Key Insights

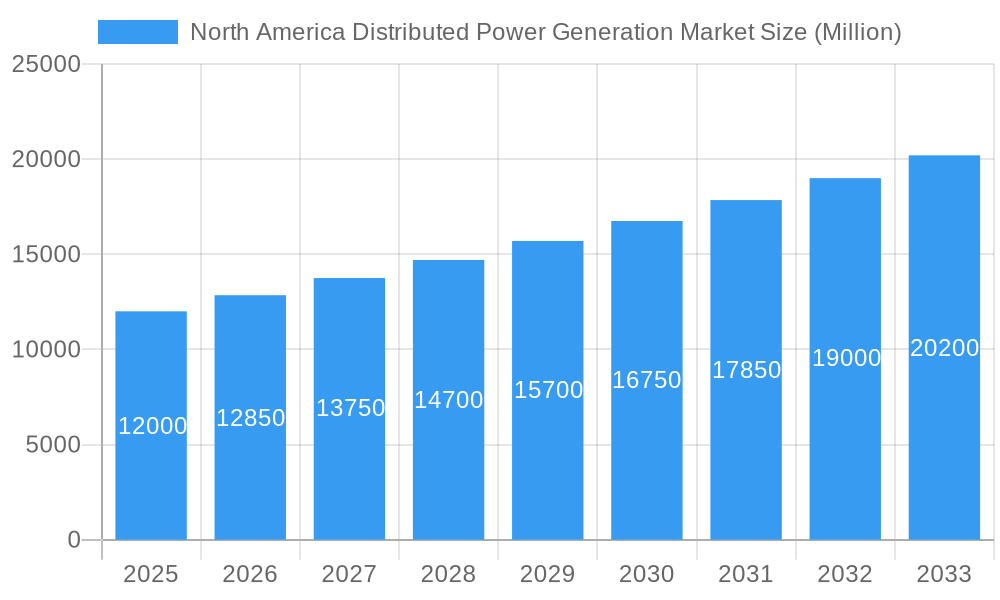

The North America Distributed Power Generation Market is projected for substantial growth, expected to reach approximately $538.2 billion by 2033, driven by a Compound Annual Growth Rate (CAGR) of over 7.00% from a base year of 2025. This expansion is fueled by the increasing demand for reliable energy infrastructure, energy independence initiatives across residential, commercial, and industrial sectors, and supportive government policies promoting renewable energy. Key growth catalysts include the necessity for backup power solutions, the cost-effectiveness of distributed generation, and advancements in solar PV, wind energy, combined heat and power (CHP), and fuel cell technologies.

North America Distributed Power Generation Market Market Size (In Billion)

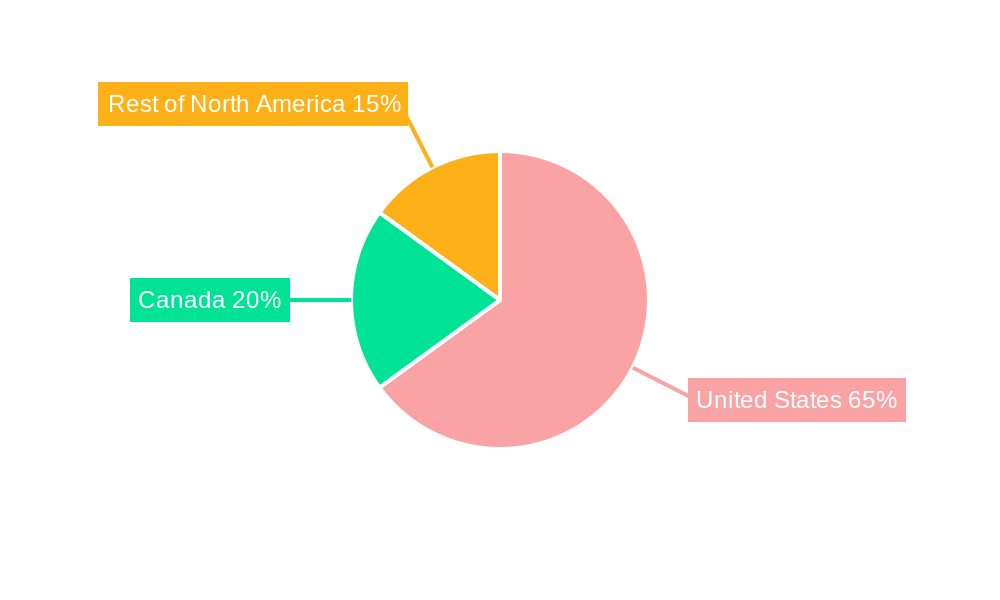

The market segmentation reveals a strong performance in Solar PV and Wind technologies due to cost reductions and efficiency improvements. CHP systems are gaining traction for their dual energy benefits, particularly in commercial and industrial applications. Emerging "Other Technologies" are poised for growth contingent on R&D and regulatory support. Geographically, the United States leads market expansion, influenced by its energy demands and renewable energy targets. Canada and other North American regions also contribute significantly, with growth shaped by local resources and policies. Leading companies such as Siemens AG, Cummins Inc., and Schneider Electric SE are key innovators in this evolving market.

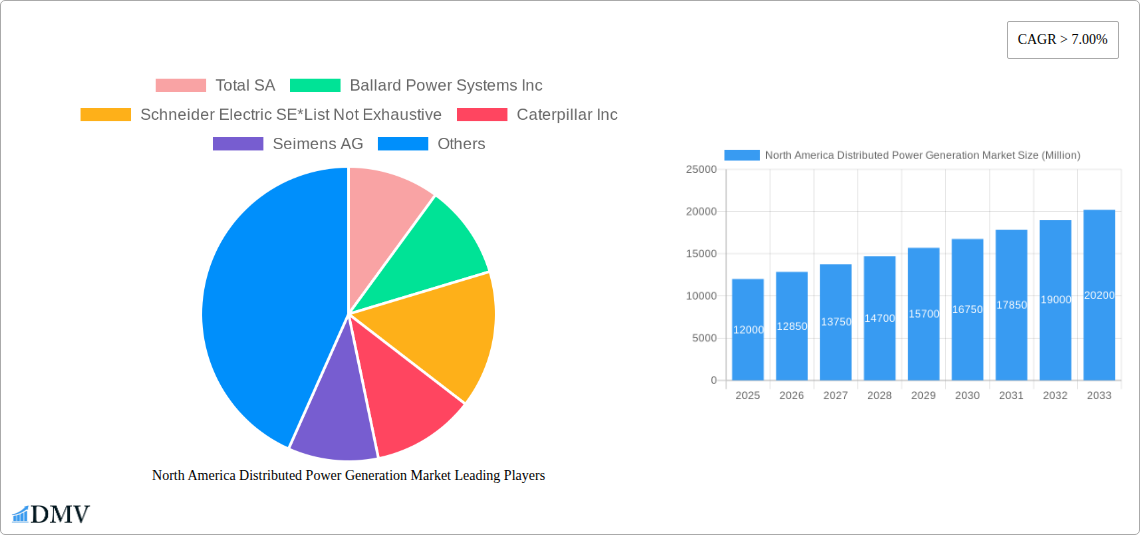

North America Distributed Power Generation Market Company Market Share

Gain strategic insights into the North America Distributed Power Generation Market. This report offers a comprehensive analysis from 2019 to 2033, with a focus on the forecast period of 2025–2033 and historical data from 2019–2024. Analyze market dynamics driven by solar PV, wind power, combined heat and power (CHP), and emerging distributed power technologies. Understand market trends across the United States, Canada, and the Rest of North America to capitalize on opportunities in the decentralized energy sector.

North America Distributed Power Generation Market Market Composition & Trends

The North America distributed power generation market exhibits a moderate to high concentration, with key players such as Schneider Electric SE, Siemens AG, Cummins Inc., and Caterpillar Inc. dominating specific technology segments and regional markets. Innovation remains a significant catalyst, primarily driven by advancements in solar PV efficiency, wind turbine scalability, and the increasing integration of energy storage solutions. The regulatory landscape is continuously evolving, with supportive policies for renewable energy adoption and grid modernization playing a crucial role. While substitute products like centralized power plants exist, the agility, resilience, and cost-effectiveness of distributed generation are increasingly favored. End-user profiles range from residential consumers seeking energy independence and cost savings to commercial entities aiming to reduce operational expenses and enhance sustainability, and industrial players requiring reliable backup power. Mergers and acquisitions (M&A) activities are prevalent, with strategic consolidations aimed at expanding technological portfolios, market reach, and operational efficiencies. For instance, recent years have seen significant deal values in the acquisition of smaller solar PV installers and energy storage companies. The market share distribution is heavily influenced by the dominance of solar PV and wind technologies, particularly in regions with abundant natural resources and favorable policy frameworks.

North America Distributed Power Generation Market Industry Evolution

The North America distributed power generation market has witnessed a profound evolution over the historical period (2019–2024) and is poised for accelerated growth through the forecast period (2025–2033). This transformative journey is characterized by a robust market growth trajectory, fueled by a confluence of technological breakthroughs, shifting consumer demands, and supportive governmental policies. The adoption of solar PV technology has been particularly remarkable, driven by declining manufacturing costs, increasing panel efficiencies, and the widespread availability of incentives. The United States has been a frontrunner, with significant investments in large-scale solar farms and a booming residential rooftop solar market. Similarly, wind power has established a strong foothold, with advancements in turbine technology enabling higher energy yields and improved reliability, especially in regions like the Canadian Prairies and the US Midwest. Combined Heat and Power (CHP) systems are gaining traction for their energy efficiency benefits in commercial and industrial applications, offering simultaneous electricity and heat generation, thereby reducing overall energy consumption and operational costs. The market has also seen the rise of other technologies, including fuel cells and microturbines, catering to niche applications requiring high reliability and specific emission profiles. Consumer demand has shifted significantly towards sustainable energy solutions, driven by growing environmental consciousness and a desire for greater control over energy expenditure. This has led to an increased uptake of distributed generation systems that offer long-term cost savings and reduced carbon footprints. Regulatory frameworks have been instrumental in shaping this evolution. Tax credits, renewable portfolio standards, and net metering policies have incentivized the deployment of distributed generation assets, making them economically viable for a wider range of end-users. The integration of smart grid technologies and energy storage solutions has further enhanced the value proposition of distributed power, enabling greater grid stability, demand response capabilities, and improved energy management. The market growth rate, estimated to be in the high single digits annually, is projected to continue its upward trend as these factors intensify.

Leading Regions, Countries, or Segments in North America Distributed Power Generation Market

The United States unequivocally stands as the dominant force in the North America distributed power generation market, owing to a compelling combination of robust policy support, substantial investment trends, and a mature technological ecosystem. Within the Technology segment, Solar PV emerges as the leading contributor to market value and installation capacity. Its dominance is fueled by continuous technological advancements, including higher efficiency panels and cost reductions in manufacturing, making it an increasingly attractive option for residential, commercial, and utility-scale projects. The United States benefits from a diverse range of solar resources across its vast geography, further enhancing the viability of solar installations.

- United States:

- Key Drivers: Federal Investment Tax Credit (ITC) for solar, State-level Renewable Portfolio Standards (RPS), net metering policies, and a significant increase in corporate power purchase agreements (PPAs) for solar energy. The presence of major solar manufacturers and a well-established installation network also contributes to its leadership.

- Dominance Factors: The sheer scale of the US economy and energy demand, coupled with aggressive decarbonization targets and a proactive approach to adopting renewable energy technologies, positions it as the undisputed leader.

- Solar PV:

- Key Drivers: Declining levelized cost of electricity (LCOE), advancements in module efficiency (e.g., bifacial panels, PERC technology), integration with battery storage systems for enhanced grid reliability and energy independence, and supportive federal and state incentives.

- Dominance Factors: Its modularity, scalability, and adaptability to various installation environments (rooftop, ground-mounted) make it a versatile solution across all end-user segments.

- Rest of North America (excluding Canada): This segment, while smaller than the US, is characterized by emerging markets with growing potential, particularly in certain states and provinces not directly captured by the leading categories, exhibiting localized growth drivers and policy initiatives.

While Wind Power holds significant potential and contributes substantially, particularly in specific regions of the United States and Canada, Solar PV's widespread applicability and rapid cost reduction have solidified its leading position in terms of installed capacity and market value across the continent. CHP systems demonstrate steady growth within industrial and commercial sectors seeking optimized energy efficiency, while Other Technologies, such as fuel cells, are carving out specialized niches.

North America Distributed Power Generation Market Product Innovations

Product innovations in the North America distributed power generation market are rapidly enhancing efficiency and cost-effectiveness. Advanced Solar PV modules, like LONGi's Hi-MO 5 series, offer higher energy yields and improved performance in various weather conditions, making them ideal for both residential and commercial applications. Fuel cell technology is seeing advancements in durability and power density, with companies like Ballard Power Systems Inc. and Toshiba Fuel Cell Power Systems Corporation driving innovation for stationary power applications and backup solutions. Microgrid controllers and smart inverters are integrating seamlessly with distributed generation assets, enabling sophisticated energy management, grid stabilization, and the seamless integration of diverse energy sources. These innovations are critical for unlocking the full potential of distributed energy resources.

Propelling Factors for North America Distributed Power Generation Market Growth

Several key factors are propelling the growth of the North America distributed power generation market. Technological advancements, particularly in solar panel efficiency and wind turbine technology, are continuously driving down costs and improving performance. Economic drivers, such as volatile fossil fuel prices and the desire for energy cost predictability, are making distributed generation increasingly attractive. Regulatory support, including tax credits, rebates, and renewable energy mandates, plays a pivotal role in incentivizing adoption. Furthermore, growing environmental consciousness and the demand for sustainable energy solutions are significant motivators for consumers and businesses alike. The increasing focus on grid resilience and energy independence in the face of climate change and extreme weather events also fuels the demand for distributed power.

Obstacles in the North America Distributed Power Generation Market Market

Despite robust growth, the North America distributed power generation market faces several obstacles. Regulatory complexities and inconsistencies across different jurisdictions can create challenges for project development and deployment. Grid interconnection hurdles and the need for substantial grid modernization to accommodate high levels of distributed generation can lead to delays and increased costs. Supply chain disruptions for critical components, particularly solar panels and battery storage systems, can impact project timelines and pricing. Intermittency of renewable sources like solar and wind requires effective integration with energy storage solutions, which can add to the upfront cost. Finally, public perception and awareness regarding the benefits and reliability of distributed power still need further enhancement in certain segments.

Future Opportunities in North America Distributed Power Generation Market

The North America distributed power generation market presents numerous future opportunities. The increasing integration of energy storage systems with distributed generation is a prime area for growth, enhancing grid stability and offering peak shaving capabilities. The expansion of microgrid development for critical infrastructure and remote communities offers significant potential for reliable and resilient power solutions. Growing demand for electric vehicle (EV) charging infrastructure powered by distributed renewable sources presents a synergistic opportunity. Furthermore, the development of smart home energy management systems that optimize the use of distributed generation and storage will drive adoption in the residential sector. Innovation in green hydrogen production using renewable energy for distributed applications also holds substantial long-term promise.

Major Players in the North America Distributed Power Generation Market Ecosystem

- Total SA

- Ballard Power Systems Inc.

- Schneider Electric SE

- Caterpillar Inc.

- Siemens AG

- Cummins Inc.

- Sunrun Inc.

- Toshiba Fuel Cell Power Systems Corporation

- Capstone Turbine Corporation

Key Developments in North America Distributed Power Generation Market Industry

- October 2022: LONGi, a leading solar technology company, announced its plan to expand its presence in Canada. As part of the expansion, the company is introducing its flagship distributed solar module, the Hi-MO 5 54-cell module, to the Canadian residential and commercial sector.

- May 2022: Hanwha Q Cells announced its plans to build a 1.4 GW solar panel factory in the United States. The company also plans to invest USD 320 million in the expansion plan, of which USD 170 million will be devoted to constructing a 1.4 GW factory in the United States.

Strategic North America Distributed Power Generation Market Market Forecast

The strategic North America distributed power generation market forecast indicates sustained and robust growth driven by an accelerating transition towards decarbonization and energy independence. Key growth catalysts include ongoing improvements in solar PV and wind power technologies, leading to further cost reductions and enhanced efficiency. The increasing adoption of energy storage solutions will be instrumental in overcoming the intermittency challenges of renewable sources, thereby boosting the reliability and value proposition of distributed generation. Supportive government policies, such as federal incentives and state-level mandates, will continue to incentivize investments. Furthermore, growing consumer and corporate demand for sustainable energy, coupled with the desire for greater energy resilience, will fuel market expansion. The integration of smart grid technologies and the emergence of innovative business models will further unlock market potential. Overall, the outlook for the North America distributed power generation market remains exceptionally positive, positioning it as a cornerstone of the future energy landscape.

North America Distributed Power Generation Market Segmentation

-

1. Technology

- 1.1. Solar PV

- 1.2. Wind

- 1.3. Combined Heat and Power (CHP)

- 1.4. Other Technologies

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America Distributed Power Generation Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Distributed Power Generation Market Regional Market Share

Geographic Coverage of North America Distributed Power Generation Market

North America Distributed Power Generation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Solar Panel Costs4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Solar PV Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Distributed Power Generation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Solar PV

- 5.1.2. Wind

- 5.1.3. Combined Heat and Power (CHP)

- 5.1.4. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. United States North America Distributed Power Generation Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Solar PV

- 6.1.2. Wind

- 6.1.3. Combined Heat and Power (CHP)

- 6.1.4. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Canada North America Distributed Power Generation Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Solar PV

- 7.1.2. Wind

- 7.1.3. Combined Heat and Power (CHP)

- 7.1.4. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Rest of North America North America Distributed Power Generation Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Solar PV

- 8.1.2. Wind

- 8.1.3. Combined Heat and Power (CHP)

- 8.1.4. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Total SA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Ballard Power Systems Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Schneider Electric SE*List Not Exhaustive

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Caterpillar Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Seimens AG

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Cummins Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Sunrun Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Toshiba Fuel Cell Power Systems Corporation

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Capstone Turbine Corporation

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Total SA

List of Figures

- Figure 1: North America Distributed Power Generation Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Distributed Power Generation Market Share (%) by Company 2025

List of Tables

- Table 1: North America Distributed Power Generation Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: North America Distributed Power Generation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: North America Distributed Power Generation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Distributed Power Generation Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 5: North America Distributed Power Generation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Distributed Power Generation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: North America Distributed Power Generation Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 8: North America Distributed Power Generation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: North America Distributed Power Generation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: North America Distributed Power Generation Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 11: North America Distributed Power Generation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Distributed Power Generation Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Distributed Power Generation Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the North America Distributed Power Generation Market?

Key companies in the market include Total SA, Ballard Power Systems Inc, Schneider Electric SE*List Not Exhaustive, Caterpillar Inc, Seimens AG, Cummins Inc, Sunrun Inc, Toshiba Fuel Cell Power Systems Corporation, Capstone Turbine Corporation.

3. What are the main segments of the North America Distributed Power Generation Market?

The market segments include Technology, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 538.2 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Solar Panel Costs4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Solar PV Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Upfront Cost.

8. Can you provide examples of recent developments in the market?

In October 2022, LONGi, a leading solar technology company, announced its plan to expand its presence in Canada. As part of the expansion, the company is introducing its flagship distributed solar module, the Hi-MO 5 54-cell module, to the Canadian residential and commercial sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Distributed Power Generation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Distributed Power Generation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Distributed Power Generation Market?

To stay informed about further developments, trends, and reports in the North America Distributed Power Generation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence