Key Insights

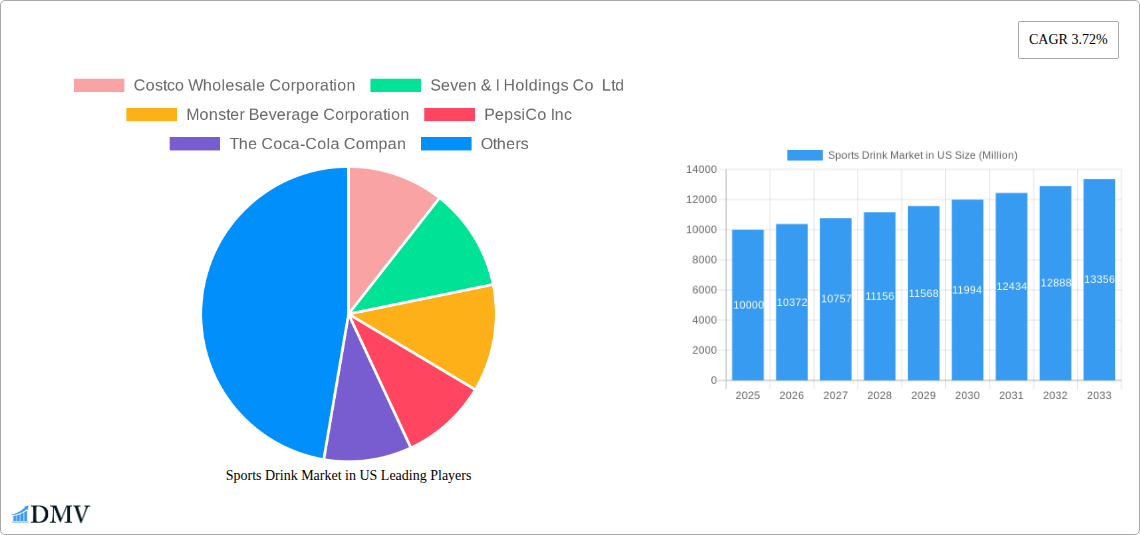

The US sports drink market, valued at approximately $28.2 billion in 2024, is poised for robust expansion. This growth is propelled by increasing health consciousness, heightened participation in fitness, and the surging popularity of functional beverages. The market's Compound Annual Growth Rate (CAGR) of 3.8% signifies sustained development through 2033. Key growth drivers include electrolyte-enhanced waters, appealing to health-conscious consumers seeking sugar-free hydration, and protein-based sports drinks, favored by athletes for muscle recovery and performance optimization. While convenience stores and supermarkets remain primary distribution channels, online retail is experiencing significant growth, mirroring broader e-commerce trends. Fierce competition exists among major players like Coca-Cola, PepsiCo, and Monster Beverage, alongside specialized brands focusing on niche formulations and innovative packaging. The demand for natural and organic ingredients is shaping product development, creating opportunities for transparent and sustainable brands. However, concerns over high sugar content and artificial additives present challenges, driving reformulation efforts.

Sports Drink Market in US Market Size (In Billion)

The projected market expansion is particularly strong within premium and functional segments. The rise of personalized nutrition and technology-integrated fitness tracking will further influence consumer choices, fostering demand for customized products. Continued growth in the health and wellness sector, encompassing athletic and fitness activities, directly supports sustained sports drink market expansion. Innovations in sustainable and convenient packaging will be crucial in influencing consumer preference and driving sales. While established brands will maintain significant market share, opportunities remain for disruptive innovations from smaller companies offering unique product propositions.

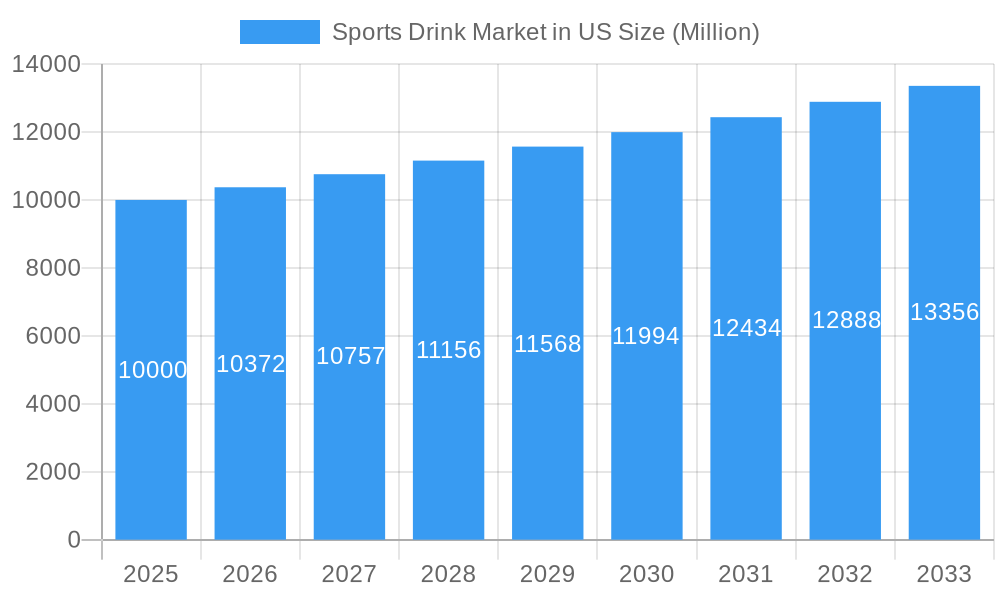

Sports Drink Market in US Company Market Share

Sports Drink Market in US: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic US sports drink market, encompassing historical data (2019-2024), the current landscape (Base Year: 2025), and a comprehensive forecast (2025-2033). It delves into market segmentation, key players, growth drivers, challenges, and future opportunities, offering valuable insights for stakeholders across the industry. The report is meticulously researched and provides data-driven projections essential for informed strategic decision-making. The market is estimated to be worth xx Million in 2025.

Sports Drink Market in US Market Composition & Trends

This section evaluates the competitive intensity, innovative forces, regulatory environment, substitute product analysis, consumer demographics, and mergers & acquisitions (M&A) activities within the US sports drink market. The market is characterized by a concentrated competitive landscape, with key players holding significant market share. For example, Coca-Cola and PepsiCo hold a combined share of approximately xx%, while other significant players like Monster Beverage and Keurig Dr Pepper contribute to the remaining market share. The market shows significant dynamism with ongoing M&A activity. Recent deal values have ranged from xx Million to xx Million, reflecting the strategic importance of market consolidation and expansion.

Key Aspects Analyzed:

- Market Concentration: High concentration with major players dominating.

- Innovation Catalysts: Focus on functional ingredients, natural flavors, and sustainable packaging.

- Regulatory Landscape: FDA regulations concerning labeling, ingredient safety, and marketing claims.

- Substitute Products: Bottled water, energy drinks, and electrolyte supplements.

- End-User Profiles: Athletes, fitness enthusiasts, and health-conscious consumers.

- M&A Activities: Consolidation and expansion strategies through acquisitions. Recent deals valued between xx Million and xx Million.

Sports Drink Market in US Industry Evolution

The US sports drink market has experienced substantial growth over the historical period (2019-2024), driven by factors such as increasing health consciousness, growing participation in fitness activities, and the proliferation of innovative product formulations. Annual growth rates averaged xx% during 2019-2024, with the segment expected to continue its expansion at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements in packaging and formulation, such as the rise of electrolyte-enhanced waters and functional hydration beverages, have further fueled market expansion. Shifting consumer preferences towards natural ingredients, low sugar options, and sustainable packaging also represent key trends shaping market evolution. The adoption rate of functional sports drinks continues to grow, reflecting a broader focus on holistic wellness.

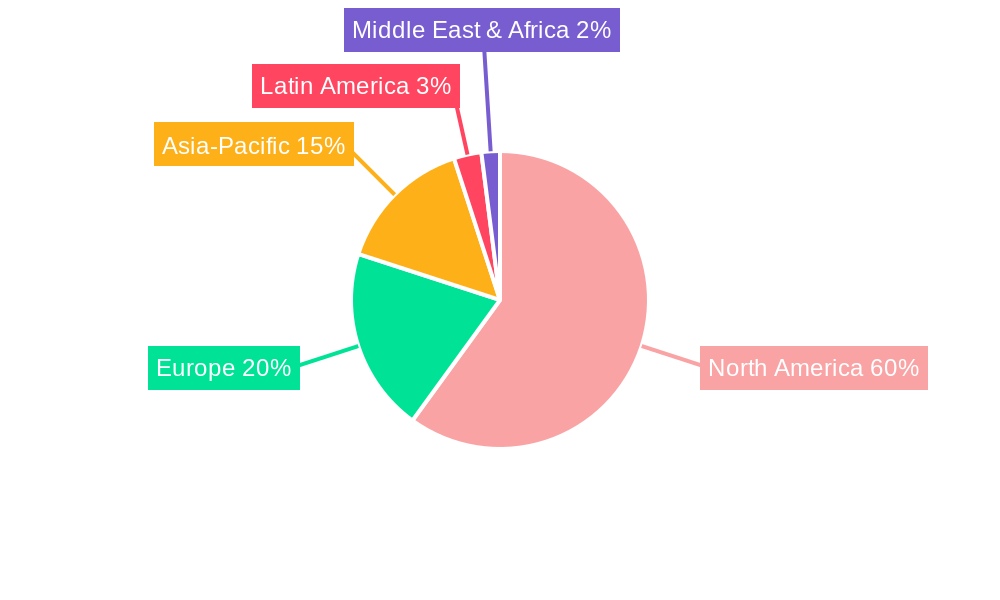

Leading Regions, Countries, or Segments in Sports Drink Market in US

The US sports drink market exhibits regional variations in consumption patterns and market dynamics. However, the report focuses on the overall market without isolating specific regions due to a lack of available detailed regional data. Specific segment analysis reveals significant dominance based on certain factors:

Dominant Segments and Key Drivers:

- Soft Drink Type: Isotonic drinks maintain a leading position due to their efficacy in rehydration. The growth of Electrolyte-Enhanced Water segment is also noteworthy due to increased health consciousness.

- Packaging Type: PET bottles dominate due to cost-effectiveness and convenience. However, aseptic packaging demonstrates increasing adoption driven by extended shelf-life benefits and sustainability concerns.

- Sub Distribution Channel: Convenience stores are the dominant distribution channel due to high foot traffic and consumer proximity, followed by Supermarket/Hypermarkets.

Dominance Factors:

- Isotonic drinks: Superior hydration properties compared to other segments.

- PET Bottles: Cost-effective, convenient, and widely available.

- Convenience Stores: High foot traffic and impulse purchases.

Sports Drink Market in US Product Innovations

Recent innovations in the US sports drink market focus on enhancing functionality, taste, and convenience. Formulations now incorporate natural sweeteners, functional ingredients (vitamins, antioxidants), and electrolytes to cater to health-conscious consumers. Advanced packaging technologies, such as lightweight and recyclable PET bottles and aseptic packaging, also play a crucial role in product innovation. These innovations are reflected in new product launches and enhanced formulations by leading brands, driving increased consumer appeal and market expansion. Unique selling propositions (USPs) are focusing on delivering enhanced hydration, optimized performance benefits, and better taste profiles.

Propelling Factors for Sports Drink Market in US Growth

Several factors propel the growth of the US sports drink market. Technological advancements in formulation and packaging, leading to better taste, convenience, and functionality, are critical. Economic growth and rising disposable incomes allow consumers to spend more on health and wellness products. Favorable government regulations support the development and marketing of functional beverages. The increasing prevalence of sports and fitness activities further drives demand for hydration and performance-enhancing beverages.

Obstacles in the Sports Drink Market in US Market

The US sports drink market faces several challenges. Stringent regulations on labeling and marketing claims can limit product development and innovation. Supply chain disruptions can cause price fluctuations and impact product availability. Intense competition from existing players and new entrants creates a dynamic environment with ongoing price wars and promotional activities. These factors contribute to uncertainty and complexity in the market dynamics and affect profitability and overall market growth.

Future Opportunities in Sports Drink Market in US

Emerging opportunities in the US sports drink market include expanding into niche segments, such as organic, plant-based, and low-sugar options. Advancements in technology will drive innovation in packaging materials and delivery systems. Growth in the functional beverage market, where sports drinks will play a key role. Changes in consumer preference will focus on the growth of functional drinks with added health benefits.

Major Players in the Sports Drink Market in US Ecosystem

- Costco Wholesale Corporation

- Seven & I Holdings Co Ltd

- Monster Beverage Corporation

- PepsiCo Inc

- The Coca-Cola Company

- Abbott Laboratories

- Suntory Holdings Limited

- Keurig Dr Pepper Inc

- Pisa Global S A de C V

- Otsuka Holdings Co Ltd

- Bluetriton Brands Holdings Inc

- Congo Brands

Key Developments in Sports Drink Market in US Industry

- December 2023: Spar partners with Congo Brands to introduce Prime drinks, expanding distribution in convenience stores.

- April 2023: Congo LLC invests USD 8.25 Million in relocating and expanding its Louisville headquarters, creating 500 jobs. This signifies substantial investment in the US market.

- February 2023: Core Hydration launches Core Hydration+, a line of nutrient-enhanced waters, indicating a growing trend towards functional hydration.

Strategic Sports Drink Market in US Market Forecast

The US sports drink market is poised for continued growth, driven by sustained consumer demand for healthier and more functional beverages. Innovative product formulations, strategic partnerships, and expanding distribution channels will be instrumental in shaping market dynamics. The market is expected to witness a significant increase in value and volume over the forecast period, presenting substantial opportunities for existing players and new entrants alike. The focus on functional hydration and personalized wellness will be key drivers of growth in the coming years.

Sports Drink Market in US Segmentation

-

1. Soft Drink Type

- 1.1. Electrolyte-Enhanced Water

- 1.2. Hypertonic

- 1.3. Hypotonic

- 1.4. Isotonic

- 1.5. Protein-based Sport Drinks

-

2. Packaging Type

- 2.1. Aseptic packages

- 2.2. Metal Can

- 2.3. PET Bottles

-

3. Sub Distribution Channel

- 3.1. Convenience Stores

- 3.2. Online Retail

- 3.3. Specialty Stores

- 3.4. Supermarket/Hypermarket

- 3.5. Others

Sports Drink Market in US Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Sports Drink Market in US Regional Market Share

Geographic Coverage of Sports Drink Market in US

Sports Drink Market in US REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumer Awareness about Health and Fitness; Increasing the Use of Casein and Caseinate in Food and Beverage Industry

- 3.3. Market Restrains

- 3.3.1. High Competition From Alternative Protein Sources

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sports Drink Market in US Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 5.1.1. Electrolyte-Enhanced Water

- 5.1.2. Hypertonic

- 5.1.3. Hypotonic

- 5.1.4. Isotonic

- 5.1.5. Protein-based Sport Drinks

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Aseptic packages

- 5.2.2. Metal Can

- 5.2.3. PET Bottles

- 5.3. Market Analysis, Insights and Forecast - by Sub Distribution Channel

- 5.3.1. Convenience Stores

- 5.3.2. Online Retail

- 5.3.3. Specialty Stores

- 5.3.4. Supermarket/Hypermarket

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6. North America Sports Drink Market in US Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6.1.1. Electrolyte-Enhanced Water

- 6.1.2. Hypertonic

- 6.1.3. Hypotonic

- 6.1.4. Isotonic

- 6.1.5. Protein-based Sport Drinks

- 6.2. Market Analysis, Insights and Forecast - by Packaging Type

- 6.2.1. Aseptic packages

- 6.2.2. Metal Can

- 6.2.3. PET Bottles

- 6.3. Market Analysis, Insights and Forecast - by Sub Distribution Channel

- 6.3.1. Convenience Stores

- 6.3.2. Online Retail

- 6.3.3. Specialty Stores

- 6.3.4. Supermarket/Hypermarket

- 6.3.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 7. South America Sports Drink Market in US Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 7.1.1. Electrolyte-Enhanced Water

- 7.1.2. Hypertonic

- 7.1.3. Hypotonic

- 7.1.4. Isotonic

- 7.1.5. Protein-based Sport Drinks

- 7.2. Market Analysis, Insights and Forecast - by Packaging Type

- 7.2.1. Aseptic packages

- 7.2.2. Metal Can

- 7.2.3. PET Bottles

- 7.3. Market Analysis, Insights and Forecast - by Sub Distribution Channel

- 7.3.1. Convenience Stores

- 7.3.2. Online Retail

- 7.3.3. Specialty Stores

- 7.3.4. Supermarket/Hypermarket

- 7.3.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 8. Europe Sports Drink Market in US Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 8.1.1. Electrolyte-Enhanced Water

- 8.1.2. Hypertonic

- 8.1.3. Hypotonic

- 8.1.4. Isotonic

- 8.1.5. Protein-based Sport Drinks

- 8.2. Market Analysis, Insights and Forecast - by Packaging Type

- 8.2.1. Aseptic packages

- 8.2.2. Metal Can

- 8.2.3. PET Bottles

- 8.3. Market Analysis, Insights and Forecast - by Sub Distribution Channel

- 8.3.1. Convenience Stores

- 8.3.2. Online Retail

- 8.3.3. Specialty Stores

- 8.3.4. Supermarket/Hypermarket

- 8.3.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 9. Middle East & Africa Sports Drink Market in US Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 9.1.1. Electrolyte-Enhanced Water

- 9.1.2. Hypertonic

- 9.1.3. Hypotonic

- 9.1.4. Isotonic

- 9.1.5. Protein-based Sport Drinks

- 9.2. Market Analysis, Insights and Forecast - by Packaging Type

- 9.2.1. Aseptic packages

- 9.2.2. Metal Can

- 9.2.3. PET Bottles

- 9.3. Market Analysis, Insights and Forecast - by Sub Distribution Channel

- 9.3.1. Convenience Stores

- 9.3.2. Online Retail

- 9.3.3. Specialty Stores

- 9.3.4. Supermarket/Hypermarket

- 9.3.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 10. Asia Pacific Sports Drink Market in US Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 10.1.1. Electrolyte-Enhanced Water

- 10.1.2. Hypertonic

- 10.1.3. Hypotonic

- 10.1.4. Isotonic

- 10.1.5. Protein-based Sport Drinks

- 10.2. Market Analysis, Insights and Forecast - by Packaging Type

- 10.2.1. Aseptic packages

- 10.2.2. Metal Can

- 10.2.3. PET Bottles

- 10.3. Market Analysis, Insights and Forecast - by Sub Distribution Channel

- 10.3.1. Convenience Stores

- 10.3.2. Online Retail

- 10.3.3. Specialty Stores

- 10.3.4. Supermarket/Hypermarket

- 10.3.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Costco Wholesale Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Seven & I Holdings Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Monster Beverage Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PepsiCo Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Coca-Cola Compan

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Abbott Laboratories

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Suntory Holdings Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Keurig Dr Pepper Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pisa Global S A de C V

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Otsuka Holdings Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bluetriton Brands Holdings Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Congo Brands

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Costco Wholesale Corporation

List of Figures

- Figure 1: Global Sports Drink Market in US Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Sports Drink Market in US Revenue (billion), by Soft Drink Type 2025 & 2033

- Figure 3: North America Sports Drink Market in US Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 4: North America Sports Drink Market in US Revenue (billion), by Packaging Type 2025 & 2033

- Figure 5: North America Sports Drink Market in US Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 6: North America Sports Drink Market in US Revenue (billion), by Sub Distribution Channel 2025 & 2033

- Figure 7: North America Sports Drink Market in US Revenue Share (%), by Sub Distribution Channel 2025 & 2033

- Figure 8: North America Sports Drink Market in US Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Sports Drink Market in US Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Sports Drink Market in US Revenue (billion), by Soft Drink Type 2025 & 2033

- Figure 11: South America Sports Drink Market in US Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 12: South America Sports Drink Market in US Revenue (billion), by Packaging Type 2025 & 2033

- Figure 13: South America Sports Drink Market in US Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 14: South America Sports Drink Market in US Revenue (billion), by Sub Distribution Channel 2025 & 2033

- Figure 15: South America Sports Drink Market in US Revenue Share (%), by Sub Distribution Channel 2025 & 2033

- Figure 16: South America Sports Drink Market in US Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Sports Drink Market in US Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Sports Drink Market in US Revenue (billion), by Soft Drink Type 2025 & 2033

- Figure 19: Europe Sports Drink Market in US Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 20: Europe Sports Drink Market in US Revenue (billion), by Packaging Type 2025 & 2033

- Figure 21: Europe Sports Drink Market in US Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 22: Europe Sports Drink Market in US Revenue (billion), by Sub Distribution Channel 2025 & 2033

- Figure 23: Europe Sports Drink Market in US Revenue Share (%), by Sub Distribution Channel 2025 & 2033

- Figure 24: Europe Sports Drink Market in US Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Sports Drink Market in US Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Sports Drink Market in US Revenue (billion), by Soft Drink Type 2025 & 2033

- Figure 27: Middle East & Africa Sports Drink Market in US Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 28: Middle East & Africa Sports Drink Market in US Revenue (billion), by Packaging Type 2025 & 2033

- Figure 29: Middle East & Africa Sports Drink Market in US Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 30: Middle East & Africa Sports Drink Market in US Revenue (billion), by Sub Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa Sports Drink Market in US Revenue Share (%), by Sub Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa Sports Drink Market in US Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa Sports Drink Market in US Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Sports Drink Market in US Revenue (billion), by Soft Drink Type 2025 & 2033

- Figure 35: Asia Pacific Sports Drink Market in US Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 36: Asia Pacific Sports Drink Market in US Revenue (billion), by Packaging Type 2025 & 2033

- Figure 37: Asia Pacific Sports Drink Market in US Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 38: Asia Pacific Sports Drink Market in US Revenue (billion), by Sub Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific Sports Drink Market in US Revenue Share (%), by Sub Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific Sports Drink Market in US Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific Sports Drink Market in US Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Sports Drink Market in US Revenue billion Forecast, by Soft Drink Type 2020 & 2033

- Table 2: Global Sports Drink Market in US Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 3: Global Sports Drink Market in US Revenue billion Forecast, by Sub Distribution Channel 2020 & 2033

- Table 4: Global Sports Drink Market in US Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Sports Drink Market in US Revenue billion Forecast, by Soft Drink Type 2020 & 2033

- Table 6: Global Sports Drink Market in US Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 7: Global Sports Drink Market in US Revenue billion Forecast, by Sub Distribution Channel 2020 & 2033

- Table 8: Global Sports Drink Market in US Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Sports Drink Market in US Revenue billion Forecast, by Soft Drink Type 2020 & 2033

- Table 13: Global Sports Drink Market in US Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 14: Global Sports Drink Market in US Revenue billion Forecast, by Sub Distribution Channel 2020 & 2033

- Table 15: Global Sports Drink Market in US Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Sports Drink Market in US Revenue billion Forecast, by Soft Drink Type 2020 & 2033

- Table 20: Global Sports Drink Market in US Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 21: Global Sports Drink Market in US Revenue billion Forecast, by Sub Distribution Channel 2020 & 2033

- Table 22: Global Sports Drink Market in US Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Sports Drink Market in US Revenue billion Forecast, by Soft Drink Type 2020 & 2033

- Table 33: Global Sports Drink Market in US Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 34: Global Sports Drink Market in US Revenue billion Forecast, by Sub Distribution Channel 2020 & 2033

- Table 35: Global Sports Drink Market in US Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global Sports Drink Market in US Revenue billion Forecast, by Soft Drink Type 2020 & 2033

- Table 43: Global Sports Drink Market in US Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 44: Global Sports Drink Market in US Revenue billion Forecast, by Sub Distribution Channel 2020 & 2033

- Table 45: Global Sports Drink Market in US Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Sports Drink Market in US Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sports Drink Market in US?

The projected CAGR is approximately 3.8%.

2. Which companies are prominent players in the Sports Drink Market in US?

Key companies in the market include Costco Wholesale Corporation, Seven & I Holdings Co Ltd, Monster Beverage Corporation, PepsiCo Inc, The Coca-Cola Compan, Abbott Laboratories, Suntory Holdings Limited, Keurig Dr Pepper Inc, Pisa Global S A de C V, Otsuka Holdings Co Ltd, Bluetriton Brands Holdings Inc, Congo Brands.

3. What are the main segments of the Sports Drink Market in US?

The market segments include Soft Drink Type, Packaging Type, Sub Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumer Awareness about Health and Fitness; Increasing the Use of Casein and Caseinate in Food and Beverage Industry.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Competition From Alternative Protein Sources.

8. Can you provide examples of recent developments in the market?

December 2023: Spar works with US distributor Congo Brands to bring Prime drinks to stores. The move makes Spar the first symbol group in the convenience channel to stock PrimeApril 2023: Congo LLC to relocate, expand Louisville headquarters with USD 8.25 million investment, creating 500 high-wage jobs. The company will relocate its Louisville headquarters to an existing 110,000-square-foot location at 13551 Triton Park Blvd., moving from its current 18,000-square-foot facility.February 2023: Premium pH-balanced water brand Core Hydration expanded with Core Hydration+, a series of nutrient-enhanced waters, each formulated to support overall health with functional ingredients. The brand is available in three flavors under the names Core Hydration+Immunity, Core Hydartion+Vibrance, and Core Hydration+ Calm.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sports Drink Market in US," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sports Drink Market in US report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sports Drink Market in US?

To stay informed about further developments, trends, and reports in the Sports Drink Market in US, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence