Key Insights

The North American Fruits and Vegetables Juice Market is projected for substantial growth, anticipated to reach $14.2 billion in 2025. The market is forecast to expand at a Compound Annual Growth Rate (CAGR) of 0.8% by 2033. This expansion is driven by increasing consumer focus on health and wellness, elevating demand for nutrient-dense beverages. The convenience and perceived health advantages of juice consumption are key factors propelling market adoption throughout North America. Major segments, including Fruit Juice and Vegetable Juice, are expected to show strong performance, with Nectar also capturing a notable market share. While Supermarkets/Hypermarkets lead distribution due to broad accessibility, Specialty Stores and Convenience Stores play a vital role in meeting niche consumer requirements and impulse buys.

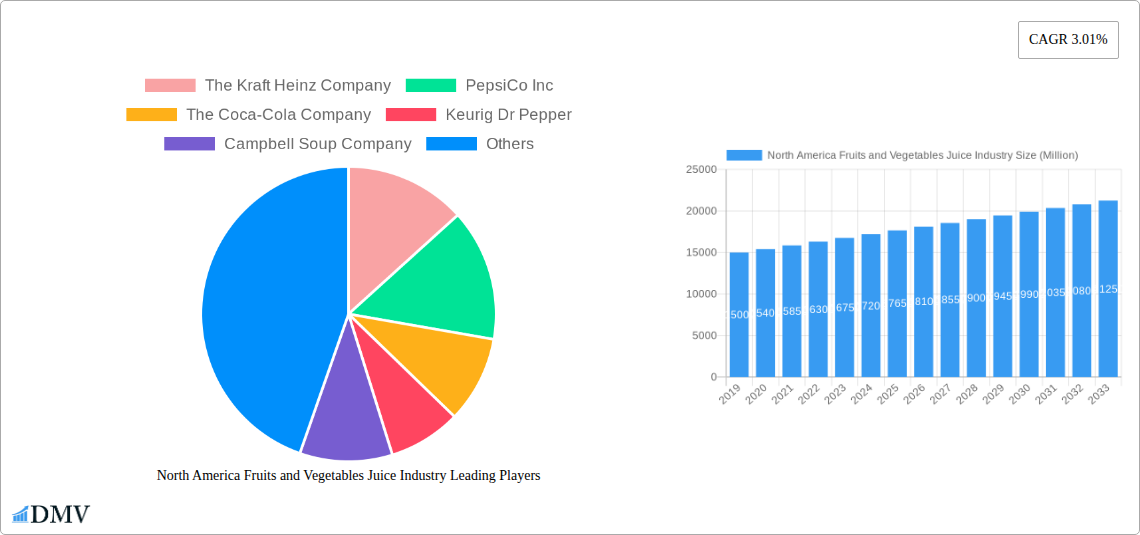

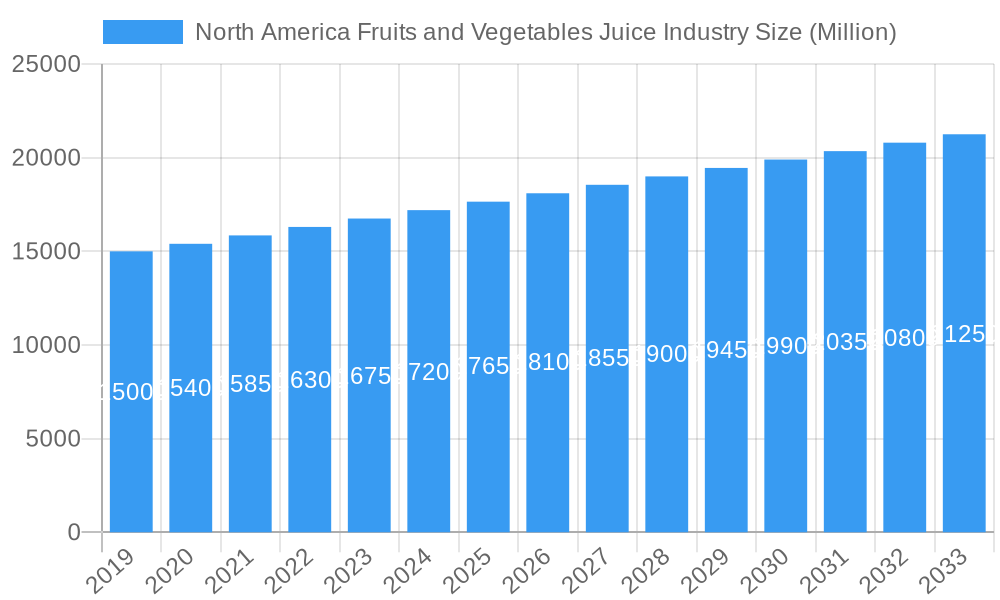

North America Fruits and Vegetables Juice Industry Market Size (In Billion)

Product innovation, such as the introduction of functional juices fortified with vitamins, antioxidants, and probiotics to address specific health needs, further fuels industry expansion. The rising preference for organic and natural juice options, appealing to health-conscious and environmentally aware demographics, represents a significant trend. Nevertheless, the market encounters challenges including volatile raw material costs, rigorous regulatory standards for labeling and production, and intensifying competition from alternative healthy beverages like smoothies and ready-to-drink (RTD) teas. Despite these obstacles, leading companies such as PepsiCo Inc., The Coca-Cola Company, and The Kraft Heinz Company are actively investing in innovation and market development to leverage the consistent demand for fruit and vegetable juices across North America.

North America Fruits and Vegetables Juice Industry Company Market Share

North America Fruits and Vegetables Juice Industry Market Outlook: Growth Drivers, Innovations, and Forecast (2019-2033)

This comprehensive report delves deep into the North American Fruits and Vegetables Juice Industry, providing an in-depth analysis of market dynamics, key trends, and future projections. Covering the historical period from 2019 to 2024 and projecting growth through 2033, with a base year of 2025, this report is an essential resource for stakeholders seeking to understand the evolving landscape of fruit juice, vegetable juice, and nectar consumption in the region. We meticulously examine market composition, evolving consumer preferences for healthy beverages, organic juices, and low-sugar options, and the impact of distribution channels like supermarkets, hypermarkets, and specialty stores. Gain valuable insights into the strategies of major players including The Kraft Heinz Company, PepsiCo Inc, The Coca-Cola Company, Keurig Dr Pepper, Campbell Soup Company, Del Monte Foods Inc, Citrus World Inc, Welch Foods Inc, Santa Cruz Organic, and RW Knudsen.

North America Fruits and Vegetables Juice Industry Market Composition & Trends

The North American Fruits and Vegetables Juice Industry exhibits a dynamic market composition, characterized by moderate to high concentration among leading players, with companies like PepsiCo Inc and The Coca-Cola Company holding significant market share in the fruit juice and nectar segments. Innovation serves as a primary catalyst, driven by increasing consumer demand for healthy juices, organic fruit juices, and vegetable juice blends fortified with functional ingredients. The regulatory landscape, while generally stable, influences product formulations, particularly concerning sugar content and labeling. Substitute products, such as ready-to-drink (RTD) teas, functional beverages, and fortified water, present a constant competitive pressure. End-user profiles are diverse, ranging from health-conscious individuals and families seeking nutritious options to those looking for convenient and refreshing beverages. Mergers and acquisitions (M&A) activities, though not at an aggressive pace, are strategic moves to expand product portfolios, enhance market reach, and acquire innovative technologies. Estimated M&A deal values in the recent past have ranged from tens of Millions to hundreds of Millions of dollars for acquisitions of smaller, niche juice brands focusing on cold-pressed juices and plant-based beverages. The market share distribution is largely influenced by brand recognition, product innovation, and extensive distribution networks.

North America Fruits and Vegetables Juice Industry Industry Evolution

The North America Fruits and Vegetables Juice Industry has undergone a significant transformation over the historical period, evolving from a market dominated by traditional fruit juices to a more diversified and health-conscious landscape. The historical period (2019-2024) witnessed a steady growth trajectory for the fruit juice segment, driven by convenience and established consumer preferences. However, a discernible shift began to emerge, with a notable rise in the popularity of vegetable juices and nutrient-rich juice blends. This evolution is closely tied to increasing consumer awareness regarding health and wellness, prompting a demand for beverages with lower sugar content and higher nutritional value. Technological advancements in processing and packaging have played a crucial role in this evolution, enabling the production of cold-pressed juices and functional juices that retain more natural nutrients and offer extended shelf life. For instance, the adoption of high-pressure processing (HPP) has allowed for the creation of minimally processed juices that align with consumer expectations for fresh, natural products. Shifting consumer demands have also seen a surge in the preference for organic juices and products with transparent ingredient lists. The market has responded by introducing a wider array of 100% fruit juices, no added sugar juices, and innovative vegetable-based formulations. This has led to a CAGR of approximately 3-4% for the overall industry during the historical period, with segments like organic vegetable juices experiencing a higher growth rate, potentially in the range of 5-7%. The estimated market size in 2025 is expected to reach upwards of $XX Billion, with continued robust growth projected throughout the forecast period.

Leading Regions, Countries, or Segments in North America Fruits and Vegetables Juice Industry

Within the North American Fruits and Vegetables Juice Industry, the United States unequivocally dominates in terms of market size, consumption, and innovation. This dominance is attributable to several key factors, including a large, health-conscious consumer base, robust retail infrastructure, and significant investment in product development.

Dominant Region: United States

The sheer population size and economic affluence of the United States create an unparalleled market for fruit juices, vegetable juices, and nectars. Consumer trends in the U.S. often set the pace for the rest of the continent, with a strong emphasis on health, wellness, and ingredient transparency.

- Investment Trends: Significant capital is channeled into research and development for new juice formulations, including functional juices and those catering to specific dietary needs. Investments in sustainable sourcing and production methods are also on the rise.

- Regulatory Support: While regulations are stringent, they also drive innovation by encouraging the development of healthier product options. Clear labeling requirements for organic juices and no added sugar products empower consumers to make informed choices.

Leading Product Type: Fruit Juice

Despite the rising popularity of vegetable-based beverages, fruit juice remains the largest segment within the North American market. This is driven by its long-standing popularity, wide variety of flavors, and widespread availability.

- Key Drivers:

- Established Consumer Palates: Familiar and beloved fruit flavors like orange, apple, and grape continue to drive high sales volumes.

- Versatility: Fruit juices are consumed on their own, as mixers, and as ingredients in various culinary applications.

- Fortification Opportunities: Many fruit juices are fortified with vitamins and minerals, further enhancing their appeal as healthy beverages.

Leading Distribution Channel: Supermarkets/Hypermarkets

The vast majority of fruit and vegetable juice sales in North America are conducted through supermarkets/hypermarkets. These retail giants offer unparalleled reach and convenience for consumers.

- Dominance Factors:

- One-Stop Shopping: Consumers can purchase their groceries and beverages simultaneously, making it the most convenient option.

- Wide Product Assortment: Supermarkets stock a diverse range of brands and product types, catering to various consumer preferences and price points.

- Promotional Activities: Retailers frequently engage in promotions, discounts, and end-cap displays, which significantly influence purchasing decisions.

While other segments like specialty stores (offering premium and niche juices) and convenience stores (for immediate consumption) play important roles, they do not rival the sheer volume and market penetration of supermarkets. The estimated market share for the U.S. in the North American juice market is approximately 85%, with fruit juice accounting for around 70% of the total market value, and supermarkets/hypermarkets capturing over 60% of all juice sales.

North America Fruits and Vegetables Juice Industry Product Innovations

Product innovation in the North America Fruits and Vegetables Juice Industry is largely driven by the pursuit of health-conscious consumers and the desire for unique flavor profiles. A key trend is the rise of cold-pressed juices, which are minimally processed to preserve vital nutrients and enzymes, offering superior nutritional value compared to traditional pasteurized juices. Another significant area of innovation is the development of functional juices infused with ingredients like probiotics, adaptogens, and antioxidants to address specific health concerns, from gut health to immune support. Furthermore, there is a pronounced movement towards low-sugar juices and zero added sugar beverages, with manufacturers reformulating their products or developing new lines that utilize natural sweeteners or focus on the inherent sweetness of fruits and vegetables. Performance metrics for these innovations are measured by market adoption rates, repeat purchase behavior, and positive consumer feedback regarding taste, perceived health benefits, and ingredient quality. The unique selling proposition often lies in the clean label, the absence of artificial additives, and the functional benefits offered by the juice.

Propelling Factors for North America Fruits and Vegetables Juice Industry Growth

Several key factors are propelling the growth of the North America Fruits and Vegetables Juice Industry. Technologically, advancements in cold-pressing technology and high-pressure processing (HPP) allow for the production of juices with enhanced nutritional profiles and longer shelf lives, meeting consumer demand for fresh and minimally processed options. Economically, rising disposable incomes in North America contribute to increased consumer spending on premium and health-oriented beverages. The growing consumer awareness regarding the health benefits associated with fruit juice and vegetable juice, such as their rich vitamin, mineral, and antioxidant content, is a significant driver. Regulatory influences, particularly policies that encourage healthier eating habits and transparent labeling of ingredients, indirectly support the market by fostering trust and demand for compliant products. Furthermore, the increasing popularity of plant-based diets and the perception of juices as a convenient way to incorporate fruits and vegetables into daily intake are substantial growth catalysts.

Obstacles in the North America Fruits and Vegetables Juice Industry Market

Despite the positive growth trajectory, the North America Fruits and Vegetables Juice Industry faces several significant obstacles. Regulatory challenges, particularly concerning sugar content and labeling of health claims, can necessitate costly product reformulation and marketing adjustments, impacting profitability. Supply chain disruptions, including adverse weather conditions affecting fruit and vegetable harvests, transportation issues, and ingredient sourcing complexities, can lead to price volatility and availability concerns, potentially costing the industry millions in lost sales annually. Intense competitive pressures from the beverage industry, including the rising popularity of healthy alternatives like flavored waters, functional beverages, and energy drinks, fragment market share and necessitate continuous innovation and aggressive marketing strategies. Furthermore, negative public perception surrounding high sugar content in some traditional juices, despite the growth of low-sugar and no added sugar options, can deter health-conscious consumers.

Future Opportunities in North America Fruits and Vegetables Juice Industry

The North America Fruits and Vegetables Juice Industry is poised for significant future opportunities driven by evolving consumer preferences and technological advancements. The burgeoning demand for functional beverages presents a lucrative avenue, with opportunities to develop juices fortified with probiotics, prebiotics, vitamins, and adaptogens catering to specific wellness needs like immunity, stress relief, and cognitive enhancement. The expanding market for plant-based diets and veganism also opens doors for innovative vegetable juice blends and fruit juice formulations that align with these lifestyles. Furthermore, the continuous development of advanced processing techniques, such as improved pasteurization methods that preserve nutrient integrity, will enable the creation of more appealing and healthier products. The growing interest in sustainable and ethically sourced ingredients provides an opportunity for brands to differentiate themselves and capture a loyal consumer base. Exploring niche markets, such as juices for specific age groups or those with particular dietary restrictions, also represents a promising growth avenue.

Major Players in the North America Fruits and Vegetables Juice Industry Ecosystem

- The Kraft Heinz Company

- PepsiCo Inc

- The Coca-Cola Company

- Keurig Dr Pepper

- Campbell Soup Company

- Del Monte Foods Inc

- Citrus World Inc

- Welch Foods Inc

- Santa Cruz Organic

- RW Knudsen

Key Developments in North America Fruits and Vegetables Juice Industry Industry

- March 2022: Kayco Beyond announced the launch of its cold-pressed juice, Wonder Lemon, in the United States. The company claimed the product was 100% organic and had zero added sugar, addressing the growing demand for healthy juices and organic beverages.

- November 2021: Ocean Spray launched its new range of low-calorie fruit juices in Walmart stores in the United States. The company stated the product was made with real fruit juice and had no added sugar, catering to the trend of low-sugar juices. The product was available in three variants: Cranberry Pineapple Passion Fruit, Cranberry Lemon Raspberry, and Cranberry Raspberry Pear.

- February 2021: PepsiCo launched its new range of fruit juice beverages for kids in the United States. The beverage, Frutly, consists of fruit juice, water, and electrolyte and has no artificial sweetener or added sugar, highlighting a focus on healthy kids' beverages and no added sugar options.

Strategic North America Fruits and Vegetables Juice Industry Market Forecast

The strategic North America Fruits and Vegetables Juice Industry market forecast indicates sustained growth, propelled by the increasing consumer focus on health and wellness. The market is expected to witness a compound annual growth rate (CAGR) of approximately 3.5% to 4.5% during the forecast period (2025-2033), reaching an estimated market valuation of over $XX Billion. Growth catalysts include the rising popularity of functional juices and cold-pressed juices, which offer enhanced nutritional benefits. The demand for organic fruit juices and no added sugar options will continue to drive product development and innovation. Furthermore, the expansion of vegetable juice segments and the integration of superfoods into juice formulations will contribute significantly to market expansion. Strategic partnerships between juice manufacturers and retailers, coupled with effective marketing campaigns emphasizing the health benefits of these beverages, will further solidify market position and unlock new opportunities.

North America Fruits and Vegetables Juice Industry Segmentation

-

1. Product Type

- 1.1. Fruit Juice

- 1.2. Vegetable Juice

- 1.3. Nectar

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Specialty Stores

- 2.3. Convenience Stores

- 2.4. Other Distribution Channels

North America Fruits and Vegetables Juice Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

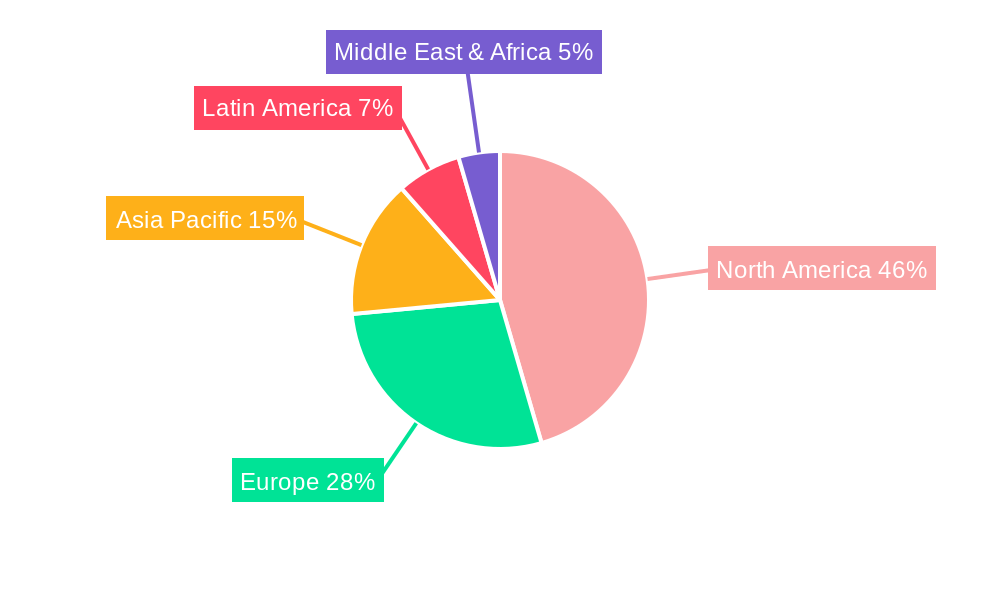

North America Fruits and Vegetables Juice Industry Regional Market Share

Geographic Coverage of North America Fruits and Vegetables Juice Industry

North America Fruits and Vegetables Juice Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Preference for the Organic Food and Beverages is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fruits and Vegetables Juice Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fruit Juice

- 5.1.2. Vegetable Juice

- 5.1.3. Nectar

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Convenience Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Kraft Heinz Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PepsiCo Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Coca-Cola Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Keurig Dr Pepper

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Campbell Soup Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Del Monte Foods Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Citrus World Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Welch Foods Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Santa Cruz Organic

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 RW Knudsen*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Kraft Heinz Company

List of Figures

- Figure 1: North America Fruits and Vegetables Juice Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Fruits and Vegetables Juice Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Fruits and Vegetables Juice Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Fruits and Vegetables Juice Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: North America Fruits and Vegetables Juice Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Fruits and Vegetables Juice Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: North America Fruits and Vegetables Juice Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: North America Fruits and Vegetables Juice Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Fruits and Vegetables Juice Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Fruits and Vegetables Juice Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Fruits and Vegetables Juice Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fruits and Vegetables Juice Industry?

The projected CAGR is approximately 0.8%.

2. Which companies are prominent players in the North America Fruits and Vegetables Juice Industry?

Key companies in the market include The Kraft Heinz Company, PepsiCo Inc, The Coca-Cola Company, Keurig Dr Pepper, Campbell Soup Company, Del Monte Foods Inc, Citrus World Inc, Welch Foods Inc, Santa Cruz Organic, RW Knudsen*List Not Exhaustive.

3. What are the main segments of the North America Fruits and Vegetables Juice Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.2 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Preference for the Organic Food and Beverages is Driving the Market Growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2022: Kayco Beyond announced the launch of its cold-pressed juice, Wonder Lemon, in the United States. The company claimed the product was 100% organic and had zero added sugar.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fruits and Vegetables Juice Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fruits and Vegetables Juice Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fruits and Vegetables Juice Industry?

To stay informed about further developments, trends, and reports in the North America Fruits and Vegetables Juice Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence