Key Insights

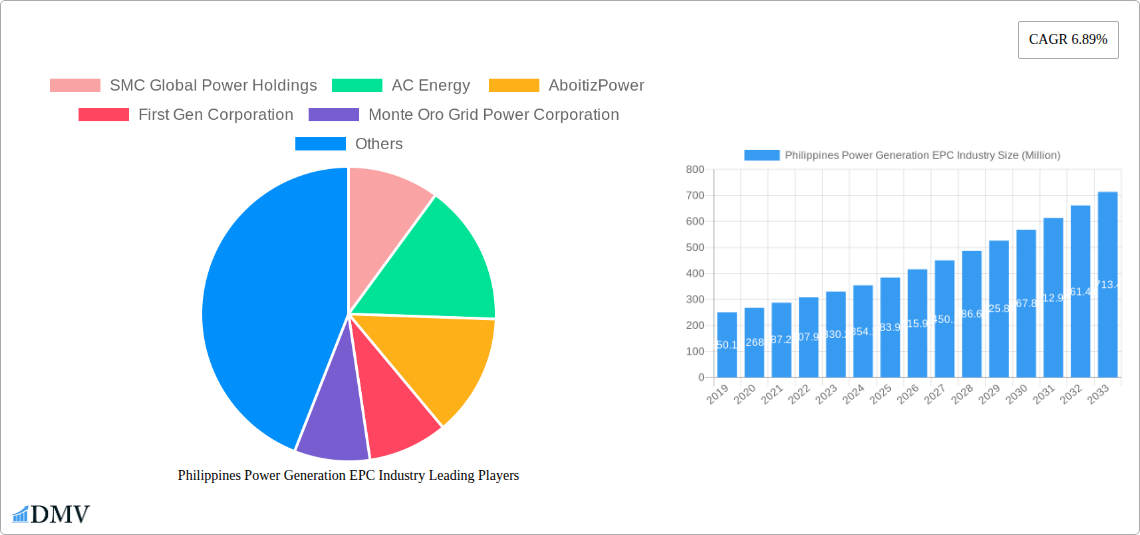

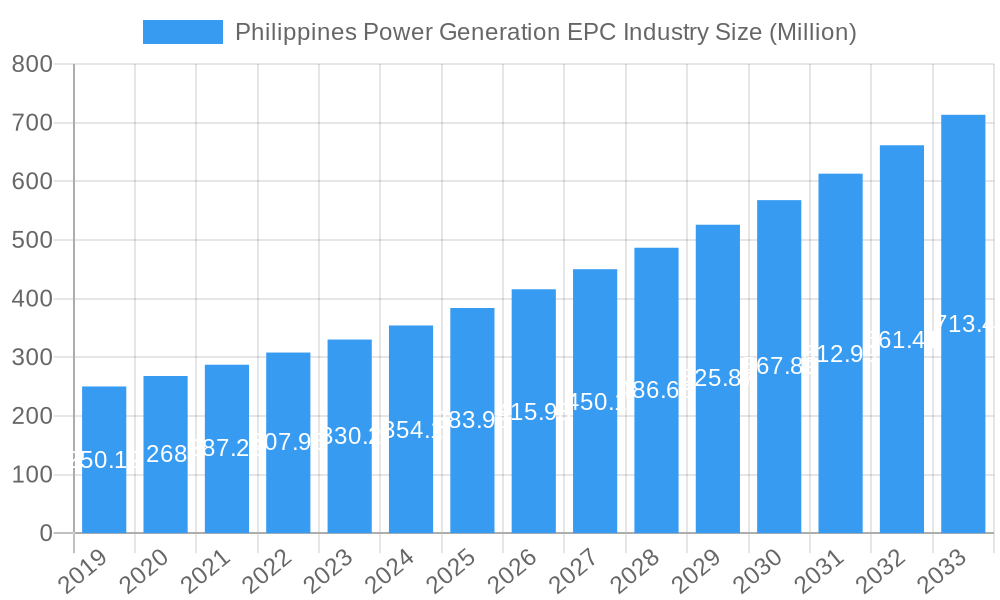

The Philippines Power Generation EPC industry is poised for significant expansion, projected to reach a market size of USD 383.98 million by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 6.89% anticipated between 2019 and 2033. A primary driver for this expansion is the nation's increasing energy demand, fueled by economic development, population growth, and a sustained push towards electrification across the archipelago. The government's commitment to enhancing energy security and reliability further bolsters the market. Key trends include a notable shift towards Non-hydro Renewable energy sources, such as solar and wind power, driven by environmental concerns, declining technology costs, and supportive regulatory frameworks. This transition is creating substantial opportunities for Engineering, Procurement, and Construction (EPC) firms specializing in these cleaner energy solutions. The industry is also witnessing increased investment in modernizing existing conventional thermal power plants to improve efficiency and reduce emissions, alongside the continued, albeit perhaps slower, development of hydropower projects where suitable.

Philippines Power Generation EPC Industry Market Size (In Million)

Despite the optimistic outlook, certain restraints could influence the pace and nature of growth. These may include the complexities associated with land acquisition for large-scale projects, particularly renewable energy farms, and the need for consistent, supportive policy implementation to ensure investor confidence. Furthermore, the availability of skilled labor and specialized technical expertise within the Philippines could present a challenge as project pipelines grow. Financing for large capital-intensive projects remains a crucial consideration, with the reliance on both domestic and international investment shaping project feasibility. Key players like SMC Global Power Holdings, AC Energy, AboitizPower, First Gen Corporation, and Monte Oro Grid Power Corporation are actively navigating these dynamics, competing and collaborating to secure contracts and deliver critical power infrastructure projects that will shape the Philippines' energy future. The continuous evolution of technology and a growing emphasis on sustainable energy practices will dictate the strategic focus for EPC providers in the coming years.

Philippines Power Generation EPC Industry Company Market Share

Philippines Power Generation EPC Industry Market Composition & Trends

This comprehensive report delves into the dynamic Philippines Power Generation EPC Industry, meticulously examining market concentration, key innovation catalysts, evolving regulatory landscapes, the impact of substitute products, detailed end-user profiles, and strategic Mergers & Acquisitions (M&A). The Philippine power sector is experiencing significant shifts, driven by the nation's escalating energy demands and a concerted push towards sustainable energy solutions. Market concentration is characterized by the influence of major conglomerates such as SMC Global Power Holdings, AC Energy, AboitizPower, First Gen Corporation, and Monte Oro Grid Power Corporation, each holding substantial market share in project development and execution. Innovation is primarily spurred by the need for greater efficiency, reduced emissions, and the integration of renewable energy sources. The regulatory environment, overseen by bodies like the Department of Energy (DOE) and the Energy Regulatory Commission (ERC), plays a pivotal role in shaping investment decisions and project approvals. Substitute products, while less direct in the EPC context, refer to advancements in energy storage and demand-side management that can influence the scale and type of generation projects undertaken. End-user profiles range from large industrial consumers and commercial enterprises to the residential sector, all demanding reliable and increasingly affordable electricity. M&A activities are a critical aspect of market consolidation and expansion, with significant deal values observed as companies seek to strengthen their portfolios and gain competitive advantages. For instance, in the historical period, M&A deals in the Philippines power sector have been valued in the hundreds of millions of US dollars, reflecting the strategic importance of acquiring operational assets and development pipelines. The market share distribution among the leading EPC players is dynamic, with major projects often awarded through competitive bidding processes.

Philippines Power Generation EPC Industry Industry Evolution

The Philippines Power Generation EPC Industry has undergone a significant transformation, driven by a confluence of technological advancements, policy shifts, and an insatiable demand for electricity to fuel its growing economy. Over the study period from 2019 to 2033, the industry's evolution is marked by a clear trajectory towards cleaner and more diversified energy sources, impacting the scope and nature of Engineering, Procurement, and Construction (EPC) services. Historically, the market was dominated by conventional thermal power plants, primarily coal-fired facilities, which provided a stable and cost-effective baseload power supply. However, a growing awareness of environmental concerns and the fluctuating global prices of fossil fuels have catalyzed a substantial pivot.

Technological advancements have been a paramount force. The declining costs of renewable energy technologies, particularly solar and wind, have made them increasingly competitive. This has led to a surge in EPC contracts for solar farms, wind farms, and hybrid projects. For example, the adoption rate of solar power capacity has seen an average annual growth of over 20% in the historical period (2019-2024), necessitating a corresponding growth in specialized EPC expertise for grid integration and complex installations. Furthermore, advancements in battery storage technology are enabling the integration of intermittent renewable sources, smoothing out power delivery and reducing the reliance on traditional backup generation. EPC firms are now required to possess expertise in designing and building systems that incorporate these sophisticated energy storage solutions.

Shifting consumer demands, influenced by both environmental consciousness and the desire for energy independence, are also shaping the industry. There is an increasing demand for distributed generation, allowing businesses and even households to generate their own power, thereby influencing the scale and location of EPC projects. This trend is further amplified by government incentives and renewable energy targets aimed at enhancing energy security and reducing carbon emissions. The forecast period (2025-2033) is expected to witness an accelerated shift away from fossil fuels, with substantial investments channeled into renewable energy and associated infrastructure. The base year (2025) serves as a crucial benchmark, capturing the current momentum of this transition. Growth rates in renewable energy deployment are projected to remain robust, potentially exceeding 15% annually, creating a sustained demand for EPC services. This evolution necessitates that EPC companies continuously invest in upskilling their workforce, adopting new construction methodologies, and forging strategic partnerships to remain competitive in this rapidly evolving landscape. The market is moving beyond traditional power plant construction to encompass a broader spectrum of energy infrastructure development.

Leading Regions, Countries, or Segments in Philippines Power Generation EPC Industry

The Philippines Power Generation EPC Industry is characterized by dynamic regional and segmental dominance, heavily influenced by resource availability, government policy, and investment trends. Among the Power Generation Sources, Non-hydro Renewables is emerging as the most dominant segment, driven by a confluence of factors that favor its rapid expansion and EPC engagement.

Dominance of Non-hydro Renewables:

- Investment Trends: The period from 2019 to 2033 is witnessing a substantial surge in investments into solar and wind power projects across the Philippines. This is fueled by a combination of declining technology costs, attractive feed-in tariffs (FiTs) and renewable energy certificates (RECs), and the government's ambitious renewable energy targets. Billions of US dollars are being allocated annually towards developing new renewable energy capacity. For example, investments in solar power alone have grown exponentially, with new project pipelines exceeding 500 Million US dollars in recent years.

- Regulatory Support: The Philippine government, through the Department of Energy (DOE) and the Renewable Energy Act of 2008, has provided a robust framework to encourage renewable energy development. Policies such as the Renewable Portfolio Standards (RPS) mandate that a certain percentage of electricity sold by power distributors must come from renewable sources, creating a guaranteed market for renewable energy producers and, consequently, EPC firms.

- Resource Availability: The Philippines, an archipelago, benefits from abundant solar irradiation and significant wind resources, particularly in areas like Luzon and Visayas. This natural advantage makes it an ideal location for large-scale solar and wind farm development, driving demand for the specialized EPC services required for these projects.

- Environmental Concerns and Energy Security: Growing public and governmental concern over climate change and the desire to reduce reliance on imported fossil fuels are powerful drivers for the adoption of domestic renewable energy sources. EPC companies specializing in non-hydro renewables are therefore well-positioned to capitalize on this demand.

Analysis of Dominance Factors:

The dominance of Non-hydro Renewables in the EPC landscape is a direct consequence of these integrated factors. While Conventional Thermal Power still constitutes a significant portion of the existing generation capacity and will see ongoing EPC work for maintenance and some new builds, the rate of growth and new project announcements is heavily skewed towards renewables. Hydro power, while important, has more geographically specific development potential and often faces longer lead times and environmental impact assessments, making its expansion less dynamic compared to solar and wind in the current market.

EPC firms that have developed strong capabilities in designing, procuring, and constructing large-scale solar photovoltaic (PV) plants, onshore and offshore wind farms, and integrating them with grid infrastructure are leading the market. This includes expertise in foundation engineering for wind turbines, module mounting systems for solar farms, electrical balance of systems, and substation construction. The ability to navigate the complex permitting processes and secure financing for these often large-scale renewable projects is also a key differentiator for dominant EPC players in this segment. The market share for EPC projects in non-hydro renewables is projected to capture over 50% of new power generation EPC contracts in the forecast period.

Philippines Power Generation EPC Industry Product Innovations

Product innovations within the Philippines Power Generation EPC industry are increasingly focused on enhancing efficiency, reliability, and sustainability. This includes the development of modular solar panel designs for faster deployment, advanced wind turbine blade aerodynamics for increased energy capture even in lower wind speeds, and more efficient heat recovery systems for conventional thermal power plants. Innovations in grid integration technology, such as smart inverters for solar farms that offer grid support services, and advanced battery energy storage systems (BESS) with sophisticated management software, are critical for balancing the grid with intermittent renewable sources. Performance metrics are improving, with solar panel efficiencies now regularly exceeding 22% and wind turbines achieving higher capacity factors. The unique selling proposition for EPC firms lies in their ability to integrate these cutting-edge technologies seamlessly into project designs, delivering optimized power generation solutions that meet stringent environmental and economic requirements.

Propelling Factors for Philippines Power Generation EPC Industry Growth

The Philippines Power Generation EPC Industry is propelled by several key growth drivers. Technological advancements in renewable energy, such as more efficient solar panels and larger wind turbines, are making these sources increasingly cost-competitive. Economic growth necessitates increased power generation capacity to meet rising industrial and residential demand. Furthermore, supportive government policies and ambitious renewable energy targets, coupled with incentives like feed-in tariffs and tax holidays, are creating a favorable investment climate. The push for energy security and diversification away from imported fossil fuels further bolsters the demand for domestic and renewable energy infrastructure projects. For instance, the government’s target of achieving 35% renewable energy in the power generation mix by 2030 is a significant driver for EPC activities.

Obstacles in the Philippines Power Generation EPC Industry Market

Several obstacles can impede the growth of the Philippines Power Generation EPC Industry. Regulatory complexities and lengthy permitting processes can cause project delays and increase costs. Supply chain disruptions, particularly for imported components and raw materials, can affect project timelines and budgets, as seen with global logistics challenges impacting the availability of specialized equipment. Financing challenges for large-scale projects, especially for newer renewable technologies, can be a barrier. Land acquisition issues and local community opposition can also present significant hurdles. Moreover, intense competition among EPC firms can lead to price pressures and reduced profit margins. The average project completion time can be extended by xx months due to these regulatory and logistical challenges.

Future Opportunities in Philippines Power Generation EPC Industry

Emerging opportunities in the Philippines Power Generation EPC Industry are abundant. The burgeoning demand for energy storage solutions, including battery systems, presents a significant avenue for EPC growth as the country integrates more intermittent renewables. Offshore wind development is a nascent but highly promising market, with vast potential in the Philippines' extensive coastlines. The expansion of the transmission and distribution network to accommodate new generation sources is another key area. Furthermore, the increasing focus on green hydrogen production and its integration into the energy mix could open up entirely new EPC markets. The trend towards digitalization and smart grid technologies also offers opportunities for EPC firms to offer integrated solutions.

Major Players in the Philippines Power Generation EPC Industry Ecosystem

- SMC Global Power Holdings

- AC Energy

- AboitizPower

- First Gen Corporation

- Monte Oro Grid Power Corporation

Key Developments in Philippines Power Generation EPC Industry Industry

- 2023/04: Launch of several new solar power projects across Luzon, with a combined capacity exceeding 500 Million Watts.

- 2023/01: AboitizPower announces significant investment in renewable energy expansion, including new wind farm projects.

- 2022/11: First Gen Corporation commences operations of its new geothermal power plant, enhancing the country's renewable energy portfolio.

- 2022/07: AC Energy secures funding for multiple large-scale solar and wind projects, signaling continued growth in the renewables sector.

- 2022/03: Department of Energy revises renewable energy targets, further incentivizing EPC work in the sector.

- 2021/10: SMC Global Power Holdings continues to expand its conventional thermal power capacity while also investing in renewable energy ventures.

- 2020/05: Monte Oro Grid Power Corporation involved in key transmission infrastructure upgrades to support new power generation facilities.

- 2019/08: Government introduces new policies to streamline permitting for renewable energy projects, aiming to accelerate EPC timelines.

Strategic Philippines Power Generation EPC Industry Market Forecast

The strategic Philippines Power Generation EPC Industry market forecast indicates robust growth, primarily driven by the nation's unwavering commitment to expanding its energy infrastructure and transitioning towards cleaner energy sources. The increasing adoption of non-hydro renewables, particularly solar and wind power, will continue to be the principal catalyst for EPC activities, with significant investment expected to flow into new project developments. The evolving regulatory landscape, coupled with supportive government initiatives aimed at enhancing energy security and sustainability, will further stimulate market expansion. Furthermore, the anticipated rise in demand for energy storage solutions and the potential development of offshore wind projects present substantial future opportunities for EPC contractors. This forecast suggests a dynamic and expanding market for specialized EPC services in the Philippines.

Philippines Power Generation EPC Industry Segmentation

-

1. Power Generation Source

- 1.1. Conventional Thermal Power

- 1.2. Hydro Power

- 1.3. Non-hydro Renewables

Philippines Power Generation EPC Industry Segmentation By Geography

- 1. Philippines

Philippines Power Generation EPC Industry Regional Market Share

Geographic Coverage of Philippines Power Generation EPC Industry

Philippines Power Generation EPC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Energy Demand4.; Upcoming and Ongoing Projects of Power Plants

- 3.3. Market Restrains

- 3.3.1. 4.; Complexity and Expensive Nature of Coal-fired and Natural-gas-fired Power Plants

- 3.4. Market Trends

- 3.4.1. Conventional Thermal Power is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines Power Generation EPC Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 5.1.1. Conventional Thermal Power

- 5.1.2. Hydro Power

- 5.1.3. Non-hydro Renewables

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SMC Global Power Holdings

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AC Energy

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AboitizPower

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 First Gen Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Monte Oro Grid Power Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 SMC Global Power Holdings

List of Figures

- Figure 1: Philippines Power Generation EPC Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Philippines Power Generation EPC Industry Share (%) by Company 2025

List of Tables

- Table 1: Philippines Power Generation EPC Industry Revenue Million Forecast, by Power Generation Source 2020 & 2033

- Table 2: Philippines Power Generation EPC Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Philippines Power Generation EPC Industry Revenue Million Forecast, by Power Generation Source 2020 & 2033

- Table 4: Philippines Power Generation EPC Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines Power Generation EPC Industry?

The projected CAGR is approximately 6.89%.

2. Which companies are prominent players in the Philippines Power Generation EPC Industry?

Key companies in the market include SMC Global Power Holdings, AC Energy , AboitizPower , First Gen Corporation, Monte Oro Grid Power Corporation.

3. What are the main segments of the Philippines Power Generation EPC Industry?

The market segments include Power Generation Source.

4. Can you provide details about the market size?

The market size is estimated to be USD 383.98 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Energy Demand4.; Upcoming and Ongoing Projects of Power Plants.

6. What are the notable trends driving market growth?

Conventional Thermal Power is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Complexity and Expensive Nature of Coal-fired and Natural-gas-fired Power Plants.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines Power Generation EPC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines Power Generation EPC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines Power Generation EPC Industry?

To stay informed about further developments, trends, and reports in the Philippines Power Generation EPC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence