Key Insights

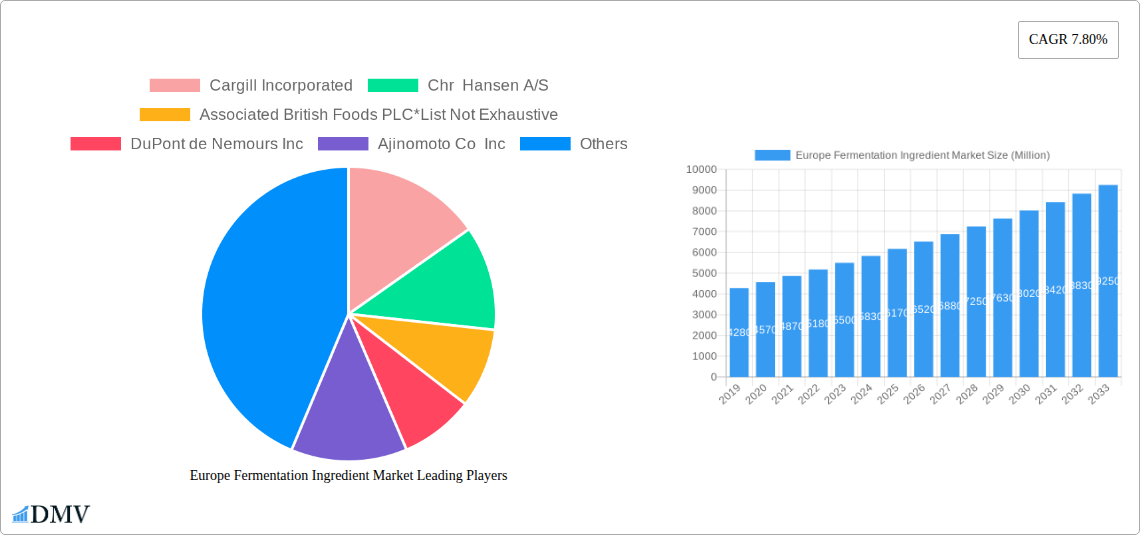

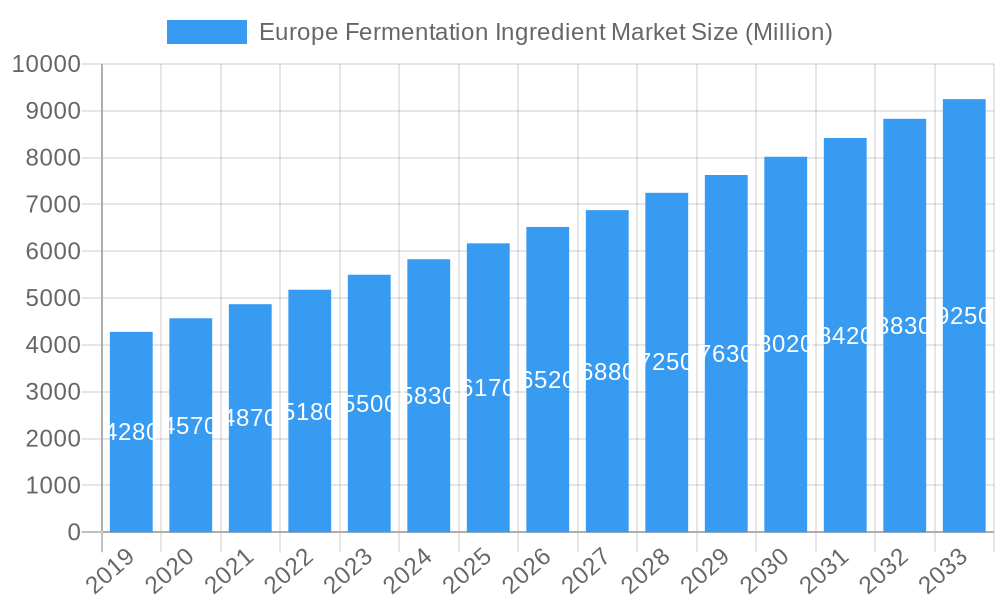

The Europe Fermentation Ingredient Market is projected to reach $4.68 billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 48.3% from 2019-2033. This significant expansion is driven by escalating demand for natural, sustainable ingredients in the food & beverage and animal feed sectors. Consumers' preference for clean labels, reduced artificial additives, and enhanced nutritional value aligns perfectly with the capabilities of fermentation ingredients. Their versatility, offering amino acids, organic acids, polymers, vitamins, and enzymes, caters to diverse applications, including improved food quality, animal feed nutrition, and sustainable industrial processes. Major players such as Cargill Incorporated, Chr Hansen A/S, and DuPont de Nemours Inc. are actively investing in R&D, production expansion, and strategic partnerships to seize these market opportunities.

Europe Fermentation Ingredient Market Market Size (In Billion)

The market's growth is further stimulated by increasing awareness of fermented foods' health benefits and the environmental advantages of fermentation processes, such as reduced waste and lower carbon footprints. The animal feed segment is experiencing substantial growth as producers adopt fermentation ingredients to enhance animal health, growth, and feed efficiency, potentially decreasing antibiotic reliance. Despite intense competition and evolving regulations, the innovation pipeline remains strong, with continuous advancements in fermentation strains and bioprocessing technologies. Europe's commitment to sustainability, a mature food industry, and a growing demand for innovative solutions position it as a key region for this market's global expansion, with notable demand in the UK, Germany, France, and Italy.

Europe Fermentation Ingredient Market Company Market Share

This comprehensive report offers a critical analysis of the Europe Fermentation Ingredient Market, detailing market composition, industry trends, key growth drivers, challenges, and future prospects. Utilizing extensive data from 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders aiming to understand and capitalize on the burgeoning fermentation ingredients market in Europe. Gain deep insights into market trends, technological advancements, leading companies, and segment-specific dynamics to inform your strategic decisions.

Europe Fermentation Ingredient Market Market Composition & Trends

The Europe fermentation ingredient market exhibits a moderate concentration, driven by significant innovation in food fermentation ingredients, feed fermentation ingredients, and industrial fermentation applications. Key innovation catalysts include advancements in biotechnology, a growing consumer demand for natural and sustainable ingredients, and the increasing adoption of enzymes and organic acids in diverse sectors. The regulatory landscape, while evolving, supports the growth of these ingredients, particularly those with proven safety and efficacy. Substitute products, primarily those derived from synthetic chemical processes, are facing increased scrutiny due to environmental concerns, bolstering the demand for fermented alternatives. End-user profiles range from large-scale food and beverage manufacturers and animal feed producers to pharmaceutical and chemical companies. Mergers and acquisitions (M&A) are a notable trend, with significant deal values indicating consolidation and strategic expansion within the market. XXX

Europe Fermentation Ingredient Market Industry Evolution

The Europe fermentation ingredient market has witnessed a remarkable evolutionary trajectory, propelled by a confluence of scientific breakthroughs, shifting consumer preferences, and expanding industrial applications. Over the historical period (2019-2024) and continuing into the forecast period (2025-2033), the market has experienced robust growth, with an estimated Compound Annual Growth Rate (CAGR) of XX% in the base year of 2025. This expansion is intrinsically linked to profound technological advancements in fermentation processes, including precision fermentation and metabolic engineering, which have enabled the efficient and cost-effective production of a wide array of ingredients. The increasing demand for sustainable food production and novel food ingredients is a primary driver, pushing manufacturers to explore and invest in fermentation-derived solutions. Consumer awareness regarding the benefits of bio-based ingredients, such as improved nutritional profiles and reduced environmental impact, has further fueled this demand. In the food and beverage sector, fermentation ingredients are instrumental in enhancing flavor, texture, shelf-life, and nutritional value, with notable growth in categories like dairy alternatives, baked goods, and processed foods. The animal feed industry is increasingly adopting fermented ingredients for improved animal health, nutrient digestibility, and the reduction of antibiotic use. Furthermore, industrial applications, including bioplastics, biofuels, and specialty chemicals, are leveraging fermentation to create eco-friendly alternatives to petrochemical-based products. The study period from 2019 to 2033 encapsulates this dynamic evolution, highlighting the shift towards a more bio-centric and sustainable chemical industry.

Leading Regions, Countries, or Segments in Europe Fermentation Ingredient Market

Within the dynamic Europe fermentation ingredient market, the Food and Beverage application segment stands out as a dominant force, driven by escalating consumer preference for natural, functional, and sustainably produced food items. This dominance is further amplified by the inherent versatility of fermentation ingredients like amino acids, organic acids, and enzymes, which are indispensable in a wide spectrum of food and beverage products.

- Food and Beverage Application Dominance:

- Amino Acids: Essential for flavor enhancement, nutritional fortification, and as building blocks for functional food components, driving demand in protein-rich products, dairy alternatives, and processed meats.

- Organic Acids: Widely utilized as acidulants, preservatives, and flavor enhancers in beverages, confectionery, baked goods, and dairy products, contributing to extended shelf-life and improved taste profiles.

- Enzymes: Crucial for modifying dough properties in baking, improving juice clarity in beverages, and enhancing protein functionality in various food formulations.

- Vitamins: Fermentation-produced vitamins offer a natural and bioavailable source for food fortification, catering to growing health and wellness trends.

- Polymers: Though a smaller segment, fermentation-derived polymers are gaining traction in food packaging for their biodegradability and sustainable properties.

Geographically, Germany consistently emerges as a leading country within the European market. This leadership is attributed to its robust industrial infrastructure, significant investments in research and development, and a strong emphasis on sustainability and biotechnology. Germany's proactive approach to adopting innovative food technologies and its substantial manufacturing base provide fertile ground for the growth of fermentation ingredients.

- Key Drivers of Dominance (Germany):

- Strong R&D Ecosystem: A high concentration of research institutions and universities focused on biotechnology and food science fosters innovation.

- Pro-Sustainability Policies: Government initiatives and consumer demand for eco-friendly products align with the benefits of fermentation ingredients.

- Advanced Food Processing Industry: A mature and sophisticated food processing sector readily integrates novel ingredients to meet evolving consumer needs.

- Significant Investment Trends: Both domestic and international companies are investing heavily in fermentation ingredient production facilities and R&D in Germany.

- Regulatory Support: A generally supportive regulatory framework for novel food ingredients and biotechnological applications.

While Food and Beverage leads, the Feed application segment is also experiencing substantial growth, driven by the demand for enhanced animal nutrition, gut health, and the reduction of antibiotic usage in livestock farming. The Industrial Use segment, encompassing areas like bioplastics, biofuels, and specialty chemicals, represents a significant emerging opportunity, propelled by the global push towards a circular economy and bio-based alternatives.

Europe Fermentation Ingredient Market Product Innovations

Product innovation within the Europe fermentation ingredient market is characterized by the development of highly specific and efficient bio-based solutions. Companies are leveraging advanced microbial strains and optimized fermentation processes to produce ingredients with superior functionality and environmental footprints. Notable innovations include the development of novel enzymes for specialized industrial processes, enhanced amino acid profiles for improved animal feed efficacy, and bio-based polymers for sustainable packaging. Performance metrics such as increased yield, improved purity, and reduced production costs are key indicators of these advancements, offering unique selling propositions in a competitive landscape.

Propelling Factors for Europe Fermentation Ingredient Market Growth

The Europe fermentation ingredient market is propelled by several interconnected factors. Technologically, advancements in biotechnology, including synthetic biology and metabolic engineering, enable more efficient and sustainable production. Economically, the growing consumer demand for natural, clean-label, and sustainable food and beverage products directly fuels the need for fermented ingredients. Regulatory support for bio-based products and a focus on reducing reliance on synthetic chemicals also contribute significantly. Furthermore, the expanding applications in animal feed for improved health and the nascent but growing industrial applications for bio-based materials create diverse avenues for growth.

Obstacles in the Europe Fermentation Ingredient Market Market

Despite its growth potential, the Europe fermentation ingredient market faces certain obstacles. Regulatory hurdles, particularly concerning the approval and labeling of novel fermentation-derived ingredients, can slow down market entry. Supply chain disruptions, exacerbated by geopolitical events and the reliance on specific raw materials, pose a consistent challenge. Intense competitive pressures from established synthetic ingredient manufacturers and the need for significant capital investment in advanced fermentation technologies can also act as restraints. Additionally, consumer perception and the education required to fully embrace bio-based alternatives in certain applications can present a barrier.

Future Opportunities in Europe Fermentation Ingredient Market

The future of the Europe fermentation ingredient market is replete with emerging opportunities. The increasing adoption of precision fermentation for highly specialized ingredients, such as novel proteins and rare biomolecules, presents a significant growth avenue. Expansion into new industrial applications, including textiles and cosmetics, driven by sustainability mandates, is a key trend. The development of fermentation solutions for the circular economy, transforming waste streams into valuable ingredients, offers immense potential. Furthermore, the growing demand for personalized nutrition and functional foods will continue to drive innovation in fermented ingredients with specific health benefits.

Major Players in the Europe Fermentation Ingredient Market Ecosystem

- Cargill Incorporated

- Chr Hansen A/S

- Associated British Foods PLC

- DuPont de Nemours Inc

- Ajinomoto Co Inc

- Döhler Group SE

- Lonza

- Angel Yeast Co Ltd

- General Mills

- Lallemand Inc

Key Developments in Europe Fermentation Ingredient Market Industry

- 2023: Chr Hansen A/S launched a new range of enzymes for improved food processing efficiency.

- 2023: DuPont de Nemours Inc announced strategic investments in expanding its fermentation capacity for bio-based ingredients.

- 2022: Cargill Incorporated acquired a significant stake in a leading European fermentation technology startup.

- 2021: Lallemand Inc introduced innovative yeast strains for enhanced animal feed performance.

- 2020: Döhler Group SE expanded its portfolio of fermentation-derived natural flavors and colors.

Strategic Europe Fermentation Ingredient Market Market Forecast

The strategic forecast for the Europe fermentation ingredient market anticipates sustained and robust growth. Key growth catalysts include the unrelenting consumer drive for natural and sustainable products, coupled with continued technological innovation in fermentation science. The expanding application landscape across food and beverage, feed, and industrial sectors, driven by increasing environmental consciousness and the pursuit of bio-based alternatives, will further bolster market potential. Investments in R&D and expanding production capacities by major players will facilitate the wider adoption of these crucial ingredients, positioning the market for significant future expansion.

Europe Fermentation Ingredient Market Segmentation

-

1. Type

- 1.1. Amino Acids

- 1.2. Organic Acids

- 1.3. Polymers

- 1.4. Vitamins

- 1.5. Enzymes

-

2. Application

- 2.1. Food and Beverage

- 2.2. Feed

- 2.3. Industrial Use

- 2.4. Other Applications

Europe Fermentation Ingredient Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

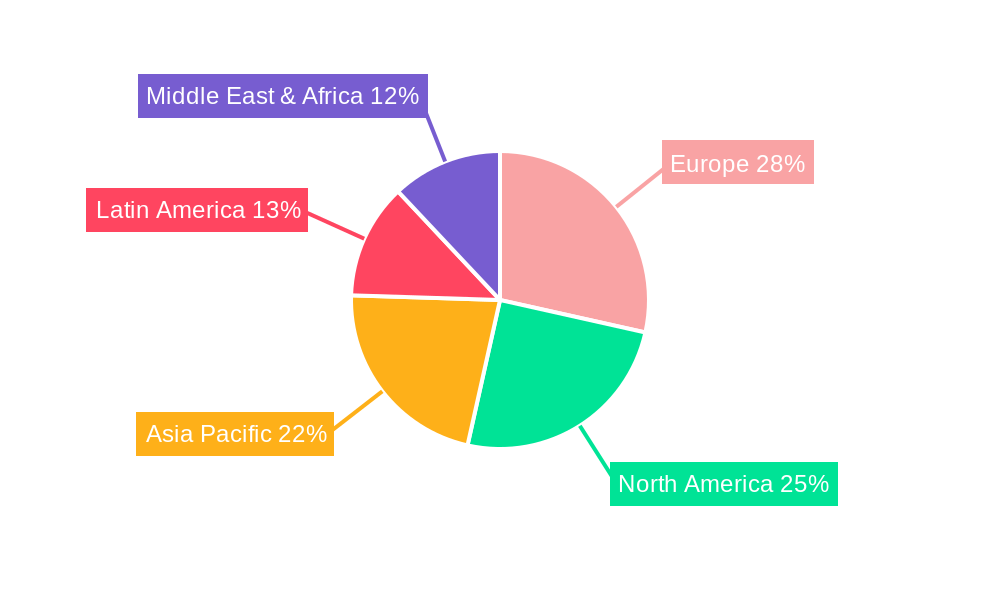

Europe Fermentation Ingredient Market Regional Market Share

Geographic Coverage of Europe Fermentation Ingredient Market

Europe Fermentation Ingredient Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 48.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Health Consciousness among consumer

- 3.3. Market Restrains

- 3.3.1. High Cost of natural Ingredients

- 3.4. Market Trends

- 3.4.1. Rising Awareness about Fermented Food and Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Fermentation Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Amino Acids

- 5.1.2. Organic Acids

- 5.1.3. Polymers

- 5.1.4. Vitamins

- 5.1.5. Enzymes

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverage

- 5.2.2. Feed

- 5.2.3. Industrial Use

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cargill Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chr Hansen A/S

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Associated British Foods PLC*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DuPont de Nemours Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ajinomoto Co Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Döhler Group SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lonza

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Angel Yeast Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 General Mills

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lallemand Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cargill Incorporated

List of Figures

- Figure 1: Europe Fermentation Ingredient Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Fermentation Ingredient Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Fermentation Ingredient Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Fermentation Ingredient Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Europe Fermentation Ingredient Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Fermentation Ingredient Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Europe Fermentation Ingredient Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Europe Fermentation Ingredient Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Fermentation Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Fermentation Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Fermentation Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Fermentation Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Fermentation Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Fermentation Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Fermentation Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Fermentation Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Fermentation Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Fermentation Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Fermentation Ingredient Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Fermentation Ingredient Market?

The projected CAGR is approximately 48.3%.

2. Which companies are prominent players in the Europe Fermentation Ingredient Market?

Key companies in the market include Cargill Incorporated, Chr Hansen A/S, Associated British Foods PLC*List Not Exhaustive, DuPont de Nemours Inc, Ajinomoto Co Inc, Döhler Group SE, Lonza, Angel Yeast Co Ltd, General Mills, Lallemand Inc.

3. What are the main segments of the Europe Fermentation Ingredient Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.68 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Health Consciousness among consumer.

6. What are the notable trends driving market growth?

Rising Awareness about Fermented Food and Beverages.

7. Are there any restraints impacting market growth?

High Cost of natural Ingredients.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Fermentation Ingredient Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Fermentation Ingredient Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Fermentation Ingredient Market?

To stay informed about further developments, trends, and reports in the Europe Fermentation Ingredient Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence