Key Insights

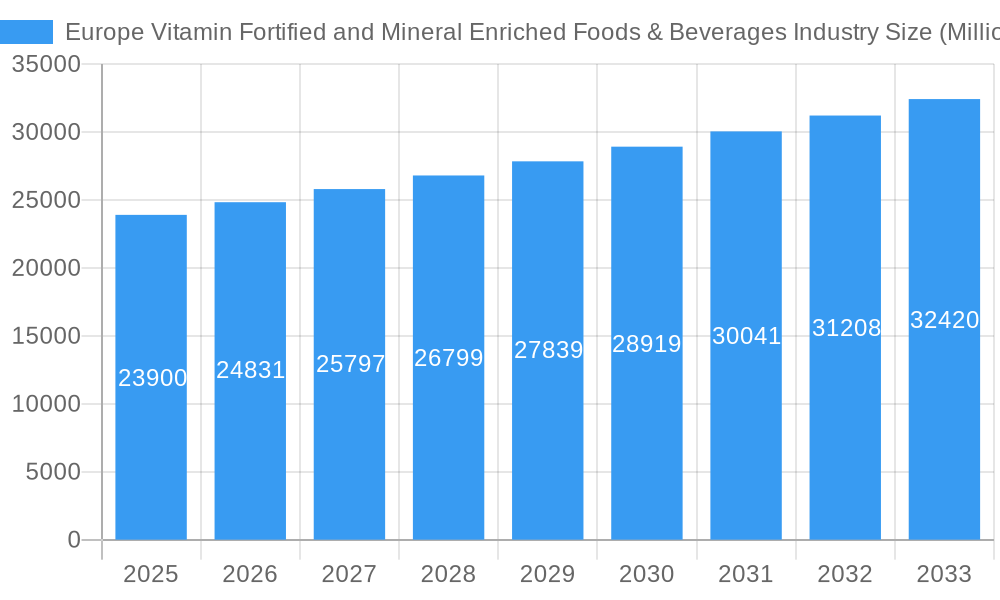

The European Vitamin Fortified and Mineral Enriched Foods & Beverages market is poised for steady growth, projected to reach approximately USD 23.90 million in market size with a Compound Annual Growth Rate (CAGR) of 3.89% from 2025 to 2033. This expansion is primarily driven by a heightened consumer awareness regarding health and wellness, leading to an increased demand for functional foods and beverages that offer added nutritional benefits. Consumers are actively seeking products that can support their immune systems, improve energy levels, and contribute to overall well-being, making fortified and enriched options a popular choice. The growing prevalence of lifestyle-related diseases and an aging population further bolster the market, as individuals look for dietary solutions to manage and prevent chronic conditions. Moreover, the convenience factor associated with these products, readily available across various retail channels, plays a significant role in their widespread adoption.

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Market Size (In Billion)

The market segmentation reveals a diverse landscape, with Cereal-based Products and Dairy Products emerging as dominant categories, catering to breakfast and everyday consumption needs. Beverages and Infant Formulas also represent substantial segments, reflecting the broad appeal across age groups and specific nutritional requirements. Distribution channels are evolving, with Supermarkets/Hypermarkets and Online Retail Stores leading the way in terms of reach and accessibility. The online channel, in particular, is expected to witness accelerated growth due to its convenience and wider product selection. Key players like Nestle SA, Danone SA, and PepsiCo Inc. are instrumental in shaping the market through continuous product innovation and strategic marketing initiatives. However, the market also faces certain restraints, including the potential for increased regulatory scrutiny regarding fortification claims and the fluctuating costs of raw materials, which could impact profit margins. Despite these challenges, the overarching trend towards proactive health management and preventive healthcare among European consumers provides a robust foundation for sustained market expansion.

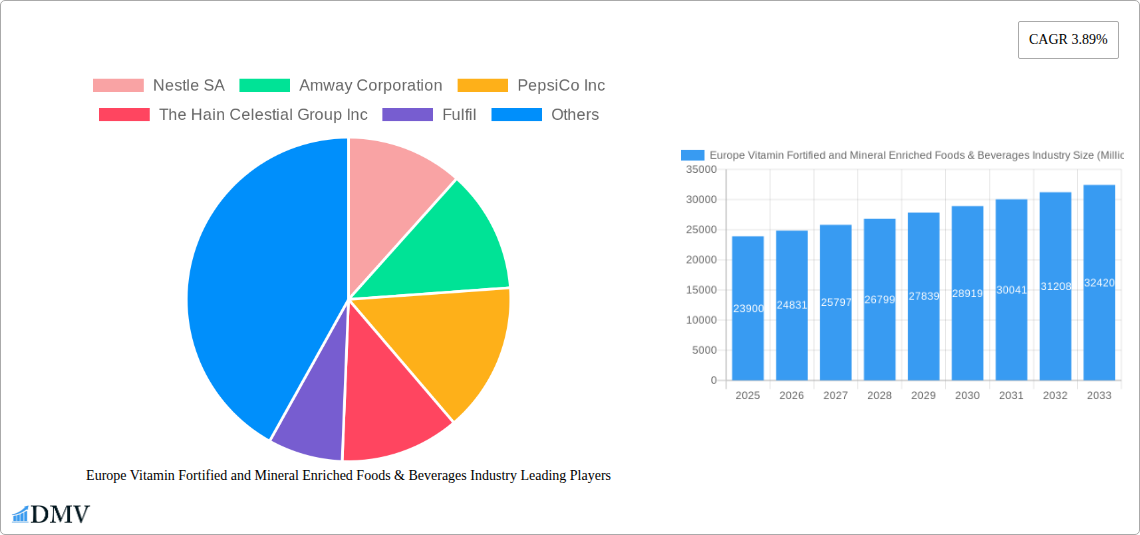

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Company Market Share

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Market Composition & Trends

This comprehensive report delves into the dynamic Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry, analyzing its market composition and evolving trends from 2019 to 2033. The market exhibits a moderate concentration, with key players like Nestle SA, Amway Corporation, PepsiCo Inc, and Danone SA holding significant shares. Innovation remains a crucial catalyst, driven by escalating consumer demand for health-conscious products and proactive government initiatives promoting nutritional fortification. Regulatory landscapes, while stringent, are increasingly geared towards supporting the growth of fortified foods and beverages, fostering a more favorable environment for market expansion. Substitute products, such as dietary supplements, present a competitive challenge, but the convenience and integrated nutritional benefits of fortified food and beverage options continue to drive consumer preference. End-user profiles are diverse, encompassing health-conscious individuals, families with children, athletes, and the elderly, all seeking to enhance their daily nutrient intake. Mergers and acquisitions (M&A) activities are expected to contribute to market consolidation and drive innovation, with estimated M&A deal values projected to reach several hundred million Euros over the forecast period. The report provides an in-depth analysis of market share distribution, highlighting the dominance of leading companies and their strategic approaches to capturing market share within this burgeoning sector.

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Industry Evolution

The Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry has witnessed a remarkable evolution, driven by a confluence of escalating health consciousness, technological advancements in food science, and supportive regulatory frameworks. Over the historical period of 2019-2024, the market experienced a steady compound annual growth rate (CAGR) of approximately 4.5%, fueled by increased consumer awareness regarding the role of vitamins and minerals in preventing chronic diseases and boosting overall well-being. Projections indicate a continued upward trajectory, with an estimated CAGR of 5.2% anticipated during the forecast period of 2025-2033. This sustained growth is underpinned by significant investments in research and development, leading to the introduction of innovative fortified products across various categories. Technological advancements in bioavailability enhancement and encapsulation techniques are enabling manufacturers to create more effective and palatable fortified foods and beverages. Shifting consumer demands have moved beyond basic fortification to a preference for personalized nutrition, functional ingredients, and clean-label products, prompting companies to reformulate existing offerings and develop new, targeted solutions. For instance, the rising popularity of plant-based diets has spurred the development of fortified dairy alternatives and protein-rich snacks. The base year of 2025 is expected to see substantial market activity, with estimated revenues projected to be in the billions of Euros. The adoption rate of vitamin-fortified and mineral-enriched products has seen a significant uptick, with surveys indicating that over 60% of European consumers actively seek out such products to support their health goals. The industry's evolution is also characterized by a growing emphasis on transparency and product traceability, with consumers demanding clear labeling of fortification levels and ingredient sourcing.

Leading Regions, Countries, or Segments in Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry

The European market for Vitamin Fortified and Mineral Enriched Foods & Beverages is characterized by significant regional variations and segment dominance. Among the product types, Dairy Products and Beverages currently command the largest market share, driven by their widespread consumption and the established infrastructure for fortification.

- Dairy Products: This segment benefits from the inherent nutritional profile of dairy and the ease with which vitamins like Vitamin D and calcium, as well as minerals like iron, can be incorporated. The continued popularity of yogurts, milk, and cheese, often fortified for bone health and immune support, solidifies its leading position.

- Beverages: The functional beverage category, including juices, sports drinks, and ready-to-drink teas, has seen explosive growth. Companies are increasingly leveraging fortification to offer added health benefits, targeting specific consumer needs such as energy enhancement, hydration, and immune system support.

Across distribution channels, Supermarket/Hypermarket remains the dominant force, offering consumers a one-stop shop for a wide array of fortified food and beverage options. However, Online Retail Stores are exhibiting the fastest growth rate, reflecting the broader e-commerce trend and the convenience it offers for health-conscious shoppers.

- Key Drivers for Segment Dominance:

- Consumer Habits: Established dietary patterns favoring dairy and readily available beverages contribute significantly to their segment leadership.

- Brand Penetration: Major players like Nestle SA and Danone SA have extensive distribution networks for these product types, ensuring wide availability.

- Innovation Pipeline: Continuous product development and marketing efforts by companies like The Coca-Cola Company and PepsiCo Inc. in the beverage sector further boost demand.

- Retailer Shelf Space: Supermarkets and hypermarkets allocate substantial shelf space to these high-demand categories, reinforcing their market position.

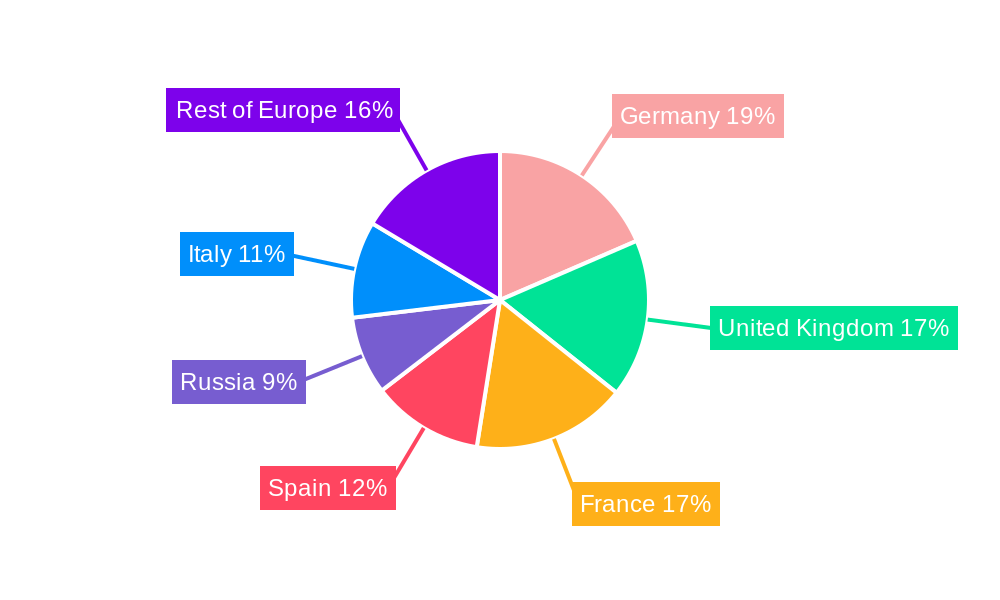

Geographically, Germany, the United Kingdom, and France represent the leading countries, accounting for a substantial portion of the European market. This dominance is attributed to factors such as higher disposable incomes, a greater prevalence of health-conscious consumers, robust regulatory support for food fortification, and a well-established food and beverage manufacturing base. Investment trends in these countries are geared towards developing premium, functional fortified products, while supportive government policies and public health initiatives actively promote the consumption of nutrient-enriched foods.

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Product Innovations

Product innovation in the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry is rapidly advancing, with a focus on enhanced nutritional delivery and targeted health benefits. Recent developments showcase a move towards integrating essential vitamins and minerals into everyday consumables. For example, Kellogg's Rice Krispies cereals, infused with Vitamin D in fruity flavors, provide 20% of the daily requirement, highlighting a novel approach to breakfast fortification. Similarly, Operate Drinks' Operate Recovery sports drink, enriched with vitamins and minerals, caters to the growing demand for post-exercise nutritional support. Moulins Dumée's Chanvrine flour mix, derived from hemp and combined with flaxseed, offers a unique blend of protein, fiber, and omega-3, demonstrating innovation in the bakery sector. These innovations emphasize improved bioavailability, appealing flavors, and convenient forms of nutrient intake, directly addressing evolving consumer preferences for healthier and more functional food options.

Propelling Factors for Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Growth

Several key factors are propelling the growth of the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry. Firstly, escalating consumer awareness regarding health and wellness, coupled with a desire for preventive healthcare, is a major driver. This is further amplified by the increasing prevalence of lifestyle diseases, prompting individuals to seek dietary solutions. Secondly, supportive government initiatives and regulations promoting food fortification for public health improvement, such as initiatives for Vitamin D fortification, create a favorable market environment. Technological advancements in food processing and ingredient development allow for the efficient and palatable incorporation of vitamins and minerals into a wider range of products. Finally, the growing demand for convenience foods that also offer nutritional benefits aligns perfectly with the product offerings in this sector, making them highly attractive to busy consumers.

Obstacles in the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Market

Despite its robust growth, the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry faces several obstacles. Stringent regulatory frameworks and varying approval processes across different European countries can pose a challenge for market entry and product standardization. Consumer skepticism and misinformation regarding the efficacy and safety of fortified foods can create barriers to adoption, requiring significant educational efforts from manufacturers. Furthermore, supply chain disruptions and fluctuating raw material costs for vitamins and minerals can impact production costs and profit margins. Intense competition from established food and beverage giants as well as emerging niche players also exerts pressure on pricing and market share.

Future Opportunities in Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry

The future opportunities within the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry are abundant and diverse. The growing demand for personalized nutrition presents a significant avenue, with opportunities to develop fortified products tailored to specific dietary needs, health goals, and genetic profiles. Expansion into emerging markets within Europe, particularly in Eastern Europe, where health awareness is rising, offers substantial untapped potential. Technological advancements in areas like nanotechnology for nutrient delivery and bio-fortification techniques will enable the creation of more sophisticated and effective fortified products. Furthermore, the increasing popularity of plant-based diets creates an opportunity for innovative fortified dairy alternatives and plant-derived functional foods. The growing focus on mental well-being also opens doors for products fortified with vitamins and minerals known to support cognitive function and mood.

Major Players in the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Ecosystem

- Nestle SA

- Amway Corporation

- PepsiCo Inc

- The Hain Celestial Group Inc

- Fulfil

- Abbott Laboratories

- Danone SA

- The Coca-Cola Company

- Kellogg Company

- Marks and Spencer

Key Developments in Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Industry

- April 2023: Kellogg's launched its new breakfast: Rice Krispies cereals infused with vitamin D in fruity flavors. The company claims that consuming one bowl of these cereals provides 20% of the daily vitamin D requirement. These products are initially available in Europe through online distribution channels.

- August 2022: Operate Drinks in Europe launched its new sports drink, Operate Recovery. The company claims that the products are infused with vitamins and minerals and are available in two flavors: peach and green tea and raspberry and cranberry.

- March 2022: Moulins Dumée launched its Chanvrine flour mix for bakery derived from the French word “chanvre,” meaning “hemp.” Moulins Bourgeois also found its hemp-fortified bread combined with flaxseed. The combination provides protein, fiber, and omega-3 sources.

Strategic Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Market Forecast

The strategic forecast for the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry points towards continued robust growth driven by persistent health trends and innovation. The market is expected to expand significantly as consumers increasingly prioritize preventive health measures and seek convenient ways to meet their nutritional needs. Key growth catalysts include the ongoing development of novel fortified products targeting specific consumer segments like athletes, pregnant women, and the elderly, alongside the expansion of plant-based fortified options. Regulatory support for food fortification and advancements in bioavailability technologies will further bolster market potential. Strategic collaborations and an increasing focus on transparency in product formulation will also play a crucial role in shaping the industry's future, ensuring sustained consumer trust and market penetration in the coming years.

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Segmentation

-

1. Product Type

- 1.1. Cereal-based Products

- 1.2. Dairy Products

- 1.3. Beverages

- 1.4. Infant Formulas

- 1.5. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarket

- 2.2. Convenience Stores

- 2.3. Pharmacy/Drug Store

- 2.4. Online Retail Store

- 2.5. Other Distribution Channels

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Spain

- 5. Russia

- 6. Italy

- 7. Rest of Europe

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Regional Market Share

Geographic Coverage of Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry

Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for healthy alternative food products; Advancements in vitamin infusion into food products

- 3.3. Market Restrains

- 3.3.1. Expensive pricing of vitamin-infused food products

- 3.4. Market Trends

- 3.4.1. Growing Demand for Functional Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cereal-based Products

- 5.1.2. Dairy Products

- 5.1.3. Beverages

- 5.1.4. Infant Formulas

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarket

- 5.2.2. Convenience Stores

- 5.2.3. Pharmacy/Drug Store

- 5.2.4. Online Retail Store

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Spain

- 5.3.5. Russia

- 5.3.6. Italy

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Cereal-based Products

- 6.1.2. Dairy Products

- 6.1.3. Beverages

- 6.1.4. Infant Formulas

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarket/Hypermarket

- 6.2.2. Convenience Stores

- 6.2.3. Pharmacy/Drug Store

- 6.2.4. Online Retail Store

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Cereal-based Products

- 7.1.2. Dairy Products

- 7.1.3. Beverages

- 7.1.4. Infant Formulas

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarket/Hypermarket

- 7.2.2. Convenience Stores

- 7.2.3. Pharmacy/Drug Store

- 7.2.4. Online Retail Store

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Cereal-based Products

- 8.1.2. Dairy Products

- 8.1.3. Beverages

- 8.1.4. Infant Formulas

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarket/Hypermarket

- 8.2.2. Convenience Stores

- 8.2.3. Pharmacy/Drug Store

- 8.2.4. Online Retail Store

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Spain Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Cereal-based Products

- 9.1.2. Dairy Products

- 9.1.3. Beverages

- 9.1.4. Infant Formulas

- 9.1.5. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarket/Hypermarket

- 9.2.2. Convenience Stores

- 9.2.3. Pharmacy/Drug Store

- 9.2.4. Online Retail Store

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Russia Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Cereal-based Products

- 10.1.2. Dairy Products

- 10.1.3. Beverages

- 10.1.4. Infant Formulas

- 10.1.5. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarket/Hypermarket

- 10.2.2. Convenience Stores

- 10.2.3. Pharmacy/Drug Store

- 10.2.4. Online Retail Store

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Italy Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Cereal-based Products

- 11.1.2. Dairy Products

- 11.1.3. Beverages

- 11.1.4. Infant Formulas

- 11.1.5. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Supermarket/Hypermarket

- 11.2.2. Convenience Stores

- 11.2.3. Pharmacy/Drug Store

- 11.2.4. Online Retail Store

- 11.2.5. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Cereal-based Products

- 12.1.2. Dairy Products

- 12.1.3. Beverages

- 12.1.4. Infant Formulas

- 12.1.5. Other Product Types

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Supermarket/Hypermarket

- 12.2.2. Convenience Stores

- 12.2.3. Pharmacy/Drug Store

- 12.2.4. Online Retail Store

- 12.2.5. Other Distribution Channels

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Nestle SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Amway Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 PepsiCo Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 The Hain Celestial Group Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Fulfil

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Abbott Laboratories

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Danone SA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 The Coca-Cola Company

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Kellogg Company

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Marks and Spencer

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Nestle SA

List of Figures

- Figure 1: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 9: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 21: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 23: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 24: Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry?

The projected CAGR is approximately 3.89%.

2. Which companies are prominent players in the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry?

Key companies in the market include Nestle SA, Amway Corporation, PepsiCo Inc, The Hain Celestial Group Inc, Fulfil, Abbott Laboratories, Danone SA, The Coca-Cola Company, Kellogg Company, Marks and Spencer.

3. What are the main segments of the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for healthy alternative food products; Advancements in vitamin infusion into food products.

6. What are the notable trends driving market growth?

Growing Demand for Functional Food.

7. Are there any restraints impacting market growth?

Expensive pricing of vitamin-infused food products.

8. Can you provide examples of recent developments in the market?

April 2023: Kellogg's launched its new breakfast: Rice Krispies cereals infused with vitamin D in fruity flavors. The company claims that consuming one bowl of these cereals provides 20% of the daily vitamin D requirement. These products are initially available in Europe through online distribution channels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry?

To stay informed about further developments, trends, and reports in the Europe Vitamin Fortified and Mineral Enriched Foods & Beverages Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence