Key Insights

The global coffee creamer market is projected to reach a market size of USD 7.5 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 6.51% through 2033. This significant growth is propelled by evolving consumer preferences for convenient and enhanced coffee experiences, coupled with the increasing integration of coffee into daily routines worldwide. The market is characterized by innovation, focusing on diverse flavors, plant-based options, and healthier formulations to attract a broader consumer base. Key growth drivers include rising disposable incomes in emerging economies, fostering increased spending on premium coffee products, and the sustained trend of at-home coffee consumption, amplified by evolving work lifestyles.

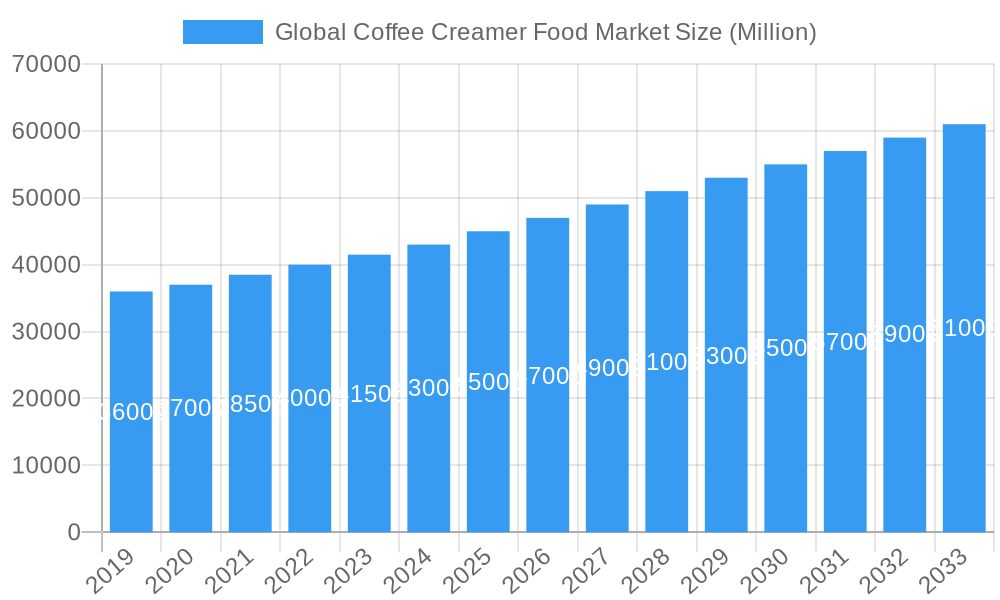

Global Coffee Creamer Food Market Market Size (In Billion)

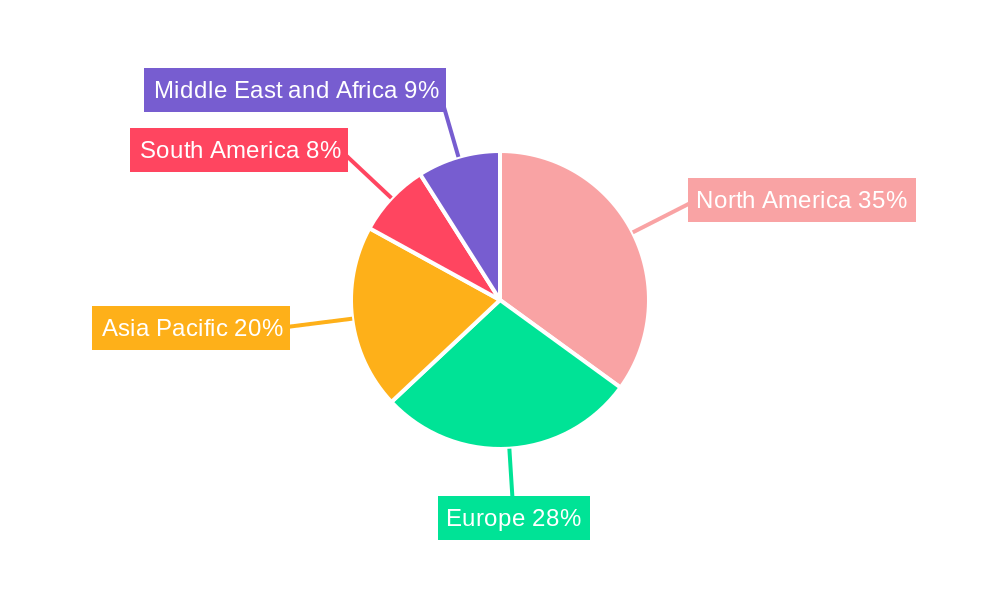

Both powdered and liquid creamer segments demonstrate strong performance, catering to diverse consumer needs for convenience, shelf-life, and ease of use. The competitive landscape features established global corporations and dynamic regional manufacturers employing strategies such as new product launches, mergers, acquisitions, and expanded distribution. Online retail is rapidly emerging as a key distribution channel, supplementing traditional sales in supermarkets and hypermarkets. However, challenges like volatile raw material costs and growing consumer awareness of sugar content and artificial ingredients necessitate strategic innovation. Intense price competition and the rising popularity of black coffee also present market dynamics. Despite these factors, the trend towards premiumization, health-conscious choices, and convenient at-home consumption indicates a robust future for the coffee creamer market. North America and Asia Pacific, driven by high coffee consumption and substantial market potential, will remain critical regions for investment and strategic development.

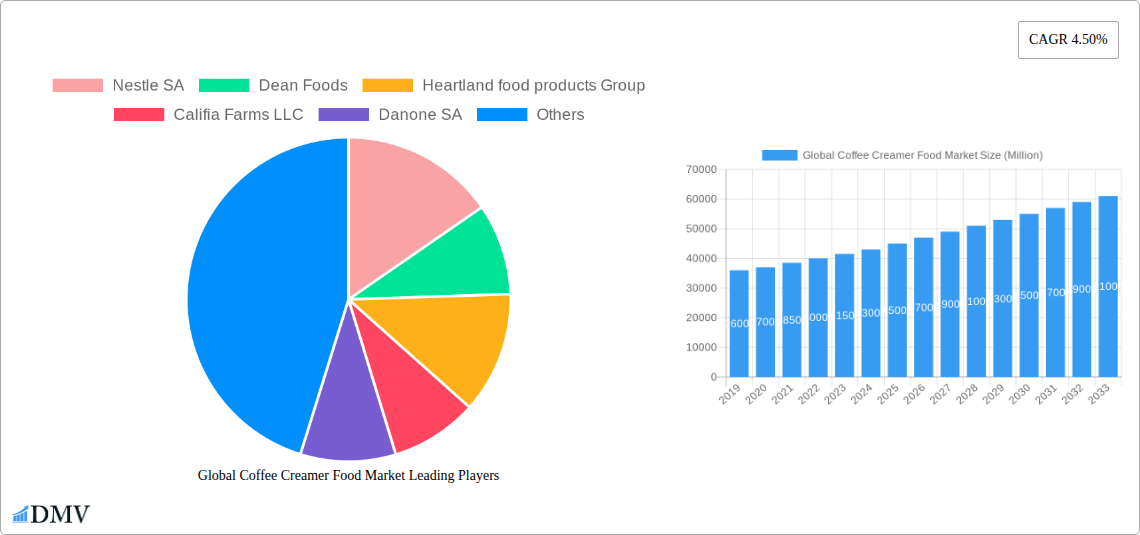

Global Coffee Creamer Food Market Company Market Share

Global Coffee Creamer Food Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report delivers a definitive analysis of the global coffee creamer food market, providing critical insights for stakeholders to navigate this dynamic industry. Covering the historical period of 2019-2024 and extending to a robust forecast through 2033, with a base year of 2025, this study unpacks market composition, growth trajectories, leading regions, product innovations, and future opportunities. Dive into the market dynamics, understand competitive landscapes, and identify strategic pathways for success in the burgeoning coffee creamer sector.

Global Coffee Creamer Food Market Market Composition & Trends

The global coffee creamer food market exhibits a moderate to high level of concentration, driven by the strategic presence of multinational giants like Nestle SA and Danone SA, alongside agile specialized players such as Califia Farms LLC and Heartland Food Products Group. Innovation serves as a primary catalyst, with companies continuously introducing novel flavors and formats to cater to evolving consumer preferences for indulgence and convenience. Regulatory landscapes vary by region, influencing product formulations, labeling requirements, and ingredient sourcing. The threat of substitute products, including dairy milk and plant-based alternatives, remains a consideration, though coffee creamers offer distinct taste profiles and functionalities. End-user profiles are diverse, encompassing daily coffee drinkers seeking enhanced flavor and texture, as well as those with specific dietary needs or a preference for indulgent coffee experiences. Mergers and acquisitions (M&A) activity, while not consistently high, plays a role in market consolidation and expansion, with deal values typically ranging from tens of millions to several hundred million dollars, influencing market share distribution. The market is characterized by a steady influx of new product launches, fostering dynamic competition and driving overall market growth. The strategic advantage lies in companies that can effectively leverage consumer trends for novel flavor development and sustainable sourcing.

Global Coffee Creamer Food Market Industry Evolution

The global coffee creamer food market has witnessed a significant evolutionary journey, marked by consistent growth driven by changing consumer lifestyles and an increasing appreciation for enhanced coffee experiences. Throughout the historical period (2019-2024) and into the forecast period (2025-2033), the market has been shaped by several key trends. Firstly, a discernible shift towards premiumization has occurred, with consumers willing to spend more on coffee creamers that offer unique flavors, healthier formulations, and artisanal qualities. This is evident in the rising demand for plant-based creamers, driven by health and environmental consciousness, and the popularity of gourmet flavor profiles, moving beyond traditional vanilla and hazelnut. Technological advancements in processing and formulation have enabled manufacturers to develop creamers with improved shelf stability, richer textures, and a wider array of flavor combinations without compromising on taste. For instance, the development of advanced emulsification techniques has led to smoother, more homogenous creamers that blend seamlessly with coffee.

Consumer demand has been profoundly influenced by the rise of the "at-home barista" culture, accelerated by global events that encouraged more consumers to replicate coffee shop experiences in their own kitchens. This has fueled demand for a broader variety of coffee creamer options that mimic the offerings found in cafes. Furthermore, the growing awareness of health and wellness has spurred innovation in low-sugar, lactose-free, and dairy-alternative creamer segments. Companies are responding by investing in research and development to create products that align with these evolving dietary preferences, contributing to a projected market growth rate of approximately 4-6% annually over the forecast period. The distribution channels have also adapted, with online retail stores experiencing substantial growth, offering consumers unparalleled convenience and access to a wider selection of products. This evolution underscores the market's responsiveness to consumer needs, technological progress, and the ever-changing landscape of beverage consumption. The industry's ability to innovate and adapt to these shifts will be crucial for sustained success.

Leading Regions, Countries, or Segments in Global Coffee Creamer Food Market

The global coffee creamer food market is demonstrably led by North America, particularly the United States, which consistently accounts for a substantial share of the market. This dominance is fueled by a deeply ingrained coffee culture, high disposable incomes, and a strong consumer appetite for flavor innovation and convenience.

Key Drivers for North America's Dominance:

- High Coffee Consumption Rates: North America, especially the US, has one of the highest per capita coffee consumption rates globally, creating a massive and consistent demand for coffee-related products, including creamers.

- Product Innovation Hub: The region is a fertile ground for product innovation, with manufacturers frequently launching new flavors, formats, and formulations that resonate with evolving consumer preferences.

- Strong Retail Infrastructure: The well-established supermarket and hypermarket chains, coupled with the rapid expansion of online retail, ensure widespread availability and accessibility of coffee creamers. Convenience stores also play a significant role in impulse purchases.

- Consumer Willingness to Experiment: American consumers are generally more open to trying new and exotic flavors, which encourages manufacturers to invest in diverse product lines.

- Growing Health and Wellness Trend: The increasing demand for plant-based, sugar-free, and functional creamers further fuels market growth within the region, with companies actively developing products to meet these specific needs.

In terms of segments, Liquid Creamer commands the largest market share within North America due to its superior taste, texture, and ease of use compared to powdered alternatives. Consumers often associate liquid creamers with a richer, more indulgent coffee experience.

- Liquid Creamer Dominance: Its widespread availability in various sizes, from single-serve to larger family-sized bottles, caters to diverse consumer needs. Brands like Nestle's Coffee Mate and Dean Foods have established strong brand loyalty in this segment.

- Supermarket & Hypermarkets as Primary Distribution Channels: These channels offer a comprehensive selection of coffee creamers, allowing consumers to compare brands and choose based on price, flavor, and dietary attributes. Promotional activities and prominent shelf placement in these outlets further bolster their importance.

- Online Retail's Growing Influence: While traditional retail remains dominant, online retail stores are rapidly gaining traction, offering convenience, a wider product selection, and competitive pricing, especially for niche or specialty creamers.

- Convenience Stores: These act as crucial touchpoints for immediate consumption needs and impulse purchases, particularly for single-serving or smaller liquid creamer options.

The market's trajectory in North America is further shaped by ongoing M&A activities and strategic partnerships that aim to consolidate market share and expand product portfolios. The region's receptiveness to new trends, coupled with a robust economic environment, positions it as the undisputed leader in the global coffee creamer food market.

Global Coffee Creamer Food Market Product Innovations

Product innovation in the global coffee creamer food market is a relentless pursuit of enhanced consumer experience and expanded market reach. Companies are actively diversifying beyond traditional vanilla and hazelnut to explore a vast spectrum of flavor profiles, often inspired by popular desserts and beverages. Examples include the introduction of indulgent flavors like M&Ms milk chocolate, oatmeal crème pie, and glazed donut by Coffee Mate in January 2021, demonstrating a clear strategy to tap into consumer nostalgia and treat-seeking behaviors. The launch of Drumstick Ice Cream Coffee Creamer by Coffee Mate in March 2022, featuring notes of milk chocolate, peanuts, and waffle cone, further exemplifies this trend towards dessert-inspired, multi-layered flavor experiences. Dunkin's Pumpkin Munchkin creamer in August 2022, with its pumpkin-forward flavor and hints of sweet donut glaze, showcases a focus on seasonal and iconic brand flavor tie-ins. These innovations not only expand the product portfolio but also drive trial and repeat purchases by offering novel and exciting taste sensations that elevate the daily coffee ritual into a more enjoyable indulgence. The performance metrics of these innovations are often measured by increased sales volumes, market share gains, and positive consumer feedback on taste and product quality.

Propelling Factors for Global Coffee Creamer Food Market Growth

The global coffee creamer food market is propelled by a confluence of interconnected factors. The escalating global demand for coffee, driven by changing lifestyle habits and the increasing popularity of coffee shop culture extending to home consumption, forms the bedrock of growth. Technological advancements in product formulation have enabled manufacturers to create a wider array of flavors, textures, and healthier options, such as plant-based and sugar-free variants, directly appealing to diverse consumer needs and preferences. Economic growth in emerging markets, coupled with rising disposable incomes, empowers a larger consumer base to opt for premium coffee and related enhancements like creamers. Furthermore, effective marketing strategies and product placement across various distribution channels, including traditional retail and booming online platforms, ensure accessibility and encourage consumer adoption. Innovations in packaging, offering convenience and longer shelf life, also play a pivotal role in attracting and retaining customers.

Obstacles in the Global Coffee Creamer Food Market Market

Despite robust growth, the global coffee creamer food market faces several obstacles. Stringent regulatory landscapes concerning ingredient sourcing, labeling, and health claims can pose challenges for manufacturers, requiring continuous adaptation and compliance. Fluctuations in the prices of key raw materials, such as dairy and plant-based ingredients, can impact production costs and profit margins, leading to price volatility for consumers. Intense competition from both established brands and emerging niche players, including plant-based alternatives, necessitates significant investment in product differentiation and marketing to capture market share. Furthermore, disruptions in global supply chains, exacerbated by geopolitical events or natural disasters, can affect the availability and timely delivery of essential components, potentially leading to stockouts and customer dissatisfaction. Evolving consumer perceptions around health and wellness, particularly regarding sugar content and artificial ingredients, can also act as a restraint, driving demand towards simpler, less processed alternatives.

Future Opportunities in Global Coffee Creamer Food Market

The future of the global coffee creamer food market is ripe with opportunities. The burgeoning demand for plant-based and functional creamers, catering to health-conscious consumers and those with dietary restrictions, presents a significant growth avenue. Expansion into emerging economies with rapidly growing middle classes and increasing coffee consumption will unlock new consumer bases. Innovations in sustainable sourcing and eco-friendly packaging will resonate with environmentally conscious consumers, creating a competitive advantage. The development of novel, exotic flavors and limited-edition offerings tied to seasonal events or popular culture can drive consumer engagement and boost sales. Leveraging e-commerce platforms for direct-to-consumer sales and personalized product offerings will further enhance market reach and customer loyalty. The integration of new technologies, such as natural flavor encapsulation and allergen-free formulations, will also open doors for product differentiation and market leadership.

Major Players in the Global Coffee Creamer Food Market Ecosystem

- Nestle SA

- Dean Foods

- Heartland Food Products Group

- Califia Farms LLC

- Danone SA

- HP Hood LLC

- Leaner Creamer LLC

- Bay Valley Foods LLC

- Shamrock Foods Company

- Walmart Inc

Key Developments in Global Coffee Creamer Food Market Industry

- March 2022: Coffee Mate Launched New Drumstick Ice Cream Coffee Creamer, featuring ice cream flavor with notes of milk chocolate, peanuts, and waffle cone.

- August 2022: Dunkin' company launched its new coffee creamer product with the new flavor Pumpkin Munchkin creamer, featuring a pumpkin-forward flavor with hints of sweet donut glaze and natural spices, available in 32oz bottles in supermarkets and local convenience stores in the United States.

- January 2021: Coffee Mate, a Nestle SA, launched three creamer flavors: M&Ms milk chocolate, oatmeal crème pie (combination of cinnamon, brown sugar, and oatmeal cookie), and glazed donut flavors.

Strategic Global Coffee Creamer Food Market Market Forecast

The strategic forecast for the global coffee creamer food market anticipates sustained growth, driven by the persistent rise in coffee consumption worldwide and an increasing consumer demand for enhanced and personalized coffee experiences. The market will be significantly shaped by the ongoing trend towards healthier options, with plant-based, lactose-free, and sugar-free creamers expected to gain substantial traction. Innovations in flavor profiles, moving beyond traditional offerings to incorporate dessert-inspired and exotic tastes, will continue to be a key growth catalyst, encouraging consumer exploration and repeat purchases. The expansion of online retail channels will provide greater accessibility and convenience, further fueling market penetration, especially in developing regions. Companies that focus on sustainability, ethical sourcing, and allergen-friendly formulations are poised to capture a larger market share, aligning with evolving consumer values. The overall market potential remains robust, with projections indicating a positive trajectory fueled by these strategic trends and consumer preferences.

Global Coffee Creamer Food Market Segmentation

-

1. Type

- 1.1. Powdered Coffee Creamer

- 1.2. Liquid Creamer

-

2. Distribution Channel

- 2.1. Supermarket & Hypermarkets

- 2.2. Convenience stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Global Coffee Creamer Food Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of the Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of south America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Global Coffee Creamer Food Market Regional Market Share

Geographic Coverage of Global Coffee Creamer Food Market

Global Coffee Creamer Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.51% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth In Foodservice Expenditure and Tourism Sector; Premiumization with the Growth of Fortified and Flavored Water

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding Plastic Waste and the Rising Inclination Toward Tap Water

- 3.4. Market Trends

- 3.4.1. Shift in consumers preference towards vegan and free-from coffee creamers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Coffee Creamer Food Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Powdered Coffee Creamer

- 5.1.2. Liquid Creamer

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket & Hypermarkets

- 5.2.2. Convenience stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Global Coffee Creamer Food Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Powdered Coffee Creamer

- 6.1.2. Liquid Creamer

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarket & Hypermarkets

- 6.2.2. Convenience stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Global Coffee Creamer Food Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Powdered Coffee Creamer

- 7.1.2. Liquid Creamer

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarket & Hypermarkets

- 7.2.2. Convenience stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Global Coffee Creamer Food Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Powdered Coffee Creamer

- 8.1.2. Liquid Creamer

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarket & Hypermarkets

- 8.2.2. Convenience stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Global Coffee Creamer Food Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Powdered Coffee Creamer

- 9.1.2. Liquid Creamer

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarket & Hypermarkets

- 9.2.2. Convenience stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Global Coffee Creamer Food Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Powdered Coffee Creamer

- 10.1.2. Liquid Creamer

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarket & Hypermarkets

- 10.2.2. Convenience stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nestle SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dean Foods

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Heartland food products Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Califia Farms LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Danone SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 HP Hood LLC*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Leaner Creamer LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bay Valley Foods LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Shamrock Foods Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Walmart Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Nestle SA

List of Figures

- Figure 1: Global Global Coffee Creamer Food Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Global Coffee Creamer Food Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Global Coffee Creamer Food Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Global Coffee Creamer Food Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Global Coffee Creamer Food Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Global Coffee Creamer Food Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Global Coffee Creamer Food Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Global Coffee Creamer Food Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Global Coffee Creamer Food Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Global Coffee Creamer Food Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: Europe Global Coffee Creamer Food Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Global Coffee Creamer Food Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Global Coffee Creamer Food Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Global Coffee Creamer Food Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Global Coffee Creamer Food Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Global Coffee Creamer Food Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Global Coffee Creamer Food Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Global Coffee Creamer Food Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Global Coffee Creamer Food Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Global Coffee Creamer Food Market Revenue (billion), by Type 2025 & 2033

- Figure 21: South America Global Coffee Creamer Food Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Global Coffee Creamer Food Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: South America Global Coffee Creamer Food Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Global Coffee Creamer Food Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Global Coffee Creamer Food Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Global Coffee Creamer Food Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Global Coffee Creamer Food Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Global Coffee Creamer Food Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Global Coffee Creamer Food Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Global Coffee Creamer Food Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Global Coffee Creamer Food Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Coffee Creamer Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Coffee Creamer Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Coffee Creamer Food Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Coffee Creamer Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Coffee Creamer Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Coffee Creamer Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Global Coffee Creamer Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Global Coffee Creamer Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Global Coffee Creamer Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Global Coffee Creamer Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Coffee Creamer Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Coffee Creamer Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Coffee Creamer Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Global Coffee Creamer Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Global Coffee Creamer Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: France Global Coffee Creamer Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Russia Global Coffee Creamer Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Global Coffee Creamer Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Global Coffee Creamer Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of the Europe Global Coffee Creamer Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Coffee Creamer Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Global Coffee Creamer Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Coffee Creamer Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: India Global Coffee Creamer Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: China Global Coffee Creamer Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Japan Global Coffee Creamer Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Global Coffee Creamer Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Global Coffee Creamer Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Coffee Creamer Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 30: Global Coffee Creamer Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Coffee Creamer Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Global Coffee Creamer Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Global Coffee Creamer Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of south America Global Coffee Creamer Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Coffee Creamer Food Market Revenue billion Forecast, by Type 2020 & 2033

- Table 36: Global Coffee Creamer Food Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Coffee Creamer Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 38: South Africa Global Coffee Creamer Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Global Coffee Creamer Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Global Coffee Creamer Food Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Coffee Creamer Food Market?

The projected CAGR is approximately 6.51%.

2. Which companies are prominent players in the Global Coffee Creamer Food Market?

Key companies in the market include Nestle SA, Dean Foods, Heartland food products Group, Califia Farms LLC, Danone SA, HP Hood LLC*List Not Exhaustive, Leaner Creamer LLC, Bay Valley Foods LLC, Shamrock Foods Company, Walmart Inc.

3. What are the main segments of the Global Coffee Creamer Food Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth In Foodservice Expenditure and Tourism Sector; Premiumization with the Growth of Fortified and Flavored Water.

6. What are the notable trends driving market growth?

Shift in consumers preference towards vegan and free-from coffee creamers.

7. Are there any restraints impacting market growth?

Concerns Regarding Plastic Waste and the Rising Inclination Toward Tap Water.

8. Can you provide examples of recent developments in the market?

In March 2022, Coffee Mate Launched New Drumstick Ice Cream Coffee Creamer. The new creamer features ice cream flavor and notes of milk chocolate, peanuts, and waffle cone.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Coffee Creamer Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Coffee Creamer Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Coffee Creamer Food Market?

To stay informed about further developments, trends, and reports in the Global Coffee Creamer Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence