Key Insights

The Asia-Pacific Flavor Enhancer Market is projected for significant growth, expected to reach $7.3 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 5.3% from the base year 2024. This expansion is propelled by rising consumer demand for processed foods and beverages, influenced by changing lifestyles and increasing disposable incomes across the region. Key growth drivers include the preference for convenient, ready-to-eat meals, an elevated focus on taste and sensory experiences in food consumption, and the expanding food processing industry, particularly in emerging economies. Innovations in flavor enhancement technologies and the development of natural, clean-label alternatives are opening new market opportunities and enhancing consumer acceptance. Strategic investments and product development by major global and regional players further contribute to the market's dynamism.

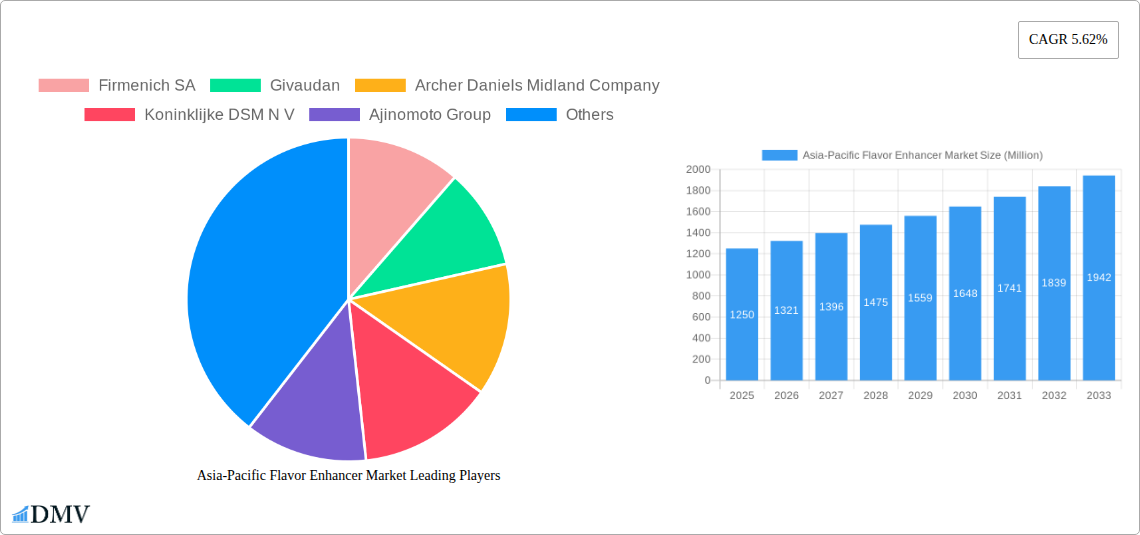

Asia-Pacific Flavor Enhancer Market Market Size (In Billion)

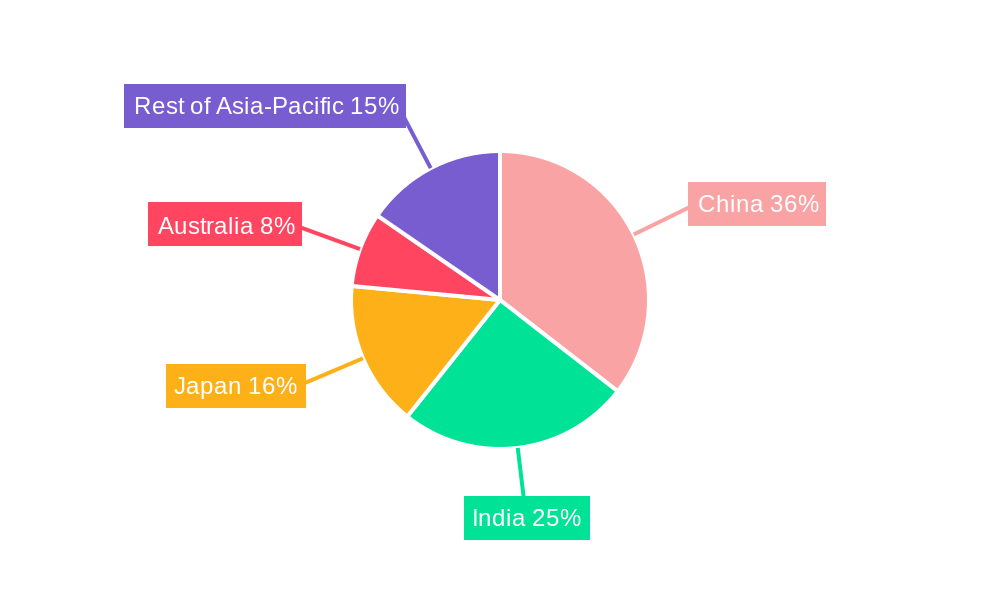

Market segmentation identifies key opportunities within various product types and applications. Acidulants and Glutamates are prominent segments, serving diverse food and beverage applications, including bakery, confectionery, dairy, and beverages. The "Others" category highlights emerging novel flavor-enhancing compounds. Geographically, China is anticipated to lead, owing to its vast consumer base and advanced food processing infrastructure. India presents substantial growth prospects due to its rapidly expanding population and increasing urbanization. While Australia and Japan contribute significantly to market value, the "Rest of Asia-Pacific" region also holds considerable untapped potential. Challenges such as fluctuating raw material prices and increased regulatory scrutiny of food additives exist; however, the overarching trend towards premiumization in food products and the pursuit of authentic, enhanced flavors are expected to drive sustained market development.

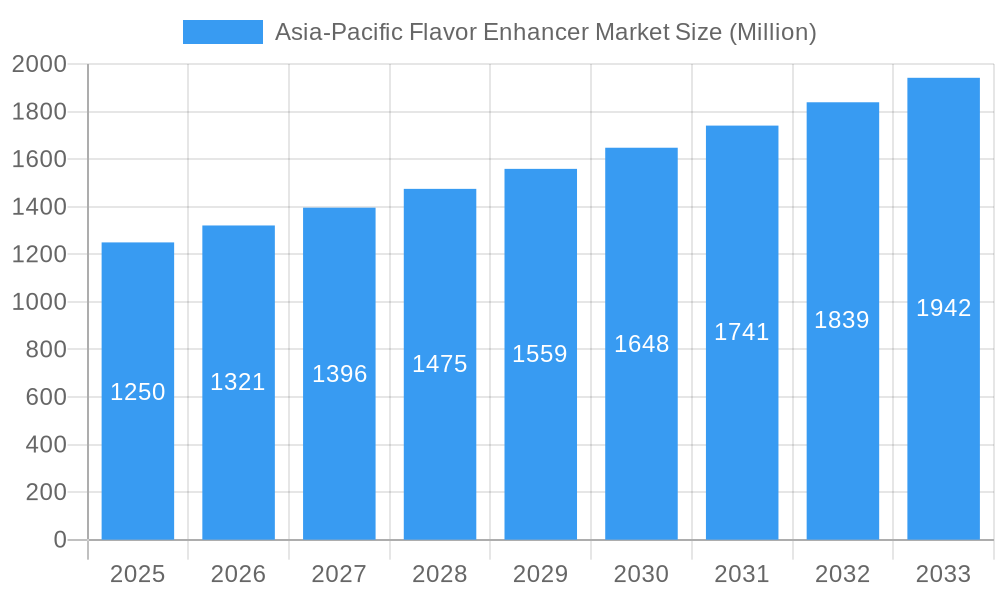

Asia-Pacific Flavor Enhancer Market Company Market Share

Explore the dynamic Asia-Pacific Flavor Enhancer Market with this comprehensive report. Covering the period from 2019 to 2033, with a focus on the base year 2024 and a forecast period of 2024–2033, this study offers in-depth insights into market composition, industry evolution, regional leadership, product innovations, growth drivers, challenges, and future opportunities. Gain a strategic edge by understanding the competitive landscape featuring industry leaders such as Firmenich SA, Givaudan, Archer Daniels Midland Company, Koninklijke DSM N V, Ajinomoto Group, Cargill Inc, Corbion N V, and Kerry Group plc. Analyze key segments including Acidulants, Glutamates, and Others by Type, and Bakery, Confectionery, Dairy Product, Beverage, and Others by Application. Comprehensively assess market dynamics across China, Australia, Japan, India, and the Rest of Asia-Pacific. This report is designed for stakeholders aiming to navigate and capitalize on the robust growth of the Asia-Pacific flavor enhancer industry.

Asia-Pacific Flavor Enhancer Market Market Composition & Trends

The Asia-Pacific flavor enhancer market is characterized by a moderate to high level of concentration, driven by strategic alliances and significant investments in innovation. Key players are actively engaged in research and development to introduce novel solutions that cater to evolving consumer preferences for natural, clean-label, and functional ingredients. The regulatory landscape, while varied across countries, is generally supportive of food safety and quality standards, influencing product development and market entry. Substitute products, such as high-intensity sweeteners and natural extracts, present a competitive challenge, yet the intrinsic benefits of flavor enhancers in taste modulation and cost optimization maintain their strong market position. End-user profiles are diverse, ranging from large-scale food and beverage manufacturers to smaller, niche product developers, all seeking to enhance the sensory experience of their offerings. Mergers and acquisitions (M&A) activities are on the rise, indicating a trend towards market consolidation and expansion of geographical reach, with M&A deal values projected to reach several hundred million dollars by 2025.

- Market Share Distribution: Dominance by a few key players, with significant contributions from emerging regional manufacturers.

- Innovation Catalysts: Growing demand for processed foods, expansion of the middle class, and a rising awareness of health and wellness trends.

- Regulatory Landscapes: Increasing stringency in food safety standards and labeling requirements across key APAC nations.

- Substitute Products: Competition from natural flavorings, high-intensity sweeteners, and sugar reduction strategies.

- End-User Profiles: Wide spectrum from multinational food corporations to local artisanal producers.

- M&A Activities: Driven by the pursuit of expanded product portfolios, technological capabilities, and market penetration.

Asia-Pacific Flavor Enhancer Market Industry Evolution

The Asia-Pacific flavor enhancer market has witnessed a remarkable evolution, propelled by a confluence of escalating consumer demand for enhanced taste experiences and advancements in food technology. Over the historical period of 2019–2024, the market demonstrated robust growth, driven by the increasing consumption of processed foods, ready-to-eat meals, and packaged beverages across the region's rapidly expanding middle class. The base year 2025 serves as a pivotal point, reflecting a mature yet dynamic market poised for sustained expansion throughout the forecast period of 2025–2033. Technological advancements have been instrumental in this evolution, with significant investments in research and development leading to the creation of more sophisticated and targeted flavor enhancement solutions. This includes the development of flavor enhancers that can mask off-notes, amplify desirable tastes, and contribute to texture and mouthfeel, thereby elevating the overall sensory appeal of food and beverage products. The adoption of these technologies has been accelerated by collaborations between flavor manufacturers and food and beverage companies, fostering an ecosystem of innovation and product development. Consumer demands have also shifted considerably, with a growing emphasis on natural ingredients, clean labels, and healthier options. This has spurred the development of natural flavor enhancers and the optimization of existing synthetic enhancers to meet these evolving preferences. The market’s growth trajectory has been further influenced by the burgeoning food service industry and the increasing popularity of diverse culinary experiences, necessitating a wider array of flavor profiles and enhancement capabilities. The market’s CAGR is projected to be a healthy xx% during the forecast period, indicating consistent and significant expansion. Penetration rates for flavor enhancers in key application segments like snacks, dairy, and beverages are steadily increasing, reaching xx% and xx% respectively by 2025. The market capitalization is estimated to reach approximately xx Million by 2033, underscoring its substantial economic significance. Furthermore, the drive towards sustainability in food production is increasingly impacting the flavor enhancer market, encouraging the development of eco-friendly sourcing and manufacturing processes.

Leading Regions, Countries, or Segments in Asia-Pacific Flavor Enhancer Market

The Asia-Pacific flavor enhancer market exhibits a clear leadership hierarchy across its diverse geographical and product segments, with China emerging as the undisputed dominant force. Its sheer market size, coupled with rapid industrialization and a burgeoning consumer base with a growing disposable income, positions it at the forefront. The country's massive food and beverage processing industry, coupled with increasing urbanization and a demand for more diverse and sophisticated food products, fuels the consumption of a wide range of flavor enhancers. Beyond China, other significant contributors to the market's dynamism include India, driven by its large population and a fast-growing food processing sector, and Japan, known for its sophisticated palate and high demand for premium and functional food ingredients. The Rest of Asia-Pacific, encompassing Southeast Asian nations and Oceania, also presents a substantial and growing market.

Within the product Type segment, Glutamates continue to hold a significant market share due to their well-established effectiveness in delivering umami taste and enhancing overall palatability across a vast array of savory applications. However, Acidulants are witnessing robust growth, driven by their dual functionality in providing tartness and extending shelf-life, particularly in the beverage and confectionery sectors. The "Others" category, encompassing a variety of enhancers like nucleotides and yeast extracts, is also expanding, catering to niche applications and the demand for natural flavor solutions.

In terms of Application, the Beverage sector is a key driver of market growth, with flavor enhancers crucial for masking bitterness, intensifying fruit flavors, and creating appealing taste profiles in soft drinks, juices, and alcoholic beverages. The Confectionery and Bakery segments are also major consumers, where these ingredients are vital for achieving desired sweetness, tartness, and complex flavor profiles. The Dairy Product segment, including yogurts, ice creams, and flavored milk, also represents a substantial application area.

Key drivers contributing to China's dominance include:

- Massive Consumer Base: A population exceeding 1.4 billion individuals with increasing purchasing power.

- Extensive Food Processing Industry: A highly developed and diversified food and beverage manufacturing sector.

- Government Support & Investment: Policies encouraging food technology innovation and industrial growth.

- Urbanization and Lifestyle Changes: A shift towards convenience foods and a greater demand for varied taste experiences.

- Technological Adoption: High receptiveness to new food science technologies and ingredient solutions.

Asia-Pacific Flavor Enhancer Market Product Innovations

Product innovations in the Asia-Pacific flavor enhancer market are increasingly focused on delivering clean-label solutions and enhancing natural tastes. Manufacturers are actively developing yeast-based flavor enhancers and fermented ingredients that provide complex umami profiles without relying on synthetic additives. There's a surge in encapsulation technologies that allow for controlled release of flavors, improving stability and performance in challenging food matrices like baked goods and dairy products. Performance metrics highlight improved taste intensity, reduced need for sugar and salt, and extended shelf-life, making these innovations highly attractive to food and beverage companies seeking to meet evolving consumer demands for healthier, more natural, and sensorially appealing products.

Propelling Factors for Asia-Pacific Flavor Enhancer Market Growth

Several key factors are propelling the Asia-Pacific flavor enhancer market. Technologically, advancements in fermentation and biotechnological processes are enabling the development of novel, natural flavor enhancers. Economically, the expanding middle class across the region leads to increased consumption of processed and convenience foods, directly driving demand. Furthermore, a growing consumer awareness of taste and sensory experience, coupled with a desire for healthier options (leading to the need for enhancers to maintain palatability when sugar and salt are reduced), are significant market stimuli. Favorable regulatory environments in many APAC nations, supporting food safety and ingredient innovation, also contribute positively.

Obstacles in the Asia-Pacific Flavor Enhancer Market Market

Despite its strong growth prospects, the Asia-Pacific flavor enhancer market faces certain obstacles. Stringent and varied regulatory frameworks across different countries can create complexities for market entry and product compliance. Supply chain disruptions, exacerbated by geopolitical factors and logistical challenges, can impact the availability and cost of raw materials. Intense competition from both established global players and emerging local manufacturers can put pressure on pricing and profit margins. Additionally, a segment of consumers remains wary of artificial ingredients, necessitating a greater focus on natural and clean-label solutions, which can be more costly to produce.

Future Opportunities in Asia-Pacific Flavor Enhancer Market

Emerging opportunities in the Asia-Pacific flavor enhancer market lie in the growing demand for plant-based and vegan food products, which require specialized flavor solutions to replicate traditional tastes. The expansion of the functional food and beverage sector, incorporating ingredients for health benefits, presents a niche for enhancers that can also mask unpleasant medicinal notes. Further innovation in natural and sustainable sourcing of ingredients, alongside the development of novel flavor profiles catering to specific regional cuisines, will unlock new market potential. Digitalization of supply chains and personalized nutrition trends also offer avenues for tailored flavor enhancement solutions.

Major Players in the Asia-Pacific Flavor Enhancer Market Ecosystem

- Firmenich SA

- Givaudan

- Archer Daniels Midland Company

- Koninklijke DSM N V

- Ajinomoto Group

- Cargill Inc

- Corbion N V

- Kerry Group plc

Key Developments in Asia-Pacific Flavor Enhancer Market Industry

- 2024: Givaudan announced an acquisition to expand its flavor enhancer capabilities in Southeast Asia.

- 2023: Firmenich SA partnered with a major beverage manufacturer in Japan to develop new low-sugar, high-impact flavor solutions.

- 2023: Archer Daniels Midland Company invested significantly in R&D for novel, fermented umami enhancers.

- 2023: Ajinomoto Group launched an innovative range of natural flavor enhancers derived from sustainable sources.

- 2022: Kerry Group plc finalized a joint venture in India to bolster its market reach in the dairy segment.

- 2022: Koninklijke DSM N V announced strategic investments in advanced biotechnological platforms for flavor development.

- 2021: Cargill Inc acquired a specialized flavor ingredient company, enhancing its product portfolio.

- 2021: Corbion N V introduced a new line of sustainable acidulants for bakery applications.

Strategic Asia-Pacific Flavor Enhancer Market Market Forecast

The Asia-Pacific flavor enhancer market is projected for robust and sustained growth, driven by evolving consumer preferences for enhanced taste experiences, healthier product formulations, and the burgeoning processed food industry. Strategic investments in research and development for natural and clean-label solutions, coupled with expansion through mergers, acquisitions, and partnerships, will define the market's trajectory. The increasing demand across diverse applications, from beverages to confectionery, within rapidly developing economies like China and India, signifies substantial untapped potential. The market is poised to benefit from a growing emphasis on sustainability and functional ingredients, creating ample opportunities for innovative players to capture significant market share and contribute to the region's dynamic food landscape.

Asia-Pacific Flavor Enhancer Market Segmentation

-

1. Type

- 1.1. Acidulants

- 1.2. Glutamates

- 1.3. Others

-

2. Application

- 2.1. Bakery

- 2.2. Confectionery

- 2.3. Dairy Product

- 2.4. Beverage

- 2.5. Others

-

3. Geography

- 3.1. China

- 3.2. Australia

- 3.3. Japan

- 3.4. India

- 3.5. Rest of Asia-Pacific

Asia-Pacific Flavor Enhancer Market Segmentation By Geography

- 1. China

- 2. Australia

- 3. Japan

- 4. India

- 5. Rest of Asia Pacific

Asia-Pacific Flavor Enhancer Market Regional Market Share

Geographic Coverage of Asia-Pacific Flavor Enhancer Market

Asia-Pacific Flavor Enhancer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. India is the Fastest Growing Market in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Flavor Enhancer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Acidulants

- 5.1.2. Glutamates

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Confectionery

- 5.2.3. Dairy Product

- 5.2.4. Beverage

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Australia

- 5.3.3. Japan

- 5.3.4. India

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Australia

- 5.4.3. Japan

- 5.4.4. India

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Flavor Enhancer Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Acidulants

- 6.1.2. Glutamates

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bakery

- 6.2.2. Confectionery

- 6.2.3. Dairy Product

- 6.2.4. Beverage

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Australia

- 6.3.3. Japan

- 6.3.4. India

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Australia Asia-Pacific Flavor Enhancer Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Acidulants

- 7.1.2. Glutamates

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bakery

- 7.2.2. Confectionery

- 7.2.3. Dairy Product

- 7.2.4. Beverage

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Australia

- 7.3.3. Japan

- 7.3.4. India

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia-Pacific Flavor Enhancer Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Acidulants

- 8.1.2. Glutamates

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bakery

- 8.2.2. Confectionery

- 8.2.3. Dairy Product

- 8.2.4. Beverage

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Australia

- 8.3.3. Japan

- 8.3.4. India

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. India Asia-Pacific Flavor Enhancer Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Acidulants

- 9.1.2. Glutamates

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bakery

- 9.2.2. Confectionery

- 9.2.3. Dairy Product

- 9.2.4. Beverage

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Australia

- 9.3.3. Japan

- 9.3.4. India

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia-Pacific Flavor Enhancer Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Acidulants

- 10.1.2. Glutamates

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Bakery

- 10.2.2. Confectionery

- 10.2.3. Dairy Product

- 10.2.4. Beverage

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Australia

- 10.3.3. Japan

- 10.3.4. India

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Firmenich SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Givaudan

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Archer Daniels Midland Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Koninklijke DSM N V

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ajinomoto Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cargill Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Corbion N V

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kerry Group plc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Firmenich SA

List of Figures

- Figure 1: Asia-Pacific Flavor Enhancer Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Flavor Enhancer Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Flavor Enhancer Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Flavor Enhancer Market?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Asia-Pacific Flavor Enhancer Market?

Key companies in the market include Firmenich SA, Givaudan, Archer Daniels Midland Company, Koninklijke DSM N V, Ajinomoto Group, Cargill Inc, Corbion N V, Kerry Group plc.

3. What are the main segments of the Asia-Pacific Flavor Enhancer Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

India is the Fastest Growing Market in the Region.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

1. Acquisitions and joint ventures to expand market reach 2. Partnerships between flavor manufacturers and food and beverage companies 3. Investments in research and development for new flavor solutions 4. Launch of innovative and sustainable flavor products

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Flavor Enhancer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Flavor Enhancer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Flavor Enhancer Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Flavor Enhancer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence