Key Insights

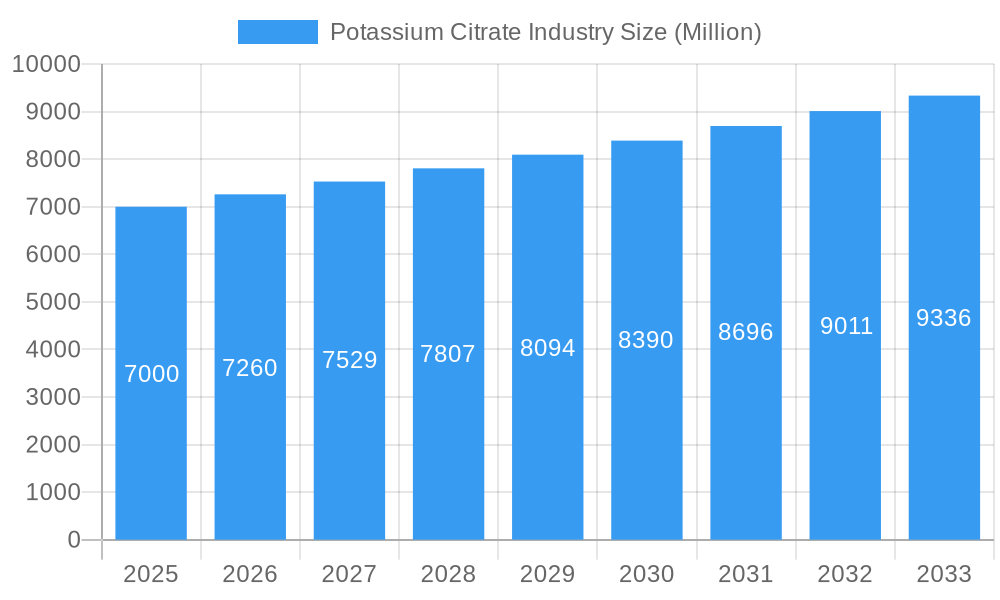

The global Potassium Citrate market is poised for steady growth, projected to reach approximately USD 7,000 million by 2025, with a Compound Annual Growth Rate (CAGR) of 3.70% through 2033. This expansion is underpinned by a confluence of factors, most notably the increasing demand from the food and beverage sector, where potassium citrate serves as a vital acidulant, preservative, and emulsifier. Its growing application in pharmaceuticals, particularly in effervescent tablets and as a urinary alkalizer, further bolsters market performance. The cosmetic industry's adoption of potassium citrate for pH adjustment and stabilization also contributes to this upward trajectory. Geographically, the Asia Pacific region, led by China, is emerging as a significant growth engine, driven by a burgeoning population, rising disposable incomes, and increasing industrialization. North America and Europe, with their established pharmaceutical and food processing industries, will continue to represent substantial market shares.

Potassium Citrate Industry Market Size (In Billion)

However, the market is not without its challenges. Fluctuations in the prices of raw materials, primarily citric acid and potassium compounds, can impact profit margins for manufacturers. Stringent regulatory compliances in various regions regarding food additives and pharmaceutical ingredients also present a complex landscape for market participants. Despite these restraints, the inherent versatility and beneficial properties of potassium citrate, coupled with ongoing research and development for novel applications, are expected to drive sustained market development. The trend towards natural and health-conscious ingredients in food and beverages is also a positive indicator, as potassium citrate is derived from natural sources. Manufacturers are focusing on expanding their production capacities and strengthening their distribution networks to cater to the escalating global demand.

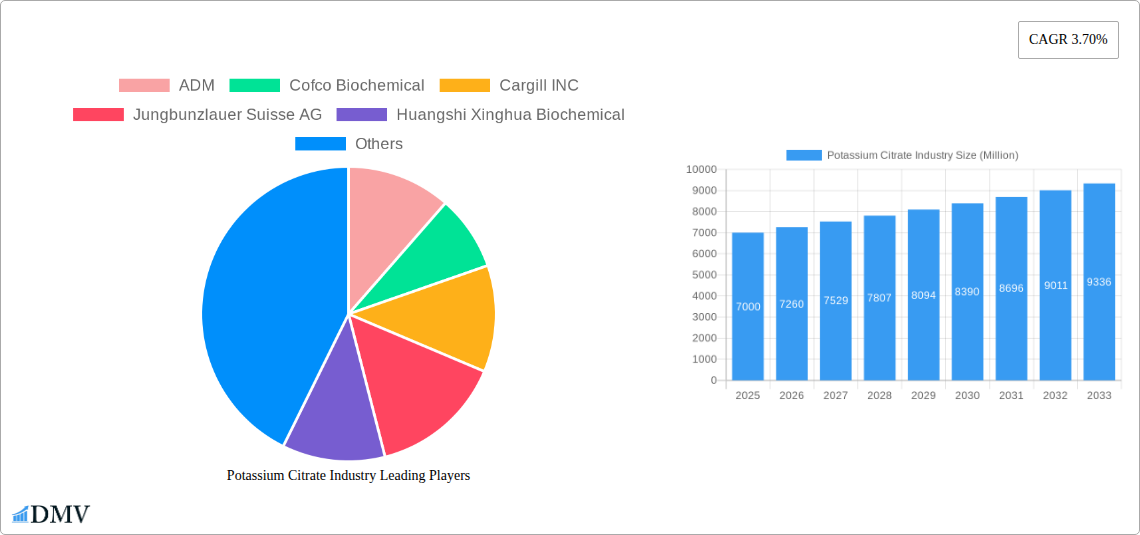

Potassium Citrate Industry Company Market Share

Potassium Citrate Industry Report: Market Analysis, Trends & Future Outlook (2019-2033)

Unlock comprehensive insights into the global Potassium Citrate market with this in-depth industry report. Covering a robust study period from 2019 to 2033, including historical data (2019-2024), a base year (2025), and an extensive forecast period (2025-2033), this report delivers critical intelligence for stakeholders seeking to capitalize on the burgeoning demand for potassium citrate, citrate salts, and related food additives, pharmaceutical ingredients, and industrial chemicals. Delve into market composition, evolving trends, leading regional dominance, product innovations, growth drivers, potential obstacles, and future opportunities, all meticulously analyzed to provide actionable strategies for market leaders and new entrants alike. This report is essential for understanding the potassium citrate market share, potassium citrate manufacturing processes, potassium citrate applications, and potassium citrate demand.

Potassium Citrate Industry Market Composition & Trends

The potassium citrate market exhibits a moderate level of concentration, with key players like ADM, Cofco Biochemical, Cargill INC, Jungbunzlauer Suisse AG, and Huangshi Xinghua Biochemical holding significant market shares. The industry is propelled by innovation in product purity and diverse applications, particularly in the food and beverage, pharmaceuticals, and cosmetics sectors. Stringent regulatory frameworks, governing the use of food additives and pharmaceutical excipients, play a crucial role in shaping market dynamics and product development. Substitute products, such as sodium citrate and other buffering agents, pose a competitive challenge, necessitating continuous product differentiation and cost-efficiency. End-user profiles range from large-scale food manufacturers and pharmaceutical companies to specialized chemical processors. Mergers and acquisitions (M&A) activities, such as the acquisition of Xinger Chemical by Jungbunzlauer Suisse AG in 2020, signify strategic consolidations aimed at expanding market reach and technological capabilities. The total M&A deal value for this period is estimated at over XXX Million USD, reflecting the strategic importance of this sector.

- Market Concentration: Moderate, with a few key players dominating.

- Innovation Catalysts: Enhanced purity, novel applications in functional foods, and pharmaceutical advancements.

- Regulatory Landscape: Strict adherence to food safety (e.g., GRAS status) and pharmaceutical (e.g., USP, EP) standards.

- Substitute Products: Sodium citrate, potassium carbonate, and other pH regulators.

- End-User Profiles: Food & Beverage manufacturers, pharmaceutical formulators, chemical industries, cosmetic producers.

- M&A Activities: Strategic acquisitions and partnerships to enhance market presence and product portfolios. Estimated deal value: XXX Million USD.

Potassium Citrate Industry Industry Evolution

The potassium citrate industry has witnessed substantial evolution driven by escalating global demand for naturally derived ingredients and functional food additives. Over the historical period (2019-2024), the market demonstrated a robust compound annual growth rate (CAGR) of approximately 6.5%, a trajectory anticipated to continue through the forecast period (2025-2033) with an estimated CAGR of 7.1%. This sustained growth is attributed to increasing consumer awareness regarding health and wellness, leading to a greater preference for products fortified with minerals like potassium, often facilitated by potassium citrate. Technological advancements in extraction and purification processes have enhanced product quality and reduced manufacturing costs, making potassium citrate more accessible for a wider range of applications. Furthermore, the expanding pharmaceutical sector's reliance on potassium citrate as an excipient for antacids, effervescent tablets, and urinary alkalinizers has been a significant market catalyst. The food and beverage industry continues to be a primary consumer, utilizing potassium citrate as an emulsifier, buffer, and antioxidant in products like dairy, processed meats, and beverages. The growing application in specialty chemicals and cosmetics, for its pH-regulating and chelating properties, further fuels industry expansion. The global market size for potassium citrate is projected to reach an impressive XXX Billion USD by 2033, underscoring its significant economic impact.

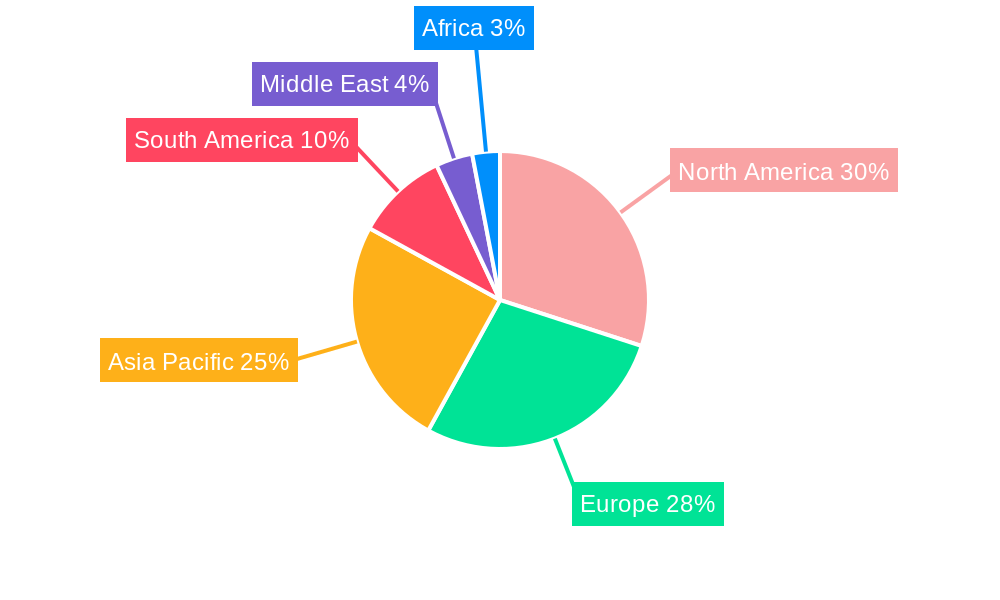

Leading Regions, Countries, or Segments in Potassium Citrate Industry

The potassium citrate market is experiencing dominance driven by several key regions and segments, with the Food and Beverage application segment consistently leading the charge. This supremacy is fueled by a growing global population, increasing disposable incomes, and a pronounced shift towards processed and convenience foods that frequently incorporate potassium citrate for its buffering, emulsifying, and preservative properties. North America and Europe currently hold substantial market shares due to well-established food processing industries and high consumer spending on fortified foods and beverages. However, the Asia-Pacific region is emerging as a high-growth market, driven by rapid industrialization, a burgeoning middle class, and increasing demand for healthier food options.

Within the Grade Type segmentation, Food Grade Potassium Citrate commands the largest share, estimated at over 55% of the total market in 2025. This is directly linked to its widespread use in dairy products, carbonated drinks, jams, jellies, and as a pH regulator in various food formulations. The Pharmaceutical Grade Potassium Citrate segment is also experiencing robust growth, projected to capture over 30% of the market by 2033. This surge is attributed to its critical role in pharmaceutical preparations, including urinary tract infection treatments, kidney stone prevention, and as an excipient in antacids and effervescent tablets. The Industrial Grade Potassium Citrate segment, though smaller in comparison, finds applications in detergents, water treatment, and as a chelating agent in various industrial processes, contributing an estimated 10-15% to the market.

- Dominant Application Segment: Food and Beverage, driven by its versatility as an additive.

- Key Drivers: Growing processed food consumption, demand for natural preservatives, and functional beverages.

- Regional Dominance: North America and Europe leading, with Asia-Pacific showing rapid expansion.

- Leading Grade Type: Food Grade, accounting for the largest market share due to extensive use in food products.

- Key Drivers: Consumer preference for fortified foods, demand for clean label ingredients, and expansion of the beverage industry.

- Growing Segment: Pharmaceutical Grade, fueled by increased demand for kidney health products and pharmaceutical formulations.

- Key Drivers: Aging populations, rising healthcare expenditure, and advancements in drug delivery systems.

- Emerging Applications: Cosmetics segment showing steady growth due to its pH balancing and chelating properties in skincare and haircare products.

Potassium Citrate Industry Product Innovations

Recent product innovations in the potassium citrate industry are focused on enhancing purity, developing specialized grades, and improving solubility. Manufacturers are investing in advanced purification techniques to achieve higher potency potassium citrate for pharmaceutical applications, meeting stringent USP and EP monograph requirements. The development of granular and microencapsulated forms of potassium citrate is another significant innovation, improving handling, stability, and controlled release properties in various applications, particularly in food fortification and supplement formulations. Furthermore, research into bio-based production methods for citric acid, the precursor to potassium citrate, is gaining traction, aligning with the growing demand for sustainable and eco-friendly ingredients. These innovations are crucial for maintaining competitive advantage and addressing evolving market needs.

Propelling Factors for Potassium Citrate Industry Growth

The potassium citrate market is propelled by a confluence of factors. The increasing global prevalence of kidney stones and urinary tract infections directly drives demand for potassium citrate in pharmaceutical applications. In the food and beverage sector, its function as a natural preservative, pH regulator, and emulsifier caters to the rising consumer preference for cleaner labels and healthier food options. Technological advancements in manufacturing processes are leading to improved product quality and cost efficiencies, further stimulating market growth. Government initiatives promoting healthier diets and food fortification programs also play a supportive role. The expanding cosmetic industry's use of potassium citrate for its chelating and pH-adjusting properties also contributes to its overall market expansion.

Obstacles in the Potassium Citrate Industry Market

Despite its growth, the potassium citrate industry faces several obstacles. Fluctuations in the prices of raw materials, primarily citric acid and potassium hydroxide, can impact profit margins for manufacturers. Stringent regulatory approvals and evolving standards in different regions can create barriers to market entry and product development, particularly for new applications. Intense competition from established players and the availability of substitute products like sodium citrate can exert downward pressure on pricing. Supply chain disruptions, amplified by geopolitical events and logistics challenges, can affect the availability and cost of finished products. Furthermore, the development of novel, potentially more effective alternatives for certain applications could pose a long-term challenge.

Future Opportunities in Potassium Citrate Industry

The potassium citrate market is ripe with future opportunities. The burgeoning demand for functional foods and beverages offering health benefits, such as bone health and electrolyte replenishment, presents a significant growth avenue. Expanding applications in the pharmaceutical sector, particularly in drug formulations for chronic diseases and nutritional supplements, offer substantial potential. The growing trend of clean label ingredients and natural preservatives in the food industry will continue to favor potassium citrate. Emerging markets in Asia-Pacific and Latin America, with their rapidly developing economies and increasing consumer spending, represent untapped potential for market penetration. Innovations in sustainable manufacturing and biodegradable packaging solutions will also create new market niches.

Major Players in the Potassium Citrate Industry Ecosystem

- ADM

- Cofco Biochemical

- Cargill INC

- Jungbunzlauer Suisse AG

- Huangshi Xinghua Biochemical

- Juxian Hongde Citric Acid Co LTD

- Niran

- Gadot Biochemical Industries

- American Tartaric Products

- Tate & Lyle

Key Developments in Potassium Citrate Industry Industry

- 2020: Jungbunzlauer Suisse AG acquired Xinger Chemical, strengthening its market position and expanding its product portfolio.

- 2021: Cofco Biochemical launched a new potassium citrate production facility, significantly increasing its production capacity and market supply.

- 2022: Juxian Hongde Citric Acid Co LTD developed innovative biodegradable packaging solutions for potassium citrate products, addressing environmental concerns and enhancing product sustainability.

Strategic Potassium Citrate Industry Market Forecast

The potassium citrate market is poised for sustained growth, driven by increasing demand in the food, beverage, and pharmaceutical sectors. Key growth catalysts include the rising health consciousness among consumers, leading to greater adoption of potassium-fortified products, and the expanding use of potassium citrate as a pharmaceutical excipient and active ingredient. Technological advancements in production and purification are enhancing product quality and cost-effectiveness. Favorable regulatory environments for food additives and pharmaceuticals in many regions further support market expansion. Emerging opportunities in developing economies and the continued innovation in product applications will ensure a robust outlook for the potassium citrate market over the forecast period, projected to reach XXX Billion USD by 2033.

Potassium Citrate Industry Segmentation

-

1. Grade Type

- 1.1. Industrial

- 1.2. Food

- 1.3. Pharmaceuticals

-

2. Application

- 2.1. Food and Beverage

- 2.2. Industrial

- 2.3. Pharmaceuticals

- 2.4. Cosmetics

Potassium Citrate Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Italy

- 2.5. Russia

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. Australia

- 3.4. India

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Colombia

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Potassium Citrate Industry Regional Market Share

Geographic Coverage of Potassium Citrate Industry

Potassium Citrate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Augmented demand for Natural Sweeteners; Rising Consumer Inclination Toward Clean Label and Organic Stevia

- 3.3. Market Restrains

- 3.3.1. Side Effects and Challenges with Stevia

- 3.4. Market Trends

- 3.4.1. Growing Popularity For Low Sodium Citrate Content In Foods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Potassium Citrate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Grade Type

- 5.1.1. Industrial

- 5.1.2. Food

- 5.1.3. Pharmaceuticals

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverage

- 5.2.2. Industrial

- 5.2.3. Pharmaceuticals

- 5.2.4. Cosmetics

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Grade Type

- 6. North America Potassium Citrate Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Grade Type

- 6.1.1. Industrial

- 6.1.2. Food

- 6.1.3. Pharmaceuticals

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverage

- 6.2.2. Industrial

- 6.2.3. Pharmaceuticals

- 6.2.4. Cosmetics

- 6.1. Market Analysis, Insights and Forecast - by Grade Type

- 7. Europe Potassium Citrate Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Grade Type

- 7.1.1. Industrial

- 7.1.2. Food

- 7.1.3. Pharmaceuticals

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverage

- 7.2.2. Industrial

- 7.2.3. Pharmaceuticals

- 7.2.4. Cosmetics

- 7.1. Market Analysis, Insights and Forecast - by Grade Type

- 8. Asia Pacific Potassium Citrate Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Grade Type

- 8.1.1. Industrial

- 8.1.2. Food

- 8.1.3. Pharmaceuticals

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverage

- 8.2.2. Industrial

- 8.2.3. Pharmaceuticals

- 8.2.4. Cosmetics

- 8.1. Market Analysis, Insights and Forecast - by Grade Type

- 9. South America Potassium Citrate Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Grade Type

- 9.1.1. Industrial

- 9.1.2. Food

- 9.1.3. Pharmaceuticals

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food and Beverage

- 9.2.2. Industrial

- 9.2.3. Pharmaceuticals

- 9.2.4. Cosmetics

- 9.1. Market Analysis, Insights and Forecast - by Grade Type

- 10. Middle East Potassium Citrate Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Grade Type

- 10.1.1. Industrial

- 10.1.2. Food

- 10.1.3. Pharmaceuticals

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food and Beverage

- 10.2.2. Industrial

- 10.2.3. Pharmaceuticals

- 10.2.4. Cosmetics

- 10.1. Market Analysis, Insights and Forecast - by Grade Type

- 11. Saudi Arabia Potassium Citrate Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Grade Type

- 11.1.1. Industrial

- 11.1.2. Food

- 11.1.3. Pharmaceuticals

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Food and Beverage

- 11.2.2. Industrial

- 11.2.3. Pharmaceuticals

- 11.2.4. Cosmetics

- 11.1. Market Analysis, Insights and Forecast - by Grade Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 ADM

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Cofco Biochemical

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Cargill INC

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Jungbunzlauer Suisse AG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Huangshi Xinghua Biochemical

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Juxian Hongde Citric Acid Co LTD*List Not Exhaustive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Niran

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Gadot Biochemical Industries

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 American Tartaric Products

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Tate & Lyle

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 ADM

List of Figures

- Figure 1: Global Potassium Citrate Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Potassium Citrate Industry Revenue (undefined), by Grade Type 2025 & 2033

- Figure 3: North America Potassium Citrate Industry Revenue Share (%), by Grade Type 2025 & 2033

- Figure 4: North America Potassium Citrate Industry Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America Potassium Citrate Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Potassium Citrate Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Potassium Citrate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Potassium Citrate Industry Revenue (undefined), by Grade Type 2025 & 2033

- Figure 9: Europe Potassium Citrate Industry Revenue Share (%), by Grade Type 2025 & 2033

- Figure 10: Europe Potassium Citrate Industry Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Potassium Citrate Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Potassium Citrate Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Potassium Citrate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Potassium Citrate Industry Revenue (undefined), by Grade Type 2025 & 2033

- Figure 15: Asia Pacific Potassium Citrate Industry Revenue Share (%), by Grade Type 2025 & 2033

- Figure 16: Asia Pacific Potassium Citrate Industry Revenue (undefined), by Application 2025 & 2033

- Figure 17: Asia Pacific Potassium Citrate Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Potassium Citrate Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Potassium Citrate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Potassium Citrate Industry Revenue (undefined), by Grade Type 2025 & 2033

- Figure 21: South America Potassium Citrate Industry Revenue Share (%), by Grade Type 2025 & 2033

- Figure 22: South America Potassium Citrate Industry Revenue (undefined), by Application 2025 & 2033

- Figure 23: South America Potassium Citrate Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Potassium Citrate Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Potassium Citrate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Potassium Citrate Industry Revenue (undefined), by Grade Type 2025 & 2033

- Figure 27: Middle East Potassium Citrate Industry Revenue Share (%), by Grade Type 2025 & 2033

- Figure 28: Middle East Potassium Citrate Industry Revenue (undefined), by Application 2025 & 2033

- Figure 29: Middle East Potassium Citrate Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East Potassium Citrate Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East Potassium Citrate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Saudi Arabia Potassium Citrate Industry Revenue (undefined), by Grade Type 2025 & 2033

- Figure 33: Saudi Arabia Potassium Citrate Industry Revenue Share (%), by Grade Type 2025 & 2033

- Figure 34: Saudi Arabia Potassium Citrate Industry Revenue (undefined), by Application 2025 & 2033

- Figure 35: Saudi Arabia Potassium Citrate Industry Revenue Share (%), by Application 2025 & 2033

- Figure 36: Saudi Arabia Potassium Citrate Industry Revenue (undefined), by Country 2025 & 2033

- Figure 37: Saudi Arabia Potassium Citrate Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Potassium Citrate Industry Revenue undefined Forecast, by Grade Type 2020 & 2033

- Table 2: Global Potassium Citrate Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Potassium Citrate Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Potassium Citrate Industry Revenue undefined Forecast, by Grade Type 2020 & 2033

- Table 5: Global Potassium Citrate Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Potassium Citrate Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Potassium Citrate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Potassium Citrate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Potassium Citrate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Potassium Citrate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Potassium Citrate Industry Revenue undefined Forecast, by Grade Type 2020 & 2033

- Table 12: Global Potassium Citrate Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 13: Global Potassium Citrate Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Potassium Citrate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Potassium Citrate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Germany Potassium Citrate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Italy Potassium Citrate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Russia Potassium Citrate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Spain Potassium Citrate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Potassium Citrate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Global Potassium Citrate Industry Revenue undefined Forecast, by Grade Type 2020 & 2033

- Table 22: Global Potassium Citrate Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Global Potassium Citrate Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: China Potassium Citrate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Japan Potassium Citrate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Australia Potassium Citrate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: India Potassium Citrate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Potassium Citrate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Potassium Citrate Industry Revenue undefined Forecast, by Grade Type 2020 & 2033

- Table 30: Global Potassium Citrate Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 31: Global Potassium Citrate Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Brazil Potassium Citrate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Colombia Potassium Citrate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Potassium Citrate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Global Potassium Citrate Industry Revenue undefined Forecast, by Grade Type 2020 & 2033

- Table 36: Global Potassium Citrate Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 37: Global Potassium Citrate Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 38: Global Potassium Citrate Industry Revenue undefined Forecast, by Grade Type 2020 & 2033

- Table 39: Global Potassium Citrate Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 40: Global Potassium Citrate Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: South Africa Potassium Citrate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East Potassium Citrate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Potassium Citrate Industry?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the Potassium Citrate Industry?

Key companies in the market include ADM, Cofco Biochemical, Cargill INC, Jungbunzlauer Suisse AG, Huangshi Xinghua Biochemical, Juxian Hongde Citric Acid Co LTD*List Not Exhaustive, Niran, Gadot Biochemical Industries, American Tartaric Products, Tate & Lyle.

3. What are the main segments of the Potassium Citrate Industry?

The market segments include Grade Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Augmented demand for Natural Sweeteners; Rising Consumer Inclination Toward Clean Label and Organic Stevia.

6. What are the notable trends driving market growth?

Growing Popularity For Low Sodium Citrate Content In Foods.

7. Are there any restraints impacting market growth?

Side Effects and Challenges with Stevia.

8. Can you provide examples of recent developments in the market?

1. Acquisition of Xinger Chemical by Jungbunzlauer Suisse AG in 2020 2. Launch of new potassium citrate production facility by Cofco Biochemical in 2021 3. Development of biodegradable packaging solutions for potassium citrate products by Juxian Hongde Citric Acid Co LTD in 2022

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Potassium Citrate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Potassium Citrate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Potassium Citrate Industry?

To stay informed about further developments, trends, and reports in the Potassium Citrate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence