Key Insights

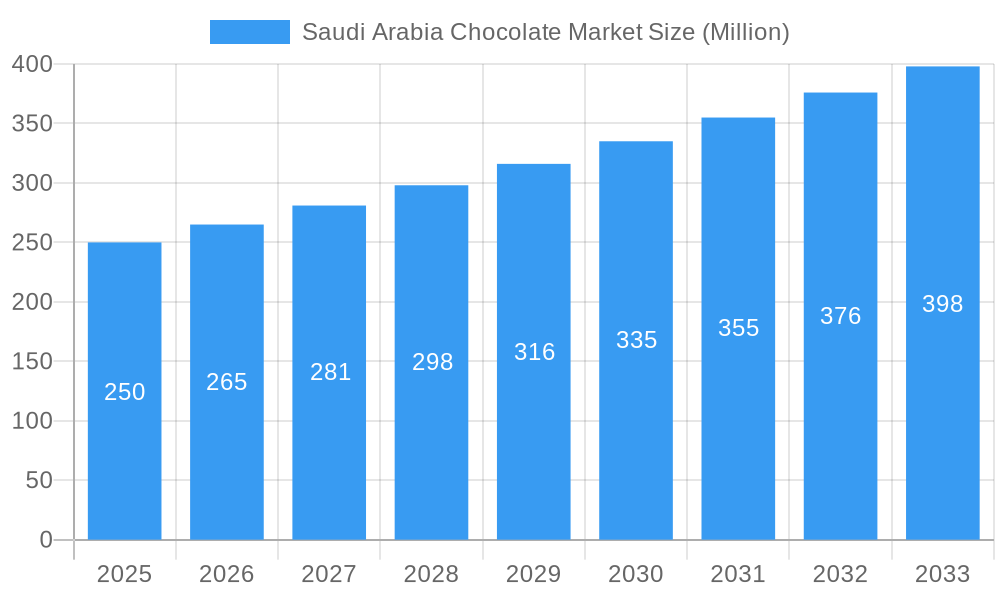

The Saudi Arabian chocolate market, projected to reach 1140.1 million in 2025, is forecast to expand at a Compound Annual Growth Rate (CAGR) of 4.18% from 2025 to 2033. Key growth drivers include rising disposable incomes, particularly among younger demographics, fueling demand for premium confectionery. The expanding tourism sector and a growing gifting culture further stimulate market growth. The market is segmented by confectionery type (dark, milk, white chocolate) and distribution channel (convenience stores, online retail, supermarkets/hypermarkets). Supermarkets and hypermarkets currently lead in market share, while dark chocolate consumption is rising due to health awareness. Online retail is a rapidly growing channel, offering convenience and broad reach. Challenges include raw material price volatility and potential regulatory changes.

Saudi Arabia Chocolate Market Market Size (In Billion)

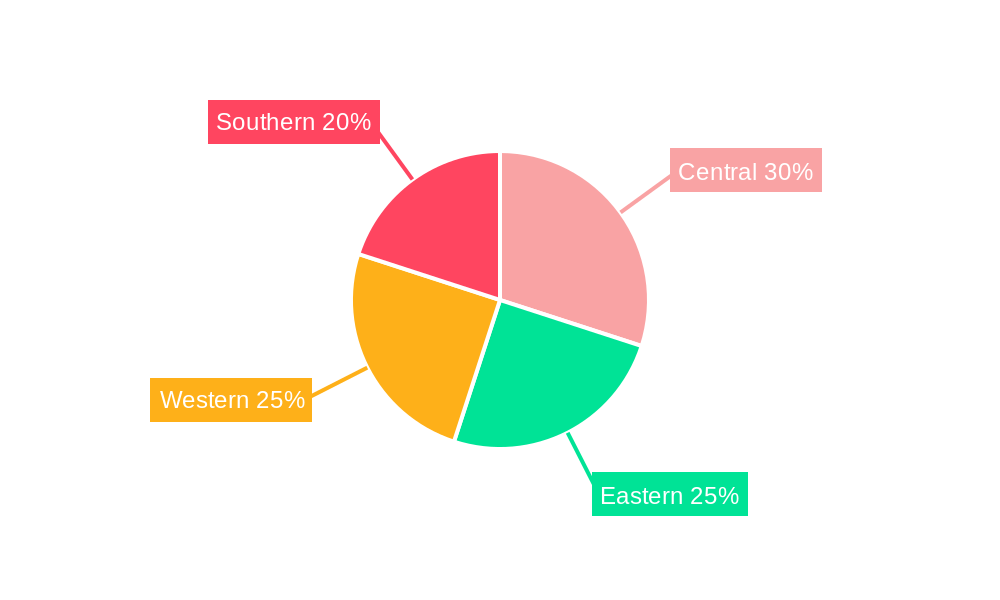

Strategic investments from global leaders like Nestlé, Ferrero, and Mars, alongside local players such as Shirin Asal and Badr Chocolate Factory, underscore strong market confidence. Companies are prioritizing product innovation with new flavors and formats to meet evolving consumer preferences. Effective marketing strategies highlighting premium quality and unique attributes are shaping the competitive landscape. Understanding regional preferences across Saudi Arabia's Central, Eastern, Western, and Southern regions is critical for targeted strategies and sustained growth. The 2025 to 2033 forecast period presents significant opportunities for expansion and innovation within this dynamic market.

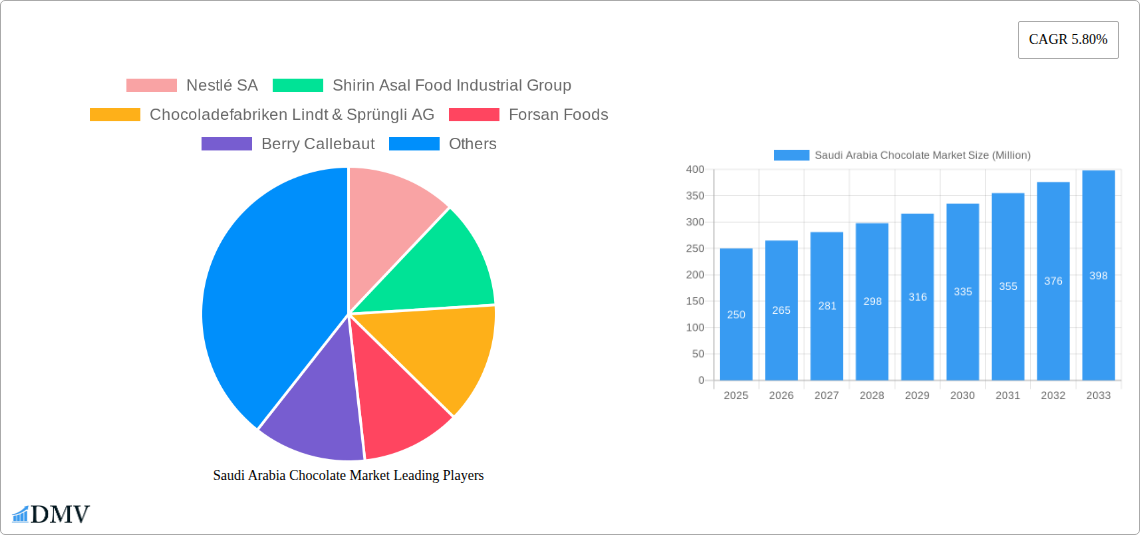

Saudi Arabia Chocolate Market Company Market Share

Saudi Arabia Chocolate Market Analysis: 2025-2033

This report delivers a comprehensive analysis of the Saudi Arabian chocolate market, offering critical insights for stakeholders. Covering the period from 2025 to 2033, with a base year of 2025, this analysis details market dynamics, key segments, and future opportunities. The market is projected to reach 1140.1 million by 2033, indicating substantial growth potential.

Saudi Arabia Chocolate Market Composition & Trends

This section delves into the competitive landscape of the Saudi Arabia chocolate market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, consumer profiles, and mergers & acquisitions (M&A) activities. The market is characterized by a mix of multinational giants and local players, with Nestlé SA, Ferrero International SA, and Mars Incorporated holding significant market share. The precise market share distribution is complex and varies by segment; however, the top three players collectively hold an estimated xx% of the market in 2025.

- Market Concentration: Highly fragmented with significant presence of both international and domestic players.

- Innovation Catalysts: Growing demand for healthier options (e.g., dark chocolate, plant-based alternatives), premiumization trends, and increasing disposable incomes.

- Regulatory Landscape: Alignment with global food safety standards, impacting packaging and labeling regulations.

- Substitute Products: Other confectionery items, desserts, and snacks compete for consumer spending.

- End-User Profiles: Diverse consumer base spanning various age groups, income levels, and preferences.

- M&A Activities: Consolidation is expected to continue, driven by expansion strategies and market share gains. Total M&A deal value in the historical period (2019-2024) is estimated at xx Million.

Saudi Arabia Chocolate Market Industry Evolution

This section traces the evolution of the Saudi Arabian chocolate market, analyzing growth trajectories, technological progress, and evolving consumer preferences. The market has witnessed a steady growth rate, averaging approximately xx% annually during the historical period (2019-2024). This growth is largely attributed to factors such as rising disposable incomes, increased urbanization, and changing dietary habits. Technological advancements, particularly in production efficiency and packaging, have also played a vital role.

The adoption of innovative manufacturing technologies, including automation and precision fermentation (for plant-based alternatives), is expected to further enhance efficiency and quality. Consumer preferences are shifting towards premium and specialized products, including organic, fair-trade, and functional chocolates. The forecast period (2025-2033) anticipates a continuation of this trend, with potential fluctuations influenced by global economic conditions.

Leading Regions, Countries, or Segments in Saudi Arabia Chocolate Market

This section identifies the dominant regions, countries, or segments within the Saudi Arabian chocolate market. The analysis encompasses confectionery variants (dark, milk, white chocolate), and distribution channels (convenience stores, online retail, supermarkets/hypermarkets, others).

- Confectionery Variant: Milk chocolate currently holds the largest market share, followed by dark chocolate and white chocolate. Growth in the dark chocolate segment is fueled by health-consciousness.

- Distribution Channel: Supermarket/hypermarkets dominate distribution, followed by convenience stores. Online retail is a growing channel, although it remains a smaller segment compared to offline channels.

- Key Drivers: Rising disposable incomes, expanding retail infrastructure, and increased online shopping penetration significantly boost market expansion. Regulatory support for the food and beverage sector provides a stable business environment.

Saudi Arabia Chocolate Market Product Innovations

The Saudi Arabian chocolate market showcases ongoing innovation. Manufacturers are introducing a wider range of flavors, incorporating healthier ingredients, and focusing on premiumization strategies. Barry Callebaut's launch of NXT, a 100% plant-based chocolate, exemplifies this trend, catering to the growing demand for vegan and allergen-free options. The introduction of unique flavor profiles tailored to local preferences is driving product differentiation. The use of sustainable and ethically sourced ingredients is gaining traction, aligning with growing consumer awareness.

Propelling Factors for Saudi Arabia Chocolate Market Growth

Several factors are fueling the growth of the Saudi Arabia chocolate market. Firstly, a steadily rising disposable income allows consumers to spend more on premium food products, including chocolate. Secondly, the growing popularity of Westernized lifestyles has created a substantial demand for confectionery items like chocolate. Finally, significant investments by major players like Nestlé, as demonstrated by their planned SAR 7 billion investment, contribute to expanded production capacity and market penetration.

Obstacles in the Saudi Arabia Chocolate Market

Despite the positive outlook, challenges remain. Fluctuations in raw material prices, particularly cocoa beans, can impact profitability. Maintaining a consistent supply chain is also crucial, given potential disruptions. Furthermore, competition from other confectionery products and the presence of well-established international players present ongoing challenges for smaller players. Stringent food safety regulations also add to operational complexities.

Future Opportunities in Saudi Arabia Chocolate Market

The Saudi Arabian chocolate market presents several opportunities. The increasing adoption of e-commerce presents a substantial opportunity for online chocolate retailers. Furthermore, the rising demand for healthier chocolate options, such as high-cocoa dark chocolate and plant-based alternatives, presents a significant growth avenue. Expanding into niche markets, such as organic or fair-trade chocolate, will attract discerning consumers.

Major Players in the Saudi Arabia Chocolate Market Ecosystem

- Nestlé SA

- Shirin Asal Food Industrial Group

- Chocoladefabriken Lindt & Sprüngli AG

- Forsan Foods

- Berry Callebaut

- Badr Chocolate Factory

- Juhaina-Al Daajan Holding

- Ferrero International SA

- Mars Incorporated

- Yıldız Holding AŞ

- IFFCO

- Patchi LLC

- Mondelēz International Inc

- The Hershey Company

Key Developments in Saudi Arabia Chocolate Market Industry

- November 2022: Nestlé announced a SAR 7 billion investment in Saudi Arabia over ten years, including USD 99.6 Million for a new manufacturing plant (opening 2025). This significantly boosts production capacity and strengthens their market position.

- November 2022: Barry Callebaut launched NXT, a 100% plant-based chocolate, responding to growing demand for vegan alternatives and enhancing product diversity. This expansion caters to evolving consumer preferences and market trends.

Strategic Saudi Arabia Chocolate Market Forecast

The Saudi Arabia chocolate market is poised for robust growth over the forecast period (2025-2033). Continued economic growth, increasing disposable incomes, and the expanding retail infrastructure will drive market expansion. Furthermore, innovations in product offerings, including healthier and more sustainable options, will contribute to growth. The rising popularity of online retail channels also presents a significant opportunity for market expansion. The market's dynamic nature and consumer preferences will, however, require manufacturers to adapt quickly to evolving trends.

Saudi Arabia Chocolate Market Segmentation

-

1. Confectionery Variant

- 1.1. Dark Chocolate

- 1.2. Milk and White Chocolate

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

Saudi Arabia Chocolate Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Chocolate Market Regional Market Share

Geographic Coverage of Saudi Arabia Chocolate Market

Saudi Arabia Chocolate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 5.1.1. Dark Chocolate

- 5.1.2. Milk and White Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nestlé SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shirin Asal Food Industrial Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chocoladefabriken Lindt & Sprüngli AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Forsan Foods

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Berry Callebaut

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Badr Chocolate Factory

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Juhaina-Al Daajan Holding

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ferrero International SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mars Incorporated

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Yıldız Holding A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 IFFCO

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Patchi LLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Mondelēz International Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 The Hershey Company

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Nestlé SA

List of Figures

- Figure 1: Saudi Arabia Chocolate Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Chocolate Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Chocolate Market Revenue million Forecast, by Confectionery Variant 2020 & 2033

- Table 2: Saudi Arabia Chocolate Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Saudi Arabia Chocolate Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Chocolate Market Revenue million Forecast, by Confectionery Variant 2020 & 2033

- Table 5: Saudi Arabia Chocolate Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Saudi Arabia Chocolate Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Chocolate Market?

The projected CAGR is approximately 4.18%.

2. Which companies are prominent players in the Saudi Arabia Chocolate Market?

Key companies in the market include Nestlé SA, Shirin Asal Food Industrial Group, Chocoladefabriken Lindt & Sprüngli AG, Forsan Foods, Berry Callebaut, Badr Chocolate Factory, Juhaina-Al Daajan Holding, Ferrero International SA, Mars Incorporated, Yıldız Holding A, IFFCO, Patchi LLC, Mondelēz International Inc, The Hershey Company.

3. What are the main segments of the Saudi Arabia Chocolate Market?

The market segments include Confectionery Variant, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1140.1 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

November 2022: Nestlé announced plans to invest SAR 7 billion in the Kingdom of Saudi Arabia in the coming ten years in a strategic move to grow its longstanding business in the country, beginning with up to USD 99.6 million to establish a cutting-edge manufacturing plant – which is set to open in 2025.November 2022: Barry Callebaut launched 100% dairy-free and plant-based chocolate NXT in Saudi Arabia. NXT is the first-of-its-kind dairy-free, lactose-free, nut-free, allergen-free, 100% plant-based, and vegan dark and milk chocolate to respond to the growing demand for plant-based foods across the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Chocolate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Chocolate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Chocolate Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Chocolate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence