Key Insights

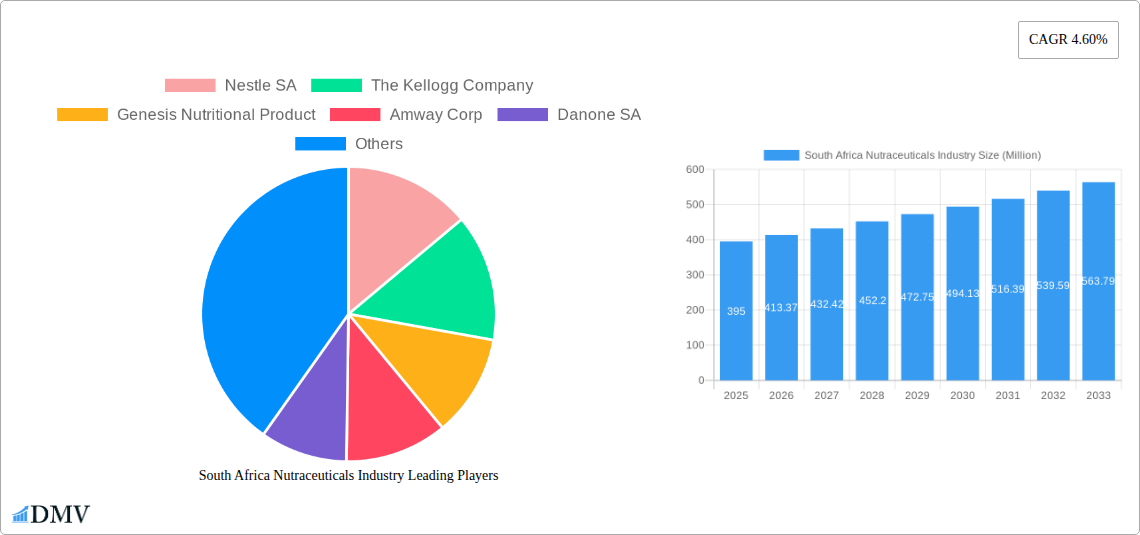

The South African nutraceuticals market, valued at approximately $395 million in 2025, is poised for robust growth, projected to expand at a compound annual growth rate (CAGR) of 4.6% from 2025 to 2033. This growth is fueled by several key factors. Increasing health consciousness among South Africans, coupled with rising disposable incomes, is driving demand for functional foods, dietary supplements, and functional beverages. The prevalence of lifestyle diseases like diabetes and cardiovascular conditions further contributes to this demand, as consumers actively seek natural and preventative healthcare solutions. Furthermore, the expanding retail landscape, particularly the growth of online retail stores and health food stores, provides enhanced accessibility to these products. While a lack of stringent regulatory frameworks and the potential for counterfeit products pose challenges, the overall market outlook remains positive. The strong presence of multinational corporations like Nestle, Kellogg's, and Danone, alongside local players, indicates a competitive and dynamic market. Specific growth within segments will likely be driven by increasing awareness of the benefits of specific nutritional components and personalized nutrition plans. The convenience of readily available options through various distribution channels also contributes to the projected market growth.

South Africa Nutraceuticals Industry Market Size (In Million)

Within the South African context, the functional foods segment is expected to hold a significant market share due to the increasing preference for incorporating health benefits into everyday diets. The dietary supplements segment is also anticipated to experience considerable growth driven by the rising awareness of specific nutrient deficiencies and the desire for targeted health improvements. The convenience store and online retail channels are predicted to exhibit faster growth rates compared to traditional channels like supermarkets, due to their accessibility and convenience for the busy modern consumer. The government's initiatives to promote healthy lifestyles and address health concerns could further stimulate market growth in the coming years. However, price sensitivity, particularly among lower-income segments, and the need for greater consumer education on the efficacy and safety of nutraceutical products remain crucial considerations for market players.

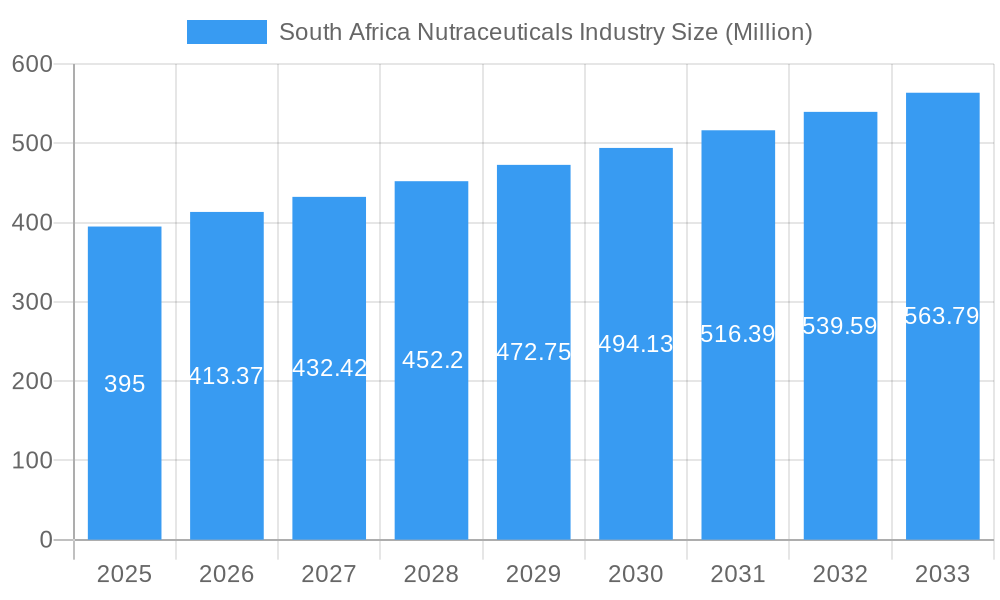

South Africa Nutraceuticals Industry Company Market Share

South Africa Nutraceuticals Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South Africa nutraceuticals industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. With a meticulous study period spanning 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report delivers precise market sizing, growth projections, and strategic recommendations. The report’s detailed segmentation, covering functional foods, dietary supplements, and functional beverages across various distribution channels, allows for granular understanding and targeted investment strategies. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

South Africa Nutraceuticals Industry Market Composition & Trends

This section dissects the South African nutraceutical landscape, examining market concentration, innovation drivers, regulatory frameworks, substitute products, and consumer profiles. We analyze the mergers and acquisitions (M&A) activity, providing insights into deal values and their implications for market dynamics. The report reveals a moderately concentrated market with key players holding significant shares.

- Market Share Distribution (2025): Nestle SA (xx%), The Kellogg Company (xx%), Amway Corp (xx%), and other players. The remaining market share is distributed amongst numerous smaller companies.

- Innovation Catalysts: Growing health consciousness, increasing disposable incomes, and government initiatives promoting healthy lifestyles are driving innovation.

- Regulatory Landscape: Analysis of relevant regulations impacting product development, labeling, and marketing.

- Substitute Products: Examination of competing products and their impact on market share.

- End-User Profiles: Detailed segmentation of consumers based on demographics, health concerns, and purchasing habits.

- M&A Activity (2019-2024): Analysis of significant M&A deals, including deal values and strategic rationale (e.g., xx Million acquisition of X company by Y company).

South Africa Nutraceuticals Industry Industry Evolution

This section provides a detailed analysis of the South Africa nutraceuticals industry's evolution, from 2019 to 2033, highlighting growth trajectories, technological advancements, and evolving consumer preferences. We examine the factors driving market expansion and explore emerging trends shaping the future of the industry. The report reveals a consistent market growth trajectory, fueled by several key factors. The historical period (2019-2024) shows a CAGR of xx%, while the forecast period (2025-2033) projects a CAGR of xx%, driven by increasing health awareness and the expanding middle class. Technological innovations, particularly in product formulation and delivery, are also significant contributors. Consumer demand is shifting towards more natural, organic, and functional products, creating new opportunities for specialized offerings.

Leading Regions, Countries, or Segments in South Africa Nutraceuticals Industry

This section identifies the leading segments and distribution channels within the South African nutraceutical market.

By Type:

- Functional Food: This segment holds the largest market share due to its accessibility and integration into everyday diets. Key drivers include increasing awareness of functional food benefits and the growing preference for convenient, nutritious options.

- Dietary Supplements: This segment is experiencing robust growth, fueled by the rising prevalence of chronic diseases and a growing desire for targeted health solutions. Regulatory changes influence the market's trajectory.

- Functional Beverages: This sector shows strong potential for growth, driven by the increasing demand for convenient and healthy beverage options.

By Distribution Channel:

- Supermarkets/Hypermarkets: This channel dominates the market, offering wide reach and product visibility.

- Drug Stores/Pharmacies: This channel is critical for specialized supplements, benefiting from the credibility associated with healthcare professionals.

- Online Retail Stores: E-commerce is growing rapidly, offering convenience and expanding access to a broader customer base. Growth is limited by factors like access to internet and digital literacy.

The dominance of specific regions or segments is analyzed based on factors including consumer preferences, regulatory environments, and infrastructure development.

South Africa Nutraceuticals Industry Product Innovations

The South African nutraceutical industry is witnessing significant product innovation, with a focus on natural ingredients, personalized formulations, and improved delivery systems. Companies are developing unique selling propositions based on scientific evidence, emphasizing functional benefits such as immunity support, cognitive enhancement, and gut health. The integration of emerging technologies, such as nanotechnology and precision medicine, is paving the way for more effective and targeted nutraceutical products.

Propelling Factors for South Africa Nutraceuticals Industry Growth

Several factors are driving the growth of the South African nutraceutical market. Increasing health consciousness among consumers, rising disposable incomes, and supportive government initiatives promoting healthy lifestyles are significant contributors. Technological advancements in product development and delivery systems are also playing a crucial role. The expanding middle class and increased access to information about health and wellness further propel market expansion.

Obstacles in the South Africa Nutraceuticals Industry Market

Despite the significant growth potential, the South African nutraceutical industry faces several challenges. Regulatory hurdles related to product labeling, safety, and efficacy create barriers to market entry. Supply chain disruptions and fluctuating raw material prices pose operational challenges. Intense competition from established multinational players and emerging local brands adds to the pressure.

Future Opportunities in South Africa Nutraceuticals Industry

The South African nutraceutical market presents several promising future opportunities. Growing demand for specialized products targeting specific health conditions, such as gut health and immunity, presents significant potential. Expansion into underserved rural markets and the incorporation of digital technologies for personalized product recommendations and targeted marketing offer avenues for growth.

Major Players in the South Africa Nutraceuticals Industry Ecosystem

- Nestle SA

- The Kellogg Company

- Genesis Nutritional Product

- Amway Corp

- Danone SA

- Red Bull GmbH

- Herbalife Nutrition

- The Coca-Cola Company

- Ascendis Health

- GlaxoSmithKline PLC

Key Developments in South Africa Nutraceuticals Industry Industry

- 2022 Q4: Launch of a new range of functional foods by Nestle SA.

- 2023 Q1: Acquisition of a local supplement company by Amway Corp.

- 2023 Q3: Introduction of new regulations concerning dietary supplement labeling. (Further details to be added upon completion of the full report)

Strategic South Africa Nutraceuticals Industry Market Forecast

The South African nutraceutical market is poised for significant growth over the forecast period (2025-2033). Continued health consciousness among consumers, increased access to information, and technological advancements will drive market expansion. Companies that can adapt to evolving consumer preferences, navigate the regulatory landscape effectively, and leverage technological innovations will be best positioned to succeed. The market's growth will be particularly pronounced in the functional food and dietary supplements segments, driven by the rising prevalence of chronic diseases and the increasing demand for convenient and effective health solutions.

South Africa Nutraceuticals Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South Africa Nutraceuticals Industry Segmentation By Geography

- 1. South Africa

South Africa Nutraceuticals Industry Regional Market Share

Geographic Coverage of South Africa Nutraceuticals Industry

South Africa Nutraceuticals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing inclination towards fitness and sports participation; Increasing demand for fortified processed food products

- 3.3. Market Restrains

- 3.3.1. Extensive presence of alternative protein products sourced from plant based ingredients

- 3.4. Market Trends

- 3.4.1. Rising Healthcare Costs and Focus on Preventive Health Management

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Nutraceuticals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nestle SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Kellogg Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Genesis Nutritional Product

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amway Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Danone SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Red Bull GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Herbalife Nutrition

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Coca-Cola Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ascendis Health*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GlaxoSmithKline PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nestle SA

List of Figures

- Figure 1: South Africa Nutraceuticals Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Africa Nutraceuticals Industry Share (%) by Company 2025

List of Tables

- Table 1: South Africa Nutraceuticals Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: South Africa Nutraceuticals Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: South Africa Nutraceuticals Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: South Africa Nutraceuticals Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: South Africa Nutraceuticals Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: South Africa Nutraceuticals Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: South Africa Nutraceuticals Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: South Africa Nutraceuticals Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: South Africa Nutraceuticals Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: South Africa Nutraceuticals Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: South Africa Nutraceuticals Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: South Africa Nutraceuticals Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Nutraceuticals Industry?

The projected CAGR is approximately 4.60%.

2. Which companies are prominent players in the South Africa Nutraceuticals Industry?

Key companies in the market include Nestle SA, The Kellogg Company, Genesis Nutritional Product, Amway Corp, Danone SA, Red Bull GmbH, Herbalife Nutrition, The Coca-Cola Company, Ascendis Health*List Not Exhaustive, GlaxoSmithKline PLC.

3. What are the main segments of the South Africa Nutraceuticals Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing inclination towards fitness and sports participation; Increasing demand for fortified processed food products.

6. What are the notable trends driving market growth?

Rising Healthcare Costs and Focus on Preventive Health Management.

7. Are there any restraints impacting market growth?

Extensive presence of alternative protein products sourced from plant based ingredients.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Nutraceuticals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Nutraceuticals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Nutraceuticals Industry?

To stay informed about further developments, trends, and reports in the South Africa Nutraceuticals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence