Key Insights

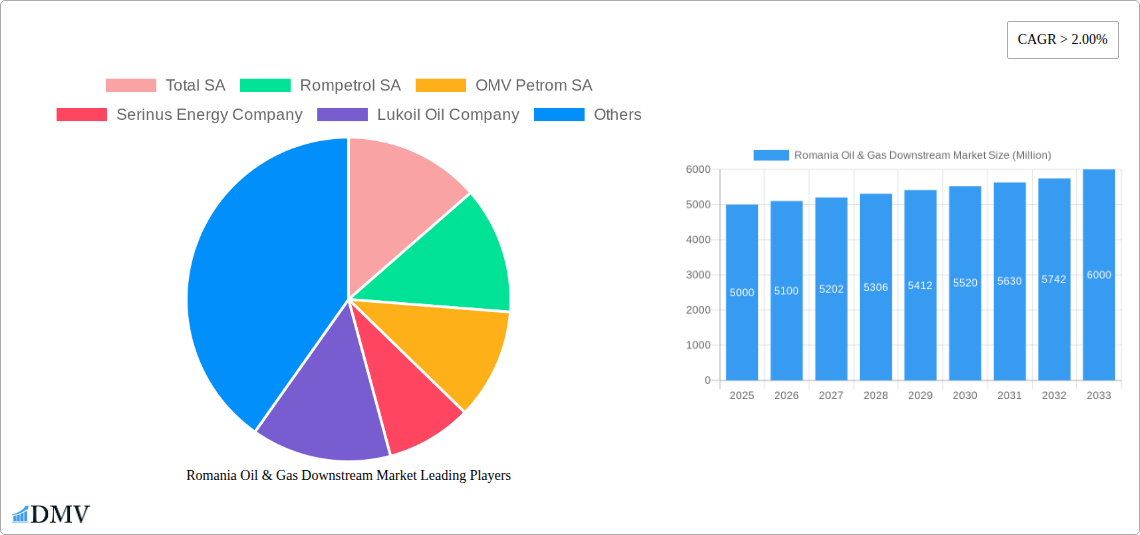

The Romania Oil & Gas Downstream Market exhibits robust growth potential, driven by increasing energy demand from transportation, residential, and industrial sectors. With a current market size (estimated 2025) of approximately $5 billion (assuming a reasonable market size based on regional comparisons and the provided CAGR), and a compound annual growth rate (CAGR) exceeding 2%, the market is projected to reach approximately $6 billion by 2033. This growth is fueled by expanding industrial activities, rising vehicle ownership, and increasing urbanization leading to higher energy consumption in residential and commercial sectors. Key players like Total SA, Rompetrol SA, OMV Petrom SA, Serinus Energy Company, and Lukoil Oil Company are actively shaping the market landscape through strategic investments and operational optimizations.

Romania Oil & Gas Downstream Market Market Size (In Billion)

However, the market faces certain restraints. Fluctuations in global crude oil prices represent a significant challenge, impacting profitability and investment decisions. Government regulations aimed at promoting renewable energy sources and improving environmental sustainability also pose a potential constraint, although they concurrently represent opportunities for companies to diversify into cleaner energy solutions. The market segmentation reveals that transportation fuels dominate the product type segment, closely followed by industrial fuels and heating fuels. The transportation sector is the leading end-user, reflecting the significant role of oil in powering Romania's transportation network. Future growth will likely be influenced by government policies concerning energy transition and infrastructure development, as well as technological advancements in fuel efficiency and renewable energy adoption. The focus for companies will be on adapting to these changes, balancing economic viability with sustainable practices.

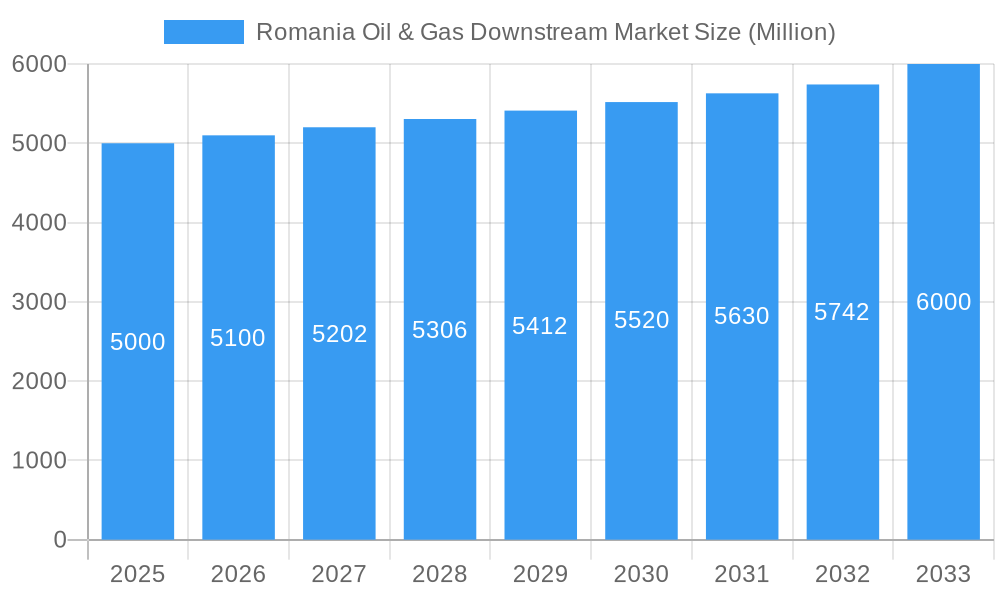

Romania Oil & Gas Downstream Market Company Market Share

Romania Oil & Gas Downstream Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Romania oil & gas downstream market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The report analyzes key segments, including transportation fuels, heating fuels, industrial fuels, and lubricants, across various end-user sectors – transportation, residential & commercial, and industrial. The market's value is projected to reach xx Million by 2033.

Romania Oil & Gas Downstream Market Composition & Trends

This section delves into the competitive landscape of the Romanian oil & gas downstream market, examining market concentration, innovation drivers, regulatory frameworks, and the impact of substitute products. We analyze end-user profiles and the influence of mergers and acquisitions (M&A) activity.

Market Concentration & M&A Activity:

- The market exhibits a moderately concentrated structure, with key players such as OMV Petrom SA, Rompetrol SA, and Lukoil Oil Company holding significant market shares. Preliminary estimates suggest OMV Petrom SA holds approximately 40% market share in 2025, while Rompetrol and Lukoil each control around 25% and 15%, respectively. The remaining share is distributed among smaller players and independent distributors.

- M&A activity has been relatively low in recent years, with deal values totaling approximately xx Million in the period 2019-2024. However, increased consolidation is expected in the coming years driven by market pressures and the need for economies of scale.

Innovation Catalysts & Regulatory Landscape:

The Romanian government's focus on energy security and diversification is driving investment in infrastructure upgrades and the adoption of cleaner fuels. Stringent environmental regulations are also pushing innovation in fuel efficiency and emissions reduction technologies. The substitution of traditional heating fuels with renewable energy sources presents challenges and opportunities, impacting market share of existing players.

End-User Profiles:

The transportation sector dominates the demand for transportation fuels, followed by the industrial sector for industrial fuels and lubricants. The residential and commercial sectors largely consume heating fuels.

Romania Oil & Gas Downstream Market Industry Evolution

This section analyzes the historical and projected growth trajectory of the Romanian oil & gas downstream market, focusing on technological advancements and evolving consumer preferences.

The market experienced a period of moderate growth during 2019-2024, driven primarily by increased vehicle ownership and industrial activity. The COVID-19 pandemic caused a temporary dip in demand, especially in the transportation sector. However, a recovery is anticipated, leading to a projected compound annual growth rate (CAGR) of xx% from 2025 to 2033. This growth will be fueled by increasing urbanization, rising disposable incomes, and continued industrial expansion. Technological advancements in fuel efficiency and renewable energy integration are expected to impact growth rates positively. Consumer demand is shifting towards cleaner fuels, impacting the competitiveness of traditional products. The implementation of stricter emission standards will accelerate the adoption of biofuels and other alternative fuels, representing both a challenge and an opportunity for market players.

Leading Regions, Countries, or Segments in Romania Oil & Gas Downstream Market

The Bucharest region, along with other major urban centers, shows the highest demand in the transportation fuels segment. The industrial sector, concentrated in Transylvania and Moldavia, displays high demand for industrial fuels and lubricants.

Key Drivers by Segment:

- Transportation Fuels: High vehicle ownership rates, rising tourism, and expanding logistics sectors are driving demand. Government investment in highway infrastructure further stimulates growth.

- Heating Fuels: Demand is influenced by weather patterns, household income levels and government subsidies for renewable alternatives.

- Industrial Fuels: Growth is directly linked to industrial output and expansion across various sectors. Government support for energy-efficient technologies moderates the growth rate.

- Lubricants: Demand is tied to industrial and transportation activities, with growth tied to the performance of the latter two segments.

The dominance of transportation fuels stems from Romania's significant reliance on road transport and a growing automotive market. Government policies promoting energy efficiency will affect the relative growth of each fuel segment.

Romania Oil & Gas Downstream Market Product Innovations

Recent innovations include the introduction of higher-octane gasoline and diesel formulations that improve engine performance and reduce emissions. Advances in lubricant technology focus on enhanced durability and fuel economy. The adoption of biofuels is also increasing to meet environmental regulations. The development of innovative fuel additives that improve efficiency and reduce harmful emissions is attracting substantial attention from researchers. Companies are focused on delivering enhanced fuel efficiency and reduced environmental impact as key differentiators.

Propelling Factors for Romania Oil & Gas Downstream Market Growth

Several factors propel growth, including rising disposable incomes fueling increased vehicle ownership, industrial expansion driving demand for industrial fuels and lubricants, and government support for infrastructure development. Increasing investments in renewable energy are also impacting the market positively.

Obstacles in the Romania Oil & Gas Downstream Market Market

Challenges include fluctuating oil prices impacting profitability and potentially limiting investments, supply chain vulnerabilities to geopolitical instability, and intense competition amongst major players. Stringent environmental regulations create compliance costs and potentially limit production of certain products. The introduction of stringent fuel quality standards adds operational challenges.

Future Opportunities in Romania Oil & Gas Downstream Market

Future opportunities lie in expanding into renewable energy sources, increased adoption of biofuels to meet emission standards, and supplying fuel for expanding transport corridors. The development of innovative technologies such as electric vehicles will present both threats and opportunities.

Major Players in the Romania Oil & Gas Downstream Market Ecosystem

- Total SA

- Rompetrol SA

- OMV Petrom SA

- Serinus Energy Company

- Lukoil Oil Company

Key Developments in Romania Oil & Gas Downstream Market Industry

- 2022 Q3: OMV Petrom announced investments in upgrading its refineries to process biofuels.

- 2023 Q1: New regulations on fuel quality came into effect.

- 2024 Q2: Rompetrol launched a new line of high-performance lubricants. (Further details on specific developments with quantified impact could be added here)

Strategic Romania Oil & Gas Downstream Market Market Forecast

The Romanian oil & gas downstream market is poised for continued growth driven by economic expansion, infrastructure development, and evolving consumer preferences. While challenges exist, the adoption of cleaner fuels and technological advancements will shape future market dynamics. The focus on sustainable practices presents both obstacles and significant opportunities. The market is anticipated to experience significant growth driven by factors highlighted above.

Romania Oil & Gas Downstream Market Segmentation

-

1. Refineries

- 1.1. Market Overview

- 1.2. Key Projects Information

-

2. Petrochemical Plants

- 2.1. Market Overview

- 2.2. Key Projects Information

Romania Oil & Gas Downstream Market Segmentation By Geography

- 1. Romania

Romania Oil & Gas Downstream Market Regional Market Share

Geographic Coverage of Romania Oil & Gas Downstream Market

Romania Oil & Gas Downstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Demand for Renewable Energy4.; Decreasing Cost per Kilowatt of Electricity Generated Through Wind Energy Sources

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Installation of Other Renewable Sources Such as Solar Energy

- 3.4. Market Trends

- 3.4.1. Petrochemical Sector is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Romania Oil & Gas Downstream Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 5.1.1. Market Overview

- 5.1.2. Key Projects Information

- 5.2. Market Analysis, Insights and Forecast - by Petrochemical Plants

- 5.2.1. Market Overview

- 5.2.2. Key Projects Information

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Romania

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Total SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rompetrol SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 OMV Petrom SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Serinus Energy Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lukoil Oil Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Total SA

List of Figures

- Figure 1: Romania Oil & Gas Downstream Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Romania Oil & Gas Downstream Market Share (%) by Company 2025

List of Tables

- Table 1: Romania Oil & Gas Downstream Market Revenue undefined Forecast, by Refineries 2020 & 2033

- Table 2: Romania Oil & Gas Downstream Market Volume Million Forecast, by Refineries 2020 & 2033

- Table 3: Romania Oil & Gas Downstream Market Revenue undefined Forecast, by Petrochemical Plants 2020 & 2033

- Table 4: Romania Oil & Gas Downstream Market Volume Million Forecast, by Petrochemical Plants 2020 & 2033

- Table 5: Romania Oil & Gas Downstream Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Romania Oil & Gas Downstream Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Romania Oil & Gas Downstream Market Revenue undefined Forecast, by Refineries 2020 & 2033

- Table 8: Romania Oil & Gas Downstream Market Volume Million Forecast, by Refineries 2020 & 2033

- Table 9: Romania Oil & Gas Downstream Market Revenue undefined Forecast, by Petrochemical Plants 2020 & 2033

- Table 10: Romania Oil & Gas Downstream Market Volume Million Forecast, by Petrochemical Plants 2020 & 2033

- Table 11: Romania Oil & Gas Downstream Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Romania Oil & Gas Downstream Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Romania Oil & Gas Downstream Market?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Romania Oil & Gas Downstream Market?

Key companies in the market include Total SA, Rompetrol SA, OMV Petrom SA, Serinus Energy Company, Lukoil Oil Company.

3. What are the main segments of the Romania Oil & Gas Downstream Market?

The market segments include Refineries, Petrochemical Plants.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Demand for Renewable Energy4.; Decreasing Cost per Kilowatt of Electricity Generated Through Wind Energy Sources.

6. What are the notable trends driving market growth?

Petrochemical Sector is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Installation of Other Renewable Sources Such as Solar Energy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Romania Oil & Gas Downstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Romania Oil & Gas Downstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Romania Oil & Gas Downstream Market?

To stay informed about further developments, trends, and reports in the Romania Oil & Gas Downstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence