Key Insights

The Canadian dairy market is projected for robust growth, with an estimated market size of $15.4 billion in 2024, and a Compound Annual Growth Rate (CAGR) of 4.7% through 2033. This expansion is fueled by shifting consumer preferences towards premium and artisanal dairy, increasing demand for yogurt and sour milk drinks due to their health benefits and convenience, and a growing market for reduced-fat and lactose-free milk options. Innovations in product formulation and packaging further enhance market appeal.

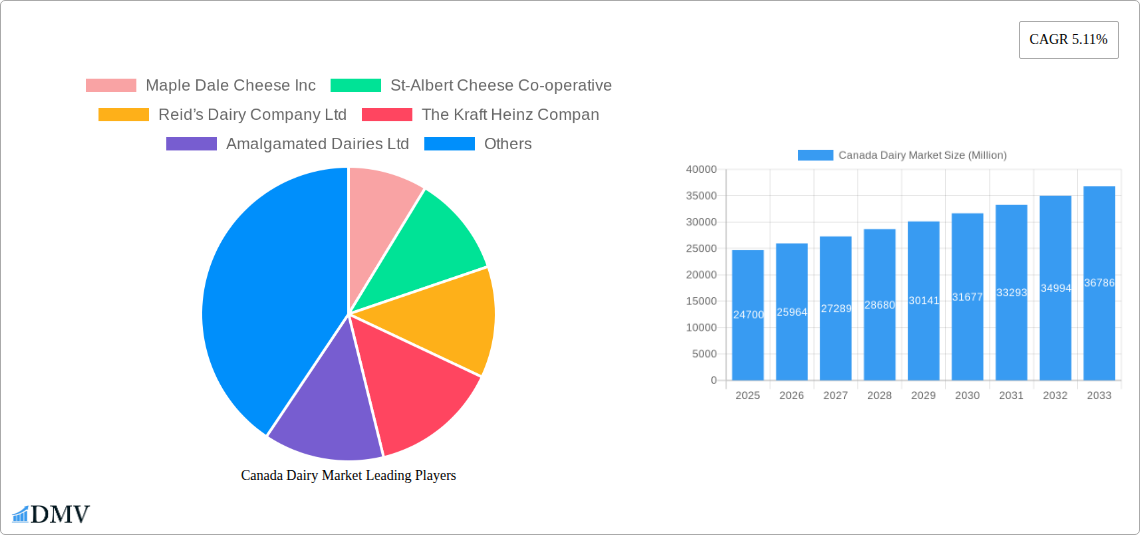

Canada Dairy Market Market Size (In Billion)

Distribution channels are evolving, with the off-trade segment (supermarkets, hypermarkets, online retail) expected to lead sales. The on-trade segment offers opportunities for premium products. Key growth drivers include strong domestic demand and a well-established industry. However, market participants must navigate challenges such as fluctuating raw milk prices, competition from alternative beverages, and regulatory changes. Major players like Saputo Inc., Agropur Dairy Cooperative, and The Kraft Heinz Company are instrumental in shaping market trends through innovation and strategic expansion.

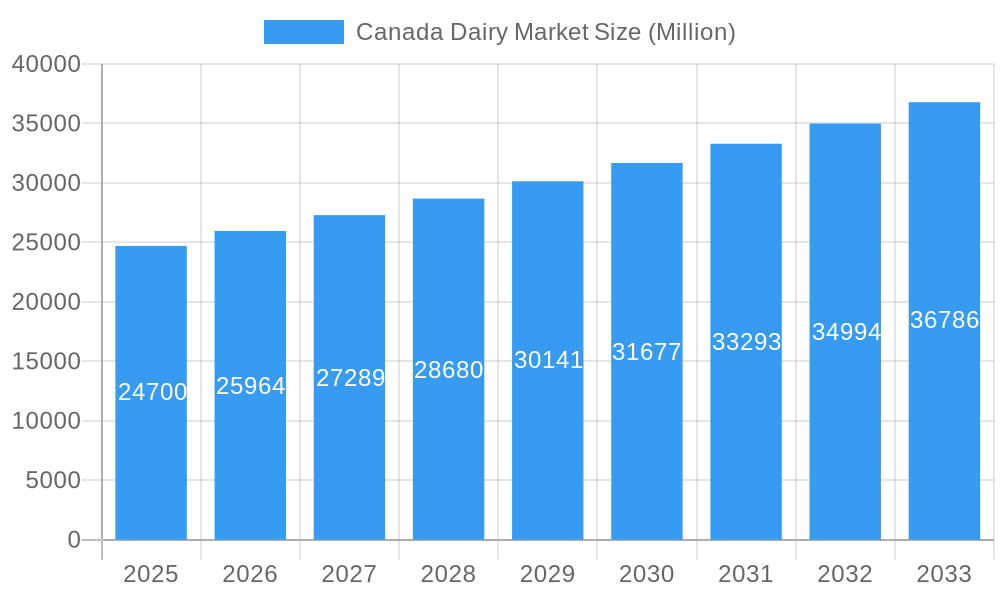

Canada Dairy Market Company Market Share

This comprehensive report analyzes the Canadian dairy market's historical trends, current dynamics, and future projections. It covers market segmentation, key developments, competitive landscapes, and emerging opportunities, providing critical insights for strategic decision-making within the 2019-2033 study period, with detailed analysis for the base year 2024 and the forecast period 2024–2033.

Canada Dairy Market Market Composition & Trends

The Canadian dairy market is characterized by a moderate concentration of key players, with a notable presence of both multinational corporations and strong domestic cooperatives. Innovation remains a significant catalyst for growth, driven by increasing consumer demand for healthier, convenient, and sustainably produced dairy products. The regulatory landscape, managed by bodies like the Canadian Dairy Commission (CDC), plays a pivotal role in shaping market dynamics, particularly concerning supply management and pricing. Substitute products, such as plant-based alternatives, are increasingly gaining traction, posing a competitive challenge that dairy producers are actively addressing through product diversification and marketing. End-user profiles are diverse, ranging from households and food service providers to industrial manufacturers. Mergers and acquisitions (M&A) activity is a consistent feature, reflecting consolidation strategies and expansion efforts. For instance, the M&A deal value in the Canadian dairy sector for the historical period (2019-2024) is estimated at over $500 Million. Market share distribution shows a dynamic interplay between established brands and niche players.

- Market Concentration: Dominated by a few major players, but with room for specialized and regional brands.

- Innovation Catalysts: Health and wellness trends, demand for convenience, and sustainability concerns.

- Regulatory Landscape: Canadian Dairy Commission (CDC) influences supply, pricing, and trade policies.

- Substitute Products: Growing competition from plant-based milk and dairy alternatives.

- End-User Profiles: Diverse consumer base, food service industry, and food manufacturers.

- M&A Activities: Strategic acquisitions to expand product portfolios and market reach.

Canada Dairy Market Industry Evolution

The Canadian dairy industry has witnessed significant evolution throughout the historical period (2019–2024) and is poised for continued transformation during the forecast period (2025–2033). Market growth trajectories are being shaped by a confluence of factors including technological advancements in processing and packaging, and a fundamental shift in consumer preferences. Consumers are increasingly seeking dairy products that align with their health and wellness goals, leading to a surge in demand for lower-fat, lactose-free, and fortified options. The adoption of new technologies in milk production, such as precision farming and automated milking systems, is enhancing efficiency and sustainability, contributing to an estimated annual growth rate of 3.5% for the overall market during the forecast period. Furthermore, the rise of e-commerce and direct-to-consumer models has opened new distribution avenues, allowing for greater market penetration and personalized offerings. The industry's adaptability to evolving dietary trends and a commitment to product quality and safety will be crucial for sustained growth. Investments in research and development for novel dairy ingredients and functional dairy products are also on the rise, reflecting a proactive approach to meeting future consumer demands. The estimated market size for the base year 2025 is projected to reach $18 Billion.

Leading Regions, Countries, or Segments in Canada Dairy Market

The Cheese segment is a dominant force within the Canadian dairy market, driven by its versatile applications and widespread consumer appeal across natural and processed forms. Within this segment, Natural Cheese, encompassing varieties like cheddar, mozzarella, and specialty cheeses, consistently commands a significant market share, estimated to be over 60% of the total cheese market value. The Milk segment, particularly Fresh Milk, remains a foundational category, contributing substantially to overall market revenue, with an estimated market value of over $7 Billion for 2025.

- Dominant Segment: Cheese

- Natural Cheese: High demand due to artisanal production, diverse flavors, and premium positioning. Significant drivers include increasing consumer interest in cheese boards and gourmet cooking.

- Processed Cheese: Continues to hold a strong position due to convenience, affordability, and widespread use in fast food and convenience meals.

- Key Segment: Milk

- Fresh Milk: Consistent consumer staple, with ongoing innovation in lactose-free and plant-fortified options. Regulatory support for domestic production underpins its stability.

- Flavored Milk: Popular among younger demographics, driving innovation in unique flavor profiles and healthier formulations.

- Growth Segment: Yogurt

- Flavored Yogurt: Experiencing robust growth driven by on-the-go consumption trends and a wide array of appealing flavors.

- Unflavored Yogurt: Benefitting from the health and wellness trend, with increased demand for Greek yogurt and probiotic-rich options.

- Distribution Channel Dominance: Off-Trade

- Supermarkets and Hypermarkets: The primary channel, offering a wide selection and competitive pricing. Investment trends are focused on enhancing in-store experience and private label offerings.

- Online Retail: Rapidly expanding, fueled by convenience and the proliferation of online grocery platforms. Adoption metrics show a 25% year-over-year growth in online dairy sales.

- Emerging Segment: Dairy Desserts

- Ice Cream & Frozen Desserts: Continues to be a significant category, with innovation in premium flavors and healthier alternatives.

- Cheesecakes: Growing in popularity as an indulgence, with new product launches catering to convenience and specific dietary needs.

Canada Dairy Market Product Innovations

Product innovation in the Canadian dairy market is centered on enhancing nutritional profiles, improving convenience, and addressing sustainability concerns. Key innovations include the development of lactose-free milk and yogurt alternatives, catering to a growing intolerance segment. Furthermore, fortified dairy products with added vitamins and minerals are gaining traction, aligning with the consumer push for functional foods. The launch of single-serve dairy desserts and ready-to-eat cheese snacks reflects the demand for on-the-go consumption. Technological advancements are enabling the creation of plant-based dairy hybrids, blending the taste and texture of dairy with the perceived health benefits of plant-based ingredients. Performance metrics show a 15% higher sales growth for innovative products compared to traditional offerings.

Propelling Factors for Canada Dairy Market Growth

Several key factors are propelling the growth of the Canadian dairy market. Technologically, advancements in ultra-high temperature (UHT) processing are extending shelf life and improving product accessibility. Economically, a rising disposable income among Canadian households translates into increased consumer spending on premium and convenience dairy products. Regulatory support, particularly through supply management systems, ensures a stable and reliable domestic supply, underpinning market stability. The increasing consumer awareness of the nutritional benefits of dairy, including protein, calcium, and vitamin D content, is a significant driver. Furthermore, the growing popularity of natural and minimally processed dairy products is creating new market niches and opportunities for artisanal producers.

- Technological Advancements: UHT processing, improved packaging, and precision agriculture.

- Economic Factors: Rising disposable incomes and consumer spending power.

- Regulatory Support: Stable domestic supply through supply management.

- Health and Nutrition Awareness: Growing consumer understanding of dairy's health benefits.

- Demand for Natural Products: Preference for minimally processed and artisanal dairy.

Obstacles in the Canada Dairy Market Market

Despite robust growth, the Canadian dairy market faces several obstacles. Regulatory complexities and trade agreements can impact import/export dynamics and introduce competitive pressures. Supply chain disruptions, exacerbated by global events, can lead to price volatility and availability issues for key inputs. The increasing competition from plant-based alternatives presents a significant challenge, requiring dairy producers to innovate and emphasize their unique value propositions. High production costs for dairy farmers, influenced by feed, labor, and energy prices, can also strain profitability. Furthermore, shifting consumer perceptions and dietary trends, sometimes influenced by misinformation, can pose a barrier to maintaining market share for traditional dairy products. The estimated impact of substitute products on market share is a reduction of 2-3% annually.

- Regulatory and Trade Challenges: Navigating international agreements and domestic policies.

- Supply Chain Disruptions: Volatility in input costs and product availability.

- Competition from Plant-Based Alternatives: A growing market share challenge.

- High Production Costs: Impacting farmer profitability and product pricing.

- Shifting Consumer Perceptions: Addressing evolving dietary preferences and trends.

Future Opportunities in Canada Dairy Market

The Canadian dairy market is rich with future opportunities. The growing demand for specialty and artisanal cheeses presents a significant avenue for growth, catering to discerning palates. Innovation in probiotic and functional dairy products aligns with the global wellness trend, offering enhanced health benefits. The expansion of online retail channels and direct-to-consumer models opens new avenues for market penetration and customer engagement. Furthermore, the development of sustainable and ethically sourced dairy products is becoming increasingly important to environmentally conscious consumers. Opportunities also lie in exploring new value-added dairy ingredients for the food manufacturing sector and in leveraging technological advancements for further efficiency and product development.

- Niche Markets: Specialty cheeses, organic dairy, and lactose-free products.

- Functional Foods: Probiotic yogurts, fortified milk, and immune-boosting dairy.

- E-commerce Expansion: Leveraging online platforms for direct sales and wider reach.

- Sustainability Focus: Developing eco-friendly packaging and production methods.

- Value-Added Ingredients: Supplying dairy components to other food industries.

Major Players in the Canada Dairy Market Ecosystem

- Maple Dale Cheese Inc

- St-Albert Cheese Co-operative

- Reid’s Dairy Company Ltd

- The Kraft Heinz Company

- Amalgamated Dairies Ltd

- Gay Lea Foods Co-operative Limited

- Danone SA

- Organic Meadow Limited Partnership

- Agropur Dairy Cooperative

- Saputo Inc

- Groupe Lactalis

Key Developments in Canada Dairy Market Industry

- December 2022: Lactalis Canada acquired Kraft Heinz's Grated Cheese business in Canada, marking its entry into the ambient category. This strategic move is expected to bolster Lactalis's market presence and product portfolio in the Canadian cheese sector.

- November 2022: The Kraft Heinz Company launched the cheesecake kit Philly Handbag. This product innovation caters to the growing demand for convenient at-home dessert solutions and expands Kraft Heinz's offerings in the dairy-based dessert category.

- June 2022: Danone North America partnered with White Plains, Boulder, and Colo and launched Activia+ Multi-Benefit Probiotic Yogurt Drinks. This launch signifies Danone's commitment to the functional beverage market and its focus on health-oriented product development within the Canadian dairy landscape.

Strategic Canada Dairy Market Market Forecast

The strategic forecast for the Canadian dairy market highlights sustained growth driven by innovative product development and evolving consumer preferences. The increasing demand for functional dairy products, coupled with the expansion of online retail channels, will be key growth catalysts. Investments in sustainable production practices and the exploration of new dairy ingredient applications will further propel market expansion. The market is projected to see a compound annual growth rate (CAGR) of approximately 3.2% during the forecast period. Stakeholders who focus on health, convenience, and sustainability are well-positioned to capitalize on future market potential, estimated to reach over $25 Billion by 2033.

Canada Dairy Market Segmentation

-

1. Category

-

1.1. Butter

-

1.1.1. By Product Type

- 1.1.1.1. Cultured Butter

- 1.1.1.2. Uncultured Butter

-

1.1.1. By Product Type

-

1.2. Cheese

- 1.2.1. Natural Cheese

- 1.2.2. Processed Cheese

-

1.3. Cream

- 1.3.1. Double Cream

- 1.3.2. Single Cream

- 1.3.3. Whipping Cream

- 1.3.4. Others

-

1.4. Dairy Desserts

- 1.4.1. Cheesecakes

- 1.4.2. Frozen Desserts

- 1.4.3. Ice Cream

- 1.4.4. Mousses

-

1.5. Milk

- 1.5.1. Condensed milk

- 1.5.2. Flavored Milk

- 1.5.3. Fresh Milk

- 1.5.4. Powdered Milk

- 1.5.5. UHT Milk

- 1.6. Sour Milk Drinks

-

1.7. Yogurt

- 1.7.1. Flavored Yogurt

- 1.7.2. Unflavored Yogurt

-

1.1. Butter

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Retail

- 2.1.3. Specialist Retailers

- 2.1.4. Supermarkets and Hypermarkets

- 2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 2.2. On-Trade

-

2.1. Off-Trade

Canada Dairy Market Segmentation By Geography

- 1. Canada

Canada Dairy Market Regional Market Share

Geographic Coverage of Canada Dairy Market

Canada Dairy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumer health conciousness; Growing consumer inclination toward Vegan/Plant-Based Proteins

- 3.3. Market Restrains

- 3.3.1. Stringent government regulation of food labels/claims

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Dairy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Butter

- 5.1.1.1. By Product Type

- 5.1.1.1.1. Cultured Butter

- 5.1.1.1.2. Uncultured Butter

- 5.1.1.1. By Product Type

- 5.1.2. Cheese

- 5.1.2.1. Natural Cheese

- 5.1.2.2. Processed Cheese

- 5.1.3. Cream

- 5.1.3.1. Double Cream

- 5.1.3.2. Single Cream

- 5.1.3.3. Whipping Cream

- 5.1.3.4. Others

- 5.1.4. Dairy Desserts

- 5.1.4.1. Cheesecakes

- 5.1.4.2. Frozen Desserts

- 5.1.4.3. Ice Cream

- 5.1.4.4. Mousses

- 5.1.5. Milk

- 5.1.5.1. Condensed milk

- 5.1.5.2. Flavored Milk

- 5.1.5.3. Fresh Milk

- 5.1.5.4. Powdered Milk

- 5.1.5.5. UHT Milk

- 5.1.6. Sour Milk Drinks

- 5.1.7. Yogurt

- 5.1.7.1. Flavored Yogurt

- 5.1.7.2. Unflavored Yogurt

- 5.1.1. Butter

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Retail

- 5.2.1.3. Specialist Retailers

- 5.2.1.4. Supermarkets and Hypermarkets

- 5.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Maple Dale Cheese Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 St-Albert Cheese Co-operative

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Reid’s Dairy Company Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Kraft Heinz Compan

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amalgamated Dairies Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gay Lea Foods Co-operative Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Danone SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Organic Meadow Limited Partnership

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Agropur Dairy Cooperative

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Saputo Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Groupe Lactalis

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Maple Dale Cheese Inc

List of Figures

- Figure 1: Canada Dairy Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Dairy Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Dairy Market Revenue billion Forecast, by Category 2020 & 2033

- Table 2: Canada Dairy Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Canada Dairy Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Canada Dairy Market Revenue billion Forecast, by Category 2020 & 2033

- Table 5: Canada Dairy Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Canada Dairy Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Dairy Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Canada Dairy Market?

Key companies in the market include Maple Dale Cheese Inc, St-Albert Cheese Co-operative, Reid’s Dairy Company Ltd, The Kraft Heinz Compan, Amalgamated Dairies Ltd, Gay Lea Foods Co-operative Limited, Danone SA, Organic Meadow Limited Partnership, Agropur Dairy Cooperative, Saputo Inc, Groupe Lactalis.

3. What are the main segments of the Canada Dairy Market?

The market segments include Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumer health conciousness; Growing consumer inclination toward Vegan/Plant-Based Proteins.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Stringent government regulation of food labels/claims.

8. Can you provide examples of recent developments in the market?

December 2022: Lactalis Canada acquired Kraft Heinz's Grated Cheese business in Canada, marking its entry into the ambient category.November 2022: The Kraft Heinz Company launched the cheesecake kit Philly Handbag.June 2022: Danone North America partnered with White Plains, Boulder, and Colo and launched Activia+ Multi-Benefit Probiotic Yogurt Drinks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Dairy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Dairy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Dairy Market?

To stay informed about further developments, trends, and reports in the Canada Dairy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence