Key Insights

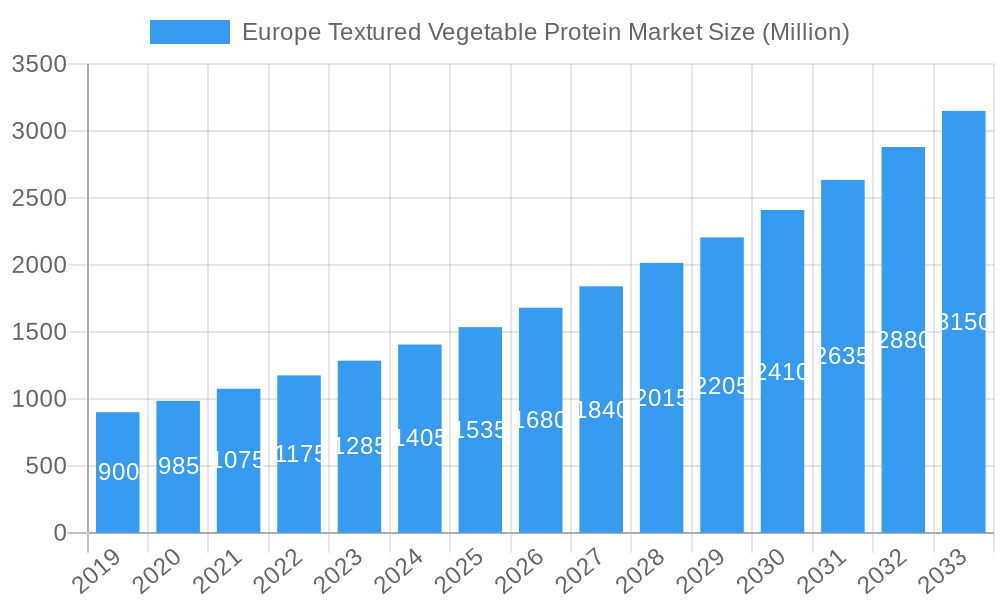

The European Textured Vegetable Protein (TVP) market is projected for significant expansion, propelled by rising consumer preference for plant-based protein and increased awareness of the environmental impact of conventional protein sources. With a current market size valued at 636.5 million and an anticipated Compound Annual Growth Rate (CAGR) of 10.95% from 2025 to 2033, the TVP sector presents a dynamic investment opportunity. This growth is underpinned by the increasing adoption of flexitarian, vegetarian, and vegan diets across the continent, particularly in the United Kingdom, Germany, and France. The inherent versatility of TVP in diverse food applications, including meat substitutes, snacks, pet food, and industrial uses, enhances its market penetration. Advancements in processing technologies are also improving TVP's texture, taste, and functionality, making it a more attractive ingredient for both manufacturers and consumers.

Europe Textured Vegetable Protein Market Market Size (In Million)

Distribution channels are segmented, with Off-Trade channels, including convenience stores, the growing online market, and supermarkets/hypermarkets, expected to lead sales due to their accessibility. The On-Trade segment, comprising restaurants and food service providers, also offers substantial potential as culinary establishments increasingly integrate plant-based options. Key market players are actively investing in research and development, production capacity expansion, and strategic partnerships to secure market share. The competitive landscape emphasizes product innovation, sustainable sourcing, and the catering to specific dietary needs and flavor profiles. Potential challenges include fluctuating raw material prices and consumer perception regarding processing, though these are being actively addressed through industry advancements.

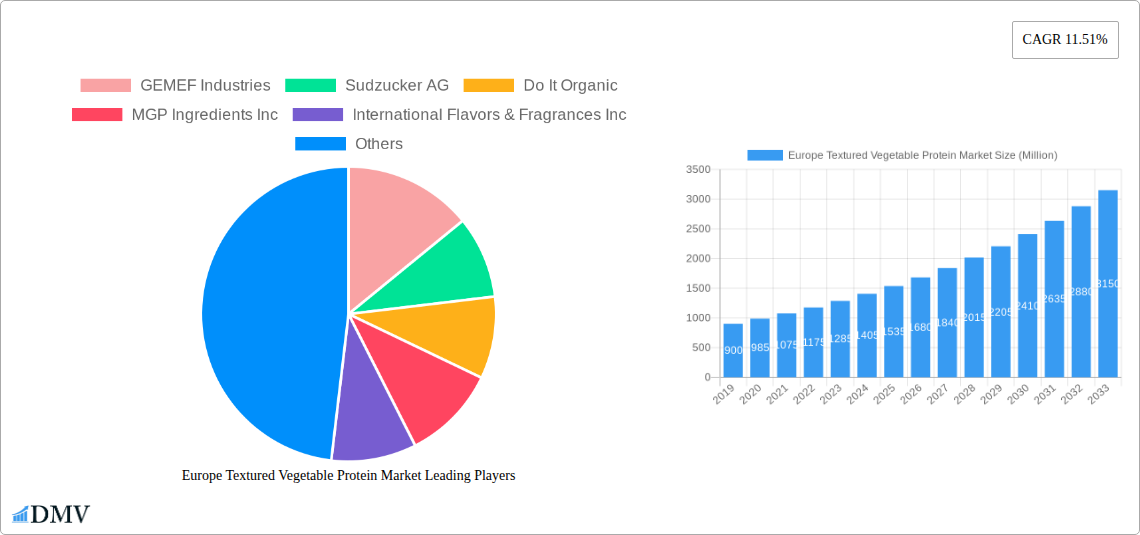

Europe Textured Vegetable Protein Market Company Market Share

This report provides a comprehensive analysis of the European Textured Vegetable Protein Market, a rapidly growing sector driven by the increasing consumer demand for sustainable, healthy, and diverse protein alternatives. The report details market composition, pivotal trends, and growth trajectories from 2019-2024 through the 2025 base year and a forecast extending to 2033. It dissects market dynamics, identifies key drivers and restraints, and highlights future opportunities, offering valuable insights for manufacturers, ingredient suppliers, food and beverage companies, investors, and regulatory bodies. The research covers a wide spectrum of TVP applications, including meat alternatives, dairy alternatives, and bakery products, emphasizing the versatility and growing acceptance of these plant-based ingredients. The market size is projected to reach 636.5 million by 2025, with a CAGR of 10.95%.

Europe Textured Vegetable Protein Market Market Composition & Trends

The Europe Textured Vegetable Protein Market exhibits a dynamic landscape characterized by moderate concentration among a few key players and a growing number of innovative startups. Innovation is a significant catalyst, fueled by advancements in processing technologies and ingredient functionality, leading to improved taste, texture, and nutritional profiles of TVP products. Regulatory frameworks in Europe, particularly those concerning food labeling and health claims, play a crucial role in shaping market growth and consumer perception. Substitute products, such as other plant-based proteins and traditional meat, continue to exert competitive pressure, yet the unique attributes of TVP, such as its versatility and cost-effectiveness, solidify its market position. End-user profiles are diversifying, encompassing health-conscious consumers, vegans, vegetarians, and flexitarians seeking to reduce meat consumption. Mergers and acquisitions (M&A) activities are on the rise as established players seek to expand their product portfolios and market reach, while new entrants aim to capture market share through niche offerings. The M&A deal values within the sector are projected to reach over XX Million in the coming years, reflecting the strategic importance of TVP ingredients. Market share distribution is gradually shifting, with companies like Roquette Freres and Ingredion Inc. holding significant portions, but innovative smaller players are gaining traction through specialized offerings.

Europe Textured Vegetable Protein Market Industry Evolution

The evolution of the Europe Textured Vegetable Protein Market is a compelling narrative of innovation, shifting consumer preferences, and strategic market expansion. Historically, TVP was primarily utilized as a cost-effective meat extender, but its role has significantly transformed. Over the historical period (2019-2024), the market witnessed steady growth, driven by initial awareness and adoption within niche vegetarian and vegan communities. The base year, 2025, marks a pivotal point where TVP is increasingly recognized for its inherent health benefits and environmental sustainability, propelling it into mainstream consumption. The forecast period (2025-2033) is anticipated to see an accelerated growth trajectory, with an estimated Compound Annual Growth Rate (CAGR) of XX%. This surge is attributed to several key factors. Firstly, technological advancements in extrusion and processing techniques have dramatically improved the sensory attributes of TVP, making it virtually indistinguishable from animal-based proteins in terms of texture and mouthfeel. This has opened up a vast array of applications beyond traditional burgers and sausages, including seafood alternatives, pet food ingredients, and even snacks. Secondly, the growing global concern over climate change and the environmental impact of animal agriculture has positioned plant-based proteins, including TVP, as a sustainable and ethical choice. Consumers are increasingly making purchasing decisions based on these factors, thereby creating substantial demand. Thirdly, a burgeoning health and wellness trend, with consumers actively seeking to reduce their intake of red meat due to perceived health risks, further fuels the demand for TVP as a nutritious and lean protein source. The adoption metrics for TVP in the food industry are on an upward trend, with a significant increase in product launches featuring TVP as a primary ingredient. For instance, the penetration of TVP in the convenience food sector is expected to rise by XX% by 2033, indicating a substantial shift in ingredient sourcing. Furthermore, the investment in R&D by major players to develop novel TVP varieties derived from diverse sources like fava beans, chickpeas, and algae is expanding the application spectrum and catering to a broader consumer base. The market's evolution is not just about replacing meat; it's about creating innovative, delicious, and sustainable food solutions for a global population.

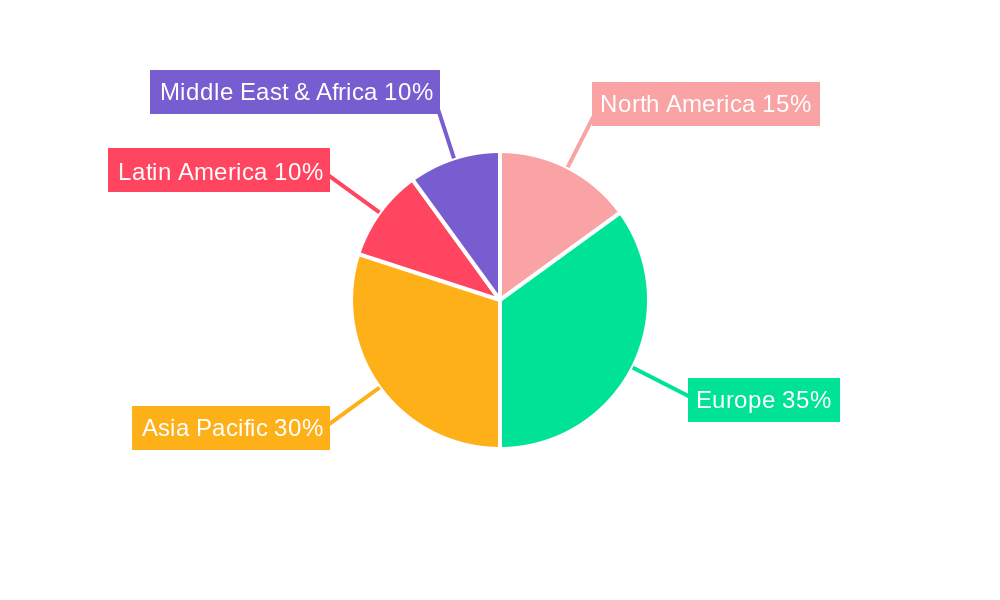

Leading Regions, Countries, or Segments in Europe Textured Vegetable Protein Market

The Europe Textured Vegetable Protein Market is dominated by several key regions and distribution channels, with the Off-Trade segment emerging as the undisputed leader, significantly outpacing the On-Trade sector. Within the Off-Trade channel, Supermarkets and Hypermarkets command the largest market share, estimated at approximately XX% of the total off-trade sales. This dominance is driven by the extensive reach of these retail formats, offering consumers a wide selection of plant-based products, including those featuring TVP, in a convenient and accessible manner. The growing consumer preference for home cooking and meal preparation, further amplified by recent global events, has significantly boosted sales through these channels.

- Supermarkets and Hypermarkets: These retail giants are at the forefront of making TVP products readily available to a mass audience. Their strategic shelf placement, promotional activities, and partnerships with TVP manufacturers ensure high visibility and drive significant sales volumes. The increasing availability of private label TVP products also contributes to their market leadership by offering more affordable options.

The Online Channel is experiencing the most rapid growth within the Off-Trade segment, with an anticipated CAGR of XX% over the forecast period. This surge is attributed to the convenience of online grocery shopping, the increasing sophistication of e-commerce platforms, and the growing comfort of consumers with purchasing food online. Many specialized plant-based online retailers and major e-commerce players are expanding their offerings of TVP-based products, catering to a digitally-savvy consumer base.

- Online Channel: This segment benefits from targeted marketing, personalized recommendations, and the ability to reach consumers in less densely populated areas. The growth is further propelled by subscription box services and direct-to-consumer (DTC) models offered by some TVP manufacturers.

Convenience Stores also play a crucial role, particularly for impulse purchases and grab-and-go options. While their individual sales volume might be smaller compared to supermarkets, their widespread presence and accessibility make them a vital part of the TVP distribution network.

- Convenience Stores: These outlets are increasingly stocking ready-to-eat meals and snacks containing TVP, catering to consumers seeking quick and convenient plant-based options.

The On-Trade segment, which includes restaurants, cafes, and food service establishments, represents a smaller but growing portion of the market. While the recovery of the hospitality sector post-pandemic is contributing to its growth, it still lags behind the Off-Trade channels in terms of overall market share. However, the increasing adoption of plant-based menu options by mainstream restaurants and fast-food chains is a positive indicator for future growth in this segment.

- On-Trade: The demand here is driven by the increasing inclusion of plant-based dishes on menus, offering consumers opportunities to try TVP in various culinary preparations.

The dominance of the Off-Trade channel, particularly Supermarkets and Hypermarkets, underscores the broad consumer acceptance and accessibility of TVP products in Europe. The rapid expansion of the Online Channel signals a significant shift in consumer purchasing habits, while Convenience Stores and the On-Trade segment offer further avenues for market penetration and growth.

Europe Textured Vegetable Protein Market Product Innovations

Product innovation in the Europe Textured Vegetable Protein Market is primarily focused on enhancing sensory attributes, expanding the range of protein sources, and developing functional ingredients. Advancements in extrusion technology have led to the creation of TVP with improved fibrous textures, mimicking meat more closely. Novel protein sources beyond soy and pea, such as fava bean and chickpea protein, are gaining traction, offering allergen-friendly and distinct nutritional profiles. For instance, International Flavors & Fragrances Inc.'s SUPRO® TEX offers high-process tolerance and neutral flavor, enabling diverse product designs in the plant-based protein category. Furthermore, the development of TVP with specific functionalities, such as improved binding, water-holding capacity, and emulsification, is expanding its application in processed foods like meat alternatives, baked goods, and dairy-free products.

Propelling Factors for Europe Textured Vegetable Protein Market Growth

Several key factors are propelling the growth of the Europe Textured Vegetable Protein Market. Firstly, the escalating consumer consciousness regarding health and wellness, coupled with a desire to reduce meat consumption for ethical and environmental reasons, is a primary driver. Secondly, significant advancements in processing technologies have led to the production of TVP with superior taste and texture, making it a more palatable and versatile ingredient. Thirdly, supportive government initiatives and regulatory frameworks in Europe that encourage the development and adoption of sustainable food sources contribute to market expansion. Lastly, the increasing availability of investment in plant-based food technology and startups, exemplified by ICL Group's investment in Arkeon, GmbH for innovative fermentation bioprocesses, fosters further product development and market penetration.

Obstacles in the Europe Textured Vegetable Protein Market Market

Despite its robust growth, the Europe Textured Vegetable Protein Market faces certain obstacles. Price sensitivity among some consumer segments can be a barrier, as TVP-based products can sometimes be more expensive than conventional meat options. Perceptions of TVP as a processed food ingredient and concerns about "clean labels" can also deter some consumers. Furthermore, supply chain disruptions, particularly those related to the sourcing of raw materials and fluctuating commodity prices, can impact production costs and availability. The presence of established meat industries and entrenched consumer habits also presents a competitive challenge that requires ongoing innovation and consumer education.

Future Opportunities in Europe Textured Vegetable Protein Market

The Europe Textured Vegetable Protein Market is ripe with future opportunities. The growing demand for personalized nutrition and specialized protein ingredients presents avenues for developing TVP with tailored nutritional profiles and functional benefits. Emerging markets in Eastern Europe, with their growing middle class and increasing adoption of Western dietary trends, offer significant untapped potential. Technological advancements in ingredient development, such as the utilization of novel protein sources and advanced processing techniques, will continue to expand the application landscape. Furthermore, the increasing integration of TVP into convenience foods and ready-to-eat meals aligns with busy consumer lifestyles, creating a substantial growth opportunity.

Major Players in the Europe Textured Vegetable Protein Market Ecosystem

- GEMEF Industries

- Sudzucker AG

- Do It Organic

- MGP Ingredients Inc

- International Flavors & Fragrances Inc

- Ingredion Inc

- ICL Group Ltd

- Associated British Foods PLC

- Univar Solutions Inc

- Axiom Foods Inc

- Roquette Freres

Key Developments in Europe Textured Vegetable Protein Market Industry

- June 2023: Roquette Freres announced the opening of Roquette’s Food Innovation Center to provide formulators with a large range of capabilities, including technical and R&D support, cutting-edge equipment, labs and scale-up testing with an ultimate goal of fostering innovation and to accelerate the go-to-market of new products.

- March 2023: International Flavors & Fragrances Inc. launched its new plant-based protein SUPRO® TEX which offers endless product design and formulation opportunities with its high-process tolerance, neutral flavor and color. SUPRO® TEX is based on soy protein.

- January 2023: ICL Group's AgriFood innovation and investment platform, ICL Planet Startup Hub, has invested USD 3 million in Arkeon, GmbH. The investment will support Arkeon’s innovative and sustainable one-step fermentation bioprocess, which creates completely customizable protein ingredients by capturing the greenhouse gas carbon dioxide (CO2) and converting it into the 20 proteinogenic amino acids. The project will also help ICL group to innovate their product portfolio.

Strategic Europe Textured Vegetable Protein Market Market Forecast

The strategic forecast for the Europe Textured Vegetable Protein Market is overwhelmingly positive, driven by a confluence of powerful market forces. The persistent growth in consumer demand for plant-based diets, fueled by health, environmental, and ethical considerations, will continue to be the primary growth catalyst. Advancements in food technology are expected to further refine the taste, texture, and nutritional value of TVP, broadening its appeal and application range. The increasing support from regulatory bodies, promoting sustainable food systems, and potential incentives for plant-based protein production will provide a conducive environment for market expansion. Furthermore, the growing penetration of TVP in convenience foods and the expansion into emerging European markets present substantial revenue opportunities. The market is projected to witness continued innovation in ingredient sourcing and processing, leading to a diverse and accessible range of TVP products.

Europe Textured Vegetable Protein Market Segmentation

-

1. Distribution Channel

-

1.1. Off-Trade

- 1.1.1. Convenience Stores

- 1.1.2. Online Channel

- 1.1.3. Supermarkets and Hypermarkets

- 1.1.4. Others

- 1.2. On-Trade

-

1.1. Off-Trade

Europe Textured Vegetable Protein Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Textured Vegetable Protein Market Regional Market Share

Geographic Coverage of Europe Textured Vegetable Protein Market

Europe Textured Vegetable Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Low-Fat and Fat-Free Food Products; Expanding Cosmetic and Personal Care Industries Utilize Gelatin for Various Purposes

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Proces Affecting Production Costs

- 3.4. Market Trends

- 3.4.1. The United Kingdom is dominating the market with an increasing young population that follows flexitarian diets

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Textured Vegetable Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Off-Trade

- 5.1.1.1. Convenience Stores

- 5.1.1.2. Online Channel

- 5.1.1.3. Supermarkets and Hypermarkets

- 5.1.1.4. Others

- 5.1.2. On-Trade

- 5.1.1. Off-Trade

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 GEMEF Industries

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sudzucker AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Do It Organic

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MGP Ingredients Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 International Flavors & Fragrances Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ingredion Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ICL Group Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Associated British Foods PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Univar Solutions Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Axiom Foods Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Roquette Freres

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 GEMEF Industries

List of Figures

- Figure 1: Europe Textured Vegetable Protein Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Textured Vegetable Protein Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Textured Vegetable Protein Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 2: Europe Textured Vegetable Protein Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 3: Europe Textured Vegetable Protein Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Textured Vegetable Protein Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: Europe Textured Vegetable Protein Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Textured Vegetable Protein Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 7: Europe Textured Vegetable Protein Market Revenue million Forecast, by Country 2020 & 2033

- Table 8: Europe Textured Vegetable Protein Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Textured Vegetable Protein Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Europe Textured Vegetable Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 11: Germany Europe Textured Vegetable Protein Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Textured Vegetable Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 13: France Europe Textured Vegetable Protein Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: France Europe Textured Vegetable Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Italy Europe Textured Vegetable Protein Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Textured Vegetable Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Textured Vegetable Protein Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Spain Europe Textured Vegetable Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Netherlands Europe Textured Vegetable Protein Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Netherlands Europe Textured Vegetable Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Belgium Europe Textured Vegetable Protein Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Belgium Europe Textured Vegetable Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Sweden Europe Textured Vegetable Protein Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Sweden Europe Textured Vegetable Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Norway Europe Textured Vegetable Protein Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Norway Europe Textured Vegetable Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Poland Europe Textured Vegetable Protein Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Poland Europe Textured Vegetable Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Denmark Europe Textured Vegetable Protein Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Denmark Europe Textured Vegetable Protein Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Textured Vegetable Protein Market?

The projected CAGR is approximately 10.95%.

2. Which companies are prominent players in the Europe Textured Vegetable Protein Market?

Key companies in the market include GEMEF Industries, Sudzucker AG, Do It Organic, MGP Ingredients Inc, International Flavors & Fragrances Inc, Ingredion Inc, ICL Group Ltd, Associated British Foods PLC, Univar Solutions Inc, Axiom Foods Inc, Roquette Freres.

3. What are the main segments of the Europe Textured Vegetable Protein Market?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 636.5 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Low-Fat and Fat-Free Food Products; Expanding Cosmetic and Personal Care Industries Utilize Gelatin for Various Purposes.

6. What are the notable trends driving market growth?

The United Kingdom is dominating the market with an increasing young population that follows flexitarian diets.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Proces Affecting Production Costs.

8. Can you provide examples of recent developments in the market?

June 2023: Roquette Freres announced the opening of Roquette’s Food Innovation Center to provide formulators with a large range of capabilities, including technical and R&D support, cutting-edge equipment, labs and scale-up testing with an ultimate goal of fostering innovation and to accelerate the go-to-market of new products.March 2023: International Flavors & Fragrances Inc. launched its new plant-based protein SUPRO® TEX which offers endless product design and formulation opportunities with its high-process tolerance, neutral flavor and color. SUPRO® TEX is based on soy protein.January 2023: ICL Group's AgriFood innovation and investment platform, ICL Planet Startup Hub, has invested USD 3 million in Arkeon, GmbH. The investment will support Arkeon’s innovative and sustainable one-step fermentation bioprocess, which creates completely customizable protein ingredients by capturing the greenhouse gas carbon dioxide (CO2) and converting it into the 20 proteinogenic amino acids. The project will also help ICL group to innovate their product portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Textured Vegetable Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Textured Vegetable Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Textured Vegetable Protein Market?

To stay informed about further developments, trends, and reports in the Europe Textured Vegetable Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence