Key Insights

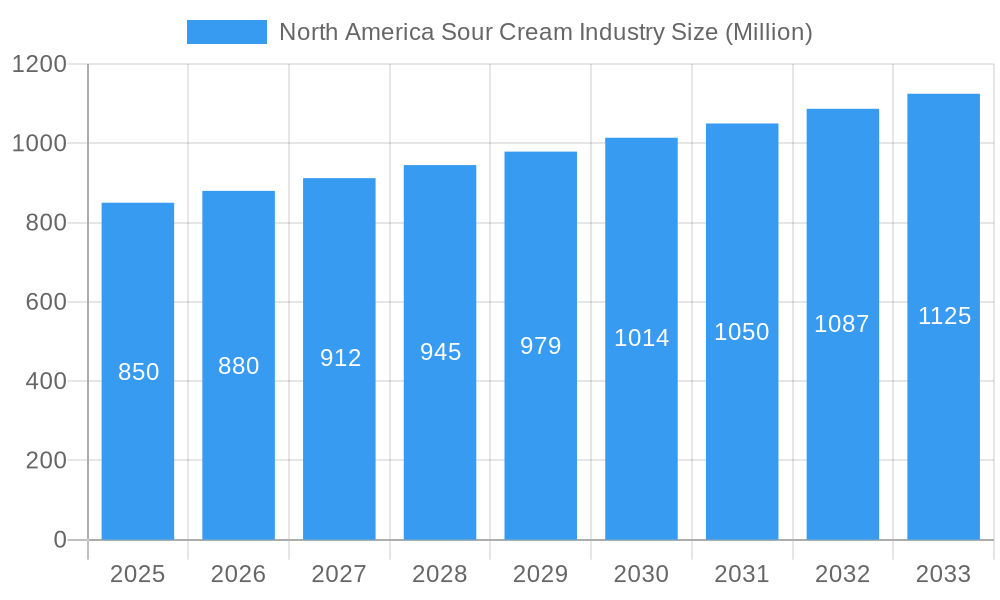

The North American sour cream market is projected for robust expansion, expected to reach $1.95 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 5.22% from the base year 2025. This growth trajectory is propelled by evolving consumer preferences and continuous product innovation. The dairy segment remains a market leader, driven by its established culinary appeal and versatility. Concurrently, the rapidly growing non-dairy segment is a key growth driver, addressing rising demand for plant-based alternatives due to health consciousness, lactose intolerance, and environmental concerns. Innovations in formulation and taste are crucial to this segment's success. Distribution channels are diversifying, with online retail experiencing significant growth due to convenience and selection, while supermarkets and hypermarkets maintain dominance. Convenience stores cater to impulse purchases. The "Rest of North America" region is anticipated to contribute substantially, indicating expanding market penetration and consumer adoption.

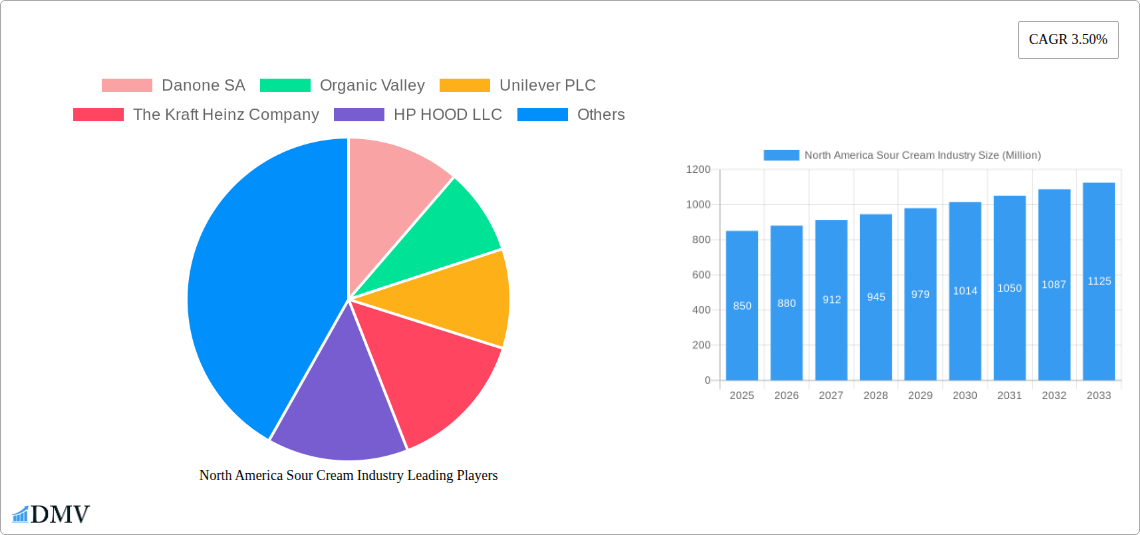

North America Sour Cream Industry Market Size (In Billion)

The competitive landscape features established dairy cooperatives, innovative ingredient suppliers, and agile startups focused on niche markets, especially in the non-dairy sector. Key players like Danone SA, Unilever PLC, and Dairy Farmers of America Inc. leverage extensive networks and brand recognition. Companies such as Organic Valley emphasize organic and sustainable practices. Strategic collaborations and acquisitions are prevalent, aimed at expanding product portfolios and market access. Emerging trends include functional sour cream variants with added probiotics or reduced fat content. Market restraints involve potential fluctuations in raw material costs and competition from substitutes like Greek yogurt. Despite these factors, the overall market outlook remains positive, driven by sour cream's culinary versatility and sustained demand across North America.

North America Sour Cream Industry Company Market Share

North America Sour Cream Industry Market Insights Report: 2019–2033

This comprehensive report delivers an in-depth analysis of the North America Sour Cream Industry, a dynamic market characterized by evolving consumer preferences, technological advancements, and a burgeoning plant-based segment. Spanning the historical period of 2019–2024 and projecting through 2033 with a base and estimated year of 2025, this report provides unparalleled insights into market composition, trends, leading players, and future growth trajectories. Uncover the strategies of key companies, the impact of innovative product launches, and the evolving distribution channels that are shaping this multi-million dollar industry.

North America Sour Cream Industry Market Composition & Trends

The North America Sour Cream Industry exhibits a moderate market concentration, with several dominant players holding significant market share alongside a growing number of niche and emerging companies. Innovation serves as a primary catalyst, driven by increasing consumer demand for healthier, more sustainable, and convenient options. The regulatory landscape, while generally stable, is adapting to the rise of plant-based alternatives and evolving labeling requirements. Substitute products, including Greek yogurt and other cultured dairy or non-dairy creams, present a continuous competitive pressure, necessitating a focus on product differentiation and value propositions. End-user profiles are diverse, ranging from households seeking versatile culinary ingredients to food service providers incorporating sour cream into a wide array of dishes. Mergers and acquisitions (M&A) activities have played a role in market consolidation and expansion, with significant deal values impacting market dynamics. For instance, the acquisition of smaller brands by larger corporations can rapidly alter market share distribution, while strategic partnerships aim to leverage synergistic capabilities. The overall market value is projected to reach [Insert Predicted Market Value in Million] million by 2025.

North America Sour Cream Industry Industry Evolution

The North America Sour Cream Industry has witnessed a significant evolution over the historical period of 2019–2024, driven by robust market growth trajectories, continuous technological advancements, and a profound shift in consumer demands. The overall market experienced a Compound Annual Growth Rate (CAGR) of approximately [Insert Predicted CAGR]% during the historical period, fueled by increasing per capita consumption and the expanding applications of sour cream in both household kitchens and commercial food establishments. Technological advancements have primarily focused on enhancing production efficiency, improving product shelf-life, and developing innovative formulations. This includes advancements in culturing techniques for improved flavor profiles and the development of advanced packaging solutions that ensure freshness and convenience.

Shifting consumer demands have been a pivotal force in this evolution. There has been a discernible trend towards healthier options, leading to increased interest in reduced-fat and lactose-free sour cream variants. Simultaneously, the demand for convenience has propelled the growth of single-serve packaging and ready-to-use formulations. Perhaps the most transformative shift has been the burgeoning demand for plant-based alternatives. Responding to growing consumer awareness regarding environmental sustainability, ethical concerns, and dietary preferences, the market has seen a significant influx of vegan sour cream options. This has not only expanded the consumer base but also spurred innovation in ingredient sourcing and product development. Consumer adoption metrics for plant-based sour cream have surged by an estimated [Insert Predicted Adoption Rate]% between 2021 and 2024, indicating a strong market receptiveness. Furthermore, the rise of online retail channels has democratized access to a wider variety of sour cream products, allowing smaller brands to reach a broader audience and contributing to a more dynamic and competitive market landscape. The market value is estimated to be [Insert Estimated Market Value in Million] million in 2025.

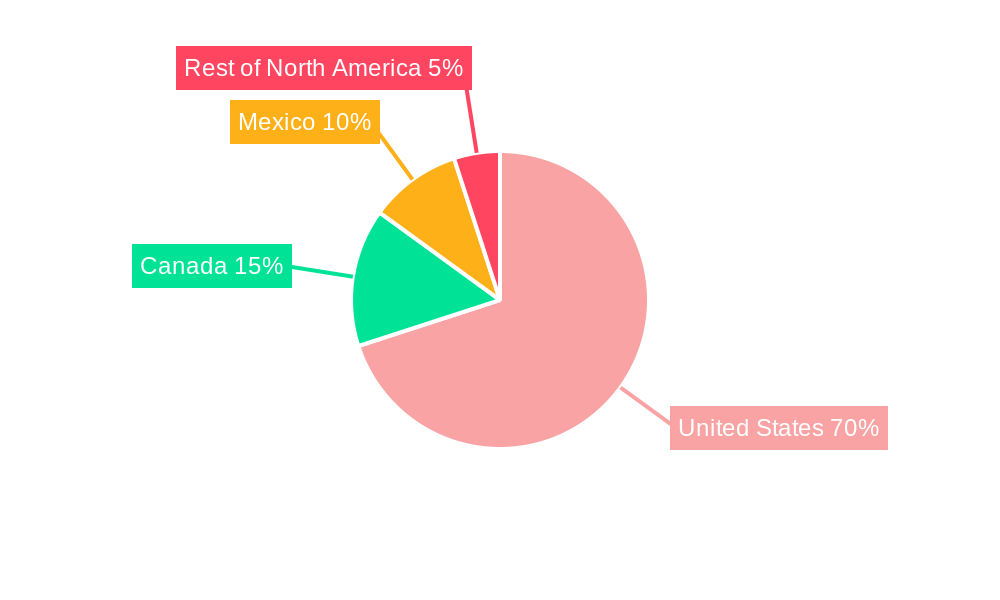

Leading Regions, Countries, or Segments in North America Sour Cream Industry

The United States unequivocally dominates the North America Sour Cream Industry, representing the largest market by both volume and value, driven by deeply ingrained culinary traditions and a substantial consumer base. Its dominance is further amplified by extensive distribution networks and high per capita consumption rates.

United States: Accounting for approximately [Insert Percentage]% of the total North American market share, the US is the undisputed leader.

- Key Drivers:

- High Consumer Spending Power: A robust economy supports consistent demand for dairy and dairy-alternative products.

- Widespread Culinary Integration: Sour cream is a staple ingredient in diverse American cuisines, from Tex-Mex to comfort food.

- Extensive Retail Infrastructure: A well-developed supermarket and hypermarket presence ensures broad product availability.

- Growing Health & Wellness Trend: Increasing demand for reduced-fat and lactose-free options, alongside a significant uptake of plant-based alternatives.

- Strong Food Service Sector: Restaurants and fast-food chains are major consumers, driving bulk purchases.

- Key Drivers:

Canada: While smaller than the US market, Canada represents a significant and growing segment within the North America Sour Cream Industry.

- Key Drivers:

- Similar Dietary Habits: Canadian culinary preferences often mirror those of the US, with sour cream featuring prominently in many dishes.

- Increasing Health Consciousness: A growing emphasis on healthier eating habits is driving demand for low-fat and plant-based sour cream.

- Expanding Online Retail: E-commerce is becoming increasingly important for product accessibility.

- Key Drivers:

Mexico: The Mexican market is characterized by a rising disposable income and a growing appreciation for diverse dairy products.

- Key Drivers:

- Culinary Versatility: Sour cream is increasingly being adopted as a versatile condiment and ingredient in Mexican cuisine.

- Growing Middle Class: An expanding middle-income demographic is fueling demand for premium and convenience food products.

- Influence of International Trends: Exposure to global food trends is encouraging the adoption of a wider variety of dairy and non-dairy products.

- Key Drivers:

Product Type Dominance: The Dairy segment continues to hold the largest market share due to its long-standing presence and consumer familiarity. However, the Non-Dairy segment is experiencing rapid growth, driven by veganism, lactose intolerance, and environmental concerns, projected to reach [Insert Predicted Non-Dairy Segment Value in Million] million by 2025.

Distribution Channel Dominance: Supermarkets/Hypermarkets remain the dominant distribution channel due to their wide reach and product assortment. However, Online Retail Stores are exhibiting the fastest growth rate, catering to convenience-seeking consumers.

North America Sour Cream Industry Product Innovations

Product innovations in the North America Sour Cream Industry are increasingly focused on catering to evolving consumer demands for healthier, more convenient, and diverse options. This includes the development of cultured sour cream with enhanced probiotic content and improved digestive benefits, as exemplified by Vermont Creamery's cultured sour cream launch. Furthermore, the industry is witnessing a surge in plant-based alternatives, such as Only Plant-Based!'s vegan sour cream, crafted with ingredients like rapeseed oil and vegetables to mimic the texture and taste of traditional sour cream. Packaging innovation is also a key trend, with companies like Prairie Farms Dairy introducing squeezable pouches for all-natural sour cream, offering enhanced convenience and portability. These innovations are crucial for maintaining competitive edge and capturing market share in a dynamic environment.

Propelling Factors for North America Sour Cream Industry Growth

Several key factors are propelling the growth of the North America Sour Cream Industry. Technologically, advancements in dairy processing and the development of sophisticated plant-based ingredients are enabling the creation of superior tasting and textured products. Economically, rising disposable incomes across North America are leading to increased consumer spending on food products, including premium sour cream variants and dairy alternatives. The growing health and wellness trend, characterized by a desire for lower-fat, lactose-free, and plant-based options, is a significant market driver. Regulatory support for food innovation and labeling transparency also plays a role in consumer confidence and market expansion.

Obstacles in the North America Sour Cream Industry Market

Despite robust growth, the North America Sour Cream Industry faces several obstacles. Regulatory challenges related to labeling of plant-based alternatives and claims about health benefits can create market uncertainty. Supply chain disruptions, exacerbated by global events, can impact the availability and cost of raw materials, including dairy and key plant-based ingredients. Intense competitive pressures from established brands and new entrants, particularly in the rapidly expanding plant-based segment, necessitate continuous product differentiation and aggressive marketing strategies. Furthermore, fluctuating consumer perceptions and potential shifts in dietary trends could also pose a restraint to sustained market expansion.

Future Opportunities in North America Sour Cream Industry

Emerging opportunities in the North America Sour Cream Industry lie in the continued expansion of the plant-based segment, with significant potential for innovation in flavors, textures, and functionalities. The development of specialized sour cream products for specific dietary needs, such as allergen-free or high-protein variants, also presents a promising avenue. Furthermore, the growing popularity of online grocery shopping and direct-to-consumer models offers new distribution channels for both established and emerging brands. Exploring international markets and adapting products to local tastes and preferences could also unlock significant growth potential.

Major Players in the North America Sour Cream Industry Ecosystem

- Danone SA

- Organic Valley

- Unilever PLC

- The Kraft Heinz Company

- HP HOOD LLC

- Meiji Holdings Co Ltd

- Dairy Farmers of America Inc

- Daisy Brand LLC

- Saputo Inc

- Redwood Hill Farm & Creamery Inc

Key Developments in North America Sour Cream Industry Industry

- September 2021: Only Plant-Based! launched vegan mayo, sour cream, and dressings at retailers nationwide. The plant-based brand uses ingredients including rapeseed oil, spirit vinegar, vegetables, and spices to craft their condiments, which come in varieties such as garlic mayo, chipotle mayo, ranch, and sour cream.

- August 2021: Websterville, Vt.-based Vermont Creamery introduced the brand's first cultured sour cream, which is available in dairy cases in September 2021.

- November 2021: Prairie Farms Dairy announced the expansion of its product lineup to include squeezable pouches of all-natural sour cream.

Strategic North America Sour Cream Industry Market Forecast

The strategic North America Sour Cream Industry forecast is highly optimistic, underpinned by several growth catalysts. The continued innovation in both dairy and plant-based sour cream, driven by consumer demand for healthier and more sustainable options, will fuel market expansion. The increasing penetration of online retail channels will broaden accessibility and create new avenues for sales. Furthermore, the growing acceptance of diverse culinary applications for sour cream, alongside its essential role in many traditional dishes, ensures sustained demand. The market is poised for substantial growth, with an estimated value of [Insert Forecasted Market Value in Million] million by 2033.

North America Sour Cream Industry Segmentation

-

1. Product Type

- 1.1. Dairy

- 1.2. Non-Dairy

-

2. Distribution Channel

- 2.1. Supermarkets/ Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Sour Cream Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Sour Cream Industry Regional Market Share

Geographic Coverage of North America Sour Cream Industry

North America Sour Cream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sports Participation; Increasing Awareness about Health and Fitness

- 3.3. Market Restrains

- 3.3.1. Adverse Effects of Overconsumption of Products

- 3.4. Market Trends

- 3.4.1. Growing Demand for Lactose-Free Sour Cream

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Sour Cream Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Dairy

- 5.1.2. Non-Dairy

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/ Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Sour Cream Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Dairy

- 6.1.2. Non-Dairy

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/ Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Sour Cream Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Dairy

- 7.1.2. Non-Dairy

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/ Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Sour Cream Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Dairy

- 8.1.2. Non-Dairy

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/ Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Sour Cream Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Dairy

- 9.1.2. Non-Dairy

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/ Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Danone SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Organic Valley

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Unilever PLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 The Kraft Heinz Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 HP HOOD LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Meiji Holdings Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Dairy Farmers of America Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Daisy Brand LLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Saputo Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Redwood Hill Farm & Creamery Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Danone SA

List of Figures

- Figure 1: North America Sour Cream Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Sour Cream Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Sour Cream Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Sour Cream Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: North America Sour Cream Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Sour Cream Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Sour Cream Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: North America Sour Cream Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: North America Sour Cream Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Sour Cream Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Sour Cream Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: North America Sour Cream Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: North America Sour Cream Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Sour Cream Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Sour Cream Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: North America Sour Cream Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: North America Sour Cream Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Sour Cream Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: North America Sour Cream Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: North America Sour Cream Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: North America Sour Cream Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America Sour Cream Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Sour Cream Industry?

The projected CAGR is approximately 5.22%.

2. Which companies are prominent players in the North America Sour Cream Industry?

Key companies in the market include Danone SA, Organic Valley, Unilever PLC, The Kraft Heinz Company, HP HOOD LLC, Meiji Holdings Co Ltd, Dairy Farmers of America Inc, Daisy Brand LLC, Saputo Inc, Redwood Hill Farm & Creamery Inc.

3. What are the main segments of the North America Sour Cream Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.95 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sports Participation; Increasing Awareness about Health and Fitness.

6. What are the notable trends driving market growth?

Growing Demand for Lactose-Free Sour Cream.

7. Are there any restraints impacting market growth?

Adverse Effects of Overconsumption of Products.

8. Can you provide examples of recent developments in the market?

In September 2021, Only Plant-Based! launched vegan mayo, sour cream, and dressings at retailers nationwide. The plant-based brand uses ingredients including rapeseed oil, spirit vinegar, vegetables, and spices to craft their condiments, which come in varieties such as garlic mayo, chipotle mayo, ranch, and sour cream.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Sour Cream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Sour Cream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Sour Cream Industry?

To stay informed about further developments, trends, and reports in the North America Sour Cream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence