Key Insights

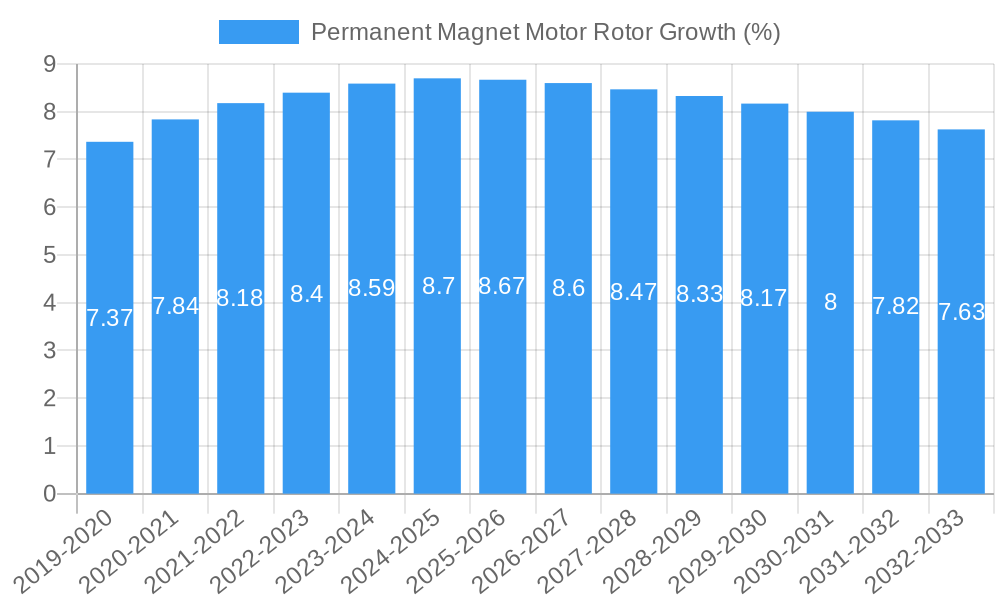

The Permanent Magnet Motor Rotor market is poised for substantial growth, estimated to reach approximately USD 15,000 million by 2025 and projected to expand at a Compound Annual Growth Rate (CAGR) of around 8.5% through 2033. This robust expansion is primarily fueled by the increasing demand for energy-efficient electric motors across various sectors, including automotive, industrial automation, renewable energy, and consumer electronics. The transition towards electric vehicles (EVs) is a paramount driver, necessitating high-performance and lightweight permanent magnet motor rotors for enhanced battery range and operational efficiency. Furthermore, stringent government regulations and incentives promoting energy conservation and reduced carbon emissions are accelerating the adoption of permanent magnet motors in industrial applications, replacing traditional induction motors. The continuous innovation in magnetic materials, motor design, and manufacturing processes, aimed at improving power density and reducing costs, is also contributing significantly to market growth.

Despite the promising outlook, the market faces certain restraints. The volatility in the prices of rare-earth elements, crucial components in high-performance permanent magnets, poses a significant challenge, impacting manufacturing costs and potentially hindering widespread adoption in cost-sensitive applications. Geopolitical factors influencing the supply chain of these rare-earth materials can also introduce uncertainties. Moreover, the initial capital investment required for advanced manufacturing facilities and the development of sophisticated motor technologies can be a barrier for smaller players. However, the ongoing research and development efforts focused on exploring alternative, more abundant magnetic materials and optimizing magnet-free motor designs are expected to mitigate these challenges over the forecast period, ensuring the sustained dynamism of the permanent magnet motor rotor market. The market segmentation by application, particularly the automotive and industrial automation sectors, is expected to dominate demand, while advancements in rotor types will cater to specific performance requirements.

Permanent Magnet Motor Rotor Market Composition & Trends

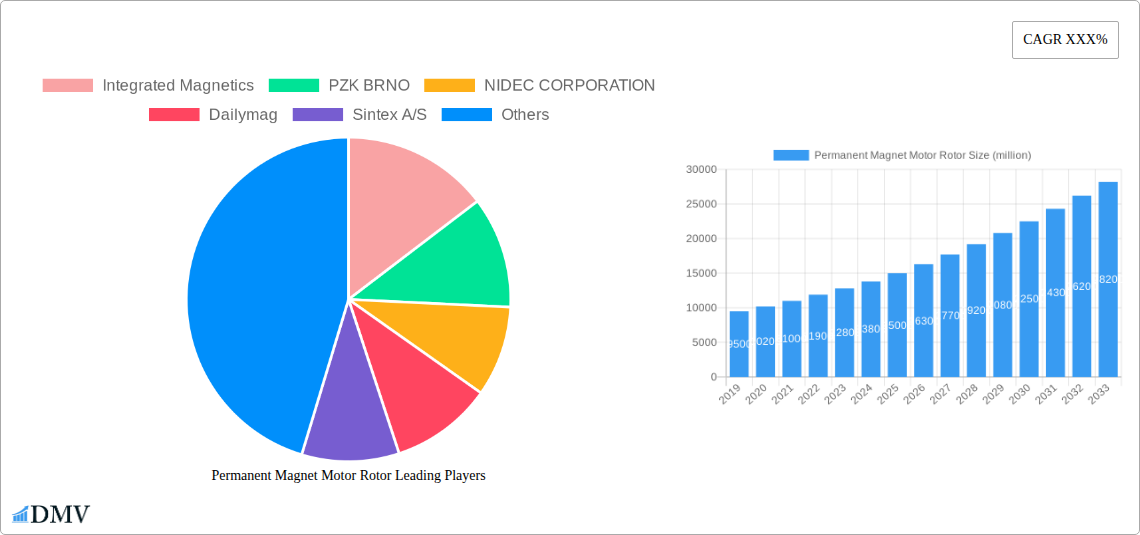

The global Permanent Magnet Motor Rotor market is characterized by a dynamic interplay of innovation, strategic alliances, and evolving regulatory landscapes. Market concentration stands at a moderate level, with key players like Integrated Magnetics, PZK BRNO, NIDEC CORPORATION, Dailymag, Sintex A/S, Tengye, GME, ZEB, Xi'an Wangbida Material Technology Co., Ltd., and Yuma Precision Technology (Jiangsu) Co., Ltd. vying for significant market share, estimated to collectively hold over 80 million in market value in 2025. Innovation catalysts, particularly in advanced magnetic materials and manufacturing techniques, are driving the development of more efficient and powerful rotors. The regulatory environment, increasingly focused on energy efficiency and reduced emissions, is a significant push factor for Permanent Magnet Motor Rotor adoption across various applications. Substitute products, while present, often fall short in delivering the same power density and efficiency, thus maintaining a strong demand for PM motor rotors. End-user profiles are diverse, ranging from automotive manufacturers seeking lightweight and high-performance solutions for electric vehicles to industrial automation companies requiring reliable and energy-efficient motors for machinery. Mergers and Acquisitions (M&A) activity is expected to continue, with an estimated 50 million in deal values anticipated over the forecast period, aimed at consolidating market positions and acquiring key technologies.

- Market Share Distribution (Estimated 2025): Leading players are projected to hold significant portions, with a few dominating over 15 million each in revenue.

- M&A Deal Values (Forecast Period): Expected to reach 50 million, fostering market consolidation and technological integration.

- Innovation Focus Areas: High-strength permanent magnets, advanced rotor designs for improved thermal management, and reduced manufacturing costs.

- Regulatory Influence: Stringent energy efficiency standards for electric vehicles and industrial equipment are a major driver.

Permanent Magnet Motor Rotor Industry Evolution

The Permanent Magnet Motor Rotor industry has witnessed a remarkable growth trajectory, driven by an unwavering pursuit of enhanced efficiency, miniaturization, and superior performance across a multitude of applications. Over the study period of 2019–2033, the market has navigated significant technological advancements, with the base year of 2025 serving as a pivotal point for established trends and future projections. The historical period from 2019 to 2024 laid the groundwork, characterized by increasing adoption of PM motors in mainstream applications and ongoing research into novel magnetic materials. The estimated year of 2025 marks a significant milestone, with projected market growth rates reaching an impressive 8% to 12% annually during the forecast period of 2025–2033. This robust expansion is largely attributed to the burgeoning demand for electric vehicles (EVs), where PM motor rotors are indispensable for their high power density, exceptional efficiency, and compact design, enabling longer ranges and better performance. Furthermore, the industrial automation sector is increasingly integrating PM motors into robotics, servo systems, and factory machinery to optimize energy consumption and improve operational precision. Consumer electronics, renewable energy systems, and aerospace are also significant contributors to this growth, reflecting a broad-based demand for the advantages offered by PM motor rotors.

Technological advancements have been a constant catalyst. The development of rare-earth magnets like Neodymium-Iron-Boron (NdFeB) has been instrumental in achieving higher magnetic flux densities, leading to smaller and lighter motor designs without compromising on power output. Innovations in rotor topology, such as the use of advanced winding techniques and magnetic circuit optimization, further enhance efficiency and reduce losses. The adoption of additive manufacturing (3D printing) for complex rotor geometries is also gaining traction, promising greater design freedom and potentially lower production costs. Consumer demand has shifted towards more sustainable and energy-efficient solutions, aligning perfectly with the inherent advantages of PM motor technology. This trend is amplified by rising energy prices and growing environmental consciousness. The market's evolution is a testament to the continuous innovation in material science, engineering design, and manufacturing processes, all aimed at delivering optimized performance and reduced environmental impact, with an estimated market size expected to reach well over 100 million by 2033.

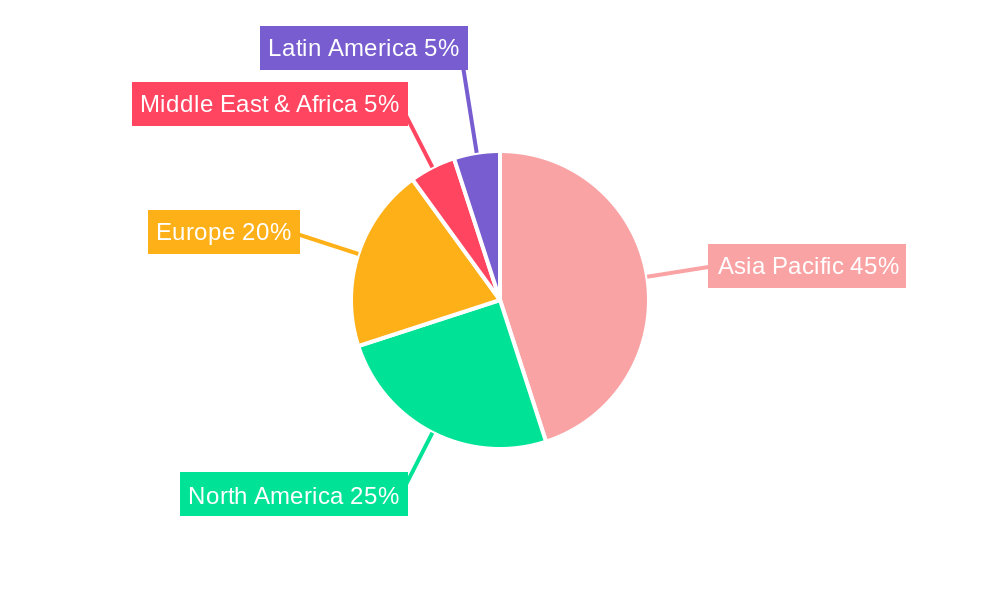

Leading Regions, Countries, or Segments in Permanent Magnet Motor Rotor

The global Permanent Magnet Motor Rotor market's dominance is characterized by a strong presence in key regions and specific application segments, driven by a confluence of technological adoption, industrial growth, and supportive policies.

Application: The Automotive (Electric Vehicle) application segment stands out as the primary driver of the Permanent Magnet Motor Rotor market, projecting a market share exceeding 40 million by 2025.

- Dominance Factors in Automotive (EVs):

- High Growth of Electric Mobility: The exponential rise in EV production worldwide necessitates a corresponding surge in demand for efficient and powerful electric motors, with PM rotors being the preferred choice for their superior power-to-weight ratio and energy efficiency.

- Government Incentives and Regulations: Favorable government policies, subsidies for EV purchases, and stringent emission regulations globally are accelerating the transition to electric powertrains.

- Performance Requirements: EVs demand high torque at low speeds and excellent efficiency across various driving conditions, capabilities that PM motor rotors excel in delivering.

- Technological Advancement in Battery Technology: Improvements in battery energy density are enabling longer driving ranges, further fueling EV adoption and, consequently, the demand for advanced motor systems.

- Integration and Miniaturization: The need for compact and lightweight motor components to maximize interior space and optimize vehicle dynamics makes PM motor rotors an ideal solution.

Type: Within the types of Permanent Magnet Motor Rotors, Internal Permanent Magnet (IPM) Rotors are carving out a significant leadership position, anticipated to capture a market value of over 30 million by 2025.

- Dominance Factors in IPM Rotors:

- Enhanced Efficiency: IPM rotors offer superior efficiency, especially at higher speeds, due to reduced rotor losses and improved magnetic flux control. This is critical for maximizing the range of electric vehicles and optimizing energy consumption in industrial applications.

- Higher Power Density: The embedded magnet design allows for a higher magnetic flux density, leading to smaller and lighter motor designs for a given power output.

- Improved Thermal Management: IPM rotors generally exhibit better thermal performance compared to surface-mounted permanent magnet (SPM) rotors, which is crucial for sustained high-power operation.

- Robustness and Durability: The magnets are protected within the rotor core, making IPM rotors more resilient to mechanical stresses and demagnetization risks, particularly in demanding environments.

- Advanced Control Strategies: IPM motors are well-suited for advanced control algorithms, enabling precise speed and torque control, which is essential for applications like robotics and advanced automotive powertrains.

The strategic importance of these segments and regions underscores the critical role of Permanent Magnet Motor Rotors in shaping the future of electric mobility and industrial automation, with global market value projected to surpass 150 million by 2033.

Permanent Magnet Motor Rotor Product Innovations

Product innovation in Permanent Magnet Motor Rotors is centered on enhancing magnetic performance, optimizing thermal management, and improving manufacturing processes for greater efficiency and cost-effectiveness. Breakthroughs in rare-earth magnet compositions are yielding rotors with significantly higher coercivity and energy product, enabling smaller motor footprints without sacrificing power. Advanced rotor geometries, such as segmented magnets and novel flux barrier designs, are being implemented to minimize torque ripple and cogging torque, resulting in smoother operation and reduced acoustic noise. Furthermore, the integration of advanced cooling channels within the rotor structure is a key innovation, allowing for sustained high-power output by effectively dissipating heat. The use of novel encapsulation materials to protect magnets from environmental factors and improve structural integrity is also gaining prominence, ensuring greater reliability in demanding applications.

Propelling Factors for Permanent Magnet Motor Rotor Growth

The growth of the Permanent Magnet Motor Rotor market is propelled by several key factors. The burgeoning electric vehicle (EV) market is a primary driver, with the demand for efficient and high-performance electric powertrains directly translating to increased rotor requirements. Stringent government regulations mandating improved energy efficiency and reduced emissions across various sectors, from automotive to industrial machinery, further incentivize the adoption of PM motors. Technological advancements in magnet materials, leading to stronger magnetic fields and improved rotor designs, contribute to smaller, lighter, and more powerful motors. The growing emphasis on sustainability and reduced carbon footprints across industries encourages the transition to more energy-efficient technologies, with PM motors being a prime example.

Obstacles in the Permanent Magnet Motor Rotor Market

Despite its robust growth, the Permanent Magnet Motor Rotor market faces several obstacles. Fluctuations in the prices and availability of rare-earth metals, such as neodymium and dysprosium, which are critical components of high-performance magnets, can impact manufacturing costs and supply chain stability. High initial investment costs associated with the advanced manufacturing processes and specialized tooling required for producing high-quality PM motor rotors can be a deterrent for some manufacturers. Potential supply chain disruptions, exacerbated by geopolitical factors or trade restrictions affecting key raw material sources, pose a significant risk. Furthermore, increasing competition from alternative motor technologies, such as induction motors or switched reluctance motors, although often less efficient, can present a challenge in specific cost-sensitive applications.

Future Opportunities in Permanent Magnet Motor Rotor

Emerging opportunities in the Permanent Magnet Motor Rotor market are abundant and diverse. The continued expansion of the electric mobility sector, including not only passenger vehicles but also commercial transport and micro-mobility, presents a vast untapped potential. The increasing adoption of renewable energy sources, such as wind turbines, which rely heavily on high-efficiency generators, offers another significant growth avenue. The development of novel, less rare-earth-dependent magnetic materials or advanced magnet recycling technologies could mitigate supply chain concerns and open new markets. Furthermore, the growing demand for smart and connected industrial automation systems will drive the need for compact, efficient, and precise PM motors in robotics, AI-powered machinery, and advanced manufacturing processes, with an estimated market potential of over 200 million by 2033.

Major Players in the Permanent Magnet Motor Rotor Ecosystem

- Integrated Magnetics

- PZK BRNO

- NIDEC CORPORATION

- Dailymag

- Sintex A/S

- Tengye

- GME

- ZEB

- Xi'an Wangbida Material Technology Co., Ltd.

- Yuma Precision Technology (Jiangsu) Co., Ltd.

Key Developments in Permanent Magnet Motor Rotor Industry

- 2023: Significant advancements in high-temperature resistant magnets, enabling wider operational temperature ranges for motors in demanding applications.

- 2023: Increased investment in R&D for rare-earth-free permanent magnets, seeking to reduce reliance on volatile raw material markets.

- 2024: Launch of new IPM rotor designs with optimized flux paths for enhanced torque density and improved efficiency in electric vehicle powertrains.

- 2024: Expansion of manufacturing capacity by key players to meet the surging demand from the electric vehicle sector.

- 2024: Introduction of advanced coating technologies to improve rotor durability and resistance to corrosion in harsh environments.

Strategic Permanent Magnet Motor Rotor Market Forecast

The strategic forecast for the Permanent Magnet Motor Rotor market remains exceptionally strong, underpinned by the accelerating global transition to electric mobility and the continuous drive for energy efficiency in industrial applications. Emerging markets and evolving consumer preferences for sustainable technologies will continue to fuel demand, creating significant growth catalysts. Technological innovations in material science and manufacturing processes will further enhance performance and reduce costs, making PM motor rotors an even more attractive solution. The market is poised for sustained expansion, with future opportunities in areas like advanced robotics, aerospace, and renewable energy integration set to solidify its position as a critical component in a decarbonized and electrified future, projected to reach over 250 million by 2033.

Permanent Magnet Motor Rotor Segmentation

-

1. Application

- 1.1. undefined

-

2. Type

- 2.1. undefined

Permanent Magnet Motor Rotor Segmentation By Geography

- 1. undefined

- 2. undefined

- 3. undefined

- 4. undefined

- 5. undefined

Permanent Magnet Motor Rotor REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Permanent Magnet Motor Rotor Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1.

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1.

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1.

- 5.3.2.

- 5.3.3.

- 5.3.4.

- 5.3.5.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. undefined Permanent Magnet Motor Rotor Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1.

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1.

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. undefined Permanent Magnet Motor Rotor Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1.

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1.

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. undefined Permanent Magnet Motor Rotor Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1.

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1.

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. undefined Permanent Magnet Motor Rotor Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1.

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1.

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. undefined Permanent Magnet Motor Rotor Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1.

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1.

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Integrated Magnetics

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PZK BRNO

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NIDEC CORPORATION

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dailymag

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sintex A/S

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tengye

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GME

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ZEB

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Xi'an Wangbida Material Technology Co. Ltd.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Yuma Precision Technology (Jiangsu) Co. Ltd.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Integrated Magnetics

List of Figures

- Figure 1: Global Permanent Magnet Motor Rotor Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: undefined Permanent Magnet Motor Rotor Revenue (million), by Application 2024 & 2032

- Figure 3: undefined Permanent Magnet Motor Rotor Revenue Share (%), by Application 2024 & 2032

- Figure 4: undefined Permanent Magnet Motor Rotor Revenue (million), by Type 2024 & 2032

- Figure 5: undefined Permanent Magnet Motor Rotor Revenue Share (%), by Type 2024 & 2032

- Figure 6: undefined Permanent Magnet Motor Rotor Revenue (million), by Country 2024 & 2032

- Figure 7: undefined Permanent Magnet Motor Rotor Revenue Share (%), by Country 2024 & 2032

- Figure 8: undefined Permanent Magnet Motor Rotor Revenue (million), by Application 2024 & 2032

- Figure 9: undefined Permanent Magnet Motor Rotor Revenue Share (%), by Application 2024 & 2032

- Figure 10: undefined Permanent Magnet Motor Rotor Revenue (million), by Type 2024 & 2032

- Figure 11: undefined Permanent Magnet Motor Rotor Revenue Share (%), by Type 2024 & 2032

- Figure 12: undefined Permanent Magnet Motor Rotor Revenue (million), by Country 2024 & 2032

- Figure 13: undefined Permanent Magnet Motor Rotor Revenue Share (%), by Country 2024 & 2032

- Figure 14: undefined Permanent Magnet Motor Rotor Revenue (million), by Application 2024 & 2032

- Figure 15: undefined Permanent Magnet Motor Rotor Revenue Share (%), by Application 2024 & 2032

- Figure 16: undefined Permanent Magnet Motor Rotor Revenue (million), by Type 2024 & 2032

- Figure 17: undefined Permanent Magnet Motor Rotor Revenue Share (%), by Type 2024 & 2032

- Figure 18: undefined Permanent Magnet Motor Rotor Revenue (million), by Country 2024 & 2032

- Figure 19: undefined Permanent Magnet Motor Rotor Revenue Share (%), by Country 2024 & 2032

- Figure 20: undefined Permanent Magnet Motor Rotor Revenue (million), by Application 2024 & 2032

- Figure 21: undefined Permanent Magnet Motor Rotor Revenue Share (%), by Application 2024 & 2032

- Figure 22: undefined Permanent Magnet Motor Rotor Revenue (million), by Type 2024 & 2032

- Figure 23: undefined Permanent Magnet Motor Rotor Revenue Share (%), by Type 2024 & 2032

- Figure 24: undefined Permanent Magnet Motor Rotor Revenue (million), by Country 2024 & 2032

- Figure 25: undefined Permanent Magnet Motor Rotor Revenue Share (%), by Country 2024 & 2032

- Figure 26: undefined Permanent Magnet Motor Rotor Revenue (million), by Application 2024 & 2032

- Figure 27: undefined Permanent Magnet Motor Rotor Revenue Share (%), by Application 2024 & 2032

- Figure 28: undefined Permanent Magnet Motor Rotor Revenue (million), by Type 2024 & 2032

- Figure 29: undefined Permanent Magnet Motor Rotor Revenue Share (%), by Type 2024 & 2032

- Figure 30: undefined Permanent Magnet Motor Rotor Revenue (million), by Country 2024 & 2032

- Figure 31: undefined Permanent Magnet Motor Rotor Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Permanent Magnet Motor Rotor Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Permanent Magnet Motor Rotor Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Permanent Magnet Motor Rotor Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Permanent Magnet Motor Rotor Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Permanent Magnet Motor Rotor Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Permanent Magnet Motor Rotor Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Permanent Magnet Motor Rotor Revenue million Forecast, by Country 2019 & 2032

- Table 8: Global Permanent Magnet Motor Rotor Revenue million Forecast, by Application 2019 & 2032

- Table 9: Global Permanent Magnet Motor Rotor Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global Permanent Magnet Motor Rotor Revenue million Forecast, by Country 2019 & 2032

- Table 11: Global Permanent Magnet Motor Rotor Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Permanent Magnet Motor Rotor Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Permanent Magnet Motor Rotor Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Permanent Magnet Motor Rotor Revenue million Forecast, by Application 2019 & 2032

- Table 15: Global Permanent Magnet Motor Rotor Revenue million Forecast, by Type 2019 & 2032

- Table 16: Global Permanent Magnet Motor Rotor Revenue million Forecast, by Country 2019 & 2032

- Table 17: Global Permanent Magnet Motor Rotor Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Permanent Magnet Motor Rotor Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Permanent Magnet Motor Rotor Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Permanent Magnet Motor Rotor?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Permanent Magnet Motor Rotor?

Key companies in the market include Integrated Magnetics, PZK BRNO, NIDEC CORPORATION, Dailymag, Sintex A/S, Tengye, GME, ZEB, Xi'an Wangbida Material Technology Co., Ltd., Yuma Precision Technology (Jiangsu) Co., Ltd..

3. What are the main segments of the Permanent Magnet Motor Rotor?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Permanent Magnet Motor Rotor," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Permanent Magnet Motor Rotor report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Permanent Magnet Motor Rotor?

To stay informed about further developments, trends, and reports in the Permanent Magnet Motor Rotor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence