Key Insights

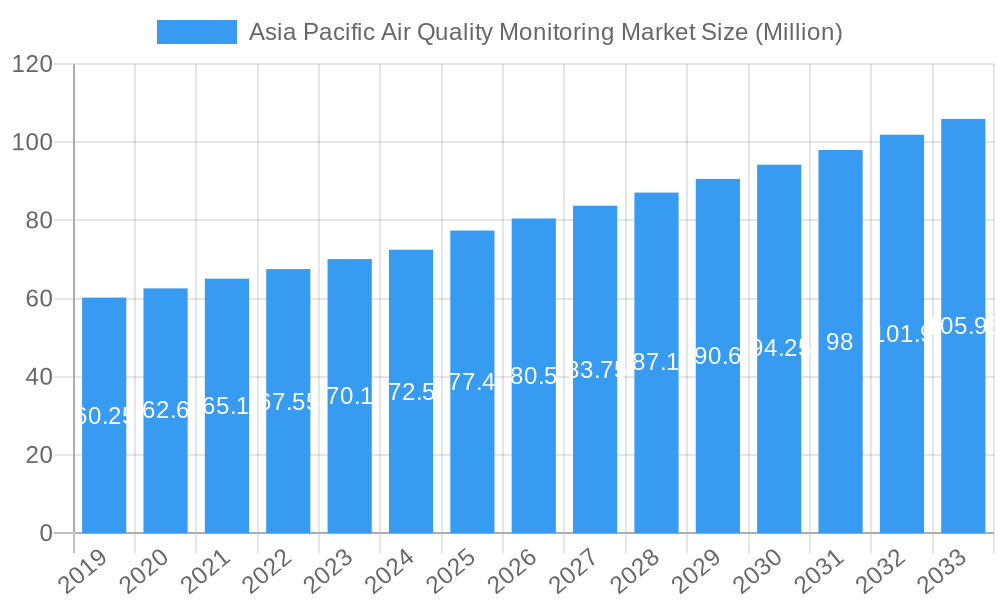

The Asia Pacific Air Quality Monitoring Market is poised for robust expansion, projected to reach a substantial market size of 77.40 million by 2025. This growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 4.55% throughout the forecast period of 2025-2033. The market's trajectory is significantly influenced by a confluence of critical drivers. Escalating concerns over the detrimental health impacts of air pollution, coupled with increasingly stringent government regulations and initiatives aimed at improving air quality across the region, are powerful catalysts. Furthermore, rapid industrialization and urbanization, particularly in emerging economies, are contributing to increased emissions, thereby driving the demand for advanced air quality monitoring solutions. Technological advancements in sensor technology, data analytics, and IoT integration are also playing a pivotal role, enabling more accurate, real-time, and comprehensive monitoring capabilities. The increasing adoption of continuous sampling methods and the expanding range of monitored pollutant types, including chemical, physical, and biological pollutants, further underscore the market's dynamism.

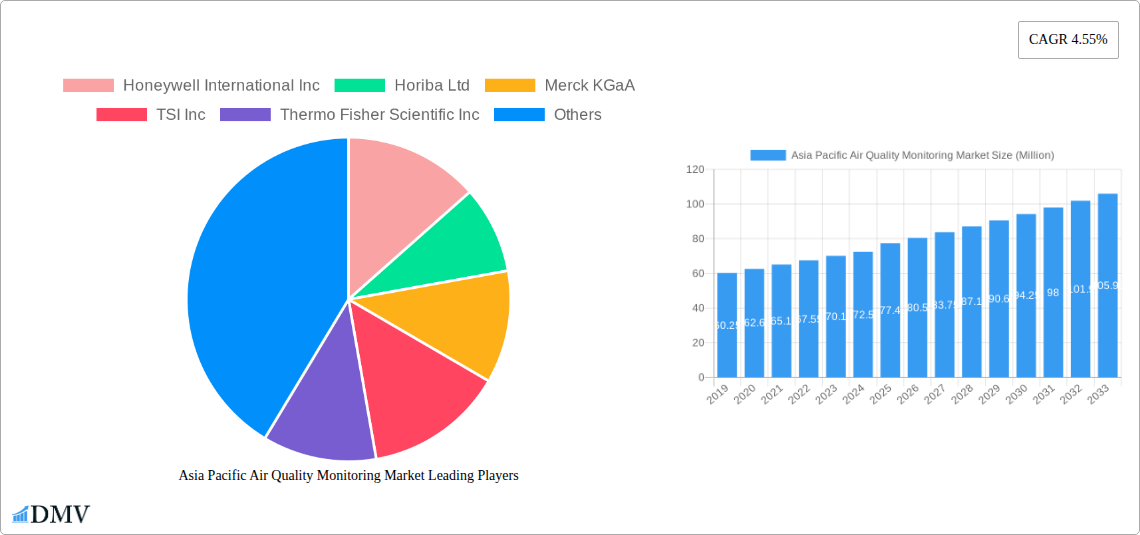

Asia Pacific Air Quality Monitoring Market Market Size (In Million)

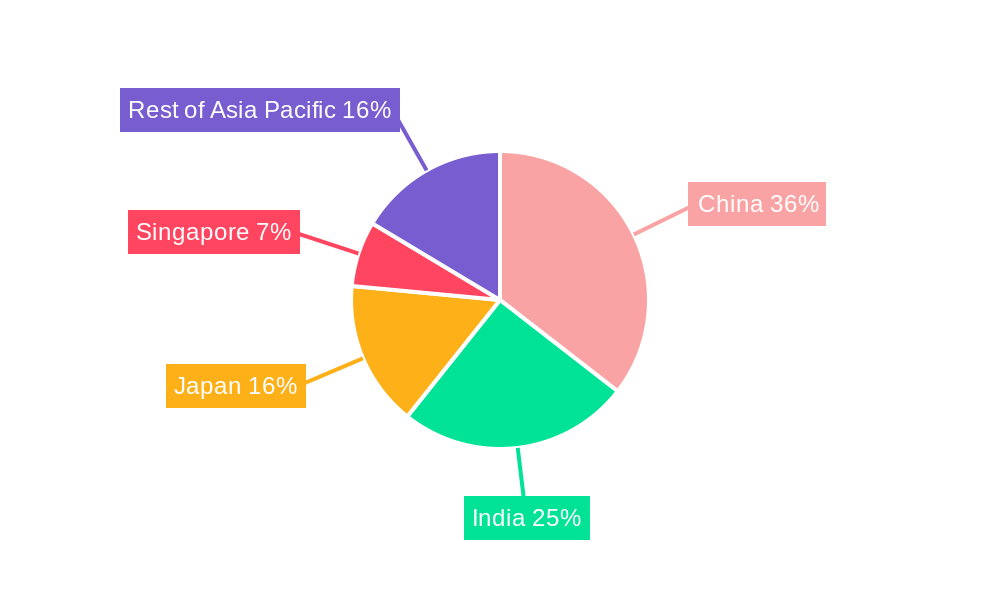

The market's segmentation reveals a diverse landscape, with both indoor and outdoor monitors experiencing significant demand. The end-user spectrum is broad, encompassing residential and commercial sectors, as well as critical industries like power generation and petrochemicals. Geographically, China, India, Japan, and Singapore are anticipated to be key growth engines, reflecting their concentrated industrial activity and significant air quality challenges. The 'Rest of Asia-Pacific' region also presents substantial untapped potential. While the market is driven by these strong forces, certain restraints, such as the high initial cost of sophisticated monitoring equipment and the need for skilled personnel for operation and maintenance, may pose challenges. However, the overarching trend towards cleaner air and sustainable development, supported by proactive government policies and growing public awareness, is expected to propel the Asia Pacific Air Quality Monitoring Market to new heights, ensuring its continued relevance and growth in the coming years.

Asia Pacific Air Quality Monitoring Market Company Market Share

This in-depth report provides a definitive analysis of the Asia Pacific Air Quality Monitoring Market, a critical sector driven by escalating environmental concerns and stringent regulatory frameworks. Covering a study period from 2019 to 2033, with a base year of 2025, this report offers unparalleled insights into market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, future opportunities, major players, and key industry developments. Navigate the complexities of air pollution monitoring solutions across the region, from indoor air quality monitors to outdoor air quality sensors, and understand the impact of continuous and intermittent sampling methods on chemical, physical, and biological pollutant detection. Stakeholders will gain a strategic advantage by understanding trends in residential and commercial air quality monitoring, power generation emissions control, petrochemical plant safety, and other vital end-user industries. The report meticulously analyzes the market landscape, including key companies such as Honeywell International Inc., Horiba Ltd., Merck KGaA, TSI Inc., Thermo Fisher Scientific Inc., Aeroqual Limited, Emerson Electric Co., Siemens AG, Agilent Technologies Inc., 3M Co., and Teledyne Technologies Inc. This is your essential guide to the Asia Pacific air quality management market, environmental monitoring systems, and pollution control technologies.

Asia Pacific Air Quality Monitoring Market Market Composition & Trends

The Asia Pacific air quality monitoring market is characterized by a moderately concentrated landscape, with several multinational corporations and regional specialists vying for market share. Innovation is primarily driven by the increasing demand for sophisticated real-time air quality data and the development of IoT-enabled monitoring devices. Regulatory mandates from governments across the region, emphasizing compliance with international air quality standards, act as significant innovation catalysts. The proliferation of smart city initiatives and increased public awareness regarding the health impacts of air pollution are further fueling market expansion. Substitute products, such as basic manual sampling kits, are gradually being phased out in favor of advanced automated systems offering higher accuracy and continuous data streams. End-user profiles are diversifying, with a growing emphasis on the residential air quality monitoring segment alongside established industrial applications. Mergers and acquisitions (M&A) activities are anticipated to increase as larger players seek to expand their product portfolios and geographical reach, aiming to consolidate market dominance. M&A deal values are expected to reflect the strategic importance of acquiring advanced technologies and established customer bases. The market share distribution is dynamic, with significant contributions from countries like China and India due to their large populations and industrial output, driving the demand for comprehensive air pollution monitoring systems.

Asia Pacific Air Quality Monitoring Market Industry Evolution

The Asia Pacific air quality monitoring market has undergone a significant evolution, transitioning from rudimentary sampling techniques to sophisticated, integrated environmental monitoring solutions. The historical period (2019–2024) witnessed a steady rise in the adoption of outdoor air quality monitoring stations driven by increasing industrialization and growing public health concerns. During this phase, the market experienced a growth rate of approximately 8-10% annually, largely propelled by government initiatives and increasing investments in pollution control. The base year (2025) marks a pivotal point where advanced technologies, including IoT-based sensors and AI-driven data analytics, are becoming mainstream. The forecast period (2025–2033) is projected to see accelerated growth, estimated at a Compound Annual Growth Rate (CAGR) of 10-12%, fueled by the escalating need for precise and continuous air quality data for regulatory compliance, public health advisories, and climate change mitigation efforts. Technological advancements have focused on improving the sensitivity and selectivity of air quality sensors, reducing the cost of deployment, and enhancing the user-friendliness of monitoring systems. Shifting consumer demands are evident in the growing preference for smart, portable, and connected indoor air quality monitors for homes and offices, reflecting a greater awareness of indoor environmental quality. The industry's evolution is further shaped by the increasing integration of air quality monitoring with broader environmental management platforms, enabling comprehensive data analysis and proactive pollution control strategies. The adoption metrics for advanced air pollution detection devices are expected to surge as more businesses and governments prioritize proactive environmental stewardship.

Leading Regions, Countries, or Segments in Asia Pacific Air Quality Monitoring Market

China emerges as the dominant force within the Asia Pacific air quality monitoring market, driven by its massive industrial base, extensive urbanization, and proactive government policies aimed at combating severe air pollution. The country’s commitment to improving air quality, particularly concerning particulate matter (PM2.5 and PM10), has led to substantial investments in advanced air quality monitoring networks. Regulatory support in China is exceptionally strong, with stringent emission standards and mandatory compliance for industrial sectors, directly fueling the demand for a wide range of air pollution monitoring solutions.

- China's Dominance Factors:

- Aggressive Environmental Regulations: Strict enforcement of air quality standards, particularly in major industrial hubs and metropolitan areas.

- Smart City Initiatives: Widespread adoption of technology in urban planning, including integrated environmental monitoring systems.

- Industrial Growth: Continuous expansion of manufacturing and petrochemical sectors, necessitating robust emission monitoring.

- Public Health Awareness: Rising public concern over air pollution-related health issues prompting demand for accessible air quality data.

India stands as another significant and rapidly growing market. The nation's increasing focus on air quality management, coupled with substantial government programs and international collaborations, is driving the adoption of air quality monitoring technologies. Key drivers include the implementation of national clean air missions and the growing recognition of the economic and health costs associated with poor air quality.

- India's Growth Catalysts:

- Government Programs: Initiatives like the National Clean Air Programme (NCAP) spurring investment in monitoring infrastructure.

- Industrial Development: Rapid growth in sectors like power generation and manufacturing requiring compliance with emission norms.

- Technological Adoption: Increasing integration of continuous emission monitoring systems (CEMS) and portable monitors.

- International Funding: Support from organizations like the Asian Development Bank (ADB) for air quality improvement projects.

Geographically, while China and India lead, other regions like Japan and Singapore are significant markets due to their advanced technological adoption and strong environmental policies. The "Rest of Asia-Pacific" segment, encompassing countries like South Korea, Vietnam, and Indonesia, also presents considerable growth potential as these economies develop and prioritize environmental sustainability.

In terms of Pollutant Type, Chemical Pollutants and Physical Pollutants (especially PM) are the primary focus of monitoring due to their immediate health and environmental impacts. However, there's a growing awareness and market for monitoring Biological Pollutants in indoor environments.

Regarding Product Type, Outdoor Monitors dominate the market due to large-scale industrial and urban monitoring needs. However, the Indoor Monitor segment is experiencing rapid growth, driven by increasing health consciousness and workplace safety regulations.

The Sampling Method of Continuous monitoring is increasingly preferred for its real-time data capabilities, crucial for effective air quality management and emergency response. Intermittent and Manual sampling methods are still employed for specific applications or in regions with budget constraints.

For End Users, Power Generation and Petrochemicals remain key sectors requiring sophisticated monitoring. However, the Residential and Commercial segments are showing remarkable growth, indicating a broader societal demand for clean air.

Asia Pacific Air Quality Monitoring Market Product Innovations

Product innovation in the Asia Pacific air quality monitoring market centers on miniaturization, enhanced portability, and increased connectivity. Companies are developing IoT-enabled air quality sensors that can measure a wider range of pollutants with greater accuracy and at lower costs. Advancements in battery life and data transmission capabilities allow for more widespread and discreet deployment. Furthermore, the integration of artificial intelligence and machine learning algorithms is enabling predictive analytics, offering early warnings for pollution spikes and identifying pollution sources more effectively. These innovations are crucial for applications ranging from personal health monitoring in homes and offices to large-scale industrial compliance and smart city environmental management, providing unique selling propositions for manufacturers in this dynamic sector.

Propelling Factors for Asia Pacific Air Quality Monitoring Market Growth

The Asia Pacific air quality monitoring market is propelled by a confluence of potent factors. Stringent government regulations and increasing public health awareness are paramount, driving demand for air pollution monitoring systems and compliance solutions. Technological advancements, particularly in IoT sensors and data analytics, are making monitoring more accessible and precise. Economic growth in the region, leading to increased industrialization and urbanization, naturally heightens the need for environmental oversight. Furthermore, international initiatives and funding aimed at improving air quality provide significant impetus. The growing adoption of smart city technologies further integrates air quality monitoring into urban infrastructure, creating a demand for sophisticated and interconnected solutions for managing chemical, physical, and biological pollutants.

Obstacles in the Asia Pacific Air Quality Monitoring Market Market

Despite robust growth, the Asia Pacific air quality monitoring market faces several obstacles. High initial investment costs for advanced monitoring equipment can be a barrier, especially for small and medium-sized enterprises and in less developed economies. Regulatory fragmentation across different countries within the region can create compliance complexities for multinational corporations. Supply chain disruptions, as seen in recent global events, can impact the availability and cost of critical components for air quality sensors. Furthermore, the lack of skilled personnel to operate and maintain sophisticated monitoring equipment in some areas can hinder adoption. Intense competition among market players also exerts downward pressure on pricing, potentially affecting profitability for some companies focused on low-cost air quality monitoring solutions.

Future Opportunities in Asia Pacific Air Quality Monitoring Market

Emerging opportunities in the Asia Pacific air quality monitoring market are abundant. The increasing demand for indoor air quality monitors in residential and commercial spaces presents a significant growth avenue. The expansion of smart city projects across the region offers a substantial platform for integrated environmental monitoring solutions and real-time air quality data dissemination. Advancements in sensor technology are opening doors for the development of highly specific and sensitive detectors for emerging pollutants. Furthermore, the growing emphasis on climate change mitigation and sustainable development is creating a demand for comprehensive air quality management strategies that integrate monitoring with emission reduction efforts. The development of portable and wearable air quality sensors also caters to a growing consumer trend for personal health and environmental awareness.

Major Players in the Asia Pacific Air Quality Monitoring Market Ecosystem

- Honeywell International Inc.

- Horiba Ltd.

- Merck KGaA

- TSI Inc.

- Thermo Fisher Scientific Inc.

- Aeroqual Limited

- Emerson Electric Co.

- Siemens AG

- Agilent Technologies Inc.

- 3M Co.

- Teledyne Technologies Inc.

Key Developments in Asia Pacific Air Quality Monitoring Market Industry

- January 2023: The government of India launched the Technology for Air Quality Monitoring System (AI-AQMS v1.0), developed under MeitY-supported projects. The Centre for Development of Advanced Computing (C-DAC), Kolkata, in partnership with TeXMIN, ISM, Dhanbad, under the ‘National program on Electronics and ICT applications in Agriculture and Environment (AgriEnIcs)’, has developed an outdoor air quality monitoring station. This station monitors environmental pollutants including PM 1.0, PM 2.5, PM 10.0, SO2, NO2, CO, O2, ambient temperature, and relative humidity for continuous air quality analysis.

- September 2022: The Asian Development Bank (ADB) launched the Asia Clean Blue Skies Program (ACBSP) to scale up ADB's investments in improving air quality in Asia and the Pacific. Launched at the Fourth Asia Pacific Clean Air Partnership joint forum in Seoul, Korea, the program supports the development and strengthening of policies and plans for ADB's developing member countries (DMCs) to stimulate investments in air quality projects, such as greenhouse gas reductions in energy, agriculture, transportation, industrial development, and urban development.

Strategic Asia Pacific Air Quality Monitoring Market Market Forecast

The strategic forecast for the Asia Pacific air quality monitoring market is exceptionally positive, driven by an accelerating global focus on environmental sustainability and public health. Key growth catalysts include continuous technological innovation in air quality sensors and data analytics, enabling more precise and accessible environmental monitoring. The increasing stringency of regulations across the region, coupled with rising public awareness of the detrimental effects of air pollution, will continue to spur demand for sophisticated air pollution control technologies. The expansion of smart city initiatives and the integration of IoT in environmental management are creating a fertile ground for comprehensive and interconnected monitoring solutions. The market is poised for substantial growth as governments and industries prioritize proactive air quality management, making significant investments in outdoor and indoor air quality monitoring systems to ensure a healthier environment for their populations.

Asia Pacific Air Quality Monitoring Market Segmentation

-

1. Product Type

- 1.1. Indoor Monitor

- 1.2. Outdoor Monitor

-

2. Sampling Method

- 2.1. Continuous

- 2.2. Manual

- 2.3. Intermittent

-

3. Pollutant Type

- 3.1. Chemical Pollutants

- 3.2. Physical Pollutants

- 3.3. Biological Pollutants

-

4. End User

- 4.1. Residential and Commercial

- 4.2. Power Generation

- 4.3. Petrochemicals

- 4.4. Other End Users

-

5. Geography

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. Singapore

- 5.5. Rest of Asia-Pacific

Asia Pacific Air Quality Monitoring Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Singapore

- 5. Rest of Asia Pacific

Asia Pacific Air Quality Monitoring Market Regional Market Share

Geographic Coverage of Asia Pacific Air Quality Monitoring Market

Asia Pacific Air Quality Monitoring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.55% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Awareness and Favorable Government Policies and Non-government Initiatives for Curbing Air Pollution

- 3.3. Market Restrains

- 3.3.1. 4.; High Costs of Air Quality Monitoring Systems

- 3.4. Market Trends

- 3.4.1. Outdoor Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Indoor Monitor

- 5.1.2. Outdoor Monitor

- 5.2. Market Analysis, Insights and Forecast - by Sampling Method

- 5.2.1. Continuous

- 5.2.2. Manual

- 5.2.3. Intermittent

- 5.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 5.3.1. Chemical Pollutants

- 5.3.2. Physical Pollutants

- 5.3.3. Biological Pollutants

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Residential and Commercial

- 5.4.2. Power Generation

- 5.4.3. Petrochemicals

- 5.4.4. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. Singapore

- 5.5.5. Rest of Asia-Pacific

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.6.2. India

- 5.6.3. Japan

- 5.6.4. Singapore

- 5.6.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia Pacific Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Indoor Monitor

- 6.1.2. Outdoor Monitor

- 6.2. Market Analysis, Insights and Forecast - by Sampling Method

- 6.2.1. Continuous

- 6.2.2. Manual

- 6.2.3. Intermittent

- 6.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 6.3.1. Chemical Pollutants

- 6.3.2. Physical Pollutants

- 6.3.3. Biological Pollutants

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Residential and Commercial

- 6.4.2. Power Generation

- 6.4.3. Petrochemicals

- 6.4.4. Other End Users

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. China

- 6.5.2. India

- 6.5.3. Japan

- 6.5.4. Singapore

- 6.5.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. India Asia Pacific Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Indoor Monitor

- 7.1.2. Outdoor Monitor

- 7.2. Market Analysis, Insights and Forecast - by Sampling Method

- 7.2.1. Continuous

- 7.2.2. Manual

- 7.2.3. Intermittent

- 7.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 7.3.1. Chemical Pollutants

- 7.3.2. Physical Pollutants

- 7.3.3. Biological Pollutants

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Residential and Commercial

- 7.4.2. Power Generation

- 7.4.3. Petrochemicals

- 7.4.4. Other End Users

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. China

- 7.5.2. India

- 7.5.3. Japan

- 7.5.4. Singapore

- 7.5.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Japan Asia Pacific Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Indoor Monitor

- 8.1.2. Outdoor Monitor

- 8.2. Market Analysis, Insights and Forecast - by Sampling Method

- 8.2.1. Continuous

- 8.2.2. Manual

- 8.2.3. Intermittent

- 8.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 8.3.1. Chemical Pollutants

- 8.3.2. Physical Pollutants

- 8.3.3. Biological Pollutants

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Residential and Commercial

- 8.4.2. Power Generation

- 8.4.3. Petrochemicals

- 8.4.4. Other End Users

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. China

- 8.5.2. India

- 8.5.3. Japan

- 8.5.4. Singapore

- 8.5.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Singapore Asia Pacific Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Indoor Monitor

- 9.1.2. Outdoor Monitor

- 9.2. Market Analysis, Insights and Forecast - by Sampling Method

- 9.2.1. Continuous

- 9.2.2. Manual

- 9.2.3. Intermittent

- 9.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 9.3.1. Chemical Pollutants

- 9.3.2. Physical Pollutants

- 9.3.3. Biological Pollutants

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. Residential and Commercial

- 9.4.2. Power Generation

- 9.4.3. Petrochemicals

- 9.4.4. Other End Users

- 9.5. Market Analysis, Insights and Forecast - by Geography

- 9.5.1. China

- 9.5.2. India

- 9.5.3. Japan

- 9.5.4. Singapore

- 9.5.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Asia Pacific Asia Pacific Air Quality Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Indoor Monitor

- 10.1.2. Outdoor Monitor

- 10.2. Market Analysis, Insights and Forecast - by Sampling Method

- 10.2.1. Continuous

- 10.2.2. Manual

- 10.2.3. Intermittent

- 10.3. Market Analysis, Insights and Forecast - by Pollutant Type

- 10.3.1. Chemical Pollutants

- 10.3.2. Physical Pollutants

- 10.3.3. Biological Pollutants

- 10.4. Market Analysis, Insights and Forecast - by End User

- 10.4.1. Residential and Commercial

- 10.4.2. Power Generation

- 10.4.3. Petrochemicals

- 10.4.4. Other End Users

- 10.5. Market Analysis, Insights and Forecast - by Geography

- 10.5.1. China

- 10.5.2. India

- 10.5.3. Japan

- 10.5.4. Singapore

- 10.5.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Horiba Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Merck KGaA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TSI Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thermo Fisher Scientific Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aeroqual Limited*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Emerson Electric Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Siemens AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Agilent Technologies Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 3M Co

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Teledyne Technologies Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Asia Pacific Air Quality Monitoring Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Air Quality Monitoring Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Sampling Method 2020 & 2033

- Table 3: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Pollutant Type 2020 & 2033

- Table 4: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 5: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Sampling Method 2020 & 2033

- Table 9: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Pollutant Type 2020 & 2033

- Table 10: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 11: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Sampling Method 2020 & 2033

- Table 15: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Pollutant Type 2020 & 2033

- Table 16: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 17: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Sampling Method 2020 & 2033

- Table 21: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Pollutant Type 2020 & 2033

- Table 22: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 23: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Sampling Method 2020 & 2033

- Table 27: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Pollutant Type 2020 & 2033

- Table 28: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 29: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Sampling Method 2020 & 2033

- Table 33: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Pollutant Type 2020 & 2033

- Table 34: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 36: Asia Pacific Air Quality Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Air Quality Monitoring Market?

The projected CAGR is approximately 4.55%.

2. Which companies are prominent players in the Asia Pacific Air Quality Monitoring Market?

Key companies in the market include Honeywell International Inc, Horiba Ltd, Merck KGaA, TSI Inc, Thermo Fisher Scientific Inc, Aeroqual Limited*List Not Exhaustive, Emerson Electric Co, Siemens AG, Agilent Technologies Inc, 3M Co, Teledyne Technologies Inc.

3. What are the main segments of the Asia Pacific Air Quality Monitoring Market?

The market segments include Product Type, Sampling Method, Pollutant Type, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 77.40 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Awareness and Favorable Government Policies and Non-government Initiatives for Curbing Air Pollution.

6. What are the notable trends driving market growth?

Outdoor Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Costs of Air Quality Monitoring Systems.

8. Can you provide examples of recent developments in the market?

Januaru 2023: The government of India launched the Technology for Air Quality Monitoring System (AI-AQMS v1.0) developed under MeitY-supported projects. The Centre for Development of Advanced Computing (C-DAC), Kolkata, in partnership with TeXMIN, ISM, Dhanbad under the ‘National program on Electronics and ICT applications in Agriculture and Environment (AgriEnIcs)’ has developed an outdoor air quality monitoring station to monitor environmental pollutants which includes parameters like PM 1.0, PM 2.5, PM 10.0, SO2, NO2, CO, O2, ambient temperature, relative humidity etc., for continuous air quality analysis of the environment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Air Quality Monitoring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Air Quality Monitoring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Air Quality Monitoring Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Air Quality Monitoring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence