Key Insights

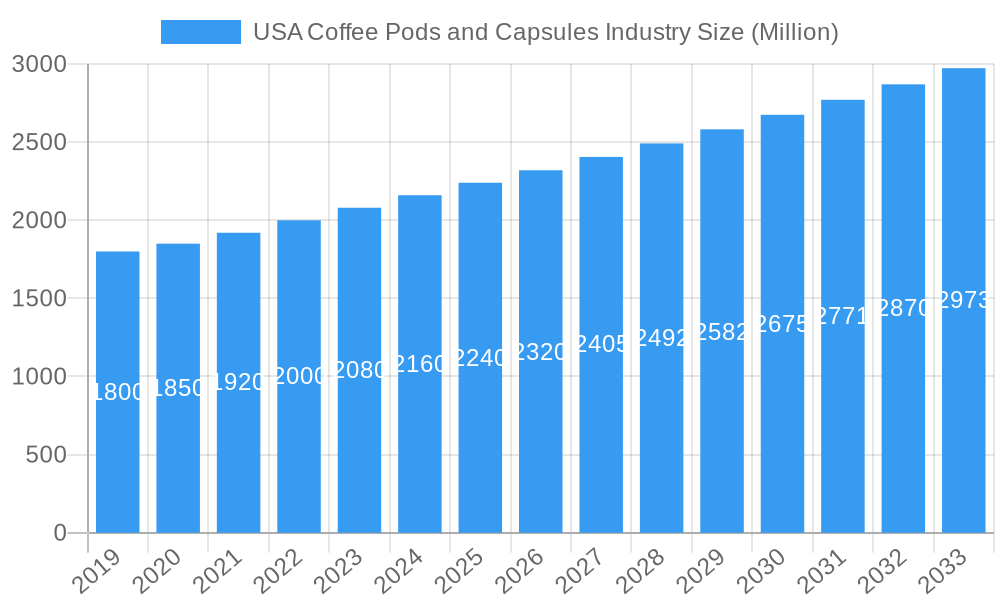

The USA coffee pods and capsules market is poised for robust growth, projected to reach an estimated XX million by 2025, and continue its upward trajectory with a compound annual growth rate (CAGR) of 3.76% through 2033. This sustained expansion is fueled by a confluence of evolving consumer preferences and technological advancements. The convenience factor remains a paramount driver, with busy lifestyles and a desire for quick, high-quality coffee experiences pushing demand for single-serve brewing systems. Advancements in pod technology, offering a wider variety of roasts, origins, and flavor profiles, are also appealing to a discerning consumer base seeking premium at-home coffee experiences. Furthermore, the increasing adoption of pod-based machines across both households and offices underscores the pervasive convenience and accessibility these products offer. The market is witnessing a significant shift towards specialty coffee and sustainable options, with consumers actively seeking ethically sourced and environmentally friendly products, impacting both product development and consumer purchasing decisions. This focus on premiumization and conscious consumption is a key differentiator within the competitive landscape.

USA Coffee Pods and Capsules Industry Market Size (In Billion)

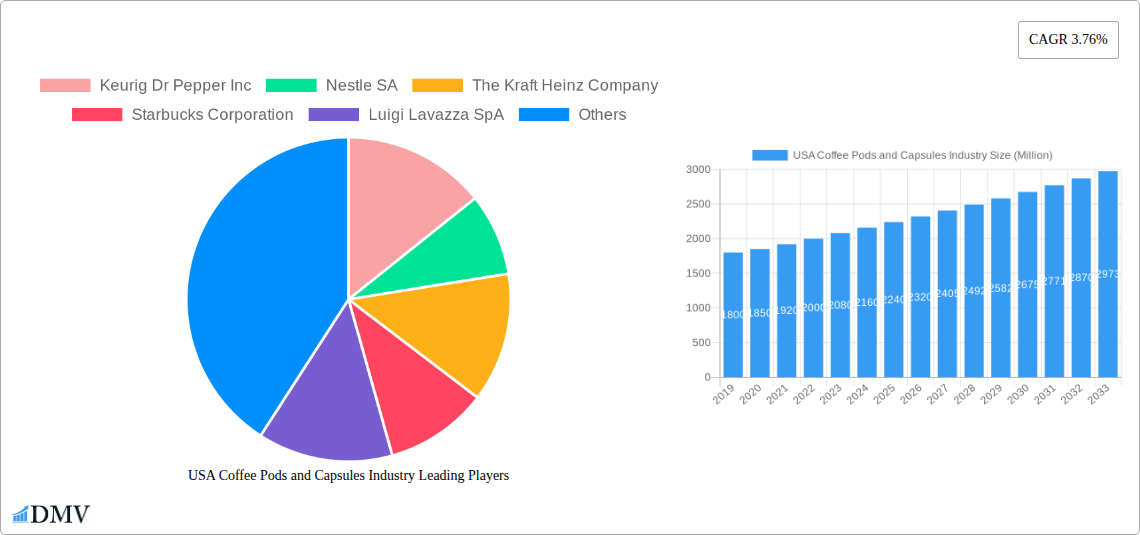

The market's dynamism is further shaped by evolving distribution channels and a competitive corporate environment. While off-trade channels, particularly supermarkets, hypermarkets, and increasingly, online retail, continue to dominate, the on-trade sector is also showing promise as establishments explore innovative coffee solutions. The competitive landscape is characterized by the presence of major global players like Keurig Dr Pepper Inc., Nestlé S.A., and Starbucks Corporation, alongside established coffee brands adapting to the pod format. These companies are actively investing in product innovation, marketing, and supply chain efficiencies to capture market share. Restraints such as increasing environmental concerns regarding single-use pods and the rising cost of raw materials like coffee beans present challenges. However, the industry is responding with the development of recyclable and compostable pod options, and strategic sourcing to mitigate price volatility. This proactive approach to sustainability and cost management will be crucial for continued market health and consumer trust.

USA Coffee Pods and Capsules Industry Company Market Share

Report Description: USA Coffee Pods and Capsules Industry Market Analysis and Forecast 2025-2033

Dive deep into the dynamic USA coffee pods and capsules industry with this comprehensive market report. Covering the historical period from 2019-2024 and projecting growth through 2033, this analysis offers unparalleled insights into market composition, trends, and future trajectories. We meticulously examine K-cup pods, Nespresso capsules, and other single-serve coffee formats, providing critical data for stakeholders in this rapidly evolving beverage sector. This report is essential for understanding market dynamics, competitive landscapes, and strategic growth avenues.

USA Coffee Pods and Capsules Industry Market Composition & Trends

The USA coffee pods and capsules industry is characterized by a moderately concentrated market, driven by innovation and evolving consumer preferences for convenience and premium coffee experiences. Key players are continuously investing in new product development and marketing to capture market share. The regulatory landscape, primarily concerning packaging sustainability and food safety, influences product design and material choices. Substitute products, such as instant coffee and whole bean coffee, pose a competitive challenge, but the convenience and consistent quality of pods and capsules continue to drive their adoption. End-user profiles span a wide demographic, from busy professionals seeking quick, quality coffee to households prioritizing ease of use and variety. Mergers and acquisitions (M&A) activities are a significant trend, with companies aiming to expand their product portfolios and distribution networks. The market is projected to reach $XX Million by 2025, with M&A deal values in the XX Million range influencing consolidation.

- Market Concentration: Moderately concentrated, dominated by a few key players.

- Innovation Catalysts: Demand for premium coffee, convenience, and sustainability.

- Regulatory Landscapes: Focus on packaging sustainability and food safety standards.

- Substitute Products: Instant coffee, ground coffee, whole bean coffee.

- End-User Profiles: Diverse, including professionals, households, and specialty coffee enthusiasts.

- M&A Activities: Ongoing consolidation to enhance market reach and product offerings.

USA Coffee Pods and Capsules Industry Industry Evolution

The USA coffee pods and capsules industry has witnessed remarkable evolution, driven by technological advancements, shifting consumer demands, and strategic market expansion. From the initial introduction of groundbreaking single-serve brewing systems, the market has matured into a sophisticated ecosystem catering to a wide array of preferences. The advent of K-cup pods revolutionized at-home coffee consumption, offering unparalleled convenience and a vast selection of coffee brands. Following suit, Nespresso capsules further elevated the premium segment, emphasizing espresso-based beverages and high-quality gourmet coffee.

Consumer demand has evolved significantly, moving beyond basic functionality to a desire for diverse flavor profiles, ethically sourced beans, and eco-friendly packaging. This has spurred significant innovation in coffee blends, roast levels, and capsule materials. The market growth trajectory has been consistently upward, with a projected Compound Annual Growth Rate (CAGR) of XX% between 2019 and 2033. Technological advancements have not only focused on brewing efficiency but also on creating recyclable and compostable capsule options, addressing growing environmental concerns. Adoption metrics for single-serve brewing systems have reached XX Million households by 2024, underscoring the widespread appeal and integration of these products into daily life. Strategic partnerships and acquisitions have further shaped the industry, with major players like Keurig Dr Pepper and Nestlé SA investing heavily in research and development to maintain their competitive edge and adapt to evolving market dynamics. The estimated market size for 2025 is projected to be $XX Million, reflecting sustained consumer interest and market resilience. The forecast period of 2025-2033 anticipates continued growth, fueled by innovation in specialty coffee offerings and a strong emphasis on sustainable solutions, further solidifying the dominance of the USA coffee pods and capsules industry.

Leading Regions, Countries, or Segments in USA Coffee Pods and Capsules Industry

The USA coffee pods and capsules industry exhibits distinct regional and segment dominance, primarily driven by consumer demographics, retail infrastructure, and brand penetration. Within the Type segment, Pods, particularly the ubiquitous K-cup format, continue to hold a commanding market share due to their widespread adoption in households and offices across the United States. Capsules, while representing a premium segment, are also experiencing robust growth, especially with the increasing popularity of espresso-based beverages.

The Distribution Channel landscape is heavily influenced by Off-Trade sales, with Supermarkets/Hypermarkets acting as the primary retail gateway for a vast majority of consumers seeking convenience and variety. These channels offer a wide array of brands and product types, making them the go-to destination for everyday coffee pod and capsule purchases. Online Retail Stores have emerged as a significant and rapidly growing channel, driven by the ease of home delivery, subscription models, and access to a broader selection of specialty and niche brands not always available in brick-and-mortar stores. This channel is expected to witness the highest growth rate in the coming years.

Specialty Stores cater to a discerning consumer base seeking premium and artisanal coffee options, contributing to the overall growth of the high-end segment. Convenience/Grocery Stores play a crucial role in capturing impulse purchases and serving consumers with immediate needs. The On-Trade segment, encompassing cafes and restaurants, also utilizes pods and capsules, albeit to a lesser extent than off-trade, often for specialized or quick-service offerings.

Key drivers for the dominance of Pods include:

- Ubiquitous Brewing System Adoption: The widespread presence of Keurig brewing machines in American households and workplaces.

- Brand Variety and Accessibility: A vast selection of coffee brands and roasters available in pod format.

- Convenience and Ease of Use: Minimal preparation time and straightforward cleaning.

The dominance of Supermarkets/Hypermarkets as a distribution channel is attributed to:

- Consumer Habit: Established shopping patterns for household essentials.

- One-Stop Shopping Experience: Consumers can purchase coffee pods alongside other groceries.

- Promotional Activities: Frequent discounts and bundle offers.

The significant growth of Online Retail Stores is propelled by:

- E-commerce Penetration: Increasing consumer comfort and trust in online shopping.

- Subscription Models: Recurring delivery services for convenience and cost savings.

- Niche Market Access: Availability of specialized and artisanal coffee brands.

The market size for Pods is estimated to be $XX Million in 2025, while Capsules are projected to reach $XX Million. The Off-Trade segment is expected to account for XX% of the total market revenue in 2025, with Online Retail Stores projected to grow at a CAGR of XX% during the forecast period.

USA Coffee Pods and Capsules Industry Product Innovations

Product innovations in the USA coffee pods and capsules industry are primarily focused on enhancing user experience, expanding flavor profiles, and addressing sustainability concerns. Companies are developing new blends of specialty and single-origin coffees, catering to a growing consumer demand for premium and diverse taste experiences. Technological advancements include improved capsule materials that preserve freshness and aroma for longer periods, as well as the introduction of compostable and recyclable options to appeal to environmentally conscious consumers. Innovations also extend to personalized brewing experiences, with smart brewing systems that allow users to customize coffee strength and temperature. These advancements ensure that the USA coffee pods and capsules industry remains at the forefront of convenient and high-quality coffee consumption, with new product launches driving market growth and consumer engagement.

Propelling Factors for USA Coffee Pods and Capsules Industry Growth

The USA coffee pods and capsules industry is propelled by a confluence of technological, economic, and consumer-driven factors. The persistent demand for convenience and speed in daily routines is a primary economic driver, making single-serve formats an attractive option for busy consumers. Technologically, the widespread adoption of single-serve brewing systems, such as Keurig machines, has created a massive installed base for coffee pods and a growing market for Nespresso capsules. Furthermore, the increasing consumer interest in specialty and gourmet coffee experiences, coupled with a willingness to pay a premium for quality and variety, fuels market expansion. Regulatory support for sustainable packaging initiatives also acts as a catalyst, encouraging innovation in eco-friendly capsule materials and manufacturing processes.

Obstacles in the USA Coffee Pods and Capsules Industry Market

Despite its robust growth, the USA coffee pods and capsules industry faces several obstacles. Environmental concerns regarding the waste generated by single-use plastic and aluminum pods remain a significant challenge, prompting calls for more sustainable alternatives and increasing regulatory scrutiny. Supply chain disruptions, including fluctuations in coffee bean prices and shipping costs, can impact profitability and product availability. Intense competition from both established brands and emerging players, as well as the persistent popularity of traditional coffee brewing methods like drip coffee and pour-over, create competitive pressures that can limit market share expansion. The cost of premium pods and capsules can also be a barrier for some price-sensitive consumers.

Future Opportunities in USA Coffee Pods and Capsules Industry

The USA coffee pods and capsules industry is poised for significant future opportunities. The growing demand for plant-based and ethically sourced coffee provides a fertile ground for new product development. Emerging technologies in biodegradable and compostable capsule materials offer solutions to environmental concerns, potentially unlocking new consumer segments. The expansion of direct-to-consumer (DTC) models and subscription services presents opportunities for increased customer loyalty and recurring revenue. Furthermore, the increasing popularity of cold brew and ready-to-drink coffee options could lead to the development of new pod and capsule formats catering to these consumption trends.

Major Players in the USA Coffee Pods and Capsules Industry Ecosystem

- Keurig Dr Pepper Inc

- Nestle SA

- The Kraft Heinz Company

- Starbucks Corporation

- Luigi Lavazza SpA

- JAB Holding Company

- Baronet Coffee

- The J M Smucker Company

- DD IP Holder LLC (Dunkin' Brands Group Inc)

- Tim Hortons

Key Developments in USA Coffee Pods and Capsules Industry Industry

- April 2023: Nestle's coffee brand Nespresso and Starbucks partnered to launch the 'Nespresso Starbucks Reserve Remix Blend,' a new limited-edition double espresso coffee capsule. The product initially retailed online, as well as at a few Nespresso boutiques and Starbucks Reserve Roasteries, and in select Reserve locations around the United States and the United Kingdom.

- October 2022: Nestlé announced their plans to acquire Seattle's Best Coffee brand from Starbucks. Seattle's Best Coffee's portfolio includes a range of whole bean, roast, and ground packaged coffee and K-Cup pods.

- July 2022: In response to the growing demand for specialty coffee in the United States, Keurig, in partnership with Dr. Pepper, has announced the introduction of Intelligentsia coffee in K-Cup pods for its Keurig brewing system. This strategic move aims to capitalize on the increasing popularity of specialty coffee among consumers, offering them a convenient and high-quality brewing experience through the Keurig platform.

Strategic USA Coffee Pods and Capsules Industry Market Forecast

The strategic USA coffee pods and capsules industry market forecast indicates sustained growth, driven by innovation and evolving consumer preferences. The continued demand for convenience and premium coffee experiences will fuel the expansion of both K-cup pods and Nespresso capsules. Key growth catalysts include advancements in sustainable packaging, the increasing popularity of specialty and single-origin coffees, and the robust growth of online retail channels. Strategic partnerships and acquisitions are expected to continue shaping the competitive landscape, enabling companies to expand their market reach and product offerings. The industry is projected to capitalize on emerging trends such as plant-based coffee and cold brew formats, ensuring its continued relevance and profitability in the coming years.

USA Coffee Pods and Capsules Industry Segmentation

-

1. Type

- 1.1. Pods

- 1.2. Capsules

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Supermarkets/Hypermarkets

- 2.1.2. Specialty Stores

- 2.1.3. Convenience/Grocery Stores

- 2.1.4. Online Retail Stores

- 2.2. On-Trade

-

2.1. Off-Trade

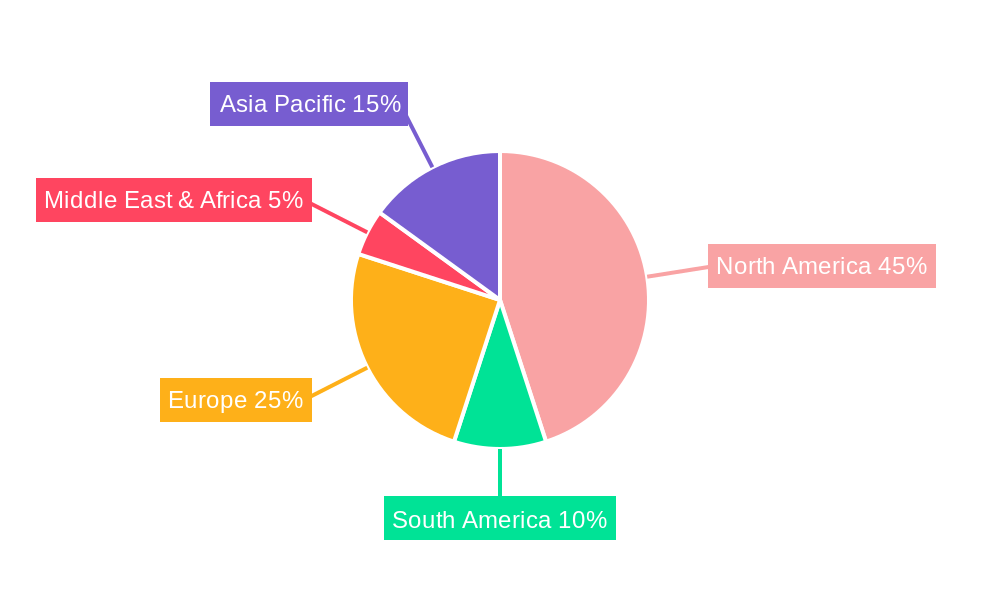

USA Coffee Pods and Capsules Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

USA Coffee Pods and Capsules Industry Regional Market Share

Geographic Coverage of USA Coffee Pods and Capsules Industry

USA Coffee Pods and Capsules Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Usage of Single-Serve Coffee in Households; Expanding Popularity of Specialty and Organic Coffee Pods and Capsules

- 3.3. Market Restrains

- 3.3.1. Increasing Usage of Single-Serve Coffee in Households; Expanding Popularity of Specialty and Organic Coffee Pods and Capsules

- 3.4. Market Trends

- 3.4.1. Increasing Usage of Single-serve Coffee in Households

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Coffee Pods and Capsules Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pods

- 5.1.2. Capsules

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Supermarkets/Hypermarkets

- 5.2.1.2. Specialty Stores

- 5.2.1.3. Convenience/Grocery Stores

- 5.2.1.4. Online Retail Stores

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America USA Coffee Pods and Capsules Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Pods

- 6.1.2. Capsules

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Off-Trade

- 6.2.1.1. Supermarkets/Hypermarkets

- 6.2.1.2. Specialty Stores

- 6.2.1.3. Convenience/Grocery Stores

- 6.2.1.4. Online Retail Stores

- 6.2.2. On-Trade

- 6.2.1. Off-Trade

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America USA Coffee Pods and Capsules Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Pods

- 7.1.2. Capsules

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Off-Trade

- 7.2.1.1. Supermarkets/Hypermarkets

- 7.2.1.2. Specialty Stores

- 7.2.1.3. Convenience/Grocery Stores

- 7.2.1.4. Online Retail Stores

- 7.2.2. On-Trade

- 7.2.1. Off-Trade

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe USA Coffee Pods and Capsules Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Pods

- 8.1.2. Capsules

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Off-Trade

- 8.2.1.1. Supermarkets/Hypermarkets

- 8.2.1.2. Specialty Stores

- 8.2.1.3. Convenience/Grocery Stores

- 8.2.1.4. Online Retail Stores

- 8.2.2. On-Trade

- 8.2.1. Off-Trade

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa USA Coffee Pods and Capsules Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Pods

- 9.1.2. Capsules

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Off-Trade

- 9.2.1.1. Supermarkets/Hypermarkets

- 9.2.1.2. Specialty Stores

- 9.2.1.3. Convenience/Grocery Stores

- 9.2.1.4. Online Retail Stores

- 9.2.2. On-Trade

- 9.2.1. Off-Trade

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific USA Coffee Pods and Capsules Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Pods

- 10.1.2. Capsules

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Off-Trade

- 10.2.1.1. Supermarkets/Hypermarkets

- 10.2.1.2. Specialty Stores

- 10.2.1.3. Convenience/Grocery Stores

- 10.2.1.4. Online Retail Stores

- 10.2.2. On-Trade

- 10.2.1. Off-Trade

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Keurig Dr Pepper Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nestle SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Kraft Heinz Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Starbucks Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Luigi Lavazza SpA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 JAB Holding Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Baronet Coffee

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The J M Smucker Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DD IP Holder LLC (Dunkin' Brands Group Inc )

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tim Hortons*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Keurig Dr Pepper Inc

List of Figures

- Figure 1: Global USA Coffee Pods and Capsules Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America USA Coffee Pods and Capsules Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America USA Coffee Pods and Capsules Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America USA Coffee Pods and Capsules Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 5: North America USA Coffee Pods and Capsules Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America USA Coffee Pods and Capsules Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America USA Coffee Pods and Capsules Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America USA Coffee Pods and Capsules Industry Revenue (undefined), by Type 2025 & 2033

- Figure 9: South America USA Coffee Pods and Capsules Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America USA Coffee Pods and Capsules Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 11: South America USA Coffee Pods and Capsules Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America USA Coffee Pods and Capsules Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America USA Coffee Pods and Capsules Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe USA Coffee Pods and Capsules Industry Revenue (undefined), by Type 2025 & 2033

- Figure 15: Europe USA Coffee Pods and Capsules Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe USA Coffee Pods and Capsules Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 17: Europe USA Coffee Pods and Capsules Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe USA Coffee Pods and Capsules Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe USA Coffee Pods and Capsules Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa USA Coffee Pods and Capsules Industry Revenue (undefined), by Type 2025 & 2033

- Figure 21: Middle East & Africa USA Coffee Pods and Capsules Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa USA Coffee Pods and Capsules Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa USA Coffee Pods and Capsules Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa USA Coffee Pods and Capsules Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa USA Coffee Pods and Capsules Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific USA Coffee Pods and Capsules Industry Revenue (undefined), by Type 2025 & 2033

- Figure 27: Asia Pacific USA Coffee Pods and Capsules Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific USA Coffee Pods and Capsules Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific USA Coffee Pods and Capsules Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific USA Coffee Pods and Capsules Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific USA Coffee Pods and Capsules Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global USA Coffee Pods and Capsules Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global USA Coffee Pods and Capsules Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global USA Coffee Pods and Capsules Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global USA Coffee Pods and Capsules Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global USA Coffee Pods and Capsules Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global USA Coffee Pods and Capsules Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global USA Coffee Pods and Capsules Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global USA Coffee Pods and Capsules Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global USA Coffee Pods and Capsules Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global USA Coffee Pods and Capsules Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: Global USA Coffee Pods and Capsules Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global USA Coffee Pods and Capsules Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global USA Coffee Pods and Capsules Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 29: Global USA Coffee Pods and Capsules Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global USA Coffee Pods and Capsules Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global USA Coffee Pods and Capsules Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 38: Global USA Coffee Pods and Capsules Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global USA Coffee Pods and Capsules Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific USA Coffee Pods and Capsules Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Coffee Pods and Capsules Industry?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the USA Coffee Pods and Capsules Industry?

Key companies in the market include Keurig Dr Pepper Inc, Nestle SA, The Kraft Heinz Company, Starbucks Corporation, Luigi Lavazza SpA, JAB Holding Company, Baronet Coffee, The J M Smucker Company, DD IP Holder LLC (Dunkin' Brands Group Inc ), Tim Hortons*List Not Exhaustive.

3. What are the main segments of the USA Coffee Pods and Capsules Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage of Single-Serve Coffee in Households; Expanding Popularity of Specialty and Organic Coffee Pods and Capsules.

6. What are the notable trends driving market growth?

Increasing Usage of Single-serve Coffee in Households.

7. Are there any restraints impacting market growth?

Increasing Usage of Single-Serve Coffee in Households; Expanding Popularity of Specialty and Organic Coffee Pods and Capsules.

8. Can you provide examples of recent developments in the market?

April 2023: Nestle's coffee brand Nespresso and Starbucks partnered to launch the 'Nespresso Starbucks Reserve Remix Blend,' a new limited-edition double espresso coffee capsule. The product initially retailed online, as well as at a few Nespresso boutiques and Starbucks Reserve Roasteries, and in select Reserve locations around the United States and the United Kingdom.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Coffee Pods and Capsules Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Coffee Pods and Capsules Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Coffee Pods and Capsules Industry?

To stay informed about further developments, trends, and reports in the USA Coffee Pods and Capsules Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence