Key Insights

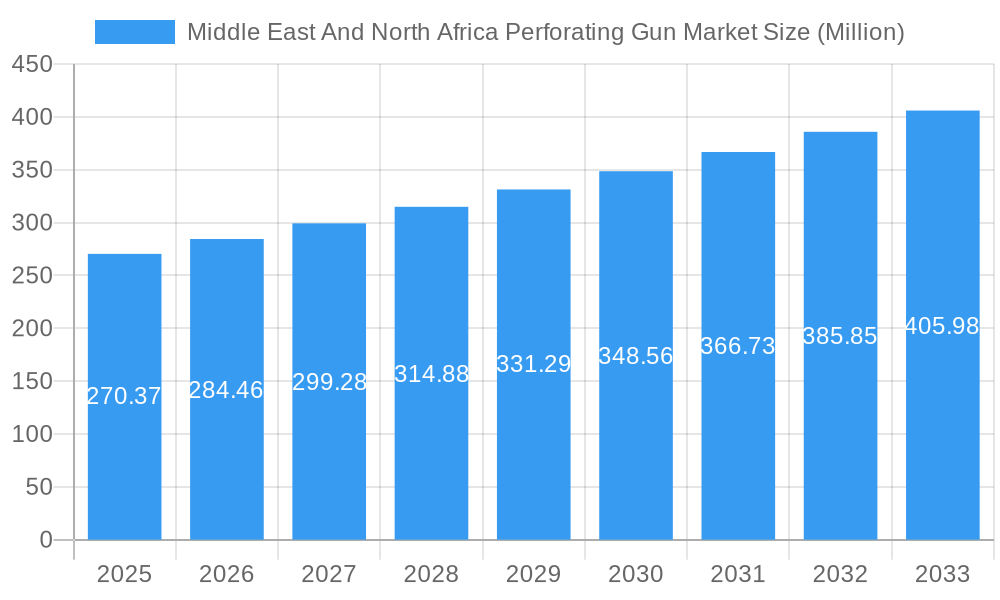

The Middle East and North Africa (MENA) Perforating Gun Market is projected for robust growth, reaching an estimated USD 270.37 million in 2025. Driven by a steady Compound Annual Growth Rate (CAGR) of 5.20%, the market is anticipated to expand significantly throughout the forecast period of 2025-2033. This growth is primarily fueled by increasing upstream oil and gas exploration and production activities across the region, necessitated by rising global energy demands. The strategic importance of MENA in global energy supply ensures continuous investment in well completion technologies, including advanced perforating systems. Furthermore, the drive to optimize production from mature fields and the exploration of new hydrocarbon reserves in both conventional and unconventional reservoirs will sustain the demand for sophisticated perforating solutions. The market’s expansion is also supported by technological advancements in perforating gun designs, focusing on enhanced efficiency, safety, and precision, which are crucial for maximizing reservoir access and hydrocarbon recovery. The increasing adoption of horizontal and deviated well drilling techniques, which require specialized perforating tools, further contributes to this positive market trajectory.

Middle East And North Africa Perforating Gun Market Market Size (In Million)

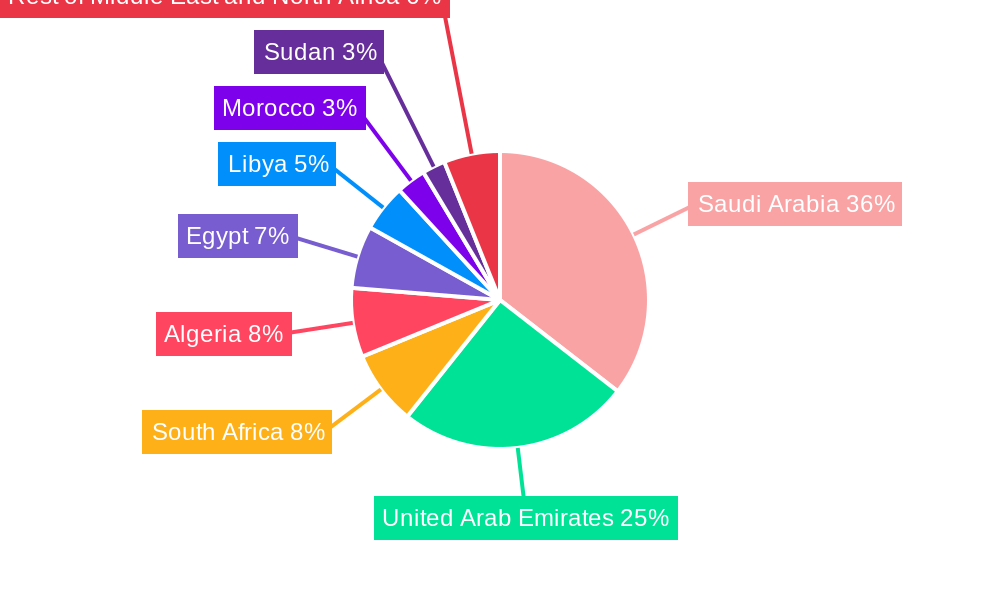

The MENA Perforating Gun Market is segmented across various carrier types, including Hollow Carriers, Expandable Shaped Charged Guns, and Other Carrier Types, catering to diverse well conditions and operational requirements. The well type segmentation highlights a strong emphasis on Horizontal and Deviated Wells, reflecting the industry's shift towards more complex wellbore trajectories to enhance productivity. Vertical Wells also represent a significant segment, especially in established fields. Geographically, Saudi Arabia and the United Arab Emirates are expected to lead market growth due to their substantial oil and gas reserves and ongoing extensive exploration and production programs. Other key markets in the region include South Africa, Algeria, Egypt, Libya, Morocco, and Sudan, all contributing to the overall market expansion through their respective oil and gas ventures. Major global players such as Schlumberger Limited, Baker Hughes Company, and Halliburton Company are actively involved, alongside regional and specialized manufacturers, fostering a competitive landscape characterized by innovation and service excellence. Despite the positive outlook, potential restraints such as fluctuating oil prices, geopolitical instability, and stringent environmental regulations could pose challenges to sustained growth, necessitating adaptive strategies from market participants.

Middle East And North Africa Perforating Gun Market Company Market Share

Unlock critical insights into the Middle East and North Africa (MENA) Perforating Gun Market, a vital segment of the oil and gas completion and production industry. This comprehensive report delves into market dynamics, technological advancements, and strategic growth opportunities, providing an indispensable resource for stakeholders aiming to capitalize on this evolving landscape. The study meticulously covers the Study Period: 2019–2033, with Base Year: 2025 and an Estimated Year: 2025, followed by a robust Forecast Period: 2025–2033 and a detailed Historical Period: 2019–2024. Gain a competitive edge with our detailed analysis of market share, innovation trends, and future projections for perforating guns in the MENA region.

Middle East And North Africa Perforating Gun Market Market Composition & Trends

The MENA Perforating Gun Market exhibits a moderately concentrated structure, with a few key players dominating the landscape. Innovation acts as a significant catalyst, driving advancements in hollow carrier perforating guns and expandable shaped charged guns designed for increased efficiency and safety in challenging well environments, particularly horizontal and deviated wells. The regulatory landscape, while evolving, generally supports the upstream oil and gas sector, encouraging investments in advanced completion technologies. Substitute products, such as alternative well stimulation methods, exist but are often outpaced by the cost-effectiveness and targeted efficacy of modern perforating guns. End-user profiles are primarily oil and gas exploration and production (E&P) companies, service providers, and drilling contractors who prioritize reliable and high-performance solutions for hydrocarbon extraction. Mergers and acquisitions (M&A) activities, though not extensively detailed in publicly available data, are anticipated to shape market consolidation. Current M&A deal values are estimated to be in the range of hundreds of Millions. The market is driven by consistent demand for enhanced oil recovery and the exploration of new reserves across the region.

Middle East And North Africa Perforating Gun Market Industry Evolution

The MENA Perforating Gun Market has undergone a significant evolution, driven by technological innovation and the increasing demand for efficient hydrocarbon extraction. Throughout the Historical Period (2019–2024), the market has witnessed a consistent upward trajectory, fueled by sustained upstream oil and gas activities across key countries like Saudi Arabia and the United Arab Emirates. The adoption of advanced perforation techniques has been crucial, with a notable shift towards solutions that enhance well productivity and reduce operational downtime. For instance, the development of more robust and precisely detonating perforating systems has become paramount for operators targeting complex geological formations. The Base Year (2025) marks a period of sustained growth, with the market size projected to reach approximately XXX Million. The Forecast Period (2025–2033) is expected to see a Compound Annual Growth Rate (CAGR) of approximately X.XX%, further solidifying the market's importance. This growth is underpinned by several factors. Firstly, the ongoing exploration and development of new oil and gas fields in the region necessitate sophisticated completion tools. Secondly, the increasing focus on maximizing recovery from existing mature fields is driving the demand for improved perforating technologies that can deliver enhanced stimulation. Thirdly, technological advancements, such as the integration of intelligent systems and specialized charge designs, are continuously improving the performance and safety of perforating guns. This evolution is not merely about the physical product but also about the integrated services and expertise that accompany them, creating a more holistic value proposition for end-users. The industry's capacity to adapt to evolving environmental regulations and embrace sustainable practices will also play a role in its long-term evolution. The shift from traditional vertical wells to more economically viable horizontal and deviated wells has necessitated the development of specialized perforating guns capable of operating effectively in these complex trajectories, further shaping product design and market demand.

Leading Regions, Countries, or Segments in Middle East And North Africa Perforating Gun Market

The Middle East and North Africa Perforating Gun Market is a dynamic landscape, with certain regions, countries, and segments exhibiting pronounced dominance and growth potential.

Dominant Segments by Carrier Type:

- Hollow Carrier Perforating Guns: This segment commands a significant market share due to its versatility and proven reliability across various well types. Their robust design allows for effective deployment in both conventional and unconventional reservoirs. The widespread adoption of hollow carrier guns is a testament to their cost-effectiveness and efficiency in delivering consistent perforation performance.

- Key Drivers: Established infrastructure for their manufacturing and deployment, strong track record in diverse geological conditions, and continued demand from major oil-producing nations.

- Expandable Shaped Charged Gun: This innovative segment is gaining traction, particularly for applications requiring precise control and minimized formation damage. These guns offer superior zonal isolation and can be tailored for specific reservoir characteristics.

- Key Drivers: Technological advancements in charge design and deployment mechanisms, increasing demand for optimized well productivity, and suitability for complex wellbore geometries.

- Other Carrier Types: While a smaller segment, these may include specialized designs catering to niche applications or emerging technologies.

- Key Drivers: Niche market demands and ongoing research and development into novel perforation solutions.

Dominant Segments by Well Type:

- Horizontal and Deviated Wells: This segment represents the largest and fastest-growing market for perforating guns in MENA. The strategic shift towards horizontal drilling to access vast hydrocarbon reserves in the region drives the demand for specialized perforating solutions.

- Key Drivers: Economic viability of horizontal drilling in MENA's geological formations, increased investment in unconventional resource development, and the need for efficient multi-stage fracturing.

- Vertical Wells: While traditional, vertical wells still constitute a significant portion of the market, particularly in mature fields requiring routine intervention and stimulation.

- Key Drivers: Continued production from legacy fields, cost-effectiveness for certain reservoir types, and the need for ongoing maintenance and production enhancement.

Dominant Geographies:

- Saudi Arabia: As the world's largest oil producer, Saudi Arabia represents a cornerstone of the MENA Perforating Gun Market. Significant investments in exploration, production, and advanced completion technologies solidify its leading position.

- Key Drivers: Massive proven hydrocarbon reserves, government initiatives to boost oil production, extensive E&P activities by Saudi Aramco, and a strong demand for high-performance completion equipment.

- United Arab Emirates (UAE): The UAE is another critical market, driven by its strategic importance in global energy markets and its commitment to maximizing oil and gas output. Investments in offshore and onshore fields contribute to robust demand.

- Key Drivers: Major oil production capacity, significant investments in advanced E&P technologies, presence of international oil companies, and focus on enhanced oil recovery (EOR) techniques.

- Algeria: As a key North African oil and gas producer, Algeria's market is influenced by its substantial reserves and ongoing development projects, particularly in conventional gas and oil fields.

- Key Drivers: Significant natural gas and oil reserves, ongoing exploration and production initiatives, and the need for efficient well completion solutions.

- South Africa: While its oil production is lower compared to the Middle Eastern giants, South Africa’s energy sector, particularly its coalbed methane and potential shale gas exploration, contributes to the perforating gun market.

- Key Drivers: Growing interest in unconventional gas resources, existing mining and energy infrastructure, and the need for specialized perforation for specific resource types.

- Rest of Middle East and North Africa: This broad category encompasses countries like Egypt, Libya, Morocco, and Sudan, each with varying degrees of oil and gas exploration and production activities. While individual market sizes may be smaller, their collective contribution is significant.

- Key Drivers: Emerging exploration opportunities, ongoing development of existing fields, and the strategic importance of energy security for these nations.

The interplay between these segments and geographies creates a complex yet opportunity-rich market. Companies that can offer tailored solutions for horizontal and deviated wells in Saudi Arabia and the UAE, while also catering to the specific needs of other regional players, are well-positioned for success.

Middle East And North Africa Perforating Gun Market Product Innovations

Product innovations in the MENA Perforating Gun Market are focused on enhancing efficiency, safety, and performance in demanding well environments. Companies are developing advanced hollow carrier perforating guns with improved jetting characteristics and charge configurations for deeper penetration and better flow efficiency. Furthermore, the integration of smart technologies allows for real-time monitoring and control during perforation operations. The development of expandable shaped charged guns offers superior zonal control and reduces the risk of formation damage, proving invaluable for complex reservoir completions. These advancements are crucial for maximizing hydrocarbon recovery and operational uptime, with performance metrics consistently improving in terms of shot density, penetration depth, and charge reliability.

Propelling Factors for Middle East And North Africa Perforating Gun Market Growth

Several key factors are propelling the growth of the MENA Perforating Gun Market. Firstly, the region's vast and largely untapped hydrocarbon reserves necessitate continuous exploration and production activities, driving demand for completion technologies. Secondly, technological advancements in perforating gun designs, such as improved hollow carrier and expandable shaped charged gun technologies, offer enhanced well productivity and efficiency, encouraging adoption. Thirdly, government initiatives and significant investments by national oil companies (NOCs) and international oil companies (IOCs) in the upstream sector are directly fueling market expansion. Finally, the increasing focus on maximizing recovery from mature fields and the development of unconventional resources further bolster the need for sophisticated perforation solutions.

Obstacles in the Middle East And North Africa Perforating Gun Market Market

Despite its robust growth, the MENA Perforating Gun Market faces certain obstacles. Regulatory complexities and varying compliance standards across different countries can create challenges for market entry and operations. Geopolitical instability in certain sub-regions can disrupt supply chains and investment flows, leading to project delays and increased operational costs. Furthermore, intense competition among a growing number of manufacturers and service providers can exert downward pressure on pricing, impacting profit margins. The reliance on imported raw materials and specialized components can also lead to vulnerabilities in the supply chain, especially during global disruptions. The significant upfront investment required for advanced perforating technologies can also be a barrier for smaller operators.

Future Opportunities in Middle East And North Africa Perforating Gun Market

Emerging opportunities within the MENA Perforating Gun Market are multifaceted. The increasing exploration of deepwater and ultra-deepwater reserves presents a demand for highly specialized and robust perforating systems. The growing interest in enhanced oil recovery (EOR) techniques, which often involve advanced stimulation methods, will drive the need for innovative perforating solutions. Furthermore, the digitalization trend in the oil and gas industry opens avenues for smart perforating guns with integrated sensors and data analytics capabilities. The development of more environmentally friendly and sustainable perforation technologies will also be a key opportunity. Expansion into less explored North African markets with growing energy demands also presents significant potential.

Major Players in the Middle East And North Africa Perforating Gun Market Ecosystem

- China Shaanxi FYPE Rigid Machinery Co Ltd

- DynaEnergetics GmbH & Co KG

- Hunting PLC

- Weatherford International PLC

- Baker Hughes Company

- Halliburton Company

- DMC Global Inc

- Schlumberger Limited

- NOV Inc

Key Developments in Middle East And North Africa Perforating Gun Market Industry

- February 2024: GEODynamics patented the EPIC suite of perforation technologies. The EPIC collection includes EPIC Precision and EPIC Flex top-loading gun systems, which can withstand the harshest conditions to deliver greater safety, uptime, and operational efficiencies.

- June 2023: DynaEnergetics launched DS GRAVITY 2.0, a self-orienting perforating gun in the oil and gas industry. The gun is expected to save time, increase efficiency, and produce more profitable wells.

Strategic Middle East And North Africa Perforating Gun Market Market Forecast

The strategic outlook for the MENA Perforating Gun Market is highly promising, driven by sustained upstream investments and continuous technological innovation. The demand for high-performance hollow carrier and expandable shaped charged guns, particularly for horizontal and deviated wells, is expected to remain robust, especially in key markets like Saudi Arabia and the UAE. Market growth will be further propelled by the increasing adoption of advanced completion strategies for maximizing hydrocarbon recovery and the ongoing exploration of new reserves. Companies that can offer customized solutions, integrate digital technologies, and maintain agility in their supply chains are poised for significant success and market share expansion in the coming years, projecting a healthy market size in the hundreds of Millions.

Middle East And North Africa Perforating Gun Market Segmentation

-

1. Carrier Type

- 1.1. Hollow Carrier

- 1.2. Expandable Shaped Charged Gun

- 1.3. Other Carrier Types

-

2. Well Type

- 2.1. Horizontal and Deviated Well

- 2.2. Vertical Well

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. South Africa

- 3.4. Algeria

- 3.5. Egypt

- 3.6. Libya

- 3.7. Morocco

- 3.8. Sudan

- 3.9. Rest of Middle East and North Africa

Middle East And North Africa Perforating Gun Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. South Africa

- 4. Algeria

- 5. Egypt

- 6. Libya

- 7. Morocco

- 8. Sudan

- 9. Rest of Middle East and North Africa

Middle East And North Africa Perforating Gun Market Regional Market Share

Geographic Coverage of Middle East And North Africa Perforating Gun Market

Middle East And North Africa Perforating Gun Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Rise in Oil and Gas Drilling Activities4.; Increased Shale Gas Exploration

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Share of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Horizontal and Deviated Well Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East And North Africa Perforating Gun Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Carrier Type

- 5.1.1. Hollow Carrier

- 5.1.2. Expandable Shaped Charged Gun

- 5.1.3. Other Carrier Types

- 5.2. Market Analysis, Insights and Forecast - by Well Type

- 5.2.1. Horizontal and Deviated Well

- 5.2.2. Vertical Well

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. South Africa

- 5.3.4. Algeria

- 5.3.5. Egypt

- 5.3.6. Libya

- 5.3.7. Morocco

- 5.3.8. Sudan

- 5.3.9. Rest of Middle East and North Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. South Africa

- 5.4.4. Algeria

- 5.4.5. Egypt

- 5.4.6. Libya

- 5.4.7. Morocco

- 5.4.8. Sudan

- 5.4.9. Rest of Middle East and North Africa

- 5.1. Market Analysis, Insights and Forecast - by Carrier Type

- 6. Saudi Arabia Middle East And North Africa Perforating Gun Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Carrier Type

- 6.1.1. Hollow Carrier

- 6.1.2. Expandable Shaped Charged Gun

- 6.1.3. Other Carrier Types

- 6.2. Market Analysis, Insights and Forecast - by Well Type

- 6.2.1. Horizontal and Deviated Well

- 6.2.2. Vertical Well

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. South Africa

- 6.3.4. Algeria

- 6.3.5. Egypt

- 6.3.6. Libya

- 6.3.7. Morocco

- 6.3.8. Sudan

- 6.3.9. Rest of Middle East and North Africa

- 6.1. Market Analysis, Insights and Forecast - by Carrier Type

- 7. United Arab Emirates Middle East And North Africa Perforating Gun Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Carrier Type

- 7.1.1. Hollow Carrier

- 7.1.2. Expandable Shaped Charged Gun

- 7.1.3. Other Carrier Types

- 7.2. Market Analysis, Insights and Forecast - by Well Type

- 7.2.1. Horizontal and Deviated Well

- 7.2.2. Vertical Well

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. South Africa

- 7.3.4. Algeria

- 7.3.5. Egypt

- 7.3.6. Libya

- 7.3.7. Morocco

- 7.3.8. Sudan

- 7.3.9. Rest of Middle East and North Africa

- 7.1. Market Analysis, Insights and Forecast - by Carrier Type

- 8. South Africa Middle East And North Africa Perforating Gun Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Carrier Type

- 8.1.1. Hollow Carrier

- 8.1.2. Expandable Shaped Charged Gun

- 8.1.3. Other Carrier Types

- 8.2. Market Analysis, Insights and Forecast - by Well Type

- 8.2.1. Horizontal and Deviated Well

- 8.2.2. Vertical Well

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. South Africa

- 8.3.4. Algeria

- 8.3.5. Egypt

- 8.3.6. Libya

- 8.3.7. Morocco

- 8.3.8. Sudan

- 8.3.9. Rest of Middle East and North Africa

- 8.1. Market Analysis, Insights and Forecast - by Carrier Type

- 9. Algeria Middle East And North Africa Perforating Gun Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Carrier Type

- 9.1.1. Hollow Carrier

- 9.1.2. Expandable Shaped Charged Gun

- 9.1.3. Other Carrier Types

- 9.2. Market Analysis, Insights and Forecast - by Well Type

- 9.2.1. Horizontal and Deviated Well

- 9.2.2. Vertical Well

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. South Africa

- 9.3.4. Algeria

- 9.3.5. Egypt

- 9.3.6. Libya

- 9.3.7. Morocco

- 9.3.8. Sudan

- 9.3.9. Rest of Middle East and North Africa

- 9.1. Market Analysis, Insights and Forecast - by Carrier Type

- 10. Egypt Middle East And North Africa Perforating Gun Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Carrier Type

- 10.1.1. Hollow Carrier

- 10.1.2. Expandable Shaped Charged Gun

- 10.1.3. Other Carrier Types

- 10.2. Market Analysis, Insights and Forecast - by Well Type

- 10.2.1. Horizontal and Deviated Well

- 10.2.2. Vertical Well

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Saudi Arabia

- 10.3.2. United Arab Emirates

- 10.3.3. South Africa

- 10.3.4. Algeria

- 10.3.5. Egypt

- 10.3.6. Libya

- 10.3.7. Morocco

- 10.3.8. Sudan

- 10.3.9. Rest of Middle East and North Africa

- 10.1. Market Analysis, Insights and Forecast - by Carrier Type

- 11. Libya Middle East And North Africa Perforating Gun Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Carrier Type

- 11.1.1. Hollow Carrier

- 11.1.2. Expandable Shaped Charged Gun

- 11.1.3. Other Carrier Types

- 11.2. Market Analysis, Insights and Forecast - by Well Type

- 11.2.1. Horizontal and Deviated Well

- 11.2.2. Vertical Well

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Saudi Arabia

- 11.3.2. United Arab Emirates

- 11.3.3. South Africa

- 11.3.4. Algeria

- 11.3.5. Egypt

- 11.3.6. Libya

- 11.3.7. Morocco

- 11.3.8. Sudan

- 11.3.9. Rest of Middle East and North Africa

- 11.1. Market Analysis, Insights and Forecast - by Carrier Type

- 12. Morocco Middle East And North Africa Perforating Gun Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Carrier Type

- 12.1.1. Hollow Carrier

- 12.1.2. Expandable Shaped Charged Gun

- 12.1.3. Other Carrier Types

- 12.2. Market Analysis, Insights and Forecast - by Well Type

- 12.2.1. Horizontal and Deviated Well

- 12.2.2. Vertical Well

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. Saudi Arabia

- 12.3.2. United Arab Emirates

- 12.3.3. South Africa

- 12.3.4. Algeria

- 12.3.5. Egypt

- 12.3.6. Libya

- 12.3.7. Morocco

- 12.3.8. Sudan

- 12.3.9. Rest of Middle East and North Africa

- 12.1. Market Analysis, Insights and Forecast - by Carrier Type

- 13. Sudan Middle East And North Africa Perforating Gun Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Carrier Type

- 13.1.1. Hollow Carrier

- 13.1.2. Expandable Shaped Charged Gun

- 13.1.3. Other Carrier Types

- 13.2. Market Analysis, Insights and Forecast - by Well Type

- 13.2.1. Horizontal and Deviated Well

- 13.2.2. Vertical Well

- 13.3. Market Analysis, Insights and Forecast - by Geography

- 13.3.1. Saudi Arabia

- 13.3.2. United Arab Emirates

- 13.3.3. South Africa

- 13.3.4. Algeria

- 13.3.5. Egypt

- 13.3.6. Libya

- 13.3.7. Morocco

- 13.3.8. Sudan

- 13.3.9. Rest of Middle East and North Africa

- 13.1. Market Analysis, Insights and Forecast - by Carrier Type

- 14. Rest of Middle East and North Africa Middle East And North Africa Perforating Gun Market Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by Carrier Type

- 14.1.1. Hollow Carrier

- 14.1.2. Expandable Shaped Charged Gun

- 14.1.3. Other Carrier Types

- 14.2. Market Analysis, Insights and Forecast - by Well Type

- 14.2.1. Horizontal and Deviated Well

- 14.2.2. Vertical Well

- 14.3. Market Analysis, Insights and Forecast - by Geography

- 14.3.1. Saudi Arabia

- 14.3.2. United Arab Emirates

- 14.3.3. South Africa

- 14.3.4. Algeria

- 14.3.5. Egypt

- 14.3.6. Libya

- 14.3.7. Morocco

- 14.3.8. Sudan

- 14.3.9. Rest of Middle East and North Africa

- 14.1. Market Analysis, Insights and Forecast - by Carrier Type

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2025

- 15.2. Company Profiles

- 15.2.1 China Shaanxi FYPE Rigid Machinery Co Ltd*List Not Exhaustive 6 4 Market Ranking/Share (%) Analysi

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 DynaEnergetics GmbH & Co KG

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Hunting PLC

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Weatherford International PLC

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Baker Hughes Company

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Halliburton Company

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 DMC Global Inc

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Schlumberger Limited

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 NOV Inc

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.1 China Shaanxi FYPE Rigid Machinery Co Ltd*List Not Exhaustive 6 4 Market Ranking/Share (%) Analysi

List of Figures

- Figure 1: Middle East And North Africa Perforating Gun Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East And North Africa Perforating Gun Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Carrier Type 2020 & 2033

- Table 2: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Carrier Type 2020 & 2033

- Table 3: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Well Type 2020 & 2033

- Table 4: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Well Type 2020 & 2033

- Table 5: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Carrier Type 2020 & 2033

- Table 10: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Carrier Type 2020 & 2033

- Table 11: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Well Type 2020 & 2033

- Table 12: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Well Type 2020 & 2033

- Table 13: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Carrier Type 2020 & 2033

- Table 18: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Carrier Type 2020 & 2033

- Table 19: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Well Type 2020 & 2033

- Table 20: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Well Type 2020 & 2033

- Table 21: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Carrier Type 2020 & 2033

- Table 26: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Carrier Type 2020 & 2033

- Table 27: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Well Type 2020 & 2033

- Table 28: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Well Type 2020 & 2033

- Table 29: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 31: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Carrier Type 2020 & 2033

- Table 34: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Carrier Type 2020 & 2033

- Table 35: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Well Type 2020 & 2033

- Table 36: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Well Type 2020 & 2033

- Table 37: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Carrier Type 2020 & 2033

- Table 42: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Carrier Type 2020 & 2033

- Table 43: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Well Type 2020 & 2033

- Table 44: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Well Type 2020 & 2033

- Table 45: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 47: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 49: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Carrier Type 2020 & 2033

- Table 50: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Carrier Type 2020 & 2033

- Table 51: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Well Type 2020 & 2033

- Table 52: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Well Type 2020 & 2033

- Table 53: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 54: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 55: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 57: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Carrier Type 2020 & 2033

- Table 58: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Carrier Type 2020 & 2033

- Table 59: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Well Type 2020 & 2033

- Table 60: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Well Type 2020 & 2033

- Table 61: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 62: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 63: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Country 2020 & 2033

- Table 64: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 65: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Carrier Type 2020 & 2033

- Table 66: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Carrier Type 2020 & 2033

- Table 67: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Well Type 2020 & 2033

- Table 68: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Well Type 2020 & 2033

- Table 69: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 70: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 71: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Carrier Type 2020 & 2033

- Table 74: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Carrier Type 2020 & 2033

- Table 75: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Well Type 2020 & 2033

- Table 76: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Well Type 2020 & 2033

- Table 77: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 78: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 79: Middle East And North Africa Perforating Gun Market Revenue Million Forecast, by Country 2020 & 2033

- Table 80: Middle East And North Africa Perforating Gun Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East And North Africa Perforating Gun Market?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Middle East And North Africa Perforating Gun Market?

Key companies in the market include China Shaanxi FYPE Rigid Machinery Co Ltd*List Not Exhaustive 6 4 Market Ranking/Share (%) Analysi, DynaEnergetics GmbH & Co KG, Hunting PLC, Weatherford International PLC, Baker Hughes Company, Halliburton Company, DMC Global Inc, Schlumberger Limited, NOV Inc.

3. What are the main segments of the Middle East And North Africa Perforating Gun Market?

The market segments include Carrier Type, Well Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 270.37 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The Rise in Oil and Gas Drilling Activities4.; Increased Shale Gas Exploration.

6. What are the notable trends driving market growth?

Horizontal and Deviated Well Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Share of Renewable Energy.

8. Can you provide examples of recent developments in the market?

February 2024: GEODynamics patented the EPIC suite of perforation technologies. The EPIC collection includes EPIC Precision and EPIC Flex top-loading gun systems, which can withstand the harshest conditions to deliver greater safety, uptime, and operational efficiencies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East And North Africa Perforating Gun Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East And North Africa Perforating Gun Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East And North Africa Perforating Gun Market?

To stay informed about further developments, trends, and reports in the Middle East And North Africa Perforating Gun Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence