Key Insights

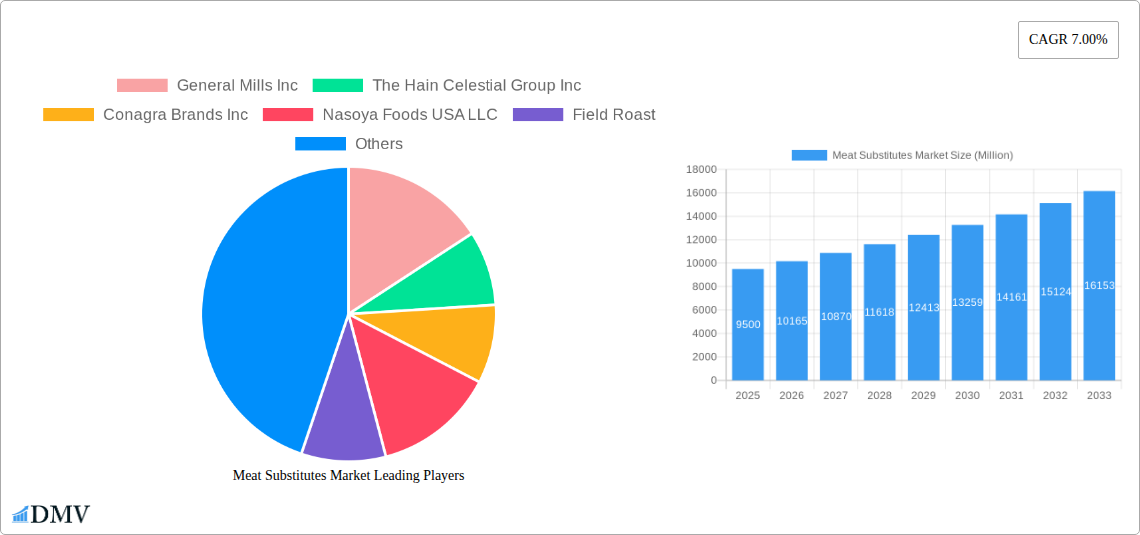

The global Meat Substitutes Market is projected for significant expansion, estimated at $9.5 billion in 2025, with a Compound Annual Growth Rate (CAGR) of 7.0% from 2025 to 2033. This growth is propelled by increasing consumer awareness of health and environmental impacts of conventional meat, and a rising demand for plant-based proteins. Health-conscious consumers are seeking meat substitutes for lower fat, cholesterol-free, and disease-mitigating properties. Environmental concerns, including the carbon footprint of livestock farming, are driving a shift towards sustainable diets, positioning meat substitutes as a key solution.

Meat Substitutes Market Market Size (In Billion)

Market dynamism is further shaped by innovation in product development and diverse offerings. Soy and mycoprotein dominate, serving as versatile bases. Convenience is a major driver, with frozen and refrigerated options catering to busy lifestyles, while unfrozen alternatives offer culinary flexibility. Key players like General Mills, Hain Celestial, and Conagra Brands are investing in R&D, expanding portfolios, and strengthening distribution. Emerging trends include "clean label" products with fewer artificial ingredients and enhanced nutrition, alongside gourmet, chef-inspired options mimicking meat's taste and texture. Potential restraints include price parity with conventional meat, consumer perception of taste and texture, and the need for product standardization.

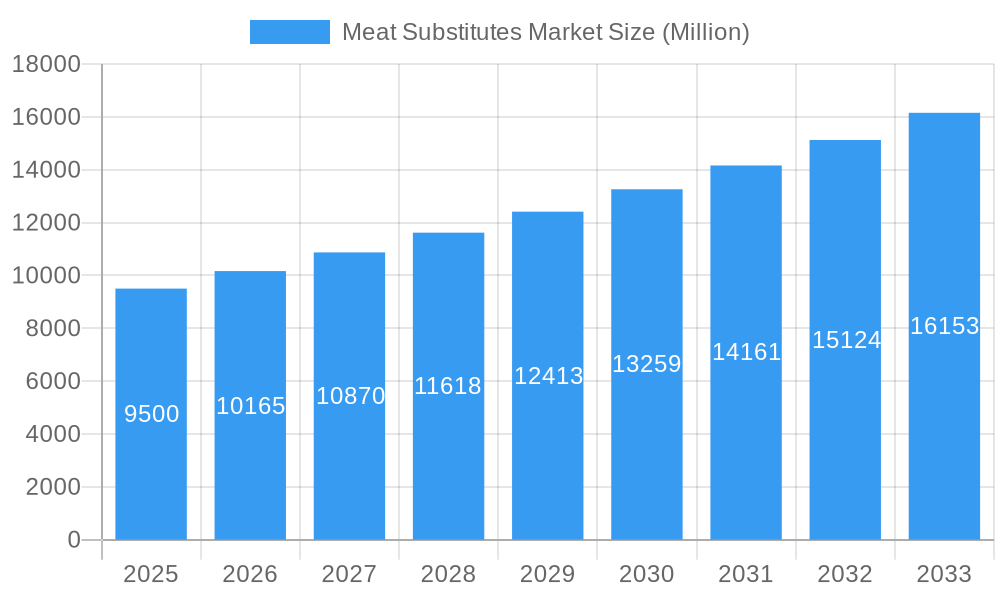

Meat Substitutes Market Company Market Share

This in-depth report analyzes the global meat substitutes market, a rapidly expanding sector driven by evolving consumer preferences for sustainable, healthy, and ethical food choices. With a detailed focus on the base year 2025 and an extensive forecast period, this report provides actionable insights into market dynamics, growth catalysts, and future trajectories. Delve into plant-based proteins, mycoprotein, and innovative meat alternatives. This research is crucial for food manufacturers, ingredient suppliers, investors, retailers, and policymakers seeking to capitalize on the burgeoning demand for protein alternatives and navigate the competitive vegan meat market, plant-based food industry, and alternative protein market.

Meat Substitutes Market Market Composition & Trends

The meat substitutes market exhibits a moderate to high degree of market concentration, with key players like General Mills Inc., The Hain Celestial Group Inc., Conagra Brands Inc., and Kellogg Company dominating significant portions of the market share. Innovation remains a primary catalyst, fueled by advancements in plant-based protein technology, product development for improved taste and texture, and the increasing availability of diverse meat alternative ingredients such as soy and mycoprotein. Regulatory landscapes are becoming more defined, influencing labeling standards and product certifications for vegan products and vegetarian foods. The competitive environment is characterized by a continuous stream of new product launches and strategic collaborations aimed at expanding consumer reach. Mergers and acquisitions are also prevalent, with substantial M&A deal values reported as companies seek to consolidate their positions and acquire innovative startups. The market's growth is intrinsically linked to evolving end-user profiles, encompassing health-conscious consumers, environmentally aware individuals, and those with dietary restrictions. The market share distribution indicates a strong presence of established food giants alongside agile specialty manufacturers, each contributing to the dynamic growth of the alternative protein market. The market size is projected to reach $XX Million by 2025, with a compound annual growth rate (CAGR) of XX% during the forecast period.

Meat Substitutes Market Industry Evolution

The meat substitutes market has undergone a dramatic evolution, transforming from a niche segment to a mainstream food category. The historical period (2019-2024) witnessed the foundational growth, marked by increasing consumer awareness and the initial diversification of product offerings beyond traditional tofu and tempeh. Technological advancements have been pivotal, with breakthroughs in extrusion, fermentation, and flavor encapsulation leading to the development of meat alternatives that closely mimic the taste, texture, and cooking experience of conventional meat. Shifting consumer demands are the primary engine of this evolution. Growing concerns over health, including reduced consumption of red meat and processed foods, coupled with a desire for lower cholesterol and saturated fat intake, are driving significant adoption of plant-based diets and flexitarian eating patterns. Environmental sustainability has emerged as a major influencer, with consumers increasingly associating plant-based foods with a lower carbon footprint and reduced land and water usage compared to animal agriculture. The market growth trajectory is steep, with projected market sizes indicating a substantial expansion. For instance, the adoption rate of soy-based meat substitutes has seen consistent year-over-year growth of XX%, while the emerging mycoprotein market is experiencing an even more accelerated adoption rate of XX%. The increasing availability of frozen meat substitutes and refrigerated meat alternatives in mainstream retail channels further democratizes access and fuels consistent demand. This evolutionary path underscores the resilience and adaptability of the meat substitutes industry in response to socio-economic and environmental pressures.

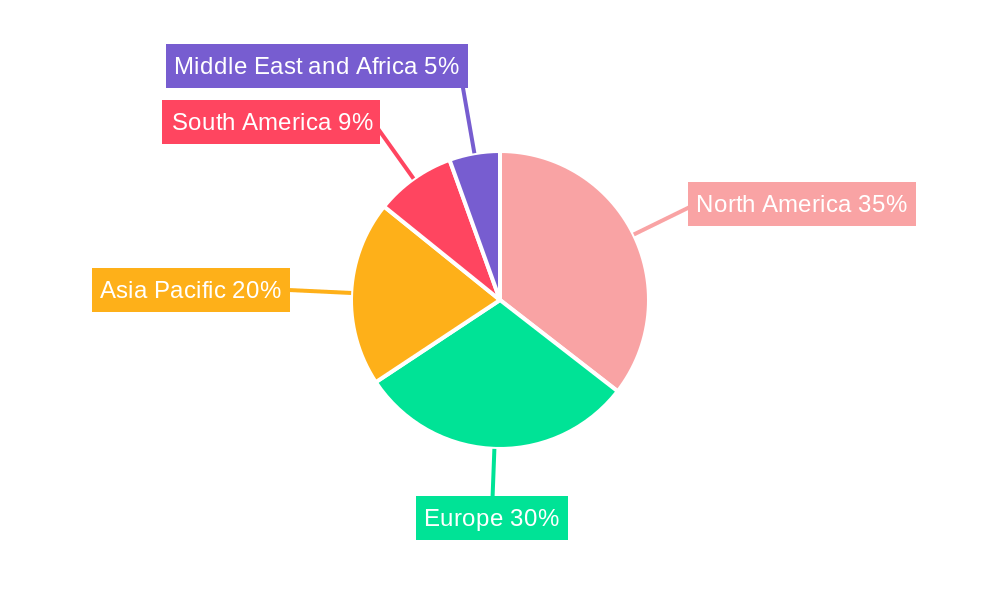

Leading Regions, Countries, or Segments in Meat Substitutes Market

North America currently leads the meat substitutes market, driven by a confluence of robust consumer acceptance, strong retail penetration, and significant investment in research and development. The United States, in particular, stands out as a dominant country, fueled by the widespread availability of plant-based meat products in supermarkets and foodservice establishments, and a growing number of health-conscious consumers actively seeking meat alternatives. Key drivers for this dominance include:

- Investment Trends: Substantial venture capital funding and investments from major food corporations are pouring into plant-based protein startups and established players, fostering innovation and market expansion.

- Regulatory Support: While still evolving, a generally supportive environment for food innovation and clear labeling for vegan and vegetarian products facilitates market growth.

Within the segments, the Frozen/Refrigerated category is currently the most dominant due to its convenience and longer shelf life, catering to busy lifestyles and widespread grocery shopping habits. Products like plant-based burgers, sausages, and nuggets are consistently popular within this segment. The Source: Soy segment remains a foundational pillar, benefiting from its long history of use and established infrastructure. However, the Source: Mycoprotein segment is exhibiting remarkable growth, propelled by its unique texture, nutritional profile, and perceived health benefits, positioning it as a significant future contender. The Unfrozen segment, encompassing ready-to-eat meals and deli slices, is also witnessing steady growth as convenience remains a key consumer priority. The market size for the North American meat substitutes market is estimated at $XX Million in 2025, with a projected CAGR of XX% through 2033. The dominance of this region is further amplified by extensive marketing campaigns and public awareness initiatives promoting the benefits of plant-based eating.

Meat Substitutes Market Product Innovations

Product innovation in the meat substitutes market is a continuous and critical element for capturing consumer interest. Companies are actively developing plant-based meats that closely replicate the sensory experience of animal protein, focusing on juiciness, mouthfeel, and umami flavors. Recent advancements include the utilization of novel ingredients and advanced processing techniques to create vegan chicken, plant-based beef, and fish alternatives with improved nutritional profiles, such as higher protein content and reduced sodium. Applications are expanding beyond traditional burgers and sausages to include plant-based deli meats, seafood alternatives, and ingredient solutions for the foodservice industry, showcasing the versatility and adaptability of these meat alternatives. Performance metrics are increasingly being benchmarked against conventional meat, with a focus on cooking performance, digestibility, and allergenicity.

Propelling Factors for Meat Substitutes Market Growth

The meat substitutes market is propelled by a confluence of powerful factors. Technological advancements in ingredient sourcing, processing, and flavor development are creating plant-based alternatives that are increasingly indistinguishable from traditional meat in terms of taste and texture. Economic influences, including the fluctuating costs of animal protein and the growing affordability of plant-based ingredients, are making meat alternatives a more economically viable choice for a wider consumer base. Regulatory influences that promote sustainable food systems and encourage plant-based diets, alongside clear labeling standards for vegan and vegetarian products, are further bolstering market expansion. Growing consumer demand for healthy eating options, driven by concerns about chronic diseases and the desire for nutrient-rich foods, is a significant driver. Furthermore, the rising global population and the need for sustainable food production to ensure food security are positioning alternative proteins as a crucial solution.

Obstacles in the Meat Substitutes Market Market

Despite its robust growth, the meat substitutes market faces several obstacles. Regulatory challenges can arise from differing labeling requirements and perceptions of processed foods, potentially creating confusion for consumers and barriers to market entry. Supply chain disruptions, particularly concerning the consistent availability and scalability of key plant-based ingredients and the ethical sourcing of raw materials, can impact production efficiency and cost. Competitive pressures from both established meat producers and a growing number of plant-based food companies intensify pricing dynamics and necessitate continuous innovation to maintain market share. Consumer perception and taste preferences remain a hurdle, with some consumers still hesitant to adopt meat alternatives due to ingrained habits and a perceived lack of authenticity. Furthermore, the cost of some premium meat substitutes can still be higher than conventional meat, impacting affordability for price-sensitive consumers.

Future Opportunities in Meat Substitutes Market

The meat substitutes market is ripe with future opportunities. The expansion into emerging markets, particularly in Asia and Latin America where traditional meat consumption is high but growing interest in health and sustainability exists, presents a significant growth avenue. Technological advancements in areas like precision fermentation and cellular agriculture promise to deliver even more sophisticated and customizable protein alternatives. The increasing demand for allergen-free and functional plant-based foods opens doors for specialized product development. Furthermore, deeper integration into the foodservice industry, including fast-casual restaurants and institutional catering, will drive widespread adoption. The development of cost-effective and scalable production methods for plant-based ingredients will also be a key opportunity for market penetration.

Major Players in the Meat Substitutes Market Ecosystem

- General Mills Inc.

- The Hain Celestial Group Inc.

- Conagra Brands Inc.

- Nasoya Foods USA LLC

- Field Roast

- Superior Natural

- The Tofurky Company Inc.

- Kellogg Company

Key Developments in Meat Substitutes Market Industry

- 2024 (Q1): Launch of new plant-based chicken tenders with improved texture and flavor profiles.

- 2023 (Q4): Significant investment in mycoprotein research by a leading ingredient supplier to scale production.

- 2023 (Q3): Major food retailer expands its private-label vegan range, including plant-based deli slices and sausages.

- 2023 (Q2): Acquisition of a plant-based seafood startup by a multinational food corporation, signaling strategic expansion into this niche.

- 2022 (Q4): Introduction of innovative plant-based burger patties using a novel blend of pea and fava bean protein.

Strategic Meat Substitutes Market Market Forecast

The strategic forecast for the meat substitutes market is exceptionally strong, driven by persistent consumer trends towards health, sustainability, and ethical eating. Anticipated growth catalysts include ongoing innovation in product formulation to enhance sensory attributes and nutritional value, coupled with increasing R&D investment in alternative protein technologies. The expanding global reach of plant-based foods, supported by evolving regulatory frameworks and growing consumer education, will further accelerate adoption. As the cost-effectiveness of plant-based ingredients improves and economies of scale are realized, meat substitutes are poised to capture an even larger share of the global protein market, presenting a compelling long-term investment opportunity.

Meat Substitutes Market Segmentation

-

1. Source

- 1.1. Soy

- 1.2. Mycoprotein

-

2. Category

- 2.1. Frozen/Refrigerated

- 2.2. Unfrozen

Meat Substitutes Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Meat Substitutes Market Regional Market Share

Geographic Coverage of Meat Substitutes Market

Meat Substitutes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Towards Reduced Sugar and Healthier Snacking Options; Surge in Demand for Organic Food Products

- 3.3. Market Restrains

- 3.3.1. Availability of Cheaper Snacking Options

- 3.4. Market Trends

- 3.4.1. Increased demand for soyfoods & beverage

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Meat Substitutes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Soy

- 5.1.2. Mycoprotein

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Frozen/Refrigerated

- 5.2.2. Unfrozen

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. North America Meat Substitutes Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Soy

- 6.1.2. Mycoprotein

- 6.2. Market Analysis, Insights and Forecast - by Category

- 6.2.1. Frozen/Refrigerated

- 6.2.2. Unfrozen

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. Europe Meat Substitutes Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Soy

- 7.1.2. Mycoprotein

- 7.2. Market Analysis, Insights and Forecast - by Category

- 7.2.1. Frozen/Refrigerated

- 7.2.2. Unfrozen

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Asia Pacific Meat Substitutes Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Soy

- 8.1.2. Mycoprotein

- 8.2. Market Analysis, Insights and Forecast - by Category

- 8.2.1. Frozen/Refrigerated

- 8.2.2. Unfrozen

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. South America Meat Substitutes Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source

- 9.1.1. Soy

- 9.1.2. Mycoprotein

- 9.2. Market Analysis, Insights and Forecast - by Category

- 9.2.1. Frozen/Refrigerated

- 9.2.2. Unfrozen

- 9.1. Market Analysis, Insights and Forecast - by Source

- 10. Middle East and Africa Meat Substitutes Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Source

- 10.1.1. Soy

- 10.1.2. Mycoprotein

- 10.2. Market Analysis, Insights and Forecast - by Category

- 10.2.1. Frozen/Refrigerated

- 10.2.2. Unfrozen

- 10.1. Market Analysis, Insights and Forecast - by Source

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 General Mills Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Hain Celestial Group Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Conagra Brands Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nasoya Foods USA LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Field Roast

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Superior Natural*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 The Tofurky Company Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kellogg Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 General Mills Inc

List of Figures

- Figure 1: Global Meat Substitutes Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Meat Substitutes Market Revenue (billion), by Source 2025 & 2033

- Figure 3: North America Meat Substitutes Market Revenue Share (%), by Source 2025 & 2033

- Figure 4: North America Meat Substitutes Market Revenue (billion), by Category 2025 & 2033

- Figure 5: North America Meat Substitutes Market Revenue Share (%), by Category 2025 & 2033

- Figure 6: North America Meat Substitutes Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Meat Substitutes Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Meat Substitutes Market Revenue (billion), by Source 2025 & 2033

- Figure 9: Europe Meat Substitutes Market Revenue Share (%), by Source 2025 & 2033

- Figure 10: Europe Meat Substitutes Market Revenue (billion), by Category 2025 & 2033

- Figure 11: Europe Meat Substitutes Market Revenue Share (%), by Category 2025 & 2033

- Figure 12: Europe Meat Substitutes Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Meat Substitutes Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Meat Substitutes Market Revenue (billion), by Source 2025 & 2033

- Figure 15: Asia Pacific Meat Substitutes Market Revenue Share (%), by Source 2025 & 2033

- Figure 16: Asia Pacific Meat Substitutes Market Revenue (billion), by Category 2025 & 2033

- Figure 17: Asia Pacific Meat Substitutes Market Revenue Share (%), by Category 2025 & 2033

- Figure 18: Asia Pacific Meat Substitutes Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Meat Substitutes Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Meat Substitutes Market Revenue (billion), by Source 2025 & 2033

- Figure 21: South America Meat Substitutes Market Revenue Share (%), by Source 2025 & 2033

- Figure 22: South America Meat Substitutes Market Revenue (billion), by Category 2025 & 2033

- Figure 23: South America Meat Substitutes Market Revenue Share (%), by Category 2025 & 2033

- Figure 24: South America Meat Substitutes Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Meat Substitutes Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Meat Substitutes Market Revenue (billion), by Source 2025 & 2033

- Figure 27: Middle East and Africa Meat Substitutes Market Revenue Share (%), by Source 2025 & 2033

- Figure 28: Middle East and Africa Meat Substitutes Market Revenue (billion), by Category 2025 & 2033

- Figure 29: Middle East and Africa Meat Substitutes Market Revenue Share (%), by Category 2025 & 2033

- Figure 30: Middle East and Africa Meat Substitutes Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Meat Substitutes Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Meat Substitutes Market Revenue billion Forecast, by Source 2020 & 2033

- Table 2: Global Meat Substitutes Market Revenue billion Forecast, by Category 2020 & 2033

- Table 3: Global Meat Substitutes Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Meat Substitutes Market Revenue billion Forecast, by Source 2020 & 2033

- Table 5: Global Meat Substitutes Market Revenue billion Forecast, by Category 2020 & 2033

- Table 6: Global Meat Substitutes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Meat Substitutes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Meat Substitutes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Meat Substitutes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Meat Substitutes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Meat Substitutes Market Revenue billion Forecast, by Source 2020 & 2033

- Table 12: Global Meat Substitutes Market Revenue billion Forecast, by Category 2020 & 2033

- Table 13: Global Meat Substitutes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 14: Spain Meat Substitutes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Meat Substitutes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Meat Substitutes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Meat Substitutes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Meat Substitutes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Russia Meat Substitutes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Meat Substitutes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Meat Substitutes Market Revenue billion Forecast, by Source 2020 & 2033

- Table 22: Global Meat Substitutes Market Revenue billion Forecast, by Category 2020 & 2033

- Table 23: Global Meat Substitutes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: China Meat Substitutes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Meat Substitutes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: India Meat Substitutes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Meat Substitutes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Meat Substitutes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Meat Substitutes Market Revenue billion Forecast, by Source 2020 & 2033

- Table 30: Global Meat Substitutes Market Revenue billion Forecast, by Category 2020 & 2033

- Table 31: Global Meat Substitutes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Meat Substitutes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Meat Substitutes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Meat Substitutes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Meat Substitutes Market Revenue billion Forecast, by Source 2020 & 2033

- Table 36: Global Meat Substitutes Market Revenue billion Forecast, by Category 2020 & 2033

- Table 37: Global Meat Substitutes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 38: South Africa Meat Substitutes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: United Arab Emirates Meat Substitutes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Meat Substitutes Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Meat Substitutes Market?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the Meat Substitutes Market?

Key companies in the market include General Mills Inc, The Hain Celestial Group Inc, Conagra Brands Inc, Nasoya Foods USA LLC, Field Roast, Superior Natural*List Not Exhaustive, The Tofurky Company Inc, Kellogg Company.

3. What are the main segments of the Meat Substitutes Market?

The market segments include Source, Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Inclination Towards Reduced Sugar and Healthier Snacking Options; Surge in Demand for Organic Food Products.

6. What are the notable trends driving market growth?

Increased demand for soyfoods & beverage.

7. Are there any restraints impacting market growth?

Availability of Cheaper Snacking Options.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Meat Substitutes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Meat Substitutes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Meat Substitutes Market?

To stay informed about further developments, trends, and reports in the Meat Substitutes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence