Key Insights

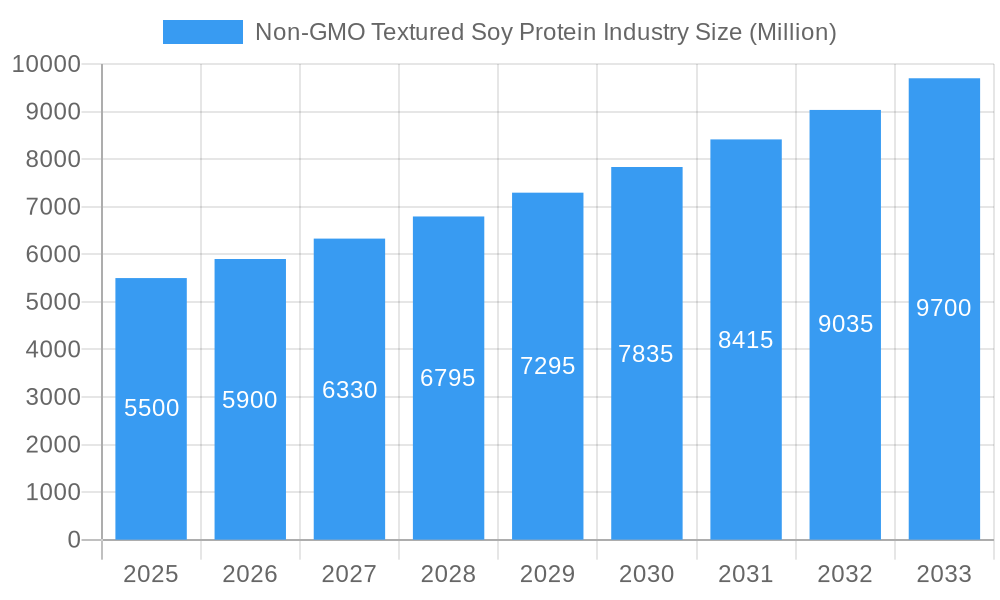

The Non-GMO Textured Soy Protein (TSP) market is set for substantial growth, projected to reach approximately 2.03 billion by 2024, with an anticipated Compound Annual Growth Rate (CAGR) of 7.66%. This expansion is primarily driven by rising consumer preference for plant-based protein due to health consciousness, ethical concerns, and environmental sustainability. The increasing incidence of chronic diseases also encourages a shift towards healthier, plant-derived protein sources like TSP. Its versatility in applications such as meat and dairy alternatives, bakery goods, and infant nutrition makes it a preferred ingredient for manufacturers addressing evolving consumer demands. The "clean label" trend, emphasizing products free from genetically modified organisms, further supports market growth.

Non-GMO Textured Soy Protein Industry Market Size (In Billion)

Technological innovations improving TSP's texture and flavor, making it comparable to meat, are enhancing its market appeal. Growing adoption of plant-based diets in emerging economies and supportive government policies for healthy eating and sustainable agriculture are also contributing to market expansion. Potential challenges include volatile soybean prices, stringent regulations for novel food ingredients, and consumer perceptions regarding soy allergies or taste. Nevertheless, the persistent demand for healthier, sustainable, and ethically produced food ensures robust and sustained growth for the Non-GMO Textured Soy Protein market.

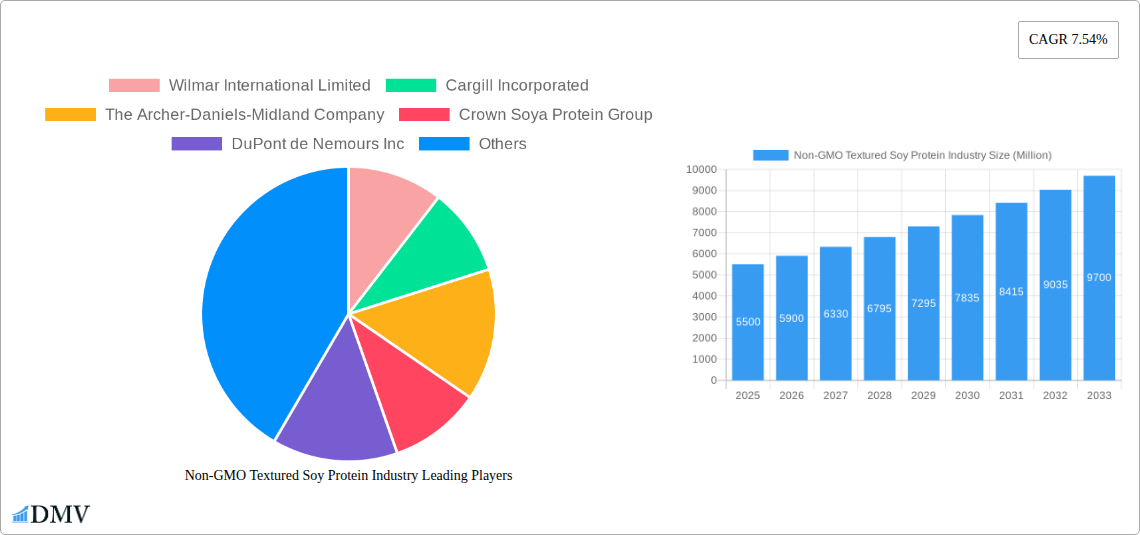

Non-GMO Textured Soy Protein Industry Company Market Share

Non-GMO Textured Soy Protein Industry Market Composition & Trends

The Non-GMO Textured Soy Protein (TSP) market is characterized by a dynamic landscape shaped by increasing consumer demand for plant-based protein and a growing awareness of genetically modified organisms (GMOs). Market concentration varies across regions, with established players dominating certain segments while niche innovators emerge. Key trends include the escalating adoption of TSP in meat substitutes and dairy alternatives, driven by evolving dietary preferences and the pursuit of sustainable protein sources. Regulatory frameworks surrounding GMO labeling and production are increasingly influencing market entry and product development. The availability and price volatility of raw soybeans, coupled with stringent quality control measures for non-GMO certification, present ongoing challenges. Substitute products, such as pea protein and fava bean protein, are gaining traction, necessitating continuous innovation and differentiation within the TSP sector. End-user profiles are diverse, encompassing food manufacturers, animal feed producers, and health-conscious consumers. Merger and acquisition (M&A) activities, such as the acquisition of soy processing facilities and strategic partnerships aimed at securing non-GMO supply chains, are significant. For instance, the total M&A deal value in this sector is estimated to be around $500 Million over the historical period.

- Market Concentration: Moderate to high, with a few global giants holding substantial market share.

- Innovation Catalysts: Growing demand for plant-based diets, health consciousness, and sustainable food systems.

- Regulatory Landscapes: Varying GMO labeling laws and certification standards across key markets.

- Substitute Products: Pea protein, fava bean protein, and other plant-based protein isolates.

- End-User Profiles: Food & Beverage manufacturers, Animal Feed producers, Health and Wellness consumers.

- M&A Activities: Strategic acquisitions for supply chain control and capacity expansion.

Non-GMO Textured Soy Protein Industry Industry Evolution

The Non-GMO Textured Soy Protein Industry has witnessed a remarkable evolutionary trajectory, driven by a confluence of shifting consumer preferences, technological advancements in food processing, and a growing global emphasis on sustainability and health. Over the study period from 2019 to 2033, the industry has transitioned from a relatively niche market to a mainstream component of the global food and feed sectors. During the historical period (2019-2024), the market experienced a compound annual growth rate (CAGR) of approximately 8.5%, fueled by heightened awareness of the health benefits associated with non-GMO foods and the increasing demand for meat alternatives. The base year, 2025, is projected to see a market size of $12.5 Billion, with significant growth anticipated in the forecast period (2025-2033).

Technological advancements have been pivotal in this evolution. Innovations in extrusion technologies have enabled the production of textured soy protein with improved mouthfeel, texture, and functionality, closely mimicking animal-based proteins. This has been crucial for the widespread adoption of TSP in meat substitutes, a segment that has exploded in popularity. Furthermore, advancements in non-GMO soybean cultivation and processing techniques have ensured a consistent and reliable supply of high-quality raw materials, addressing initial concerns about availability and purity.

Shifting consumer demands have played an equally critical role. A growing segment of consumers, particularly in developed economies, are actively seeking out plant-based protein sources due to perceived health benefits, environmental concerns, and ethical considerations regarding animal welfare. This trend is further amplified by the increasing prevalence of food allergies and intolerances, where non-GMO options are often preferred. The "clean label" movement, emphasizing natural and minimally processed ingredients, also favors non-GMO TSP. The industry's ability to adapt and innovate in response to these evolving consumer needs has been a key factor in its sustained growth. The estimated adoption rate of non-GMO TSP in meat substitutes is projected to reach 40% by 2030. The organic segment, while smaller, is experiencing an even higher CAGR of 12%, indicating a strong premiumization trend.

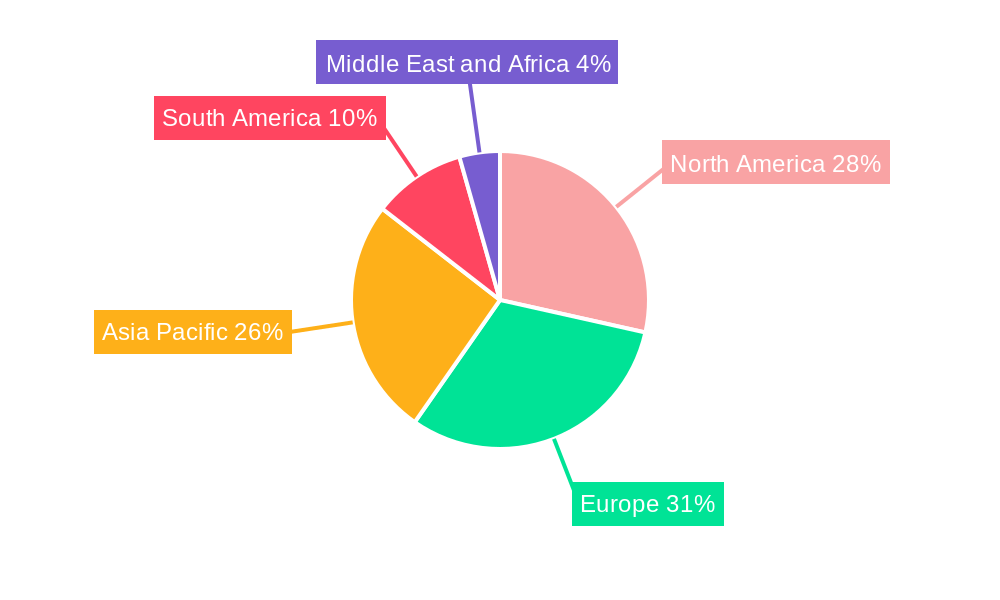

Leading Regions, Countries, or Segments in Non-GMO Textured Soy Protein Industry

The Non-GMO Textured Soy Protein (TSP) Industry exhibits distinct regional leadership and segment dominance, driven by a complex interplay of consumer preferences, agricultural output, regulatory environments, and economic development. North America and Europe currently lead in market value, largely due to their established plant-based food markets and strong consumer demand for healthy and sustainable protein options. However, the Asia Pacific region is emerging as the fastest-growing market, propelled by a rapidly expanding middle class, increasing adoption of Western dietary trends, and a growing awareness of the health and environmental benefits of plant-based proteins.

Within the Type segment, the Conventional non-GMO TSP holds the largest market share due to its cost-effectiveness and wider availability. However, the Organic segment is exhibiting a significantly higher growth rate, indicating a strong premiumization trend and a burgeoning consumer base willing to pay more for certified organic products. This growth is particularly pronounced in North America and Europe, where organic certifications are well-recognized and trusted.

In terms of Application, the Food and Beverages segment overwhelmingly dominates the market, with meat substitutes leading the charge. This sub-segment alone is projected to account for over 50% of the total food and beverage applications by 2030. The "flexitarian" and vegetarian/vegan movements have created a massive demand for plant-based alternatives that mimic the texture and taste of meat, and non-GMO TSP is a key ingredient in achieving this.

- Key Drivers for Food and Beverages Dominance:

- Rising Health Consciousness: Consumers seek healthier protein alternatives to animal meat.

- Environmental Concerns: Plant-based diets are perceived as more sustainable.

- Ethical Considerations: Growing awareness of animal welfare issues.

- Technological Advancements: Improved texture and flavor profiles of TSP in meat analogs.

The Dairy Alternatives sub-segment is also experiencing robust growth, with TSP being used in plant-based yogurts, cheeses, and milk. Infant Nutrition is another important application, where non-GMO TSP offers a hypoallergenic and nutrient-rich protein source. Bakery Products and Cereal and Snacks are also significant application areas, benefiting from TSP's ability to enhance protein content and improve texture.

The Animal Feed segment represents a substantial portion of the market, particularly in regions with large livestock industries. Non-GMO TSP offers a high-quality, digestible protein source for animal feed, contributing to improved animal health and growth. The demand for antibiotic-free and naturally produced animal feed further boosts the appeal of non-GMO TSP in this segment. The global animal feed market for non-GMO TSP is estimated to reach $4 Billion by 2030.

- Dominance Factors in Asia Pacific:

- Large and Growing Population: Massive consumer base with increasing disposable income.

- Adoption of Western Diets: Integration of plant-based protein into traditional cuisines.

- Government Initiatives: Support for sustainable agriculture and food innovation.

- Increasing Awareness of Health Benefits: Growing concern about chronic diseases linked to meat consumption.

Non-GMO Textured Soy Protein Industry Product Innovations

Product innovation in the Non-GMO Textured Soy Protein Industry is rapidly enhancing its versatility and appeal. Manufacturers are focusing on developing TSP with improved water-holding capacity, enhanced emulsification properties, and finer particle sizes for smoother textures in applications like dairy alternatives and infant nutrition. Innovations in processing techniques, such as enzyme treatment and granulation, are yielding TSP with superior bite and chewability, making meat substitutes more indistinguishable from their animal-based counterparts. Furthermore, advancements in flavoring encapsulation are enabling the delivery of nuanced taste profiles, addressing a key consumer demand for palatable plant-based options. The development of specialized TSP grades, optimized for specific applications like gluten-free baking or low-sodium formulations, is also a significant area of innovation, expanding the product's market reach and utility.

Propelling Factors for Non-GMO Textured Soy Protein Industry Growth

Several key factors are propelling the growth of the Non-GMO Textured Soy Protein Industry. Firstly, the escalating global demand for plant-based diets, driven by health consciousness, environmental concerns, and ethical considerations, is a primary catalyst. Consumers are actively seeking protein sources perceived as healthier and more sustainable than traditional animal proteins. Secondly, advancements in food processing technology, particularly extrusion techniques, have significantly improved the texture, taste, and functionality of TSP, making it a more viable and appealing ingredient for a wider range of food applications, especially meat substitutes. Thirdly, stringent regulations and consumer preference for non-GMO labeling in major markets like the United States and the European Union create a favorable environment for non-GMO TSP producers. The projected market size for non-GMO TSP in the food and beverage sector is estimated to reach $10 Billion by 2030.

Obstacles in the Non-GMO Textured Soy Protein Industry Market

Despite robust growth, the Non-GMO Textured Soy Protein Industry faces several obstacles. Regulatory hurdles, including differing standards for non-GMO certification across regions and complex labeling requirements, can impede market entry and increase compliance costs. Supply chain disruptions, from unpredictable soybean yields due to climate change to geopolitical factors affecting trade, can lead to price volatility and impact the availability of raw materials. Intense competition from other plant-based protein sources, such as pea protein and fava bean protein, which are also gaining market traction, necessitates continuous innovation and competitive pricing strategies. Consumer perception issues, although diminishing, still exist regarding the taste and texture of some soy-based products, requiring ongoing efforts in product development and consumer education. The estimated cost increase due to supply chain disruptions can range from 5% to 10%.

Future Opportunities in Non-GMO Textured Soy Protein Industry

The Non-GMO Textured Soy Protein Industry is poised for significant future opportunities. The burgeoning demand for convenient, plant-based meal solutions presents a vast avenue for product development, including ready-to-eat meals and plant-based snacks incorporating TSP. Expansion into emerging economies, particularly in Asia Pacific and Latin America, where the adoption of plant-based diets is accelerating, offers substantial untapped market potential. Innovations in bioprocessing and fermentation technologies could unlock new functionalities and product formats for TSP, further diversifying its applications. The growing trend of personalized nutrition and functional foods also presents an opportunity for TSP-enriched products tailored to specific dietary needs and health benefits. The integration of TSP into novel food categories beyond traditional meat and dairy alternatives, such as plant-based seafood and alternative protein blends, will also drive future growth.

Major Players in the Non-GMO Textured Soy Protein Industry Ecosystem

- Wilmar International Limited

- Cargill Incorporated

- The Archer-Daniels-Midland Company

- Crown Soya Protein Group

- DuPont de Nemours Inc

- Sonic Bioche

- Victoria Group

- Bremil Group

- Hoya Food

Key Developments in Non-GMO Textured Soy Protein Industry Industry

- 2023 January: DuPont de Nemours Inc. launched a new line of plant-based protein ingredients, including non-GMO textured soy protein, aimed at enhancing texture and functionality in meat alternatives.

- 2022 November: Cargill Incorporated announced significant investment in expanding its non-GMO soy processing capacity to meet growing global demand.

- 2022 July: The Archer-Daniels-Midland Company reported strong sales growth in its plant-based protein portfolio, with a particular focus on non-GMO textured soy protein for the European market.

- 2021 December: Crown Soya Protein Group introduced innovative extrusion technologies for producing TSP with improved meat-like textures, receiving positive market reception.

- 2021 June: Wilmar International Limited expanded its sustainability initiatives, emphasizing the sourcing of non-GMO soybeans for its textured soy protein production.

- 2020 October: Victoria Group invested in research and development to create specialized non-GMO TSP for the infant nutrition sector, addressing growing parental demand for clean-label products.

Strategic Non-GMO Textured Soy Protein Industry Market Forecast

The strategic outlook for the Non-GMO Textured Soy Protein Industry remains exceptionally positive, underpinned by sustained consumer shifts towards healthier, more sustainable protein sources. The forecast period (2025–2033) is expected to witness continued robust growth, driven by ongoing innovation in product development and the expansion of applications within the food and beverage sector, particularly in meat substitutes and dairy alternatives. Furthermore, the increasing adoption of non-GMO TSP in animal feed, propelled by demands for cleaner animal protein production, will contribute significantly to market expansion. Emerging economies represent a critical growth frontier, offering substantial untapped potential as dietary habits evolve. The industry's adaptability in addressing supply chain challenges and capitalizing on consumer preferences for clean-label, plant-based ingredients positions it for a prosperous future.

Non-GMO Textured Soy Protein Industry Segmentation

-

1. Type

- 1.1. Conventional

- 1.2. Organic

-

2. Application

-

2.1. Food and Beverages

- 2.1.1. Meat Substitutes

- 2.1.2. Dairy Alternatives

- 2.1.3. Infant Nutrition

- 2.1.4. Bakery Products

- 2.1.5. Cereal and Snacks

- 2.1.6. Other Food Applications

- 2.2. Animal Feed

-

2.1. Food and Beverages

Non-GMO Textured Soy Protein Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Non-GMO Textured Soy Protein Industry Regional Market Share

Geographic Coverage of Non-GMO Textured Soy Protein Industry

Non-GMO Textured Soy Protein Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Vegan Food & Beverages Driving the Market; Intolerance and Allergies Associated with Animal Protein Products

- 3.3. Market Restrains

- 3.3.1. High Market Penetration of Animal Protein

- 3.4. Market Trends

- 3.4.1. Non-GMO Textured Soy Protein to gain Prominence

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Non-GMO Textured Soy Protein Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Conventional

- 5.1.2. Organic

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverages

- 5.2.1.1. Meat Substitutes

- 5.2.1.2. Dairy Alternatives

- 5.2.1.3. Infant Nutrition

- 5.2.1.4. Bakery Products

- 5.2.1.5. Cereal and Snacks

- 5.2.1.6. Other Food Applications

- 5.2.2. Animal Feed

- 5.2.1. Food and Beverages

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Non-GMO Textured Soy Protein Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Conventional

- 6.1.2. Organic

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverages

- 6.2.1.1. Meat Substitutes

- 6.2.1.2. Dairy Alternatives

- 6.2.1.3. Infant Nutrition

- 6.2.1.4. Bakery Products

- 6.2.1.5. Cereal and Snacks

- 6.2.1.6. Other Food Applications

- 6.2.2. Animal Feed

- 6.2.1. Food and Beverages

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Non-GMO Textured Soy Protein Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Conventional

- 7.1.2. Organic

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverages

- 7.2.1.1. Meat Substitutes

- 7.2.1.2. Dairy Alternatives

- 7.2.1.3. Infant Nutrition

- 7.2.1.4. Bakery Products

- 7.2.1.5. Cereal and Snacks

- 7.2.1.6. Other Food Applications

- 7.2.2. Animal Feed

- 7.2.1. Food and Beverages

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Non-GMO Textured Soy Protein Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Conventional

- 8.1.2. Organic

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverages

- 8.2.1.1. Meat Substitutes

- 8.2.1.2. Dairy Alternatives

- 8.2.1.3. Infant Nutrition

- 8.2.1.4. Bakery Products

- 8.2.1.5. Cereal and Snacks

- 8.2.1.6. Other Food Applications

- 8.2.2. Animal Feed

- 8.2.1. Food and Beverages

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Non-GMO Textured Soy Protein Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Conventional

- 9.1.2. Organic

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food and Beverages

- 9.2.1.1. Meat Substitutes

- 9.2.1.2. Dairy Alternatives

- 9.2.1.3. Infant Nutrition

- 9.2.1.4. Bakery Products

- 9.2.1.5. Cereal and Snacks

- 9.2.1.6. Other Food Applications

- 9.2.2. Animal Feed

- 9.2.1. Food and Beverages

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Non-GMO Textured Soy Protein Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Conventional

- 10.1.2. Organic

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food and Beverages

- 10.2.1.1. Meat Substitutes

- 10.2.1.2. Dairy Alternatives

- 10.2.1.3. Infant Nutrition

- 10.2.1.4. Bakery Products

- 10.2.1.5. Cereal and Snacks

- 10.2.1.6. Other Food Applications

- 10.2.2. Animal Feed

- 10.2.1. Food and Beverages

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Wilmar International Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cargill Incorporated

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Archer-Daniels-Midland Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Crown Soya Protein Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DuPont de Nemours Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sonic Bioche

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Victoria Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bremil Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hoya Food

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Wilmar International Limited

List of Figures

- Figure 1: Global Non-GMO Textured Soy Protein Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Non-GMO Textured Soy Protein Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Non-GMO Textured Soy Protein Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Non-GMO Textured Soy Protein Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Non-GMO Textured Soy Protein Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Non-GMO Textured Soy Protein Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Non-GMO Textured Soy Protein Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Non-GMO Textured Soy Protein Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Non-GMO Textured Soy Protein Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Non-GMO Textured Soy Protein Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Non-GMO Textured Soy Protein Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Non-GMO Textured Soy Protein Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Non-GMO Textured Soy Protein Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Non-GMO Textured Soy Protein Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Non-GMO Textured Soy Protein Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Non-GMO Textured Soy Protein Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Non-GMO Textured Soy Protein Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Non-GMO Textured Soy Protein Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Non-GMO Textured Soy Protein Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Non-GMO Textured Soy Protein Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: South America Non-GMO Textured Soy Protein Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Non-GMO Textured Soy Protein Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: South America Non-GMO Textured Soy Protein Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Non-GMO Textured Soy Protein Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Non-GMO Textured Soy Protein Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Non-GMO Textured Soy Protein Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Non-GMO Textured Soy Protein Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Non-GMO Textured Soy Protein Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Non-GMO Textured Soy Protein Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Non-GMO Textured Soy Protein Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Non-GMO Textured Soy Protein Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Non-GMO Textured Soy Protein Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Non-GMO Textured Soy Protein Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Non-GMO Textured Soy Protein Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Non-GMO Textured Soy Protein Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Non-GMO Textured Soy Protein Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Non-GMO Textured Soy Protein Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Non-GMO Textured Soy Protein Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Non-GMO Textured Soy Protein Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Non-GMO Textured Soy Protein Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Non-GMO Textured Soy Protein Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Non-GMO Textured Soy Protein Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Non-GMO Textured Soy Protein Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 13: Global Non-GMO Textured Soy Protein Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 14: Germany Non-GMO Textured Soy Protein Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Non-GMO Textured Soy Protein Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: France Non-GMO Textured Soy Protein Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Italy Non-GMO Textured Soy Protein Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Spain Non-GMO Textured Soy Protein Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Non-GMO Textured Soy Protein Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Global Non-GMO Textured Soy Protein Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 21: Global Non-GMO Textured Soy Protein Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Non-GMO Textured Soy Protein Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: India Non-GMO Textured Soy Protein Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: China Non-GMO Textured Soy Protein Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Non-GMO Textured Soy Protein Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Australia Non-GMO Textured Soy Protein Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Non-GMO Textured Soy Protein Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Non-GMO Textured Soy Protein Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 29: Global Non-GMO Textured Soy Protein Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 30: Global Non-GMO Textured Soy Protein Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Brazil Non-GMO Textured Soy Protein Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Argentina Non-GMO Textured Soy Protein Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of South America Non-GMO Textured Soy Protein Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Non-GMO Textured Soy Protein Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 35: Global Non-GMO Textured Soy Protein Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 36: Global Non-GMO Textured Soy Protein Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 37: South Africa Non-GMO Textured Soy Protein Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Saudi Arabia Non-GMO Textured Soy Protein Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Middle East and Africa Non-GMO Textured Soy Protein Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Non-GMO Textured Soy Protein Industry?

The projected CAGR is approximately 7.66%.

2. Which companies are prominent players in the Non-GMO Textured Soy Protein Industry?

Key companies in the market include Wilmar International Limited, Cargill Incorporated, The Archer-Daniels-Midland Company, Crown Soya Protein Group, DuPont de Nemours Inc, Sonic Bioche, Victoria Group, Bremil Group, Hoya Food.

3. What are the main segments of the Non-GMO Textured Soy Protein Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.03 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Vegan Food & Beverages Driving the Market; Intolerance and Allergies Associated with Animal Protein Products.

6. What are the notable trends driving market growth?

Non-GMO Textured Soy Protein to gain Prominence.

7. Are there any restraints impacting market growth?

High Market Penetration of Animal Protein.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Non-GMO Textured Soy Protein Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Non-GMO Textured Soy Protein Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Non-GMO Textured Soy Protein Industry?

To stay informed about further developments, trends, and reports in the Non-GMO Textured Soy Protein Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence