Key Insights

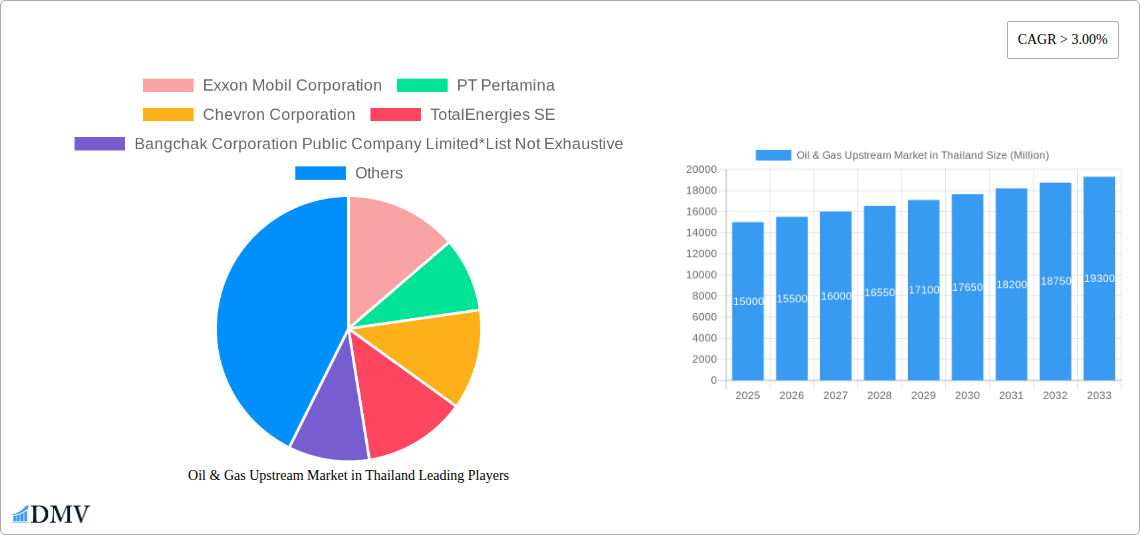

Thailand's Oil & Gas Upstream Market is projected for significant growth, fueled by robust domestic energy demand essential for industrial and economic expansion. The market is anticipated to reach approximately 4847.93 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 4.4%. This growth is supported by Thailand's strategic Southeast Asian location and the government's commitment to energy security. The sector encompasses both onshore and offshore exploration and production, with a growing emphasis on technological innovation for improved extraction efficiency and environmental stewardship.

Oil & Gas Upstream Market in Thailand Market Size (In Million)

Key growth catalysts for Thailand's upstream sector include rising domestic consumption of refined products and a consistent demand for natural gas in power generation and industrial applications. The potential for new discoveries in exploration blocks also presents opportunities. Emerging trends, such as the integration of digital technologies for seismic analysis, drilling optimization, and production management, are expected to enhance operational efficiency and reduce costs. Challenges include volatile global oil prices, the complexities of offshore operations, and evolving environmental regulations. The competitive landscape comprises major international oil companies and national entities focused on meeting Thailand's energy needs.

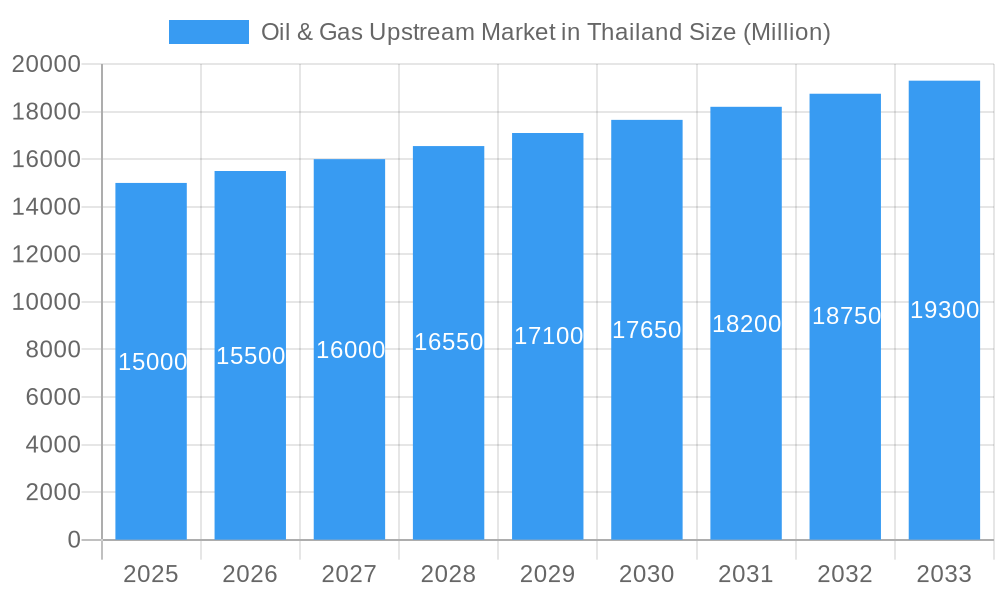

Oil & Gas Upstream Market in Thailand Company Market Share

Unlocking Thailand's Energy Future: A Comprehensive Report on the Oil & Gas Upstream Market

This in-depth report provides an indispensable analysis of the Oil & Gas Upstream Market in Thailand, offering stakeholders unparalleled insights into its current landscape and future trajectory. Covering the period from 2019 to 2033, with a detailed focus on the Base Year 2025 and a robust Forecast Period of 2025–2033, this analysis delves into every facet of Thailand's crucial energy sector. Discover the intricate interplay of market dynamics, technological innovations, investment opportunities, and regulatory frameworks shaping the Thai oil and gas exploration and production (E&P) sector.

Oil & Gas Upstream Market in Thailand Market Composition & Trends

The Oil & Gas Upstream Market in Thailand is characterized by a dynamic composition and evolving trends, driven by significant investments and strategic partnerships. Market concentration is influenced by the presence of national oil companies and international energy giants, with key players vying for dominant market shares in exploration and production activities. Innovation catalysts are emerging from advancements in seismic surveying, drilling technologies, and enhanced oil recovery (EOR) techniques, aimed at maximizing yields from existing and new reserves. The regulatory landscape, overseen by the Department of Mineral Fuels (DMF), plays a pivotal role in governing exploration rights, production sharing agreements, and environmental standards, fostering a more transparent and attractive investment environment. While direct substitute products for crude oil and natural gas in the upstream sector are limited, the increasing focus on energy efficiency and diversification into renewables indirectly influences long-term upstream demand. End-user profiles in Thailand's upstream market primarily consist of national oil companies, international oil companies (IOCs), independent exploration and production firms, and service providers. Merger and acquisition (M&A) activities are carefully scrutinized, often driven by portfolio optimization, access to new exploration blocks, and the acquisition of advanced technologies. M&A deal values, though fluctuating, reflect the strategic importance of Thailand's hydrocarbon resources.

- Market Concentration: Influenced by PTT Public Company Limited, Chevron Corporation, and other major IOCs.

- Innovation Catalysts: Adoption of AI in exploration, advanced drilling fluid technologies, and digital twin for reservoir management.

- Regulatory Landscape: Evolving policies on domestic production incentives and foreign investment.

- Substitute Products: Limited direct substitutes in upstream, but indirect influence from renewable energy growth.

- End-User Profiles: National oil companies, IOCs, independent E&P companies, and oilfield service providers.

- M&A Activities: Driven by strategic acquisitions of exploration assets and technology integration.

- M&A Deal Values: Not explicitly available, but significant investment in exploration blocks is a key indicator.

Oil & Gas Upstream Market in Thailand Industry Evolution

The Oil & Gas Upstream Market in Thailand has undergone a significant evolution, marked by consistent growth trajectories, rapid technological advancements, and shifting consumer demands that have reshaped its operational and strategic paradigms. Historically, the industry’s growth was propelled by the discovery of substantial natural gas reserves, particularly in the Gulf of Thailand, which fueled the nation's industrialization and energy security. Over the Historical Period of 2019–2024, the market witnessed a steady, albeit sometimes volatile, demand for both oil and natural gas, influenced by global commodity prices and domestic economic activity.

Technological advancements have been a cornerstone of this evolution. Early exploration relied on conventional seismic methods and standard drilling techniques. However, the Study Period 2019–2033 encompasses a transition towards more sophisticated technologies. The adoption of 3D and 4D seismic imaging has significantly improved reservoir characterization, leading to more accurate drilling targets and reduced exploration risk. Furthermore, the implementation of advanced drilling technologies, including horizontal drilling and hydraulic fracturing (where applicable and environmentally permissible), has enabled the extraction of hydrocarbons from previously uneconomical or technically challenging formations. Enhanced Oil Recovery (EOR) techniques, such as gas injection and chemical flooding, are increasingly being explored and deployed to maximize production from mature fields, thereby extending their economic life.

Shifting consumer demands, particularly the growing global and domestic awareness of environmental sustainability, are also influencing the upstream sector. While the primary demand remains for fossil fuels, there is an increasing pressure to operate with lower emissions and greater environmental stewardship. This has spurred investment in technologies that reduce flaring, minimize methane leakage, and improve the overall environmental footprint of upstream operations. The focus on natural gas as a transitional fuel, offering a cleaner alternative to coal and oil in power generation, has also been a significant driver for upstream investment, particularly in the exploration and production of natural gas reserves. The Base Year 2025 and the subsequent Forecast Period of 2025–2033 are expected to see this trend intensify, with greater emphasis on sustainable upstream practices and the exploration of unconventional resources if market conditions and regulatory frameworks permit. The market growth rates, while subject to global price volatility, have shown resilience, with an estimated average annual growth rate of approximately 3-5% in recent years, driven by consistent domestic demand and strategic investments by major players. Adoption metrics for new technologies, such as digital subsurface modeling, are steadily increasing, indicating a clear move towards data-driven decision-making and operational efficiency in the Thai upstream sector.

Leading Regions, Countries, or Segments in Oil & Gas Upstream Market in Thailand

The Oil & Gas Upstream Market in Thailand is predominantly characterized by the dominance of its Offshore segment, significantly outperforming its onshore counterpart in terms of production volume, investment, and strategic importance. This offshore dominance is primarily concentrated in the Gulf of Thailand, a hydrocarbon-rich basin that has been the bedrock of Thailand's oil and gas production for decades. The inherent geological characteristics of the Gulf, offering access to substantial natural gas reserves and associated liquids, have cemented its position as the leading region.

Offshore Dominance: The Gulf of Thailand continues to be the primary hub for oil and gas exploration and production in Thailand. This segment accounts for the vast majority of the country's hydrocarbon output. Key drivers for this dominance include:

- Significant Natural Gas Reserves: The Gulf holds substantial proven reserves of natural gas, which is crucial for meeting Thailand's energy demands, particularly for power generation.

- Mature Production Infrastructure: Decades of exploration and development have resulted in well-established offshore infrastructure, including platforms, pipelines, and processing facilities, making new developments more cost-effective.

- Strategic Government Support: The Thai government has consistently prioritized the development of its offshore resources through favorable licensing rounds, fiscal terms, and regulatory frameworks aimed at attracting foreign investment.

- Technological Advancements: The offshore segment has been a prime beneficiary of technological advancements in deep-water exploration, subsea technologies, and floating production, storage, and offloading (FPSO) units, enabling access to more challenging reservoirs.

- Major Player Concentration: Leading companies like Chevron Corporation and PTT Public Company Limited have extensive offshore operations and maintain significant production from fields in the Gulf of Thailand.

Onshore Segment: While less significant in terms of overall production volume compared to offshore, the onshore segment, particularly in the northern and northeastern regions of Thailand, plays a vital role in certain aspects of the upstream market.

- Lignite and Coal Bed Methane (CBM) Potential: Some onshore areas hold potential for unconventional resources like coal bed methane, which, though currently less developed, represents a future exploration frontier.

- Smaller-Scale Operations: Onshore fields are generally smaller and more mature, often operated by domestic players or smaller independent companies.

- Exploration Challenges: Onshore exploration can face challenges related to land access, environmental concerns, and geological complexities, which have historically limited large-scale development compared to offshore.

The overwhelming success and strategic focus on the offshore segment are underpinned by consistent investment trends, robust regulatory support for offshore exploration blocks, and the sheer volume of hydrocarbon resources discovered and currently being exploited. The Forecast Period 2025–2033 is anticipated to see continued investment in mature offshore fields, alongside the exploration of deeper waters and potentially new frontier areas within the Gulf of Thailand, solidifying its position as the dominant force in Thailand's upstream oil and gas landscape.

Oil & Gas Upstream Market in Thailand Product Innovations

The Oil & Gas Upstream Market in Thailand is witnessing a wave of product innovations aimed at enhancing efficiency, reducing environmental impact, and unlocking previously inaccessible hydrocarbon reserves. Advancements in drilling fluid formulations are enabling faster drilling rates and improved wellbore stability, particularly in challenging geological formations encountered in the Gulf of Thailand. Furthermore, the development of intelligent completion systems and advanced downhole sensors allows for real-time monitoring of reservoir performance and optimized production, directly improving output metrics. Innovations in seismic data processing, utilizing machine learning and artificial intelligence, are leading to more accurate subsurface imaging, reducing exploration risks and identifying potential reserves with greater precision. These technological leaps are crucial for maximizing the recovery factor from both existing and newly discovered fields, ensuring the continued viability of Thailand's upstream sector.

Propelling Factors for Oil & Gas Upstream Market in Thailand Growth

Several key factors are propelling the growth of the Oil & Gas Upstream Market in Thailand. Technologically, advancements in seismic imaging and drilling techniques are enabling more efficient exploration and production, unlocking reserves that were previously uneconomical. Economically, strong domestic energy demand, particularly for natural gas in power generation, provides a stable market and encourages investment. The Thai government’s strategic focus on energy security and the implementation of attractive fiscal terms for exploration and production licenses are significant regulatory influences. Furthermore, ongoing investments by national oil companies like PTT Public Company Limited and international players such as Chevron Corporation in developing existing fields and exploring new potential are crucial growth catalysts.

Obstacles in the Oil & Gas Upstream Market in Thailand Market

Despite its growth potential, the Oil & Gas Upstream Market in Thailand faces several obstacles. Regulatory challenges, including complex permitting processes and evolving environmental standards, can sometimes slow down project development. Supply chain disruptions, exacerbated by global events, can impact the timely delivery of equipment and services, leading to increased costs and project delays. Competitive pressures from international markets and the increasing global focus on renewable energy sources pose long-term challenges to sustained investment in fossil fuel exploration. Furthermore, the declining production from some mature fields requires significant investment in enhanced recovery techniques, which can be costly and technologically demanding, posing a quantifiable impact on overall profitability.

Future Opportunities in Oil & Gas Upstream Market in Thailand

The Oil & Gas Upstream Market in Thailand presents several promising future opportunities. The exploration of deeper waters in the Gulf of Thailand and the potential for developing unconventional resources, such as coal bed methane, offer significant untapped potential. Technological advancements in carbon capture, utilization, and storage (CCUS) could also open new avenues for more environmentally responsible upstream operations. Furthermore, strategic partnerships and joint ventures with technology providers can accelerate the adoption of innovative E&P solutions, enhancing recovery rates and operational efficiency. The increasing demand for natural gas as a transitional fuel in the region also presents a sustained opportunity for Thai natural gas producers.

Major Players in the Oil & Gas Upstream Market in Thailand Ecosystem

- Exxon Mobil Corporation

- PT Pertamina

- Chevron Corporation

- TotalEnergies SE

- Bangchak Corporation Public Company Limited

- Schlumberger Limited

- PTT Public Company Limited

Key Developments in Oil & Gas Upstream Market in Thailand Industry

- February 2021: Thailand's state-controlled oil firm, PTT, announced an investment of USD 28.3 Billion across all its operations for 2021-2025, focusing on developing the country's natural gas industry and seeking future energy opportunities.

- May 2021: Valaris Limited secured a contract extension of approximately 240 days with Mubadala Petroleum Thailand offshore Thailand for the VALARIS JU-115 jackup rig. The extension was anticipated to begin in the first quarter of 2022 and run through September 2022.

- December 2021: Shelf Drilling announced contract extensions for two jack-up drilling rigs, Shelf Drilling Chaophraya (39 months) and Shelf Drilling Krathong (36 months), with Chevron Thailand Exploration and Production, Ltd. for operations in the Gulf of Thailand. These extensions were expected to commence in Q3 2022 and Q4 2022, respectively.

Strategic Oil & Gas Upstream Market in Thailand Market Forecast

The Oil & Gas Upstream Market in Thailand is poised for strategic growth, driven by continued demand for natural gas and concerted efforts to optimize existing production. Future opportunities lie in the exploration of deeper offshore blocks and the potential development of unconventional resources, supported by ongoing technological advancements in exploration and extraction. The government's commitment to energy security and its supportive regulatory framework will continue to attract investment, fostering a stable environment for both domestic and international players. Strategic market forecasts indicate sustained, albeit moderate, growth, emphasizing efficiency gains and the responsible development of Thailand's hydrocarbon assets, ensuring a critical role for the upstream sector in the nation’s energy landscape.

Oil & Gas Upstream Market in Thailand Segmentation

- 1. Onshore

- 2. Offshore

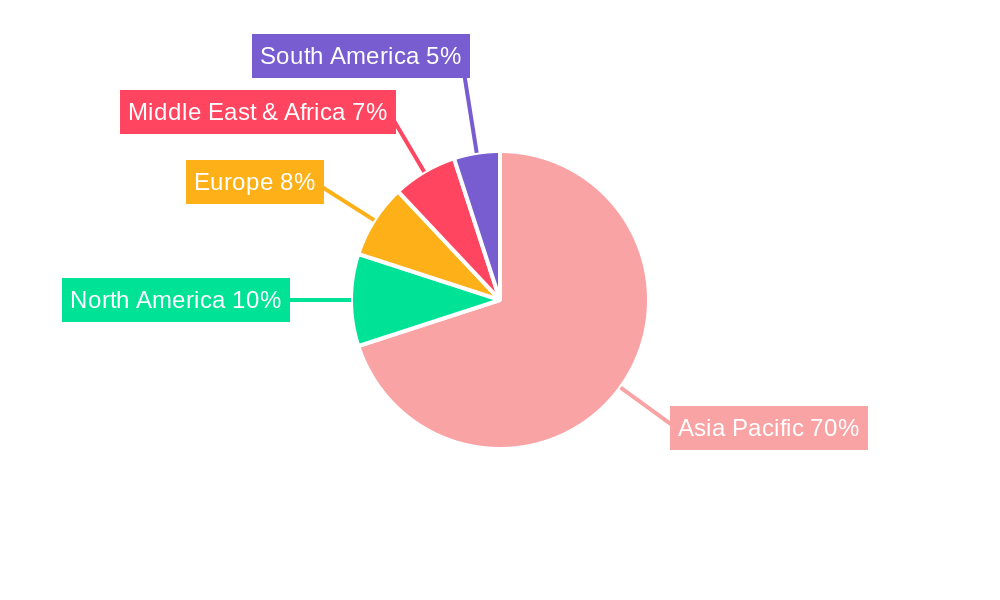

Oil & Gas Upstream Market in Thailand Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Oil & Gas Upstream Market in Thailand Regional Market Share

Geographic Coverage of Oil & Gas Upstream Market in Thailand

Oil & Gas Upstream Market in Thailand REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand from Industrial Applications4.; Growing Infrastructure Across the World

- 3.3. Market Restrains

- 3.3.1. 4.; A Rise In Concerns Related To Carbon Emissions And A Shift Towards Electric Vehicles And Renewable Sources Of Energy

- 3.4. Market Trends

- 3.4.1. Offshore Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oil & Gas Upstream Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 5.2. Market Analysis, Insights and Forecast - by Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Onshore

- 6. North America Oil & Gas Upstream Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Onshore

- 6.2. Market Analysis, Insights and Forecast - by Offshore

- 6.1. Market Analysis, Insights and Forecast - by Onshore

- 7. South America Oil & Gas Upstream Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Onshore

- 7.2. Market Analysis, Insights and Forecast - by Offshore

- 7.1. Market Analysis, Insights and Forecast - by Onshore

- 8. Europe Oil & Gas Upstream Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Onshore

- 8.2. Market Analysis, Insights and Forecast - by Offshore

- 8.1. Market Analysis, Insights and Forecast - by Onshore

- 9. Middle East & Africa Oil & Gas Upstream Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Onshore

- 9.2. Market Analysis, Insights and Forecast - by Offshore

- 9.1. Market Analysis, Insights and Forecast - by Onshore

- 10. Asia Pacific Oil & Gas Upstream Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Onshore

- 10.2. Market Analysis, Insights and Forecast - by Offshore

- 10.1. Market Analysis, Insights and Forecast - by Onshore

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Exxon Mobil Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PT Pertamina

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Chevron Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TotalEnergies SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bangchak Corporation Public Company Limited*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Schlumberger Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PTT Public Company Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Exxon Mobil Corporation

List of Figures

- Figure 1: Global Oil & Gas Upstream Market in Thailand Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Oil & Gas Upstream Market in Thailand Volume Breakdown (Tonnes, %) by Region 2025 & 2033

- Figure 3: North America Oil & Gas Upstream Market in Thailand Revenue (billion), by Onshore 2025 & 2033

- Figure 4: North America Oil & Gas Upstream Market in Thailand Volume (Tonnes), by Onshore 2025 & 2033

- Figure 5: North America Oil & Gas Upstream Market in Thailand Revenue Share (%), by Onshore 2025 & 2033

- Figure 6: North America Oil & Gas Upstream Market in Thailand Volume Share (%), by Onshore 2025 & 2033

- Figure 7: North America Oil & Gas Upstream Market in Thailand Revenue (billion), by Offshore 2025 & 2033

- Figure 8: North America Oil & Gas Upstream Market in Thailand Volume (Tonnes), by Offshore 2025 & 2033

- Figure 9: North America Oil & Gas Upstream Market in Thailand Revenue Share (%), by Offshore 2025 & 2033

- Figure 10: North America Oil & Gas Upstream Market in Thailand Volume Share (%), by Offshore 2025 & 2033

- Figure 11: North America Oil & Gas Upstream Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Oil & Gas Upstream Market in Thailand Volume (Tonnes), by Country 2025 & 2033

- Figure 13: North America Oil & Gas Upstream Market in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Oil & Gas Upstream Market in Thailand Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Oil & Gas Upstream Market in Thailand Revenue (billion), by Onshore 2025 & 2033

- Figure 16: South America Oil & Gas Upstream Market in Thailand Volume (Tonnes), by Onshore 2025 & 2033

- Figure 17: South America Oil & Gas Upstream Market in Thailand Revenue Share (%), by Onshore 2025 & 2033

- Figure 18: South America Oil & Gas Upstream Market in Thailand Volume Share (%), by Onshore 2025 & 2033

- Figure 19: South America Oil & Gas Upstream Market in Thailand Revenue (billion), by Offshore 2025 & 2033

- Figure 20: South America Oil & Gas Upstream Market in Thailand Volume (Tonnes), by Offshore 2025 & 2033

- Figure 21: South America Oil & Gas Upstream Market in Thailand Revenue Share (%), by Offshore 2025 & 2033

- Figure 22: South America Oil & Gas Upstream Market in Thailand Volume Share (%), by Offshore 2025 & 2033

- Figure 23: South America Oil & Gas Upstream Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 24: South America Oil & Gas Upstream Market in Thailand Volume (Tonnes), by Country 2025 & 2033

- Figure 25: South America Oil & Gas Upstream Market in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Oil & Gas Upstream Market in Thailand Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Oil & Gas Upstream Market in Thailand Revenue (billion), by Onshore 2025 & 2033

- Figure 28: Europe Oil & Gas Upstream Market in Thailand Volume (Tonnes), by Onshore 2025 & 2033

- Figure 29: Europe Oil & Gas Upstream Market in Thailand Revenue Share (%), by Onshore 2025 & 2033

- Figure 30: Europe Oil & Gas Upstream Market in Thailand Volume Share (%), by Onshore 2025 & 2033

- Figure 31: Europe Oil & Gas Upstream Market in Thailand Revenue (billion), by Offshore 2025 & 2033

- Figure 32: Europe Oil & Gas Upstream Market in Thailand Volume (Tonnes), by Offshore 2025 & 2033

- Figure 33: Europe Oil & Gas Upstream Market in Thailand Revenue Share (%), by Offshore 2025 & 2033

- Figure 34: Europe Oil & Gas Upstream Market in Thailand Volume Share (%), by Offshore 2025 & 2033

- Figure 35: Europe Oil & Gas Upstream Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 36: Europe Oil & Gas Upstream Market in Thailand Volume (Tonnes), by Country 2025 & 2033

- Figure 37: Europe Oil & Gas Upstream Market in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Oil & Gas Upstream Market in Thailand Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Oil & Gas Upstream Market in Thailand Revenue (billion), by Onshore 2025 & 2033

- Figure 40: Middle East & Africa Oil & Gas Upstream Market in Thailand Volume (Tonnes), by Onshore 2025 & 2033

- Figure 41: Middle East & Africa Oil & Gas Upstream Market in Thailand Revenue Share (%), by Onshore 2025 & 2033

- Figure 42: Middle East & Africa Oil & Gas Upstream Market in Thailand Volume Share (%), by Onshore 2025 & 2033

- Figure 43: Middle East & Africa Oil & Gas Upstream Market in Thailand Revenue (billion), by Offshore 2025 & 2033

- Figure 44: Middle East & Africa Oil & Gas Upstream Market in Thailand Volume (Tonnes), by Offshore 2025 & 2033

- Figure 45: Middle East & Africa Oil & Gas Upstream Market in Thailand Revenue Share (%), by Offshore 2025 & 2033

- Figure 46: Middle East & Africa Oil & Gas Upstream Market in Thailand Volume Share (%), by Offshore 2025 & 2033

- Figure 47: Middle East & Africa Oil & Gas Upstream Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 48: Middle East & Africa Oil & Gas Upstream Market in Thailand Volume (Tonnes), by Country 2025 & 2033

- Figure 49: Middle East & Africa Oil & Gas Upstream Market in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Oil & Gas Upstream Market in Thailand Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Oil & Gas Upstream Market in Thailand Revenue (billion), by Onshore 2025 & 2033

- Figure 52: Asia Pacific Oil & Gas Upstream Market in Thailand Volume (Tonnes), by Onshore 2025 & 2033

- Figure 53: Asia Pacific Oil & Gas Upstream Market in Thailand Revenue Share (%), by Onshore 2025 & 2033

- Figure 54: Asia Pacific Oil & Gas Upstream Market in Thailand Volume Share (%), by Onshore 2025 & 2033

- Figure 55: Asia Pacific Oil & Gas Upstream Market in Thailand Revenue (billion), by Offshore 2025 & 2033

- Figure 56: Asia Pacific Oil & Gas Upstream Market in Thailand Volume (Tonnes), by Offshore 2025 & 2033

- Figure 57: Asia Pacific Oil & Gas Upstream Market in Thailand Revenue Share (%), by Offshore 2025 & 2033

- Figure 58: Asia Pacific Oil & Gas Upstream Market in Thailand Volume Share (%), by Offshore 2025 & 2033

- Figure 59: Asia Pacific Oil & Gas Upstream Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 60: Asia Pacific Oil & Gas Upstream Market in Thailand Volume (Tonnes), by Country 2025 & 2033

- Figure 61: Asia Pacific Oil & Gas Upstream Market in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Oil & Gas Upstream Market in Thailand Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Oil & Gas Upstream Market in Thailand Revenue billion Forecast, by Onshore 2020 & 2033

- Table 2: Global Oil & Gas Upstream Market in Thailand Volume Tonnes Forecast, by Onshore 2020 & 2033

- Table 3: Global Oil & Gas Upstream Market in Thailand Revenue billion Forecast, by Offshore 2020 & 2033

- Table 4: Global Oil & Gas Upstream Market in Thailand Volume Tonnes Forecast, by Offshore 2020 & 2033

- Table 5: Global Oil & Gas Upstream Market in Thailand Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Oil & Gas Upstream Market in Thailand Volume Tonnes Forecast, by Region 2020 & 2033

- Table 7: Global Oil & Gas Upstream Market in Thailand Revenue billion Forecast, by Onshore 2020 & 2033

- Table 8: Global Oil & Gas Upstream Market in Thailand Volume Tonnes Forecast, by Onshore 2020 & 2033

- Table 9: Global Oil & Gas Upstream Market in Thailand Revenue billion Forecast, by Offshore 2020 & 2033

- Table 10: Global Oil & Gas Upstream Market in Thailand Volume Tonnes Forecast, by Offshore 2020 & 2033

- Table 11: Global Oil & Gas Upstream Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Oil & Gas Upstream Market in Thailand Volume Tonnes Forecast, by Country 2020 & 2033

- Table 13: United States Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 15: Canada Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 17: Mexico Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 19: Global Oil & Gas Upstream Market in Thailand Revenue billion Forecast, by Onshore 2020 & 2033

- Table 20: Global Oil & Gas Upstream Market in Thailand Volume Tonnes Forecast, by Onshore 2020 & 2033

- Table 21: Global Oil & Gas Upstream Market in Thailand Revenue billion Forecast, by Offshore 2020 & 2033

- Table 22: Global Oil & Gas Upstream Market in Thailand Volume Tonnes Forecast, by Offshore 2020 & 2033

- Table 23: Global Oil & Gas Upstream Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Oil & Gas Upstream Market in Thailand Volume Tonnes Forecast, by Country 2020 & 2033

- Table 25: Brazil Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Brazil Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 27: Argentina Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Argentina Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 31: Global Oil & Gas Upstream Market in Thailand Revenue billion Forecast, by Onshore 2020 & 2033

- Table 32: Global Oil & Gas Upstream Market in Thailand Volume Tonnes Forecast, by Onshore 2020 & 2033

- Table 33: Global Oil & Gas Upstream Market in Thailand Revenue billion Forecast, by Offshore 2020 & 2033

- Table 34: Global Oil & Gas Upstream Market in Thailand Volume Tonnes Forecast, by Offshore 2020 & 2033

- Table 35: Global Oil & Gas Upstream Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global Oil & Gas Upstream Market in Thailand Volume Tonnes Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 39: Germany Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Germany Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 41: France Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: France Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 43: Italy Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Italy Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 45: Spain Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Spain Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 47: Russia Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Russia Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 49: Benelux Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Benelux Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 51: Nordics Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Nordics Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 55: Global Oil & Gas Upstream Market in Thailand Revenue billion Forecast, by Onshore 2020 & 2033

- Table 56: Global Oil & Gas Upstream Market in Thailand Volume Tonnes Forecast, by Onshore 2020 & 2033

- Table 57: Global Oil & Gas Upstream Market in Thailand Revenue billion Forecast, by Offshore 2020 & 2033

- Table 58: Global Oil & Gas Upstream Market in Thailand Volume Tonnes Forecast, by Offshore 2020 & 2033

- Table 59: Global Oil & Gas Upstream Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global Oil & Gas Upstream Market in Thailand Volume Tonnes Forecast, by Country 2020 & 2033

- Table 61: Turkey Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Turkey Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 63: Israel Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: Israel Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 65: GCC Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: GCC Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 67: North Africa Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: North Africa Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 69: South Africa Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: South Africa Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 73: Global Oil & Gas Upstream Market in Thailand Revenue billion Forecast, by Onshore 2020 & 2033

- Table 74: Global Oil & Gas Upstream Market in Thailand Volume Tonnes Forecast, by Onshore 2020 & 2033

- Table 75: Global Oil & Gas Upstream Market in Thailand Revenue billion Forecast, by Offshore 2020 & 2033

- Table 76: Global Oil & Gas Upstream Market in Thailand Volume Tonnes Forecast, by Offshore 2020 & 2033

- Table 77: Global Oil & Gas Upstream Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 78: Global Oil & Gas Upstream Market in Thailand Volume Tonnes Forecast, by Country 2020 & 2033

- Table 79: China Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: China Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 81: India Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 82: India Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 83: Japan Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 84: Japan Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 85: South Korea Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 86: South Korea Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 89: Oceania Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 90: Oceania Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Oil & Gas Upstream Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Oil & Gas Upstream Market in Thailand Volume (Tonnes) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oil & Gas Upstream Market in Thailand?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the Oil & Gas Upstream Market in Thailand?

Key companies in the market include Exxon Mobil Corporation, PT Pertamina, Chevron Corporation, TotalEnergies SE, Bangchak Corporation Public Company Limited*List Not Exhaustive, Schlumberger Limited, PTT Public Company Limited.

3. What are the main segments of the Oil & Gas Upstream Market in Thailand?

The market segments include Onshore, Offshore.

4. Can you provide details about the market size?

The market size is estimated to be USD 4847.93 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand from Industrial Applications4.; Growing Infrastructure Across the World.

6. What are the notable trends driving market growth?

Offshore Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; A Rise In Concerns Related To Carbon Emissions And A Shift Towards Electric Vehicles And Renewable Sources Of Energy.

8. Can you provide examples of recent developments in the market?

In February 2021, Thailand's state-controlled oil firm, PTT, announced that it was planning an investment of USD 28.3 billion across all its operations for 2021-2025. It focuses on developing the country's natural gas industry while seeking future energy opportunities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oil & Gas Upstream Market in Thailand," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oil & Gas Upstream Market in Thailand report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oil & Gas Upstream Market in Thailand?

To stay informed about further developments, trends, and reports in the Oil & Gas Upstream Market in Thailand, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence