Key Insights

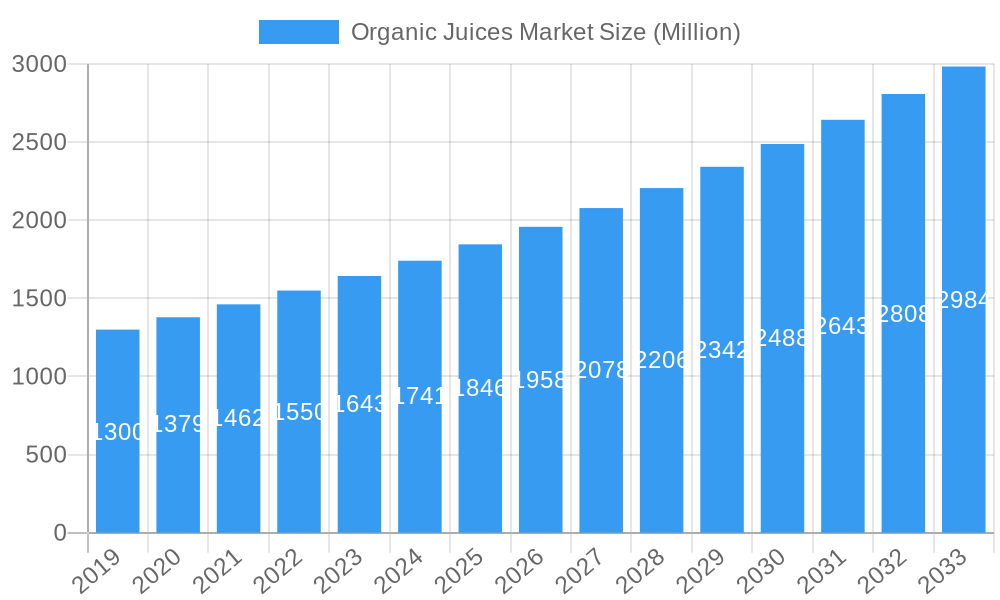

The global Organic Juices market is poised for robust expansion, with an estimated market size of $1.56 billion in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of 6.52% through 2033. This significant growth is propelled by a confluence of escalating consumer demand for healthier beverage alternatives and a heightened awareness of the benefits associated with organically sourced products. The increasing prevalence of lifestyle-related diseases is a primary driver, compelling consumers to opt for natural and chemical-free options like organic juices. Furthermore, the expanding distribution networks, particularly the surge in online sales channels and the growing popularity of subscription-based models, are making organic juices more accessible to a wider consumer base. The market's dynamism is further fueled by innovation in product offerings, including a greater variety of fruit-vegetable blends and functional juice formulations designed to cater to specific health and wellness needs. This trend towards specialized and nutrient-rich beverages is a key factor in capturing consumer interest and driving market penetration.

Organic Juices Market Market Size (In Billion)

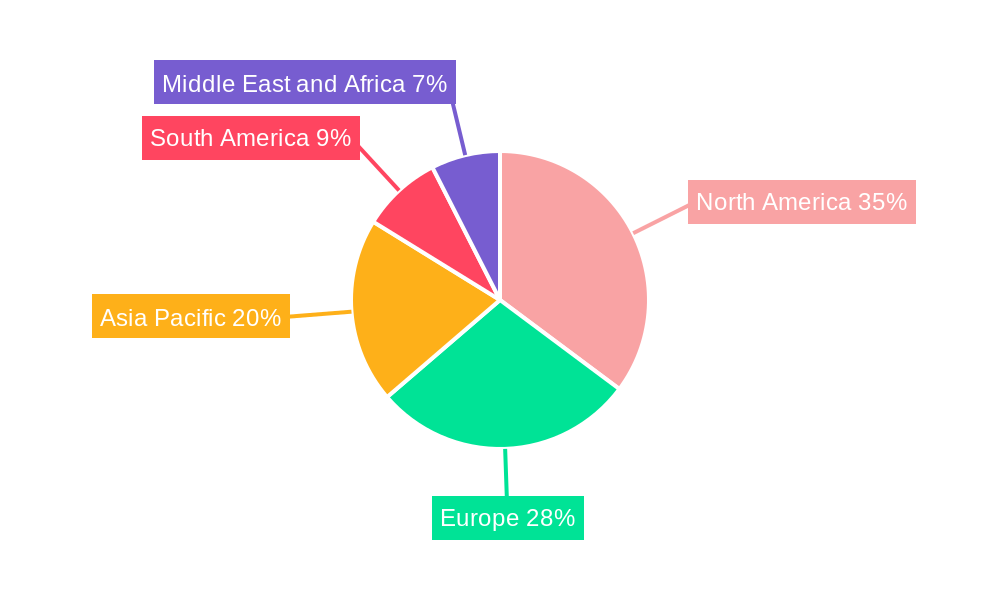

The organic juice landscape is characterized by a diverse segmentation, encompassing distinct categories such as pure Fruit Juices, nutrient-dense Vegetable Juices, and innovative Blends that combine the benefits of both. Distribution channels are equally varied, with On-Trade establishments like cafes and restaurants playing a role, alongside a dominant Off-Trade segment that includes Supermarkets/Hypermarkets, Convenience/Grocery Stores, and a rapidly growing Online Stores sector. Key players like The Hain Celestial Group, Suja Life LLC, and Naked Juice Company (PepsiCo Inc.) are actively shaping the market through product development, strategic partnerships, and aggressive marketing campaigns. The market's geographic reach spans across North America, Europe, Asia Pacific, South America, and the Middle East and Africa, with each region exhibiting unique growth patterns influenced by local consumer preferences and economic conditions. Emerging economies, particularly in the Asia Pacific and Middle East and Africa regions, are anticipated to present substantial growth opportunities due to increasing disposable incomes and a growing health consciousness among their populations.

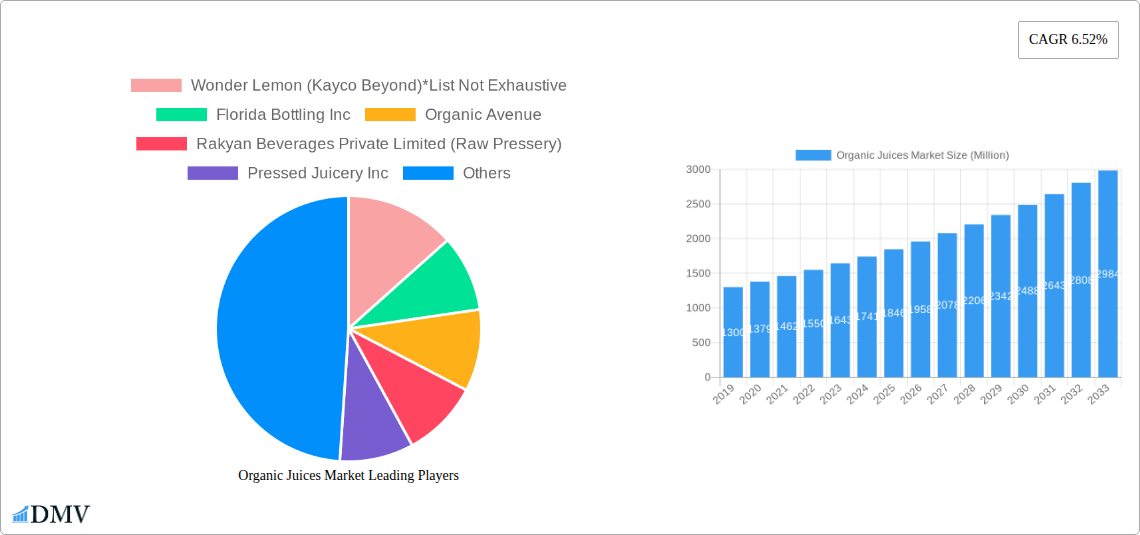

Organic Juices Market Company Market Share

This in-depth report delivers a definitive analysis of the global Organic Juices Market, offering strategic insights and actionable intelligence for stakeholders. Delving into market composition, trends, and evolution, this study provides a holistic view of the burgeoning organic beverage sector. With a focus on the historical period (2019-2024), base year (2025), and an extensive forecast period (2025-2033), this report equips you with the data to navigate market dynamics and capitalize on future opportunities.

Organic Juices Market Market Composition & Trends

The Organic Juices Market exhibits a moderate to high degree of concentration, driven by innovation catalysts such as the growing consumer demand for healthy and natural beverages. Regulatory landscapes are evolving, with increasing scrutiny on organic certifications and labeling, impacting market entry and competition. Substitute products, including conventional juices and other healthy beverages, pose a continuous challenge, necessitating a strong emphasis on the unique selling propositions of organic options. End-user profiles are predominantly health-conscious millennials and Gen Z consumers, alongside families prioritizing nutrition. Mergers and acquisitions (M&A) activities are shaping market consolidation, with significant deal values often driven by strategic expansions and portfolio diversification. For instance, The Hain Celestial Group's acquisition of snack brands signifies a move towards integrated healthy eating solutions. Market share distribution is influenced by brand recognition, product innovation, and distribution network strength. The current market size is estimated at XXX Million USD.

Organic Juices Market Industry Evolution

The Organic Juices Market has witnessed remarkable growth trajectories, largely propelled by a paradigm shift in consumer preferences towards healthier, sustainable, and ethically sourced food and beverage options. Over the historical period of 2019-2024, the market has experienced a compound annual growth rate (CAGR) of approximately 6.5%, reaching an estimated market size of XXX Million USD by the end of 2024. This growth is underpinned by significant technological advancements in cold-pressing and pasteurization techniques, ensuring maximum nutrient retention and extended shelf life for organic juices. For example, advancements in high-pressure processing (HPP) technology have enabled the production of juices with a longer shelf life without compromising on taste or nutritional value, a key adoption metric. Shifting consumer demands are also playing a pivotal role. Consumers are increasingly educated about the detrimental effects of artificial ingredients, pesticides, and GMOs, leading to a strong preference for certified organic products. This has fostered a demand for a wider variety of organic juice categories, including functional juices enriched with superfoods and adaptogens, and plant-based milk alternatives. The market is projected to continue its upward trajectory, with an estimated CAGR of 7.2% during the forecast period of 2025-2033, driven by ongoing innovations and a sustained commitment to health and wellness. The estimated market size for 2025 is XXX Million USD.

Leading Regions, Countries, or Segments in Organic Juices Market

North America currently dominates the Organic Juices Market, driven by a deeply ingrained health-conscious consumer base and a robust retail infrastructure that supports the widespread availability of organic products. The United States, in particular, is a powerhouse, with high disposable incomes and a strong advocacy for organic and natural food products.

- Dominant Segment: Fruit Juice Within the categories, Fruit Juice holds the largest market share, accounting for approximately 55% of the total market value. This is attributed to the widespread popularity of established fruit flavors and the perception of fruit juices as a primary source of vitamins and refreshment.

- Key Distribution Channel: Off-Trade (Supermarkets/Hypermarkets) The Off-Trade channel, specifically Supermarkets/Hypermarkets, emerges as the leading distribution avenue, capturing an estimated 60% of sales. These large retail formats offer extensive shelf space for organic juice brands and cater to the bulk purchasing habits of consumers.

- Drivers of Dominance in North America:

- Investment Trends: Significant investments from both established beverage giants and emerging organic brands have fueled market expansion and product innovation.

- Regulatory Support: Government initiatives promoting organic farming and stringent labeling laws have fostered consumer trust and demand.

- Consumer Awareness: High levels of consumer awareness regarding the health benefits of organic produce and the environmental impact of conventional farming practices.

- Availability of Premium Products: A wide array of premium and niche organic juice offerings catering to diverse dietary needs and taste preferences.

While North America leads, other regions like Europe are rapidly catching up due to increasing consumer awareness and favorable government policies. Asia Pacific is also showing promising growth, fueled by rising disposable incomes and a growing middle class adopting healthier lifestyles. The forecast period is expected to see continued growth in these emerging markets, potentially reshaping the global dominance landscape.

Organic Juices Market Product Innovations

Product innovations in the Organic Juices Market are centered on enhancing nutritional profiles and offering unique consumer experiences. Companies are increasingly launching cold-pressed juices fortified with functional ingredients like probiotics, adaptogens, and antioxidants to cater to specific health needs such as immunity boosting and stress reduction. Novel flavor combinations and unique blends, such as beetroot and ginger or kale and apple, are gaining traction. Advanced processing technologies ensure preservation of vital nutrients and enzymes, translating to superior taste and perceived health benefits. The integration of sustainable packaging solutions is also a key innovation, aligning with the eco-conscious values of the target demographic.

Propelling Factors for Organic Juices Market Growth

The organic juices market is being propelled by several key factors. Firstly, a significant and growing consumer awareness regarding the health benefits of organic products, including the absence of pesticides and synthetic additives, is a primary driver. Secondly, increasing disposable incomes in emerging economies are enabling consumers to opt for premium organic beverages. Thirdly, a strong regulatory push towards promoting sustainable agriculture and organic certifications fosters consumer trust and market growth. For instance, government subsidies for organic farmers and stringent organic labeling standards in regions like the European Union directly contribute to market expansion. The growing trend of "health and wellness" lifestyles further fuels demand for nutrient-rich, natural beverages.

Obstacles in the Organic Juices Market Market

Despite its robust growth, the Organic Juices Market faces several obstacles. High production costs associated with organic farming and certification processes lead to premium pricing, which can deter price-sensitive consumers. Supply chain disruptions, including seasonal availability of certain organic fruits and vegetables, can impact consistent production and lead to price volatility. Furthermore, stringent regulatory compliance across different regions presents a complex challenge for market expansion. Intense competition from both established conventional juice brands and the growing "natural" beverage category also poses a restraint. The perceived shorter shelf life of some organic juices compared to their conventionally processed counterparts can also be a barrier.

Future Opportunities in Organic Juices Market

Emerging opportunities in the Organic Juices Market are abundant. The burgeoning plant-based diet trend presents a significant avenue for innovation in vegetable-based and plant-derived juice blends. Expanding into developing economies with growing health consciousness and increasing disposable incomes offers substantial market potential. The development of functional organic juices targeted at specific health concerns, such as gut health or cognitive function, represents a promising niche. Furthermore, the integration of advanced technologies for extended shelf-life and enhanced nutrient retention can unlock new market segments. Sustainable packaging and ethical sourcing initiatives present opportunities to deepen brand loyalty and attract environmentally conscious consumers.

Major Players in the Organic Juices Market Ecosystem

- Wonder Lemon (Kayco Beyond)

- Florida Bottling Inc

- Organic Avenue

- Rakyan Beverages Private Limited (Raw Pressery)

- Pressed Juicery Inc

- The Hain Celestial Group Inc

- Suja Life LLC

- Evolution Fresh Inc (Starbucks Corporation)

- Odwalla Inc (The Coca-Cola Company)

- Just Pressed

- Naked Juice Company (PepsiCo Inc)

Key Developments in Organic Juices Market Industry

- March 2022: Kayco Beyond launched the new brand "Wonder Lemon," offering 100% organic cold-pressed juice with fresh citrus flavors and health benefits.

- February 2022: Naked Juice Company launched a new smoothie featuring orange and lime flavors, aiming to attract consumers and meet evolving preferences.

- December 2021: The Hain Celestial Group Inc. acquired snack brands ParmCrisps and Thinsters, strategically positioning to offer organic juices alongside snacks and strengthen brand dominance.

Strategic Organic Juices Market Market Forecast

The Organic Juices Market is poised for sustained and robust growth, driven by a confluence of escalating consumer demand for healthier and sustainably sourced beverages, coupled with continuous product innovation. The forecast period (2025-2033) will likely witness significant market expansion, with projected growth catalysts including the increasing adoption of functional beverages, the rise of plant-based diets, and further penetration into untapped emerging markets. Investments in advanced processing technologies and eco-friendly packaging will also play a crucial role in shaping market dynamics. The market's future potential is immense, driven by an unwavering commitment to consumer well-being and environmental consciousness. The estimated market size for 2033 is expected to reach XXX Million USD.

Organic Juices Market Segmentation

-

1. Category

- 1.1. Fruit Juice

- 1.2. Vegetable Juice

- 1.3. Blends

-

2. Distribution Channel

- 2.1. On-Trade

-

2.2. Off-Trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience/Grocery Stores

- 2.2.3. Online Stores

- 2.2.4. Other Off-Trade Channels

Organic Juices Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Organic Juices Market Regional Market Share

Geographic Coverage of Organic Juices Market

Organic Juices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Convenience and Processed Foods Drives Demand; Expanding Cosmetic and Personal Care Industries Utilize Gelatin for Various Purposes

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Proces Affecting Production Costs

- 3.4. Market Trends

- 3.4.1. Rising Demand for Organic Juices

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Organic Juices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Fruit Juice

- 5.1.2. Vegetable Juice

- 5.1.3. Blends

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience/Grocery Stores

- 5.2.2.3. Online Stores

- 5.2.2.4. Other Off-Trade Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. North America Organic Juices Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Category

- 6.1.1. Fruit Juice

- 6.1.2. Vegetable Juice

- 6.1.3. Blends

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-Trade

- 6.2.2. Off-Trade

- 6.2.2.1. Supermarkets/Hypermarkets

- 6.2.2.2. Convenience/Grocery Stores

- 6.2.2.3. Online Stores

- 6.2.2.4. Other Off-Trade Channels

- 6.1. Market Analysis, Insights and Forecast - by Category

- 7. Europe Organic Juices Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Category

- 7.1.1. Fruit Juice

- 7.1.2. Vegetable Juice

- 7.1.3. Blends

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-Trade

- 7.2.2. Off-Trade

- 7.2.2.1. Supermarkets/Hypermarkets

- 7.2.2.2. Convenience/Grocery Stores

- 7.2.2.3. Online Stores

- 7.2.2.4. Other Off-Trade Channels

- 7.1. Market Analysis, Insights and Forecast - by Category

- 8. Asia Pacific Organic Juices Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Category

- 8.1.1. Fruit Juice

- 8.1.2. Vegetable Juice

- 8.1.3. Blends

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-Trade

- 8.2.2. Off-Trade

- 8.2.2.1. Supermarkets/Hypermarkets

- 8.2.2.2. Convenience/Grocery Stores

- 8.2.2.3. Online Stores

- 8.2.2.4. Other Off-Trade Channels

- 8.1. Market Analysis, Insights and Forecast - by Category

- 9. South America Organic Juices Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Category

- 9.1.1. Fruit Juice

- 9.1.2. Vegetable Juice

- 9.1.3. Blends

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-Trade

- 9.2.2. Off-Trade

- 9.2.2.1. Supermarkets/Hypermarkets

- 9.2.2.2. Convenience/Grocery Stores

- 9.2.2.3. Online Stores

- 9.2.2.4. Other Off-Trade Channels

- 9.1. Market Analysis, Insights and Forecast - by Category

- 10. Middle East and Africa Organic Juices Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Category

- 10.1.1. Fruit Juice

- 10.1.2. Vegetable Juice

- 10.1.3. Blends

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-Trade

- 10.2.2. Off-Trade

- 10.2.2.1. Supermarkets/Hypermarkets

- 10.2.2.2. Convenience/Grocery Stores

- 10.2.2.3. Online Stores

- 10.2.2.4. Other Off-Trade Channels

- 10.1. Market Analysis, Insights and Forecast - by Category

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Wonder Lemon (Kayco Beyond)*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Florida Bottling Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Organic Avenue

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rakyan Beverages Private Limited (Raw Pressery)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pressed Juicery Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Hain Celestial Group Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Suja Life LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Evolution Fresh Inc (Starbucks Corporation)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Odwalla Inc (The Coca-Cola Company )

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Just Pressed

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Naked Juice Company (PepsiCo Inc )

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Wonder Lemon (Kayco Beyond)*List Not Exhaustive

List of Figures

- Figure 1: Global Organic Juices Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Organic Juices Market Revenue (Million), by Category 2025 & 2033

- Figure 3: North America Organic Juices Market Revenue Share (%), by Category 2025 & 2033

- Figure 4: North America Organic Juices Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Organic Juices Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Organic Juices Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Organic Juices Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Organic Juices Market Revenue (Million), by Category 2025 & 2033

- Figure 9: Europe Organic Juices Market Revenue Share (%), by Category 2025 & 2033

- Figure 10: Europe Organic Juices Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Organic Juices Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Organic Juices Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Organic Juices Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Organic Juices Market Revenue (Million), by Category 2025 & 2033

- Figure 15: Asia Pacific Organic Juices Market Revenue Share (%), by Category 2025 & 2033

- Figure 16: Asia Pacific Organic Juices Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Organic Juices Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Organic Juices Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Organic Juices Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Organic Juices Market Revenue (Million), by Category 2025 & 2033

- Figure 21: South America Organic Juices Market Revenue Share (%), by Category 2025 & 2033

- Figure 22: South America Organic Juices Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: South America Organic Juices Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Organic Juices Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Organic Juices Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Organic Juices Market Revenue (Million), by Category 2025 & 2033

- Figure 27: Middle East and Africa Organic Juices Market Revenue Share (%), by Category 2025 & 2033

- Figure 28: Middle East and Africa Organic Juices Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Organic Juices Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Organic Juices Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Organic Juices Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Organic Juices Market Revenue Million Forecast, by Category 2020 & 2033

- Table 2: Global Organic Juices Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Organic Juices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Organic Juices Market Revenue Million Forecast, by Category 2020 & 2033

- Table 5: Global Organic Juices Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Organic Juices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Organic Juices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Organic Juices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Organic Juices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Organic Juices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Organic Juices Market Revenue Million Forecast, by Category 2020 & 2033

- Table 12: Global Organic Juices Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Organic Juices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Germany Organic Juices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Organic Juices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Organic Juices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Organic Juices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Organic Juices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Russia Organic Juices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Organic Juices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Organic Juices Market Revenue Million Forecast, by Category 2020 & 2033

- Table 22: Global Organic Juices Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Organic Juices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Organic Juices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Organic Juices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Organic Juices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Organic Juices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Organic Juices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Organic Juices Market Revenue Million Forecast, by Category 2020 & 2033

- Table 30: Global Organic Juices Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Organic Juices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Organic Juices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Organic Juices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Organic Juices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Organic Juices Market Revenue Million Forecast, by Category 2020 & 2033

- Table 36: Global Organic Juices Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Organic Juices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South Africa Organic Juices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Organic Juices Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Organic Juices Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Organic Juices Market?

The projected CAGR is approximately 6.52%.

2. Which companies are prominent players in the Organic Juices Market?

Key companies in the market include Wonder Lemon (Kayco Beyond)*List Not Exhaustive, Florida Bottling Inc, Organic Avenue, Rakyan Beverages Private Limited (Raw Pressery), Pressed Juicery Inc, The Hain Celestial Group Inc, Suja Life LLC, Evolution Fresh Inc (Starbucks Corporation), Odwalla Inc (The Coca-Cola Company ), Just Pressed, Naked Juice Company (PepsiCo Inc ).

3. What are the main segments of the Organic Juices Market?

The market segments include Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Convenience and Processed Foods Drives Demand; Expanding Cosmetic and Personal Care Industries Utilize Gelatin for Various Purposes.

6. What are the notable trends driving market growth?

Rising Demand for Organic Juices.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Proces Affecting Production Costs.

8. Can you provide examples of recent developments in the market?

March 2022: Kayco Beyond launched the new brand "Wonder Lemon," which offers 100% organic cold-pressed juice. The brand provides fresh and delicious citrus flavor juices with health and wellness benefits.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Organic Juices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Organic Juices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Organic Juices Market?

To stay informed about further developments, trends, and reports in the Organic Juices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence