Key Insights

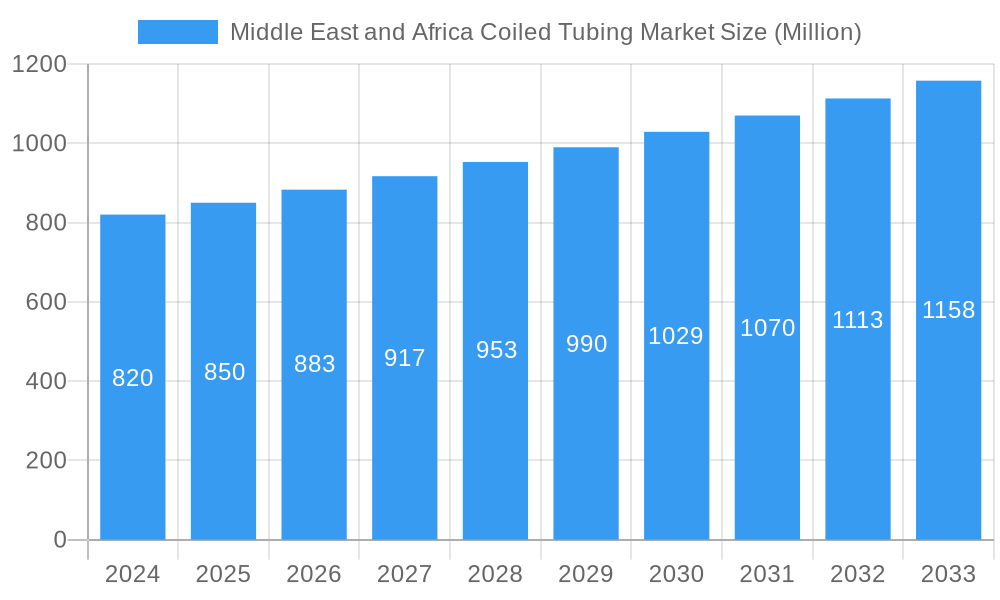

The Middle East and Africa (MEA) coiled tubing market is projected for substantial growth, reaching a market size of $850 million by 2025, with a Compound Annual Growth Rate (CAGR) of 7.2% through 2033. This expansion is driven by heightened upstream oil and gas activities, fueled by sustained energy demand. Key factors include new reserve exploration, enhanced oil recovery (EOR) in mature fields, and ongoing well maintenance. The drilling segment is expected to dominate, followed by well intervention and completion services, where coiled tubing offers efficiency and cost-effectiveness.

Middle East and Africa Coiled Tubing Market Market Size (In Billion)

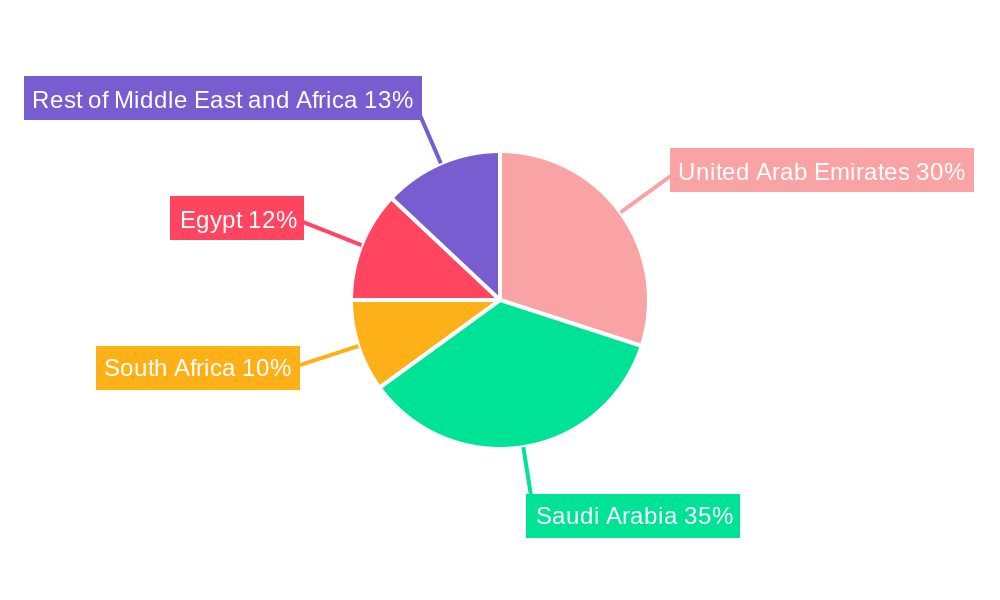

The market is witnessing significant investments in technology and infrastructure to boost operational efficiency and safety. Trends include adopting advanced coiled tubing for challenging environments and integrating real-time data analytics. Restraints include fluctuating oil prices impacting capital expenditure and increasing environmental scrutiny. The United Arab Emirates and Saudi Arabia are anticipated to lead, supported by extensive reserves and investments. South Africa and Egypt, along with other MEA nations, are also expected to see steady growth. Major players like Schlumberger, Halliburton, and Baker Hughes are active in the region.

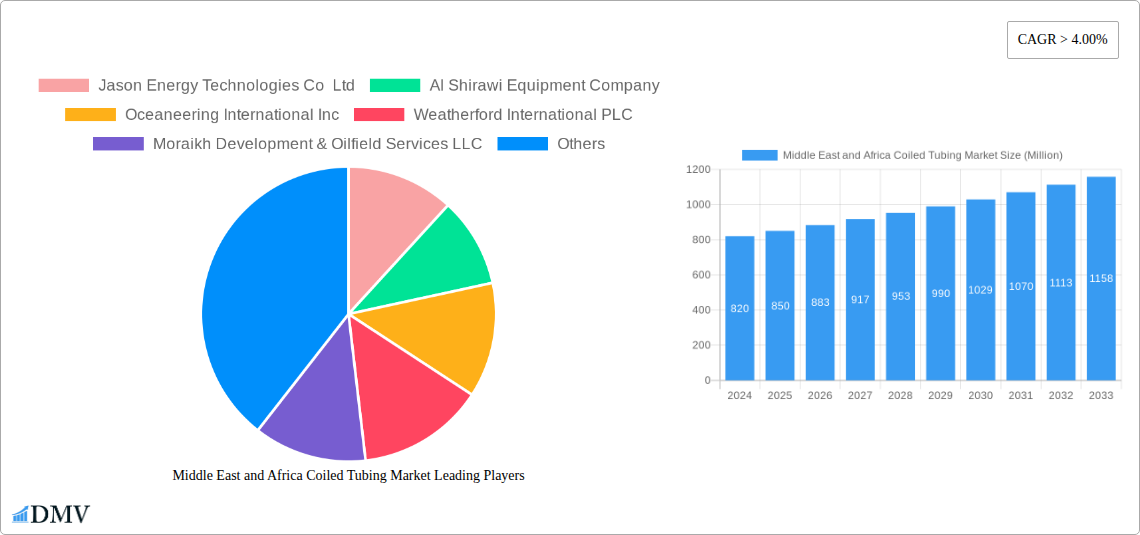

Middle East and Africa Coiled Tubing Market Company Market Share

This report provides a critical analysis of the MEA Coiled Tubing market, offering insights into its current state and future outlook. Our analysis covers 2019–2033, with a specific focus on the base year 2025 and the forecast period 2025–2033, building on historical data from 2019–2024.

Middle East and Africa Coiled Tubing Market Market Composition & Trends

The MEA coiled tubing market is characterized by a moderately consolidated structure, with a few major players dominating a significant portion of the market share. Innovation is primarily driven by advancements in coiled tubing technology to enhance operational efficiency, reduce well intervention costs, and improve safety standards in challenging geological formations prevalent across the region. Regulatory frameworks, particularly concerning environmental standards and operational safety, are evolving, influencing service provider strategies. Substitute products, while present in certain applications, are largely unable to match the versatility and cost-effectiveness of coiled tubing for complex interventions. End-user profiles range from national oil companies (NOCs) with extensive production and exploration activities to independent exploration and production (E&P) companies. Mergers and acquisitions (M&A) activity is a notable trend, with companies strategically consolidating their offerings and expanding their geographical reach to capture market share. M&A deal values are substantial, reflecting the strategic importance of securing integrated service capabilities. The market share distribution is heavily influenced by the presence of major international oilfield service providers alongside strong regional players.

Middle East and Africa Coiled Tubing Market Industry Evolution

The Middle East and Africa coiled tubing market has undergone significant evolution, driven by a confluence of factors including surging oil and gas demand, technological innovation, and strategic investments in upstream activities. The historical period (2019–2024) witnessed a steady increase in demand for coiled tubing services, primarily fueled by the need for efficient well intervention, completion, and drilling operations in both mature and exploration fields across key MEA nations. Growth rates during this period were robust, averaging approximately 5-7% annually, as operators increasingly adopted coiled tubing solutions over conventional methods for their enhanced operational speed, reduced personnel exposure, and cost savings. Technological advancements have been a cornerstone of this evolution. Innovations such as high-strength coiled tubing, advanced downhole tools, and real-time data acquisition systems have enabled operators to perform more complex operations, including deep well interventions, hydraulic fracturing, and horizontal drilling in increasingly challenging environments. The adoption metrics for these advanced technologies have been steadily rising, with a significant percentage of new coiled tubing units being equipped with the latest technological enhancements.

Shifting consumer demands have also played a crucial role. As oil prices fluctuate, the emphasis on cost optimization and operational efficiency has intensified. Coiled tubing's ability to perform multiple operations in a single trip, its reduced footprint, and its lower logistical requirements have made it an attractive proposition for operators seeking to maximize their return on investment. Furthermore, the growing focus on enhanced oil recovery (EOR) techniques and the development of unconventional reserves have opened new avenues for coiled tubing applications, leading to sustained market growth. The geopolitical landscape and the strategic importance of energy security in the MEA region have further bolstered investments in the oil and gas sector, thereby creating a conducive environment for the sustained expansion of the coiled tubing market. The integration of digital technologies, such as AI and machine learning for predictive maintenance and operational optimization, is also beginning to shape the future evolution of the market, promising further gains in efficiency and safety.

Leading Regions, Countries, or Segments in Middle East and Africa Coiled Tubing Market

Within the Middle East and Africa coiled tubing market, Saudi Arabia and the United Arab Emirates emerge as dominant geographical players, showcasing exceptional growth and demand for coiled tubing services. This dominance is underpinned by substantial ongoing investments in exploration and production activities by national oil companies and a proactive approach to optimizing existing hydrocarbon reserves. The United Arab Emirates stands out as a key market, driven by its strategic position as a global energy hub and its commitment to expanding production capacity. Major projects and the continuous need for well maintenance and enhancement fuel a consistent demand for coiled tubing services across onshore and offshore deployments.

- Saudi Arabia: As the world's largest oil exporter, Saudi Arabia's commitment to its Vision 2030, which includes significant downstream and upstream expansions, propels the demand for advanced coiled tubing solutions. The country's vast oil fields require continuous intervention, completion, and drilling operations, making coiled tubing an indispensable tool. The significant ongoing projects and future exploration initiatives contribute to a substantial market share. Investment trends are consistently high, with national oil companies like Saudi Aramco investing billions in expanding their production capabilities. Regulatory support for oilfield services is strong, encouraging technological adoption.

- United Arab Emirates: The UAE's diversified energy strategy, coupled with its role as a major producer, ensures a robust market for coiled tubing. The focus on maximizing recovery from mature fields and exploring new offshore reserves creates sustained demand. High levels of investment in infrastructure and technology by entities like ADNOC are key drivers. The regulatory environment is conducive to technological advancements and service provision.

- Egypt: Egypt's growing energy sector, with its significant offshore gas discoveries, presents a rapidly expanding market for coiled tubing. The need for efficient well intervention and completion in these new fields is driving demand. Investment in gas exploration and production is a primary growth catalyst.

- South Africa: While a smaller market compared to the Middle Eastern giants, South Africa's nascent but growing oil and gas exploration activities, particularly in offshore blocks, offer emerging opportunities for coiled tubing services. Government initiatives to boost the energy sector and attract foreign investment are key drivers.

Analyzing by Application, Well Intervention consistently represents the largest segment within the MEA coiled tubing market. This is attributed to the extensive need for maintaining and optimizing production from aging fields, addressing well integrity issues, and performing various remedial operations. The application of coiled tubing in drilling and completion activities is also significant, especially in unconventional plays and complex well designs, contributing to its substantial market share. The choice between onshore and offshore deployment is largely dictated by the geographical distribution of hydrocarbon reserves, with both segments experiencing robust demand. Offshore operations, while often more complex and costly, are critical for accessing vast reserves in the MEA region, thus driving significant coiled tubing utilization.

Middle East and Africa Coiled Tubing Market Product Innovations

Product innovations in the MEA coiled tubing market are geared towards enhancing efficiency, safety, and cost-effectiveness in challenging operating environments. Advanced coiled tubing materials offering superior tensile strength and corrosion resistance are being developed, allowing for deeper and more demanding well interventions. Integrated downhole tools and advanced deployment systems, enabling real-time data acquisition and diagnostics, are also key areas of innovation. These advancements facilitate precise control and quicker decision-making during operations, leading to reduced downtime and improved well productivity. Unique selling propositions lie in the development of solutions for high-pressure, high-temperature wells and the integration of digital technologies for remote monitoring and predictive analytics, offering operators unparalleled operational intelligence and control.

Propelling Factors for Middle East and Africa Coiled Tubing Market Growth

The Middle East and Africa coiled tubing market is propelled by several key factors. Firstly, the region's vast and largely untapped hydrocarbon reserves necessitate sophisticated well intervention and completion techniques, for which coiled tubing is ideally suited. Secondly, the increasing focus on maximizing production from mature fields and optimizing recovery rates from existing assets drives demand for efficient and cost-effective solutions. Technological advancements in coiled tubing equipment and downhole tools further enhance their applicability in complex operations. Furthermore, favorable government policies and significant investments by national oil companies in the energy sector provide a stable and supportive environment for market expansion.

Obstacles in the Middle East and Africa Coiled Tubing Market Market

Despite robust growth prospects, the MEA coiled tubing market faces several obstacles. Volatile oil prices can lead to reduced capital expenditure by exploration and production companies, directly impacting demand for coiled tubing services. Intense competition among service providers can put pressure on pricing and margins. Geopolitical instability and regulatory uncertainties in certain parts of the region can also pose challenges. Furthermore, the scarcity of skilled personnel and the need for specialized training can create operational bottlenecks and impact the timely execution of projects, potentially increasing project costs. Supply chain disruptions, particularly for specialized equipment and components, can also hinder market growth.

Future Opportunities in Middle East and Africa Coiled Tubing Market

Future opportunities in the MEA coiled tubing market are significant and diverse. The growing demand for natural gas, particularly in Africa, presents a substantial avenue for expansion, as coiled tubing plays a crucial role in well completion and intervention for gas wells. The development of unconventional resources, though nascent in some MEA countries, offers long-term potential for coiled tubing applications. Advancements in digitalization and automation are creating opportunities for remote operations and data-driven optimization, leading to enhanced efficiency and safety. Emerging markets within the MEA region, with increasing E&P activities, also represent untapped potential for coiled tubing service providers.

Major Players in the Middle East and Africa Coiled Tubing Market Ecosystem

- Jason Energy Technologies Co Ltd

- Al Shirawi Equipment Company

- Oceaneering International Inc

- Weatherford International PLC

- Moraikh Development & Oilfield Services LLC

- Baker Hughes Company

- Halliburton Company

- UniArab Engineering & Oilfield Services

- Schlumberger Limited

- Emirates Western Oil Well Drilling & Maint Co LLC

Key Developments in Middle East and Africa Coiled Tubing Market Industry

- March 2022: The National Energy Services Reunited Corporation (NESR) secured a major contract for cementing services from the Abu Dhabi National Oil Company (ADNOC). This award, part of framework agreements valued at USD 658 million, includes a significant scope for NESR's cementing services for up to seven years, encompassing coiled tubing and other production services.

- February 2022: TAQA Well Services LLC signed a substantial Integrated Fracturing service contract, valued at over SAR billion (USD 266 million) in Saudi Arabia. The contract scope encompasses fracturing, perforations, well testing, and coiled tubing services, highlighting the integrated nature of service offerings in the region.

Strategic Middle East and Africa Coiled Tubing Market Market Forecast

The MEA coiled tubing market is projected for sustained growth, driven by the region's critical role in global energy supply and the ongoing need for efficient hydrocarbon extraction. Key growth catalysts include substantial investments in upstream projects, the adoption of advanced technologies to optimize production from mature fields, and the increasing exploration of new energy resources. The market is expected to benefit from the growing demand for natural gas and the potential development of unconventional reserves. Strategic partnerships, technological innovation, and a focus on cost-effective solutions will be crucial for service providers to capitalize on future opportunities and navigate market complexities. The forecast indicates a compound annual growth rate (CAGR) of approximately 6-8% during the forecast period.

Middle East and Africa Coiled Tubing Market Segmentation

-

1. Application

- 1.1. Drilling

- 1.2. Completion

- 1.3. Well Intervention

-

2. Location of Deployment

- 2.1. Onshore

- 2.2. Offshore

-

3. Geography

- 3.1. United Arab Emirates

- 3.2. Saudi Arabia

- 3.3. South Africa

- 3.4. Egypt

- 3.5. Rest of Middle East and Africa

Middle East and Africa Coiled Tubing Market Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. South Africa

- 4. Egypt

- 5. Rest of Middle East and Africa

Middle East and Africa Coiled Tubing Market Regional Market Share

Geographic Coverage of Middle East and Africa Coiled Tubing Market

Middle East and Africa Coiled Tubing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Emphasis on Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Well Intervention Application Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Coiled Tubing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Drilling

- 5.1.2. Completion

- 5.1.3. Well Intervention

- 5.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. South Africa

- 5.3.4. Egypt

- 5.3.5. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.4.2. Saudi Arabia

- 5.4.3. South Africa

- 5.4.4. Egypt

- 5.4.5. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. United Arab Emirates Middle East and Africa Coiled Tubing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Drilling

- 6.1.2. Completion

- 6.1.3. Well Intervention

- 6.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.2.1. Onshore

- 6.2.2. Offshore

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United Arab Emirates

- 6.3.2. Saudi Arabia

- 6.3.3. South Africa

- 6.3.4. Egypt

- 6.3.5. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Saudi Arabia Middle East and Africa Coiled Tubing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Drilling

- 7.1.2. Completion

- 7.1.3. Well Intervention

- 7.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.2.1. Onshore

- 7.2.2. Offshore

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United Arab Emirates

- 7.3.2. Saudi Arabia

- 7.3.3. South Africa

- 7.3.4. Egypt

- 7.3.5. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. South Africa Middle East and Africa Coiled Tubing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Drilling

- 8.1.2. Completion

- 8.1.3. Well Intervention

- 8.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.2.1. Onshore

- 8.2.2. Offshore

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United Arab Emirates

- 8.3.2. Saudi Arabia

- 8.3.3. South Africa

- 8.3.4. Egypt

- 8.3.5. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Egypt Middle East and Africa Coiled Tubing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Drilling

- 9.1.2. Completion

- 9.1.3. Well Intervention

- 9.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.2.1. Onshore

- 9.2.2. Offshore

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United Arab Emirates

- 9.3.2. Saudi Arabia

- 9.3.3. South Africa

- 9.3.4. Egypt

- 9.3.5. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Rest of Middle East and Africa Middle East and Africa Coiled Tubing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Drilling

- 10.1.2. Completion

- 10.1.3. Well Intervention

- 10.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 10.2.1. Onshore

- 10.2.2. Offshore

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. United Arab Emirates

- 10.3.2. Saudi Arabia

- 10.3.3. South Africa

- 10.3.4. Egypt

- 10.3.5. Rest of Middle East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Jason Energy Technologies Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Al Shirawi Equipment Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Oceaneering International Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Weatherford International PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Moraikh Development & Oilfield Services LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Baker Hughes Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Halliburton Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 UniArab Engineering & Oilfield Services

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Schlumberger Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Emirates Western Oil Well Drilling & Maint Co LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Jason Energy Technologies Co Ltd

List of Figures

- Figure 1: Middle East and Africa Coiled Tubing Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Coiled Tubing Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 3: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 7: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 11: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 15: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 19: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 23: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Middle East and Africa Coiled Tubing Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Coiled Tubing Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Middle East and Africa Coiled Tubing Market?

Key companies in the market include Jason Energy Technologies Co Ltd, Al Shirawi Equipment Company, Oceaneering International Inc, Weatherford International PLC, Moraikh Development & Oilfield Services LLC, Baker Hughes Company, Halliburton Company, UniArab Engineering & Oilfield Services, Schlumberger Limited, Emirates Western Oil Well Drilling & Maint Co LLC.

3. What are the main segments of the Middle East and Africa Coiled Tubing Market?

The market segments include Application, Location of Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.66 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives.

6. What are the notable trends driving market growth?

Well Intervention Application Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Emphasis on Electric Vehicles.

8. Can you provide examples of recent developments in the market?

March 2022: The National Energy Services Reunited Corporation (NESR) was awarded one of the major contracts for cementing services by the Abu Dhabi National Oil Company (ADNOC). The award of framework agreements to five oilfield service providers was valued at USD 658 million, a vital portion of which includes NESR's scope for cementing services for up to seven years. NESR provides production services such as hydraulic fracturing, cementing, coiled tubing, filtration, completions, stimulation, pumping, and nitrogen services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Coiled Tubing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Coiled Tubing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Coiled Tubing Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Coiled Tubing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence