Key Insights

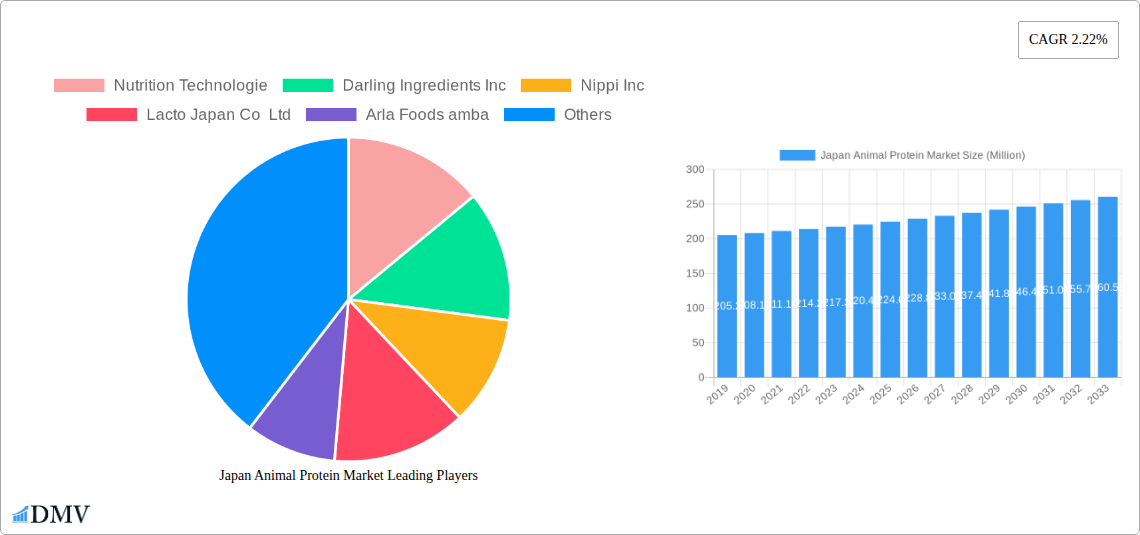

The Japanese animal protein market is poised for steady growth, projected to reach approximately ¥224.60 million by 2025, with a Compound Annual Growth Rate (CAGR) of 2.22% anticipated over the forecast period from 2025 to 2033. This expansion is primarily fueled by a rising demand for high-quality protein sources across various end-user industries. The animal feed segment, a cornerstone of the market, is witnessing increased adoption of protein-rich ingredients to enhance livestock health and productivity, thereby contributing significantly to market value. Concurrently, the food and beverage sector, particularly in categories like dairy and dairy alternatives, bakery, and ready-to-eat/ready-to-cook products, is leveraging animal proteins for their nutritional benefits and functional properties, driving innovation and consumer preference. The supplements segment, encompassing baby food, infant formula, elderly nutrition, and sports nutrition, also plays a crucial role, catering to a growing health-conscious population seeking specialized protein solutions.

Japan Animal Protein Market Market Size (In Million)

Emerging trends within the Japanese animal protein landscape include a notable shift towards premium and specialized protein types. While casein, whey, and milk proteins continue to dominate, there's a burgeoning interest in collagen for its perceived benefits in personal care and cosmetics, as well as for joint health in supplements. The demand for insect protein, although nascent, is also gaining traction as a sustainable and environmentally friendly alternative. The market, however, faces certain restraints, including fluctuating raw material costs and increasing consumer preference for plant-based alternatives, which necessitate continuous innovation and strategic pricing by key players. Leading companies are focusing on product diversification, technological advancements in protein extraction and processing, and strategic collaborations to strengthen their market position and capitalize on the evolving consumer demands within this dynamic sector.

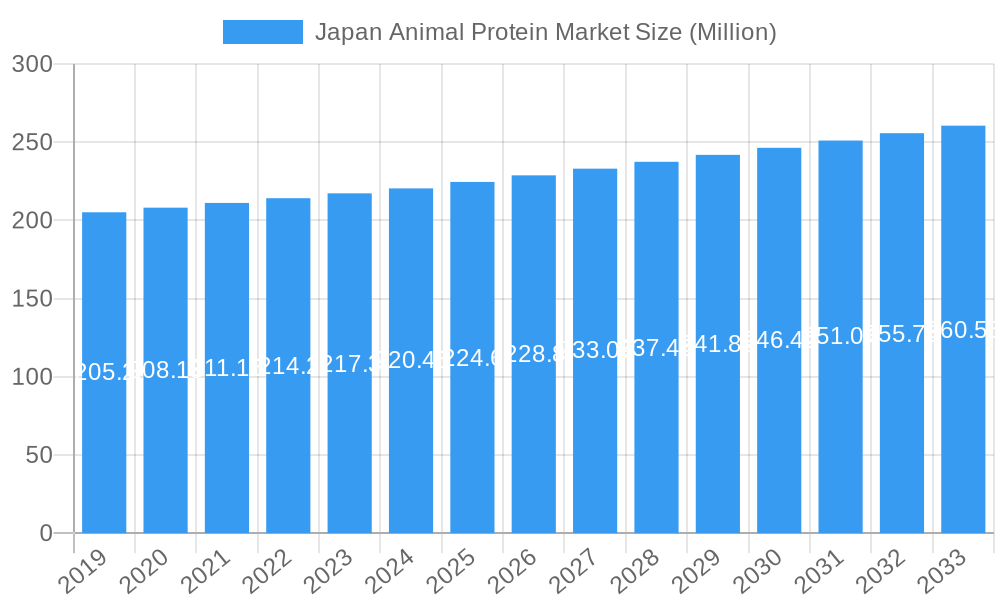

Japan Animal Protein Market Company Market Share

Japan Animal Protein Market: Comprehensive Analysis and Future Outlook (2019-2033)

Report Description:

Unlock the immense potential of Japan's burgeoning animal protein market with this in-depth, SEO-optimized report. Analyzing the period from 2019 to 2033, with a base year of 2025, this comprehensive study provides crucial insights into market composition, industry evolution, and future growth trajectories. Driven by increasing demand for high-quality protein in food and beverages, supplements, and animal feed, coupled with advancements in novel protein sources like insect protein, the Japan animal protein market is poised for significant expansion. Our report delves into key segments such as whey protein, collagen, and egg protein, examining their applications across diverse end-user industries including dairy, bakery, sports nutrition, and personal care. Discover the market's leading regions, emerging product innovations, propeling factors, and critical obstacles. This report is an indispensable tool for stakeholders, investors, and market participants seeking to capitalize on the dynamic Japanese animal protein landscape.

Japan Animal Protein Market Market Composition & Trends

The Japan animal protein market is characterized by a moderate concentration, with key players actively investing in product innovation and market expansion. The demand for diverse animal protein types, including milk protein, collagen, and increasingly, insect protein, is a significant catalyst for market growth. Regulatory frameworks, particularly concerning food safety and novel food ingredients, play a crucial role in shaping market dynamics. The growing awareness of health and wellness among Japanese consumers is driving demand for protein-rich products in both food and supplement categories. Substitute products, such as plant-based proteins, present a competitive challenge, but the distinct nutritional and functional benefits of animal proteins continue to secure their market dominance. Mergers and acquisitions (M&A) activities, while not extensively detailed in current public data, are expected to increase as companies seek to consolidate market share and expand their product portfolios. The market share distribution is heavily influenced by the established dominance of traditional animal proteins like milk and whey, with emerging segments like insect protein showing rapid growth potential.

Japan Animal Protein Market Industry Evolution

The Japan animal protein market has witnessed a significant evolutionary trajectory, driven by a confluence of factors including shifting consumer preferences, technological advancements, and a growing emphasis on health and nutritional well-being. Historically, the market has been dominated by conventional sources such as milk protein and its derivatives, alongside collagen and gelatin, primarily catering to the food and beverage industry, particularly in confectionery, dairy products, and bakery items. The period between 2019 and 2024 saw a steady growth underpinned by these established segments, with an estimated market valuation of approximately XX Million in 2024. However, recent years have marked a pivotal shift towards diversification and innovation. Consumer awareness regarding the benefits of higher protein intake for muscle health, satiety, and overall wellness has spurred demand for specialized protein supplements. This has led to a surge in the market for whey protein and caseinates, especially within the sports nutrition and elderly nutrition segments, projected to reach XX Million by 2025.

Technological advancements have been instrumental in this evolution. Innovations in processing and extraction techniques have improved the quality, bioavailability, and functional properties of various animal proteins. For instance, the development of advanced collagen peptide solutions has opened new avenues in the personal care and cosmetics sector, leveraging their skin-rejuvenating and joint-supporting benefits, contributing an estimated XX Million to the market in 2025. Furthermore, the global push for sustainable and alternative protein sources has catalyzed the emergence of insect protein within the Japanese market. While still nascent, the potential for insect protein in animal feed and, increasingly, in human food products, is substantial, with collaborations like that between Marubeni Corporation and SAS Ÿnsect signaling a strong intent to tap into this segment. This diversification is not only expanding the market’s breadth but also contributing to its overall growth rate, with a projected Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. The increasing adoption of ready-to-eat/ready-to-cook food products also presents a significant avenue for incorporating animal proteins, further enhancing market expansion.

Leading Regions, Countries, or Segments in Japan Animal Protein Market

The Japan animal protein market is a multifaceted landscape, with dominance and growth varying across its diverse segments and end-user industries. Among the Protein Types, Milk Protein and its associated components, such as Whey Protein and Casein and Caseinates, consistently hold a leading position. This is attributed to their long-standing integration into staple food products, widespread consumer familiarity, and established supply chains. The robust dairy industry in Japan, coupled with the increasing demand for protein fortification in infant formulas and elderly nutrition products, solidifies their market share. Whey protein, in particular, is a high-growth segment within sports nutrition and general wellness supplements, appealing to a broad demographic.

The End-User segment of Food and Beverages represents the largest market share, driven by the extensive use of animal proteins in bakery items, confectionery, dairy and dairy alternative products, and ready-to-eat/ready-to-cook meals. The burgeoning Supplements sector, encompassing Baby Food and Infant Formula, Elderly Nutrition and Medical Nutrition, and Sport/Performance Nutrition, is a critical growth engine, showcasing significant year-on-year expansion. The Animal Feed segment also contributes substantially, with animal proteins forming essential components for livestock and aquaculture nutrition.

Emerging segments like Insect Protein are demonstrating remarkable growth potential, albeit from a smaller base. This growth is fueled by increased awareness of sustainability and novel food sources, alongside strategic industry developments. For instance, the collaboration between Marubeni Corporation and SAS Ÿnsect highlights a significant push to integrate insect protein into the Japanese market.

Key drivers for dominance and growth include:

- Investment Trends: Significant investments are being channeled into research and development for novel protein extraction and processing, particularly for collagen peptides and insect protein, aiming to enhance their functionality and appeal.

- Regulatory Support: While stringent, regulatory frameworks are evolving to accommodate novel protein sources, such as insect protein, paving the way for wider market acceptance and application.

- Consumer Demand: A growing health-conscious population prioritizes high-quality protein intake for various health benefits, from muscle building to age-related nutritional support.

- Technological Advancements: Innovations in encapsulation, bioavailability enhancement, and product formulation are expanding the applications of animal proteins across different end-user segments.

The Collagen segment, particularly Bioactive Collagen Peptides, is experiencing rapid growth due to its expanding applications in nutraceuticals and cosmetics, with companies like Gelita actively introducing tailored solutions for women's health. Egg Protein also maintains a steady presence, valued for its complete amino acid profile and versatility. The overall dominance is a testament to the established infrastructure, consumer trust, and continuous innovation within the Japan animal protein market.

Japan Animal Protein Market Product Innovations

Product innovation within the Japan animal protein market is rapidly evolving to meet diverse consumer needs and industry demands. Manufacturers are focusing on developing highly bioavailable and functional protein ingredients. For instance, advanced processing techniques are yielding collagen peptides with enhanced absorption rates and targeted benefits, such as those designed for women's health, as exemplified by Gelita's offerings. Whey protein isolates are being engineered for faster digestion and improved muscle recovery in sports nutrition. Novel protein sources, like insect protein, are being explored for their unique nutritional profiles and sustainable production methods, finding applications in both animal feed and specialized food products. These innovations are driven by a desire to offer superior performance, improved texture, and enhanced health benefits across a wide spectrum of applications, from fortified food and beverages to advanced dietary supplements and cutting-edge personal care products.

Propelling Factors for Japan Animal Protein Market Growth

The Japan animal protein market is propelled by several key factors. Foremost is the growing health consciousness among Japanese consumers, leading to increased demand for protein-rich foods and supplements to support muscle health, satiety, and overall wellness. This is further amplified by an aging population, driving demand for elderly nutrition and medical nutrition products fortified with easily digestible animal proteins. Technological advancements in protein extraction and processing are enabling the development of high-quality, functional ingredients with enhanced bioavailability and specific health benefits, such as bioactive collagen peptides. Furthermore, the global trend towards sustainable and alternative protein sources is opening new avenues, with insect protein poised for significant growth in both animal feed and food applications. Supportive government initiatives promoting food innovation and safety also contribute to market expansion.

Obstacles in the Japan Animal Protein Market Market

Despite robust growth, the Japan animal protein market faces several obstacles. Stringent regulatory frameworks for novel food ingredients and food safety, while ensuring quality, can slow down the market entry of new products, particularly for emerging protein sources like insect protein. Supply chain vulnerabilities, exacerbated by geopolitical factors and global trade dynamics, can impact the availability and cost of raw materials. Intense competition, both from established animal protein players and the rapidly growing plant-based protein sector, presents a continuous challenge, requiring constant innovation and effective marketing strategies. Additionally, consumer perception and acceptance, particularly concerning novel protein sources, can be a barrier to widespread adoption, necessitating significant educational efforts and transparent communication regarding safety and benefits. The cost-competitiveness of certain animal protein products compared to their plant-based alternatives can also influence purchasing decisions.

Future Opportunities in Japan Animal Protein Market

The Japan animal protein market is ripe with future opportunities. The growing demand for functional ingredients in the nutraceutical and pharmaceutical sectors presents a significant avenue for specialized protein derivatives with specific health benefits. Expansion of insect protein applications, beyond animal feed into human food products, offers immense potential for sustainable protein solutions. The increasing popularity of personalized nutrition creates opportunities for tailored protein blends and supplements catering to individual dietary needs and health goals. Furthermore, the development of convenience food products incorporating high-quality animal proteins for busy lifestyles is another promising area. Strategic partnerships and collaborations aimed at research, development, and market penetration, particularly for emerging protein technologies, will be crucial for capitalizing on these opportunities.

Major Players in the Japan Animal Protein Market Ecosystem

- Nutrition Technologie

- Darling Ingredients Inc

- Nippi Inc

- Lacto Japan Co Ltd

- Arla Foods amba

- Nitta Gelatin Inc

- Royal FrieslandCampina NV

- Kerry Group PLC

- Gelita

- Marubeni Corporation

- Jellice Group

- Morinaga Milk Industry Co Ltd

Key Developments in Japan Animal Protein Market Industry

- March 2023: Marubeni Corporation revealed its collaboration with SAS Ÿnsect, the global leader in insect protein production and natural insect fertilizers, as they make their foray into the Japanese market, signaling a major push for insect protein adoption.

- September 2022: Nutrition Technologies, Asia's pioneering industrial insect company, disclosed its plans for product expansion and market growth, emphasizing its export activities to numerous countries, including Japan, indicating a growing regional focus on insect-based proteins.

- September 2022: Gelita introduced its latest Bioactive Collagen Peptides solutions tailored for women's health, utilizing specific gelatins for personalized delivery methods. The company proudly maintains a presence in Japan, with its products enjoying widespread adoption among food and beverage manufacturers, highlighting innovation in the collagen segment.

Strategic Japan Animal Protein Market Market Forecast

The strategic forecast for the Japan animal protein market is exceptionally promising, driven by a convergence of escalating consumer demand for health-conscious products and significant technological advancements. The anticipated growth is largely fueled by the expanding sports nutrition and elderly nutrition segments, where the nutritional superiority and bioavailability of animal proteins are highly valued. Innovations in collagen peptides for both internal and external applications, coupled with the nascent but rapidly developing insect protein sector, are expected to unlock substantial market potential. Strategic collaborations and investments in research and development will be key to overcoming regulatory hurdles and consumer acceptance challenges, paving the way for diversified product offerings. The market is projected to witness robust expansion, driven by a sustained commitment to quality, functionality, and the exploration of novel protein sources to meet the evolving needs of the Japanese populace.

Japan Animal Protein Market Segmentation

-

1. Protein Type

- 1.1. Casein and Caseinates

- 1.2. Collagen

- 1.3. Egg Protein

- 1.4. Gelatin

- 1.5. Insect Protein

- 1.6. Milk Protein

- 1.7. Whey Protein

- 1.8. Other Animal Protein

-

2. End-User

- 2.1. Animal Feed

- 2.2. Personal Care and Cosmetics

-

2.3. Food and Beverages

- 2.3.1. Bakery

- 2.3.2. Breakfast Cereals

- 2.3.3. Condiments/Sauces

- 2.3.4. Confectionery

- 2.3.5. Dairy and Dairy Alternative Products

- 2.3.6. RTE/RTC Food Products

- 2.3.7. Snacks

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

Japan Animal Protein Market Segmentation By Geography

- 1. Japan

Japan Animal Protein Market Regional Market Share

Geographic Coverage of Japan Animal Protein Market

Japan Animal Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trend and Increasing Inclination towards Protein-rich Functional Food and Beverages; Increasing Awareness about Health Benefits Associated with Animal Protein

- 3.3. Market Restrains

- 3.3.1. Competition from Vegan/Plant-based Protein Sources

- 3.4. Market Trends

- 3.4.1. Growing Trend and Increasing Inclination towards Protein-rich Functional Food and Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Animal Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 5.1.1. Casein and Caseinates

- 5.1.2. Collagen

- 5.1.3. Egg Protein

- 5.1.4. Gelatin

- 5.1.5. Insect Protein

- 5.1.6. Milk Protein

- 5.1.7. Whey Protein

- 5.1.8. Other Animal Protein

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Animal Feed

- 5.2.2. Personal Care and Cosmetics

- 5.2.3. Food and Beverages

- 5.2.3.1. Bakery

- 5.2.3.2. Breakfast Cereals

- 5.2.3.3. Condiments/Sauces

- 5.2.3.4. Confectionery

- 5.2.3.5. Dairy and Dairy Alternative Products

- 5.2.3.6. RTE/RTC Food Products

- 5.2.3.7. Snacks

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nutrition Technologie

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Darling Ingredients Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nippi Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lacto Japan Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Arla Foods amba

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nitta Gelatin Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Royal FrieslandCampina NV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kerry Group PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gelita

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Marubeni Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Jellice Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Morinaga Milk Industry Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Nutrition Technologie

List of Figures

- Figure 1: Japan Animal Protein Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Animal Protein Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Animal Protein Market Revenue Million Forecast, by Protein Type 2020 & 2033

- Table 2: Japan Animal Protein Market Volume K Tons Forecast, by Protein Type 2020 & 2033

- Table 3: Japan Animal Protein Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Japan Animal Protein Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 5: Japan Animal Protein Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Japan Animal Protein Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Japan Animal Protein Market Revenue Million Forecast, by Protein Type 2020 & 2033

- Table 8: Japan Animal Protein Market Volume K Tons Forecast, by Protein Type 2020 & 2033

- Table 9: Japan Animal Protein Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 10: Japan Animal Protein Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 11: Japan Animal Protein Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Japan Animal Protein Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Animal Protein Market?

The projected CAGR is approximately 2.22%.

2. Which companies are prominent players in the Japan Animal Protein Market?

Key companies in the market include Nutrition Technologie, Darling Ingredients Inc, Nippi Inc, Lacto Japan Co Ltd, Arla Foods amba, Nitta Gelatin Inc, Royal FrieslandCampina NV, Kerry Group PLC, Gelita, Marubeni Corporation, Jellice Group, Morinaga Milk Industry Co Ltd.

3. What are the main segments of the Japan Animal Protein Market?

The market segments include Protein Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 224.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trend and Increasing Inclination towards Protein-rich Functional Food and Beverages; Increasing Awareness about Health Benefits Associated with Animal Protein.

6. What are the notable trends driving market growth?

Growing Trend and Increasing Inclination towards Protein-rich Functional Food and Beverages.

7. Are there any restraints impacting market growth?

Competition from Vegan/Plant-based Protein Sources.

8. Can you provide examples of recent developments in the market?

March 2023: Marubeni Corporation revealed its collaboration with SAS Ÿnsect, the global leader in insect protein production and natural insect fertilizers, as they make their foray into the Japanese market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Animal Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Animal Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Animal Protein Market?

To stay informed about further developments, trends, and reports in the Japan Animal Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence