Key Insights

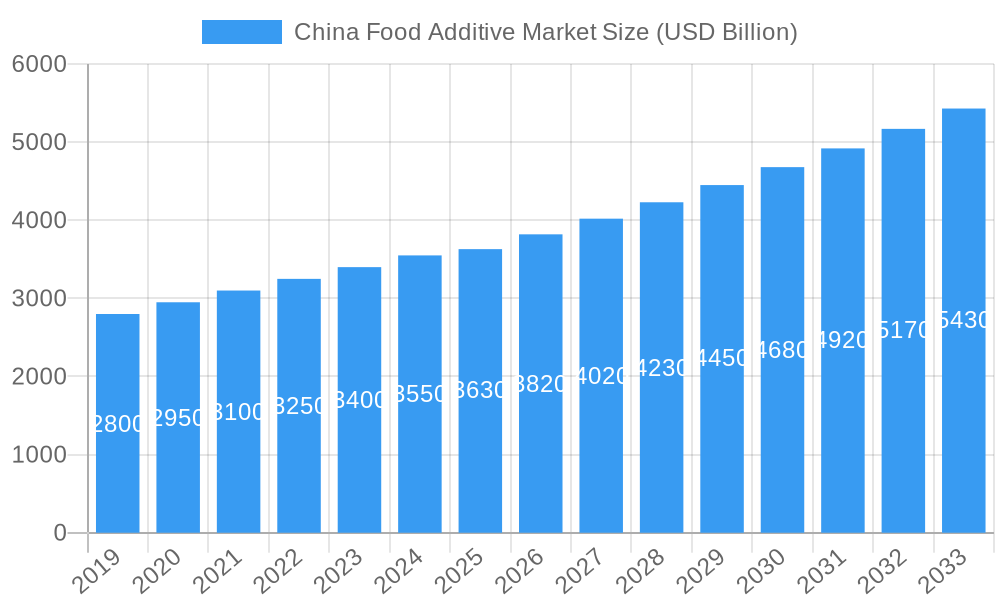

The China Food Additive Market is poised for substantial growth, projected to reach $3.63 billion by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 5.20% through 2033. This robust expansion is fueled by a confluence of factors, including the increasing demand for processed and convenience foods, a rising middle class with greater disposable income, and a growing awareness and preference for visually appealing and palatable food products. Key market drivers include the escalating consumption of packaged foods, the innovation in product development driven by food manufacturers seeking to enhance taste, texture, and shelf-life, and the evolving regulatory landscape which, while stringent, is also fostering advancements in safer and more effective food additive technologies. The burgeoning health and wellness trend is also indirectly influencing the market, as manufacturers seek to reformulate products with cleaner labels and potentially beneficial additives.

China Food Additive Market Market Size (In Billion)

The market is segmented across various food additive types, with Preservatives, Sweeteners and Sugar Substitutes, Emulsifiers, Enzymes, Hydrocolloids, Food Colors, and Flavors and Enhancers representing key categories. Applications span across Bakery and Confectionery, Dairy and Frozen Products, Beverages, Meat Products, and Other Applications. The Bakery and Confectionery and Beverage segments are anticipated to remain dominant due to their widespread consumption and continuous product innovation. Despite the positive outlook, the market faces certain restraints, such as fluctuating raw material prices, increasing consumer scrutiny regarding the safety and naturalness of ingredients, and the potential for stricter regulations that could impact production costs and ingredient choices. However, ongoing research and development focused on natural and sustainable food additives, coupled with technological advancements in production processes, are expected to mitigate these challenges and unlock new opportunities for market players.

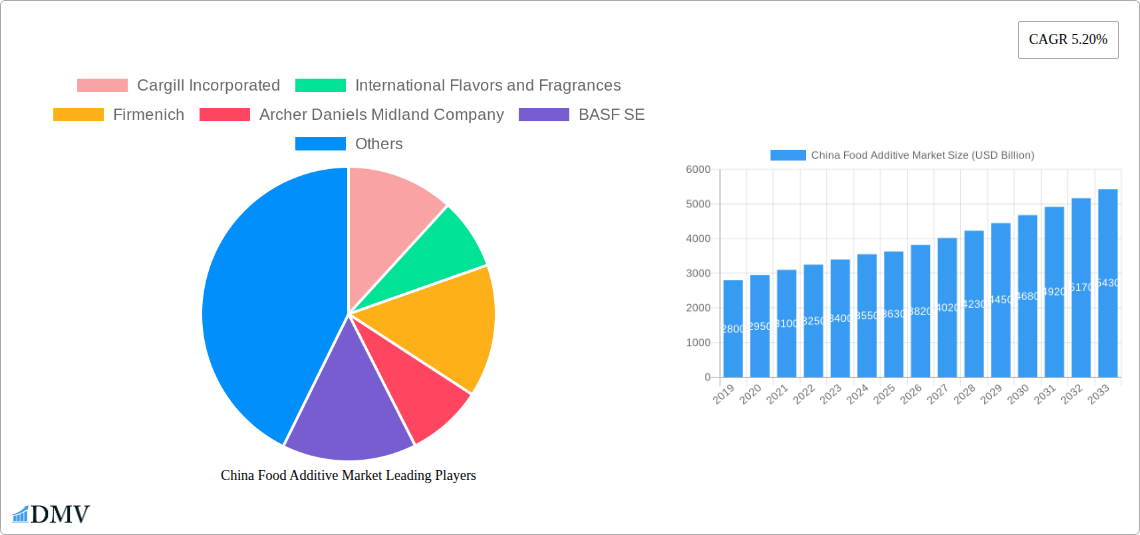

China Food Additive Market Company Market Share

Here is an SEO-optimized, insightful report description for the China Food Additive Market:

China Food Additive Market Report: Navigating Growth and Innovation in a Dynamic Landscape

This comprehensive report delves into the intricate China Food Additive Market, a sector experiencing robust expansion driven by evolving consumer preferences, technological advancements, and a growing food processing industry. Covering the historical period from 2019–2024, with a base year of 2025 and a forecast period extending to 2033, this analysis provides critical insights into market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. For stakeholders seeking to capitalize on the burgeoning China food additive industry, this report offers an indispensable roadmap.

China Food Additive Market Market Composition & Trends

The China Food Additive Market is characterized by a moderate to high level of concentration, with key players actively investing in research and development to introduce novel solutions that cater to the demand for healthier, safer, and more functional food products. Regulatory frameworks are continuously evolving, influencing product development and market entry strategies, emphasizing food safety and compliance. Substitute products are emerging, particularly those derived from natural sources, presenting both challenges and opportunities for traditional additive manufacturers. End-user profiles are diverse, spanning large-scale food manufacturers to smaller artisanal producers, each with distinct needs and purchasing behaviors. Mergers and acquisitions (M&A) activities are a significant trend, as companies aim to consolidate market share, acquire innovative technologies, and expand their product portfolios. For instance, the M&A deal value in the food ingredient sector reached approximately USD 15.8 Billion in 2023, indicating strategic consolidation and investment. Market share distribution within the China food additive market is dynamic, with leading companies holding substantial portions in specific segments.

China Food Additive Market Industry Evolution

The China Food Additive Market has witnessed a remarkable evolution over the past decade, transitioning from a basic supply-driven sector to a sophisticated, innovation-led industry. The historical period from 2019–2024 saw steady growth, fueled by China's expanding middle class, increased disposable incomes, and a growing demand for processed and convenience foods. This period was marked by an escalating adoption of advanced food processing technologies, necessitating a parallel rise in the demand for high-performance food additives. Key growth trajectories have been shaped by significant investments in R&D, leading to the development of additives that enhance not only sensory attributes but also nutritional value and shelf-life. Technological advancements in areas like encapsulation, enzymatic processing, and the synthesis of novel flavoring compounds have been instrumental in this evolution. Shifting consumer demands towards healthier options, including reduced sugar, salt, and artificial ingredients, have been a primary catalyst for innovation. This has propelled the market towards natural and clean-label alternatives, driving substantial growth in segments like natural food colors and plant-based sweeteners. The overall market size for food additives in China is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period, reaching an estimated USD 25.6 Billion by 2033, a substantial increase from an estimated USD 10.2 Billion in 2025. This growth is intrinsically linked to the expansion of China's food and beverage industry, which is itself projected to reach over USD 1.5 Trillion by 2030.

Leading Regions, Countries, or Segments in China Food Additive Market

The dominance within the China Food Additive Market is multifaceted, with specific regions and product segments exhibiting exceptional growth and influence.

Dominant Segments by Type:

- Sweeteners and Sugar Substitutes: This segment is experiencing unparalleled growth due to rising health consciousness and government initiatives to curb sugar consumption. Market penetration is driven by the increasing popularity of low-calorie and sugar-free food and beverage products, projected to contribute over 25% of the total market revenue by 2033.

- Flavors and Enhancers: With a growing demand for diverse and appealing taste profiles in food products, this segment remains a cornerstone of the market. Investments in innovative flavor technologies and natural flavor extracts are key drivers, expected to account for approximately 20% of market share.

- Preservatives: Essential for extending shelf life and ensuring food safety, preservatives continue to hold a significant market share, driven by the expansion of the processed food industry. The market for preservatives is estimated to reach USD 3.1 Billion by 2033.

- Hydrocolloids: Crucial for texture modification and stability in various food applications, hydrocolloids are witnessing increased demand, particularly from the dairy and bakery sectors.

Dominant Segments by Application:

- Bakery and Confectionery: This sector consistently represents a substantial portion of the food additive market, fueled by evolving consumer tastes and the continuous introduction of new products. The market for food additives in bakery and confectionery alone is projected to exceed USD 4.2 Billion by 2033.

- Beverages: The rapidly expanding beverage industry, encompassing soft drinks, juices, and alcoholic beverages, is a major consumer of food additives, particularly sweeteners, flavors, and colors. This application segment is expected to grow at a CAGR of 8.2%.

- Dairy and Frozen Products: The demand for additives that improve texture, stability, and sensory appeal in dairy and frozen items continues to drive significant market share.

Geographical Dominance:

- Eastern China: Regions like Shanghai, Jiangsu, and Zhejiang, with their highly developed economies, dense urban populations, and extensive food processing infrastructure, are leading the market. High disposable incomes and a concentration of major food manufacturers contribute to their dominant position. Investment trends in these regions focus on advanced ingredient technologies and sustainable sourcing.

- Southern China: Guangdong province, a manufacturing hub and a gateway to international markets, also plays a crucial role in the food additive market, particularly in catering to export-oriented food production.

China Food Additive Market Product Innovations

Product innovation in the China Food Additive Market is rapidly advancing, focusing on clean-label solutions, natural sourcing, and enhanced functionality. Companies are heavily investing in developing natural food colors derived from fruits and vegetables, as well as plant-based sweeteners that mimic the taste of sugar without the caloric impact. Innovations in emulsifiers are addressing the need for improved stability and texture in plant-based alternatives, while enzymes are being engineered for greater efficiency in food processing, reducing waste and improving yields. Performance metrics are increasingly being benchmarked against traditional synthetic ingredients, with a strong emphasis on allergen-free and non-GMO formulations. Unique selling propositions often revolve around sustainability, traceability, and the perceived health benefits of these novel additives, meeting the evolving demands of conscious consumers.

Propelling Factors for China Food Additive Market Growth

Several key factors are propelling the growth of the China Food Additive Market. Economically, the sustained growth of China's middle class and their increasing disposable income directly translates to higher consumption of processed and convenience foods, thereby boosting demand for additives. Technologically, continuous advancements in food processing and ingredient innovation enable the development of more sophisticated and functional additives, catering to specific needs like shelf-life extension, improved texture, and enhanced nutritional profiles. Regulatory support, while stringent, is also becoming more conducive to approved and safe food additives, particularly those promoting healthier eating habits. For instance, government initiatives promoting reduced sugar intake indirectly drive the demand for sugar substitutes. The increasing focus on food safety and quality standards further encourages the use of approved and traceable food additives.

Obstacles in the China Food Additive Market Market

Despite robust growth, the China Food Additive Market faces several obstacles. Stringent and evolving regulatory landscapes can pose challenges for new market entrants and necessitate continuous compliance updates, impacting R&D and product approval timelines. Supply chain disruptions, exacerbated by global events, can affect the availability and cost of raw materials, leading to price volatility. Intense competitive pressures, both from domestic and international players, demand constant innovation and cost-efficiency. Consumer perception and scrutiny regarding the safety and necessity of certain food additives can also create headwinds, pushing the market towards natural alternatives and requiring extensive consumer education. For example, negative publicity surrounding artificial sweeteners can dampen demand for specific product categories.

Future Opportunities in China Food Additive Market

The China Food Additive Market presents numerous future opportunities. The growing demand for clean-label and natural ingredients, driven by health-conscious consumers, opens avenues for plant-based additives, natural colors, and flavors. The expanding plant-based protein market also presents a significant opportunity for functional additives that enhance texture, taste, and stability in these novel products. Furthermore, the increasing focus on personalized nutrition and functional foods creates demand for specialized additives that offer health benefits, such as probiotics, prebiotics, and vitamins. Technological advancements in biotechnology and fermentation offer potential for the development of novel, sustainable, and cost-effective food additives. The burgeoning e-commerce landscape also provides new channels for reaching consumers directly with specialized food products incorporating these innovative additives.

Major Players in the China Food Additive Market Ecosystem

- Cargill Incorporated

- International Flavors and Fragrances

- Firmenich

- Archer Daniels Midland Company

- BASF SE

- Kerry Group

- Palsgaard Gods A/S

- Corbion NV

- Tate & Lyle PLC

- DuPont Nutrition & Biosciences

Key Developments in China Food Additive Market Industry

- 2024: Launch of novel natural sweetener blends catering to the demand for sugar reduction in confectionery.

- 2023: Significant investment in R&D for plant-based emulsifiers to support the growing alternative protein market.

- 2023: Expansion of a major player's production capacity for natural food colors derived from fruit extracts.

- 2022: Introduction of a new range of clean-label preservatives for bakery products.

- 2021: Merger of two key players to strengthen their position in the hydrocolloids market.

- 2020: Increased focus on sustainable sourcing and production methods for all food additive categories.

Strategic China Food Additive Market Market Forecast

The strategic China Food Additive Market forecast indicates sustained and robust growth, driven by an interplay of increasing consumer demand for healthier and more convenient food options, coupled with ongoing technological advancements. The shift towards natural, clean-label ingredients will continue to be a dominant trend, opening significant opportunities for innovative product development. Emerging markets within China, along with untapped application segments, offer considerable expansion potential. The market's trajectory will also be shaped by strategic collaborations and investments aimed at enhancing production capabilities and addressing evolving regulatory requirements, positioning the China food additive market as a critical global player.

China Food Additive Market Segmentation

-

1. Type

- 1.1. Preservatives

- 1.2. Sweeteners and Sugar Substitutes

- 1.3. Emulsifiers

- 1.4. Enzymes

- 1.5. Hydrocolloids

- 1.6. Food Colors, Flavors and Enhancers

- 1.7. Other Types

-

2. Application

- 2.1. Bakery and Confectionery

- 2.2. Dairy and Frozen Products

- 2.3. Beverages

- 2.4. Meat Products

- 2.5. Other Applications

China Food Additive Market Segmentation By Geography

- 1. China

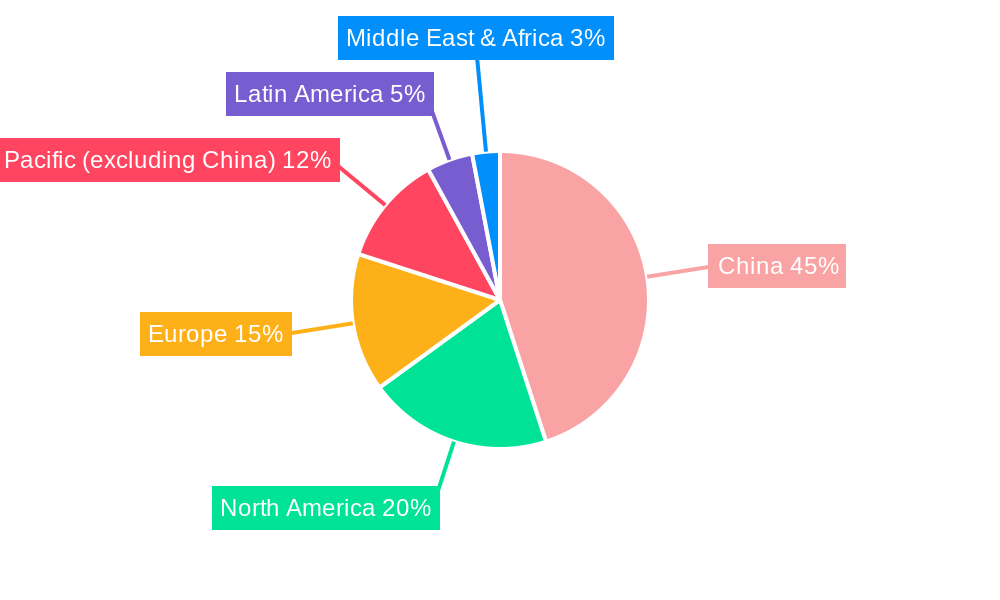

China Food Additive Market Regional Market Share

Geographic Coverage of China Food Additive Market

China Food Additive Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Towards Fitness and Increasing Intake of Plant-based Protein; Increase in Consumer Inclination Towards Meat Substitutes

- 3.3. Market Restrains

- 3.3.1. Gluten-Intolerance Among the Population Hindering the Market

- 3.4. Market Trends

- 3.4.1. Growing Trend for Clean Label Ingredients

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Food Additive Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Preservatives

- 5.1.2. Sweeteners and Sugar Substitutes

- 5.1.3. Emulsifiers

- 5.1.4. Enzymes

- 5.1.5. Hydrocolloids

- 5.1.6. Food Colors, Flavors and Enhancers

- 5.1.7. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery and Confectionery

- 5.2.2. Dairy and Frozen Products

- 5.2.3. Beverages

- 5.2.4. Meat Products

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cargill Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 International Flavors and Fragrances

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Firmenich

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Archer Daniels Midland Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BASF SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kerry Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Palsgaard Gods A/S*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Corbion NV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tate & Lyle PLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DuPont Nutrition & Biosciences

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cargill Incorporated

List of Figures

- Figure 1: China Food Additive Market Revenue Breakdown (USD Billion, %) by Product 2025 & 2033

- Figure 2: China Food Additive Market Share (%) by Company 2025

List of Tables

- Table 1: China Food Additive Market Revenue USD Billion Forecast, by Type 2020 & 2033

- Table 2: China Food Additive Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: China Food Additive Market Revenue USD Billion Forecast, by Application 2020 & 2033

- Table 4: China Food Additive Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: China Food Additive Market Revenue USD Billion Forecast, by Region 2020 & 2033

- Table 6: China Food Additive Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: China Food Additive Market Revenue USD Billion Forecast, by Type 2020 & 2033

- Table 8: China Food Additive Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 9: China Food Additive Market Revenue USD Billion Forecast, by Application 2020 & 2033

- Table 10: China Food Additive Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: China Food Additive Market Revenue USD Billion Forecast, by Country 2020 & 2033

- Table 12: China Food Additive Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Food Additive Market?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the China Food Additive Market?

Key companies in the market include Cargill Incorporated, International Flavors and Fragrances, Firmenich, Archer Daniels Midland Company, BASF SE, Kerry Group, Palsgaard Gods A/S*List Not Exhaustive, Corbion NV, Tate & Lyle PLC , DuPont Nutrition & Biosciences.

3. What are the main segments of the China Food Additive Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.63 USD Billion as of 2022.

5. What are some drivers contributing to market growth?

Inclination Towards Fitness and Increasing Intake of Plant-based Protein; Increase in Consumer Inclination Towards Meat Substitutes.

6. What are the notable trends driving market growth?

Growing Trend for Clean Label Ingredients.

7. Are there any restraints impacting market growth?

Gluten-Intolerance Among the Population Hindering the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in USD Billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Food Additive Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Food Additive Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Food Additive Market?

To stay informed about further developments, trends, and reports in the China Food Additive Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence