Key Insights

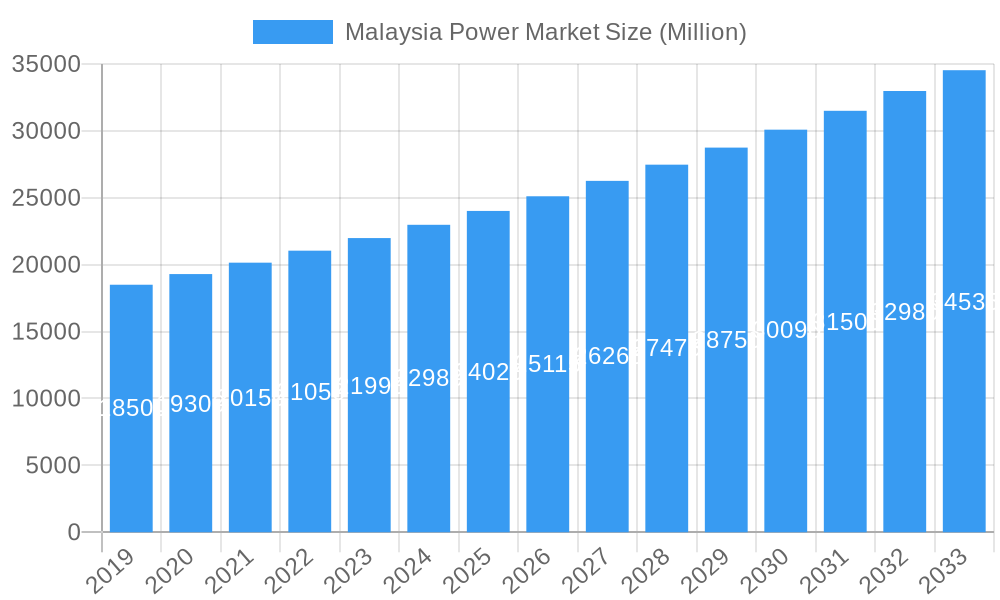

The Malaysia Power Market is projected for substantial growth, expected to reach 25.5 billion by 2033. This expansion is driven by a Compound Annual Growth Rate (CAGR) of 4.2% from the base year 2024. Key growth catalysts include rising energy demand from industrialization, urbanization, and population increase. Government initiatives focused on energy security and sustainable energy transition further stimulate market development. Investments in modernizing power infrastructure and developing efficient generation facilities are critical for meeting escalating energy needs and supporting economic advancement.

Malaysia Power Market Market Size (In Billion)

The market features a mix of conventional and renewable energy sources, with a notable shift towards solar energy aligning with global sustainability goals and national policies. The transmission and distribution sector is undergoing significant upgrades to integrate renewable energy and ensure grid stability. The residential, commercial, and industrial sectors are the primary electricity consumers, with emerging demand from agriculture and transportation due to vehicle electrification and agricultural mechanization. Major industry players such as Tenaga Nasional Berhad, Korea Electric Power Corporation, and Solarvest Holdings Bhd are instrumental in driving innovation and capacity enhancement.

Malaysia Power Market Company Market Share

Malaysia Power Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report offers a strategic analysis of the dynamic Malaysia power market, providing critical insights into its current composition, evolutionary trends, and future trajectory. Delving into market dynamics from 2019 to 2033, with a base and estimated year of 2025 and a forecast period spanning 2025–2033, this report equips stakeholders with the intelligence needed to navigate this rapidly evolving sector. We meticulously examine power generation sources including Oil, Natural Gas, Coal, Renewables, and Other Power Generation Sources, alongside the crucial Transmission and Distribution infrastructure, and diverse end-user segments such as Residential, Commercial, Industrial, Transport, Agriculture, and Industry.

Malaysia Power Market Market Composition & Trends

The Malaysian power market is characterized by a moderately concentrated landscape, with Tenaga Nasional Berhad (TNB) holding a significant share in power generation and distribution. Innovation is increasingly driven by the push for renewable energy adoption and grid modernization. Key regulatory catalysts include government incentives for solar power and the ongoing liberalization of the power sector. While traditional fuels like Oil, Natural Gas, and Coal remain important, the growing investment in solar power generation and other renewable energy sources signifies a clear shift. Substitute products are less of a concern for electricity itself, but efficiency improvements and alternative energy storage solutions are becoming relevant. End-user profiles are diverse, with Residential, Commercial, and Industrial sectors being the primary consumers. Mergers and acquisitions (M&A) activities are expected to increase as companies consolidate their positions and pursue strategic partnerships, with estimated M&A deal values reaching into the hundreds of Millions. The market share distribution reflects a blend of established incumbents and emerging players in the renewable space, with Solarvest Holdings Bhd and Pathgreen Energy Sdn Bhd showing significant growth potential.

Malaysia Power Market Industry Evolution

The evolution of the Malaysia power market is a compelling narrative of transition, driven by a confluence of technological advancements, shifting policy landscapes, and evolving energy demands. Over the historical period (2019–2024) and into the forecast period (2025–2033), the industry has witnessed a notable trajectory away from a heavy reliance on fossil fuels towards a more sustainable and diversified energy mix. Renewable energy, particularly solar photovoltaic (PV), has emerged as a cornerstone of this transformation. The government's commitment to increasing the renewable energy capacity has spurred significant investment and innovation, leading to a consistent annual growth rate of approximately 10-15% in the renewable sector over the past few years. This growth is directly linked to advancements in solar panel efficiency, battery storage technology, and smart grid solutions.

Technological advancements have not only focused on generation but also on optimizing the transmission and distribution networks. Investments in smart grid technologies, including advanced metering infrastructure and digital substations, are enhancing grid reliability, reducing transmission losses, and improving the integration of intermittent renewable sources. The adoption of digital technologies for grid management and predictive maintenance is becoming standard practice, leading to more resilient and efficient power delivery.

Shifting consumer demands are also playing a pivotal role. There is a growing awareness and preference for cleaner energy sources, particularly among commercial and industrial end-users seeking to meet their sustainability targets and reduce their carbon footprint. The Residential sector is also showing increased interest in rooftop solar installations, driven by falling technology costs and supportive government feed-in tariffs. The transport sector's electrification, with the rise of electric vehicles (EVs), is creating a new demand for electricity and driving investments in charging infrastructure and grid upgrades to support this burgeoning segment. Industry stakeholders are increasingly prioritizing energy efficiency solutions to manage operational costs and environmental impact, further shaping the market's evolution.

Leading Regions, Countries, or Segments in Malaysia Power Market

The Malaysia power market exhibits distinct leadership across its various segments, with Renewables emerging as the most dynamic and rapidly expanding power generation source. The dominance of renewables is fueled by a clear national agenda to diversify the energy portfolio and reduce carbon emissions. This segment is projected to see a compound annual growth rate (CAGR) of over 15% during the forecast period, significantly outpacing traditional sources like Oil, Natural Gas, and Coal. The Transmission and Distribution segment is also critical, with ongoing investments to upgrade infrastructure and accommodate the increasing influx of renewable energy into the grid.

Within the end-user segments, the Industrial sector consistently represents the largest consumer of electricity, followed closely by the Commercial sector. However, the Residential sector is exhibiting the fastest growth in terms of adoption of distributed generation, particularly rooftop solar. The Transport sector, driven by the accelerating adoption of electric vehicles, is poised for substantial growth in electricity demand. The Agriculture sector, while smaller, is also a growing area for renewable energy adoption, particularly for powering irrigation systems and processing facilities.

Key drivers for the dominance of renewables include:

- Government Policy and Incentives: The Malaysian government has set ambitious renewable energy targets, supported by policies such as the Large-Scale Solar (LSS) program and Net Energy Metering (NEM).

- Declining Technology Costs: The significant reduction in the cost of solar panels and battery storage technology has made renewables increasingly competitive.

- Environmental Concerns and Sustainability Goals: Growing awareness of climate change and corporate sustainability commitments are driving demand for clean energy.

- Energy Security: Diversification through renewables enhances energy security by reducing reliance on imported fossil fuels.

The Renewables segment is further propelled by substantial investments in solar farms, with companies like Solarvest Holdings Bhd and ERS Energy Sdn Bhd at the forefront of development and implementation. The government's proactive approach to land allocation and grid connection for solar projects has been instrumental. The Transmission and Distribution segment's leadership is characterized by continuous modernization efforts, including the integration of smart grid technologies to manage the intermittency of renewables and ensure grid stability. The Industrial sector's sustained demand is met through reliable power supply, with ongoing efforts to incorporate cleaner energy sources into their operations, often through power purchase agreements (PPAs) with renewable energy developers.

Malaysia Power Market Product Innovations

Product innovations in the Malaysia power market are predominantly focused on enhancing the efficiency, reliability, and sustainability of power generation and distribution. Advancements in solar panel technology, including higher conversion efficiencies and bifacial panels, are increasing energy yield. Furthermore, breakthroughs in battery storage solutions, such as lithium-ion and emerging solid-state technologies, are crucial for grid stability and enabling higher penetration of intermittent renewables. Smart grid technologies, encompassing advanced metering, grid automation, and AI-powered grid management systems, are revolutionizing power distribution, leading to reduced losses and improved fault detection. The development of integrated energy management systems for industrial and commercial clients offers optimized energy consumption and cost savings.

Propelling Factors for Malaysia Power Market Growth

Several key factors are propelling the growth of the Malaysia power market. Firstly, strong government support through clear renewable energy targets, policy frameworks like the National Energy Transition Roadmap, and financial incentives significantly drives investment in clean energy solutions. Secondly, the declining cost of renewable energy technologies, particularly solar PV and battery storage, is making them increasingly competitive with traditional fossil fuels, attracting private sector investment. Thirdly, rising demand for electricity, fueled by economic growth, industrial expansion, and the electrification of the transport sector, necessitates continuous capacity additions and infrastructure upgrades. Finally, a growing emphasis on sustainability and environmental responsibility among consumers and corporations is creating a favorable market for greener energy alternatives.

Obstacles in the Malaysia Power Market Market

Despite the positive growth trajectory, the Malaysia power market faces several obstacles. Regulatory uncertainties and the pace of policy implementation can sometimes hinder swift investment decisions. The integration of a large volume of intermittent renewable energy sources into the existing grid infrastructure presents significant technical challenges, requiring substantial upgrades to transmission and distribution networks. Supply chain disruptions for critical components, particularly during global events, can lead to project delays and cost overruns. Furthermore, the high upfront capital investment required for large-scale renewable energy projects and grid modernization can be a barrier for some developers. Competition from established fossil fuel players and the potential for fluctuating fossil fuel prices can also create market volatility.

Future Opportunities in Malaysia Power Market

The future of the Malaysia power market is rife with opportunities. The continued expansion of renewable energy capacity, particularly solar and potentially wind and hydro, presents significant investment avenues. The burgeoning electric vehicle (EV) market creates a substantial opportunity for increased electricity demand and the development of smart charging infrastructure. Furthermore, the push for energy efficiency and smart grid technologies offers opportunities for technology providers and solution developers. Emerging opportunities also lie in exploring green hydrogen production and utilization, as well as the development of offshore wind energy. The increasing focus on sustainability and decarbonization by corporations will continue to drive demand for renewable energy procurement through PPAs and corporate power purchase agreements.

Major Players in the Malaysia Power Market Ecosystem

- Tenaga Nasional Berhad

- Korea Electric Power Corporation

- Solarvest Holdings Bhd

- Pathgreen Energy Sdn Bhd

- Sarawak Electricity Supply Corporation

- Cutech Green Ventures

- Verdant Solar Inc

- ERS Energy Sdn Bhd

- Sunway Construction Group Bhd

- LYS Energy Group

Key Developments in Malaysia Power Market Industry

- August 2021: Malaysian power utility Tenaga Nasional Bhd (TNB) entered a 21-year PPA (Power Purchase Agreement) with 10 solar power plants to be commissioned in four Malaysian states by 2023. Each solar project has a capacity of 50 MWac, significantly boosting the renewable energy capacity.

- March 2021: The Energy Commission of Malaysia, Suruhanjaya Tenaga, completed the bidding process for 823 MW of large-scale solar photovoltaic (LSSPV) projects. The projects will be in operation from 2022 to 2023, with construction in two phases (323 MW and 500 MW), involving around 31 companies, underscoring the strong government commitment to solar energy expansion.

Strategic Malaysia Power Market Market Forecast

The strategic forecast for the Malaysia power market indicates robust and sustained growth, primarily driven by the accelerated adoption of renewable energy sources and the ongoing modernization of transmission and distribution infrastructure. Government initiatives, coupled with declining technology costs, will continue to propel the solar and other renewable segments to new heights. The increasing electrification of transportation and the industrial sector's demand for cleaner energy will further solidify the upward growth trajectory. While challenges related to grid integration and regulatory frameworks persist, proactive measures and strategic investments are expected to mitigate these obstacles, paving the way for a more sustainable, reliable, and diversified power ecosystem in Malaysia. The market is poised for significant expansion, with opportunities abundant for both established players and innovative new entrants.

Malaysia Power Market Segmentation

-

1. Power Generation Source

- 1.1. Oil

- 1.2. Natural Gas

- 1.3. Coal

- 1.4. Renewables

- 1.5. Other Power Generation Sources

- 2. Transmission and Distribution

-

3. End User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

- 3.4. Transport

- 3.5. Agriculture

Malaysia Power Market Segmentation By Geography

- 1. Malaysia

Malaysia Power Market Regional Market Share

Geographic Coverage of Malaysia Power Market

Malaysia Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources

- 3.3. Market Restrains

- 3.3.1. 4.; The Recycling Rate of Waste in Germany

- 3.4. Market Trends

- 3.4.1. Natural Gas Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Power Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 5.1.1. Oil

- 5.1.2. Natural Gas

- 5.1.3. Coal

- 5.1.4. Renewables

- 5.1.5. Other Power Generation Sources

- 5.2. Market Analysis, Insights and Forecast - by Transmission and Distribution

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.3.4. Transport

- 5.3.5. Agriculture

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Korea Electric Power Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Solarvest Holdings Bhd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pathgreen Energy Sdn Bh

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sarawak Electricity Supply Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cutech Green Ventures

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Verdant Solar Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ERS Energy Sdn Bhd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sunway Construction Group Bhd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 LYS Energy Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tenaga Nasional Berhad

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Korea Electric Power Corporation

List of Figures

- Figure 1: Malaysia Power Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Malaysia Power Market Share (%) by Company 2025

List of Tables

- Table 1: Malaysia Power Market Revenue billion Forecast, by Power Generation Source 2020 & 2033

- Table 2: Malaysia Power Market Revenue billion Forecast, by Transmission and Distribution 2020 & 2033

- Table 3: Malaysia Power Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Malaysia Power Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Malaysia Power Market Revenue billion Forecast, by Power Generation Source 2020 & 2033

- Table 6: Malaysia Power Market Revenue billion Forecast, by Transmission and Distribution 2020 & 2033

- Table 7: Malaysia Power Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Malaysia Power Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Power Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Malaysia Power Market?

Key companies in the market include Korea Electric Power Corporation, Solarvest Holdings Bhd, Pathgreen Energy Sdn Bh, Sarawak Electricity Supply Corporation, Cutech Green Ventures, Verdant Solar Inc, ERS Energy Sdn Bhd, Sunway Construction Group Bhd, LYS Energy Group, Tenaga Nasional Berhad.

3. What are the main segments of the Malaysia Power Market?

The market segments include Power Generation Source, Transmission and Distribution, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources.

6. What are the notable trends driving market growth?

Natural Gas Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Recycling Rate of Waste in Germany.

8. Can you provide examples of recent developments in the market?

In August 2021, Malaysian power utility Tenaga Nasional Bhd (TNB) entered a 21-year PPA (Power Purchase Agreement) with 10 solar power plants to be commissioned in four Malaysian states by 2023. Each solar project has a capacity of 50 MWac.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Power Market?

To stay informed about further developments, trends, and reports in the Malaysia Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence