Key Insights

The global direct drive wind turbine market is projected for significant growth, driven by increasing demand for clean energy and technological innovations. The market, valued at 36.8 billion in the base year of 2025, is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 11.8%. This expansion is supported by supportive government policies, substantial investments in offshore wind farms, and the inherent benefits of direct drive systems, including enhanced reliability, reduced maintenance, and improved efficiency due to the absence of gearboxes. The deployment of higher capacity turbines (over 3 MW) is also a key factor in meeting renewable energy targets. Emerging economies are increasingly adopting sustainable energy infrastructure to address rising power needs.

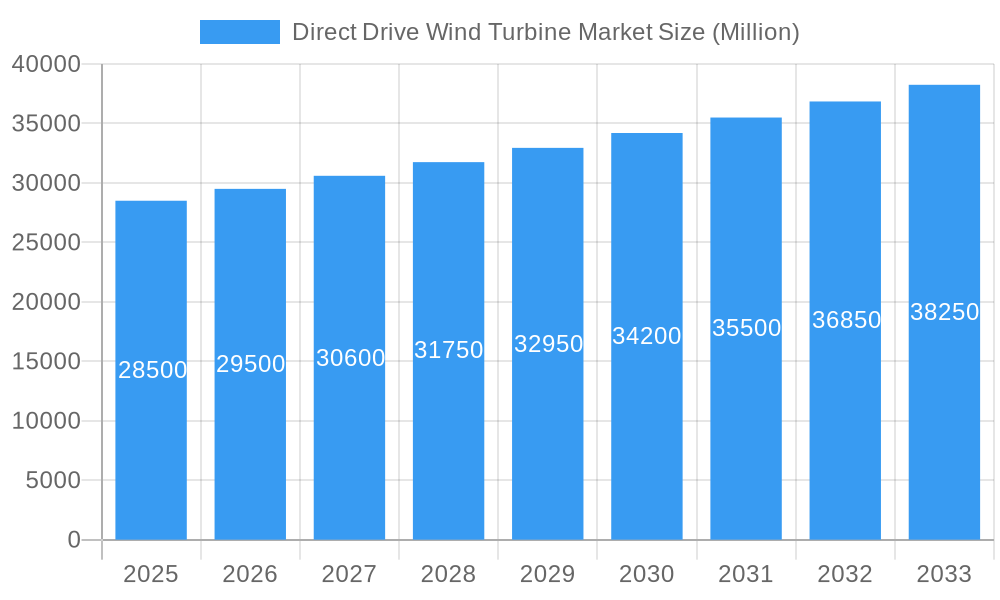

Direct Drive Wind Turbine Market Market Size (In Billion)

Key market trends include continuous advancements in materials science and engineering, leading to more efficient and cost-effective components, and the integration of digital technologies like AI and IoT for performance optimization and predictive maintenance. Asia Pacific is expected to lead market growth due to favorable government policies and investment. Challenges include high initial capital costs, grid integration complexities for renewable sources, and potential supply chain disruptions. However, the global push for decarbonization and energy independence will continue to drive the direct drive wind turbine market.

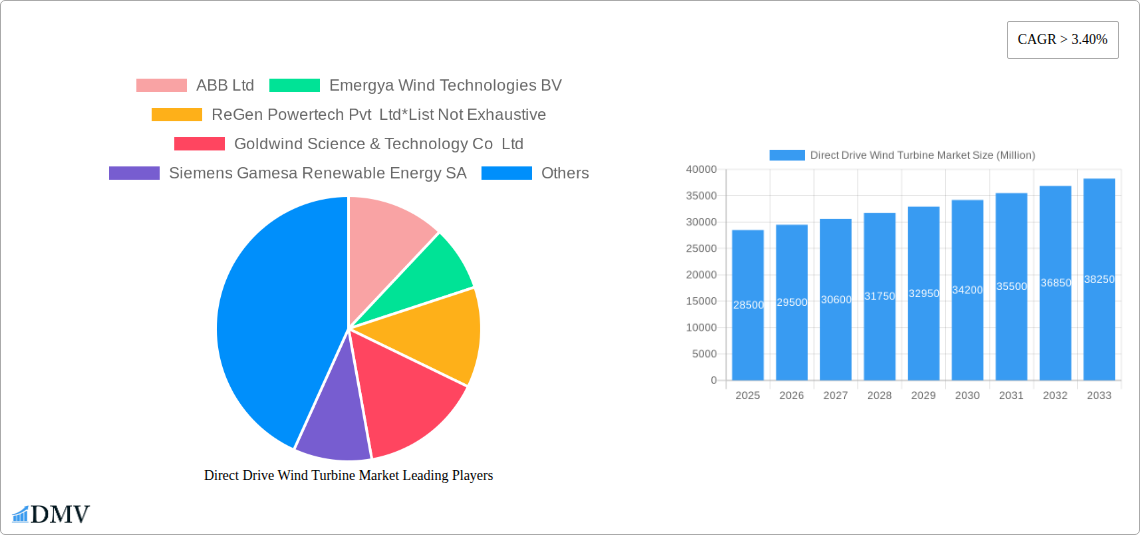

Direct Drive Wind Turbine Market Company Market Share

This report offers a comprehensive analysis of the global direct drive wind turbine market, providing strategic insights and actionable intelligence for stakeholders. It covers market dynamics, technological advancements, regional trends, and future growth prospects, serving as a definitive guide to the evolving direct drive wind technology landscape.

Direct Drive Wind Turbine Market Composition & Trends

The Direct Drive Wind Turbine Market exhibits a moderate concentration, driven by significant investments in renewable energy infrastructure and continuous technological innovation. Key trends shaping the market include the increasing demand for higher capacity turbines, the drive for enhanced grid stability, and the growing adoption of direct drive technology due to its inherent advantages in reliability and reduced maintenance. Regulatory frameworks worldwide are increasingly favoring renewable energy sources, further accelerating market growth. While traditional geared wind turbines remain prevalent, direct drive technology is steadily gaining traction, particularly in offshore applications where its robustness is paramount. Substitute products, such as advanced geared systems and emerging storage solutions, present a degree of competition, but the unique benefits of direct drive—eliminating gearboxes and their associated failure points—provide a strong competitive edge. End-users, primarily utility companies, independent power producers, and large industrial consumers, are prioritizing projects that offer long-term operational efficiency and reduced total cost of ownership. Mergers and acquisitions (M&A) activity, with deal values ranging from tens of millions to several billion dollars, are prevalent as larger players consolidate their market positions and acquire innovative technologies. For instance, strategic acquisitions of smaller direct drive component manufacturers by established turbine OEMs are common, aimed at vertical integration and securing intellectual property. The market share distribution is dynamic, with leading players holding significant stakes but with emerging innovators consistently challenging the status quo through specialized solutions. XXX

Direct Drive Wind Turbine Market Industry Evolution

The Direct Drive Wind Turbine Market has witnessed a transformative evolution, characterized by a consistent upward trajectory in market growth, fueled by a confluence of technological breakthroughs and evolving global energy policies. Over the historical period from 2019 to 2024, the market has seen a Compound Annual Growth Rate (CAGR) of approximately 8.5%, driven by initial deployments and increasing investor confidence. The base year, 2025, marks a pivotal point with an estimated market size of $18.5 Billion. The forecast period, 2025–2033, projects a sustained CAGR of 9.2%, reaching an estimated market value of $35.2 Billion by the end of the forecast horizon. This growth is underpinned by significant technological advancements, most notably in generator design, magnet technology, and advanced control systems, which have improved the efficiency and reliability of direct drive turbines. The shift from traditional geared turbines to direct drive systems is a prominent trend, driven by the inherent advantages of reduced mechanical complexity, lower maintenance requirements, and improved operational uptime. This is particularly evident in the offshore wind sector, where the harsh operating environment magnifies the benefits of direct drive technology. Consumer demands are also evolving, with a greater emphasis on the long-term cost of energy (LCOE) and the environmental footprint of power generation. Direct drive turbines, with their potential for longer operational life and reduced maintenance costs, align perfectly with these evolving demands. Adoption metrics show a steady increase in the proportion of new direct drive installations, especially in medium to large-scale projects. For example, the adoption rate of direct drive technology in offshore wind projects has surged from an estimated 40% in 2019 to over 65% in 2024. This industry evolution reflects a mature market embracing a more robust and efficient technology.

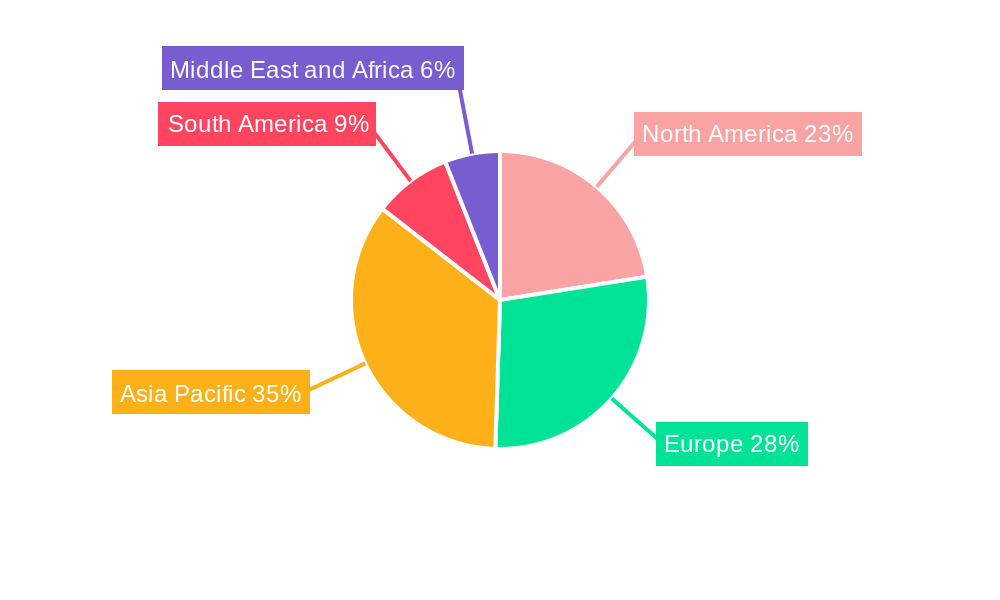

Leading Regions, Countries, or Segments in Direct Drive Wind Turbine Market

The Direct Drive Wind Turbine Market is significantly influenced by regional investments, regulatory support, and the prevailing demand for specific turbine capacities. Among the key segments, Greater than 3 MW capacity turbines are demonstrating unparalleled dominance. This leadership is primarily driven by the escalating demand for larger, more efficient turbines in utility-scale wind farms, both onshore and offshore, which are critical for achieving ambitious renewable energy targets globally.

Dominant Factors Driving the "Greater than 3 MW" Segment:

- Economies of Scale and Efficiency: Larger turbines, particularly direct drive models, offer superior energy capture per unit, leading to a lower Levelized Cost of Energy (LCOE). This makes them the preferred choice for major wind power projects aiming for maximum output and economic viability.

- Offshore Wind Expansion: The offshore wind sector is a primary driver for the >3 MW segment. Direct drive technology's inherent reliability and reduced maintenance needs are crucial in the challenging offshore environment, making it the technology of choice for these high-investment projects.

- Technological Advancements: Continuous innovation in generator design, materials science (e.g., rare-earth magnets), and power electronics has enabled the development of increasingly powerful and efficient direct drive turbines exceeding 3 MW.

Regional Dominance and Key Drivers:

- Europe: This region, particularly Germany, Denmark, and the United Kingdom, consistently leads in the adoption of direct drive wind turbines, especially in the >3 MW capacity segment. Strong government policies, substantial offshore wind development pipelines, and established manufacturing bases are key drivers. For instance, Germany's commitment to phasing out nuclear power and expanding renewable energy sources has fueled significant investments in offshore wind, where large-capacity direct drive turbines are paramount.

- Asia-Pacific: China is emerging as a dominant force, driven by massive domestic renewable energy targets and its robust manufacturing capabilities in wind turbine production. The region's focus on large-scale onshore and increasingly offshore wind projects also bolsters the demand for >3 MW direct drive turbines.

- North America: The United States is witnessing substantial growth, particularly in offshore wind development along the East Coast and large onshore projects in states like Texas. Supportive policies and the pursuit of energy independence are propelling the adoption of higher-capacity direct drive turbines.

The 1 MW - 3 MW capacity segment remains a significant contributor, particularly for distributed generation, smaller onshore wind farms, and specific industrial applications where installation constraints or grid connection limitations favor these sizes. The Less than 1 MW segment continues to cater to niche markets such as remote communities, off-grid applications, and small-scale commercial use, though its overall market share is gradually diminishing compared to larger capacity turbines.

Direct Drive Wind Turbine Market Product Innovations

Product innovations in the Direct Drive Wind Turbine Market are focused on enhancing efficiency, reliability, and reducing the overall cost of energy. Leading manufacturers are developing larger rotor diameters and advanced generator designs, such as permanent magnet generators (PMGs) with improved magnetic materials and optimized winding configurations, to maximize power output. Innovations in gearbox-less designs continue to reduce mechanical stress and maintenance intervals. Advanced control systems and predictive maintenance algorithms are being integrated to optimize turbine performance and anticipate potential failures. Applications are expanding beyond traditional utility-scale wind farms to include hybrid renewable energy systems and specialized industrial power generation. For instance, the development of modular direct drive systems allows for easier transportation and installation, especially in challenging terrains. Performance metrics such as increased capacity factors (reaching over 55% for offshore models) and extended operational lifespans (up to 25-30 years) are becoming standard benchmarks.

Propelling Factors for Direct Drive Wind Turbine Market Growth

Several key factors are propelling the growth of the Direct Drive Wind Turbine Market. Technological advancements in generator efficiency and materials science have made these turbines more competitive. Increasing global investments in renewable energy, driven by climate change concerns and energy security objectives, are creating substantial demand. Supportive government policies and incentives, such as tax credits and renewable energy mandates, further accelerate market penetration. The inherent reliability and lower maintenance costs of direct drive systems, especially in harsh offshore environments, make them a preferred choice for long-term energy projects. For example, the widespread adoption of offshore wind farms, which rely heavily on robust direct drive technology, is a significant growth catalyst.

Obstacles in the Direct Drive Wind Turbine Market Market

Despite robust growth, the Direct Drive Wind Turbine Market faces several obstacles. High upfront capital costs associated with direct drive turbines, particularly those utilizing rare-earth magnets, can be a deterrent for some projects compared to traditional geared systems. Supply chain vulnerabilities, especially concerning the availability and price volatility of critical raw materials like rare-earth elements, can impact production schedules and costs. Complex regulatory approval processes and permitting challenges in certain regions can lead to project delays. Furthermore, the availability of skilled labor for the installation and maintenance of these advanced systems is a growing concern. For instance, fluctuations in the price of Neodymium, a key component in PMGs, have historically caused significant cost pressures.

Future Opportunities in Direct Drive Wind Turbine Market

The Direct Drive Wind Turbine Market presents numerous future opportunities. The continued expansion of offshore wind power, particularly in emerging markets like Asia and the Americas, will drive demand for high-capacity direct drive turbines. Advancements in floating offshore wind technology will open up new geographical areas for wind energy development, further boosting the need for robust direct drive solutions. The integration of smart grid technologies and energy storage systems with direct drive turbines offers opportunities for enhanced grid stability and energy management. Furthermore, the development of alternative magnet materials and innovative generator designs could reduce reliance on rare-earth elements, potentially lowering costs and mitigating supply chain risks. The increasing focus on circular economy principles and turbine recycling will also foster innovation in material science and end-of-life management.

Major Players in the Direct Drive Wind Turbine Market Ecosystem

- ABB Ltd

- Emergya Wind Technologies BV

- ReGen Powertech Pvt Ltd

- Goldwind Science & Technology Co Ltd

- Siemens Gamesa Renewable Energy SA

- Avantis Energy Group

- Northern Power System

- Bachmann electronic GmbH

- Rockwell Automation Inc

- M Torres Olvega Industrial

- Enercon GmbH

Key Developments in Direct Drive Wind Turbine Market Industry

- December 2021: Siemens Gamesa received an order from Orsted for a German offshore wind power project to supply 23 Siemens Gamesa 11.0-200 direct drive offshore wind turbines. The scope of the order includes a five-year service agreement. This order may enhance the company's presence in the German offshore wind industry.

Strategic Direct Drive Wind Turbine Market Market Forecast

The Direct Drive Wind Turbine Market is poised for substantial growth, driven by the global imperative to decarbonize energy systems and the increasing competitiveness of wind power. Key growth catalysts include ongoing technological advancements leading to higher efficiency and reliability, particularly in the Greater than 3 MW turbine segment, which is crucial for large-scale offshore and onshore wind projects. Supportive government policies and substantial investments in renewable energy infrastructure worldwide will continue to fuel demand. Emerging opportunities in floating offshore wind and grid integration further bolster the market's potential. While challenges related to supply chain volatility and upfront costs persist, ongoing innovation in materials and design, coupled with strategic collaborations and market expansion, are expected to drive a positive and sustained growth trajectory for the direct drive wind turbine market over the forecast period.

Direct Drive Wind Turbine Market Segmentation

-

1. Capacity

- 1.1. Less than 1 MW

- 1.2. 1 MW - 3 MW

- 1.3. Greater than 3 MW

Direct Drive Wind Turbine Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Direct Drive Wind Turbine Market Regional Market Share

Geographic Coverage of Direct Drive Wind Turbine Market

Direct Drive Wind Turbine Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Substantial Investments and Efforts to Modernize the T&D Grid

- 3.3. Market Restrains

- 3.3.1. 4.; Expansion of High Voltage Direct Current (HVDC) Networks

- 3.4. Market Trends

- 3.4.1. Offshore Segment to Witness Growth for Turbine Capacity of 1 MW – 3 MW

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Direct Drive Wind Turbine Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 5.1.1. Less than 1 MW

- 5.1.2. 1 MW - 3 MW

- 5.1.3. Greater than 3 MW

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 6. North America Direct Drive Wind Turbine Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 6.1.1. Less than 1 MW

- 6.1.2. 1 MW - 3 MW

- 6.1.3. Greater than 3 MW

- 6.1. Market Analysis, Insights and Forecast - by Capacity

- 7. Europe Direct Drive Wind Turbine Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 7.1.1. Less than 1 MW

- 7.1.2. 1 MW - 3 MW

- 7.1.3. Greater than 3 MW

- 7.1. Market Analysis, Insights and Forecast - by Capacity

- 8. Asia Pacific Direct Drive Wind Turbine Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 8.1.1. Less than 1 MW

- 8.1.2. 1 MW - 3 MW

- 8.1.3. Greater than 3 MW

- 8.1. Market Analysis, Insights and Forecast - by Capacity

- 9. South America Direct Drive Wind Turbine Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 9.1.1. Less than 1 MW

- 9.1.2. 1 MW - 3 MW

- 9.1.3. Greater than 3 MW

- 9.1. Market Analysis, Insights and Forecast - by Capacity

- 10. Middle East and Africa Direct Drive Wind Turbine Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Capacity

- 10.1.1. Less than 1 MW

- 10.1.2. 1 MW - 3 MW

- 10.1.3. Greater than 3 MW

- 10.1. Market Analysis, Insights and Forecast - by Capacity

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ABB Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Emergya Wind Technologies BV

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ReGen Powertech Pvt Ltd*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Goldwind Science & Technology Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Siemens Gamesa Renewable Energy SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Avantis Energy Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Northern Power System

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bachmann electronic GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rockwell Automation Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 M Torres Olvega Industrial

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Enercon GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 ABB Ltd

List of Figures

- Figure 1: Global Direct Drive Wind Turbine Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Direct Drive Wind Turbine Market Revenue (billion), by Capacity 2025 & 2033

- Figure 3: North America Direct Drive Wind Turbine Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 4: North America Direct Drive Wind Turbine Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Direct Drive Wind Turbine Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Direct Drive Wind Turbine Market Revenue (billion), by Capacity 2025 & 2033

- Figure 7: Europe Direct Drive Wind Turbine Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 8: Europe Direct Drive Wind Turbine Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Direct Drive Wind Turbine Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Direct Drive Wind Turbine Market Revenue (billion), by Capacity 2025 & 2033

- Figure 11: Asia Pacific Direct Drive Wind Turbine Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 12: Asia Pacific Direct Drive Wind Turbine Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Direct Drive Wind Turbine Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Direct Drive Wind Turbine Market Revenue (billion), by Capacity 2025 & 2033

- Figure 15: South America Direct Drive Wind Turbine Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 16: South America Direct Drive Wind Turbine Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Direct Drive Wind Turbine Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Direct Drive Wind Turbine Market Revenue (billion), by Capacity 2025 & 2033

- Figure 19: Middle East and Africa Direct Drive Wind Turbine Market Revenue Share (%), by Capacity 2025 & 2033

- Figure 20: Middle East and Africa Direct Drive Wind Turbine Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Direct Drive Wind Turbine Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Direct Drive Wind Turbine Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 2: Global Direct Drive Wind Turbine Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Direct Drive Wind Turbine Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 4: Global Direct Drive Wind Turbine Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Direct Drive Wind Turbine Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 6: Global Direct Drive Wind Turbine Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Direct Drive Wind Turbine Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 8: Global Direct Drive Wind Turbine Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Direct Drive Wind Turbine Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 10: Global Direct Drive Wind Turbine Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Direct Drive Wind Turbine Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 12: Global Direct Drive Wind Turbine Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Direct Drive Wind Turbine Market?

The projected CAGR is approximately 11.8%.

2. Which companies are prominent players in the Direct Drive Wind Turbine Market?

Key companies in the market include ABB Ltd, Emergya Wind Technologies BV, ReGen Powertech Pvt Ltd*List Not Exhaustive, Goldwind Science & Technology Co Ltd, Siemens Gamesa Renewable Energy SA, Avantis Energy Group, Northern Power System, Bachmann electronic GmbH, Rockwell Automation Inc, M Torres Olvega Industrial, Enercon GmbH.

3. What are the main segments of the Direct Drive Wind Turbine Market?

The market segments include Capacity.

4. Can you provide details about the market size?

The market size is estimated to be USD 36.8 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Substantial Investments and Efforts to Modernize the T&D Grid.

6. What are the notable trends driving market growth?

Offshore Segment to Witness Growth for Turbine Capacity of 1 MW – 3 MW.

7. Are there any restraints impacting market growth?

4.; Expansion of High Voltage Direct Current (HVDC) Networks.

8. Can you provide examples of recent developments in the market?

In December 2021, Siemens Gamesa received an order from Orsted for a German offshore wind power project to supply 23 Siemens Gamesa 11.0-200 direct drive offshore wind turbines. The scope of the order includes a five-year service agreement. This order may enhance the company's presence in the German offshore wind industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Direct Drive Wind Turbine Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Direct Drive Wind Turbine Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Direct Drive Wind Turbine Market?

To stay informed about further developments, trends, and reports in the Direct Drive Wind Turbine Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence