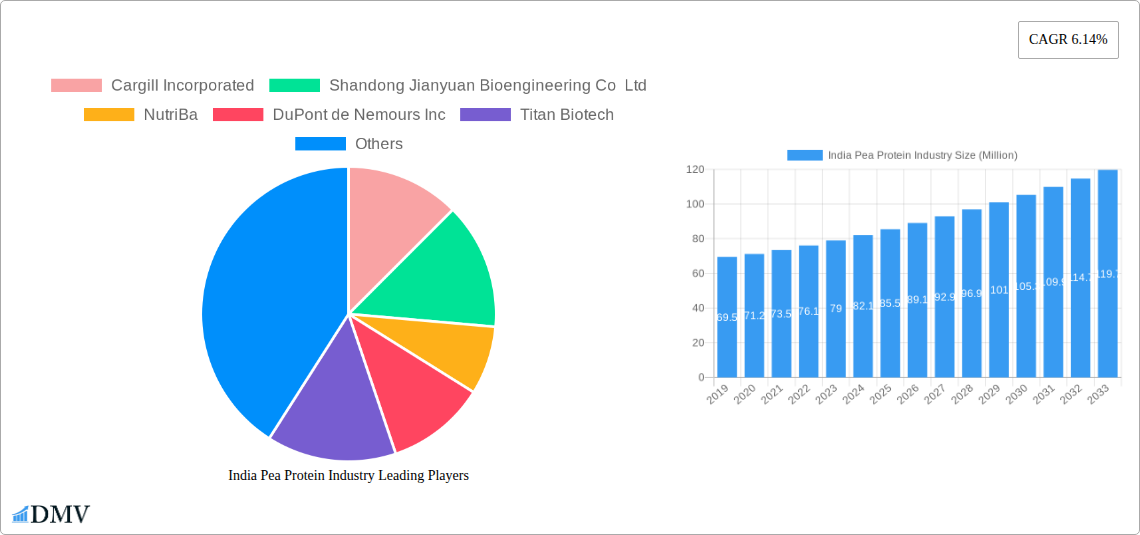

India Pea Protein Industry Market Size (In Million)

The market segments include isolates and concentrates, favored by manufacturers for their purity. Applications span animal feed, offering a sustainable option, and the personal care and cosmetics sector, leveraging pea protein's moisturizing properties. The food and beverage industry extensively uses pea protein in bakery, dairy alternatives, meat substitutes, and snacks. The supplements sector is also expanding, incorporating pea protein into infant formula, elderly nutrition, medical nutrition, and sports nutrition products.

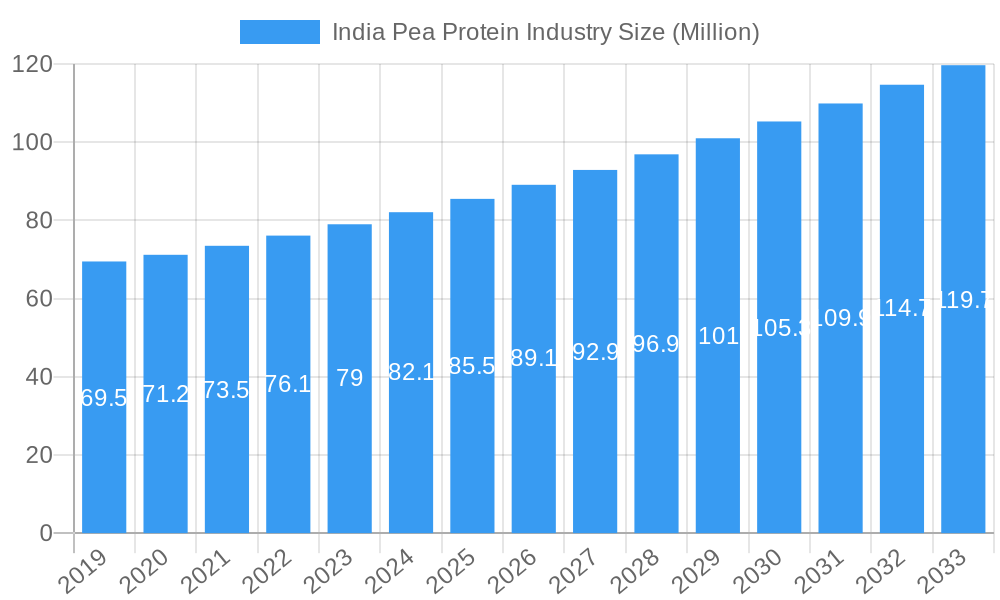

India Pea Protein Industry Company Market Share

This report provides an in-depth analysis of the India Pea Protein Market, covering its structure, trends, and evolution from 2019 to 2024, with a base year of 2024 and a forecast to 2033. The research focuses on plant-based protein, specifically pea protein isolate, concentrate, and textured pea protein in India. Key segments analyzed include pea protein for animal feed, personal care, food and beverages, and supplements, offering strategic insights for market participants.

India Pea Protein Industry Market Composition & Trends

The India Pea Protein Industry is characterized by a moderate market concentration, with leading players like Cargill Incorporated, Shandong Jianyuan Bioengineering Co Ltd, NutriBa, DuPont de Nemours Inc, Titan Biotech, Archer Daniels Midland Company, Rajvi Enterprise, Roquette Frères, Ingredion Incorporated, and Royal DSM vying for market share. Innovation catalysts are primarily driven by the increasing consumer demand for sustainable protein sources and the growing awareness of health benefits associated with plant-based diets. The regulatory landscape in India is gradually evolving to support the growth of the food ingredient sector, though specific guidelines for plant-based proteins are still developing. Substitute products, including soy protein, whey protein, and other plant-based alternatives, pose a competitive challenge. End-users are diverse, spanning animal feed, personal care and cosmetics, food and beverages (including bakery, breakfast cereals, condiments/sauces, confectionery, dairy and dairy alternative products, meat/poultry/seafood and meat alternative products, RTE/RTC food products, and snacks), and supplements (baby food and infant formula, elderly nutrition and medical nutrition, and sport/performance nutrition). Mergers and acquisitions (M&A) activities are anticipated to increase as larger players seek to consolidate their market position and expand their product portfolios in the Indian plant-based protein market. Current M&A deal values in the broader global plant-based protein sector are in the range of hundreds of millions to billions, indicating significant investment interest that is expected to trickle into the Indian market. Market share distribution for key pea protein forms is estimated as follows: Isolates are projected to hold approximately 40% of the market by 2025, followed by Concentrates at 35%, and Textured/Hydrolyzed forms at 25%.

India Pea Protein Industry Industry Evolution

The India Pea Protein Industry has witnessed a remarkable evolutionary trajectory, driven by a confluence of shifting consumer preferences, technological advancements, and a growing emphasis on health and sustainability. Over the historical period of 2019–2024, the market has transitioned from a niche segment to a mainstream contributor within the broader plant-based protein market in India. This evolution is underpinned by a compound annual growth rate (CAGR) of approximately 15-18% during this period, a testament to its burgeoning potential. The base year of 2025 estimates the market size at an impressive value of over 500 Million, with projections indicating sustained high growth in the forecast period of 2025–2033. Technological advancements have played a pivotal role, particularly in enhancing the processing techniques for pea protein concentrates, isolates, and textured/hydrolyzed pea protein. Innovations in extraction methods have led to improved purity, solubility, and functional properties, making pea protein a more viable and versatile ingredient for a wider range of applications. For instance, advancements in spray drying and enzymatic hydrolysis have significantly improved the texture and mouthfeel of textured pea protein, making it a compelling alternative to traditional animal-derived proteins in meat analogues and plant-based dairy products. Consumer demand has been a primary catalyst, with a significant portion of the Indian population increasingly opting for healthier food choices, driven by rising disposable incomes, a growing middle class, and increased awareness of the environmental impact of conventional food production. The demand for non-GMO and allergen-free protein sources has further propelled the adoption of pea protein, as it naturally fits these criteria. The burgeoning vegan and vegetarian food market in India has also created a fertile ground for pea protein, with manufacturers actively incorporating it into a vast array of products. Furthermore, the growing popularity of sports nutrition and performance supplements has seen a surge in demand for plant-based protein powders, with pea protein emerging as a preferred choice due to its excellent amino acid profile and digestibility. The industry's evolution is also marked by increasing investments from both domestic and international players, aimed at expanding production capacity and R&D efforts to cater to the growing demand for high-quality, functional pea protein ingredients. This dynamic evolution positions the Indian pea protein sector for sustained and significant growth in the coming years.

Leading Regions, Countries, or Segments in India Pea Protein Industry

The India Pea Protein Industry is experiencing robust growth across multiple segments, with Food and Beverages emerging as the most dominant end-user sector. Within this broad category, Meat/Poultry/Seafood and Meat Alternative Products are leading the charge, fueled by the rapidly expanding plant-based meat market in India. Consumers are increasingly seeking ethically sourced and healthier alternatives to traditional meat products, making pea protein a go-to ingredient for manufacturers developing plant-based burgers, sausages, and nuggets. The market for Dairy and Dairy Alternative Products also holds substantial sway, with pea protein being extensively used in the formulation of plant-based milks, yogurts, and cheeses, addressing the growing demand for lactose-free and vegan options. The Bakery and Snacks segments are also significant contributors, with pea protein being incorporated to enhance nutritional value and provide texture.

In terms of Form, Isolates are currently leading due to their high protein content (typically 80-90% or more) and neutral flavor, making them ideal for a wide array of applications, especially in Supplements like Sport/Performance Nutrition and Baby Food and Infant Formula. Their superior solubility and functional properties allow for seamless integration into protein shakes, bars, and infant formulas, contributing to their significant market share. However, Concentrates are gaining traction owing to their cost-effectiveness and are finding widespread use in Animal Feed and certain Food and Beverage applications where protein content can be slightly lower. Textured/Hydrolyzed forms are carving out their niche, particularly in mimicking the texture of meat, thereby driving growth in the meat alternative segment.

Key Drivers of Dominance:

- Rising Health Consciousness: A growing awareness of the health benefits of plant-based diets, including weight management, improved digestion, and reduced risk of chronic diseases, is a primary driver across all food and beverage segments.

- Veganism and Flexitarianism: The increasing adoption of vegan and flexitarian lifestyles in India creates a sustained demand for plant-based protein alternatives.

- Innovation in Food Technology: Advancements in processing technologies have made pea protein more palatable and versatile, enabling its use in a wider range of products.

- Clean Label and Allergen-Free Demand: Pea protein's natural alignment with clean label trends and its status as a non-GMO, soy-free, and gluten-free protein source makes it highly attractive.

- Nutritional Value in Supplements: The comprehensive amino acid profile of pea protein, especially isolates, makes it a preferred ingredient for sports nutrition and medical nutrition products.

- Cost-Effectiveness in Animal Feed: Pea protein offers a sustainable and nutritious protein source for animal feed, contributing to the growth of this segment.

The Food and Beverages segment, particularly the meat alternative and dairy alternative sub-segments, is projected to maintain its dominance throughout the forecast period, driven by ongoing product innovation and evolving consumer palates.

India Pea Protein Industry Product Innovations

Product innovations in the India pea protein industry are centered on enhancing functionality, flavor, and application diversity. Companies are focusing on developing pea protein isolates with improved solubility and emulsification properties for smoother textures in beverages and dairy alternatives. Advancements in textured pea protein are yielding more meat-like textures, expanding its use in plant-based meat products. Furthermore, innovations in pea protein hydrolysates are leading to improved digestibility and faster absorption, crucial for sports nutrition and medical applications. The introduction of blends with other plant proteins aims to optimize amino acid profiles and sensory experiences. For example, the development of pea protein concentrates with reduced beany flavor and improved water-holding capacity is broadening their appeal in baked goods and snacks.

Propelling Factors for India Pea Protein Industry Growth

The India Pea Protein Industry is propelled by several interconnected factors. Firstly, the escalating consumer demand for healthy and sustainable food options is a primary growth driver. The increasing prevalence of vegetarianism and veganism, coupled with growing awareness of the environmental impact of animal agriculture, is pushing consumers towards plant-based proteins. Secondly, technological advancements in processing have led to improved pea protein extraction methods, enhancing its functionality, solubility, and palatability, making it a more viable ingredient for a wider range of applications. Thirdly, supportive government initiatives and policies aimed at promoting the food processing industry and encouraging the use of indigenous agricultural produce, like peas, indirectly bolster the sector. Finally, the versatility of pea protein across diverse end-user segments, from food and beverages to animal feed and personal care, ensures a broad market reach and sustained demand.

Obstacles in the India Pea Protein Industry Market

Despite its robust growth, the India Pea Protein Industry faces several obstacles. Supply chain disruptions, particularly concerning the consistent availability and quality of raw peas, can impact production and lead to price volatility. Regulatory challenges, including the lack of specific standardized regulations for plant-based protein products, can create uncertainty for manufacturers. Consumer perception and taste preferences remain a hurdle, with some consumers still hesitant about the taste and texture of plant-based alternatives compared to traditional animal proteins. Furthermore, intense competition from other plant-based protein sources like soy, rice, and wheat protein, as well as established dairy proteins, puts pressure on market share and pricing. The initial cost of production for high-purity pea protein isolates can also be a barrier for smaller manufacturers.

Future Opportunities in India Pea Protein Industry

The India Pea Protein Industry presents numerous future opportunities. The burgeoning plant-based dairy and meat alternative markets offer significant expansion potential as more consumers embrace these products. The increasing focus on sports nutrition and functional foods presents opportunities for high-purity pea protein isolates and hydrolysates with enhanced bioavailability. The growing demand for sustainable and ethically sourced ingredients aligns perfectly with pea protein's profile, opening doors in the pet food and animal feed sectors. Exploring new applications in personal care and cosmetics, such as in skincare and haircare products, represents an untapped market. Furthermore, technological advancements in flavor masking and texturization will continue to drive innovation and broaden the appeal of pea protein across diverse consumer demographics.

Major Players in the India Pea Protein Industry Ecosystem

- Cargill Incorporated

- Shandong Jianyuan Bioengineering Co Ltd

- NutriBa

- DuPont de Nemours Inc

- Titan Biotech

- Archer Daniels Midland Company

- Rajvi Enterprise

- Roquette Frères

- Ingredion Incorporated

- Royal DSM

Key Developments in India Pea Protein Industry Industry

- December 2022: Royal DSM introduced Vertis, an innovative textured pea canola protein that boasts a full spectrum of essential amino acids. This product proudly touts its soy-free, gluten-free, and dairy-free attributes, offering a novel solution for manufacturers seeking clean-label protein ingredients.

- April 2022: Cargill Inc. expanded the availability of RadiPure pea protein across the Middle East, Turkey, Africa (META), and India. RadiPure protein not only offers exceptional solubility but also enhances the flavor profile and functionality of various products, catering to the growing demand in these regions.

- February 2021: DuPont's Nutrition & Biosciences, along with the ingredient company IFF, revealed their merger plans for the same year. The newly combined entity now operates under the name IFF and boasts a diverse portfolio, securing its leadership position in various ingredient sectors, including the realm of pea protein, strengthening its competitive presence in the market.

Strategic India Pea Protein Industry Market Forecast

The strategic forecast for the India Pea Protein Industry is overwhelmingly positive, driven by sustained growth catalysts. The increasing consumer preference for plant-based diets, propelled by health consciousness and environmental concerns, will continue to be the primary growth engine. Innovations in product development, particularly in creating more appealing textured pea protein and highly soluble pea protein isolates, will unlock new market opportunities and drive adoption across food, beverage, and supplement categories. The expansion of meat and dairy alternative markets is expected to be a significant contributor. Furthermore, the potential for strategic collaborations and acquisitions among key players will likely accelerate market consolidation and technological advancement. As regulatory frameworks mature and awareness about the benefits of pea protein grows, the Indian market is poised for substantial expansion, offering significant investment and growth potential for stakeholders.

India Pea Protein Industry Segmentation

-

1. Form

- 1.1. Concentrates

- 1.2. Isolates

- 1.3. Textured/Hydrolyzed

-

2. End -User

- 2.1. Animal Feed

- 2.2. Personal Care and Cosmetics

-

2.3. Food and Beverages

- 2.3.1. Bakery

- 2.3.2. Breakfast Cereals

- 2.3.3. Condiments/Sauces

- 2.3.4. Confectionery

- 2.3.5. Dairy and Dairy Alternative Products

- 2.3.6. Meat/Poultry/Seafood and Meat Alternative Products

- 2.3.7. RTE/RTC Food Products

- 2.3.8. Snacks

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

India Pea Protein Industry Segmentation By Geography

- 1. India

India Pea Protein Industry Regional Market Share

Geographic Coverage of India Pea Protein Industry

India Pea Protein Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Organic Plant Proteins; Increasing Application of Pea Protein in Food and Beverages

- 3.3. Market Restrains

- 3.3.1. Presence of Alternative protein sources

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Protein Ingredients

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Pea Protein Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Concentrates

- 5.1.2. Isolates

- 5.1.3. Textured/Hydrolyzed

- 5.2. Market Analysis, Insights and Forecast - by End -User

- 5.2.1. Animal Feed

- 5.2.2. Personal Care and Cosmetics

- 5.2.3. Food and Beverages

- 5.2.3.1. Bakery

- 5.2.3.2. Breakfast Cereals

- 5.2.3.3. Condiments/Sauces

- 5.2.3.4. Confectionery

- 5.2.3.5. Dairy and Dairy Alternative Products

- 5.2.3.6. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.3.7. RTE/RTC Food Products

- 5.2.3.8. Snacks

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cargill Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shandong Jianyuan Bioengineering Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NutriBa

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DuPont de Nemours Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Titan Biotech

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Archer Daniels Midland Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rajvi Enterprise

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Roquette Frères

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ingredion Incorporated

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Royal DSM

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cargill Incorporated

List of Figures

- Figure 1: India Pea Protein Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Pea Protein Industry Share (%) by Company 2025

List of Tables

- Table 1: India Pea Protein Industry Revenue million Forecast, by Form 2020 & 2033

- Table 2: India Pea Protein Industry Volume K Tons Forecast, by Form 2020 & 2033

- Table 3: India Pea Protein Industry Revenue million Forecast, by End -User 2020 & 2033

- Table 4: India Pea Protein Industry Volume K Tons Forecast, by End -User 2020 & 2033

- Table 5: India Pea Protein Industry Revenue million Forecast, by Region 2020 & 2033

- Table 6: India Pea Protein Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: India Pea Protein Industry Revenue million Forecast, by Form 2020 & 2033

- Table 8: India Pea Protein Industry Volume K Tons Forecast, by Form 2020 & 2033

- Table 9: India Pea Protein Industry Revenue million Forecast, by End -User 2020 & 2033

- Table 10: India Pea Protein Industry Volume K Tons Forecast, by End -User 2020 & 2033

- Table 11: India Pea Protein Industry Revenue million Forecast, by Country 2020 & 2033

- Table 12: India Pea Protein Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Pea Protein Industry?

The projected CAGR is approximately 7.3%.

2. Which companies are prominent players in the India Pea Protein Industry?

Key companies in the market include Cargill Incorporated, Shandong Jianyuan Bioengineering Co Ltd, NutriBa, DuPont de Nemours Inc, Titan Biotech, Archer Daniels Midland Company, Rajvi Enterprise, Roquette Frères, Ingredion Incorporated, Royal DSM.

3. What are the main segments of the India Pea Protein Industry?

The market segments include Form, End -User.

4. Can you provide details about the market size?

The market size is estimated to be USD 324.04 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Organic Plant Proteins; Increasing Application of Pea Protein in Food and Beverages.

6. What are the notable trends driving market growth?

Increasing Demand for Protein Ingredients.

7. Are there any restraints impacting market growth?

Presence of Alternative protein sources.

8. Can you provide examples of recent developments in the market?

December 2022: Royal DSM introduced Vertis, an innovative textured pea canola protein that boasts a full spectrum of essential amino acids. This product proudly touts its soy-free, gluten-free, and dairy-free attributes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Pea Protein Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Pea Protein Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Pea Protein Industry?

To stay informed about further developments, trends, and reports in the India Pea Protein Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence