Key Insights

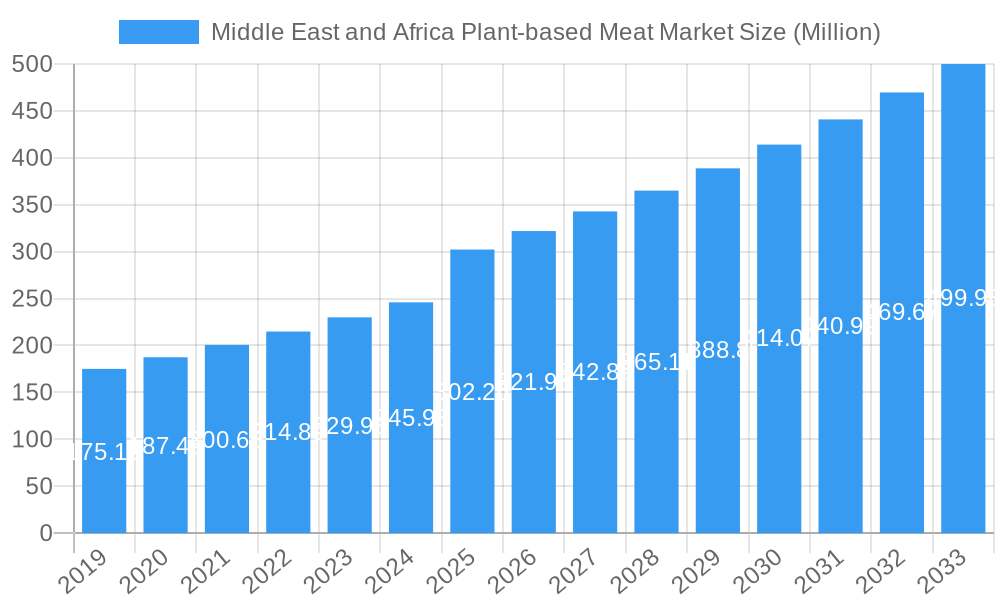

The Middle East and Africa (MEA) plant-based meat market is poised for significant expansion, projected to reach USD 302.26 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.44% anticipated through 2033. This upward trajectory is propelled by a confluence of escalating health consciousness, a growing environmental awareness, and the increasing availability of diverse plant-based alternatives. Consumers across the region are actively seeking healthier dietary options, reducing their intake of animal products due to concerns about cholesterol, saturated fats, and potential health risks. Simultaneously, the environmental footprint associated with traditional meat production is a growing consideration, further driving the adoption of sustainable plant-based proteins. The market's segmentation reflects this demand, with plant-based meat products, including burger patties, sausages, and strips, leading the charge. Plant-based dairy, encompassing milk, yogurt, butter, and cheese, also presents a substantial growth avenue as consumers explore dairy-free alternatives.

Middle East and Africa Plant-based Meat Market Market Size (In Million)

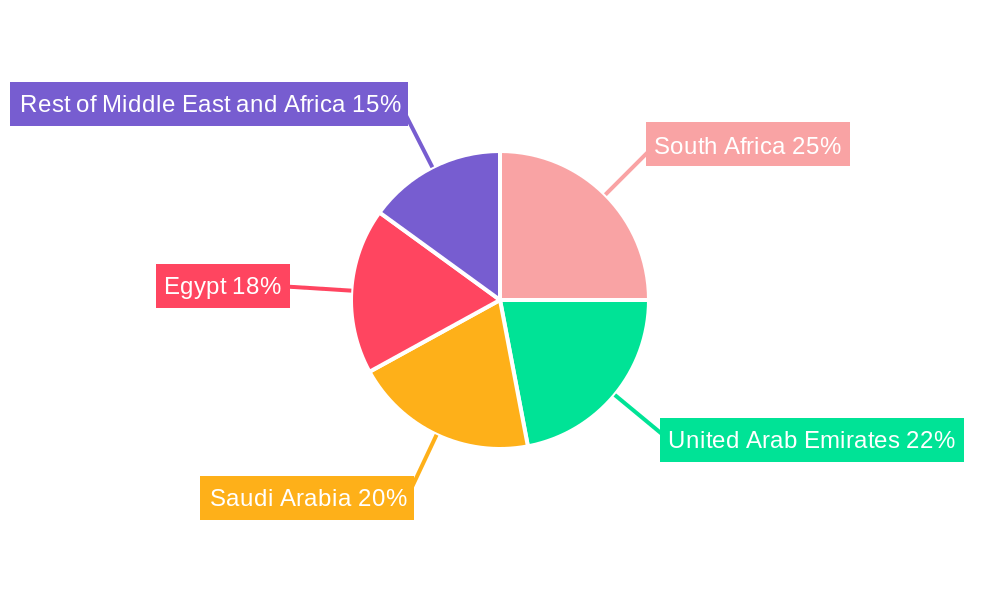

The MEA plant-based meat market's growth is further fueled by evolving distribution channels and a widening geographical reach. Hypermarkets and supermarkets are emerging as primary retail touchpoints, offering consumers convenient access to a growing array of plant-based products. The rise of online retail channels is also playing a crucial role, catering to an increasingly digitally connected consumer base and expanding market penetration into remote areas. Geographically, key markets like South Africa, the United Arab Emirates, Saudi Arabia, and Egypt are spearheading this growth, driven by progressive consumer trends and supportive regulatory environments. While the availability of a wide range of plant-based options is a strong driver, challenges such as the higher price point of some plant-based alternatives compared to conventional meat, coupled with lingering consumer skepticism regarding taste and texture, represent potential restraints. However, continuous innovation in product development and strategic collaborations among leading companies are expected to overcome these hurdles, solidifying the MEA plant-based meat market's vibrant future.

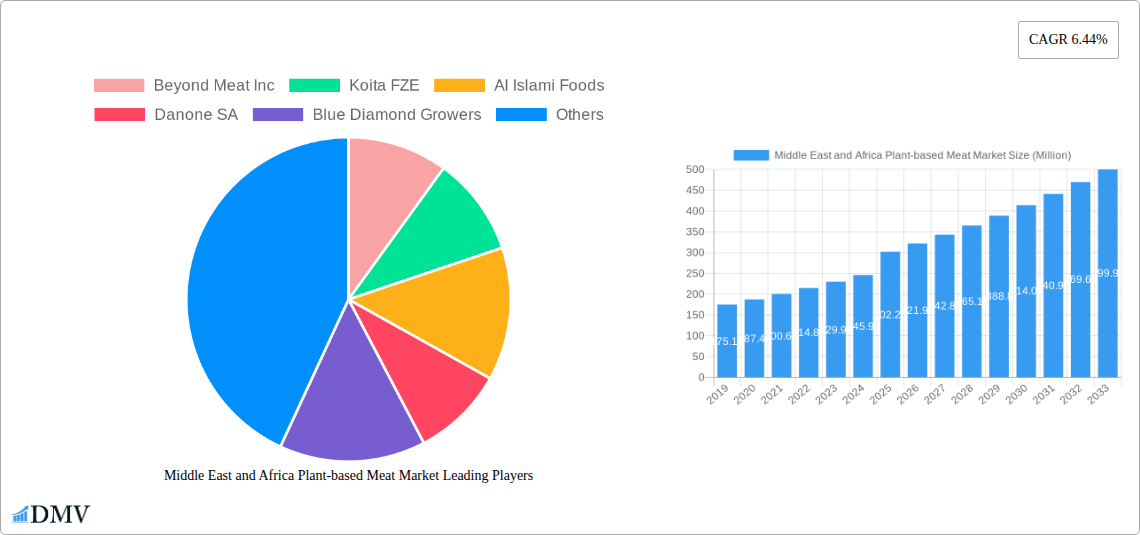

Middle East and Africa Plant-based Meat Market Company Market Share

This in-depth report provides a definitive analysis of the burgeoning Middle East and Africa (MEA) plant-based meat market. Covering the historical period from 2019 to 2024, base year 2025, and a detailed forecast from 2025 to 2033, this research delves into market dynamics, key players, and emerging trends. Our expert analysis uncovers the significant growth trajectory of this evolving sector, driven by rising health consciousness, environmental awareness, and innovative product development. The report is designed to equip stakeholders with actionable insights into market size, segmentation, competitive landscape, and future opportunities within the MEA region, offering a clear roadmap for strategic decision-making.

Middle East and Africa Plant-based Meat Market Market Composition & Trends

The MEA plant-based meat market is characterized by a dynamic interplay of established food giants and agile innovators, fostering a competitive yet collaborative ecosystem. Market concentration is gradually shifting as new entrants vie for market share, propelled by increasing consumer demand for sustainable and healthy protein alternatives. Innovation catalysts are primarily driven by a desire to replicate the taste, texture, and nutritional profile of conventional meat, alongside the development of novel plant-based dairy products. The regulatory landscape, while evolving, presents both opportunities and challenges, with governments increasingly recognizing the potential of plant-based foods. Substitute products, ranging from traditional vegetarian options to lab-grown meat, are also contributing to market complexity. End-user profiles are diverse, encompassing health-conscious millennials, environmentally aware consumers, and individuals with dietary restrictions. Mergers and acquisitions (M&A) activities are anticipated to play a crucial role in consolidating market power and expanding product portfolios. For instance, a significant M&A deal value of approximately $500 Million is projected in the coming years, indicative of consolidation trends. Market share distribution is expected to see a gradual shift, with plant-based meat products holding an estimated 65% share in 2025, while plant-based dairy is projected to account for 35%.

- Market Concentration: Moderate, with a growing number of new entrants challenging established players.

- Innovation Catalysts: Demand for healthier, sustainable alternatives, taste and texture replication, diverse product offerings.

- Regulatory Landscapes: Evolving, with increasing government support for food innovation and sustainability initiatives.

- Substitute Products: Traditional vegetarian options, emerging cultured meat technologies.

- End-User Profiles: Health-conscious individuals, environmentally aware consumers, flexitarians, vegans, and vegetarians.

- M&A Activities: Expected to increase as companies seek market expansion and portfolio diversification.

Middle East and Africa Plant-based Meat Market Industry Evolution

The Middle East and Africa plant-based meat market has witnessed a remarkable evolution over the historical period, transitioning from a niche segment to a rapidly expanding industry. Fueled by a confluence of increasing health consciousness, a growing concern for environmental sustainability, and a rising preference for ethical food choices, consumer demand for plant-based alternatives has surged across the region. This surge is not merely a fleeting trend but a fundamental shift in dietary patterns, driven by a younger, more globally connected population that is more receptive to innovative food technologies and sustainable living. Technological advancements have been pivotal in this evolution, enabling manufacturers to create plant-based products that closely mimic the taste, texture, and nutritional value of conventional meat. Innovations in processing techniques, ingredient sourcing, and flavor encapsulation have played a crucial role in enhancing the appeal and palatability of these products, thus broadening their consumer base.

The market growth trajectory has been consistently upward, with an estimated Compound Annual Growth Rate (CAGR) of approximately 18.5% during the forecast period (2025–2033). This robust growth is supported by significant investments in research and development, leading to a wider array of product types, from plant-based burgers and sausages to more sophisticated offerings like plant-based chicken strips and meatballs. The proliferation of plant-based dairy products, including milk, yogurt, butter, and cheese, has further diversified the market, catering to a broader spectrum of consumer needs and preferences. Adoption metrics indicate a growing acceptance, with penetration rates in urban centers of key MEA countries showing an increase of over 25% from 2020 to 2024. Shifting consumer demands are a primary driver, with consumers actively seeking out products that align with their values of health, sustainability, and ethical sourcing. This has created a fertile ground for both established food corporations and agile startups to innovate and expand their offerings, making the MEA region a compelling market for plant-based food innovation and investment.

Leading Regions, Countries, or Segments in Middle East and Africa Plant-based Meat Market

The Middle East and Africa plant-based meat market is a multifaceted landscape, with distinct regions and segments exhibiting varying growth dynamics and market dominance. Among the product types, Plant-Based Meat holds a significant lead, projected to account for an estimated 65% of the total market value in 2025. This dominance is driven by the direct substitution appeal it offers to a large consumer base accustomed to traditional meat consumption. Within the Plant-Based Meat segment, Burger Patties and Strips and Nuggets are expected to lead, appealing to convenience and familiar meal formats. The demand for Plant-Based Dairy, while growing, is currently positioned as a complementary segment, projected to capture 35% of the market in 2025, with Milk being the primary driver.

Geographically, the United Arab Emirates (UAE) and Saudi Arabia are emerging as the leading markets within the MEA region. Their dominance is attributable to a confluence of factors:

- High Disposable Income: Enabling consumers to afford premium plant-based products.

- Growing Health and Wellness Trends: A significant portion of the population is actively seeking healthier dietary options.

- Government Initiatives and Support: Both nations are increasingly promoting food innovation, sustainability, and healthier lifestyles, creating a favorable regulatory and investment environment. The UAE, in particular, has become a hub for food technology and innovation in the region.

- Urbanization and Westernization: These factors contribute to the adoption of global food trends, including the increasing popularity of plant-based diets.

- Presence of Major Retailers: Extensive networks of hypermarkets and supermarkets, alongside a growing online retail presence, ensure widespread product availability.

The Hypermarkets/Supermarkets distribution channel is expected to remain the most dominant, commanding an estimated 55% of the market share in 2025 due to their broad reach and ability to cater to diverse consumer needs. However, Online Retail Channels are exhibiting the fastest growth rate, projected to expand at a CAGR of over 22% during the forecast period, driven by increasing internet penetration and the convenience offered. Egypt and South Africa are also significant contributors to the MEA plant-based market, with growing awareness and increasing product availability. The "Rest of Middle East and Africa" segment represents a vast, nascent market with considerable untapped potential for future growth as awareness and infrastructure develop.

Middle East and Africa Plant-based Meat Market Product Innovations

Product innovation is a critical driver in the MEA plant-based meat market. Manufacturers are continuously developing novel formulations that enhance the sensory experience, catering to diverse palates and dietary requirements. Innovations focus on replicating the juiciness and umami flavors of animal meat using a combination of plant-derived proteins like soy, pea, and fava bean, alongside advanced texturization techniques. For instance, the development of plant-based chicken alternatives that exhibit a fibrous texture and a satisfying bite is gaining traction. Furthermore, there's a growing emphasis on leveraging indigenous ingredients, such as pulses and grains prevalent in the region, to create unique and culturally relevant plant-based products. Performance metrics for these innovations are tracked through consumer acceptance studies, taste panel results, and nutritional profiling, with a keen eye on meeting protein content and minimizing processed ingredients.

Propelling Factors for Middle East and Africa Plant-based Meat Market Growth

The growth of the Middle East and Africa plant-based meat market is propelled by several key factors. Rising health consciousness among consumers, driven by increased awareness of the health benefits associated with plant-based diets, is a primary catalyst. This is complemented by a growing environmental awareness regarding the ecological footprint of traditional meat production, influencing consumer choices towards more sustainable alternatives. Technological advancements in food processing and ingredient innovation have significantly improved the taste, texture, and overall appeal of plant-based products, making them more accessible and desirable. Furthermore, government initiatives in several MEA countries are actively promoting the adoption of healthier and more sustainable food options through supportive policies and investments. The increasing availability of a wider variety of plant-based products across diverse distribution channels, from hypermarkets to online platforms, is also crucial in driving market expansion.

Obstacles in the Middle East and Africa Plant-based Meat Market Market

Despite its robust growth, the Middle East and Africa plant-based meat market faces several obstacles. High production costs compared to conventional meat can lead to premium pricing, making plant-based options less accessible for a significant portion of the price-sensitive consumer base in the region. Limited consumer awareness and education about the benefits and availability of plant-based alternatives remain a challenge in certain markets, leading to skepticism or a lack of understanding. Supply chain complexities, including sourcing of specialized ingredients and maintaining product freshness across vast geographical areas, can pose logistical hurdles. Cultural and traditional dietary preferences, deeply ingrained in many MEA societies, present a significant barrier to widespread adoption, requiring extensive efforts in product adaptation and marketing. Regulatory hurdles and the lack of standardized labeling for plant-based products in some countries can also create uncertainty for manufacturers and consumers.

Future Opportunities in Middle East and Africa Plant-based Meat Market

Emerging opportunities in the Middle East and Africa plant-based meat market are vast and promising. The increasing penetration of e-commerce and online food delivery platforms presents a significant avenue for reaching a wider consumer base, particularly in urban centers. The development of plant-based alternatives to traditional regional dishes can unlock significant market potential by catering to local tastes and preferences. Furthermore, exploring partnerships with established food service providers and hospitality chains can accelerate product adoption and brand visibility. There is also a substantial opportunity in developing cost-effective and locally sourced plant-based protein ingredients, which can help reduce production costs and enhance accessibility. Investments in food technology innovation hubs and research facilities within the region can foster further product development and attract foreign investment.

Major Players in the Middle East and Africa Plant-based Meat Market Ecosystem

- Beyond Meat Inc

- Koita FZE

- Al Islami Foods

- Danone SA

- Blue Diamond Growers

- Upfield Holdings B V

- The Meatless Farm Co

- Saudi Dairy and Food Stuff Company

- Rude Health

- Superbom Alimentos

- Vbites Foods Limited

Key Developments in Middle East and Africa Plant-based Meat Market Industry

- May 2022: Saudi Dairy and Food Stuff Company launched Saudia oat milk, claiming it is the Kingdom's first locally produced oat-based milk, enhancing the plant-based dairy offerings in Saudi Arabia.

- February 2021: Danone SA announced its purchase of US-based firm 'Earth Island,' which is a producer of a pioneering plant-based brand named Follow Your Heart. This strategic acquisition significantly expanded Danone's product range to meet growing consumer needs for diverse plant-based options in the MEA region.

- January 2021: Vbites Food Limited expanded its business in the Middle East with a listing of products that were announced in the United Arab Emirates. Nine products from its 51-strong portfolio of plant-based products have been listed in 90 stores, including Waitrose locations in Dubai and Spinneys stores across the United Arab Emirates, marking a key entry into the lucrative UAE market.

Strategic Middle East and Africa Plant-based Meat Market Market Forecast

The strategic forecast for the Middle East and Africa plant-based meat market is exceptionally optimistic, driven by sustained growth catalysts. The ongoing shift in consumer preferences towards healthier and more sustainable food choices, coupled with continuous product innovation that enhances taste and affordability, will fuel market expansion. Increased government support for the food tech sector and growing foreign investment are expected to further accelerate growth. The expanding distribution networks, particularly in online retail, will ensure greater accessibility of plant-based products across the region. These converging factors paint a promising picture for substantial market growth, offering significant opportunities for market players to capitalize on the evolving dietary landscape of the MEA region. The market is projected to reach a valuation of approximately $3,500 Million by 2033.

Middle East and Africa Plant-based Meat Market Segmentation

-

1. Product Type

-

1.1. Plant-Based Meat

- 1.1.1. Burger Patties

- 1.1.2. Sausages

- 1.1.3. Strips and Nuggets

- 1.1.4. Meatballs

- 1.1.5. Other Plant-Based Meats

-

1.2. Plant-Based Dairy

- 1.2.1. Milk

- 1.2.2. Yogurt

- 1.2.3. Butter and Cheese

- 1.2.4. Other Plant-based Dairy

-

1.1. Plant-Based Meat

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Channels

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. South Africa

- 3.2. United Arab Emirates

- 3.3. Saudi Arabia

- 3.4. Egypt

- 3.5. Rest of Middle East and Africa

Middle East and Africa Plant-based Meat Market Segmentation By Geography

- 1. South Africa

- 2. United Arab Emirates

- 3. Saudi Arabia

- 4. Egypt

- 5. Rest of Middle East and Africa

Middle East and Africa Plant-based Meat Market Regional Market Share

Geographic Coverage of Middle East and Africa Plant-based Meat Market

Middle East and Africa Plant-based Meat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Health Concerns are Supporting the Market's Growth; Growing Consumer Preference for Convenience Seafood

- 3.3. Market Restrains

- 3.3.1. Rising Concern About Quality and Safety Standards of Canned Tuna

- 3.4. Market Trends

- 3.4.1. Increasing Health Concerns Are Supporting the Market’s Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Plant-based Meat Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Plant-Based Meat

- 5.1.1.1. Burger Patties

- 5.1.1.2. Sausages

- 5.1.1.3. Strips and Nuggets

- 5.1.1.4. Meatballs

- 5.1.1.5. Other Plant-Based Meats

- 5.1.2. Plant-Based Dairy

- 5.1.2.1. Milk

- 5.1.2.2. Yogurt

- 5.1.2.3. Butter and Cheese

- 5.1.2.4. Other Plant-based Dairy

- 5.1.1. Plant-Based Meat

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Channels

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. United Arab Emirates

- 5.3.3. Saudi Arabia

- 5.3.4. Egypt

- 5.3.5. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. United Arab Emirates

- 5.4.3. Saudi Arabia

- 5.4.4. Egypt

- 5.4.5. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. South Africa Middle East and Africa Plant-based Meat Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Plant-Based Meat

- 6.1.1.1. Burger Patties

- 6.1.1.2. Sausages

- 6.1.1.3. Strips and Nuggets

- 6.1.1.4. Meatballs

- 6.1.1.5. Other Plant-Based Meats

- 6.1.2. Plant-Based Dairy

- 6.1.2.1. Milk

- 6.1.2.2. Yogurt

- 6.1.2.3. Butter and Cheese

- 6.1.2.4. Other Plant-based Dairy

- 6.1.1. Plant-Based Meat

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarkets/Supermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Channels

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. United Arab Emirates

- 6.3.3. Saudi Arabia

- 6.3.4. Egypt

- 6.3.5. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Arab Emirates Middle East and Africa Plant-based Meat Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Plant-Based Meat

- 7.1.1.1. Burger Patties

- 7.1.1.2. Sausages

- 7.1.1.3. Strips and Nuggets

- 7.1.1.4. Meatballs

- 7.1.1.5. Other Plant-Based Meats

- 7.1.2. Plant-Based Dairy

- 7.1.2.1. Milk

- 7.1.2.2. Yogurt

- 7.1.2.3. Butter and Cheese

- 7.1.2.4. Other Plant-based Dairy

- 7.1.1. Plant-Based Meat

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarkets/Supermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Channels

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. United Arab Emirates

- 7.3.3. Saudi Arabia

- 7.3.4. Egypt

- 7.3.5. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Saudi Arabia Middle East and Africa Plant-based Meat Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Plant-Based Meat

- 8.1.1.1. Burger Patties

- 8.1.1.2. Sausages

- 8.1.1.3. Strips and Nuggets

- 8.1.1.4. Meatballs

- 8.1.1.5. Other Plant-Based Meats

- 8.1.2. Plant-Based Dairy

- 8.1.2.1. Milk

- 8.1.2.2. Yogurt

- 8.1.2.3. Butter and Cheese

- 8.1.2.4. Other Plant-based Dairy

- 8.1.1. Plant-Based Meat

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarkets/Supermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Channels

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. United Arab Emirates

- 8.3.3. Saudi Arabia

- 8.3.4. Egypt

- 8.3.5. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Egypt Middle East and Africa Plant-based Meat Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Plant-Based Meat

- 9.1.1.1. Burger Patties

- 9.1.1.2. Sausages

- 9.1.1.3. Strips and Nuggets

- 9.1.1.4. Meatballs

- 9.1.1.5. Other Plant-Based Meats

- 9.1.2. Plant-Based Dairy

- 9.1.2.1. Milk

- 9.1.2.2. Yogurt

- 9.1.2.3. Butter and Cheese

- 9.1.2.4. Other Plant-based Dairy

- 9.1.1. Plant-Based Meat

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hypermarkets/Supermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online Retail Channels

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. South Africa

- 9.3.2. United Arab Emirates

- 9.3.3. Saudi Arabia

- 9.3.4. Egypt

- 9.3.5. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Middle East and Africa Middle East and Africa Plant-based Meat Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Plant-Based Meat

- 10.1.1.1. Burger Patties

- 10.1.1.2. Sausages

- 10.1.1.3. Strips and Nuggets

- 10.1.1.4. Meatballs

- 10.1.1.5. Other Plant-Based Meats

- 10.1.2. Plant-Based Dairy

- 10.1.2.1. Milk

- 10.1.2.2. Yogurt

- 10.1.2.3. Butter and Cheese

- 10.1.2.4. Other Plant-based Dairy

- 10.1.1. Plant-Based Meat

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Hypermarkets/Supermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Online Retail Channels

- 10.2.4. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. South Africa

- 10.3.2. United Arab Emirates

- 10.3.3. Saudi Arabia

- 10.3.4. Egypt

- 10.3.5. Rest of Middle East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Beyond Meat Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Koita FZE

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Al Islami Foods

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Danone SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Blue Diamond Growers

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Upfield Holdings B V

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 The Meatless Farm Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Saudi Dairy and Food Stuff Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rude Health

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Superbom Alimentos

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Vbites Foods Limited *List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Beyond Meat Inc

List of Figures

- Figure 1: Middle East and Africa Plant-based Meat Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Plant-based Meat Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 11: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 19: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Middle East and Africa Plant-based Meat Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Plant-based Meat Market?

The projected CAGR is approximately 6.44%.

2. Which companies are prominent players in the Middle East and Africa Plant-based Meat Market?

Key companies in the market include Beyond Meat Inc, Koita FZE, Al Islami Foods, Danone SA, Blue Diamond Growers, Upfield Holdings B V, The Meatless Farm Co, Saudi Dairy and Food Stuff Company, Rude Health, Superbom Alimentos, Vbites Foods Limited *List Not Exhaustive.

3. What are the main segments of the Middle East and Africa Plant-based Meat Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 302.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Health Concerns are Supporting the Market's Growth; Growing Consumer Preference for Convenience Seafood.

6. What are the notable trends driving market growth?

Increasing Health Concerns Are Supporting the Market’s Growth.

7. Are there any restraints impacting market growth?

Rising Concern About Quality and Safety Standards of Canned Tuna.

8. Can you provide examples of recent developments in the market?

May 2022: Saudi Dairy and Food Stuff Company launched Saudia oat milk, claiming it is the Kingdom's first locally produced oat-based milk.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Plant-based Meat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Plant-based Meat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Plant-based Meat Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Plant-based Meat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence