Key Insights

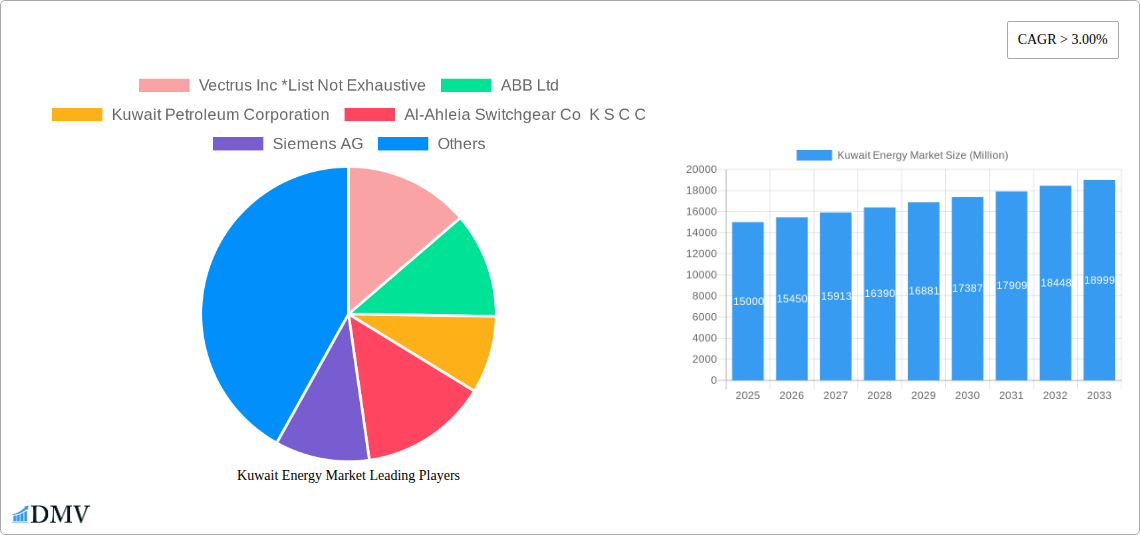

The Kuwait Energy Market is poised for robust growth, with an estimated market size of approximately $15,000 million in 2025, projecting a Compound Annual Growth Rate (CAGR) exceeding 3.00% through 2033. This expansion is primarily fueled by significant investments in enhancing power generation capabilities and modernizing the power transmission and distribution infrastructure. The nation's commitment to diversifying its energy mix, with a notable emphasis on renewable energy sources alongside traditional oil and natural gas, is a key driver. Furthermore, the ongoing need to upgrade existing grid infrastructure to meet rising energy demand and improve grid reliability for both industrial and residential sectors underscores the market's positive trajectory. The increasing adoption of smart grid technologies and the focus on energy efficiency initiatives are also contributing to market expansion.

Kuwait Energy Market Market Size (In Billion)

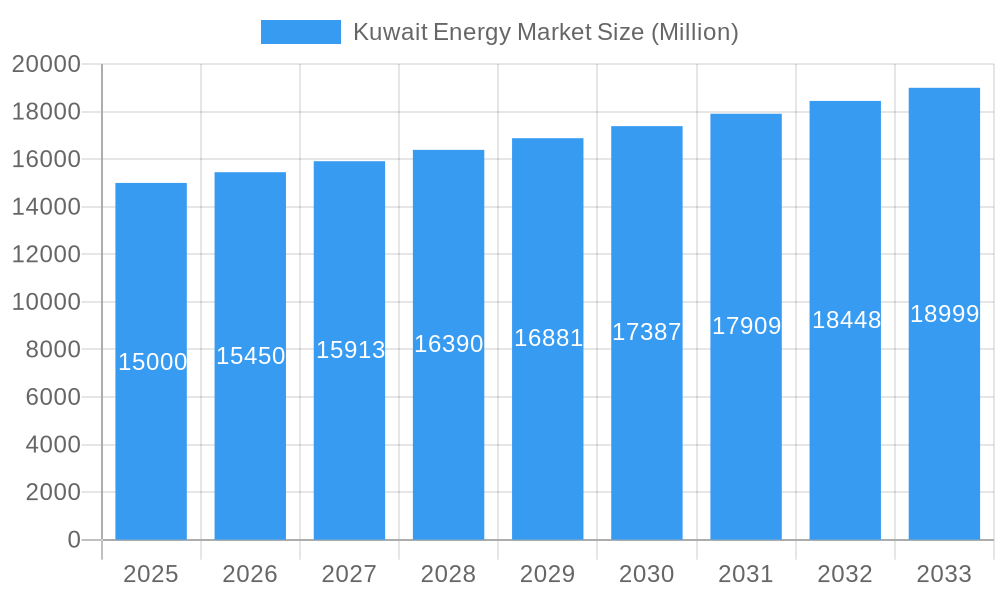

However, the market faces certain restraints, including the substantial capital investment required for large-scale energy projects and the complexities associated with integrating intermittent renewable energy sources into the existing grid. Geopolitical factors and fluctuations in global oil prices, while historically a significant influence, are being addressed through strategic diversification efforts. The market is segmented into Power Generation (encompassing Oil, Natural Gas, and Renewables) and Power Transmission and Distribution. Key players actively shaping this landscape include global giants like Siemens AG and General Electric Company, alongside significant regional entities such as Kuwait Petroleum Corporation and Kharafi National S.A.E., reflecting a dynamic competitive environment focused on delivering advanced energy solutions.

Kuwait Energy Market Company Market Share

Kuwait Energy Market Market Composition & Trends

The Kuwait energy market is characterized by a dynamic interplay of established players and evolving industry trends. Market concentration is notable, with Kuwait Petroleum Corporation (KPC) holding a significant share across the hydrocarbon value chain. However, innovation catalysts are increasingly driving diversification, particularly in the renewable energy sector. Regulatory landscapes are progressively aligning with global decarbonization efforts, fostering an environment for sustainable energy solutions. While traditional energy sources remain dominant, substitute products, such as advanced battery storage and energy-efficient technologies, are gaining traction. End-user profiles are segmented, ranging from large industrial consumers to residential electricity users, each with distinct energy demands. Mergers and acquisitions (M&A) activity, while not yet at peak levels, is expected to grow as companies seek to consolidate market presence and invest in new technologies. The estimated market share distribution indicates a steady dominance of oil and gas, with renewables projected for substantial growth. M&A deal values are anticipated to escalate, reflecting strategic investments in power generation and transmission infrastructure. The market is undergoing a crucial transformation, balancing its legacy as an oil powerhouse with the imperative to embrace a more diversified and sustainable energy future.

- Market Share Distribution: Oil & Gas: XX%, Renewables: XX%, Power Transmission & Distribution: XX%.

- M&A Deal Values: Projected to reach over $XXX Million in the forecast period.

- Innovation Catalysts: Government incentives for solar power, advancements in grid modernization, and increasing adoption of smart grid technologies.

- Regulatory Landscapes: Kuwait's Vision 2035 aims to increase the contribution of renewable energy to the national power mix, supported by supportive policies and frameworks.

Kuwait Energy Market Industry Evolution

The Kuwait energy market is undergoing a profound industry evolution, driven by a confluence of market growth trajectories, technological advancements, and shifting consumer demands. Historically reliant on its vast oil and natural gas reserves, the nation is now actively pursuing a strategic diversification of its energy portfolio. This evolution is marked by significant investments in renewable energy sources, particularly solar power, aimed at meeting escalating domestic electricity needs and reducing carbon emissions. The market growth trajectory for renewables is projected at an impressive XX% compound annual growth rate (CAGR) during the forecast period. Technological advancements are at the forefront of this transformation. Innovations in solar photovoltaic (PV) technology, including higher efficiency panels and advanced tracking systems, are making solar power more economically viable. Furthermore, advancements in power transmission and distribution infrastructure are crucial for integrating intermittent renewable sources into the grid. This includes the deployment of smart grid technologies, advanced metering infrastructure, and robust energy storage solutions, which are witnessing an adoption rate of XX% in new projects. Shifting consumer demands are also playing a pivotal role. Increased awareness of environmental issues and a desire for energy security are pushing both the government and the private sector towards cleaner energy alternatives. Industrial consumers are seeking more cost-effective and sustainable energy solutions, while residential consumers are becoming more receptive to energy-efficient appliances and distributed generation systems. The government's commitment to energy transition, as evidenced by ambitious targets for renewable energy integration, is a key factor shaping this industry evolution. The ongoing development of large-scale solar power projects and the modernization of existing power generation facilities underscore the commitment to this transformation. The entire energy ecosystem, from generation to consumption, is being reshaped by these intertwined forces, promising a more sustainable and resilient energy future for Kuwait.

Leading Regions, Countries, or Segments in Kuwait Energy Market

Within the Kuwait energy market, Power Generation emerges as the dominant segment, encompassing the critical sub-segments of Oil, Natural Gas, and a rapidly growing Renewables sector. This dominance is fueled by a confluence of factors, including Kuwait's historical reliance on hydrocarbon resources, strategic investments in modernizing existing power plants, and a strong push towards diversifying its energy mix with sustainable alternatives.

The Oil and Natural Gas sub-segments continue to be foundational, providing the bedrock of Kuwait's energy supply for baseload power generation. Significant investments are channeled into maintaining and upgrading these facilities, ensuring reliability and efficiency. The sheer volume of domestic oil and gas production underpins their continued importance, providing a secure and readily available fuel source.

However, the Renewables sub-segment is experiencing exponential growth, positioning itself as a key driver of future energy production. This expansion is propelled by ambitious government targets outlined in Kuwait's Vision 2035, which aims to significantly increase the share of renewables in the national energy mix. Regulatory support, including favorable feed-in tariffs and streamlined permitting processes, is crucial in attracting investment and accelerating project development. Key drivers for this segment's rise include:

- Investment Trends: Substantial government and private sector investment in large-scale solar PV projects, such as the Shagaya Renewable Energy Park, are transforming the energy landscape. Projected investments in renewable energy infrastructure are estimated to reach $XXX Million over the forecast period.

- Regulatory Support: Favorable policies and incentives are designed to attract both domestic and international investment in renewable energy projects. This includes land allocation for solar farms and tax incentives.

- Technological Advancements: The decreasing cost of solar PV technology, coupled with advancements in energy storage solutions, makes renewables increasingly competitive with traditional power sources. The efficiency of solar panels has improved by XX% over the historical period.

- Environmental Concerns: Growing awareness of climate change and the need for decarbonization are driving the adoption of cleaner energy alternatives.

The Power Transmission and Distribution segment, while essential for the seamless integration of all energy sources, acts as an enabler rather than a primary generation driver. Investments in this sector are strategically focused on grid modernization, enhancing resilience, and accommodating the influx of decentralized renewable energy generation. This includes the development of smart grids and the expansion of high-voltage transmission networks to efficiently transport power from remote generation sites to consumption centers. The combined strength of established hydrocarbon-based generation and the burgeoning renewable sector, supported by robust transmission and distribution infrastructure, solidifies Power Generation as the leading segment in the Kuwait energy market.

Kuwait Energy Market Product Innovations

The Kuwait energy market is witnessing significant product innovations aimed at enhancing efficiency, sustainability, and grid integration. In Power Generation, advancements include the deployment of high-efficiency gas turbines with reduced emissions, contributing to cleaner fossil fuel utilization. For Renewables, innovations span from next-generation bifacial solar panels that capture light from both sides, increasing energy yield by up to XX%, to advanced energy storage systems, such as large-scale lithium-ion battery installations and emerging flow battery technologies, ensuring grid stability and reliable power supply even during intermittent solar generation. In Power Transmission and Distribution, smart grid technologies are at the forefront, incorporating IoT-enabled sensors for real-time monitoring and predictive maintenance, advanced grid automation systems, and high-capacity underground cabling solutions for enhanced resilience against environmental factors. These innovations collectively contribute to a more robust, efficient, and environmentally conscious energy infrastructure.

Propelling Factors for Kuwait Energy Market Growth

The Kuwait energy market's growth is propelled by a strategic push towards economic diversification and energy security. Government initiatives, aligned with Kuwait's Vision 2035, are a primary driver, fostering substantial investments in renewable energy projects. Technological advancements in solar PV and energy storage are making these alternatives increasingly cost-competitive. Furthermore, a growing emphasis on reducing carbon footprints and meeting international climate commitments is encouraging the adoption of cleaner energy solutions. The increasing demand for electricity, driven by population growth and industrial expansion, necessitates the development of new power generation capacity and the modernization of existing infrastructure. Economic stability, supported by hydrocarbon revenues, provides the financial impetus for these ambitious energy transition plans.

Obstacles in the Kuwait Energy Market Market

Despite strong growth potential, the Kuwait energy market faces several obstacles. Regulatory hurdles and the pace of policy implementation can sometimes slow down project development. Dependence on imported technology and equipment for renewable energy projects can lead to supply chain disruptions and increased costs. The intermittency of renewable sources, particularly solar power, requires significant investment in energy storage and grid modernization to ensure a stable power supply. Competition from established fossil fuel industries, with their existing infrastructure and established market presence, also presents a challenge. Furthermore, the upfront capital investment required for large-scale renewable energy projects can be substantial, requiring robust financing mechanisms and investor confidence.

Future Opportunities in Kuwait Energy Market

Emerging opportunities in the Kuwait energy market are abundant, particularly in the burgeoning renewable energy sector. The expansion of solar power capacity, driven by government targets and decreasing technology costs, presents a significant avenue for growth. The development of smart grid technologies and associated infrastructure offers opportunities for companies specializing in grid modernization, automation, and data analytics. Furthermore, the increasing demand for energy storage solutions, crucial for integrating renewables, is a key area for future investment and innovation. The nation's strategic location also presents potential for regional energy export opportunities in the long term.

Major Players in the Kuwait Energy Market Ecosystem

- Vectrus Inc

- ABB Ltd

- Kuwait Petroleum Corporation

- Al-Ahleia Switchgear Co K S C C

- Siemens AG

- L&T-Sargent & Lundy Limited

- Kharafi National S A E

- General Electric Company

- ACWA Power International

- Mitsubishi Heavy Industries Ltd

Key Developments in Kuwait Energy Market Industry

- 2024 February: Launch of the Al-Dabdaba Solar PV plant, contributing XX MW to the national grid.

- 2023 December: Kuwait Petroleum Corporation announces strategic partnerships to explore green hydrogen production.

- 2023 October: Siemens AG secures a contract for the upgrade of transmission substations, enhancing grid reliability.

- 2023 July: Kharafi National S A E commences construction on a new solar power project with a capacity of XX MW.

- 2023 March: ACWA Power International awarded a tender for a large-scale renewable energy project.

- 2022 November: ABB Ltd supplies advanced grid automation solutions to improve power distribution efficiency.

- 2022 August: Kuwait Petroleum Corporation outlines plans for enhanced oil recovery using advanced technologies.

- 2022 April: L&T-Sargent & Lundy Limited engaged for the design and engineering of a new gas-fired power plant.

- 2021 October: General Electric Company delivers new turbines for a major power generation facility, improving efficiency by XX%.

- 2021 June: Al-Ahleia Switchgear Co K S C C expands its manufacturing capabilities for electrical components.

Strategic Kuwait Energy Market Market Forecast

The strategic forecast for the Kuwait energy market is robust, driven by a clear commitment to energy diversification and sustainability. The sustained growth in renewable energy adoption, particularly solar power, is expected to significantly reshape the energy mix. Investments in modernizing power generation and transmission infrastructure will further bolster market stability and efficiency. The ongoing technological advancements in energy storage and smart grid solutions will unlock new opportunities for innovation and operational excellence. Coupled with supportive government policies and increasing private sector participation, the Kuwait energy market is poised for a transformative period of growth, contributing to enhanced energy security and a cleaner environmental footprint.

Kuwait Energy Market Segmentation

-

1. Power Generation

- 1.1. Oil

- 1.2. Natural Gas

- 1.3. Renewables

- 2. Power Transmission and Distribution

Kuwait Energy Market Segmentation By Geography

- 1. Kuwait

Kuwait Energy Market Regional Market Share

Geographic Coverage of Kuwait Energy Market

Kuwait Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Power Demand from the Commercial and Industrial Sectors

- 3.3. Market Restrains

- 3.3.1. 4.; Stringent Environmental and Safety Regulations

- 3.4. Market Trends

- 3.4.1. Natural Gas to be the Fastest Growing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kuwait Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 5.1.1. Oil

- 5.1.2. Natural Gas

- 5.1.3. Renewables

- 5.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Vectrus Inc *List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kuwait Petroleum Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Al-Ahleia Switchgear Co K S C C

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 L&T-Sargent & Lundy Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kharafi National S A E

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Electric Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ACWA Power International

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mitsubishi Heavy Industries Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Vectrus Inc *List Not Exhaustive

List of Figures

- Figure 1: Kuwait Energy Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Kuwait Energy Market Share (%) by Company 2025

List of Tables

- Table 1: Kuwait Energy Market Revenue undefined Forecast, by Power Generation 2020 & 2033

- Table 2: Kuwait Energy Market Revenue undefined Forecast, by Power Transmission and Distribution 2020 & 2033

- Table 3: Kuwait Energy Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Kuwait Energy Market Revenue undefined Forecast, by Power Generation 2020 & 2033

- Table 5: Kuwait Energy Market Revenue undefined Forecast, by Power Transmission and Distribution 2020 & 2033

- Table 6: Kuwait Energy Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kuwait Energy Market?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the Kuwait Energy Market?

Key companies in the market include Vectrus Inc *List Not Exhaustive, ABB Ltd, Kuwait Petroleum Corporation, Al-Ahleia Switchgear Co K S C C, Siemens AG, L&T-Sargent & Lundy Limited, Kharafi National S A E, General Electric Company, ACWA Power International, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Kuwait Energy Market?

The market segments include Power Generation, Power Transmission and Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Power Demand from the Commercial and Industrial Sectors.

6. What are the notable trends driving market growth?

Natural Gas to be the Fastest Growing Market.

7. Are there any restraints impacting market growth?

4.; Stringent Environmental and Safety Regulations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kuwait Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kuwait Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kuwait Energy Market?

To stay informed about further developments, trends, and reports in the Kuwait Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence