Key Insights

The European Cereal Bars Market is projected to reach $14.08 billion by 2033, expanding at a Compound Annual Growth Rate (CAGR) of 7.34% from 2025. This robust growth is driven by increasing consumer demand for convenient, healthy, and portable snack options. Heightened health consciousness, alongside a preference for natural ingredients and nutritional value, is accelerating cereal bar adoption as consumers seek healthier alternatives to traditional snacks. Continuous product innovation, including diverse flavors, specialized formulations (e.g., gluten-free, vegan, high-protein), and sustainable packaging, is expanding the consumer base and market penetration.

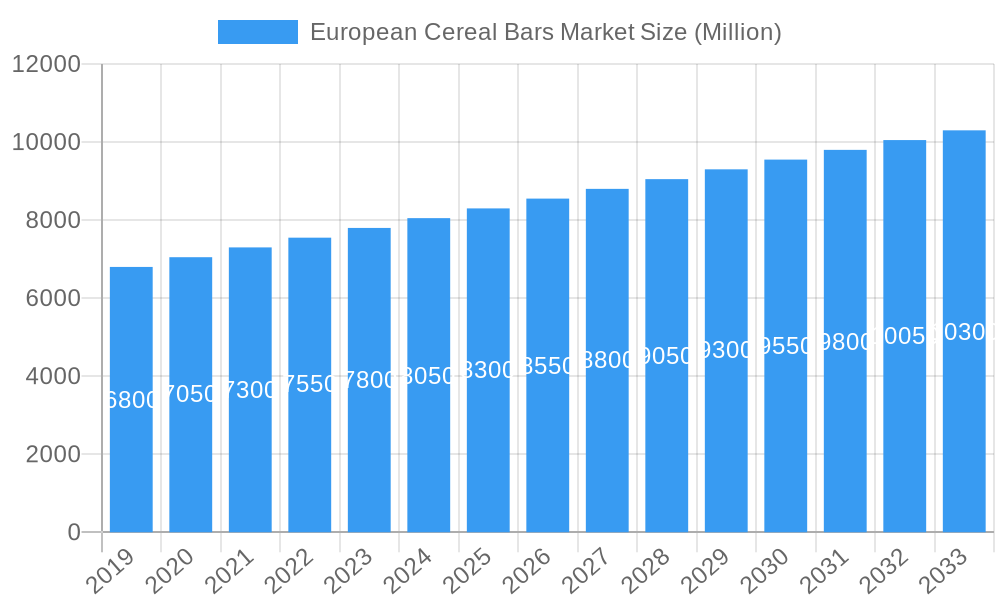

European Cereal Bars Market Market Size (In Billion)

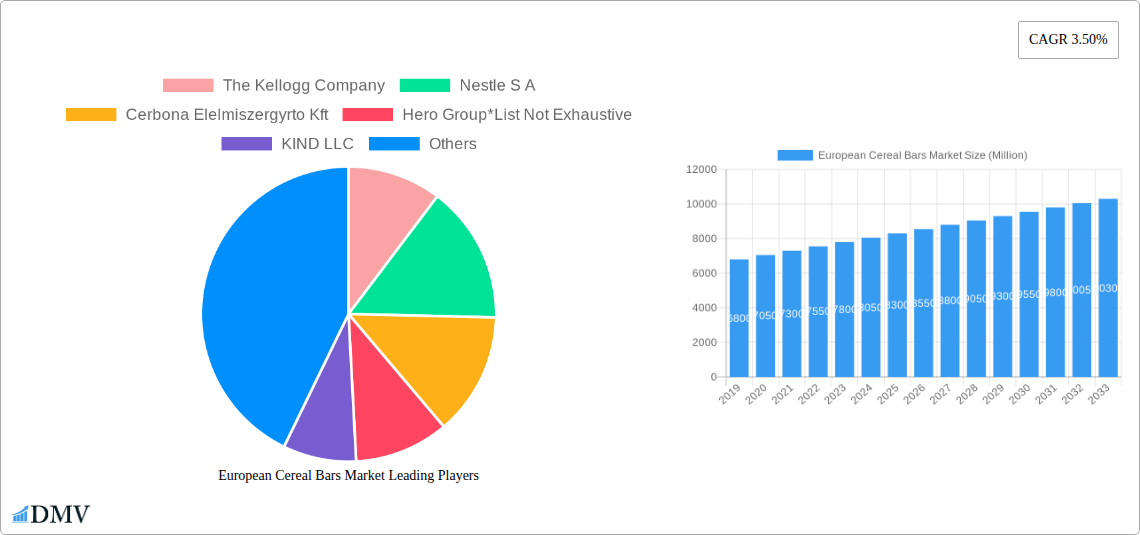

Evolving distribution channels and competitive dynamics further shape the market. The accessibility of cereal bars is enhanced by the growth of online retail and the convenience of supermarkets and hypermarkets, indicating a shift in consumer shopping habits. Leading companies such as The Kellogg Company, Nestle S.A., and General Mills are investing in marketing and product development to secure market share. However, intense competition from alternative snack categories and consumer price sensitivity, influenced by fluctuating raw material costs, present challenges. Despite these factors, the prevailing trend towards healthier lifestyles and convenient nutrition supports sustained growth in the European cereal bars market.

European Cereal Bars Market Company Market Share

This report provides a detailed analysis of the European Cereal Bars Market. The base year for the study is 2025, with projections extending through 2033. It offers critical insights into market structure, industry evolution, and future growth prospects, examining key players, emerging trends, and strategic drivers.

European Cereal Bars Market Market Composition & Trends

The European Cereal Bars Market is characterized by a moderate level of concentration, with key players actively shaping its trajectory. Innovation remains a primary catalyst, driven by evolving consumer preferences for healthier, more convenient, and ethically sourced food options. Regulatory landscapes, including food safety standards and labeling requirements, exert considerable influence on product development and market entry strategies. The presence of substitute products, such as other convenient snacks and functional food items, necessitates continuous differentiation and value proposition refinement. End-user profiles are diverse, encompassing health-conscious individuals, busy professionals, athletes, and families seeking on-the-go nutrition. Mergers and acquisitions (M&A) activity is a notable trend, with strategic deals aimed at expanding market reach, acquiring innovative technologies, and consolidating market share. For instance, the Kellogg Company and Nestle S.A., alongside Hero Group and KIND LLC, are consistently involved in strategic maneuvers to maintain and enhance their competitive positions. Estimated M&A deal values for key transactions are projected to reach significant figures in the coming years, underscoring the market's attractiveness.

- Market Share Distribution: Leading players are estimated to hold substantial shares, with detailed breakdowns provided for Granola/Muesli Bars and Other Bars segments.

- Innovation Catalysts: Focus on natural ingredients, low-sugar alternatives, plant-based options, and functional benefits like added protein or fiber.

- Regulatory Landscapes: Stringent EU regulations on food composition, labeling, and health claims are critical considerations.

- Substitute Products: Analysis of competition from energy bars, protein bars, fruit snacks, and savory snacks.

- End-User Profiles: Detailed segmentation based on age, lifestyle, dietary needs, and purchasing habits.

- M&A Activities: Examination of recent and anticipated consolidation trends, including key deal drivers and target acquisitions.

European Cereal Bars Market Industry Evolution

The European Cereal Bars Market has witnessed a significant evolution driven by a confluence of factors, including robust market growth trajectories, continuous technological advancements, and a profound shift in consumer demands. Over the historical period (2019–2024) and projected through the forecast period (2025–2033), the market has demonstrated consistent expansion. This growth is underpinned by increasing consumer awareness regarding healthy eating habits and the demand for convenient, on-the-go food solutions. Technological advancements in food processing, ingredient sourcing, and packaging have enabled manufacturers to introduce innovative products that cater to specific dietary needs and preferences. For example, advancements in extrusion technology and natural ingredient preservation techniques have allowed for the creation of bars with improved texture, shelf-life, and nutritional profiles.

Consumer demand has shifted considerably, moving beyond basic caloric intake to a focus on functional benefits and clean labels. Consumers are actively seeking gluten-free cereal bars, vegan cereal bars, and options with high protein content. The rise of personalized nutrition is also influencing product development, leading to an increased demand for low-sugar cereal bars and bars tailored for specific athletic performances or dietary restrictions. The market is seeing a growing demand for organic cereal bars and those that are ethically and sustainably sourced. These evolving consumer expectations have spurred significant investment in research and development, with companies like Eat Natural and General Mills investing heavily in understanding and meeting these demands. The penetration of online cereal bar sales has also increased, reflecting changing purchasing habits and the convenience offered by e-commerce platforms. The adoption rate of new product formulations and packaging technologies has been steadily rising, indicating a receptive market for innovation. The market’s annual growth rate is projected to be robust throughout the forecast period, driven by these underlying trends.

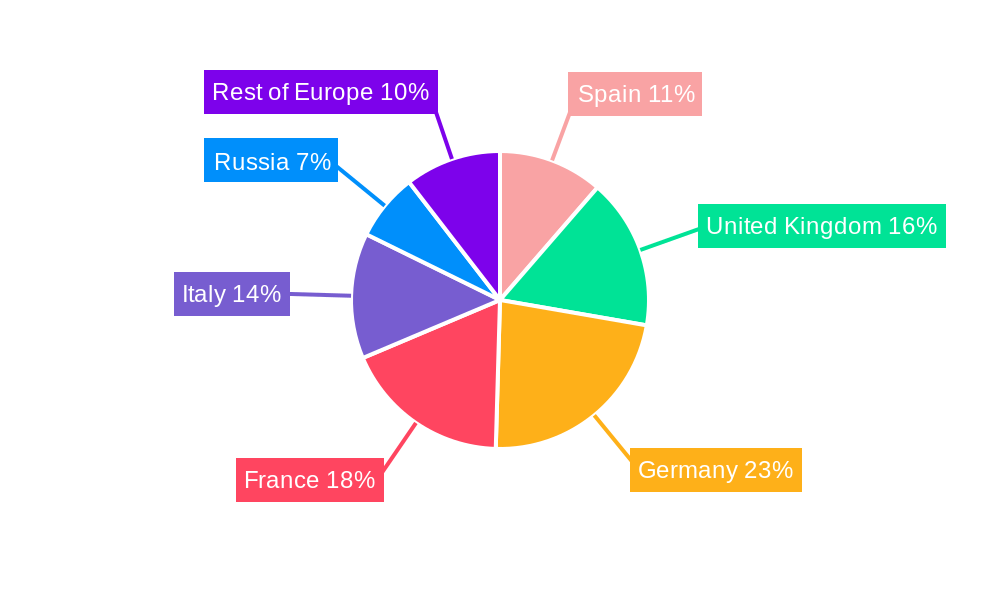

Leading Regions, Countries, or Segments in European Cereal Bars Market

Dominance within the European Cereal Bars Market is not monolithic, but rather a complex interplay of regional strengths, country-specific demands, and segment preferences. The Granola/Muesli Bars segment consistently leads due to its established presence and perceived health benefits, appealing to a broad consumer base seeking wholesome and fiber-rich options. Countries like Germany, the United Kingdom, and France represent major consumption hubs, driven by a combination of high disposable incomes, health-conscious populations, and well-developed retail infrastructures.

In terms of distribution channels, Supermarkets/Hypermarkets remain the primary avenue for cereal bar sales, offering extensive shelf space and accessibility to a large customer base. However, the rapid growth of Online Stores is a significant trend, particularly for specialized or niche brands and direct-to-consumer offerings. Convenience Stores also play a crucial role in capturing impulse purchases and serving on-the-go consumers. Investment trends in these regions are largely directed towards product innovation and marketing campaigns that emphasize health, natural ingredients, and convenience. Regulatory support for healthy food products further bolsters market growth.

- Dominant Product Type: Granola/Muesli Bars continue to hold the largest market share, attributed to their perception as a healthy and filling snack.

- Key Drivers: Consumer preference for fiber-rich and natural ingredients.

- Market Penetration: High availability and brand loyalty across major European countries.

- Leading Distribution Channels: Supermarkets/Hypermarkets dominate due to their widespread reach and diverse product offerings.

- Key Drivers: Convenience, one-stop shopping experience, and promotional activities.

- Growth Trajectory: Steady growth projected, with increasing focus on private label offerings.

- Emerging Distribution Channel: Online Stores are witnessing significant growth, fueled by e-commerce adoption and the demand for specialized and direct-to-consumer products.

- Key Drivers: Convenience, wider selection, and competitive pricing.

- Adoption Metrics: Increasing click-and-collect services and subscription models.

- Key Country Markets: Germany and the UK are at the forefront, driven by strong consumer spending on health and wellness products.

- Investment Trends: Significant investment in R&D and marketing by major players.

- Regulatory Support: Favorable policies promoting healthier food choices.

European Cereal Bars Market Product Innovations

Product innovations in the European Cereal Bars Market are centered on enhancing nutritional value, catering to specific dietary needs, and improving taste and texture. Companies are increasingly focusing on developing plant-based cereal bars, keto-friendly cereal bars, and those fortified with probiotics or adaptogens. Unique selling propositions often revolve around the use of premium, ethically sourced ingredients like ancient grains, superfruits, and natural sweeteners. Technological advancements in ingredient processing and formulation are enabling the creation of bars with superior mouthfeel and extended shelf-life without artificial preservatives. Performance metrics such as protein content, sugar levels, and fiber richness are key differentiators, driving the development of bars tailored for athletes, busy professionals, and individuals managing specific health conditions.

Propelling Factors for European Cereal Bars Market Growth

Several key factors are propelling the European Cereal Bars Market forward. The growing health and wellness trend is paramount, with consumers actively seeking convenient and nutritious snack options. Technological advancements in food manufacturing allow for the creation of diverse and appealing products. Economically, rising disposable incomes in many European nations support increased spending on premium and health-focused food items. Furthermore, regulatory environments that promote healthier food choices and clear labeling contribute to market expansion. For instance, the increasing demand for vegan cereal bars and gluten-free cereal bars reflects these evolving consumer preferences and regulatory support for clearer allergen information.

Obstacles in the European Cereal Bars Market Market

Despite robust growth, the European Cereal Bars Market faces several obstacles. Stringent and evolving regulatory challenges regarding ingredient sourcing, labeling accuracy, and health claims can pose significant hurdles for new entrants and product development. Supply chain disruptions, particularly in the sourcing of key ingredients like oats and nuts, can impact production costs and availability. Intense competitive pressures from both established brands and emerging niche players also necessitate continuous innovation and aggressive marketing strategies to maintain market share. The increasing consumer demand for transparency regarding ingredient origins and ethical sourcing also presents a challenge for companies with complex global supply chains.

Future Opportunities in European Cereal Bars Market

Emerging opportunities in the European Cereal Bars Market are abundant and diverse. The growing demand for personalized nutrition presents a significant avenue, with potential for customizable bars catering to individual dietary requirements and health goals. Innovations in alternative sweeteners and protein sources will continue to drive product development. The expansion of online retail channels and direct-to-consumer models offers a direct pathway to reach niche consumer segments. Furthermore, the increasing focus on sustainability and ethical sourcing creates opportunities for brands that can demonstrate a strong commitment to environmental and social responsibility, such as Cerbona Elelmiszergyrto Kft's potential for sustainable sourcing initiatives.

Major Players in the European Cereal Bars Market Ecosystem

- The Kellogg Company

- Nestle S A

- Cerbona Elelmiszergyrto Kft

- Hero Group

- KIND LLC

- Eat Natural

- General Mills

Key Developments in European Cereal Bars Market Industry

- 2023/Q4: Launch of new plant-based protein bars by Nestle S A, targeting vegan consumers.

- 2023/Q3: The Kellogg Company expands its healthy snacking portfolio with a range of low-sugar granola bars.

- 2023/Q2: Hero Group acquires a smaller organic cereal bar producer to enhance its market presence in specialty foods.

- 2023/Q1: KIND LLC introduces innovative functional cereal bars with added adaptogens.

- 2022/Q4: General Mills reports strong growth in its cereal bar segment, driven by demand for convenient breakfast options.

- 2022/Q3: Eat Natural launches a new line of gluten-free and dairy-free cereal bars.

- 2022/Q2: Cerbona Elelmiszergyrto Kft focuses on expanding its export markets for its traditional muesli bars.

Strategic European Cereal Bars Market Market Forecast

The European Cereal Bars Market is poised for continued substantial growth, fueled by a confluence of expanding consumer demand for healthy and convenient food options, ongoing product innovation, and favorable economic conditions. Key growth catalysts include the relentless pursuit of healthier formulations, such as low-sugar cereal bars and high-protein cereal bars, alongside the rising popularity of plant-based cereal bars and organic cereal bars. The increasing penetration of online retail and direct-to-consumer models will further democratize market access. Strategic investments in research and development, coupled with a keen understanding of evolving consumer preferences for transparency and sustainability, will be crucial for capturing future market potential. The market is expected to witness continued consolidation and new product introductions, driven by the desire to cater to increasingly sophisticated and health-conscious European consumers.

European Cereal Bars Market Segmentation

-

1. Product Type

- 1.1. Granola/Muesli Bars

- 1.2. Other Bars

-

2. Distribution Channel

- 2.1. Convenience Stores

- 2.2. Supermarkets/Hypermarkets

- 2.3. Specialty Stores

- 2.4. Online Stores

- 2.5. Other Distribution Channels

European Cereal Bars Market Segmentation By Geography

- 1. Spain

- 2. United Kingdom

- 3. Germany

- 4. France

- 5. Italy

- 6. Russia

- 7. Rest of Europe

European Cereal Bars Market Regional Market Share

Geographic Coverage of European Cereal Bars Market

European Cereal Bars Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology

- 3.3. Market Restrains

- 3.3.1. Deteriorating Fertility of Agricultural Lands

- 3.4. Market Trends

- 3.4.1 Increased Preference for on-the-go Breakfast

- 3.4.2 Convenience

- 3.4.3 and Meal Replacement Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Cereal Bars Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Granola/Muesli Bars

- 5.1.2. Other Bars

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Stores

- 5.2.2. Supermarkets/Hypermarkets

- 5.2.3. Specialty Stores

- 5.2.4. Online Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.3.2. United Kingdom

- 5.3.3. Germany

- 5.3.4. France

- 5.3.5. Italy

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Spain European Cereal Bars Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Granola/Muesli Bars

- 6.1.2. Other Bars

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Convenience Stores

- 6.2.2. Supermarkets/Hypermarkets

- 6.2.3. Specialty Stores

- 6.2.4. Online Stores

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom European Cereal Bars Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Granola/Muesli Bars

- 7.1.2. Other Bars

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Convenience Stores

- 7.2.2. Supermarkets/Hypermarkets

- 7.2.3. Specialty Stores

- 7.2.4. Online Stores

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Germany European Cereal Bars Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Granola/Muesli Bars

- 8.1.2. Other Bars

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Convenience Stores

- 8.2.2. Supermarkets/Hypermarkets

- 8.2.3. Specialty Stores

- 8.2.4. Online Stores

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. France European Cereal Bars Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Granola/Muesli Bars

- 9.1.2. Other Bars

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Convenience Stores

- 9.2.2. Supermarkets/Hypermarkets

- 9.2.3. Specialty Stores

- 9.2.4. Online Stores

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Italy European Cereal Bars Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Granola/Muesli Bars

- 10.1.2. Other Bars

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Convenience Stores

- 10.2.2. Supermarkets/Hypermarkets

- 10.2.3. Specialty Stores

- 10.2.4. Online Stores

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Russia European Cereal Bars Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Granola/Muesli Bars

- 11.1.2. Other Bars

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. Convenience Stores

- 11.2.2. Supermarkets/Hypermarkets

- 11.2.3. Specialty Stores

- 11.2.4. Online Stores

- 11.2.5. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe European Cereal Bars Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Granola/Muesli Bars

- 12.1.2. Other Bars

- 12.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.2.1. Convenience Stores

- 12.2.2. Supermarkets/Hypermarkets

- 12.2.3. Specialty Stores

- 12.2.4. Online Stores

- 12.2.5. Other Distribution Channels

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 The Kellogg Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Nestle S A

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Cerbona Elelmiszergyrto Kft

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Hero Group*List Not Exhaustive

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 KIND LLC

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Eat Natural

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 General Mills

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.1 The Kellogg Company

List of Figures

- Figure 1: European Cereal Bars Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: European Cereal Bars Market Share (%) by Company 2025

List of Tables

- Table 1: European Cereal Bars Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: European Cereal Bars Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: European Cereal Bars Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: European Cereal Bars Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: European Cereal Bars Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: European Cereal Bars Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: European Cereal Bars Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: European Cereal Bars Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 9: European Cereal Bars Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: European Cereal Bars Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: European Cereal Bars Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: European Cereal Bars Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: European Cereal Bars Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: European Cereal Bars Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: European Cereal Bars Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: European Cereal Bars Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: European Cereal Bars Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: European Cereal Bars Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: European Cereal Bars Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: European Cereal Bars Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 21: European Cereal Bars Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: European Cereal Bars Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 23: European Cereal Bars Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 24: European Cereal Bars Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Cereal Bars Market?

The projected CAGR is approximately 7.34%.

2. Which companies are prominent players in the European Cereal Bars Market?

Key companies in the market include The Kellogg Company, Nestle S A, Cerbona Elelmiszergyrto Kft, Hero Group*List Not Exhaustive, KIND LLC, Eat Natural, General Mills.

3. What are the main segments of the European Cereal Bars Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.08 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology.

6. What are the notable trends driving market growth?

Increased Preference for on-the-go Breakfast. Convenience. and Meal Replacement Products.

7. Are there any restraints impacting market growth?

Deteriorating Fertility of Agricultural Lands.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Cereal Bars Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Cereal Bars Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Cereal Bars Market?

To stay informed about further developments, trends, and reports in the European Cereal Bars Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence