Key Insights

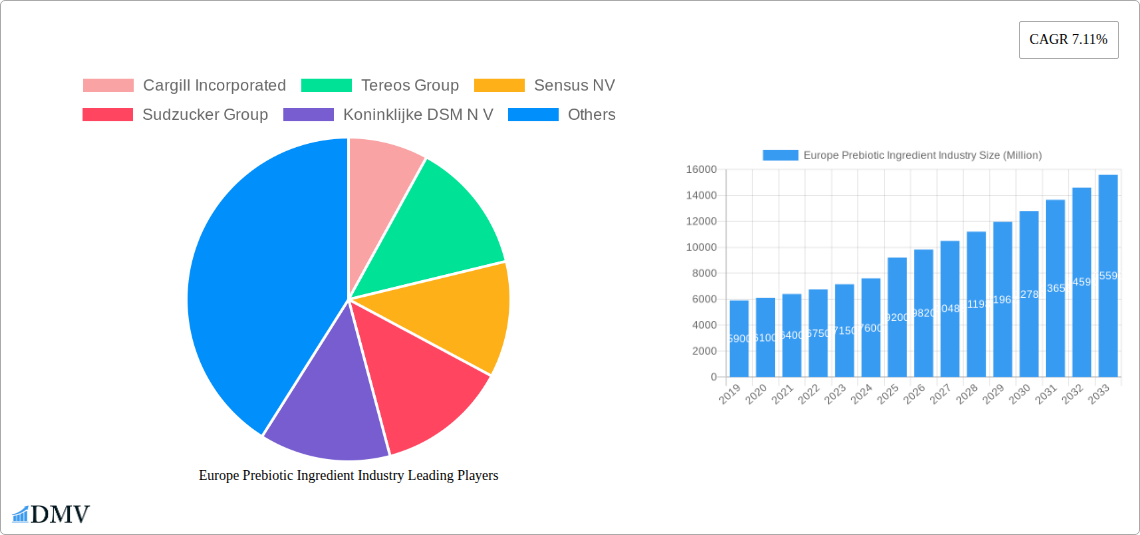

The European Prebiotic Ingredient market is projected for significant expansion, expected to reach 5.67 billion by 2025, driven by a Compound Annual Growth Rate (CAGR) of 16.94% through 2033. This growth is propelled by increasing consumer demand for functional foods and beverages that offer advanced health benefits. Heightened awareness of the gut microbiome's crucial role in overall wellness is a key driver, encouraging the integration of prebiotics into diverse food products. Key prebiotic types, Fructo-oligosaccharides (FOS) and Galacto-oligosaccharides (GOS), are anticipated to lead due to their proven effectiveness and formulation flexibility. The dietary supplements and infant formula sectors are particularly influential, as consumers actively seek products supporting digestive health and immunity. Leading companies are investing in R&D to innovate and broaden product offerings, aligning with evolving consumer preferences and regulatory standards.

Europe Prebiotic Ingredient Industry Market Size (In Billion)

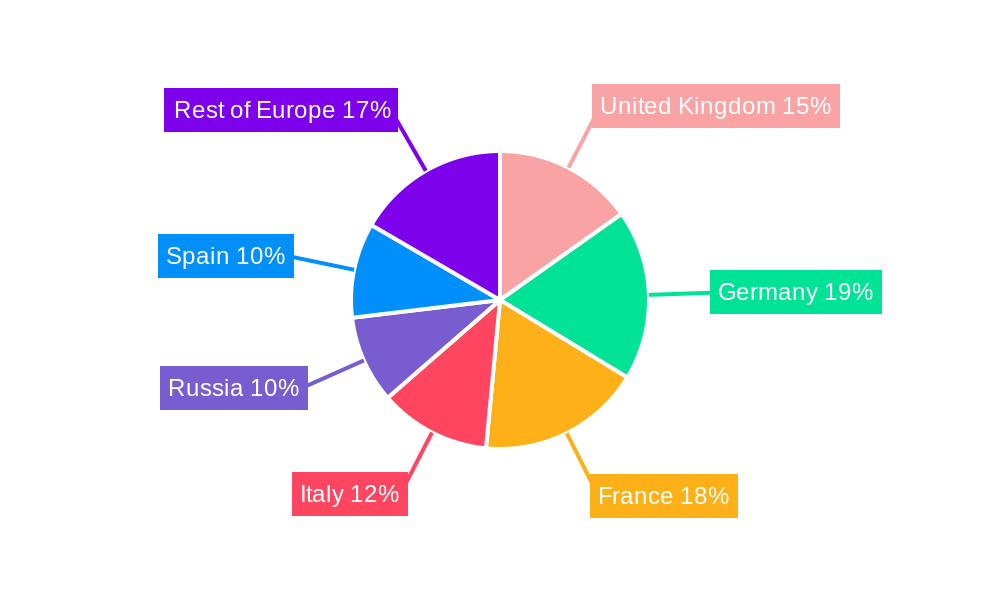

Potential restraints include production costs and consumer skepticism regarding efficacy. However, technological advancements and enhanced consumer education initiatives are expected to mitigate these challenges. Emerging trends include the development of novel prebiotic sources and combinations for optimized health outcomes. The animal feed sector is also adopting prebiotics to improve livestock health and reduce antibiotic use, further contributing to market growth. Geographically, Europe represents a vital market, with substantial demand in countries like Germany, France, and the United Kingdom, supported by advanced food processing capabilities and higher disposable incomes, which favor the adoption of premium, health-focused ingredients.

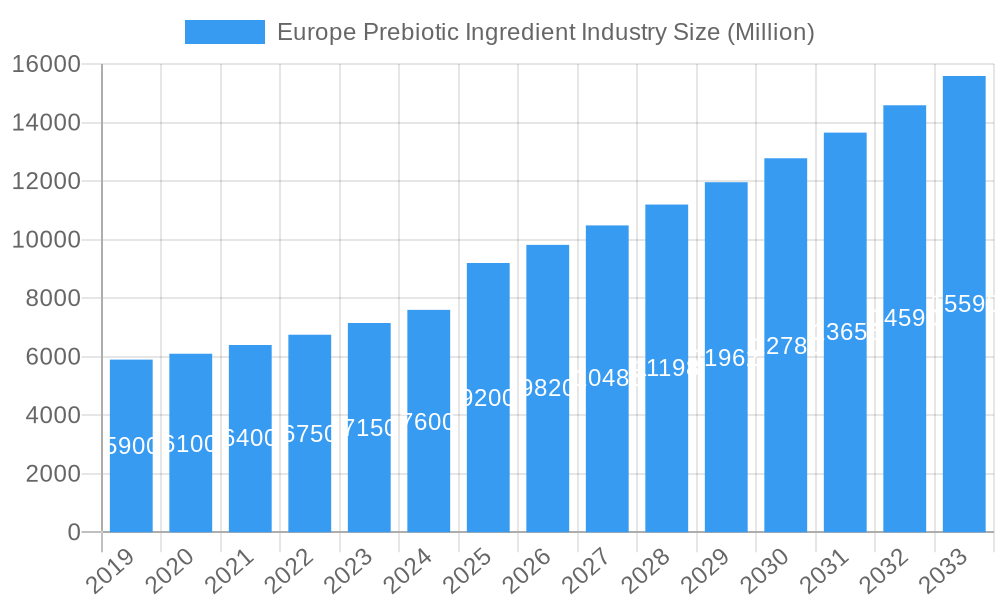

Europe Prebiotic Ingredient Industry Company Market Share

Europe Prebiotic Ingredient Market Report: Growth & Forecast (2025-2033)

Report Overview:

This comprehensive analysis delves into the dynamic European Prebiotic Ingredient market from 2019 to 2033, with 2025 as the base year and a forecast period of 2025-2033. It offers in-depth insights into market trends, growth catalysts, challenges, and future prospects. Explore the evolving landscape of prebiotic ingredients, including inulin, FOS, and GOS, and their applications in infant formula, fortified foods and beverages, dietary supplements, animal feed, and pharmaceuticals. This report is indispensable for food manufacturers, nutraceutical companies, ingredient suppliers, and investors aiming to leverage the expanding market for gut health and functional foods in Europe.

Europe Prebiotic Ingredient Industry Market Composition & Trends

The Europe prebiotic ingredient market exhibits a moderate concentration, with key players like Cargill Incorporated, Tereos Group, Sensus NV, Sudzucker Group, Koninklijke DSM N V, Cosucra Groupe Warcoing SA, Ingredion Incorporated, and Kerry Group plc holding significant market share. Innovation remains a crucial catalyst, driven by increasing consumer awareness of gut health benefits and demand for natural, plant-based ingredients. The regulatory landscape is evolving, with a focus on substantiated health claims and product safety, influencing product development and market entry. Substitute products, such as probiotics and synbiotics, present a competitive dynamic, necessitating continuous differentiation for prebiotic ingredients. End-user profiles are diverse, ranging from infant formula manufacturers seeking optimal gut development for babies to the growing dietary supplement sector targeting adult wellness. Mergers and acquisitions (M&A) activity is anticipated to shape market consolidation, with recent deals valued in the XX Million range. Understanding these intricate market dynamics is paramount for strategic decision-making within the European prebiotic ingredient ecosystem.

- Market Concentration: Moderately concentrated with key players dominating.

- Innovation Catalysts: Growing consumer awareness of gut health, demand for natural and plant-based ingredients.

- Regulatory Landscapes: Evolving regulations focusing on health claims and product safety.

- Substitute Products: Probiotics and synbiotics offer competitive alternatives.

- End-User Profiles: Infant formula, fortified foods, dietary supplements, animal feed, and pharmaceuticals.

- M&A Activities: Anticipated for market consolidation, with recent deal values at XX Million.

Europe Prebiotic Ingredient Industry Industry Evolution

The Europe prebiotic ingredient industry has undergone a significant transformation, evolving from niche applications to mainstream consumer products. This evolution is characterized by robust market growth trajectories, fueled by a heightened understanding of the gut microbiome's impact on overall health. Technological advancements in extraction and purification processes have led to higher quality, more bioavailable prebiotic ingredients, expanding their usability across various applications. Shifting consumer demands have been a primary driver, with a palpable surge in interest for products that support digestive health, immunity, and well-being. This has translated into increased adoption of prebiotics in functional foods and beverages, moving beyond traditional dietary supplements. The historical period (2019–2024) witnessed consistent growth, with the base year of 2025 projecting continued upward momentum. Growth rates are estimated to be in the XX% range, with adoption metrics for inulin and FOS showing particularly strong penetration in the food and beverage sector. The forecast period (2025–2033) is expected to see sustained expansion, driven by new product development and an expanding consumer base actively seeking health-promoting ingredients. This dynamic evolution underscores the strategic importance of prebiotics in the modern food and health landscape.

Leading Regions, Countries, or Segments in Europe Prebiotic Ingredient Industry

The European prebiotic ingredient industry's dominance is most pronounced in Western Europe, driven by high consumer disposable income, a mature functional food market, and strong regulatory frameworks that support health claims. Within this region, countries such as Germany, the United Kingdom, and France lead in consumption and innovation. The segment of Inulin consistently commands the largest market share due to its widespread availability from chicory and its versatile applications in food and beverages as a fiber and fat replacer.

Key drivers for this dominance include:

- Investment Trends: Significant investments in research and development by major players to enhance prebiotic efficacy and explore novel sources.

- Regulatory Support: Favorable regulatory environments that allow for substantiated health claims, encouraging product innovation and consumer trust.

- Consumer Awareness: A highly informed consumer base actively seeking out health-boosting ingredients for gut health and overall wellness.

- Food and Beverage Innovation: The robust fortified food and beverage sector readily incorporates prebiotics to meet consumer demand for healthier options.

- Dietary Supplement Market Maturity: A well-established dietary supplement market with a long history of incorporating prebiotic ingredients for targeted health benefits.

The application segment of Fortified Food and Beverage is a significant growth engine, with prebiotics being incorporated into products like yogurts, cereals, baked goods, and beverages. Infant Formula is another critical application, where GOS and FOS are essential for mimicking the oligosaccharides found in breast milk, promoting a healthy gut microbiome in developing infants. While Dietary Supplements remain a strong segment, the growth in food and beverage applications is outpacing it due to broader consumer reach. The Animal Feed segment is also showing promising growth as awareness of animal gut health and its impact on productivity increases. Pharmaceutical applications, while smaller, represent a high-value niche with potential for specialized prebiotic formulations.

Europe Prebiotic Ingredient Industry Product Innovations

Product innovation in the Europe prebiotic ingredient industry is sharply focused on enhancing functional benefits and improving sensory profiles. Manufacturers are developing novel inulin and FOS derivatives with improved solubility and heat stability for broader food applications. Advances in enzymatic synthesis are enabling the production of specialized GOS with tailored prebiotic activity for specific gut bacteria. Performance metrics such as prebiotic index (PI) and specific growth stimulation of beneficial bacteria like Bifidobacteria and Lactobacilli are key differentiators. Unique selling propositions often revolve around clean-label attributes, non-GMO sourcing, and the ability to withstand stringent processing conditions. Technological advancements are also enabling the encapsulation of prebiotics for targeted release in the digestive tract, maximizing their efficacy and consumer acceptance.

Propelling Factors for Europe Prebiotic Ingredient Industry Growth

The Europe prebiotic ingredient industry is propelled by several significant factors. Growing consumer awareness and demand for health and wellness products, particularly those supporting gut health and immunity, is a primary driver. The increasing incidence of digestive disorders and the recognized link between the gut microbiome and overall health are further accelerating adoption. Technological advancements in ingredient extraction and formulation have led to more effective and versatile prebiotic ingredients. Furthermore, favorable regulatory frameworks in many European countries that support substantiated health claims provide a strong impetus for product development and market expansion. Economic stability and rising disposable incomes also contribute, enabling consumers to invest in premium health-promoting food and supplement options.

Obstacles in the Europe Prebiotic Ingredient Industry Market

Despite robust growth, the Europe prebiotic ingredient market faces certain obstacles. Stringent regulatory requirements for health claims in some nations can hinder rapid product launches and require extensive clinical substantiation, increasing development costs. Supply chain disruptions, particularly concerning raw material availability and quality, can impact production and pricing. Intense competition from alternative functional ingredients, including probiotics and dietary fibers, necessitates continuous innovation and clear differentiation. The cost of high-quality prebiotic ingredients can also be a barrier for some mass-market food applications, limiting their widespread adoption in price-sensitive segments.

Future Opportunities in Europe Prebiotic Ingredient Industry

Emerging opportunities in the Europe prebiotic ingredient industry are abundant. The expansion of prebiotic applications into new food categories, such as plant-based alternatives and convenience meals, offers significant growth potential. The development of prebiotics for personalized nutrition based on individual gut microbiome profiles represents a cutting-edge frontier. Furthermore, the increasing focus on sustainable sourcing and production methods aligns with growing consumer demand for eco-conscious products. The burgeoning pet food sector, recognizing the importance of gut health in animals, presents a substantial untapped market for prebiotic ingredients. Exploring novel prebiotic sources and synergistic combinations with other functional ingredients will also unlock new market avenues.

Major Players in the Europe Prebiotic Ingredient Industry Ecosystem

- Cargill Incorporated

- Tereos Group

- Sensus NV

- Sudzucker Group

- Koninklijke DSM N V

- Cosucra Groupe Warcoing SA

- Ingredion Incorporated

- Kerry Group plc

Key Developments in Europe Prebiotic Ingredient Industry Industry

- 2024/Q1: Launch of novel inulin-based prebiotic with enhanced digestive tolerance for bakery applications.

- 2023/Q4: Acquisition of a specialized GOS producer by a leading ingredient supplier to expand its infant nutrition portfolio.

- 2023/Q2: Significant investment in R&D for fermentation-derived prebiotics targeting immune support.

- 2022/Q3: Introduction of a new FOS ingredient with proven prebiotic effects on gut microbiota diversity.

- 2022/Q1: Major food manufacturer announces increased incorporation of prebiotics across its beverage product lines.

Strategic Europe Prebiotic Ingredient Industry Market Forecast

The strategic Europe prebiotic ingredient market forecast is optimistic, fueled by escalating consumer demand for gut health solutions and continuous innovation in ingredient technology. Growth catalysts include the expanding applications in fortified foods and beverages, the maturation of the dietary supplement market, and emerging opportunities in animal feed and personalized nutrition. Investments in research to substantiate health claims and develop novel prebiotic formulations will further drive market expansion. The market is projected to witness a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033, reaching an estimated market size of XX Million by the end of the forecast period. This trajectory underscores the enduring and growing importance of prebiotic ingredients in promoting consumer well-being across Europe.

Europe Prebiotic Ingredient Industry Segmentation

-

1. Type

- 1.1. Inulin

- 1.2. FOS (Fructo-oligosaccharide)

- 1.3. GOS (Galacto-oligosaccharide)

- 1.4. Others

-

2. Application

- 2.1. Infant Formula

- 2.2. Fortified Food and Beverage

- 2.3. Dietary Supplements

- 2.4. Animal Feed

- 2.5. Pharmaceuticals

Europe Prebiotic Ingredient Industry Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Italy

- 5. Russia

- 6. Spain

- 7. Rest of Europe

Europe Prebiotic Ingredient Industry Regional Market Share

Geographic Coverage of Europe Prebiotic Ingredient Industry

Europe Prebiotic Ingredient Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Alternative Proteins

- 3.4. Market Trends

- 3.4.1. Infant Formula to Foster Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Prebiotic Ingredient Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Inulin

- 5.1.2. FOS (Fructo-oligosaccharide)

- 5.1.3. GOS (Galacto-oligosaccharide)

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Infant Formula

- 5.2.2. Fortified Food and Beverage

- 5.2.3. Dietary Supplements

- 5.2.4. Animal Feed

- 5.2.5. Pharmaceuticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Russia

- 5.3.6. Spain

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Kingdom Europe Prebiotic Ingredient Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Inulin

- 6.1.2. FOS (Fructo-oligosaccharide)

- 6.1.3. GOS (Galacto-oligosaccharide)

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Infant Formula

- 6.2.2. Fortified Food and Beverage

- 6.2.3. Dietary Supplements

- 6.2.4. Animal Feed

- 6.2.5. Pharmaceuticals

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Germany Europe Prebiotic Ingredient Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Inulin

- 7.1.2. FOS (Fructo-oligosaccharide)

- 7.1.3. GOS (Galacto-oligosaccharide)

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Infant Formula

- 7.2.2. Fortified Food and Beverage

- 7.2.3. Dietary Supplements

- 7.2.4. Animal Feed

- 7.2.5. Pharmaceuticals

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Prebiotic Ingredient Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Inulin

- 8.1.2. FOS (Fructo-oligosaccharide)

- 8.1.3. GOS (Galacto-oligosaccharide)

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Infant Formula

- 8.2.2. Fortified Food and Beverage

- 8.2.3. Dietary Supplements

- 8.2.4. Animal Feed

- 8.2.5. Pharmaceuticals

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Italy Europe Prebiotic Ingredient Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Inulin

- 9.1.2. FOS (Fructo-oligosaccharide)

- 9.1.3. GOS (Galacto-oligosaccharide)

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Infant Formula

- 9.2.2. Fortified Food and Beverage

- 9.2.3. Dietary Supplements

- 9.2.4. Animal Feed

- 9.2.5. Pharmaceuticals

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Russia Europe Prebiotic Ingredient Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Inulin

- 10.1.2. FOS (Fructo-oligosaccharide)

- 10.1.3. GOS (Galacto-oligosaccharide)

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Infant Formula

- 10.2.2. Fortified Food and Beverage

- 10.2.3. Dietary Supplements

- 10.2.4. Animal Feed

- 10.2.5. Pharmaceuticals

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Spain Europe Prebiotic Ingredient Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Inulin

- 11.1.2. FOS (Fructo-oligosaccharide)

- 11.1.3. GOS (Galacto-oligosaccharide)

- 11.1.4. Others

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Infant Formula

- 11.2.2. Fortified Food and Beverage

- 11.2.3. Dietary Supplements

- 11.2.4. Animal Feed

- 11.2.5. Pharmaceuticals

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe Europe Prebiotic Ingredient Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Inulin

- 12.1.2. FOS (Fructo-oligosaccharide)

- 12.1.3. GOS (Galacto-oligosaccharide)

- 12.1.4. Others

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Infant Formula

- 12.2.2. Fortified Food and Beverage

- 12.2.3. Dietary Supplements

- 12.2.4. Animal Feed

- 12.2.5. Pharmaceuticals

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Cargill Incorporated

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Tereos Group

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Sensus NV

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Sudzucker Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Koninklijke DSM N V

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Cosucra Groupe Warcoing SA

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Ingredion Incorporated

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Kerry Group plc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Cargill Incorporated

List of Figures

- Figure 1: Europe Prebiotic Ingredient Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Prebiotic Ingredient Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Type 2020 & 2033

- Table 3: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Application 2020 & 2033

- Table 5: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Region 2020 & 2033

- Table 7: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Type 2020 & 2033

- Table 9: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Application 2020 & 2033

- Table 11: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Country 2020 & 2033

- Table 13: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Type 2020 & 2033

- Table 15: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 16: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Application 2020 & 2033

- Table 17: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Country 2020 & 2033

- Table 19: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Type 2020 & 2033

- Table 21: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Application 2020 & 2033

- Table 23: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Country 2020 & 2033

- Table 25: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Type 2020 & 2033

- Table 27: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Application 2020 & 2033

- Table 29: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Country 2020 & 2033

- Table 31: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 32: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Type 2020 & 2033

- Table 33: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Application 2020 & 2033

- Table 35: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Country 2020 & 2033

- Table 37: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Type 2020 & 2033

- Table 39: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 40: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Application 2020 & 2033

- Table 41: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Country 2020 & 2033

- Table 43: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 44: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Type 2020 & 2033

- Table 45: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 46: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Application 2020 & 2033

- Table 47: Europe Prebiotic Ingredient Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Europe Prebiotic Ingredient Industry Volume K tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Prebiotic Ingredient Industry?

The projected CAGR is approximately 16.94%.

2. Which companies are prominent players in the Europe Prebiotic Ingredient Industry?

Key companies in the market include Cargill Incorporated, Tereos Group, Sensus NV, Sudzucker Group, Koninklijke DSM N V, Cosucra Groupe Warcoing SA, Ingredion Incorporated, Kerry Group plc.

3. What are the main segments of the Europe Prebiotic Ingredient Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.67 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

Infant Formula to Foster Market Growth.

7. Are there any restraints impacting market growth?

Presence of Alternative Proteins.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Prebiotic Ingredient Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Prebiotic Ingredient Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Prebiotic Ingredient Industry?

To stay informed about further developments, trends, and reports in the Europe Prebiotic Ingredient Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence