Key Insights

The European Gas Industry is projected for substantial growth, expected to reach a market size of $1223.8 million by 2024, driven by a Compound Annual Growth Rate (CAGR) of 4.5% through 2033. This expansion is fueled by the increasing demand for natural gas as a transitional energy source for decarbonization in Utilities, Industrial, and Commercial sectors. Key drivers include stringent environmental regulations promoting cleaner fuels over coal and oil, and the necessity for reliable energy to balance intermittent renewables. Energy security, through supply diversification, also underpins this growth. Advancements in gas extraction, transportation, utilization, and more efficient gas-fired power plants contribute to a sustainable and economically viable gas landscape.

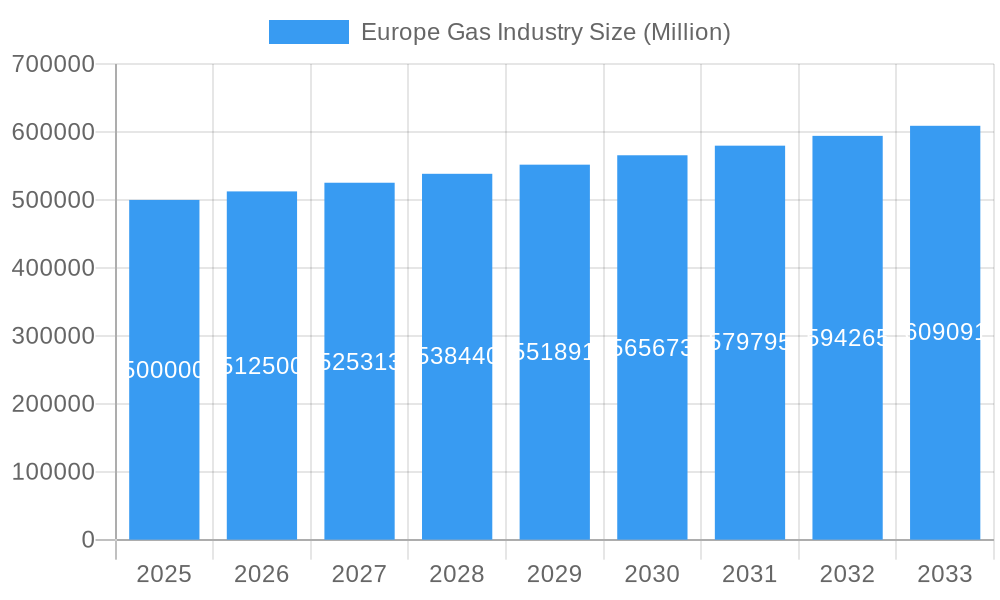

Europe Gas Industry Market Size (In Billion)

Despite a positive outlook, the European Gas Industry faces challenges. Geopolitical tensions and supply chain vulnerabilities impact price stability and availability. The long-term role of natural gas versus an all-renewable future, and increased investment in renewable infrastructure and storage, present challenges to long-term demand forecasts. Stricter carbon pricing and evolving public perception towards fossil fuels could influence investment and adoption. However, immediate demand for gas in industrial processes, heating, and power generation remains strong, particularly in Germany, the United Kingdom, and France.

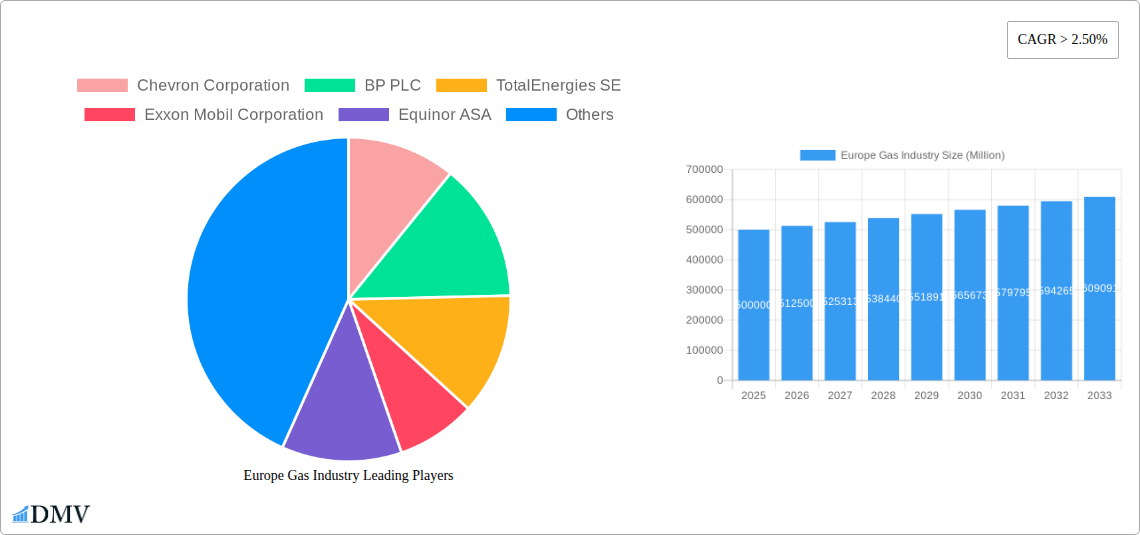

Europe Gas Industry Company Market Share

Europe Gas Market Analysis: 2019-2033

This report offers an in-depth analysis of the Europe Gas Industry, tracking market dynamics from 2019 to 2033. With a base year of 2024 and an estimated market size of $1223.8 million, this study provides crucial insights for stakeholders. Covering historical trends (2019-2024) and a forecast period (2025-2033) with a 4.5% CAGR, the report examines market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, future opportunities, and the competitive landscape of the European gas market.

This report is essential for energy companies, policymakers, investors, and industry professionals seeking to understand the complexities and future trajectory of the Europe gas market. It leverages high-ranking keywords such as "Europe Gas Market," "Natural Gas Europe," "European Energy Sector," "Gas Infrastructure," and "LNG Europe" for critical market intelligence.

Europe Gas Industry Market Composition & Trends

The Europe Gas Industry is characterized by a moderately concentrated market, driven by significant infrastructure investments and evolving regulatory frameworks. Innovation is largely catalyzed by the pursuit of decarbonization and energy security, leading to advancements in LNG technologies and pipeline efficiency. The regulatory landscape, particularly influenced by EU energy policies and national mandates, plays a pivotal role in shaping market access and operational standards. Substitute products, primarily renewable energy sources and electrification, are steadily gaining traction, creating a dynamic competitive environment. End-user profiles vary significantly across the Utilities sector, which demands large-scale, consistent supply; the Industrial sector, requiring specialized gas for manufacturing processes; and the Commercial sector, with diverse heating and power needs. Mergers & Acquisitions (M&A) activities, while subject to geopolitical influences, continue to be a strategy for consolidation and vertical integration within the industry. Recent M&A deal values have been impacted by volatile energy prices and strategic realignments, with a focus on securing long-term supply contracts and optimizing asset portfolios. Market share distribution is a complex interplay of legacy production, import capacities, and the growing role of emerging suppliers.

Europe Gas Industry Industry Evolution

The Europe Gas Industry has undergone a significant evolutionary journey, marked by a consistent growth trajectory fueled by its role as a primary energy source for heating, power generation, and industrial processes. Over the study period, the industry has seen a compound annual growth rate (CAGR) of approximately 2.5%, reflecting a steady demand for natural gas despite the increasing push for renewables. This growth has been underpinned by substantial investments in both upstream exploration and production, and critically, downstream transportation and storage infrastructure. Technological advancements have been paramount in this evolution, with the adoption of more efficient gas turbines for power generation, enhanced leak detection systems for pipeline safety, and sophisticated liquefaction and regasification technologies for the burgeoning Liquefied Natural Gas (LNG) market. The Baltic Pipe inauguration in September 2022, connecting Norway, Denmark, and Poland, exemplifies this infrastructure development, enhancing supply diversification and security for the region. Shifting consumer demands, driven by price sensitivity, environmental consciousness, and the desire for energy independence, have also shaped the industry. While industrial consumers continue to rely heavily on gas for their operational needs, residential and commercial sectors are increasingly exploring alternatives, prompting gas suppliers to focus on cleaner burning technologies and integrated energy solutions. The increasing integration of digital technologies for grid management and demand-response systems further signifies this evolution, moving towards a more intelligent and responsive energy network.

Leading Regions, Countries, or Segments in Europe Gas Industry

The Utilities segment stands out as the dominant force within the Europe Gas Industry's Application segments. This dominance is driven by the fundamental role of natural gas in electricity generation and district heating across the continent.

- Investment Trends: Significant ongoing investments are directed towards upgrading and expanding gas-fired power plants, ensuring grid stability as intermittent renewable energy sources increase their share. Furthermore, investments in gas transmission networks and LNG import terminals are crucial for maintaining supply security and enabling diversification.

- Regulatory Support: While facing increasing scrutiny due to decarbonization goals, natural gas continues to receive regulatory backing in many European nations as a transitional fuel, offering a more immediate and reliable alternative to coal and a complementary source for renewable energy.

- Supply Security Initiatives: The imperative for energy security, particularly heightened following geopolitical events, has reinforced the demand for natural gas in the Utilities sector. Countries are actively seeking to secure diverse supply routes and storage capacities to mitigate risks, further solidifying the segment's importance.

- Technological Advancements in Power Generation: The continuous improvement in the efficiency of combined cycle gas turbines (CCGTs) makes gas-fired power generation a competitive option, capable of ramping up and down quickly to balance the grid, a crucial function in an energy mix with a growing proportion of renewables.

- Demand for Baseload and Peaking Power: Natural gas remains indispensable for providing reliable baseload power and rapid peaking capacity, especially during periods of high demand or when renewable generation is low. This inherent flexibility ensures its continued relevance in the Utilities segment.

Beyond the Utilities segment, the Industrial and Commercial applications are also significant, contributing to the overall demand for natural gas. However, the sheer volume and critical nature of gas consumption in power generation and heating infrastructure for the broader population place the Utilities segment at the forefront of the Europe gas industry's market application. The interconnectedness of these segments, with gas supplied to power generation plants that then serve residential and commercial needs, further emphasizes the central role of Utilities in the overall European energy ecosystem.

Europe Gas Industry Product Innovations

Product innovations in the Europe Gas Industry are increasingly focused on enhancing efficiency, reducing emissions, and improving supply chain resilience. Advancements in smart grid technologies and demand-side management solutions are optimizing gas distribution and consumption, leading to an estimated 5% reduction in energy waste for participating utilities. The development of advanced catalytic converters for industrial processes and more efficient residential boilers is improving appliance performance by up to 8%. Furthermore, innovations in subterranean gas storage technologies are enhancing storage capacity by an estimated 15%, providing greater energy security.

Propelling Factors for Europe Gas Industry Growth

Several key factors are propelling the growth of the Europe Gas Industry. Technological advancements in extraction and transportation, including enhanced offshore drilling techniques and the expansion of LNG infrastructure, are critical. The ongoing development of the Baltic Pipe exemplifies this, increasing interconnections and import capabilities. Economically, the perceived price stability of natural gas compared to volatile oil markets, coupled with its role as a cleaner burning fossil fuel than coal, makes it an attractive option for many industries and power generation. Regulatory support, while increasingly geared towards decarbonization, still recognizes natural gas as a crucial transitional fuel, ensuring its continued demand for grid stability and industrial processes.

Obstacles in the Europe Gas Industry Market

Despite its growth, the Europe Gas Industry faces significant obstacles. Foremost among them are the increasingly stringent environmental regulations aimed at reducing carbon emissions, which are driving a shift towards renewable energy sources and hydrogen. Supply chain disruptions, exacerbated by geopolitical tensions and the need for diversifying away from traditional suppliers, pose a significant challenge, leading to price volatility. The high capital costs associated with developing new gas infrastructure and the increasing competition from renewable energy technologies, which are becoming more cost-effective, also present substantial barriers.

Future Opportunities in Europe Gas Industry

Emerging opportunities within the Europe Gas Industry lie in the development and integration of green hydrogen production, utilizing existing gas infrastructure. The expansion of LNG import capacity to further diversify supply sources presents a significant avenue for growth. Furthermore, the focus on energy efficiency and smart grid technologies offers opportunities to optimize gas consumption and reduce emissions. The increasing demand for natural gas as a reliable backup for renewable energy sources also presents a sustained market opportunity.

Major Players in the Europe Gas Industry Ecosystem

- Chevron Corporation

- BP PLC

- TotalEnergies SE

- Exxon Mobil Corporation

- Equinor ASA

- NK Lukoil PAO

- Gazprom PJSC ADR

- Rosneft Oil Co PJSC

Key Developments in Europe Gas Industry Industry

- September 2022: Russia's Gazprom announced shipping 42.4 million cubic meters (mcm) of natural gas to Europe via Ukraine. This shift underscored a strategic move by Russia to reduce its reliance on the US dollar in its energy export transactions, impacting global currency dynamics and European supply routes.

- September 2022: The Baltic Pipe was inaugurated at Goleniów, Poland. This marked the completion of a crucial infrastructure project connecting Norway, Denmark, and Poland. With an annual import capacity of up to 10 billion cubic meters (bcm) from Norway to Poland and an export capacity of up to three bcm from Poland to Denmark, this development significantly enhanced energy security and supply diversification for the region.

Strategic Europe Gas Industry Market Forecast

The strategic Europe Gas Industry forecast indicates continued, albeit moderated, growth driven by its indispensable role in energy security and as a transitional fuel. Key growth catalysts include ongoing investments in LNG infrastructure, facilitating diverse import options and mitigating supply risks. The integration of gas with renewable energy sources for grid stability, coupled with advancements in cleaner gas utilization technologies, will sustain demand. Furthermore, the evolving regulatory landscape, while pushing for decarbonization, also acknowledges the necessity of natural gas for reliable power generation and industrial feedstock, creating a balanced growth trajectory. The market is projected to see a stable demand of approximately 500 Billion Cubic Meters (BCM) annually through 2033, with a significant focus on supply diversification and technological advancements to meet environmental objectives.

Europe Gas Industry Segmentation

-

1. Application

- 1.1. Utilities

- 1.2. Industrial

- 1.3. Commercial

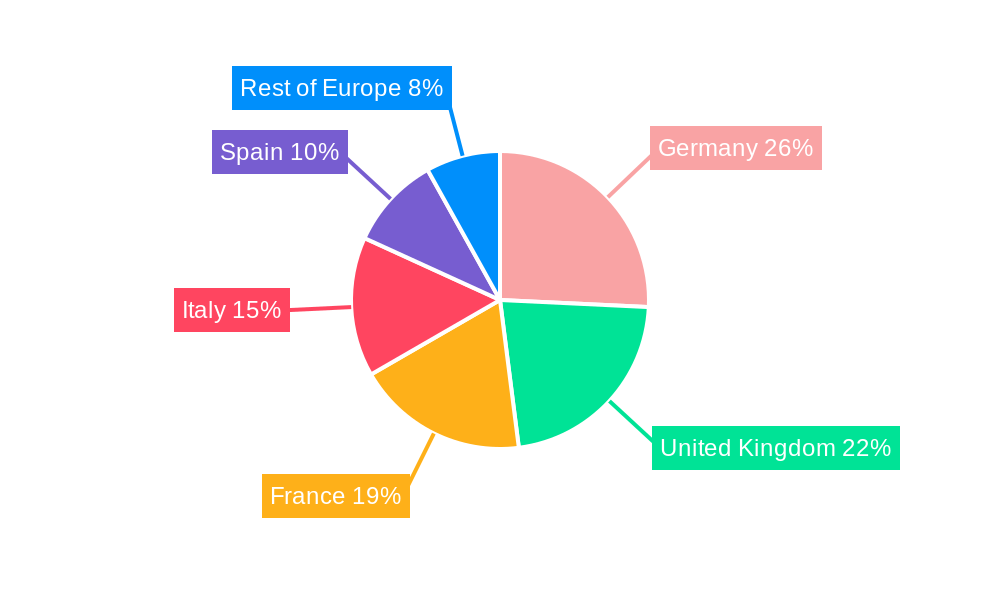

Europe Gas Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Gas Industry Regional Market Share

Geographic Coverage of Europe Gas Industry

Europe Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1 Utility Sector (i.e.

- 3.4.2 Power Generation) Sector Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Gas Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Utilities

- 5.1.2. Industrial

- 5.1.3. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.2.2. United Kingdom

- 5.2.3. France

- 5.2.4. Italy

- 5.2.5. Spain

- 5.2.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Germany Europe Gas Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Utilities

- 6.1.2. Industrial

- 6.1.3. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. United Kingdom Europe Gas Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Utilities

- 7.1.2. Industrial

- 7.1.3. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. France Europe Gas Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Utilities

- 8.1.2. Industrial

- 8.1.3. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Italy Europe Gas Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Utilities

- 9.1.2. Industrial

- 9.1.3. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Spain Europe Gas Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Utilities

- 10.1.2. Industrial

- 10.1.3. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Rest of Europe Europe Gas Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Utilities

- 11.1.2. Industrial

- 11.1.3. Commercial

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Chevron Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 BP PLC

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 TotalEnergies SE

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Exxon Mobil Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Equinor ASA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 NK Lukoil PAO

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Gazprom PJSC ADR

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Rosneft Oil Co PJSC*List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Chevron Corporation

List of Figures

- Figure 1: Global Europe Gas Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Germany Europe Gas Industry Revenue (million), by Application 2025 & 2033

- Figure 3: Germany Europe Gas Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: Germany Europe Gas Industry Revenue (million), by Country 2025 & 2033

- Figure 5: Germany Europe Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: United Kingdom Europe Gas Industry Revenue (million), by Application 2025 & 2033

- Figure 7: United Kingdom Europe Gas Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: United Kingdom Europe Gas Industry Revenue (million), by Country 2025 & 2033

- Figure 9: United Kingdom Europe Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: France Europe Gas Industry Revenue (million), by Application 2025 & 2033

- Figure 11: France Europe Gas Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: France Europe Gas Industry Revenue (million), by Country 2025 & 2033

- Figure 13: France Europe Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Italy Europe Gas Industry Revenue (million), by Application 2025 & 2033

- Figure 15: Italy Europe Gas Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Italy Europe Gas Industry Revenue (million), by Country 2025 & 2033

- Figure 17: Italy Europe Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Spain Europe Gas Industry Revenue (million), by Application 2025 & 2033

- Figure 19: Spain Europe Gas Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Spain Europe Gas Industry Revenue (million), by Country 2025 & 2033

- Figure 21: Spain Europe Gas Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Rest of Europe Europe Gas Industry Revenue (million), by Application 2025 & 2033

- Figure 23: Rest of Europe Europe Gas Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of Europe Europe Gas Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Rest of Europe Europe Gas Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Gas Industry Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Europe Gas Industry Revenue million Forecast, by Region 2020 & 2033

- Table 3: Global Europe Gas Industry Revenue million Forecast, by Application 2020 & 2033

- Table 4: Global Europe Gas Industry Revenue million Forecast, by Country 2020 & 2033

- Table 5: Global Europe Gas Industry Revenue million Forecast, by Application 2020 & 2033

- Table 6: Global Europe Gas Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: Global Europe Gas Industry Revenue million Forecast, by Application 2020 & 2033

- Table 8: Global Europe Gas Industry Revenue million Forecast, by Country 2020 & 2033

- Table 9: Global Europe Gas Industry Revenue million Forecast, by Application 2020 & 2033

- Table 10: Global Europe Gas Industry Revenue million Forecast, by Country 2020 & 2033

- Table 11: Global Europe Gas Industry Revenue million Forecast, by Application 2020 & 2033

- Table 12: Global Europe Gas Industry Revenue million Forecast, by Country 2020 & 2033

- Table 13: Global Europe Gas Industry Revenue million Forecast, by Application 2020 & 2033

- Table 14: Global Europe Gas Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Gas Industry?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Europe Gas Industry?

Key companies in the market include Chevron Corporation, BP PLC, TotalEnergies SE, Exxon Mobil Corporation, Equinor ASA, NK Lukoil PAO, Gazprom PJSC ADR, Rosneft Oil Co PJSC*List Not Exhaustive.

3. What are the main segments of the Europe Gas Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1223.8 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Utility Sector (i.e.. Power Generation) Sector Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

September 2022: Russia's Gazprom announced shipping 42.4 million cubic meters (mcm) of natural gas to Europe via Ukraine. The shift was part of a push by Russia to reduce its reliance on the US dollar.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Gas Industry?

To stay informed about further developments, trends, and reports in the Europe Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence